Solid Recovered Fuel Market

Solid Recovered Fuel Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_702675 | Last Updated : July 31, 2025 |

Format : ![]()

![]()

![]()

![]()

Solid Recovered Fuel Market Size

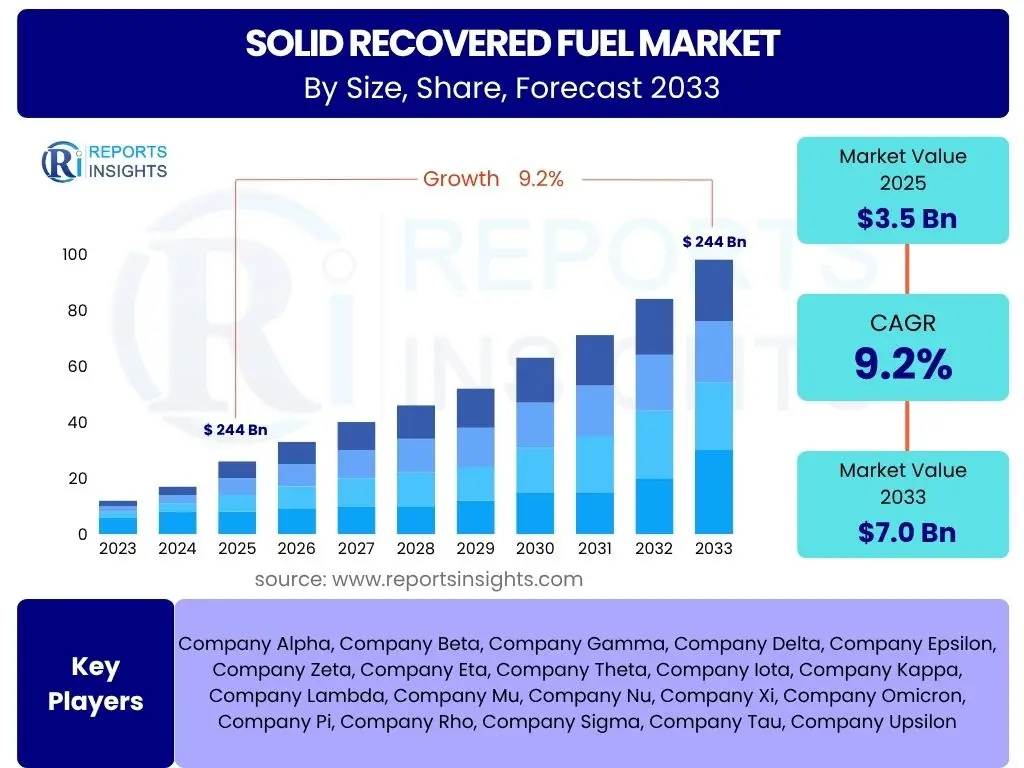

According to Reports Insights Consulting Pvt Ltd, The Solid Recovered Fuel Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.2% between 2025 and 2033. The market is estimated at USD 3.5 billion in 2025 and is projected to reach USD 7.0 billion by the end of the forecast period in 2033.

Key Solid Recovered Fuel Market Trends & Insights

The Solid Recovered Fuel (SRF) market is experiencing significant evolution, driven by increasing global focus on waste management efficiency and the transition towards a circular economy. A primary trend observed is the growing adoption of SRF as a viable alternative fuel source in energy-intensive industries, particularly cement manufacturing and power generation. This shift is largely propelled by the desire to reduce reliance on fossil fuels, mitigate carbon emissions, and leverage waste as a resource. Furthermore, advancements in waste sorting and processing technologies are enhancing the quality and consistency of SRF, making it a more attractive and reliable energy input.

