Tank Gauge System for Fueling Station Market

Tank Gauge System for Fueling Station Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_704233 | Last Updated : August 05, 2025 |

Format : ![]()

![]()

![]()

![]()

Tank Gauge System for Fueling Station Market Size

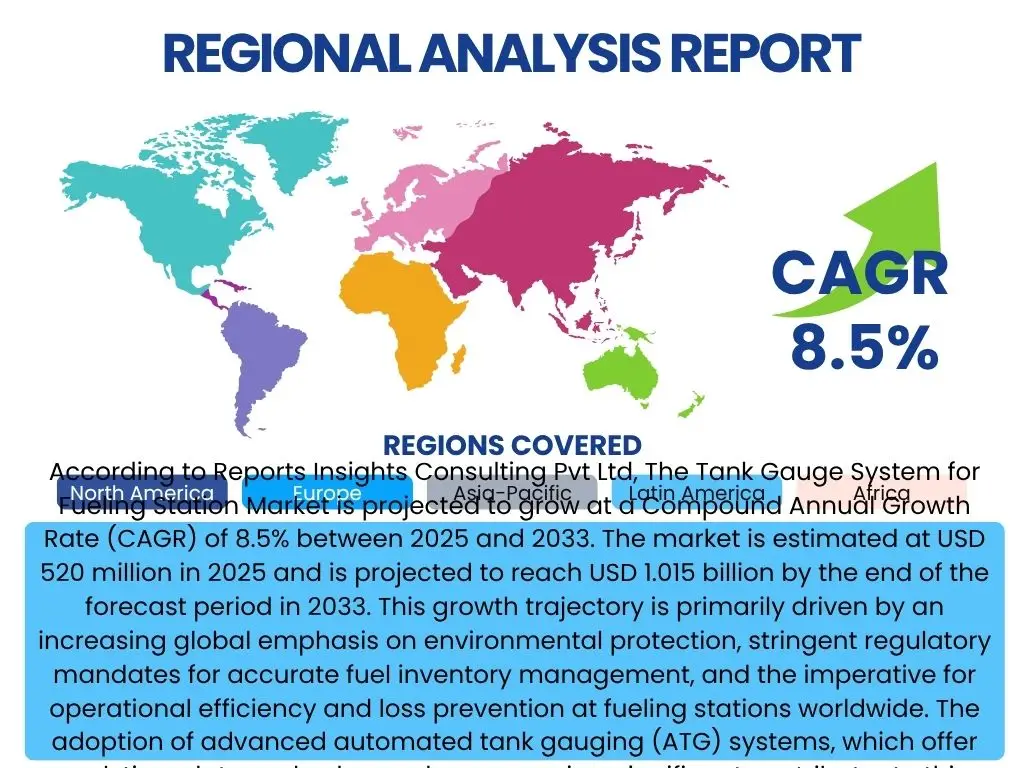

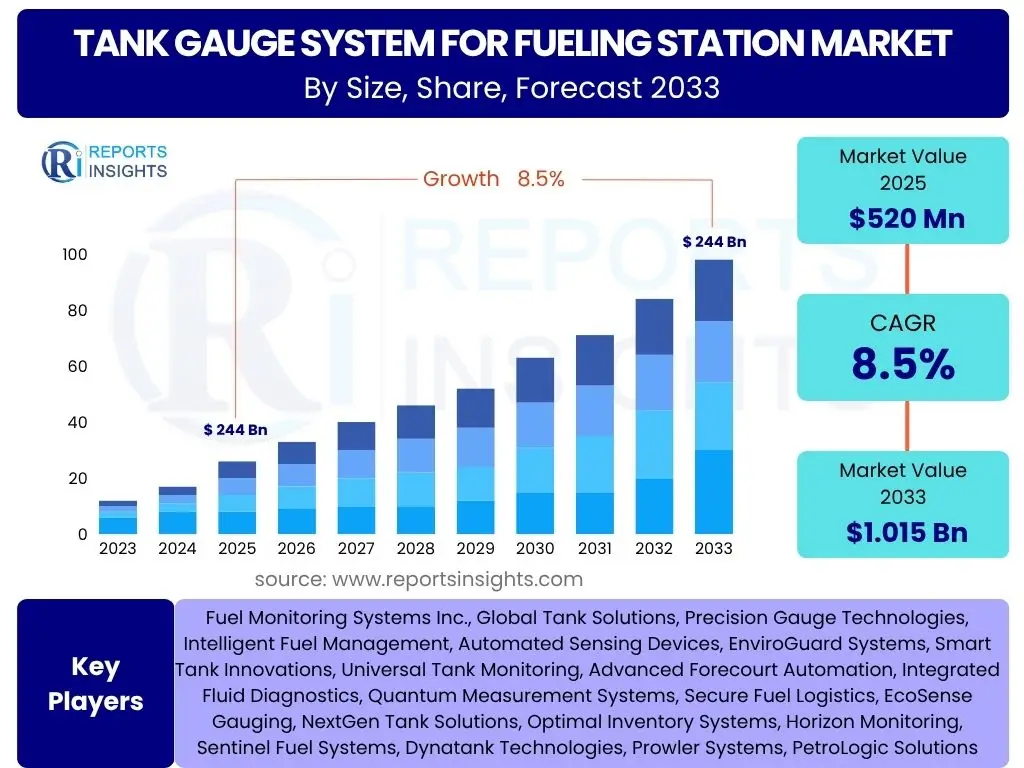

According to Reports Insights Consulting Pvt Ltd, The Tank Gauge System for Fueling Station Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2025 and 2033. The market is estimated at USD 520 million in 2025 and is projected to reach USD 1.015 billion by the end of the forecast period in 2033. This growth trajectory is primarily driven by an increasing global emphasis on environmental protection, stringent regulatory mandates for accurate fuel inventory management, and the imperative for operational efficiency and loss prevention at fueling stations worldwide. The adoption of advanced automated tank gauging (ATG) systems, which offer real-time data and enhanced accuracy, is a significant contributor to this market expansion.

The market's expansion is also influenced by the modernization of existing fueling infrastructure and the construction of new stations, particularly in rapidly developing economies. As fuel dispensing operations become more complex, encompassing various fuel types including traditional gasoline and diesel, and increasingly alternative fuels, the need for precise and reliable inventory monitoring solutions becomes paramount. The integration of tank gauging systems with broader forecourt management and enterprise resource planning (ERP) systems is further enhancing their value proposition, enabling seamless data flow and improved decision-making for station operators and fuel distributors.

Key Tank Gauge System for Fueling Station Market Trends & Insights

The Tank Gauge System for Fueling Station market is experiencing several transformative trends, primarily driven by technological advancements, evolving regulatory landscapes, and the growing demand for operational efficiencies. Users frequently inquire about how new technologies like IoT, cloud computing, and advanced analytics are being integrated into these systems, and the implications for real-time monitoring and predictive capabilities. There is also significant interest in how environmental regulations are shaping the demand for more sophisticated leak detection and inventory management solutions. Furthermore, the push towards digitalization in the fuel retail sector is a key driver, influencing the adoption of integrated forecourt solutions.

- Increased adoption of IoT and cloud-based solutions for real-time monitoring and remote data access.

- Growing demand for advanced analytics and predictive maintenance capabilities to optimize fuel inventory and prevent losses.

- Integration of tank gauging systems with broader forecourt management and payment systems for comprehensive operational control.

- Emphasis on enhanced security features to prevent fuel theft and ensure data integrity.

- Development of systems compatible with alternative fuels and multi-fuel dispensing stations.

- Stricter environmental regulations driving the need for highly accurate leak detection and compliance monitoring.

