Aerospace Wiring Harness Market

Aerospace Wiring Harness Market Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_707343 | Last Updated : September 08, 2025 |

Format : ![]()

![]()

![]()

![]()

Aerospace Wiring Harness Market Size

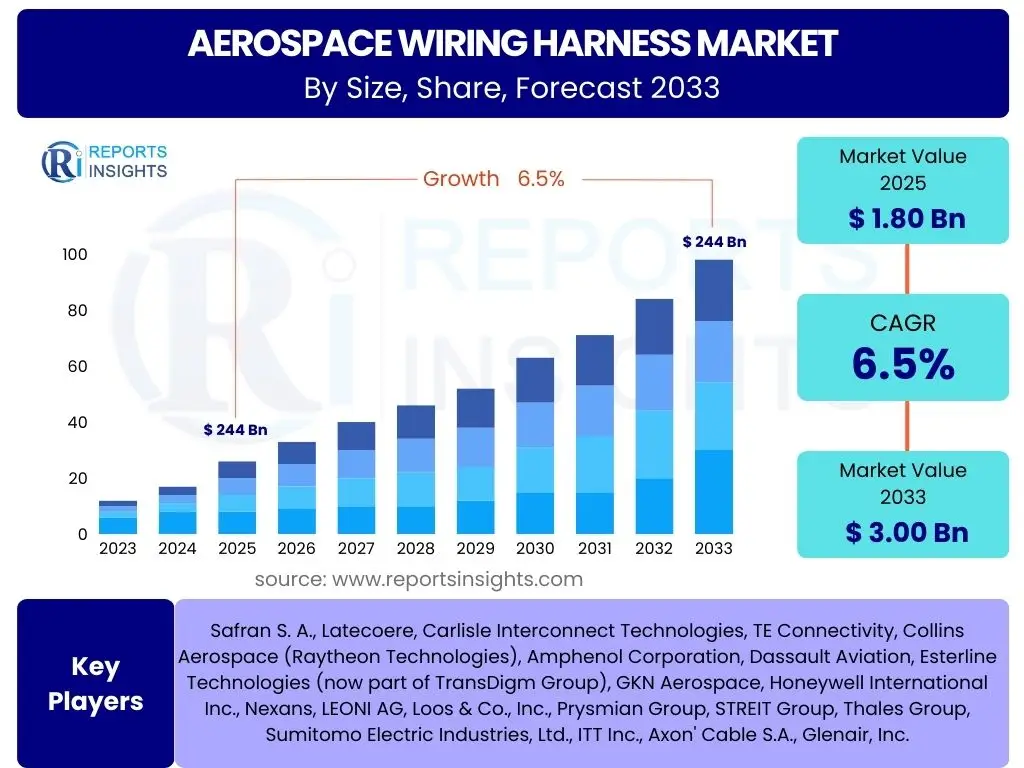

According to Reports Insights Consulting Pvt Ltd, The Aerospace Wiring Harness Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2025 and 2033. The market is estimated at USD 1.80 Billion in 2025 and is projected to reach USD 3.00 Billion by the end of the forecast period in 2033.

Key Aerospace Wiring Harness Market Trends & Insights

Common user inquiries regarding market trends for aerospace wiring harnesses frequently center on the adoption of advanced materials, the push towards miniaturization, and the integration of smart technologies. Users are keen to understand how developments in aircraft design, such as the increasing electrification of systems and the growth of unmanned aerial vehicles (UAVs), are influencing the evolution of wiring harness technology. There is also significant interest in sustainable manufacturing practices and the impact of digital twins on product lifecycle management within the industry.

Furthermore, questions often arise about the expanding role of fiber optics for high-speed data transmission and the demand for higher bandwidth in modern aircraft. The trend towards modular design and plug-and-play components to simplify installation and maintenance is another area of user focus. Overall, the market is characterized by a drive for enhanced performance, reduced weight, improved reliability, and greater system integration, addressing the complex demands of next-generation aircraft platforms.