Another prominent trend is the diversification of waste streams utilized for SRF production. Beyond municipal solid waste, there is an increasing emphasis on processing commercial and industrial (C&I) waste, construction and demolition (C&D) waste, and specific non-recyclable plastics and biomass fractions. This broader material feedstock not only increases the availability of raw materials for SRF but also addresses the challenge of managing diverse waste types. Regional variations in waste composition and regulatory frameworks are also influencing the types of SRF produced and their specific applications, leading to localized market developments and specialized technological solutions tailored to regional needs.

- Increasing adoption of SRF in cement kilns and power plants.

- Rising focus on circular economy principles and waste-to-energy solutions.

- Technological advancements in waste sorting and SRF production, improving fuel quality.

- Diversification of feedstock to include industrial, commercial, and select agricultural waste.

- Growing government initiatives and stringent environmental regulations promoting alternative fuels.

- Emphasis on high calorific value and consistent SRF quality for industrial applications.

- Emergence of decentralized SRF production facilities closer to waste generation sites.

AI Impact Analysis on Solid Recovered Fuel

Artificial intelligence (AI) is poised to significantly transform the Solid Recovered Fuel (SRF) market by enhancing operational efficiencies, improving fuel quality, and optimizing supply chains. Users frequently inquire about how AI can contribute to more precise waste characterization and sorting, which is critical for producing high-quality SRF with consistent calorific value. AI-powered vision systems and robotics can automate the identification and segregation of different waste materials with unprecedented accuracy, minimizing impurities and maximizing the recovery of valuable components, thereby directly impacting SRF feedstock quality and reducing processing costs. This precision is essential for meeting the stringent quality requirements of industrial consumers.

Furthermore, there is considerable interest in AI's role in optimizing the combustion process in facilities utilizing SRF. AI algorithms can analyze real-time data from combustion chambers, such as temperature, oxygen levels, and emission profiles, to dynamically adjust feeding rates and airflow for optimal energy recovery and emission control. Predictive maintenance, another key application, can forecast equipment failures in SRF production plants or combustion facilities, enabling proactive interventions that reduce downtime and maintenance costs. Ultimately, AI's analytical capabilities will lead to more efficient, sustainable, and economically viable SRF production and utilization, addressing common concerns about operational variability and environmental performance.

- Enhanced waste sorting and characterization through AI-powered vision systems and robotics.

- Optimization of SRF combustion processes for improved energy efficiency and reduced emissions.

- Predictive maintenance for SRF production equipment, minimizing downtime and operational costs.

- Supply chain optimization for waste collection and SRF distribution, improving logistics.

- Real-time monitoring and quality control of SRF parameters, ensuring consistency.

- Data-driven forecasting of waste generation and SRF demand, aiding strategic planning.

- Development of smart contracts for SRF transactions, increasing transparency and efficiency.

Key Takeaways Solid Recovered Fuel Market Size & Forecast

The Solid Recovered Fuel (SRF) market is on a robust growth trajectory, primarily driven by increasing global waste generation and the imperative for sustainable waste management solutions. The projected compound annual growth rate (CAGR) signifies a strong market expansion, reflecting the escalating demand for alternative energy sources across various industries, notably cement and power generation. A key takeaway for stakeholders is the growing recognition of SRF not merely as a waste disposal method but as a valuable energy commodity that contributes significantly to decarbonization efforts and energy security, positioning it as a critical component in the transition towards a low-carbon economy.

Moreover, the forecast highlights the market's resilience and adaptability, with ongoing technological advancements expected to further enhance SRF quality and application versatility. Investments in advanced sorting, shredding, and drying technologies are crucial for improving the calorific value and consistency of SRF, which are vital for broader industrial adoption. The increasing regulatory support and incentives for waste-to-energy projects globally will also act as a significant catalyst, ensuring continued market expansion and fostering new opportunities for innovation and market penetration. Companies focusing on integrated waste management and energy recovery solutions are particularly well-positioned to capitalize on this expanding market.

- Substantial market growth projected, reaching USD 7.0 billion by 2033.

- SRF is increasingly recognized as a vital alternative fuel for industrial decarbonization.

- Technological advancements are critical for improving SRF quality and expanding applications.

