Aerospace and Defense Chemical Distribution Market

Aerospace and Defense Chemical Distribution Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_705040 | Last Updated : August 11, 2025 |

Format : ![]()

![]()

![]()

![]()

Aerospace and Defense Chemical Distribution Market Size

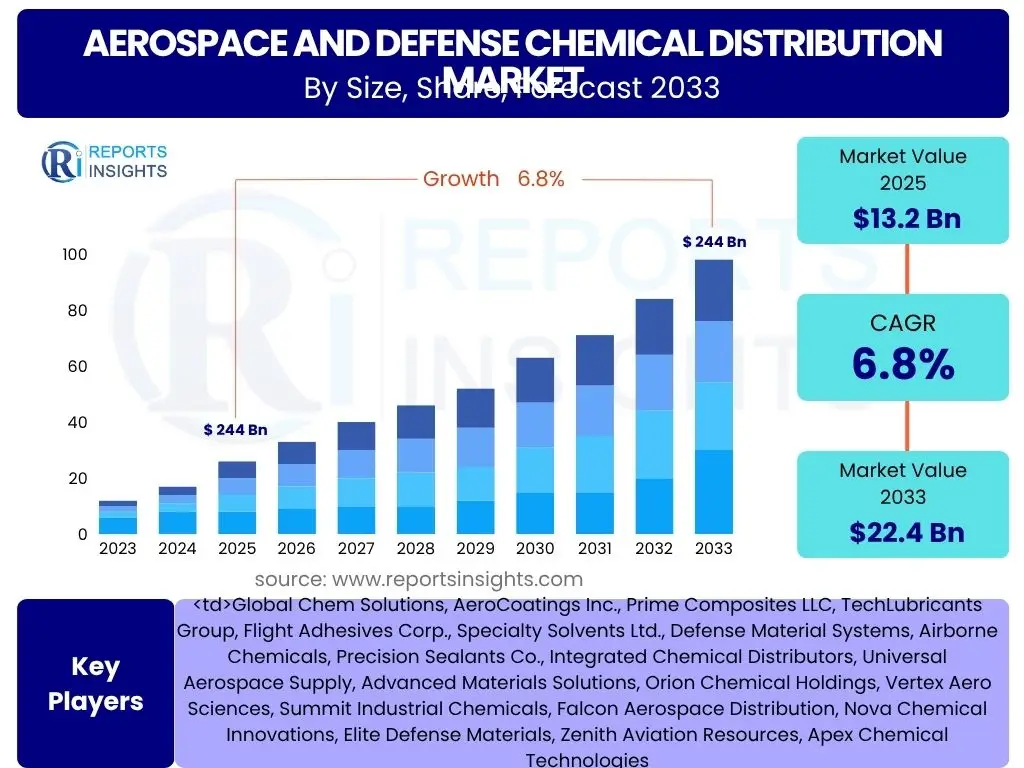

According to Reports Insights Consulting Pvt Ltd, The Aerospace and Defense Chemical Distribution Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2033. The market is estimated at USD 13.2 billion in 2025 and is projected to reach USD 22.4 billion by the end of the forecast period in 2033. This growth trajectory reflects the robust demand from both commercial aviation and defense sectors, driven by increasing aircraft fleet sizes, extensive maintenance, repair, and overhaul (MRO) activities, and advancements in material science requiring specialized chemical inputs.

The market's expansion is intrinsically linked to global macroeconomic stability and geopolitical dynamics, which influence defense spending and commercial aerospace investment. Specialized chemicals, including high-performance adhesives, sealants, coatings, and lubricants, are indispensable for ensuring the structural integrity, operational efficiency, and longevity of aerospace and defense assets. The sustained innovation in these chemical formulations, coupled with stringent regulatory requirements for safety and environmental compliance, further underpins the market's value proposition.

Key Aerospace and Defense Chemical Distribution Market Trends & Insights

The Aerospace and Defense Chemical Distribution market is undergoing significant transformation, driven by a confluence of technological advancements, evolving regulatory landscapes, and a heightened focus on sustainability. Users frequently inquire about the integration of eco-friendly chemicals, the impact of advanced manufacturing techniques like additive manufacturing, and the role of digitalization in supply chain management. These queries highlight a market moving towards greater efficiency, reduced environmental footprint, and enhanced material performance. The shift towards lighter, more durable materials in aircraft construction, for instance, necessitates specialized chemical solutions, creating new niches and opportunities for distributors.

