Tanker Shipping Market

Tanker Shipping Market Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_706987 | Last Updated : September 08, 2025 |

Format : ![]()

![]()

![]()

![]()

Tanker Shipping Market Size

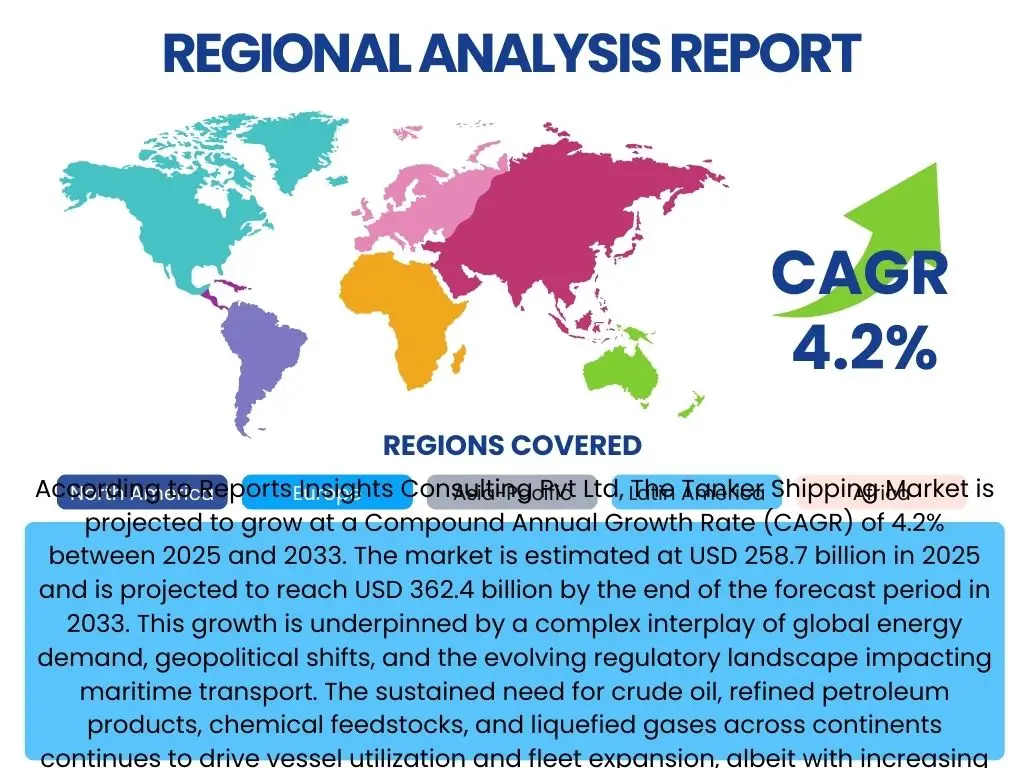

According to Reports Insights Consulting Pvt Ltd, The Tanker Shipping Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.2% between 2025 and 2033. The market is estimated at USD 258.7 billion in 2025 and is projected to reach USD 362.4 billion by the end of the forecast period in 2033. This growth is underpinned by a complex interplay of global energy demand, geopolitical shifts, and the evolving regulatory landscape impacting maritime transport. The sustained need for crude oil, refined petroleum products, chemical feedstocks, and liquefied gases across continents continues to drive vessel utilization and fleet expansion, albeit with increasing emphasis on efficiency and environmental compliance.

The valuation reflects the combined revenue generated from the seaborne transportation of crude oil, petroleum products, chemicals, liquefied natural gas (LNG), and liquefied petroleum gas (LPG) via specialized vessels. Factors such as new refinery capacities coming online, increasing consumption in emerging economies, and the strategic stockpiling of oil reserves contribute significantly to market expansion. While the transition towards renewable energy sources presents a long-term shift, the immediate and medium-term reliance on fossil fuels and their derivatives ensures robust demand for tanker shipping services.