- Miniaturization and Weight Reduction: Focus on developing lighter and smaller harness solutions using advanced materials and optimized designs to enhance fuel efficiency and aircraft performance.

- Increased Electrification of Aircraft (More Electric Aircraft - MEA): Growing demand for wiring harnesses capable of handling higher power loads and managing complex electrical systems in MEA architectures.

- Integration of Fiber Optics: Rising adoption of fiber optic cables for high-speed data transmission, electromagnetic interference (EMI) immunity, and weight reduction in communication and data networks.

- Modular and Standardized Designs: Shift towards modular wiring harness systems to facilitate easier installation, maintenance, and system upgrades, reducing operational costs.

- Emphasis on Durability and Harsh Environment Performance: Development of harnesses designed to withstand extreme temperatures, vibrations, moisture, and chemical exposure, ensuring long-term reliability.

- Automated Manufacturing and Digitalization: Increasing use of automation, robotics, and digital twin technology in the manufacturing and testing of wiring harnesses to improve precision and efficiency.

AI Impact Analysis on Aerospace Wiring Harness

User queries regarding the impact of Artificial Intelligence (AI) on the aerospace wiring harness sector frequently revolve around its potential to optimize design, enhance manufacturing processes, and improve predictive maintenance. There is a keen interest in how AI can analyze vast datasets from design specifications, material properties, and operational performance to identify optimal routing, reduce weight, and minimize electromagnetic interference. Expectations are high for AI's ability to automate complex design iterations, significantly shortening development cycles and reducing human error in a highly critical component area.

Moreover, concerns often emerge regarding the reliability and validation of AI-generated designs in safety-critical aerospace applications, necessitating robust verification and validation frameworks. Users also inquire about AI's role in quality control, predictive failure analysis, and supply chain optimization for harness components. The overall sentiment is one of cautious optimism, recognizing AI's transformative potential while emphasizing the need for stringent regulatory oversight and comprehensive testing to ensure integrity and safety in aerospace applications.

- Design Optimization: AI algorithms can analyze complex design parameters to optimize wire routing, reduce weight, and minimize signal interference, leading to more efficient and reliable harness designs.

- Automated Quality Inspection: AI-powered vision systems and machine learning can rapidly identify defects and anomalies in wiring harnesses during manufacturing, enhancing quality control and reducing manual inspection time.

- Predictive Maintenance: AI can analyze sensor data from in-service harnesses to predict potential failures, enabling proactive maintenance and reducing unscheduled downtime for aircraft.

- Manufacturing Process Enhancement: AI can optimize production workflows, manage material inventory, and improve assembly precision through real-time data analysis and robotic integration.

- Supply Chain Management: AI can enhance the efficiency of the wiring harness supply chain by predicting demand, optimizing logistics, and identifying potential disruptions.

- Material Science and Innovation: AI can accelerate the discovery and testing of new materials for wiring harnesses, leading to advancements in conductivity, insulation, and durability.

Key Takeaways Aerospace Wiring Harness Market Size & Forecast

Common user questions about the key takeaways from the Aerospace Wiring Harness market size and forecast consistently highlight the market's consistent growth trajectory and the underlying factors driving it. Users are primarily interested in understanding the primary drivers behind the projected increase in market valuation, the role of technological advancements, and the influence of global aerospace production trends. There is a strong focus on identifying whether the growth is sustainable and what specific segments within the market are expected to exhibit the most significant expansion over the forecast period.

Insights frequently sought include the impact of new aircraft programs, the ongoing modernization of military fleets, and the burgeoning demand from emerging aerospace applications such as Urban Air Mobility (UAM) and space exploration. The discussions often touch upon the critical need for suppliers to innovate and adapt to stricter performance requirements and cost pressures. Overall, the market is poised for significant expansion, underpinned by sustained demand for air travel and defense capabilities, coupled with continuous technological evolution in aircraft design and manufacturing.

- Robust Market Expansion: The market is projected for substantial growth, driven by increasing aircraft deliveries and a strong aftermarket demand.

