Data Center Colocation Market

Data Center Colocation Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_704905 | Last Updated : August 11, 2025 |

Format : ![]()

![]()

![]()

![]()

Data Center Colocation Market Size

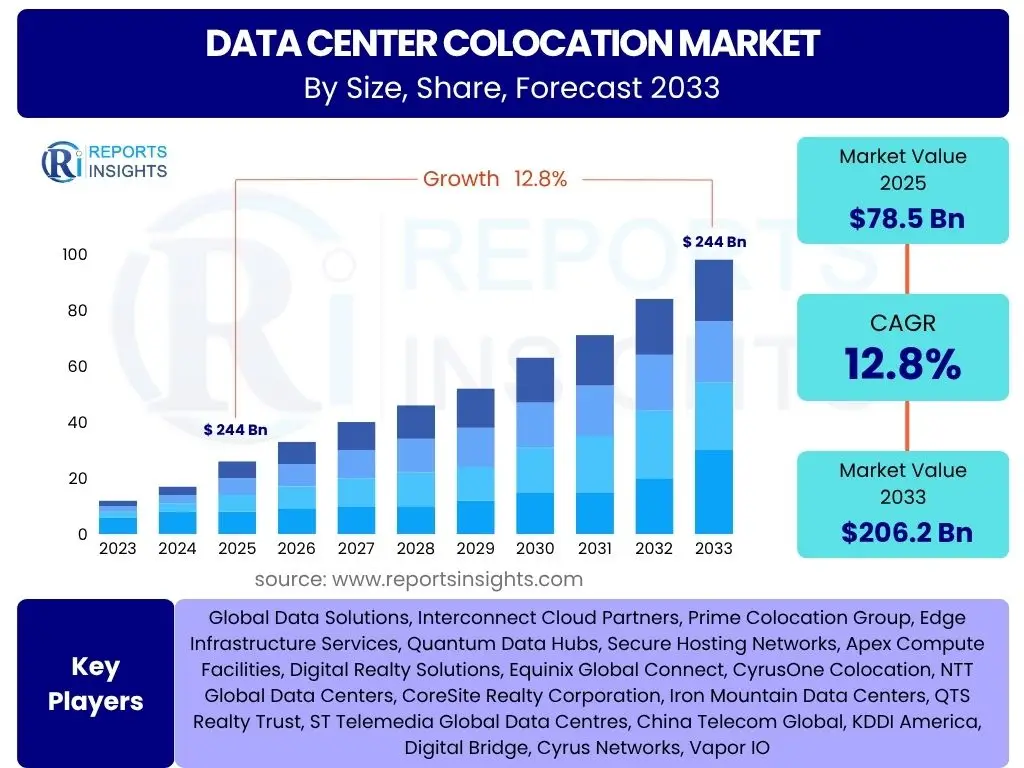

According to Reports Insights Consulting Pvt Ltd, The Data Center Colocation Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.8% between 2025 and 2033. The market is estimated at USD 78.5 billion in 2025 and is projected to reach USD 206.2 billion by the end of the forecast period in 2033.

Key Data Center Colocation Market Trends & Insights

The data center colocation market is experiencing transformative shifts driven by global digital expansion and evolving enterprise IT strategies. Common inquiries from users revolve around how cloud adoption, the proliferation of edge computing, and increasing demands for specialized infrastructure are reshaping the landscape. There is significant interest in the shift towards hybrid IT environments, where organizations balance on-premises resources with cloud services and colocation facilities to optimize performance, cost, and security. Additionally, the market is seeing a growing emphasis on sustainability and energy efficiency, pushing providers to innovate in power management and cooling technologies to meet environmental, social, and governance (ESG) objectives.