Moreover, the increasing complexity of modern aerospace and defense systems demands highly specialized chemical products with tailored properties, such as extreme temperature resistance, anti-corrosion capabilities, and advanced fire retardancy. This demand spurs innovation within the chemical industry, pushing distributors to offer more sophisticated product portfolios and value-added services, including technical support and inventory management. The focus on life cycle management and extending the service life of assets also reinforces the demand for high-quality, durable chemical solutions, making long-term performance a key consideration for end-users.

- Emphasis on sustainable and eco-friendly chemical formulations.

- Rising adoption of advanced materials like composites and smart coatings.

- Digitalization of supply chains for enhanced transparency and efficiency.

- Growing demand for specialized chemicals for additive manufacturing processes.

- Increased focus on MRO activities driving demand for maintenance chemicals.

AI Impact Analysis on Aerospace and Defense Chemical Distribution

The integration of Artificial Intelligence (AI) within the Aerospace and Defense Chemical Distribution sector is a topic of growing interest, with users often questioning its potential to optimize logistics, enhance predictive maintenance, and revolutionize chemical formulation. Common themes include AI's role in demand forecasting, inventory optimization, and quality control, alongside concerns about data security and the need for specialized AI expertise. The expectation is that AI will streamline operations, reduce waste, and improve the overall responsiveness of the distribution network, leading to significant cost efficiencies and improved service delivery.

AI's analytical capabilities are particularly valuable in processing vast datasets related to chemical properties, usage patterns, and environmental conditions, enabling more precise application recommendations and troubleshooting. Furthermore, AI-powered systems can facilitate smarter procurement decisions by identifying optimal suppliers and predicting price fluctuations, thereby mitigating supply chain risks. While the adoption is still in its nascent stages for many market participants, the long-term vision involves fully autonomous distribution networks, predictive material degradation analysis, and AI-assisted new product development, fundamentally altering how chemicals are managed and utilized across the aerospace and defense value chain.

- Predictive demand forecasting and inventory optimization for chemicals.

- Enhanced quality control and anomaly detection in chemical batches.

- Optimized logistics and route planning for efficient chemical delivery.

- AI-driven insights for chemical formulation and material science research.

- Automated compliance monitoring for hazardous chemical regulations.

Key Takeaways Aerospace and Defense Chemical Distribution Market Size & Forecast

The Aerospace and Defense Chemical Distribution market is poised for significant and sustained growth, driven by an expanding global aircraft fleet, robust defense spending, and a perpetual need for high-performance materials in extreme operational environments. Key takeaways for stakeholders often revolve around identifying the most lucrative segments, understanding the impact of regulatory changes, and leveraging technological advancements for competitive advantage. The market's resilience is underscored by its essential role in maintaining the operational readiness and safety of critical aerospace and defense assets, making it relatively immune to broader economic fluctuations compared to other industrial sectors.

Moreover, the increasing emphasis on sustainability and the development of next-generation aircraft and defense platforms will continue to shape demand patterns, favoring distributors capable of supplying innovative, environmentally compliant, and high-performance chemical solutions. Strategic partnerships and investments in digital capabilities are also emerging as crucial elements for market players seeking to enhance efficiency and responsiveness in a complex global supply chain. The underlying forecast indicates a robust trajectory, suggesting ample opportunities for both established players and new entrants specializing in niche chemical applications.

- Market demonstrates robust growth potential, driven by commercial and military aerospace.

- MRO segment is a significant growth engine due to aging fleets and operational intensity.

- Asia Pacific is emerging as a key growth region for chemical demand.

- Sustainability initiatives are reshaping product offerings and supply chain practices.

- Technological advancements in materials science continue to expand chemical applications.

Aerospace and Defense Chemical Distribution Market Drivers Analysis

The Aerospace and Defense Chemical Distribution market is primarily propelled by several fundamental factors, including the increasing global demand for new aircraft, continuous expansion of maintenance, repair, and overhaul (MRO) activities, and escalating defense budgets across various nations. The growth in air passenger traffic and cargo volumes necessitates the production of more commercial aircraft, each requiring a diverse array of specialized chemicals for manufacturing, assembly, and ongoing maintenance. Concurrently, the imperative to maintain aging fleets and ensure the operational readiness of military assets fuels consistent demand for chemicals used in MRO operations.