AI Impact Analysis on Tank Gauge System for Fueling Station

The impact of Artificial Intelligence (AI) on the Tank Gauge System for Fueling Station market is a frequently discussed topic among users, who are keen to understand how AI can enhance the functionality and efficiency of these critical systems. Common user questions revolve around AI's role in predictive analytics for fuel demand, anomaly detection for potential leaks, and the automation of inventory management processes. Users also express interest in how AI could contribute to improved security, reduced human error, and more efficient resource allocation within fueling station operations. Concerns sometimes arise regarding data privacy, the complexity of AI integration, and the potential for AI systems to require specialized maintenance, but the overall expectation is that AI will significantly advance the capabilities of tank gauging.

- AI-powered predictive analytics for optimized fuel ordering and delivery schedules, minimizing stockouts and overstocking.

- Enhanced anomaly detection and leak prevention through AI algorithms that identify subtle deviations in tank levels and environmental data.

- Automated reconciliation of fuel deliveries and sales data, significantly reducing manual effort and improving accuracy.

- Improved security monitoring by identifying unusual activities or potential tampering with tank systems using AI-driven patterns.

- Real-time performance optimization of tank gauging equipment, enabling predictive maintenance and reducing downtime.

Key Takeaways Tank Gauge System for Fueling Station Market Size & Forecast

Analyzing common user questions about the Tank Gauge System for Fueling Station market size and forecast reveals a strong interest in understanding the core growth drivers, the technological shifts enabling this expansion, and the long-term sustainability of demand. Users frequently seek clarity on how regulatory changes impact market growth and the role of digitalization in shaping future market dynamics. The key takeaways emphasize the essential nature of these systems for operational integrity, environmental compliance, and financial management within the fueling sector, highlighting their continuous evolution to meet modern demands.

- The market is experiencing robust growth driven by stringent environmental regulations and the need for precise inventory management.

- Technological advancements, particularly in IoT, cloud computing, and AI, are pivotal in enhancing system capabilities and market expansion.

- Increasing automation and digitalization of fueling stations globally are primary factors accelerating the adoption of advanced tank gauging solutions.

- The shift towards multi-fuel stations and the modernization of aging infrastructure present significant opportunities for market participants.

- Operational efficiency, loss prevention, and enhanced safety remain core value propositions driving investment in tank gauge systems.

Tank Gauge System for Fueling Station Market Drivers Analysis

The Tank Gauge System for Fueling Station market is significantly propelled by a confluence of factors, foremost among them being the increasing stringency of environmental regulations. Governments worldwide are implementing stricter mandates concerning underground and aboveground storage tanks, primarily to prevent fuel leaks and associated environmental contamination. These regulations necessitate the adoption of accurate and reliable tank gauging systems that can provide continuous monitoring and rapid leak detection, thereby driving demand for advanced automated solutions. Compliance with these evolving standards is not merely a legal obligation but also a critical aspect of corporate responsibility, pushing fueling station operators to invest in sophisticated monitoring technologies.

Another major driver is the escalating demand for operational efficiency and loss prevention at fueling stations. Fuel is a high-value commodity, and even minor discrepancies in inventory can lead to substantial financial losses over time. Tank gauge systems offer precise real-time inventory data, enabling operators to optimize fuel ordering, minimize shrinkage due to theft or spillage, and improve overall supply chain management. The ability to monitor multiple tanks remotely and integrate data with inventory management systems provides a holistic view of operations, leading to better decision-making and reduced operational costs. This drive for efficiency is paramount for profitability in a competitive market.

Furthermore, the global expansion of fueling station networks, particularly in emerging economies, and the modernization of existing infrastructure in developed regions contribute substantially to market growth. As new stations are constructed, they are often equipped with the latest tank gauging technologies to meet contemporary operational and regulatory standards. Simultaneously, older stations are upgrading their outdated manual systems to automated ones, driven by the desire for enhanced accuracy, automation, and compliance. The increasing adoption of digitalization and automation across the energy sector also plays a crucial role, creating a favorable environment for the proliferation of advanced tank gauging systems.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Stringent Environmental Regulations | +2.1% | Global, particularly North America, Europe, APAC | Short to Long-term (2025-2033) |

| Growing Demand for Operational Efficiency & Loss Prevention | +1.8% | Global | Short to Mid-term (2025-2029) |

| Modernization of Fueling Infrastructure & New Station Construction | +1.5% | APAC, Middle East & Africa, Latin America | Mid to Long-term (2027-2033) |

| Technological Advancements (IoT, Cloud, AI Integration) | +1.6% | Global, particularly developed economies | Short to Long-term (2025-2033) |

| Increasing Fuel Prices and Need for Accurate Inventory | +0.9% | Global | Short-term (2025-2027) |