Key Tanker Shipping Market Trends & Insights

The tanker shipping market is undergoing significant transformations, driven by a confluence of environmental pressures, technological advancements, and shifting global trade dynamics. Users frequently inquire about the market's response to sustainability demands, the adoption of digital technologies, and the impact of geopolitical events on trade routes and freight rates. The pervasive theme centers on how the industry balances the imperative for operational efficiency and profitability with stringent environmental regulations and the need for resilient supply chains. The drive towards decarbonization, digital integration, and diversification of energy sources are recurring topics of interest, alongside the implications of fleet modernization and the evolving risk landscape.

One prominent trend is the accelerating push for decarbonization, compelling operators to invest in alternative fuels, energy-efficient designs, and carbon capture technologies. This includes a growing interest in LNG-fueled vessels and exploring ammonia or methanol as future marine fuels. Concurrently, digital transformation is enhancing operational efficiency through advanced data analytics, real-time vessel tracking, and predictive maintenance, optimizing routes and reducing fuel consumption. Geopolitical developments, such as regional conflicts and trade tensions, frequently reshape established shipping lanes, sometimes leading to longer voyages and higher freight rates, while also creating uncertainties that influence investment decisions.

- Decarbonization and Adoption of Alternative Fuels: Growing investment in LNG, methanol, and ammonia-fueled vessels to meet emissions targets.

- Digitalization and Automation: Increased use of IoT, AI, and big data for route optimization, predictive maintenance, and operational efficiency.

- Fleet Modernization and Scrapping: Focus on newbuilds incorporating eco-friendly designs and the accelerated scrapping of older, less efficient vessels.

- Geopolitical Influence on Trade Routes: Rerouting and increased transit times due to regional conflicts and heightened security concerns.

- Increased Focus on Supply Chain Resilience: Diversification of supply sources and logistical strategies to mitigate disruptions.

- Stricter Environmental Regulations: Compliance with IMO 2020, EEXI, CII, and regional emissions mandates driving operational changes.

AI Impact Analysis on Tanker Shipping

User queries regarding the influence of Artificial Intelligence (AI) on tanker shipping often revolve around its potential to revolutionize operational efficiency, enhance safety, and support environmental compliance. Common themes include how AI can optimize voyages, predict equipment failures, and improve decision-making in complex logistical scenarios. There is also considerable interest in the long-term implications for crew roles, cybersecurity vulnerabilities introduced by new technologies, and the ethical considerations surrounding autonomous vessel operations. Stakeholders seek to understand the tangible benefits AI can deliver, such as fuel savings and reduced emissions, alongside the practical challenges of integration and scalability across diverse fleets.

AI's impact spans several critical areas, from real-time data analysis for optimal routing and weather avoidance to predictive analytics for machinery maintenance, significantly reducing downtime and operational costs. It also plays a crucial role in enhancing navigation safety through collision avoidance systems and improving cargo management by optimizing loading and unloading processes. Furthermore, AI-powered platforms are instrumental in monitoring and reporting carbon emissions, aiding compliance with increasingly stringent environmental regulations. While the adoption curve is gradual, the long-term trajectory points towards more automated, data-driven, and resilient tanker operations, transforming traditional maritime practices.

- Route Optimization: AI algorithms analyze weather, currents, and congestion to determine the most fuel-efficient and safe routes, reducing transit times and emissions.

- Predictive Maintenance: AI models forecast equipment failures based on sensor data, enabling proactive maintenance and minimizing unscheduled downtime.

- Autonomous Navigation and Operations: Development of semi-autonomous and potentially fully autonomous vessels, enhancing safety and efficiency over long voyages.

- Supply Chain Optimization: AI integrates disparate data sources to provide end-to-end visibility, improving scheduling, cargo tracking, and port turnaround times.

- Emissions Monitoring and Reporting: AI-driven systems accurately track and report vessel emissions, aiding compliance with environmental regulations and decarbonization efforts.

- Enhanced Safety and Security: AI supports threat detection, anomaly identification, and advanced warning systems for navigation and cybersecurity.