Furthermore, technological advancements in materials science and engineering are driving the development and adoption of high-performance chemical formulations. These include advanced composites, specialized coatings, and sophisticated lubricants that enhance durability, reduce weight, and improve fuel efficiency for aerospace platforms. Stringent safety regulations and performance standards in both civil aviation and defense sectors also mandate the use of certified, high-quality chemicals, thereby bolstering market demand and ensuring a steady revenue stream for distributors specializing in compliant products.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Commercial Aircraft Deliveries | +1.8% | North America, Europe, Asia Pacific (China, India) | 2025-2033 |

| Rising Defense Spending Globally | +1.5% | North America (USA), Europe (NATO), Asia Pacific (China, India) | 2025-2033 |

| Expansion of MRO Activities | +1.3% | Global, particularly emerging MRO hubs | 2025-2033 |

| Advancements in Material Science | +1.2% | Global, particularly developed economies | 2025-2033 |

| Stringent Regulatory Compliance and Safety Standards | +1.0% | Global, highly regulated regions | 2025-2033 |

Aerospace and Defense Chemical Distribution Market Restraints Analysis

Despite robust growth prospects, the Aerospace and Defense Chemical Distribution market faces several significant restraints that could impede its expansion. One primary challenge is the volatility of raw material prices, which can directly impact the cost of chemical production and, consequently, the final product prices. Fluctuations in the cost of petroleum-based derivatives and other key chemical inputs create pricing instability for distributors and manufacturers, potentially leading to reduced profit margins or increased costs for end-users, thus affecting overall market demand.

Moreover, the highly regulated nature of the aerospace and defense industries, especially concerning environmental and safety standards, imposes considerable compliance burdens. Stringent regulations related to hazardous chemicals, emissions, and waste disposal necessitate significant investments in research, development, and infrastructure to ensure adherence, which can increase operational costs and limit the adoption of certain chemical types. Geopolitical instability and trade protectionism further add to market complexities by disrupting global supply chains and creating barriers to international trade, impacting the seamless distribution of chemicals worldwide.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Volatile Raw Material Prices | -1.0% | Global | Short to Medium Term |

| Stringent Environmental Regulations | -0.8% | Europe, North America, parts of Asia | Ongoing |

| Supply Chain Disruptions and Logistics Challenges | -0.7% | Global, particularly vulnerable regions | Short to Medium Term |

| High R&D and Certification Costs | -0.6% | Global | Long Term |

| Economic Downturns and Budget Constraints | -0.5% | Global, highly dependent on national economies | Event-driven |

Aerospace and Defense Chemical Distribution Market Opportunities Analysis

The Aerospace and Defense Chemical Distribution market presents a multitude of growth opportunities, primarily driven by the increasing demand for sustainable chemical solutions and the ongoing digitalization of supply chain operations. The aerospace industry's commitment to reducing its environmental footprint is creating a strong impetus for the development and adoption of bio-based chemicals, low-VOC coatings, and non-chrome sealants. Distributors capable of offering a diverse portfolio of environmentally responsible products will gain a significant competitive edge and address a burgeoning market segment seeking greener alternatives without compromising performance.

Moreover, the expansion into emerging markets, particularly in Asia Pacific and Latin America, offers substantial untapped potential. These regions are witnessing significant investments in commercial aviation infrastructure and increasing defense modernization programs, translating into higher demand for aerospace and defense chemicals. Furthermore, the development of smart factories and the integration of Industry 4.0 technologies within the aerospace manufacturing sector create opportunities for distributors to provide integrated supply chain solutions, leveraging data analytics and automation to enhance efficiency and customer service, moving beyond traditional product distribution to value-added service provision.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growing Demand for Sustainable Chemicals | +1.5% | Global, particularly Europe, North America | 2025-2033 |

| Expansion into Emerging Markets | +1.3% | Asia Pacific (India, Southeast Asia), Latin America | 2025-2033 |

| Digitalization of Supply Chains and E-commerce | +1.2% | Global | 2025-2033 |

| Development of Advanced Composites and Materials | +1.0% | Global | 2025-2033 |

| Increased Focus on Space Exploration Programs | +0.8% | North America, Europe, Asia Pacific (China, India) | 2025-2033 |

Aerospace and Defense Chemical Distribution Market Challenges Impact Analysis

The Aerospace and Defense Chemical Distribution market is confronted by several complex challenges that necessitate strategic navigation from market participants. One significant hurdle is the intense competition and price sensitivity within various market segments, where end-users often seek cost-effective solutions without compromising performance or regulatory compliance. This competitive pressure can lead to margin erosion for distributors, especially in commoditized chemical categories, pushing them to differentiate through specialized services or niche product offerings.

