System on Module Market

System on Module Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_704502 | Last Updated : August 05, 2025 |

Format : ![]()

![]()

![]()

![]()

System on Module Market Size

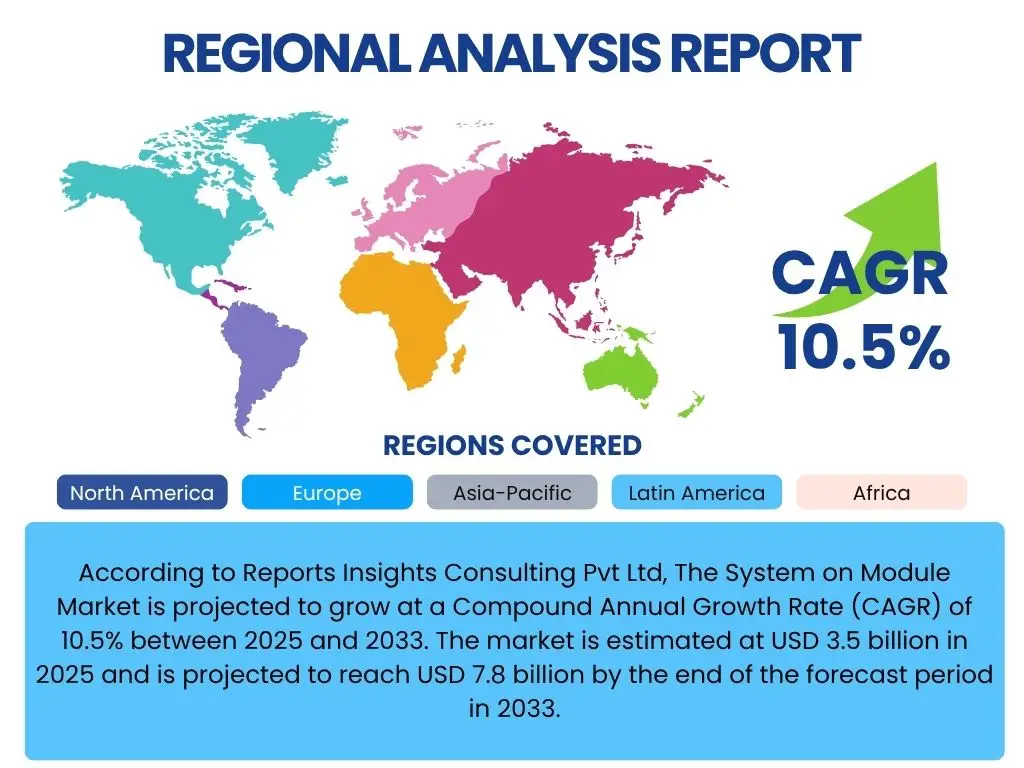

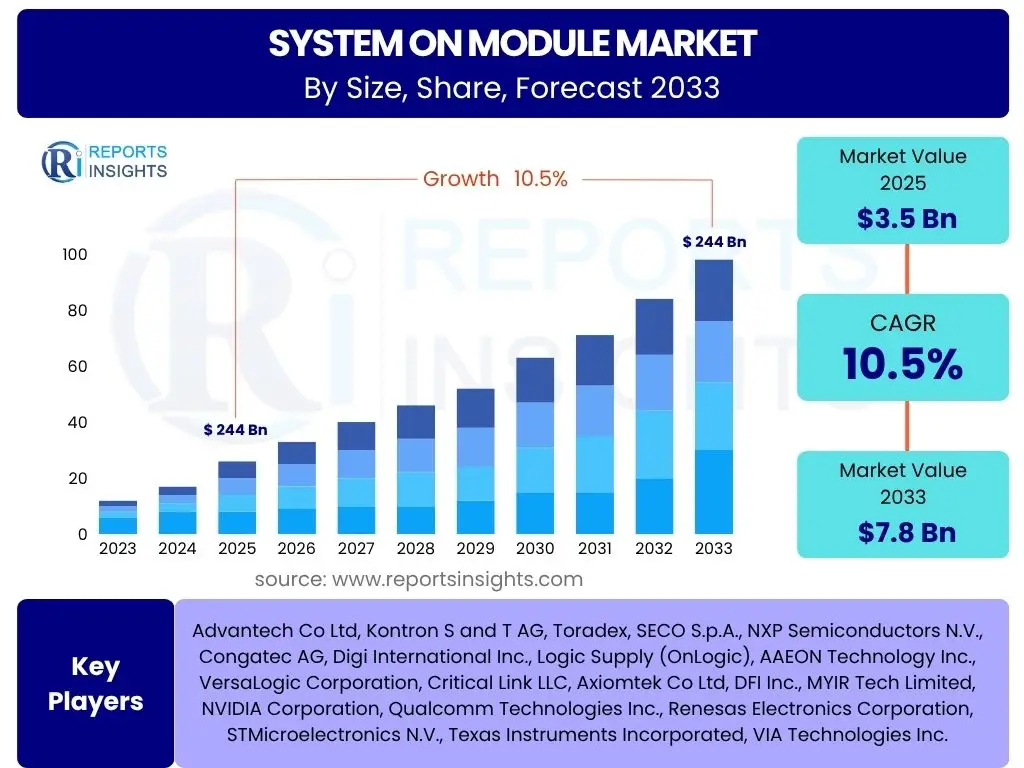

According to Reports Insights Consulting Pvt Ltd, The System on Module Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2025 and 2033. The market is estimated at USD 3.5 billion in 2025 and is projected to reach USD 7.8 billion by the end of the forecast period in 2033.

Key System on Module Market Trends & Insights

The System on Module (SoM) market is experiencing a significant transformation driven by the escalating demand for embedded intelligence and compact, high-performance computing solutions. A primary trend involves the continued miniaturization of SoM solutions, enabling their integration into increasingly smaller and more power-constrained devices. This miniaturization is coupled with a parallel trend of enhanced processing capabilities, including multi-core processors, integrated graphics, and dedicated accelerators for artificial intelligence (AI) and machine learning (ML) tasks, particularly at the edge.

Another prominent insight revolves around the growing emphasis on connectivity options, with 5G integration and advanced wireless technologies becoming standard features. The modular nature of SoMs inherently supports rapid development and deployment, making them highly attractive for industries focused on accelerating time-to-market for complex embedded systems. Furthermore, there is an observable shift towards more secure SoM designs, addressing the increasing cybersecurity concerns associated with connected devices and critical infrastructure applications. Customization and scalability are also gaining importance, allowing developers to tailor solutions precisely to specific application requirements without extensive redesigns.

- Miniaturization and higher integration density.

- Increased demand for edge AI and machine learning capabilities.

- Advancements in connectivity, including 5G and Wi-Fi 6E.

- Emphasis on enhanced security features and trusted execution environments.