Key Takeaways Tanker Shipping Market Size & Forecast

User inquiries about key takeaways from the tanker shipping market size and forecast consistently highlight the drivers of growth, the resilience of the industry amidst global volatility, and the strategic importance of sustainability. The primary insights center on understanding the market's growth trajectory driven by continued energy demand, particularly from emerging economies, and the necessity for significant investment in fleet renewal and technological upgrades. There is a strong emphasis on how regulatory shifts, especially those related to environmental performance, are not merely compliance burdens but also critical drivers of innovation and competitive differentiation. Furthermore, the market's cyclical nature and its sensitivity to geopolitical events are frequently discussed, underscoring the need for adaptive strategies.

The forecast indicates a steady, albeit moderated, growth path for the tanker shipping sector, reflecting its foundational role in global energy supply chains. This growth is expected despite the overarching global energy transition, as fossil fuels will continue to be a primary energy source for the foreseeable future, especially in industrial and transportation sectors. The market is increasingly characterized by a dichotomy: robust demand for efficient and compliant vessels coexists with pressures to phase out older tonnage. Successful players will be those who strategically navigate the complexities of environmental regulations, embrace digital transformation, and demonstrate agility in response to evolving geopolitical landscapes and energy consumption patterns. The long-term profitability will hinge on fleet modernization and operational excellence.

- Sustained Growth Forecast: The market is projected for steady growth driven by global energy demand and refined product consumption.

- Decarbonization as a Core Strategy: Environmental regulations are mandating significant investments in eco-friendly vessels and operational practices.

- Technological Integration is Crucial: Digitalization and AI adoption are key to enhancing efficiency, safety, and competitiveness.

- Geopolitical Influences are Significant: Global events profoundly impact trade routes, freight rates, and market stability.

- Fleet Modernization Imperative: Ongoing need to replace aging vessels with new, compliant, and energy-efficient designs.

- Emerging Economies as Growth Drivers: Increasing energy demand from countries in Asia Pacific and other developing regions fuels trade volumes.

Tanker Shipping Market Drivers Analysis

The tanker shipping market is primarily driven by the enduring global demand for energy and petrochemicals, necessitating the efficient seaborne transportation of crude oil, refined products, and various gases. Population growth, industrial expansion, and urbanization, particularly in emerging economies, directly correlate with increased energy consumption, which in turn stimulates demand for tanker services. Furthermore, the strategic location of major oil and gas reserves, often distant from consumption centers and refineries, inherently creates a requirement for a robust tanker fleet to bridge these geographical gaps. The expansion of refining capacities globally also fuels the need for crude oil imports and product exports, contributing significantly to market dynamism.

Another critical driver is the evolving global energy security landscape, where nations seek diversified energy supply chains, often relying on long-haul crude and product tanker movements. Geopolitical factors, while sometimes disruptive, can also act as drivers by re-routing trade and increasing voyage distances, thereby tightening vessel supply and improving freight rates. The continuous renewal of the global tanker fleet, driven by aging vessels and stricter environmental regulations, also represents a consistent demand for new, more efficient tonnage, indirectly supporting market activity. This combination of fundamental demand, strategic energy considerations, and fleet renewal ensures a persistent underlying momentum for the tanker shipping sector.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Global Energy Demand Growth | +1.5% | Asia Pacific, Middle East, Africa | Long-term (2025-2033) |

| Refinery Capacity Expansion | +0.8% | China, India, Middle East | Medium-term (2025-2029) |

| Geopolitical Trade Route Adjustments | +0.6% | Europe, Asia, Americas | Short to Medium-term (2025-2028) |

| Increased Consumption of LNG & LPG | +0.7% | Europe, Asia Pacific | Long-term (2025-2033) |

| Strategic Petroleum Reserves | +0.3% | North America, Europe, Asia | Short to Medium-term (2025-2027) |

Tanker Shipping Market Restraints Analysis

The tanker shipping market faces several significant restraints that can temper its growth trajectory and profitability. Chief among these are stringent environmental regulations, such as those imposed by the International Maritime Organization (IMO), which necessitate substantial investments in compliance technologies, alternative fuels, and vessel upgrades. These regulations, while crucial for sustainability, often increase operational costs and capital expenditure for shipowners. Additionally, the inherent cyclicality of the shipping industry, characterized by periods of oversupply of vessels, can lead to depressed freight rates and reduced profitability, as supply outstrips demand for vessel capacity.