Furthermore, managing the intricate global supply chain for aerospace and defense chemicals is a perpetual challenge due to the specialized nature of products, strict handling and storage requirements, and geopolitical risks. Ensuring timely delivery, maintaining product integrity across vast distances, and navigating customs regulations add layers of complexity and cost. The continuous evolution of regulatory frameworks, particularly those related to chemical registration, hazardous material transport, and environmental impact, also demands constant vigilance and investment in compliance, posing a significant operational burden for distributors operating across multiple jurisdictions.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Intense Competition and Price Sensitivity | -1.2% | Global | Ongoing |

| Complex Regulatory Compliance and Certification | -1.0% | Global, highly regulated regions | Ongoing |

| Supply Chain Vulnerabilities and Geopolitical Risks | -0.9% | Global, particularly volatile regions | Short to Medium Term |

| Technological Obsolescence and Innovation Pace | -0.7% | Global | Medium to Long Term |

| Shortage of Skilled Labor in Chemical Handling | -0.6% | North America, Europe | Ongoing |

Aerospace and Defense Chemical Distribution Market - Updated Report Scope

This comprehensive market research report provides an in-depth analysis of the Aerospace and Defense Chemical Distribution Market, offering a detailed understanding of its size, growth trajectory, key trends, drivers, restraints, opportunities, and challenges. The scope encompasses a thorough examination of various product types, applications, and end-users across key geographical regions. It aims to furnish stakeholders with actionable insights to inform strategic decision-making, identify lucrative market segments, and anticipate future market dynamics in this specialized industrial domain.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 13.2 Billion |

| Market Forecast in 2033 | USD 22.4 Billion |

| Growth Rate | 6.8% CAGR |

| Number of Pages | 247 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Global Chem Solutions, AeroCoatings Inc., Prime Composites LLC, TechLubricants Group, Flight Adhesives Corp., Specialty Solvents Ltd., Defense Material Systems, Airborne Chemicals, Precision Sealants Co., Integrated Chemical Distributors, Universal Aerospace Supply, Advanced Materials Solutions, Orion Chemical Holdings, Vertex Aero Sciences, Summit Industrial Chemicals, Falcon Aerospace Distribution, Nova Chemical Innovations, Elite Defense Materials, Zenith Aviation Resources, Apex Chemical Technologies |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Aerospace and Defense Chemical Distribution market is meticulously segmented to provide a granular understanding of its diverse components and drivers. This segmentation allows for precise analysis of demand patterns, technological preferences, and growth opportunities across various product types, applications, end-user categories, and distribution channels. Understanding these segments is crucial for market participants to tailor their strategies, optimize product portfolios, and target specific niches within the expansive aerospace and defense sectors.

The breakdown by product type highlights the specific chemical formulations essential for various functions, from structural bonding to surface protection and operational efficiency. Application-based segmentation underscores the differing chemical needs between manufacturing and MRO, as well as across air, space, and ground defense platforms. End-user classification differentiates demand from commercial versus military or space entities, each with unique requirements and procurement processes. Lastly, analyzing distribution channels reveals the most effective pathways for chemical products to reach end-users, reflecting shifts towards digital platforms and direct engagement in a highly specialized market.

- By Product Type: Adhesives, Sealants, Coatings, Lubricants, Cleaners, Solvents, Composites, Specialty Additives.

- By Application: Aircraft Manufacturing (Commercial, Military), Maintenance, Repair, and Overhaul (MRO), Spacecraft and Satellite Manufacturing, Missiles and Ammunition, Defense Ground Vehicles, Naval Vessels.

- By End-User: Commercial Aviation, Military & Defense, Space Exploration & Satellite, General Aviation.

- By Distribution Channel: Direct Sales, Distributors, Online Channels (E-commerce Platforms, B2B Portals).

Regional Highlights

- North America: This region dominates the Aerospace and Defense Chemical Distribution market, driven by the presence of major aircraft manufacturers, a robust defense industry, and extensive MRO infrastructure. The United States, in particular, is a significant contributor due to high defense spending, a large commercial aircraft fleet, and strong research and development in advanced aerospace materials. Stringent regulatory frameworks and a focus on high-performance chemical solutions further solidify its market leadership. The demand for specialized adhesives, sealants, and coatings is consistently high, supported by ongoing aerospace programs and a mature supply chain network.