- Growing adoption in industrial IoT (IIoT) and smart city applications.

- Development of application-specific SoMs for niche markets.

- Greater focus on power efficiency for battery-operated devices.

AI Impact Analysis on System on Module

The advent and widespread adoption of Artificial Intelligence are profoundly reshaping the System on Module market, creating both immense opportunities and complex challenges. User inquiries frequently highlight the critical role SoMs play in enabling on-device AI processing, commonly known as edge AI. This capability is paramount for applications requiring real-time data analysis, reduced latency, enhanced privacy, and lower bandwidth consumption, as data does not need to be transmitted to cloud servers for processing. The integration of specialized AI accelerators, such as Neural Processing Units (NPUs) or powerful Graphics Processing Units (GPUs), directly onto SoM boards is a key area of interest, allowing for efficient execution of AI inference tasks in compact form factors.

However, the integration of AI also introduces significant engineering considerations. Users are concerned about managing the increased power consumption and thermal dissipation associated with high-performance AI processors within a small SoM footprint. Furthermore, the complexity of developing and deploying AI models on embedded hardware necessitates robust software development kits, optimized AI frameworks, and comprehensive support for various machine learning libraries. The evolving landscape of AI algorithms and frameworks requires SoM manufacturers to offer flexible, future-proof platforms that can adapt to new advancements, while also addressing data security and intellectual property protection for on-device AI models.

- Enables on-device Artificial Intelligence (AI) and Machine Learning (ML) inference.

- Drives demand for higher processing power and specialized AI accelerators (NPUs, GPUs).

- Reduces data latency and bandwidth requirements for AI applications.

- Improves data privacy and security by keeping sensitive data local.

- Facilitates real-time decision-making in autonomous systems and robotics.