Geopolitical instability and trade protectionism also pose considerable restraints, disrupting established trade routes, imposing sanctions, and increasing the risks associated with international shipping. Such events can lead to significant market volatility, higher insurance premiums, and reduced cargo volumes in affected regions. Furthermore, the long-term global energy transition towards renewable sources, while gradual, presents a fundamental challenge to the traditional demand base for crude oil and petroleum product tankers. This evolving energy mix could, over time, lead to a structural decline in demand for certain types of tanker services, necessitating diversification and adaptation within the industry.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Stringent Environmental Regulations | -1.0% | Global, particularly Europe, North America | Long-term (2025-2033) |

| Vessel Oversupply and Low Freight Rates | -0.7% | Global | Short to Medium-term (2025-2028) |

| Geopolitical Instability & Sanctions | -0.5% | Global, specific regions (e.g., Middle East, Russia/Ukraine) | Short to Medium-term (2025-2027) |

| Global Economic Slowdowns | -0.4% | Global | Short-term (2025-2026) |

| Increasing Operating Costs | -0.3% | Global | Long-term (2025-2033) |

Tanker Shipping Market Opportunities Analysis

Significant opportunities are emerging within the tanker shipping market, particularly driven by technological innovation and the evolving global energy landscape. The imperative for decarbonization is creating a substantial market for eco-friendly vessels capable of utilizing alternative fuels like LNG, methanol, or ammonia, as well as those equipped with carbon capture technologies. This transition presents a chance for shipyards and operators to invest in and benefit from advanced, environmentally compliant newbuilds, meeting the growing demand for sustainable logistics solutions. Digitalization offers another expansive opportunity, with the adoption of advanced analytics, IoT, and AI improving operational efficiency, predictive maintenance, and overall fleet management, thereby reducing costs and enhancing safety across the board.

Furthermore, the long-term growth in demand for specific energy commodities, such as liquefied natural gas (LNG) and liquefied petroleum gas (LPG), presents a robust opportunity for specialized tanker segments. The global shift towards gas as a transitional fuel, coupled with new liquefaction and regasification terminal projects, will bolster the need for more LNG and LPG carriers. Niche markets, such as the transportation of specialized chemicals or bio-fuels, also offer avenues for diversification and value creation. Companies that proactively invest in these areas, embrace digital transformation, and prioritize sustainable practices are well-positioned to capitalize on these evolving market dynamics and secure a competitive advantage.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Investment in Eco-Friendly Vessels | +0.9% | Global, particularly Europe, APAC | Long-term (2025-2033) |

| Digitalization & AI Integration | +0.8% | Global | Long-term (2025-2033) |

| Growth in LNG & LPG Trade | +0.7% | Asia Pacific, Europe, North America | Long-term (2025-2033) |

| Niche Chemical & Product Markets | +0.5% | Global | Medium-term (2025-2029) |

| Scrubbers & Ballast Water Management | +0.3% | Global | Short to Medium-term (2025-2027) |

Tanker Shipping Market Challenges Impact Analysis

The tanker shipping market grapples with a multitude of challenges that demand strategic foresight and operational agility from industry participants. Foremost among these are the escalating costs associated with regulatory compliance, especially for environmental mandates, which often require significant capital outlay for new technologies or vessel modifications. Cyber security threats also represent a growing concern, as increased digitalization exposes operational technology and sensitive data to potential malicious attacks, risking operational disruption and financial losses. The cyclical nature of the market, with its inherent volatility in freight rates, presents a continuous challenge for maintaining consistent profitability and long-term financial stability for operators.