- Technological Advancements as a Catalyst: Innovation in materials, design, and manufacturing processes will be crucial for meeting evolving aerospace requirements.

- OEM and MRO Demand Synergy: Both new aircraft production (OEM) and maintenance, repair, and overhaul (MRO) activities contribute significantly to market volume.

- Emphasis on Lightweighting and Performance: Future growth is heavily dependent on solutions that offer reduced weight, improved electrical performance, and enhanced durability.

- Emerging Aircraft Segments: New opportunities are arising from the development of Urban Air Mobility (UAM) vehicles, electric aircraft, and advanced UAVs.

Aerospace Wiring Harness Market Drivers Analysis

The aerospace wiring harness market is significantly propelled by the escalating global demand for new commercial aircraft. This surge is attributed to increasing passenger traffic, the expansion of low-cost carriers in emerging economies, and the necessity for airlines to replace aging, less fuel-efficient fleets with modern, technologically advanced aircraft. The robust order backlogs for major aircraft manufacturers translate directly into higher production rates, thereby amplifying the demand for a multitude of complex wiring harnesses essential for integrating various onboard systems, from avionics to in-flight entertainment.

Concurrently, the continuous modernization and expansion of military aircraft fleets worldwide represent another formidable driver. Defense spending, particularly in North America and Asia Pacific, is fueling the procurement of new fighter jets, transport aircraft, and specialized mission aircraft, all of which require highly durable, high-performance wiring harnesses designed to withstand extreme operational conditions. Furthermore, the burgeoning segment of Unmanned Aerial Vehicles (UAVs) across both military and commercial applications is creating new demand avenues for compact, lightweight, and highly reliable wiring solutions. The imperative for lightweight aircraft design, driven by fuel efficiency goals and environmental regulations, also necessitates the development and adoption of advanced harness materials and designs that contribute to overall weight reduction.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Commercial Aircraft Production & Deliveries | +1.8% | Global, particularly North America, Europe, Asia Pacific | 2025-2033 |

| Growth in Military Aircraft Modernization & Procurement | +1.5% | North America, Europe, Middle East, Asia Pacific (China, India) | 2025-2033 |

| Rising Demand for Lightweight & Fuel-Efficient Aircraft | +1.2% | Global | 2025-2033 |

| Technological Advancements in Avionics & Electrical Systems | +1.0% | North America, Europe | 2025-2033 |

| Expansion of Unmanned Aerial Vehicle (UAV) Applications | +0.8% | Global, particularly North America, Asia Pacific | 2025-2033 |

Aerospace Wiring Harness Market Restraints Analysis

The aerospace wiring harness market faces significant restraints primarily due to the industry's stringent regulatory standards and the exceptionally long certification processes. Aviation authorities such as the FAA and EASA impose rigorous requirements for every component used in aircraft, especially critical systems like wiring harnesses, to ensure maximum safety and reliability. Compliance involves extensive testing, documentation, and validation, which not only extends the product development cycle but also substantially increases research and development costs. This barrier to entry can deter new players and slow down the adoption of innovative, but unproven, technologies.

Another major restraint is the high cost associated with advanced materials and complex manufacturing processes. The demand for lightweight, high-performance, and durable harnesses often necessitates the use of specialized alloys, high-performance plastics, and fiber optic components, which are inherently expensive. Furthermore, the precision manufacturing required for intricate harness assemblies, coupled with the need for highly skilled labor, contributes to elevated production costs. These high costs can put upward pressure on prices, potentially impacting the affordability of new aircraft programs or forcing manufacturers to seek cost-cutting measures, which might compromise technological advancements or quality if not managed carefully. The volatility in raw material prices further exacerbates this cost pressure, impacting profit margins for harness manufacturers.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Stringent Regulatory Standards & Certification Processes | -1.5% | Global | 2025-2033 |

| High Cost of Advanced Materials & Manufacturing | -1.2% | Global | 2025-2033 |

| Supply Chain Vulnerabilities & Geopolitical Instability | -0.9% | Global | Short to Mid-Term (2025-2029) |

| Skilled Labor Shortages in Manufacturing & Engineering | -0.7% | North America, Europe | 2025-2033 |

