Shipping Container Market

Shipping Container Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_704256 | Last Updated : August 05, 2025 |

Format : ![]()

![]()

![]()

![]()

Shipping Container Market Size

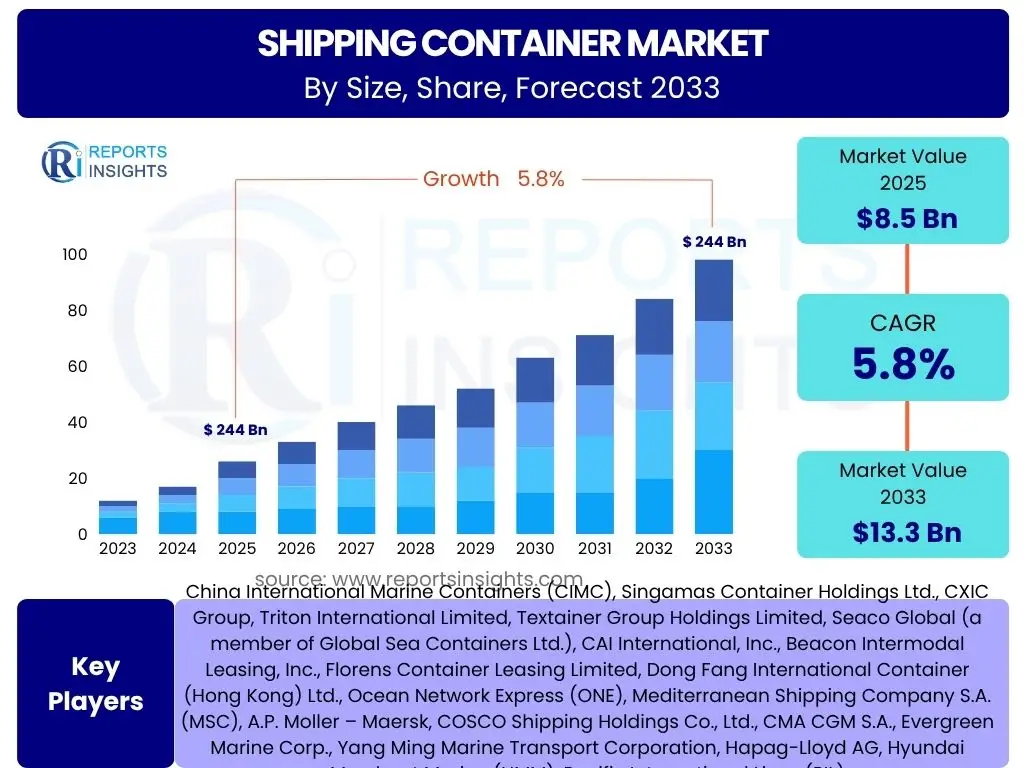

According to Reports Insights Consulting Pvt Ltd, The Shipping Container Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2033. The market is estimated at USD 8.5 Billion in 2025 and is projected to reach USD 13.3 Billion by the end of the forecast period in 2033.

Key Shipping Container Market Trends & Insights

The shipping container market is experiencing dynamic shifts driven by evolving global trade patterns, technological advancements, and increasing emphasis on supply chain resilience. Key trends reflect a move towards greater efficiency, sustainability, and connectivity within the logistics ecosystem. Stakeholders are keen to understand how geopolitical factors, e-commerce proliferation, and environmental regulations are reshaping demand and operational paradigms for containerized cargo.

There is a growing demand for specialized container types to accommodate diverse cargo needs, alongside a focus on enhancing the digital integration of containers within broader logistics networks. The industry is also witnessing a concerted effort to adopt more environmentally friendly practices, driven by both regulatory pressures and corporate sustainability initiatives. These trends collectively contribute to a complex market landscape that prioritizes adaptive strategies for long-term growth and stability.

- Increasing demand for smart containers equipped with IoT for real-time tracking and monitoring.

- Rising adoption of sustainable and eco-friendly container materials and manufacturing processes.

- Growth in intermodal transportation, enhancing the efficiency and reach of container shipping.

- Expansion of e-commerce driving demand for last-mile delivery and efficient container logistics.

- Development of advanced container technologies for specialized cargo, including refrigerated and dangerous goods.

- Emphasis on supply chain resilience leading to diversified sourcing and logistics strategies.

AI Impact Analysis on Shipping Container

The integration of Artificial Intelligence (AI) into the shipping container sector is poised to revolutionize operational efficiency, predictive capabilities, and decision-making processes. Common user inquiries often revolve around how AI can optimize container logistics, enhance predictive maintenance, improve security, and automate various aspects of container management. Expectations are high for AI to address longstanding industry challenges such as empty container repositioning, demurrage and detention issues, and cargo visibility.