Tank Gauge System for Fueling Station Market Restraints Analysis

Despite the positive growth trajectory, the Tank Gauge System for Fueling Station market faces several significant restraints. One primary challenge is the high initial investment required for implementing advanced automated tank gauging (ATG) systems. These systems involve sophisticated probes, consoles, software, and installation, which can represent a substantial capital expenditure for fueling station owners, particularly independent operators or those with multiple sites. This high upfront cost can deter smaller players from upgrading older manual systems or adopting new technologies, especially in regions with tighter profit margins or less access to capital, thereby slowing market penetration.

Another restraint pertains to the complexity of installation, calibration, and maintenance of modern tank gauge systems. These systems require specialized technical expertise for proper setup and ongoing calibration to ensure accuracy and compliance. A shortage of skilled technicians in certain regions, coupled with the intricate nature of integrating these systems with existing forecourt infrastructure, can pose significant challenges. Furthermore, ongoing maintenance and periodic recalibration add to the operational costs, which can be a deterrent for operators seeking low-maintenance solutions. Ensuring the reliability and precision of these systems over their operational lifespan demands continuous investment in training and technical support.

Cybersecurity concerns also act as a growing restraint, particularly with the increasing connectivity and digitalization of tank gauging systems. As these systems become integrated with cloud platforms and broader IT networks, they become potential targets for cyber threats. Data breaches, system manipulation, or ransomware attacks could compromise sensitive inventory data, disrupt operations, or even lead to safety hazards. The need for robust cybersecurity measures adds to the complexity and cost of deploying and managing these systems, as operators must invest in secure networks, software updates, and threat detection protocols. This concern is especially pronounced for large networks of stations where a single vulnerability could have widespread implications.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Initial Investment & Installation Costs | -1.2% | Global, particularly developing economies | Short to Mid-term (2025-2029) |

| Complexity of Integration & Maintenance | -0.9% | Global | Short to Mid-term (2025-2029) |

| Cybersecurity Risks and Data Vulnerability | -0.7% | Global | Mid to Long-term (2027-2033) |

| Economic Downturns Affecting Fuel Consumption | -0.5% | Region-specific | Short-term (2025-2026) |

| Resistance to Technological Adoption by Small Operators | -0.4% | Developing economies, fragmented markets | Short to Long-term (2025-2033) |

Tank Gauge System for Fueling Station Market Opportunities Analysis

The Tank Gauge System for Fueling Station market presents numerous opportunities for growth and innovation. One significant area is the increasing adoption of IoT and cloud-based platforms, which enable seamless data flow, real-time remote monitoring, and enhanced analytical capabilities. This connectivity allows fueling station operators to manage multiple sites from a centralized location, providing instant insights into inventory levels, delivery statuses, and potential issues. The integration with cloud platforms also facilitates easier software updates, remote diagnostics, and improved scalability, making these systems more attractive to operators looking for efficient and future-proof solutions. This trend towards digitalization offers significant potential for market expansion, particularly with the proliferation of smart fueling stations.

Another substantial opportunity lies in the expansion into emerging markets and the modernization of existing infrastructure. Regions such as Asia Pacific, Latin America, and the Middle East and Africa are experiencing rapid industrialization, urbanization, and an increase in vehicle fleets, leading to the construction of numerous new fueling stations. These new installations often prioritize advanced, automated systems from the outset to meet contemporary operational and environmental standards. Simultaneously, in mature markets, there is a continuous need to replace or upgrade aging tank gauging systems that may not meet current regulatory requirements or offer the efficiency of modern solutions. This dual demand from new builds and retrofits provides a sustained growth avenue for market players.