- Poses challenges related to power consumption, thermal management, and software optimization.

- Expands SoM applications in computer vision, voice recognition, and predictive maintenance.

Key Takeaways System on Module Market Size & Forecast

The System on Module market is positioned for robust growth throughout the forecast period, driven by fundamental shifts in various technology sectors. A primary takeaway is the indispensable role SoMs play in the proliferation of the Internet of Things (IoT) and Industrial IoT (IIoT), providing the essential computing backbone for millions of connected devices across diverse industries. The forecast underscores that the inherent advantages of SoMs, such as rapid prototyping, reduced development costs, and accelerated time-to-market, will continue to make them a preferred choice over traditional embedded board designs, especially for complex applications requiring high processing power in a compact form factor.

Another crucial insight is the increasing strategic importance of modularity in embedded system design. This modularity allows businesses to focus on application-specific software development and user interface design, rather than expending significant resources on low-level hardware design. The market's expansion is further bolstered by the burgeoning adoption of AI at the edge, requiring powerful yet efficient processing units that SoMs are ideally positioned to deliver. Stakeholders should recognize the critical need for continuous innovation in processor architectures, power management, and integrated connectivity to capitalize on emerging opportunities and navigate the evolving technological landscape, including considerations for long-term product lifecycle management and supply chain resilience.

- Significant market growth projected, indicating strong demand.

- IoT and Industrial IoT are major growth catalysts for SoM adoption.

- Edge computing applications are increasingly reliant on high-performance SoMs.

- Modularity provides faster development cycles and reduced engineering costs.

- Strategic partnerships and mergers and acquisitions are shaping the competitive landscape.

- Technological advancements in processor efficiency and integrated features are critical for market leadership.

- Supply chain stability and component availability remain vital considerations.

System on Module Market Drivers Analysis

The System on Module market's expansion is fundamentally propelled by several powerful drivers, each contributing to its accelerating adoption across diverse industries. The burgeoning ecosystem of the Internet of Things (IoT) and Industrial IoT (IIoT) stands as a primary catalyst. As industries increasingly automate processes, gather vast amounts of data, and connect disparate devices, the demand for compact, efficient, and robust computing modules capable of managing and processing this data at the edge has surged. SoMs offer the ideal balance of performance, size, and power efficiency required for these embedded applications, facilitating rapid deployment of smart devices and sensor networks without extensive custom hardware development.

Furthermore, the imperative for reduced time-to-market and lower development costs in product design cycles significantly drives SoM adoption. Instead of designing a full custom embedded board from scratch, which is a time-consuming and expensive endeavor, companies can leverage pre-validated SoMs. This modular approach allows engineers to focus on application-specific features, software development, and overall product differentiation, thereby accelerating product launch timelines and optimizing resource allocation. The inherent flexibility and scalability of SoMs also enable manufacturers to easily upgrade or customize their products with minimal hardware changes, extending product lifecycles and adapting to evolving market demands.

The increasing sophistication of artificial intelligence and machine learning applications, particularly at the edge, further fuels the SoM market. Edge AI processing requires significant computational power to perform inference tasks locally, reducing reliance on cloud infrastructure and enhancing real-time decision-making, data privacy, and overall system responsiveness. SoM vendors are responding by integrating powerful processors, specialized AI accelerators (NPUs, GPUs), and optimized software stacks into their modules, making them critical components for advanced robotics, autonomous vehicles, smart surveillance, and other AI-driven embedded systems. This convergence of high-performance computing and compact design positions SoMs as indispensable for the next generation of intelligent devices.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Proliferation of IoT and IIoT devices | +2.5% | Global, particularly Asia Pacific, North America | Short to Mid-term (2025-2030) |

| Growing demand for Edge AI and ML applications | +2.0% | Global, particularly North America, Europe | Mid to Long-term (2027-2033) |

| Reduced time-to-market and development costs | +1.5% | Global, especially for SMBs and startups | Short to Mid-term (2025-2029) |

| Increasing adoption in industrial automation and robotics | +1.0% | Europe, Asia Pacific, North America | Mid-term (2026-2031) |

System on Module Market Restraints Analysis

Despite the robust growth trajectory, the System on Module market faces several significant restraints that could temper its expansion. One prominent challenge is the relatively higher initial cost associated with some high-performance SoMs compared to designing a basic custom single-board computer (SBC) for very specific, high-volume applications. While SoMs offer long-term benefits in terms of development time and flexibility, the upfront investment for complex modules with advanced features can be prohibitive for budget-constrained projects or applications where extreme cost-optimization per unit is paramount. This economic hurdle often requires a careful cost-benefit analysis, especially for manufacturers accustomed to more traditional, rigid embedded design approaches.