AI's influence extends from port operations and vessel routing to inventory management within container depots. Concerns, however, include data privacy, the need for robust cybersecurity measures to protect sensitive cargo information, and the significant initial investment required for AI infrastructure. Despite these challenges, the consensus suggests that AI will be a transformative force, enabling more agile, intelligent, and cost-effective container services throughout the global supply chain.

- AI-driven optimization of container routing and empty container repositioning, reducing operational costs.

- Enhanced predictive maintenance for containers and related equipment, minimizing downtime and extending asset life.

- Automated cargo tracking and monitoring systems, providing real-time visibility and improving supply chain transparency.

- Improved port and terminal efficiency through AI-powered crane operations, yard management, and vessel scheduling.

- Advanced demand forecasting for container availability, leading to more strategic procurement and allocation.

- Enhanced security and fraud detection in container logistics through AI-powered anomaly detection.

Key Takeaways Shipping Container Market Size & Forecast

The shipping container market is on a steady growth trajectory, underpinned by the ongoing expansion of global trade, burgeoning e-commerce activities, and increasing industrialization in developing economies. Key insights from the market forecast indicate a sustained demand for various container types, with specialized and smart containers emerging as significant contributors to future growth. Stakeholders are particularly interested in identifying sectors and regions that will drive the most substantial growth, as well as the technological shifts influencing market dynamics.

The market's resilience is further supported by investments in port infrastructure and logistics technologies aimed at improving the efficiency of container handling and movement. The forecast highlights opportunities in areas such as digitalization and sustainability, which are expected to shape investment decisions and competitive strategies over the next decade. Understanding these multifaceted drivers and the anticipated shifts is crucial for businesses aiming to capitalize on the evolving landscape of global containerized shipping.

- Projected steady market growth driven by global trade expansion and e-commerce penetration.

- Significant opportunities in specialized and smart container segments due to evolving cargo needs and technological advancements.

- Increasing importance of Asia Pacific as a manufacturing hub and key demand center.

- Emphasis on digital transformation and automation within port and logistics operations for enhanced efficiency.

- Growing investment in sustainable shipping practices, including eco-friendly container materials and energy-efficient logistics.

Shipping Container Market Drivers Analysis

The shipping container market is fundamentally propelled by the expansion of global merchandise trade, which necessitates efficient and standardized methods for transporting goods across continents. The surge in e-commerce activities globally also plays a pivotal role, as it generates high volumes of packaged consumer goods requiring containerized transport from manufacturing hubs to distribution centers and end-consumers. Furthermore, ongoing industrialization in emerging economies, particularly in Asia, fuels demand for raw materials and machinery, often transported in containers, and subsequently drives exports of finished goods.

The development of robust intermodal transportation networks, integrating sea, rail, and road, significantly enhances the efficiency and reach of container shipping, making it a preferred mode for international logistics. Technological advancements leading to the development of smart containers with IoT capabilities for real-time tracking and monitoring are also driving adoption, as they offer improved visibility, security, and operational optimization. These combined factors create a strong foundation for sustained market growth.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Global Trade Growth & Economic Expansion | +1.5% | Global, particularly Asia Pacific & Emerging Economies | Long-term (2025-2033) |

| Rise of E-commerce & Online Retail | +1.2% | North America, Europe, Asia Pacific | Mid to Long-term (2025-2033) |

| Development of Intermodal Transportation | +0.8% | Europe, North America, China | Mid-term (2025-2030) |

| Industrialization in Developing Countries | +0.9% | Asia (India, Southeast Asia), Africa | Long-term (2025-2033) |

| Technological Advancements (Smart Containers, IoT) | +0.6% | Global, especially developed markets | Mid to Long-term (2025-2033) |

Shipping Container Market Restraints Analysis

Despite the inherent growth drivers, the shipping container market faces notable restraints that can impede its expansion. Geopolitical tensions and trade protectionist policies, such as tariffs and trade disputes, disrupt established supply chains and can lead to reduced global trade volumes, directly impacting container demand. The cyclical nature of the shipping industry, often characterized by volatile freight rates and periods of oversupply or undersupply of containers, introduces market instability and affects profitability for container manufacturers and lessors.