- Strong regulatory support and environmental policies are key market enablers.

- Demand from cement and power industries remains a primary growth driver.

- Focus on waste valorization and circular economy principles is accelerating adoption.

- Market expansion driven by both waste management needs and energy security concerns.

Solid Recovered Fuel Market Drivers Analysis

The Solid Recovered Fuel market is primarily propelled by the escalating volumes of waste generated globally and the urgent need for sustainable waste management solutions that deviate from traditional landfilling. As urban populations grow and industrial activities expand, the quantity of municipal solid waste (MSW) and commercial and industrial (C&I) waste continues to rise, creating an abundant feedstock for SRF production. Governments and environmental agencies worldwide are increasingly imposing stricter regulations on waste disposal and promoting diversion strategies, which in turn incentivize the conversion of waste into energy products like SRF, thus fostering market expansion.

A significant driver is the increasing demand for alternative fuels from energy-intensive industries, particularly the cement, lime, and power generation sectors. These industries are seeking cost-effective and environmentally friendly alternatives to fossil fuels to reduce operational expenses and comply with carbon emission reduction targets. SRF offers a viable solution, providing a high calorific value fuel derived from waste, which helps industries achieve their sustainability goals while maintaining energy supply. The economic benefits of utilizing SRF, including potential savings on fuel costs and landfill taxes, further strengthen its appeal and act as a strong market driver.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Waste Generation & Landfill Diversion Policies | +2.5% | Global, particularly Europe, Asia Pacific | 2025-2033 |

| Rising Demand for Alternative Fuels from Industries (Cement, Power) | +2.0% | Europe, North America, Asia Pacific | 2025-2033 |

| Strict Environmental Regulations & Carbon Emission Reduction Targets | +1.8% | EU, North America, China, India | 2025-2033 |

| Economic Benefits of Waste-to-Energy (Reduced Fuel Costs, Landfill Taxes) | +1.5% | Global, especially developed economies | 2025-2033 |

| Advancements in Waste Processing Technologies for SRF Production | +1.4% | Europe, Japan, North America | 2025-2033 |

Solid Recovered Fuel Market Restraints Analysis

Despite its significant growth potential, the Solid Recovered Fuel market faces several restraints that could impede its expansion. One primary challenge is the high initial capital investment required for establishing SRF production facilities, including specialized sorting, shredding, and drying equipment. This substantial upfront cost can be a barrier for new entrants and smaller waste management companies, limiting the widespread adoption and scaling of SRF projects. Furthermore, the operational complexities associated with ensuring consistent SRF quality, given the variable nature of waste feedstock, pose a continuous challenge for producers and end-users alike.

Another significant restraint is the public perception and potential environmental concerns associated with waste-to-energy facilities. While SRF production aims to divert waste from landfills and reduce emissions, concerns about air quality, ash disposal, and the "not in my backyard" (NIMBY) syndrome can lead to public opposition and delays in project development. Additionally, the fluctuating prices of conventional fossil fuels, such as coal and natural gas, can sometimes reduce the economic competitiveness of SRF, especially during periods of low fossil fuel prices, making it less attractive for industries seeking cost optimization. Competition from other waste treatment methods, such as recycling and composting, also presents a restraint, as these alternatives may be prioritized based on local policies or economic viability.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Capital Investment & Operational Costs for SRF Facilities | -1.5% | Global, especially developing regions | 2025-2033 |

| Variability in Waste Composition & Challenges in Maintaining SRF Quality | -1.2% | Global | 2025-2033 |

| Public Opposition & Environmental Concerns Regarding Waste-to-Energy Plants | -1.0% | Europe, North America | 2025-2033 |

| Fluctuations in Fossil Fuel Prices Affecting SRF Competitiveness | -0.8% | Global | 2025-2033 |

| Logistical Challenges and High Transportation Costs for Waste Feedstock | -0.7% | Regions with dispersed waste generation | 2025-2033 |

Solid Recovered Fuel Market Opportunities Analysis

Significant opportunities exist within the Solid Recovered Fuel market, driven by the evolving landscape of global energy and waste management. One major opportunity lies in the expansion into emerging economies, particularly in Asia Pacific and Latin America, where rapid urbanization and industrialization are leading to substantial increases in waste generation without adequate disposal infrastructure. These regions offer immense untapped potential for SRF production and utilization, as they seek sustainable solutions for both waste management and energy supply. The implementation of favorable government policies, incentives, and public-private partnerships in these regions can further accelerate market penetration and growth.