Furthermore, the availability of skilled maritime labor and crew welfare remain persistent challenges, impacted by demanding working conditions, long periods at sea, and the need for specialized training to operate advanced vessels. Geopolitical tensions, trade disputes, and regional conflicts continue to pose unpredictable disruptions, altering trade flows, increasing insurance premiums, and sometimes leading to direct operational hazards. Navigating these complexities, from balancing capital expenditure with freight market uncertainties to mitigating evolving risks like cyberattacks and talent shortages, requires a robust and adaptable business model to ensure sustained success in the competitive global tanker shipping landscape.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Regulatory Compliance Costs | -0.9% | Global | Long-term (2025-2033) |

| Cyber Security Risks | -0.6% | Global | Long-term (2025-2033) |

| Crew Shortages & Training | -0.5% | Global | Long-term (2025-2033) |

| Freight Rate Volatility | -0.4% | Global | Short to Medium-term (2025-2028) |

| Port Congestion & Infrastructure | -0.3% | Asia Pacific, Europe, Americas | Medium-term (2025-2029) |

Tanker Shipping Market - Updated Report Scope

This market research report provides a comprehensive analysis of the global tanker shipping market, segmenting it by product type, vessel size, and end-use industry, alongside an extensive regional breakdown. The scope encompasses detailed historical data from 2019 to 2023, providing a solid foundation for understanding past performance, and offers precise market size estimations for 2025. Crucially, the report delivers a forward-looking forecast extending to 2033, projecting future growth trends and market valuations. It critically examines key market trends, growth drivers, inherent restraints, emerging opportunities, and significant challenges that will shape the industry landscape during the forecast period.

Furthermore, the report incorporates an in-depth impact analysis of Artificial Intelligence on the tanker shipping sector, identifying how technological advancements are set to redefine operational paradigms. A dedicated section highlights crucial market takeaways, offering strategic insights for stakeholders. The competitive landscape is thoroughly assessed, profiling top key players and their strategic initiatives, providing a holistic view of the market structure. This comprehensive coverage aims to equip industry participants, investors, and policymakers with actionable intelligence to navigate the complexities and capitalize on the opportunities within the tanker shipping market.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 258.7 Billion |

| Market Forecast in 2033 | USD 362.4 Billion |

| Growth Rate | 4.2% |

| Number of Pages | 247 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Global Maritime Carriers, Oceanic Shipping Solutions, Deep Sea Logistics Corp, Apex Tanker Group, Synergy Marine Lines, Horizon Shipping Group, Blue Ocean Tankers, Pacific Energy Transport, North Star Tankers, Continental Maritime Ltd., Transoceanic Vessel Services, Trident Tanker Management, Stellar Ocean Freight, Elite Maritime Holdings, Atlas Shipping & Trading, Meridian Energy Transport, Coastal Tanker Fleets, Vector Seaborne Logistics, Zenith Marine Transport, Prime Tanker Solutions |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The tanker shipping market is extensively segmented to provide a granular view of its diverse components and dynamics. This segmentation helps in understanding the specific drivers and restraints impacting various sub-sectors, enabling more precise market analysis and strategic planning. Key differentiators include the type of product transported, which dictates the vessel's design and operational requirements, and the vessel's size, which influences its capacity, range, and suitability for specific trade routes and port accesses. Furthermore, analyzing the market by end-use industry clarifies the primary demand sources and the unique logistical needs of sectors such as oil & gas, chemicals, and energy utilities.

Each segment possesses distinct market characteristics. For instance, crude oil tankers, especially VLCCs (Very Large Crude Carriers), are central to long-haul global energy supply chains, while product tankers are crucial for regional distribution of refined petroleum. LNG and LPG tankers represent a growing segment driven by the global shift towards gas as a cleaner fuel. Understanding these segment-specific nuances is vital for stakeholders to identify growth opportunities, assess competitive landscapes, and formulate targeted business strategies that align with evolving market demands and regulatory frameworks. This detailed breakdown highlights the complexity and specialization inherent in the tanker shipping industry.

- By Product Type:

- Crude Oil Tankers: Transportation of unrefined crude oil.

- Product Tankers: Carries refined petroleum products like gasoline, diesel, jet fuel.

- Chemical Tankers: Transports various chemicals, often requiring specialized coatings and handling.

- LNG Tankers: Designed for carrying liquefied natural gas.

- LPG Tankers: Specialized vessels for liquefied petroleum gas.

- By Vessel Size:

- VLCC (Very Large Crude Carrier): Largest crude oil carriers, typically over 200,000 DWT.

- Suezmax: Can pass through the Suez Canal, generally 120,000-200,000 DWT.

