Cathode Material Market

Cathode Material Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_704127 | Last Updated : August 05, 2025 |

Format : ![]()

![]()

![]()

![]()

Cathode Material Market Size

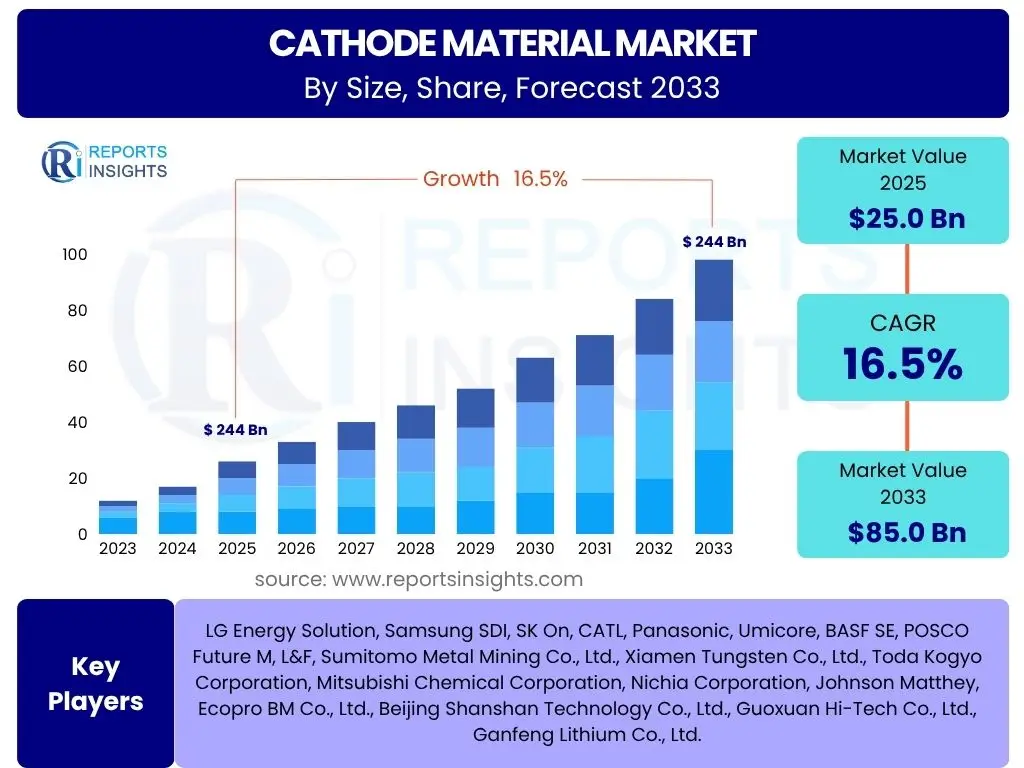

According to Reports Insights Consulting Pvt Ltd, The Cathode Material Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 16.5% between 2025 and 2033. The market is estimated at USD 25.0 billion in 2025 and is projected to reach USD 85.0 billion by the end of the forecast period in 2033.

Key Cathode Material Market Trends & Insights

The cathode material market is undergoing a significant transformation driven by the escalating global demand for electric vehicles (EVs) and advanced energy storage systems (ESS). A prominent trend involves the rapid adoption of high-nickel chemistries, such as NMC (Nickel Manganese Cobalt) with higher nickel content, to enhance energy density and extend battery range for automotive applications. Concurrently, the increasing emphasis on cost-effectiveness and safety, particularly for stationary storage and commercial vehicles, is fueling the robust growth of Lithium Iron Phosphate (LFP) cathode materials, leading to a diversification of preferred chemistries across various applications.

Further insights reveal a strong focus on supply chain resilience and localization, as geopolitical factors and raw material price volatility underscore the need for diversified sourcing and regional manufacturing capabilities. Innovations in material synthesis, including dry electrode processes and advanced coating technologies, are gaining traction to improve performance, reduce manufacturing costs, and enhance the lifespan of battery cells. The market is also witnessing a concerted effort towards sustainable practices, encompassing the development of recycling technologies for end-of-life batteries and the exploration of more environmentally friendly material extraction methods, reflecting a holistic approach to the lifecycle management of cathode materials.