- Europe: Europe represents a substantial market share, characterized by its advanced aerospace manufacturing capabilities, significant defense budgets, and a strong emphasis on environmental regulations. Countries like France, Germany, and the United Kingdom are key players, with major aircraft and defense contractors driving demand for specialized chemicals. The region is also at the forefront of sustainable chemical innovation, fostering the adoption of eco-friendly and low-VOC products. The MRO sector is well-established, contributing significantly to the demand for maintenance chemicals, while collaborative defense initiatives ensure a steady need for military-grade formulations.

- Asia Pacific (APAC): The Asia Pacific region is projected to be the fastest-growing market, primarily due to expanding commercial aviation fleets, increasing defense modernization programs, and growing domestic aircraft manufacturing capabilities, especially in China and India. Rapid urbanization, rising disposable incomes, and the expansion of low-cost carriers are fueling unprecedented demand for new aircraft. Consequently, this drives the need for aerospace-grade chemicals for both manufacturing and MRO. Investment in space programs and defense capabilities by regional powers further accelerates market growth, making APAC a critical growth hub for chemical distributors.

- Latin America: This region presents emerging opportunities, driven by increasing commercial aircraft deliveries and modest but growing defense spending. Countries such as Brazil and Mexico are leading the demand, supported by their developing aerospace industries and MRO facilities. While smaller in market size compared to North America or Europe, the region's long-term growth potential is significant as its aviation sector matures and defense modernization efforts continue. The focus is often on cost-effective yet reliable chemical solutions for fleet maintenance and upgrades.

- Middle East and Africa (MEA): The MEA region is characterized by substantial investments in commercial aviation infrastructure, driven by major airline hubs and a strategic geographical location. Significant defense spending, particularly in the Middle East, also contributes to market demand for military-grade chemicals. While the market is still developing, the long-term outlook is positive due to ongoing fleet expansion, MRO facility development, and strategic defense partnerships. The demand is often for high-performance and robust chemical solutions suitable for extreme climatic conditions and demanding operational environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aerospace and Defense Chemical Distribution Market.- Global Chem Solutions

- AeroCoatings Inc.

- Prime Composites LLC

- TechLubricants Group

- Flight Adhesives Corp.

- Specialty Solvents Ltd.

- Defense Material Systems

- Airborne Chemicals

- Precision Sealants Co.

- Integrated Chemical Distributors

- Universal Aerospace Supply

- Advanced Materials Solutions

- Orion Chemical Holdings

- Vertex Aero Sciences

- Summit Industrial Chemicals

- Falcon Aerospace Distribution

- Nova Chemical Innovations

- Elite Defense Materials

- Zenith Aviation Resources

- Apex Chemical Technologies

Frequently Asked Questions

Analyze common user questions about the Aerospace and Defense Chemical Distribution market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Aerospace and Defense Chemical Distribution market?

The market's growth is primarily driven by increasing global aircraft production, rising defense expenditures, extensive maintenance, repair, and overhaul (MRO) activities, and the continuous demand for advanced, high-performance chemical materials in aerospace and defense applications.

How is sustainability impacting the Aerospace and Defense Chemical Distribution market?

Sustainability is a significant driver, leading to increased demand for eco-friendly and bio-based chemical formulations, low-VOC coatings, and non-chrome products. Distributors are focusing on offering greener alternatives to meet stringent environmental regulations and industry commitments to reduce carbon footprints.

What role does AI play in the Aerospace and Defense Chemical Distribution sector?

AI is increasingly being adopted for optimizing supply chain logistics, enhancing predictive maintenance capabilities, improving demand forecasting, and streamlining inventory management. It aids in data analysis for quality control and can accelerate R&D for new chemical formulations, leading to greater operational efficiency and cost savings.

Which regions are expected to show the most significant growth in this market?

The Asia Pacific region is projected to exhibit the fastest growth, propelled by robust commercial aviation expansion, increasing defense modernization efforts, and growing domestic aircraft manufacturing in countries like China and India. North America and Europe will continue to hold significant market shares due to established aerospace industries.

What are the key challenges faced by the Aerospace and Defense Chemical Distribution market?

Major challenges include volatile raw material prices, complex and stringent regulatory compliance for hazardous chemicals, potential supply chain disruptions, intense market competition, and the high costs associated with research, development, and certification of specialized aerospace and defense chemicals.