Aerospace Wiring Harness Market Opportunities Analysis

Significant opportunities in the aerospace wiring harness market are emerging from the burgeoning Urban Air Mobility (UAM) and electric vertical takeoff and landing (eVTOL) aircraft sectors. These nascent industries are poised for substantial growth, driven by advancements in battery technology, distributed electric propulsion, and the quest for sustainable urban transport solutions. As eVTOLs and UAM vehicles enter various stages of development and certification, they will require highly specialized, compact, and lightweight wiring harnesses tailored for electric propulsion systems, complex flight controls, and advanced avionics in confined spaces. This presents a greenfield opportunity for wiring harness manufacturers to innovate and secure early partnerships with leading UAM developers.

Another compelling opportunity lies in the increasing adoption of More Electric Aircraft (MEA) concepts across both commercial and military platforms. MEA designs aim to replace traditional hydraulic and pneumatic systems with electrical equivalents, leading to improved fuel efficiency, reduced maintenance, and simplified aircraft architecture. This paradigm shift necessitates a complete overhaul of aircraft electrical systems, driving demand for advanced wiring harnesses capable of handling higher power loads, greater bandwidth, and more complex data integration. Furthermore, advancements in material science, such as the development of lightweight composites, nanotechnology, and improved insulation materials, offer opportunities to create next-generation harnesses that provide superior performance, reduced weight, and enhanced durability, addressing key industry demands for efficiency and reliability in a highly competitive market.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Emergence of Urban Air Mobility (UAM) & eVTOL Aircraft | +1.7% | North America, Europe, Asia Pacific | 2027-2033 |

| Increased Adoption of More Electric Aircraft (MEA) Concepts | +1.4% | Global | 2025-2033 |

| Advancements in Material Science for Lighter, Durable Harnesses | +1.1% | Global | 2025-2033 |

| Demand for High-Speed Data Transmission & Fiber Optics | +0.9% | Global | 2025-2033 |

| Growth in Space Exploration & Satellite Constellations | +0.7% | North America, Europe, Asia Pacific | 2026-2033 |

Aerospace Wiring Harness Market Challenges Impact Analysis

The aerospace wiring harness market is confronted with significant challenges, notably the complex integration requirements with evolving aircraft systems. As aircraft become increasingly sophisticated, incorporating advanced avionics, interconnected digital systems, and electric propulsion, the wiring harnesses must seamlessly integrate with these diverse technologies. This complexity demands highly customized and intricate designs, leading to longer development cycles and higher engineering costs. Ensuring electromagnetic compatibility (EMC) and signal integrity across a vast network of wires within a confined airframe poses a continuous technical hurdle, requiring advanced shielding and routing solutions.

Another critical challenge involves maintaining reliability and integrity in extreme operating environments. Aerospace wiring harnesses are subjected to a harsh combination of fluctuating temperatures, high vibrations, moisture, chemical exposure, and pressure variations. Designing and manufacturing harnesses that can consistently perform under such demanding conditions over decades of aircraft lifespan requires rigorous material selection, robust construction, and extensive testing. Furthermore, the pervasive threat of cybersecurity in interconnected aircraft systems presents a growing challenge, as harnesses are critical conduits for data. Protecting these pathways from malicious intrusion and ensuring data integrity is paramount, adding layers of complexity to design and validation, and necessitating continuous innovation in secure wiring solutions to mitigate potential vulnerabilities in an increasingly networked aerospace ecosystem.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Complexity of System Integration & Interoperability | -1.3% | Global | 2025-2033 |

| Ensuring Reliability & Performance in Extreme Environments | -1.0% | Global | 2025-2033 |

| Cybersecurity Threats to Connected Aircraft Systems | -0.8% | Global | 2025-2033 |

| Pressure to Reduce Cost while Maintaining High Quality | -0.7% | Global | 2025-2033 |

| Managing Obsolescence of Components & Materials | -0.6% | Global | Mid to Long-Term (2027-2033) |