- Dominance of high-nickel NMC chemistries for improved energy density in EVs.

- Surging demand for LFP materials driven by cost-effectiveness and safety in ESS and commercial EVs.

- Intensified focus on diversifying raw material sourcing and localizing cathode material production.

- Advancements in dry electrode manufacturing and advanced coating technologies for enhanced performance.

- Growing investment in battery recycling infrastructure to address sustainability and resource scarcity.

- Research and development into novel cathode chemistries, including solid-state battery compatibility.

AI Impact Analysis on Cathode Material

Artificial intelligence is poised to revolutionize the cathode material sector by accelerating the discovery and development of novel materials. Through advanced machine learning algorithms, researchers can analyze vast datasets of material properties, predict performance characteristics of new compositions, and identify optimal synthesis pathways with unprecedented speed and accuracy. This capability significantly reduces the time and cost traditionally associated with experimental trial-and-error, enabling faster iteration and commercialization of next-generation cathode materials with improved energy density, lifespan, and safety profiles. AI-driven simulations can model atomic structures and predict electrochemical behavior, pushing the boundaries of material design beyond conventional human intuition.

Beyond research and development, AI is enhancing efficiency and quality control within cathode material manufacturing processes. Predictive analytics can optimize production parameters, minimize defects, and ensure consistency in material batches, leading to higher yields and reduced waste. AI-powered sensors and vision systems can monitor production lines in real-time, identifying anomalies and enabling immediate corrective actions. Furthermore, AI contributes to supply chain optimization by forecasting demand, managing inventory, and identifying potential disruptions, thereby ensuring a stable and cost-effective flow of raw materials. This comprehensive integration of AI across the value chain promises to drive significant advancements and efficiencies in the cathode material market.

- Accelerated discovery of new cathode material compositions through AI-driven simulations and data analysis.

- Optimization of material synthesis processes and manufacturing parameters for improved efficiency and yield.

- Enhanced quality control and defect detection in production lines using AI-powered monitoring systems.

- Predictive maintenance for manufacturing equipment, minimizing downtime and operational costs.

- Supply chain optimization through demand forecasting and risk assessment for raw material procurement.

- Personalized material design based on specific application requirements, driven by AI insights.

Key Takeaways Cathode Material Market Size & Forecast

The cathode material market is experiencing a robust and sustained growth trajectory, primarily fueled by the accelerating global transition to electric vehicles and the increasing deployment of large-scale energy storage solutions. The projected expansion to USD 85.0 billion by 2033 underscores the critical role cathode materials play in the broader energy transition. This growth is not merely volumetric but also qualitative, driven by continuous innovation in material chemistries that aim for higher performance, greater safety, and enhanced sustainability, thereby addressing the evolving demands of advanced battery technologies across diverse applications.

A significant takeaway is the strategic shift towards diversified material portfolios, with both high-nickel NMC and LFP chemistries dominating the market for different applications, reflecting a nuanced approach to battery design. Furthermore, the market's future will be heavily influenced by efforts to establish secure and ethical supply chains, as well as the successful implementation of circular economy principles through advanced recycling technologies. These factors, combined with supportive government policies and significant investments in research and development, position the cathode material sector as a cornerstone of the global electrification movement.

- Robust market expansion to USD 85.0 billion by 2033, driven by EV and ESS growth.

- Dual dominance of high-nickel NMC for performance and LFP for cost-efficiency.

- Critical importance of secure and diversified raw material supply chains.

- Increasing focus on sustainable practices, including battery recycling and ethical sourcing.

- Continuous technological advancements aimed at improving energy density, lifespan, and safety.

- Strong governmental support and investment in battery technology and manufacturing.