Another key area of interest is the impact of emerging technologies like Artificial Intelligence (AI), Machine Learning (ML), and the Internet of Things (IoT) on colocation demand. These technologies require high-density power, advanced cooling, and low-latency connectivity, compelling colocation providers to upgrade their infrastructure and offer more specialized services. Users are also keen on understanding the role of hyperscale providers and the increasing strategic partnerships between colocation companies and cloud giants, which further blurs the lines between traditional hosting and integrated cloud solutions. This evolution underscores a market moving towards greater customization, higher performance capabilities, and a stronger focus on resilient and secure infrastructure.

- Surging demand for hybrid cloud strategies driving colocation adoption.

- Rapid expansion of edge computing infrastructure for low-latency applications.

- Growing focus on sustainability, renewable energy, and energy efficiency in data centers.

- Increasing adoption of high-performance computing (HPC) and AI/ML workloads demanding higher power densities.

- Emphasis on enhanced connectivity, including direct cloud access and robust network interconnections.

AI Impact Analysis on Data Center Colocation

User inquiries frequently center on the profound impact of Artificial Intelligence (AI) on the data center colocation sector. A primary concern is how AI workloads, characterized by their high computational intensity, will drive demand for specialized colocation services. This includes the need for significantly higher power densities per rack, advanced cooling solutions like liquid cooling, and robust, low-latency network connectivity to support large-scale AI model training and inference. Many users are curious about the infrastructure upgrades colocation providers must undertake to remain competitive and cater to AI-driven enterprises, distinguishing them from standard colocation offerings.

Furthermore, there is keen interest in whether AI represents a new revenue stream or a significant operational challenge for colocation providers. The operational efficiencies that AI itself can bring to data center management, such as predictive maintenance, optimized energy consumption, and automated resource allocation, are also a focus of user questions. Conversely, concerns about the environmental footprint of AI, particularly its energy consumption, are prompting discussions on how colocation providers can integrate sustainable practices while meeting the intense power demands of AI. The consensus indicates that AI is a critical growth driver, compelling colocation facilities to evolve rapidly to support next-generation computing requirements.

- Significant increase in power density requirements per rack for AI workloads.

- Accelerated demand for advanced cooling technologies, including liquid and direct-to-chip cooling.

- Requirement for enhanced network infrastructure to support high-speed data transfer for AI processing.

- Opportunity for colocation providers to offer specialized AI-ready infrastructure and managed services.

- Potential for AI to optimize data center operations, including energy management and predictive maintenance.

Key Takeaways Data Center Colocation Market Size & Forecast

Users frequently seek concise insights into the most critical aspects of the data center colocation market's future. A central takeaway is the sustained, robust growth projected for the market, driven by the relentless pace of digital transformation across industries. The forecast highlights that colocation remains a strategic choice for enterprises seeking scalable, secure, and cost-effective IT infrastructure without the capital expenditure and operational burden of building and maintaining their own facilities. The increasing complexity of IT environments, coupled with the need for reliable uptime and global reach, reinforces the value proposition of colocation services. This trajectory indicates a flourishing market well into the next decade.

Another significant insight derived from market size and forecast analysis is the expanding role of colocation in enabling emerging technologies. The market's growth is not merely organic but is significantly bolstered by the foundational requirements of technologies such as artificial intelligence, 5G networks, and the burgeoning edge computing paradigm. These innovations demand specialized infrastructure that colocation providers are uniquely positioned to offer, making them indispensable partners for technological advancement. Consequently, the market is poised for expansion, characterized by a shift towards more specialized, high-density, and interconnected facilities capable of supporting the next wave of digital innovation. The emphasis on sustainability and energy efficiency will also become a critical differentiator and a key driver of future investment in the sector.

- The data center colocation market is poised for significant and sustained growth through 2033.

- Digital transformation initiatives and cloud adoption continue to be primary market accelerators.

- Emerging technologies, especially AI and edge computing, are creating new demand for specialized colocation infrastructure.

- Increased focus on energy efficiency and sustainable practices is becoming a critical competitive factor.

- Strategic partnerships between colocation providers and hyperscale cloud operators are shaping market dynamics.