Aerospace Wiring Harness Market - Updated Report Scope

This report provides an in-depth analysis of the global aerospace wiring harness market, offering comprehensive insights into market dynamics, segmentation, and regional trends. It covers the historical performance, current market size, and future growth projections, identifying key drivers, restraints, opportunities, and challenges shaping the industry. The scope encompasses detailed analyses of various product types, applications, and end-user segments, alongside a competitive landscape assessment of major market participants.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 1.80 Billion |

| Market Forecast in 2033 | USD 3.00 Billion |

| Growth Rate | 6.5% |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Safran S. A., Latecoere, Carlisle Interconnect Technologies, TE Connectivity, Collins Aerospace (Raytheon Technologies), Amphenol Corporation, Dassault Aviation, Esterline Technologies (now part of TransDigm Group), GKN Aerospace, Honeywell International Inc., Nexans, LEONI AG, Loos & Co., Inc., Prysmian Group, STREIT Group, Thales Group, Sumitomo Electric Industries, Ltd., ITT Inc., Axon' Cable S.A., Glenair, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The aerospace wiring harness market is segmented comprehensively to provide granular insights into its diverse components and applications. This segmentation allows for a detailed understanding of how different types of harnesses cater to specific aircraft systems, the varying demands across different aircraft platforms, and the distinct requirements of the original equipment manufacturing versus the aftermarket sectors. Analyzing these segments helps stakeholders identify high-growth areas, allocate resources effectively, and tailor their product development strategies to meet specific market needs.

The intricate nature of aerospace applications necessitates a multi-faceted approach to market analysis, differentiating between power harnesses vital for electrical distribution, data transmission harnesses for critical communication, and specialized fiber optic harnesses for high-bandwidth needs. Furthermore, the market is dissected by the specific aircraft section where the harness is installed, such as avionics or engine systems, reflecting the unique environmental and performance demands of each area. This detailed segmentation offers a robust framework for assessing market dynamics and identifying strategic growth opportunities across the entire aerospace value chain.

- By Type:

- Power Harness: For electrical power distribution.

- Data Transmission Harness: For transferring data signals.

- Control Harness: For managing aircraft control systems.

- Fiber Optic Harness: For high-speed data and light transmission.

- Hybrid Harness: Combining multiple functionalities (e.g., power and data).

- By Application:

- Avionics: For flight control, navigation, and communication systems.

- Engine Systems: For engine management, ignition, and monitoring.

- Airframe: For general aircraft structure and system integration.

- Landing Gear: For retractable mechanisms, braking, and steering.

- Electrical and Lighting Systems: For internal and external lighting, and power outlets.

- Communication Systems: For internal and external voice and data communication.

- Cabin Interiors: For in-flight entertainment, seating, and galley systems.

- By Aircraft Type:

- Commercial Aircraft:

- Narrow-Body Aircraft

- Wide-Body Aircraft

- Regional Jets

- Military Aircraft:

- Fighter Jets

- Transport Aircraft

- Helicopters (Military)

- Special Mission Aircraft

- Business Jets

- Helicopters (Commercial)

- Unmanned Aerial Vehicles (UAVs)

- Urban Air Mobility (UAM) / eVTOL

- By End-Use:

- Original Equipment Manufacturer (OEM): For new aircraft assembly.

- Aftermarket (MRO - Maintenance, Repair, and Overhaul): For repairs, replacements, and upgrades.

Regional Highlights

The aerospace wiring harness market exhibits distinct regional dynamics driven by varying levels of aerospace manufacturing, defense spending, and air travel growth. North America, particularly the United States, holds a dominant position due to the presence of major aircraft manufacturers, significant defense contractors, and extensive MRO activities. The region's robust research and development ecosystem also fosters innovation in advanced harness technologies. This strong foundation ensures a sustained demand for high-performance wiring harnesses across commercial, military, and emerging aerospace sectors.