Furthermore, the growing emphasis on environmental compliance and safety offers a continuous opportunity for innovation and market penetration. As regulatory bodies impose stricter rules regarding leak detection, spill prevention, and accurate inventory reporting, fueling stations are compelled to invest in highly sensitive and reliable tank gauging systems. This includes demand for systems capable of monitoring new and alternative fuels, such as biofuels, hydrogen, or electricity charging components, which will require specialized monitoring solutions. Manufacturers and service providers who can offer solutions that not only meet but exceed these regulatory requirements, while also integrating advanced safety features, will find substantial market traction. The drive for sustainability and enhanced safety remains a powerful impetus for market growth.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Integration with IoT & Cloud-based Platforms | +1.9% | Global | Short to Long-term (2025-2033) |

| Expansion in Emerging Economies & Infrastructure Modernization | +1.7% | APAC, Latin America, MEA | Mid to Long-term (2027-2033) |

| Growing Demand for Advanced Analytics & Predictive Maintenance | +1.5% | Global | Short to Mid-term (2025-2029) |

| Development of Solutions for Alternative Fuels | +1.2% | Europe, North America, parts of APAC | Mid to Long-term (2028-2033) |

| Emphasis on Enhanced Security & Theft Prevention | +0.8% | Global | Short to Mid-term (2025-2029) |

Tank Gauge System for Fueling Station Market Challenges Impact Analysis

The Tank Gauge System for Fueling Station market faces distinct challenges that can impede its growth and widespread adoption. One significant challenge is the intense competition among market players, leading to pricing pressures and the need for continuous innovation. The market includes both established global enterprises and numerous regional manufacturers, all vying for market share. This competitive landscape often results in reduced profit margins for vendors and necessitates significant investment in research and development to differentiate products through enhanced features, accuracy, and reliability. Maintaining a competitive edge requires not only technological superiority but also robust distribution networks and efficient customer support, which can be challenging for new entrants or smaller firms.

Another critical challenge is the inherent complexity associated with regulatory compliance, which varies significantly across different regions and countries. Fueling station operators must adhere to a myriad of local, national, and international standards related to environmental protection, safety, and inventory accuracy. These regulations are subject to frequent updates and can differ in their requirements for leak detection thresholds, reporting protocols, and system certification. This fragmented regulatory environment poses a significant challenge for manufacturers, who must design systems that are adaptable to diverse compliance frameworks, and for operators, who must ensure their systems consistently meet evolving legal obligations, often requiring costly upgrades or retraining.

Furthermore, the market is challenged by the need for highly skilled personnel for the installation, calibration, and ongoing maintenance of sophisticated tank gauging systems. The advanced nature of modern ATG systems, incorporating IoT sensors, complex software, and network integration, requires technicians with specialized training in electronics, IT, and fuel handling safety. A shortage of such skilled labor in certain regions can lead to delays in installation, suboptimal system performance, and increased operational costs due to reliance on external experts. This human capital challenge necessitates ongoing investment in training programs and partnerships with educational institutions to develop a workforce capable of supporting the evolving technological demands of the industry.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Intense Market Competition & Pricing Pressures | -1.0% | Global | Short to Long-term (2025-2033) |

| Varying & Evolving Regulatory Compliance | -0.8% | Region-specific | Short to Mid-term (2025-2029) |

| Need for Skilled Labor for Installation & Maintenance | -0.6% | Global, particularly developing economies | Mid to Long-term (2027-2033) |

| Technological Obsolescence & Rapid Innovation Cycles | -0.5% | Global | Mid to Long-term (2028-2033) |

| Data Management & Integration Complexities | -0.4% | Global | Short to Mid-term (2025-2029) |