Furthermore, the development of advanced SRF processing technologies, including pyrolysis, gasification, and advanced mechanical biological treatment (MBT) systems, presents a compelling opportunity. These innovations can enhance the efficiency of SRF production, improve fuel quality, and broaden the range of waste streams that can be effectively converted into fuel. There is also an increasing opportunity for SRF to be used in a wider array of industrial applications beyond traditional cement kilns and power plants, such as in district heating systems, paper mills, and other manufacturing processes, which are actively seeking greener energy alternatives. The growing emphasis on achieving Net Zero targets and investing in renewable and alternative energy sources globally also opens up new avenues for SRF market growth and technological innovation.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Expansion into Emerging Economies with Growing Waste Volumes | +2.0% | Asia Pacific, Latin America, MEA | 2025-2033 |

| Technological Advancements in SRF Production & Conversion Technologies | +1.8% | Global, particularly Europe, Japan, North America | 2025-2033 |

| Diversification of End-Use Applications Beyond Cement & Power Generation | +1.5% | Global | 2025-2033 |

| Increased Government Support & Incentives for Waste-to-Energy Projects | +1.2% | Europe, Asia Pacific, North America | 2025-2033 |

| Focus on Circular Economy and Resource Recovery Initiatives | +1.0% | Global, especially developed economies | 2025-2033 |

Solid Recovered Fuel Market Challenges Impact Analysis

The Solid Recovered Fuel market faces several persistent challenges that require strategic solutions to ensure sustained growth. A significant challenge is ensuring the consistent quality and homogeneity of SRF, given the inherent variability of waste feedstock. Achieving standardized parameters for calorific value, moisture content, and impurity levels is crucial for industrial applications, and inconsistencies can lead to operational inefficiencies or even damage to equipment. This necessitates continuous investment in advanced sorting and processing technologies, along with robust quality control measures, which can add to production costs and complexity.

Another major challenge involves the regulatory landscape, which can be fragmented and complex across different regions and countries. Differences in waste classification, permitting processes, emission standards, and definitions of what constitutes "waste" versus "product" can create significant hurdles for SRF producers and exporters. Navigating these diverse regulations and obtaining necessary approvals can be time-consuming and costly, potentially delaying project development. Additionally, the logistics of collecting, transporting, and processing vast quantities of waste feedstock to meet the demands of large-scale SRF facilities can be logistically challenging and expensive, particularly in regions with dispersed waste generation sources or underdeveloped infrastructure, impacting overall project viability.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Ensuring Consistent Quality and Homogeneity of SRF | -1.3% | Global | 2025-2033 |

| Complex and Evolving Regulatory Frameworks & Permitting | -1.0% | Global, particularly Europe, Asia Pacific | 2025-2033 |

| Logistical Hurdles and High Transportation Costs of Waste Feedstock | -0.9% | Global, especially rural areas | 2025-2033 |

| Competition from Established Fossil Fuels and Other Waste Treatment Methods | -0.7% | Global | 2025-2033 |

| Management and Disposal of Residual Ash and By-products from SRF Combustion | -0.6% | Global | 2025-2033 |