Furthermore, significant fluctuations in raw material prices, particularly for steel and aluminum, directly influence manufacturing costs of containers, potentially leading to higher container prices or reduced profit margins. Regulatory complexities, including varying customs procedures and environmental regulations across different regions, add operational hurdles and increase compliance costs. These factors necessitate careful strategic planning and risk management within the industry.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Geopolitical Tensions & Trade Protectionism | -0.7% | Global, particularly US-China, Europe | Mid-term (2025-2030) |

| Volatile Freight Rates & Shipping Industry Cyclicality | -0.5% | Global | Short to Mid-term (2025-2028) |

| Fluctuations in Raw Material Prices | -0.4% | Global (manufacturing regions: China, Vietnam) | Short-term (2025-2027) |

| Oversupply of Container Vessels/Equipment | -0.3% | Global | Short to Mid-term (2025-2028) |

| Stricter Environmental Regulations & Compliance Costs | -0.2% | Europe, North America, International Maritime Organization (IMO) | Long-term (2025-2033) |

Shipping Container Market Opportunities Analysis

The shipping container market is ripe with opportunities stemming from the increasing demand for specialized container types tailored to specific cargo needs, such as reefer containers for perishables or tank containers for liquids. The integration of smart technologies, including IoT sensors, GPS, and AI-driven analytics, presents a significant avenue for value creation by offering enhanced visibility, security, and efficiency throughout the supply chain. These technological advancements enable predictive maintenance, optimal routing, and real-time cargo monitoring, appealing to a broad range of industries.

Furthermore, the global push towards sustainability and reduced carbon emissions in logistics creates opportunities for manufacturers to innovate with eco-friendly materials and energy-efficient designs. The expansion into emerging markets, particularly in Africa and Southeast Asia, driven by rising consumption and industrial development, offers new demand centers. Additionally, the growing popularity of modular construction and container architecture presents a niche but expanding market for repurposing decommissioned containers, diversifying revenue streams for manufacturers and lessors.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growing Demand for Specialized Containers (Reefer, Tank, etc.) | +1.0% | Global, particularly food, pharma industries | Long-term (2025-2033) |

| Integration of Smart Technologies (IoT, AI, Big Data) | +1.1% | Global, especially developed markets | Long-term (2025-2033) |

| Focus on Sustainable & Green Logistics Solutions | +0.7% | Europe, North America, Asia Pacific | Long-term (2025-2033) |

| Expansion in Emerging Markets & Developing Economies | +0.9% | Africa, Southeast Asia, Latin America | Long-term (2025-2033) |

| Repurposing of Containers for Modular Construction & Architecture | +0.4% | North America, Europe | Mid to Long-term (2025-2033) |

Shipping Container Market Challenges Impact Analysis

The shipping container market navigates several significant challenges that can impede its smooth operation and growth. Disruptions in global supply chains, exemplified by events like port congestion, labor shortages, or unforeseen geopolitical crises, can severely impact container availability and movement, leading to delays and increased costs. The industry also grapples with the inherent complexity of managing container fleets, including efficient repositioning of empty containers to meet demand in different regions, which often incurs substantial operational expenses.

Moreover, the adoption of new technologies, particularly smart containers and AI solutions, presents challenges related to data security and the need for significant upfront investment in infrastructure and training. Cybersecurity risks become more pronounced with increased digitalization, potentially exposing sensitive cargo data or operational systems to threats. Maintaining an aging container fleet while meeting stringent international safety and environmental standards also poses a persistent financial and operational burden. Addressing these challenges requires collaborative efforts across the logistics ecosystem and continuous innovation.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Global Supply Chain Disruptions & Bottlenecks | -0.6% | Global | Short to Mid-term (2025-2028) |

| Empty Container Repositioning Inefficiencies | -0.4% | Global | Long-term (Ongoing) |

| High Initial Investment for Smart Container Technologies | -0.3% | Global | Short to Mid-term (2025-2030) |

| Cybersecurity Risks for Digitalized Logistics | -0.2% | Global | Long-term (Ongoing) |

| Meeting Stringent Environmental & Safety Regulations | -0.2% | Europe, North America, IMO | Long-term (Ongoing) |

Shipping Container Market - Updated Report Scope

This report provides a comprehensive analysis of the shipping container market, covering market sizing, growth forecasts, key trends, and a detailed examination of drivers, restraints, opportunities, and challenges influencing the industry. It delves into the impact of emerging technologies such as Artificial Intelligence (AI) and Internet of Things (IoT) on container logistics and operational efficiency. The scope includes a granular segmentation analysis by type, material, and end-use, offering insights into various sub-segments and their growth potential. Regional dynamics are thoroughly explored, highlighting significant markets and their contributions to global demand. The report also profiles key market participants, providing an overview of the competitive landscape and strategic developments.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 13.3 Billion |

| Growth Rate | 5.8% |

| Number of Pages | 255 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | China International Marine Containers (CIMC), Singamas Container Holdings Ltd., CXIC Group, Triton International Limited, Textainer Group Holdings Limited, Seaco Global (a member of Global Sea Containers Ltd.), CAI International, Inc., Beacon Intermodal Leasing, Inc., Florens Container Leasing Limited, Dong Fang International Container (Hong Kong) Ltd., Ocean Network Express (ONE), Mediterranean Shipping Company S.A. (MSC), A.P. Moller – Maersk, COSCO Shipping Holdings Co., Ltd., CMA CGM S.A., Evergreen Marine Corp., Yang Ming Marine Transport Corporation, Hapag-Lloyd AG, Hyundai Merchant Marine (HMM), Pacific International Lines (PIL) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The shipping container market is highly diversified, segmented across various parameters including container type, material used for construction, and the specific end-use industries they serve. Each segment reflects unique demand drivers and operational characteristics, contributing to the overall market complexity and growth trajectory. Understanding these segmentations is critical for stakeholders to identify niche markets, target specific customer needs, and develop tailored strategies for product development and market penetration.