Tank Gauge System for Fueling Station Market - Updated Report Scope

This comprehensive market research report provides an in-depth analysis of the Tank Gauge System for Fueling Station Market, offering critical insights into its current size, historical performance, and future growth projections. The scope includes a detailed examination of market drivers, restraints, opportunities, and challenges, along with an extensive segmentation analysis across various types, components, technologies, applications, and end-use verticals. The report also highlights key regional market dynamics and profiles leading market participants, ensuring a holistic understanding of the industry landscape for stakeholders and potential investors.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 520 million |

| Market Forecast in 2033 | USD 1.015 billion |

| Growth Rate | 8.5% |

| Number of Pages | 245 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Fuel Monitoring Systems Inc., Global Tank Solutions, Precision Gauge Technologies, Intelligent Fuel Management, Automated Sensing Devices, EnviroGuard Systems, Smart Tank Innovations, Universal Tank Monitoring, Advanced Forecourt Automation, Integrated Fluid Diagnostics, Quantum Measurement Systems, Secure Fuel Logistics, EcoSense Gauging, NextGen Tank Solutions, Optimal Inventory Systems, Horizon Monitoring, Sentinel Fuel Systems, Dynatank Technologies, Prowler Systems, PetroLogic Solutions |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Tank Gauge System for Fueling Station market is comprehensively segmented to provide a granular understanding of its diverse components and applications. This segmentation analysis helps in identifying specific growth areas, technological preferences, and regional adoption patterns, allowing stakeholders to pinpoint opportunities within distinct market niches. The primary segmentation categories include system type, component, underlying technology, application type, and the end-use vertical, each revealing unique market dynamics and demand drivers.

- By Type:

- Automatic Tank Gauging (ATG) Systems: These systems offer continuous, real-time monitoring of fuel levels, temperature, and water content, crucial for accurate inventory management and leak detection. They are highly preferred due to their automation and data reporting capabilities.

- Manual Tank Gauging (MTG) Systems: While less sophisticated, these traditional methods still see use in smaller, less regulated facilities, though their market share is steadily declining in favor of automated solutions.

- By Component:

- Probes and Sensors: These are the core elements for measuring fuel levels, temperature, and detecting water or leaks within the tank. Accuracy and durability are paramount.

- Consoles and Displays: Provide the interface for operators to view data, configure settings, and receive alerts. They range from basic readouts to advanced touchscreen displays.

- Communication Modules: Facilitate data transmission from the probes to the console and to remote systems via various protocols (e.g., wired, wireless, cellular).

- Software and Cloud Solutions: Enable data processing, analysis, reporting, and remote access, often integrating with inventory management and ERP systems.

- Alarms and Ancillary Devices: Include audible/visual alarms for critical events (e.g., high/low fuel, leak detection) and other peripheral equipment.

- By Technology:

- Magnetostrictive: Known for high accuracy and reliability, widely used in ATG systems.

- Hydrostatic: Measures fuel level by pressure, suitable for various tank configurations.

- Radar-based: Non-contact measurement, offers precision and is suitable for aggressive media.

- Ultrasonic: Uses sound waves for level measurement, offering a cost-effective solution in certain applications.

- By Application:

- Underground Storage Tanks (USTs): Predominant application, driven by strict environmental regulations for leak detection and prevention.

- Aboveground Storage Tanks (ASTs): Used in various industrial and commercial settings, also subject to regulatory oversight but with different monitoring challenges.

- By End-Use Vertical:

- Retail Fueling Stations: The largest segment, driven by the need for precise inventory, loss prevention, and regulatory compliance.

- Commercial Fleets and Transportation Hubs: For managing fuel consumption and storage for logistics, trucking, and public transport.

- Industrial Facilities: Includes manufacturing plants, mining sites, and construction sites with on-site fuel storage.

- Public Sector and Government Agencies: For municipal fleets, emergency services, and defense facilities.

- Data Centers and Power Generation Sites: For monitoring diesel or other fuel reserves for backup generators.