Another critical restraint involves supply chain vulnerabilities and component obsolescence. The manufacturing of SoMs relies on a global network of semiconductor foundries and component suppliers. Geopolitical tensions, natural disasters, and unforeseen events, as witnessed during recent global crises, can disrupt the supply of critical components, leading to shortages, increased lead times, and price volatility. Moreover, the rapid pace of technological innovation in the semiconductor industry can lead to the obsolescence of certain processors or memory types within a relatively short timeframe, posing challenges for long-lifecycle industrial or medical applications that require product availability for a decade or more. Managing these obsolescence risks requires proactive strategies from SoM vendors and their customers.

Finally, the complexity involved in integrating advanced SoMs into a complete system can act as a restraint. While SoMs simplify board-level design, the comprehensive integration still requires expertise in software development, operating system customization, driver development, and thermal management. Ensuring seamless compatibility between the SoM, carrier board, peripherals, and application software demands specialized engineering skills. Additionally, regulatory compliance and certification processes for end products incorporating SoMs can be intricate, particularly for sensitive sectors like medical devices or automotive systems, adding layers of complexity and cost to the overall development lifecycle, especially for smaller enterprises with limited regulatory experience.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Higher initial cost for complex SoMs | -0.8% | Global, particularly cost-sensitive markets | Short to Mid-term (2025-2029) |

| Supply chain vulnerabilities and component obsolescence | -1.2% | Global, impacting all regions | Ongoing, Variable Impact |

| Technical complexity of full system integration | -0.7% | Global, affects less experienced developers | Short to Mid-term (2025-2030) |

| Thermal management challenges in compact designs | -0.5% | Global, for high-performance applications | Ongoing |

System on Module Market Opportunities Analysis

The System on Module market is poised to capitalize on several significant opportunities, driven by technological advancements and evolving industry needs. The proliferation of 5G networks presents a substantial growth avenue, as these high-speed, low-latency communication infrastructures require advanced edge computing capabilities that SoMs are ideally suited to provide. SoMs equipped with 5G connectivity can power a new generation of industrial gateways, smart city infrastructure, autonomous drones, and real-time monitoring systems, enabling applications that were previously limited by network bandwidth or latency. This integration of 5G into SoM designs will open up new market segments and enhance the performance of existing ones, particularly in telecommunications, smart grid, and public safety sectors.

Another major opportunity lies in the burgeoning market for autonomous systems and advanced robotics. As these complex machines become more pervasive in manufacturing, logistics, agriculture, and even consumer applications, the demand for powerful, compact, and energy-efficient embedded processing solutions escalates. SoMs offer the ideal platform for integrating perception, navigation, decision-making, and control algorithms, often incorporating dedicated AI acceleration for tasks like computer vision and path planning. The flexibility of SoMs allows robotics developers to rapidly iterate on designs, scale production, and adapt to specific robotic platforms, positioning them as a cornerstone technology for the robotics revolution.

Furthermore, the increasing focus on sustainability and energy efficiency across all industries presents an opportunity for SoM innovation. Developing ultra-low-power SoMs that maintain high performance can cater to the growing demand for battery-operated devices, remote sensors, and environmentally conscious designs. This includes optimizing power management techniques, leveraging energy-efficient processor architectures, and integrating advanced sleep modes. Additionally, the expansion into niche markets such as augmented reality (AR) and virtual reality (VR) devices, highly specialized medical equipment, and advanced aerospace applications provides fertile ground for custom and high-performance SoM solutions, allowing manufacturers to differentiate their offerings and capture premium market segments with tailored modular computing. This diversification ensures continued market relevance and sustained growth.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Integration with 5G and next-generation wireless technologies | +1.8% | Global, particularly North America, Asia Pacific | Mid to Long-term (2026-2033) |

| Expansion into autonomous systems and advanced robotics | +1.5% | Global, especially developed economies | Mid-term (2026-2031) |

| Emerging demand in smart city infrastructure and smart agriculture | +1.0% | Asia Pacific, Europe, Middle East | Short to Mid-term (2025-2029) |

| Development of ultra-low-power and sustainable SoM solutions | +0.7% | Global, driven by environmental mandates | Long-term (2028-2033) |