Solid Recovered Fuel Market - Updated Report Scope

This report provides an in-depth analysis of the Solid Recovered Fuel (SRF) market, offering a comprehensive overview of its size, growth trends, key drivers, restraints, and opportunities. It delves into the impact of emerging technologies like Artificial Intelligence on market dynamics and presents a detailed segmentation analysis, highlighting regional insights and the competitive landscape. The scope encompasses historical data, current market conditions, and future projections, providing stakeholders with critical intelligence for strategic decision-making in the waste-to-energy sector.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 3.5 billion |

| Market Forecast in 2033 | USD 7.0 billion |

| Growth Rate | 9.2% |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Company Alpha, Company Beta, Company Gamma, Company Delta, Company Epsilon, Company Zeta, Company Eta, Company Theta, Company Iota, Company Kappa, Company Lambda, Company Mu, Company Nu, Company Xi, Company Omicron, Company Pi, Company Rho, Company Sigma, Company Tau, Company Upsilon |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Solid Recovered Fuel (SRF) market is comprehensively segmented to provide a nuanced understanding of its diverse applications and sources. Segmentation by source delineates the origins of waste materials, such as municipal solid waste (MSW) and commercial & industrial (C&I) waste, each having distinct characteristics and processing requirements. This categorization helps in understanding the primary drivers of feedstock availability and the varying quality of SRF produced from different sources. The market's growth is often influenced by the volume and composition of these waste streams, necessitating tailored collection and pre-treatment strategies.

Further segmentation by form, including fluff, baled, and pellets, highlights the different physical presentations of SRF, each suited for specific transportation, storage, and combustion needs. Pelletized SRF, for instance, offers advantages in terms of higher energy density and easier handling, making it preferable for certain industrial applications. Moreover, the segmentation by application, such as cement kilns, power plants, and combined heat & power (CHP) facilities, reveals the primary end-use industries driving demand for SRF. Understanding these segments is crucial for market players to tailor their production processes, quality specifications, and marketing strategies to meet the precise requirements of various industrial consumers, thereby optimizing market penetration and value creation.

- By Source:

- Municipal Solid Waste (MSW)

- Commercial & Industrial (C&I) Waste

- Construction & Demolition (C&D) Waste

- Agricultural Residues & Biomass

- Other Non-Hazardous Waste

- By Form:

- Fluff

- Baled

- Pellets

- Granules

- By Application:

- Cement Kilns

- Power Plants (Coal-fired, Dedicated Waste-to-Energy)

- Combined Heat & Power (CHP) Plants

- Other Industrial Furnaces (e.g., lime kilns, steel mills, paper mills)

- By End-Use Industry:

- Cement Industry

- Power Generation Industry

- Pulp & Paper Industry

- Chemical Industry

- Metal & Mining Industry

- Others (e.g., Glass, Ceramics)

Regional Highlights

The Solid Recovered Fuel market exhibits distinct regional dynamics driven by varying waste management policies, industrial landscapes, and environmental regulations. Europe stands as a leading region, propelled by stringent landfill diversion targets, robust circular economy initiatives, and a well-established infrastructure for waste-to-energy technologies. Countries like Germany, the UK, and the Nordics have been pioneers in SRF adoption, with strong government support and high demand from their energy-intensive industries. The region continues to innovate in SRF production and utilization, setting benchmarks for quality and sustainability.

Asia Pacific is emerging as the fastest-growing market, primarily due to rapid industrialization, burgeoning urban populations, and increasing waste generation in countries like China, India, and Southeast Asian nations. While facing challenges in waste collection and processing infrastructure, the immense waste volumes and growing environmental concerns are driving significant investments in SRF projects. North America also presents substantial growth potential, with increasing awareness about sustainable waste management and the need for alternative fuels, particularly in the U.S. and Canada. Latin America, the Middle East, and Africa are gradually adopting SRF technologies, driven by the need to manage rising waste quantities and diversify energy sources, often supported by international collaborations and technology transfers.

- Europe: Dominant market share due to stringent waste regulations, advanced waste management infrastructure, and high adoption in cement and power industries. Emphasis on circular economy.