- Aframax: Medium-sized tankers, typically 80,000-120,000 DWT.

- Panamax: Can pass through the Panama Canal, around 60,000-80,000 DWT.

- Handysize: Smallest of the conventional tankers, up to 50,000 DWT, used for regional trade.

- Others: Includes MR (Medium Range), LR1 (Long Range 1), LR2 (Long Range 2) product tankers.

- By End-Use Industry:

- Oil & Gas: Primary consumer for crude and product tankers.

- Chemicals: Utilizes chemical tankers for various liquid chemicals.

- Energy Utilities: Primarily uses LNG and LPG tankers for power generation fuels.

- Others: Includes other industrial applications requiring liquid bulk transport.

Regional Highlights

- North America: Characterized by strong domestic oil and gas production, impacting both import and export dynamics. The region is a significant consumer of refined products and is witnessing increased exports of crude oil and LNG, driving demand for specific tanker segments. Regulatory emphasis on environmental standards influences fleet modernization.

- Europe: Heavily reliant on energy imports, making it a crucial market for crude oil and LNG tankers. The region is at the forefront of implementing stringent environmental regulations (e.g., EU Emissions Trading System for shipping), driving innovation in sustainable shipping practices and fostering investment in eco-friendly vessels.

- Asia Pacific (APAC): Represents the largest and fastest-growing market for tanker shipping due to surging energy demand from rapidly industrializing economies like China, India, and Southeast Asian nations. Significant refinery expansions and growing consumption of crude, products, and LNG underpin robust trade flows and fleet requirements.

- Latin America: A key producer and exporter of crude oil, particularly from countries like Brazil and Mexico, generating substantial demand for crude tankers. The region also exhibits growing domestic energy consumption, increasing demand for product tankers for inter-regional distribution.

- Middle East and Africa (MEA): Dominates global crude oil and LPG exports, making it a critical hub for VLCC and LPG tanker operations. The region's strategic importance in global energy supply chains ensures consistent high demand for large-scale energy transportation services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tanker Shipping Market.- Global Maritime Carriers

- Oceanic Shipping Solutions

- Deep Sea Logistics Corp

- Apex Tanker Group

- Synergy Marine Lines

- Horizon Shipping Group

- Blue Ocean Tankers

- Pacific Energy Transport

- North Star Tankers

- Continental Maritime Ltd.

- Transoceanic Vessel Services

- Trident Tanker Management

- Stellar Ocean Freight

- Elite Maritime Holdings

- Atlas Shipping & Trading

- Meridian Energy Transport

- Coastal Tanker Fleets

- Vector Seaborne Logistics

- Zenith Marine Transport

- Prime Tanker Solutions

Frequently Asked Questions

Analyze common user questions about the Tanker Shipping market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the current growth outlook for the Tanker Shipping Market?

The Tanker Shipping Market is projected for steady growth with a CAGR of 4.2% from 2025 to 2033, driven by sustained global energy demand and evolving trade patterns. The market value is expected to reach USD 362.4 billion by 2033 from USD 258.7 billion in 2025.

How are environmental regulations impacting tanker shipping operations?

Environmental regulations, such as those from IMO, are significantly impacting operations by mandating investments in greener fuels, energy-efficient designs, and technologies like scrubbers and ballast water treatment systems. This drives fleet modernization and increases operational costs for compliance.

What role does AI play in the future of tanker shipping?

AI is set to revolutionize tanker shipping through advanced route optimization, predictive maintenance, enhanced safety systems, and improved supply chain visibility. It is crucial for reducing fuel consumption, minimizing downtime, and supporting decarbonization efforts across the fleet.

Which regions are key growth drivers for the tanker shipping market?

Asia Pacific is the leading growth driver due to burgeoning energy demand, particularly from China and India. Other significant regions include the Middle East and Africa for exports, and Europe and North America due to their import reliance and stringent regulatory frameworks.

What are the main challenges facing the tanker shipping industry?

Key challenges include high costs associated with regulatory compliance, the persistent risk of cyber security threats, ongoing vessel oversupply issues leading to freight rate volatility, and concerns regarding crew shortages and welfare in the long term.