System on Module Market Challenges Impact Analysis

The System on Module market, while dynamic, faces several significant challenges that necessitate strategic navigation by market participants. One pressing concern is the escalating threat of cybersecurity. As SoMs become integral components of connected devices in critical infrastructure, industrial control systems, and consumer electronics, they become attractive targets for malicious actors. Ensuring robust security at the hardware and software levels, including secure boot, trusted execution environments, secure communication protocols, and regular vulnerability patching, is a continuous and complex endeavor. Failure to address these security concerns can lead to data breaches, system compromises, and severe reputational damage, potentially hindering broader adoption, especially in sensitive sectors.

Another substantial challenge is the increasing complexity of software integration and ecosystem development. While SoMs simplify hardware design, the seamless integration of operating systems, drivers, middleware, and application software remains a demanding task. Developers often require extensive support, comprehensive documentation, and robust software development kits (SDKs) to efficiently bring their products to market. The fragmentation across different processor architectures (ARM, x86, RISC-V), operating systems (Linux, Android, Windows Embedded), and software frameworks adds layers of complexity. SoM vendors must invest heavily in building and maintaining comprehensive software ecosystems and providing expert technical support to facilitate easier adoption and reduce integration hurdles for their customers.

Furthermore, managing the balance between performance, power consumption, and thermal management in ever-shrinking form factors presents a persistent engineering challenge. As demand for higher processing power, integrated AI accelerators, and advanced connectivity grows, SoMs generate more heat. Efficiently dissipating this heat while maintaining a compact and rugged design is critical for product reliability and longevity, particularly in industrial or outdoor environments. This requires innovative thermal solutions, careful component selection, and sophisticated power management strategies. Additionally, the global talent shortage in embedded systems development, particularly with expertise in SoM integration and optimization, could limit the pace of innovation and adoption across certain regions, making it difficult for companies to fully leverage SoM capabilities and bring new products to market effectively.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing cybersecurity threats and vulnerabilities | -1.0% | Global, critical for all connected applications | Ongoing |

| Complexity of software integration and ecosystem development | -0.9% | Global, affects developer productivity | Ongoing, Mid-term (2025-2030) |

| Thermal management and power efficiency in compact designs | -0.6% | Global, specific to high-performance SoMs | Ongoing |

| Global shortage of skilled embedded system developers | -0.4% | Global, particularly in emerging markets | Long-term (2028-2033) |

System on Module Market - Updated Report Scope

This comprehensive market research report provides an in-depth analysis of the System on Module market, covering historical trends, current market dynamics, and future projections. The report offers detailed insights into market size, growth drivers, restraints, opportunities, and challenges across various segments and key regions. It also includes an extensive competitive landscape analysis, profiling leading companies and examining their strategies. The aim is to equip stakeholders with actionable intelligence to make informed strategic decisions in this evolving market.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 3.5 billion |

| Market Forecast in 2033 | USD 7.8 billion |

| Growth Rate | 10.5% |

| Number of Pages | 245 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Advantech Co Ltd, Kontron S and T AG, Toradex, SECO S.p.A., NXP Semiconductors N.V., Congatec AG, Digi International Inc., Logic Supply (OnLogic), AAEON Technology Inc., VersaLogic Corporation, Critical Link LLC, Axiomtek Co Ltd, DFI Inc., MYIR Tech Limited, NVIDIA Corporation, Qualcomm Technologies Inc., Renesas Electronics Corporation, STMicroelectronics N.V., Texas Instruments Incorporated, VIA Technologies Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The System on Module market is comprehensively segmented to provide granular insights into its diverse components and drivers. This segmentation allows for a detailed understanding of how different technologies, applications, and end-use industries contribute to the overall market landscape, highlighting specific growth pockets and areas of strategic importance. Analyzing these segments helps stakeholders identify key trends, target specific customer needs, and develop tailored products and services that align with market demands, ranging from high-performance computing modules for industrial applications to ultra-low-power solutions for portable consumer devices.