- Asia Pacific (APAC): Fastest-growing region, driven by rapid urbanization, increasing waste generation, industrial growth, and emerging waste-to-energy projects in countries like China, India, and Japan.

- North America: Significant growth driven by increasing landfill diversion goals, demand for alternative fuels, and technological advancements in waste processing, particularly in the U.S. and Canada.

- Latin America: Emerging market with increasing investments in waste management and energy recovery, spurred by growing waste volumes and the need for sustainable solutions in countries like Brazil and Mexico.

- Middle East & Africa (MEA): Growing potential due to rapid economic development, rising waste generation, and government initiatives promoting waste-to-energy projects for energy security and environmental protection.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Solid Recovered Fuel Market.- Leading Waste Management Corporation

- Global Energy Recovery Solutions Provider

- Industrial Fuel Supply Innovator

- Sustainable Resources Group

- Advanced Waste-to-Energy Technologist

- Material Recovery & Recycling Specialist

- Environmental Services & Resource Management Firm

- Renewable Energy Fuel Producer

- Integrated Waste Solutions Provider

- Circular Economy Catalyst

- Alternative Fuels Developer

- Industrial Combustion Optimization Expert

- Waste Processing Equipment Manufacturer

- Bio-mass & SRF Co-processing Company

- Green Energy Infrastructure Developer

- Waste Heat Recovery Systems Integrator

- Resource Efficiency Consulting Group

- Sustainable Industrial Materials Supplier

- Energy from Waste Project Developer

- Hazardous Waste Management & SRF Producer

Frequently Asked Questions

What is Solid Recovered Fuel (SRF) and its primary purpose?

Solid Recovered Fuel (SRF) is a high-quality fuel produced from non-hazardous waste materials that have undergone specific processing, including sorting, shredding, and drying, to meet stringent specifications for calorific value and environmental parameters. Its primary purpose is to serve as an alternative to fossil fuels in energy-intensive industries such as cement production, power generation, and other industrial applications, contributing to waste diversion from landfills and greenhouse gas emission reductions.

How does SRF differ from Refuse Derived Fuel (RDF)?

While both Solid Recovered Fuel (SRF) and Refuse Derived Fuel (RDF) are produced from waste, SRF typically undergoes more rigorous processing and adheres to stricter quality standards, resulting in a higher calorific value, lower moisture content, and reduced levels of impurities. This makes SRF a more consistent and predictable fuel source, often suitable for co-incineration in industrial processes where precise fuel specifications are critical, whereas RDF might be used in dedicated waste-to-energy plants with broader fuel quality tolerance.

Which industries are the primary consumers of Solid Recovered Fuel?

The primary consumers of Solid Recovered Fuel are industries with high energy demands that can effectively utilize a consistent, high-calorific value alternative fuel. The cement industry is a leading consumer, using SRF in kilns for clinker production. Power plants, including both dedicated waste-to-energy facilities and those co-firing with conventional fuels like coal, are also significant users. Other industrial sectors such as pulp and paper, lime production, and steel manufacturing are increasingly exploring SRF for their energy needs.

What are the key benefits of using SRF over traditional fossil fuels?

Using Solid Recovered Fuel offers several key benefits over traditional fossil fuels. Environmentally, it contributes to significant reductions in greenhouse gas emissions and diverts waste from landfills, promoting a circular economy. Economically, SRF can provide a more cost-effective energy source, especially with fluctuating fossil fuel prices and rising carbon taxes. It also enhances energy security by utilizing domestically available waste resources, reducing reliance on imported fuels and offering a sustainable pathway for industrial operations.

What are the main challenges facing the SRF market?

The Solid Recovered Fuel market faces challenges including ensuring consistent SRF quality due to variable waste composition, which requires sophisticated sorting and processing technologies. High initial capital investment for production facilities and the logistical complexities of waste collection and transportation also pose hurdles. Furthermore, navigating diverse and evolving regulatory frameworks across different regions and managing public perception regarding waste-to-energy facilities remain significant challenges for widespread adoption and project development.