The dominance of dry van containers is a testament to their versatility and widespread application in general cargo shipping, while specialized containers like reefers and tanks cater to specific logistical demands for temperature-sensitive or liquid cargo. The choice of material impacts durability, cost, and environmental footprint. Furthermore, the varying requirements of diverse end-use sectors, from food and beverages to industrial goods, dictate container specifications and service expectations. This granular breakdown provides a comprehensive view of the market's internal dynamics and growth pockets.

- By Type:

- Dry Van Containers (Standard, High Cube)

- Reefer Containers

- Tank Containers

- Flat Rack Containers

- Open Top Containers

- Specialty Containers

- By Material:

- Steel

- Aluminum

- Composites

- By End-Use:

- Food & Beverages

- Consumer Goods & Retail

- Industrial Products

- Chemicals & Pharmaceuticals

- Automotive

- Others

Regional Highlights

- Asia Pacific (APAC): Dominates the market due to its status as a global manufacturing hub and high volume of exports. China, India, Japan, and Southeast Asian countries are key contributors, driven by rapid industrialization, increasing trade activities, and growing e-commerce penetration. The region also hosts major container manufacturing facilities.

- North America: A significant importer of goods, driven by strong consumer demand and a robust retail sector. The region heavily relies on containerized shipping for consumer goods, automotive parts, and industrial components. Focus on intermodal logistics and technological adoption for supply chain efficiency.

- Europe: Characterized by a mature trade network and a strong emphasis on sustainability and digitalization in logistics. Key countries like Germany, the UK, and the Netherlands serve as major trading hubs. Regulatory frameworks favoring green logistics are influencing container design and operations.

- Latin America: Emerging market with increasing trade volumes, particularly in agricultural products, raw materials, and manufactured goods. Brazil and Mexico are leading the growth, with investments in port infrastructure and logistics enhancing container handling capabilities.

- Middle East and Africa (MEA): Growth driven by infrastructure development projects, increasing intra-regional trade, and growing consumer markets. Strategic geographical location serving as a transit point between Asia and Europe further boosts container traffic.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Shipping Container Market.- China International Marine Containers (CIMC)

- Singamas Container Holdings Ltd.

- CXIC Group

- Triton International Limited

- Textainer Group Holdings Limited

- Seaco Global (a member of Global Sea Containers Ltd.)

- CAI International, Inc.

- Beacon Intermodal Leasing, Inc.

- Florens Container Leasing Limited

- Dong Fang International Container (Hong Kong) Ltd.

- Ocean Network Express (ONE)

- Mediterranean Shipping Company S.A. (MSC)

- A.P. Moller – Maersk

- COSCO Shipping Holdings Co., Ltd.

- CMA CGM S.A.

- Evergreen Marine Corp.

- Yang Ming Marine Transport Corporation

- Hapag-Lloyd AG

- Hyundai Merchant Marine (HMM)

- Pacific International Lines (PIL)

Frequently Asked Questions

What is the projected growth rate for the Shipping Container Market?

The Shipping Container Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2033, reaching an estimated USD 13.3 Billion by 2033.

Which key trends are shaping the Shipping Container Market?

Key trends include the increasing adoption of smart containers with IoT capabilities, a focus on sustainable and eco-friendly container solutions, the expansion of intermodal transportation, and the rising impact of e-commerce on global logistics.

How is AI impacting the Shipping Container industry?

AI is transforming the industry through optimized container routing, predictive maintenance for assets, automated cargo tracking, improved port efficiency, and advanced demand forecasting, leading to enhanced operational effectiveness and cost reduction.

What are the main challenges facing the Shipping Container Market?

Major challenges include global supply chain disruptions, inefficiencies in empty container repositioning, the high initial investment required for new technologies, cybersecurity risks, and the need to comply with stringent environmental and safety regulations.

Which regions are key contributors to the Shipping Container Market?

Asia Pacific is the leading region due to its strong manufacturing and export activities, while North America and Europe are significant import and trade hubs, driving demand. Emerging markets in Latin America and MEA also show substantial growth potential.