The segmentation by type focuses on the underlying processor architectures, reflecting the diverse computational needs of various applications. Application-based segmentation provides insights into the primary use cases where SoMs are deployed, such as industrial automation, medical devices, or the burgeoning Internet of Things. Further segmentation by end-use industry allows for a deeper dive into specific vertical markets, revealing how different sectors leverage SoM technology to achieve their operational and strategic objectives, from smart manufacturing to advanced healthcare systems. This multi-dimensional approach ensures a holistic view of the market's structure and potential for future growth.

- By Type:

- ARM-based SoM

- x86-based SoM

- PowerPC-based SoM

- FPGA-based SoM

- Other Architectures

- By Application:

- Industrial Automation

- Medical Devices

- Automotive Systems

- Aerospace and Defense

- Consumer Electronics

- Smart City Solutions

- Internet of Things (IoT)

- Robotics

- Digital Signage

- Other Applications

- By End-Use Industry:

- Manufacturing

- Healthcare

- Transportation and Logistics

- Energy and Utilities

- Telecommunications

- Retail and Hospitality

- Defense and Security

- Consumer Goods

Regional Highlights

- North America: Exhibits strong market adoption driven by early technology adoption, extensive research and development activities, and a robust presence of key players in industrial automation, medical technology, and defense sectors. High demand for edge computing and AI-driven solutions further accelerates growth.

- Europe: Characterized by significant demand from the industrial automation, automotive, and healthcare sectors. Germany's strong manufacturing base and the region's focus on Industry 4.0 initiatives are key drivers. Emphasis on robust, long-lifecycle solutions contributes to steady market expansion.

- Asia Pacific (APAC): Emerges as the fastest-growing region, fueled by rapid industrialization, massive manufacturing capabilities, and burgeoning investments in IoT, smart cities, and consumer electronics. Countries like China, Japan, South Korea, and India are pivotal in driving regional demand and innovation.

- Latin America: Shows emerging growth opportunities driven by increasing digital transformation initiatives, smart city projects, and industrial modernization efforts. While starting from a smaller base, the region is poised for gradual adoption of SoM technologies.

- Middle East and Africa (MEA): Represents a developing market with growth primarily driven by infrastructure development projects, smart oil and gas initiatives, and increasing investment in renewable energy and telecommunications. Adoption is slower but steadily increasing with greater technological awareness.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the System on Module Market.- Advantech Co Ltd

- Kontron S and T AG

- Toradex

- SECO S.p.A.

- NXP Semiconductors N.V.

- Congatec AG

- Digi International Inc.

- Logic Supply (OnLogic)

- AAEON Technology Inc.

- VersaLogic Corporation

- Critical Link LLC

- Axiomtek Co Ltd

- DFI Inc.

- MYIR Tech Limited

- NVIDIA Corporation

- Qualcomm Technologies Inc.

- Renesas Electronics Corporation

- STMicroelectronics N.V.

- Texas Instruments Incorporated

- VIA Technologies Inc.

Frequently Asked Questions

Analyze common user questions about the System on Module market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is a System on Module (SoM)?

A System on Module (SoM) is a circuit board that integrates a processor, memory, power management, and essential interfaces onto a single, compact module. It functions as the core computing engine of an embedded system, designed to be mounted onto a custom carrier board, simplifying the development of complex electronic products.

What are the primary advantages of using a System on Module?

Key advantages include significantly reduced development time and costs, faster time-to-market due to pre-validated components, enhanced flexibility for upgrades and customization, reduced design complexity, and lower risk during product development, particularly for complex embedded applications.

Which industries benefit most from System on Module technology?

Industries such as Industrial Automation, Medical Devices, Automotive, Aerospace and Defense, IoT, Robotics, and Consumer Electronics extensively benefit from SoM technology due to their need for compact, high-performance, and rapidly deployable embedded computing solutions.

How does a System on Module differ from a Single Board Computer (SBC)?

While both integrate core computing components, an SBC is a complete, standalone computer on one board, ready for immediate use. A SoM, in contrast, is designed to be a component of a larger system, requiring a separate, application-specific carrier board to provide necessary I/O connectors and specialized interfaces.

What is the future outlook for System on Module technology?

The future outlook for SoM technology is highly positive, driven by the expansion of IoT, edge AI, 5G connectivity, and autonomous systems. Expect continued advancements in processing power, miniaturization, energy efficiency, and security features, making SoMs indispensable for next-generation intelligent embedded applications.