Data Center Colocation Market Drivers Analysis

The data center colocation market is significantly propelled by several macro and micro-economic factors, primarily stemming from the pervasive digital transformation impacting nearly every industry worldwide. Enterprises are increasingly moving away from traditional on-premise data centers due to the high capital expenditure, operational complexities, and scalability limitations associated with them. Colocation offers a flexible, scalable, and cost-efficient alternative that allows businesses to focus on their core competencies while leveraging state-of-the-art infrastructure managed by experts. The global shift towards cloud-based services and hybrid IT architectures further fuels the demand for colocation, as it provides seamless connectivity and integration capabilities with public and private cloud environments, enabling organizations to optimize their IT footprints.

Furthermore, the exponential growth of data generated from various sources, including IoT devices, big data analytics, and multimedia content, necessitates robust and scalable storage and processing capabilities that colocation facilities are well-equipped to provide. The imperative for enhanced cybersecurity and disaster recovery solutions also drives colocation adoption, as these facilities offer superior physical security, redundant systems, and geographically diverse options that are often cost-prohibitive for individual enterprises to replicate. The rising need for high-performance computing (HPC) for complex workloads like AI, machine learning, and advanced analytics, which demand high power densities and specialized cooling, is creating a new segment of demand that colocation providers are uniquely positioned to serve, thus acting as a strong growth catalyst for the market.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Rapid Digital Transformation and Cloud Adoption | +3.5% | Global, particularly North America, Europe, APAC | Short to Mid-term (2025-2029) |

| Surge in Big Data, IoT, and AI/ML Workloads | +2.8% | Global, high impact in technologically advanced regions | Mid to Long-term (2027-2033) |

| Increased Focus on Data Security and Business Continuity | +2.0% | Global, especially regulated industries | Short to Mid-term (2025-2028) |

| Need for Scalability, Flexibility, and Cost Efficiency | +2.5% | Global, prominent in emerging and established markets | Short to Long-term (2025-2033) |

Data Center Colocation Market Restraints Analysis

Despite the robust growth projections, the data center colocation market faces several significant restraints that could temper its expansion. One of the primary concerns is the substantial initial capital expenditure required for building and equipping state-of-the-art colocation facilities. This high upfront investment can be a barrier for new entrants and can limit the pace of expansion for existing providers, especially in rapidly growing regions where demand outstrips supply. Furthermore, the rising costs of energy, particularly electricity, pose a considerable challenge, as data centers are inherently power-intensive. Volatile energy prices directly impact operational expenditures, which can erode profit margins for providers and potentially lead to increased service costs for end-users, thereby dampening demand.

Another significant restraint comes from the increasing complexity of regulatory compliance and environmental regulations. Data centers must adhere to stringent data privacy laws (e.g., GDPR, CCPA), industry-specific compliance standards (e.g., HIPAA, PCI DSS), and evolving environmental mandates aimed at reducing carbon footprints. Navigating this intricate web of regulations adds to operational overheads, requiring significant investments in governance, risk management, and compliance systems. Moreover, the long sales cycles and complex contractual negotiations often associated with large-scale colocation deals can delay market penetration and revenue realization. The perceived lack of direct control over infrastructure for some enterprises, compared to on-premise solutions, also remains a psychological barrier, influencing decision-making in favor of alternative solutions like public cloud services or private cloud deployments.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Capital Investment and Operational Costs | -1.5% | Global, particularly high-cost regions like Western Europe, North America | Short to Mid-term (2025-2029) |

| Stringent Regulatory Compliance and Environmental Mandates | -1.0% | Europe, North America, increasingly APAC | Mid to Long-term (2027-2033) |

| Competition from Hyperscale Cloud Providers | -1.2% | Global, especially for non-specialized workloads | Short to Long-term (2025-2033) |

| Limited Customization and Control for Some Enterprises | -0.8% | Global, particularly for large enterprises with unique needs | Short-term (2025-2027) |