Europe represents another key region, supported by leading aircraft OEMs and a strong network of Tier 1 and Tier 2 suppliers. Countries such as France, Germany, and the UK are at the forefront of aerospace manufacturing and technological development, driving demand for sophisticated wiring solutions. The Asia Pacific region is projected to experience the highest growth rate, fueled by rapid expansion in commercial aviation, increasing defense budgets in countries like China and India, and a burgeoning domestic aircraft manufacturing industry. Latin America and the Middle East and Africa regions are expected to demonstrate steady growth, primarily influenced by fleet modernization efforts, increasing air traffic, and strategic defense investments.

- North America: Dominant market share due to the presence of major aircraft manufacturers (e.g., Boeing, Lockheed Martin), high defense spending, and a well-established MRO sector. Strong focus on R&D for advanced and lightweight harness solutions.

- Europe: Significant market contributor with key players like Airbus and a robust aerospace supply chain (e.g., France, Germany, UK). Emphasis on innovation, electrification, and sustainable aviation technologies driving harness demand.

- Asia Pacific (APAC): Fastest-growing region, driven by expanding commercial aviation fleets, rising passenger traffic, and increasing defense expenditures in countries like China, India, and Japan. Growing domestic aircraft manufacturing capabilities further fuel market expansion.

- Latin America: Emerging market with increasing demand for new aircraft deliveries and MRO services, particularly in Brazil and Mexico. Gradual fleet modernization efforts contribute to market growth.

- Middle East and Africa (MEA): Steady growth attributed to increasing commercial air travel, significant investments in defense capabilities, and the establishment of new MRO facilities. Emphasis on security and modernization drives demand for advanced military aircraft harnesses.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aerospace Wiring Harness Market.

- Safran S. A.

- Latecoere

- Carlisle Interconnect Technologies

- TE Connectivity

- Collins Aerospace (Raytheon Technologies)

- Amphenol Corporation

- Dassault Aviation

- Esterline Technologies (now part of TransDigm Group)

- GKN Aerospace

- Honeywell International Inc.

- Nexans

- LEONI AG

- Loos & Co., Inc.

- Prysmian Group

- STREIT Group

- Thales Group

- Sumitomo Electric Industries, Ltd.

- ITT Inc.

- Axon' Cable S.A.

- Glenair, Inc.

Frequently Asked Questions

Common user questions about the Aerospace Wiring Harness market often seek clarity on market size, growth drivers, technological advancements, and the competitive landscape. Users frequently inquire about the future outlook for the market, key applications within aircraft, and the specific challenges faced by manufacturers. These questions reflect a broad interest in understanding the core dynamics and emerging trends impacting this critical aerospace component sector.

What is the projected growth rate for the Aerospace Wiring Harness Market?

The Aerospace Wiring Harness Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2025 and 2033. This indicates a consistent and healthy expansion driven by various industry factors.

What factors are primarily driving the growth of this market?

Key drivers include the increasing global demand for new commercial and military aircraft, the ongoing modernization of existing fleets, the imperative for lightweight and fuel-efficient aircraft designs, and advancements in avionics and electrical systems, including the growth of More Electric Aircraft (MEA) concepts.

How does AI impact the Aerospace Wiring Harness industry?

AI significantly impacts the industry by optimizing design processes for efficiency and weight reduction, automating quality inspection to enhance reliability, enabling predictive maintenance for in-service harnesses, and streamlining manufacturing workflows. AI-driven insights contribute to more robust and cost-effective solutions.

Which regions are key contributors to the Aerospace Wiring Harness Market?

North America holds a dominant market share due to its established aerospace manufacturing base and high defense spending. Europe is another significant contributor, while the Asia Pacific region is expected to exhibit the fastest growth owing to increasing aircraft demand and defense investments.

What are the main challenges faced by manufacturers in this market?

Manufacturers face challenges such as stringent regulatory standards and lengthy certification processes, the high cost of advanced materials and complex manufacturing techniques, ensuring reliability in extreme operating environments, and managing the increasing complexity of system integration within modern aircraft designs.