Regional Highlights

- North America: This region represents a significant market share, driven by stringent environmental regulations (e.g., EPA mandates in the U.S.) requiring advanced leak detection and inventory monitoring systems. The presence of a mature fueling infrastructure and a high adoption rate of automation technologies further contributes to market growth. Continuous upgrades and replacements of existing systems are key drivers.

- Europe: Europe is characterized by a strong emphasis on environmental protection and safety standards, leading to the early adoption of advanced tank gauging systems. Countries like Germany, the UK, and France are at the forefront of implementing smart fueling station technologies. The region also sees a push towards renewable fuels and multi-fuel stations, necessitating adaptable gauging solutions.

- Asia Pacific (APAC): The APAC region is projected to exhibit the highest growth rate due to rapid industrialization, urbanization, and the expansion of vehicle fleets, particularly in countries like China, India, and Southeast Asian nations. Significant investments in new fueling station infrastructure, coupled with an increasing awareness of environmental compliance, are fueling market expansion. Cost-effectiveness and scalability are key considerations in this region.

- Latin America: This region is undergoing infrastructure development and modernization, leading to increased demand for efficient fuel management solutions. While growth may be slower than APAC, the push for improved operational efficiency and adherence to emerging environmental standards is gradually driving the adoption of automated tank gauging systems.

- Middle East and Africa (MEA): MEA presents substantial opportunities due to its vast oil and gas reserves and the expansion of fueling networks. The region is investing in modern infrastructure, including advanced tank gauging systems, to ensure accurate inventory control, minimize losses, and meet growing energy demands. Economic diversification efforts also contribute to the growth of commercial and industrial fueling segments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tank Gauge System for Fueling Station Market.- Fuel Monitoring Systems Inc.

- Global Tank Solutions

- Precision Gauge Technologies

- Intelligent Fuel Management

- Automated Sensing Devices

- EnviroGuard Systems

- Smart Tank Innovations

- Universal Tank Monitoring

- Advanced Forecourt Automation

- Integrated Fluid Diagnostics

- Quantum Measurement Systems

- Secure Fuel Logistics

- EcoSense Gauging

- NextGen Tank Solutions

- Optimal Inventory Systems

- Horizon Monitoring

- Sentinel Fuel Systems

- Dynatank Technologies

- Prowler Systems

- PetroLogic Solutions

Frequently Asked Questions

What is a Tank Gauge System for Fueling Stations?

A Tank Gauge System is a sophisticated monitoring solution used at fueling stations to precisely measure the volume of fuel, detect leaks, and monitor temperature and water levels within underground or aboveground storage tanks. These systems provide real-time data, enabling accurate inventory management, loss prevention, and environmental compliance.

Why are Tank Gauge Systems important for fueling stations?

Tank Gauge Systems are crucial for fueling stations because they ensure accurate inventory reconciliation, prevent significant financial losses due to theft or leaks, and facilitate compliance with stringent environmental regulations that mandate precise leak detection and reporting, thereby protecting both profitability and the environment.

What are the key technologies used in modern Tank Gauge Systems?

Modern Tank Gauge Systems primarily utilize automated technologies such as magnetostrictive probes, hydrostatic sensors, and increasingly, radar-based and ultrasonic methods. These systems often integrate with IoT for remote monitoring, cloud platforms for data analytics, and sometimes AI for predictive capabilities and enhanced anomaly detection.

How do Tank Gauge Systems contribute to environmental protection?

Tank Gauge Systems play a vital role in environmental protection by providing continuous leak detection capabilities. They quickly identify even minute fuel leaks from storage tanks, preventing soil and groundwater contamination, which helps stations comply with environmental regulations and avoid costly clean-up operations and penalties.

What are the benefits of upgrading to an Automated Tank Gauging (ATG) system?

Upgrading to an ATG system offers numerous benefits, including real-time, highly accurate inventory data, automated leak detection, reduced manual labor, minimized fuel shrinkage, improved operational efficiency, better compliance with environmental regulations, and enhanced data integration with other forecourt management systems.