Data Center Colocation Market Opportunities Analysis

The data center colocation market is rich with emerging opportunities that are poised to accelerate its growth trajectory. The proliferation of edge computing represents a significant avenue for expansion. As more data is generated and processed closer to its source, driven by IoT, autonomous vehicles, and real-time applications, there is an escalating need for smaller, distributed colocation facilities at the network edge. This allows colocation providers to offer low-latency services that cannot be efficiently delivered from centralized cloud data centers, creating new demand segments in urban centers and remote areas alike. Additionally, the growing focus on sustainability and corporate social responsibility creates an immense opportunity for providers to differentiate themselves by building and operating green data centers, leveraging renewable energy sources, and implementing highly efficient cooling technologies. This not only meets regulatory requirements but also appeals to environmentally conscious enterprises, unlocking new market segments.

Furthermore, the increasing complexity of modern IT infrastructure and the ongoing skill gap in managing advanced data center operations present an opportunity for colocation providers to expand their service offerings beyond basic space and power. Offering value-added managed services, such as network management, security services, disaster recovery planning, and even private cloud deployments, can significantly enhance their revenue streams and deepen customer relationships. The strategic partnership model with hyperscale cloud providers is another pivotal opportunity. By serving as interconnection hubs and hybrid cloud gateways, colocation facilities can provide direct, secure, and high-performance access to public cloud resources, catering to enterprises that require seamless integration of their on-premise, colocation, and public cloud environments. This positions colocation as an essential component of the evolving hybrid multicloud landscape, driving demand for robust and interconnected ecosystems.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Expansion into Edge Computing Facilities | +2.0% | Global, particularly urban and remote areas with high data generation | Mid to Long-term (2027-2033) |

| Development of Green and Sustainable Data Centers | +1.5% | Europe, North America, increasingly APAC | Mid to Long-term (2027-2033) |

| Offering Value-Added Managed Services | +1.8% | Global, especially for SMEs and enterprises seeking simplified IT operations | Short to Mid-term (2025-2029) |

| Strategic Partnerships with Hyperscale Cloud Providers | +1.7% | Global, particularly regions with high cloud adoption | Short to Long-term (2025-2033) |

Data Center Colocation Market Challenges Impact Analysis

The data center colocation market, while experiencing significant growth, is not without its formidable challenges. A primary concern is the escalating demand for power and the limitations of existing electrical grids to supply the immense energy required by modern, high-density data centers. This power scarcity can lead to delays in data center construction, restrict expansion plans, and even result in higher operational costs for providers forced to seek alternative, more expensive energy sources. Another critical challenge is the growing scarcity of skilled labor. The specialized nature of data center operations, requiring expertise in areas such as power engineering, cooling systems, network management, and cybersecurity, makes it difficult to find and retain qualified personnel. This talent gap can hinder operational efficiency, impact service quality, and increase labor costs, thus slowing market growth.

Furthermore, cybersecurity threats pose a constant and evolving challenge for colocation providers. As repositories of vast amounts of sensitive data, data centers are prime targets for cyberattacks, including ransomware, data breaches, and denial-of-service attacks. Maintaining robust security infrastructure, implementing advanced threat detection systems, and adhering to evolving security best practices require continuous investment and vigilance. Any security lapse can severely damage a provider's reputation and lead to significant financial and legal repercussions. Additionally, securing suitable land for new data center construction, especially in densely populated urban areas or regions with robust connectivity, is becoming increasingly challenging due to zoning restrictions, environmental concerns, and escalating real estate prices. These land acquisition difficulties can inflate project costs and extend development timelines, impacting the overall market's expansion capacity.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Power Scarcity and Grid Limitations | -1.3% | North America, Europe, parts of APAC | Short to Mid-term (2025-2029) |

| Shortage of Skilled Data Center Workforce | -1.1% | Global, particularly developed economies | Short to Long-term (2025-2033) |

| Evolving Cybersecurity Threats and Data Breaches | -0.9% | Global, critical for all regions | Short to Long-term (2025-2033) |

| Land Acquisition and Zoning Restrictions | -0.7% | Urban centers globally, key connectivity hubs | Short to Mid-term (2025-2029) |

Data Center Colocation Market - Updated Report Scope

This report offers a detailed and comprehensive analysis of the global Data Center Colocation Market, encompassing historical data from 2019 to 2023, a base year of 2024, and forward-looking projections up to 2033. It provides an in-depth examination of market size, growth drivers, restraints, opportunities, and challenges, alongside a thorough segmentation analysis and regional insights, designed to provide stakeholders with actionable intelligence for strategic decision-making in this evolving sector.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 78.5 billion |

| Market Forecast in 2033 | USD 206.2 billion |

| Growth Rate | 12.8% |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Global Data Solutions, Interconnect Cloud Partners, Prime Colocation Group, Edge Infrastructure Services, Quantum Data Hubs, Secure Hosting Networks, Apex Compute Facilities, Digital Realty Solutions, Equinix Global Connect, CyrusOne Colocation, NTT Global Data Centers, CoreSite Realty Corporation, Iron Mountain Data Centers, QTS Realty Trust, ST Telemedia Global Data Centres, China Telecom Global, KDDI America, Digital Bridge, Cyrus Networks, Vapor IO |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Data Center Colocation Market is meticulously segmented to provide a granular understanding of its diverse components and drivers. This segmentation allows for precise analysis of market dynamics across various service types, target industries, and enterprise sizes, reflecting the varied demands and adoption patterns within the global market. Understanding these segments is crucial for identifying key growth areas, competitive landscapes, and strategic opportunities for both providers and consumers of colocation services. Each segment exhibits unique characteristics and growth potentials, driven by specific technological needs and business priorities, thereby shaping the overall market trajectory.

- By Type:

- Retail Colocation: Catered primarily to smaller enterprises, offering shared data center infrastructure with flexible space options (e.g., racks, cages) and managed services.

- Wholesale Colocation: Designed for large enterprises, hyperscalers, or cloud providers, providing dedicated, larger spaces (e.g., full suites, entire halls) with greater control over infrastructure.

- By End-Use Industry:

- BFSI (Banking, Financial Services, and Insurance): Driven by stringent regulatory compliance, data security, and high transaction volumes.

- IT and Telecom: Characterized by high demand for connectivity, network optimization, and scalable infrastructure to support cloud and communication services.

- Healthcare: Focus on data privacy, regulatory adherence (e.g., HIPAA), and reliable infrastructure for patient records and medical applications.

- Government and Public Sector: Emphasizes data sovereignty, security, and robust infrastructure for critical public services.

- Manufacturing: Needs for operational technology (OT) integration, IoT data processing, and support for Industry 4.0 initiatives.

- Energy and Utilities: Requirements for reliable infrastructure to manage smart grids, operational data, and critical energy systems.

- Media and Entertainment: Driven by content delivery networks (CDNs), high-bandwidth requirements, and large-scale data storage for multimedia content.

- Others: Includes retail, education, transportation, and other sectors leveraging colocation for their specific IT needs.

- By Enterprise Size:

- Small and Medium Enterprises (SMEs): Seeking cost-effective, scalable solutions without significant upfront investment.

- Large Enterprises: Requiring high capacity, advanced security, and global footprint support, often opting for wholesale solutions.

Regional Highlights

- North America: This region holds a significant share of the global data center colocation market, primarily driven by the presence of a large number of hyperscale cloud providers, extensive digital transformation initiatives, and high adoption of advanced technologies like AI and IoT. The United States, in particular, remains a dominant market due to its robust infrastructure, strong regulatory framework, and continuous investment in data center expansion and innovation. Canada also contributes significantly, especially with its focus on renewable energy and strategic positioning for cross-border data traffic.

- Europe: Europe is a rapidly growing market, propelled by stringent data privacy regulations such as GDPR, increasing cloud adoption, and a strong push towards sustainable data center operations. Countries like Germany, the United Kingdom, France, and the Netherlands are key hubs due to their strong economies, well-developed digital infrastructure, and strategic locations for international connectivity. The emphasis on green data centers and energy efficiency is a distinct regional trend.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by massive digital transformation efforts, rapid urbanization, and a burgeoning internet user base. Countries such as China, India, Japan, Australia, and Singapore are experiencing exponential growth in data generation and consumption, leading to increased demand for colocation services. Government initiatives supporting digitalization and the influx of foreign direct investment in data center infrastructure are further accelerating market expansion.

- Latin America: This region is an emerging market for data center colocation, driven by increasing internet penetration, cloud adoption, and the need for improved digital infrastructure across various industries. Brazil and Mexico are leading the charge, benefiting from rising foreign investments and the growing demand for local data processing capabilities to enhance data sovereignty and reduce latency for regional businesses.

- Middle East and Africa (MEA): The MEA region is witnessing substantial growth, supported by government-led digital transformation agendas, diversification efforts away from oil economies, and strategic investments in smart city projects. The UAE, Saudi Arabia, and South Africa are key markets, focusing on building robust digital ecosystems to attract international businesses and support local economic development. The demand for secure and reliable data storage is paramount in this region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Data Center Colocation Market.- Global Data Solutions

- Interconnect Cloud Partners

- Prime Colocation Group

- Edge Infrastructure Services

- Quantum Data Hubs

- Secure Hosting Networks

- Apex Compute Facilities

- Digital Realty Solutions

- Equinix Global Connect

- CyrusOne Colocation

- NTT Global Data Centers

- CoreSite Realty Corporation

- Iron Mountain Data Centers

- QTS Realty Trust

- ST Telemedia Global Data Centres

- China Telecom Global

- KDDI America

- Digital Bridge

- Cyrus Networks

- Vapor IO

Frequently Asked Questions

Analyze common user questions about the Data Center Colocation market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is data center colocation?

Data center colocation is a service where businesses rent space for their servers and other computing hardware within a third-party data center facility. The colocation provider supplies the building, power, cooling, security, and network connectivity, while the client maintains ownership and control over their IT equipment. This model helps businesses reduce capital expenditure and operational costs associated with building and maintaining their own data centers.

Why should a business choose colocation over an on-premise data center?

Businesses choose colocation to benefit from enhanced reliability, scalability, and cost efficiency. Colocation facilities offer superior infrastructure, including redundant power and cooling, robust security, and advanced network connectivity, which can be prohibitively expensive to replicate on-premise. It frees up internal IT staff to focus on core business functions, reduces capital expenditure, and allows for flexible scaling of IT resources as business needs evolve.

What are the primary benefits of data center colocation?

Key benefits include reduced costs (no large upfront investment), improved reliability (redundant systems, uptime guarantees), enhanced security (physical and digital protection), scalability (easy expansion of space and power), superior connectivity (access to multiple carriers), and expert support (specialized staff managing infrastructure). It also supports business continuity and disaster recovery strategies effectively.

How does sustainability factor into data center colocation?

Sustainability is a growing priority for data center colocation providers. It involves adopting energy-efficient technologies, using renewable energy sources, implementing advanced cooling methods to reduce power consumption, and optimizing water usage. Sustainable practices not only reduce the environmental footprint but also offer long-term cost savings and appeal to environmentally conscious clients, aligning with global ESG goals.

What is the future outlook for the data center colocation market?

The future of the data center colocation market is robust, driven by continued digital transformation, the proliferation of AI and edge computing, and increasing cloud adoption. Demand for high-density, specialized, and interconnected facilities will grow. The market is expected to see further innovation in cooling and power management, along with a stronger emphasis on global expansion and strategic partnerships to meet evolving enterprise needs and enable emerging technologies.