Cathode Material Market Drivers Analysis

The cathode material market is primarily driven by the escalating global demand for lithium-ion batteries across various applications. The rapid expansion of the electric vehicle industry stands out as the most significant driver, as EVs rely heavily on high-performance cathode materials for energy storage. Additionally, the increasing deployment of renewable energy sources such as solar and wind power necessitates robust energy storage systems, creating substantial demand for cathode materials in grid-scale and residential applications. Technological advancements leading to improved battery performance and reduced costs further stimulate market growth by making lithium-ion batteries more competitive and accessible.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Electric Vehicle (EV) Adoption | +5.5% | Global, particularly China, Europe, North America | Long-term (2025-2033) |

| Renewable Energy Storage Systems (ESS) | +4.0% | North America, Europe, Asia Pacific | Mid to Long-term (2025-2033) |

| Government Incentives and Regulations | +3.0% | Europe, USA, China | Mid-term (2025-2030) |

| Advancements in Battery Technology | +4.0% | Global, R&D Hubs (East Asia, North America, Europe) | Ongoing (2025-2033) |

Cathode Material Market Restraints Analysis

Despite its significant growth potential, the cathode material market faces several notable restraints. The volatility of raw material prices, particularly for lithium, cobalt, and nickel, poses a considerable challenge, impacting manufacturing costs and profitability for cathode material producers. Geopolitical tensions and concentration of raw material extraction in a few regions lead to supply chain vulnerabilities and potential disruptions. Furthermore, the high initial investment required for establishing new production facilities and the extensive research and development needed for advanced materials can slow down market expansion, especially for smaller players.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Raw Material Price Volatility | -2.5% | Global | Short to Mid-term (2025-2028) |

| Supply Chain Disruptions & Geopolitical Risks | -2.0% | Global, specific to raw material source regions | Mid-term (2025-2030) |

| High R&D and Capital Costs | -1.5% | Global | Long-term (2025-2033) |

| Environmental Regulations and Permitting | -1.0% | Europe, North America | Ongoing (2025-2033) |

Cathode Material Market Opportunities Analysis

The cathode material market presents numerous opportunities for innovation and growth. The development of solid-state batteries offers a significant opportunity for next-generation cathode materials, promising enhanced safety and energy density. The burgeoning sector of battery recycling is another key area, enabling the recovery of valuable materials from end-of-life batteries, thereby mitigating raw material scarcity and promoting a circular economy. Furthermore, the expansion of giga-factories globally to meet rising EV and ESS demand creates a direct increase in the need for high-volume cathode material supply, opening doors for increased production capacities and localized supply chains. Investment in next-generation chemistries beyond traditional lithium-ion further diversifies growth avenues.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Development of Solid-State Batteries | +3.5% | Global, R&D intensive regions | Long-term (2028-2033) |

| Growth in Battery Recycling Technologies | +2.5% | Europe, North America, Asia Pacific | Mid to Long-term (2025-2033) |

| Expansion of Giga-factories | +3.0% | Global, especially USA, Europe, China | Mid-term (2025-2030) |

| Emergence of Next-Gen Chemistries (e.g., Sodium-ion) | +1.5% | Global | Long-term (2030-2033) |

Cathode Material Market Challenges Impact Analysis

The cathode material market faces several critical challenges that require strategic solutions to sustain its growth trajectory. The complex and energy-intensive manufacturing processes for cathode materials contribute to higher production costs and environmental concerns, necessitating innovation in sustainable manufacturing techniques. Ensuring the ethical sourcing of raw materials, particularly cobalt, remains a persistent challenge due to social and environmental issues associated with mining practices in certain regions. Scaling up production to meet exponentially growing demand while maintaining consistent quality and performance across different material batches presents another significant hurdle for manufacturers globally.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Complex Manufacturing Processes | -1.5% | Global | Ongoing (2025-2033) |

| Ethical Sourcing and Sustainability Concerns | -1.0% | Global, particularly Africa | Ongoing (2025-2033) |

| Scalability and Quality Consistency | -1.0% | Global | Mid-term (2025-2030) |

| Intense Competition and IP Protection | -0.5% | Global | Ongoing (2025-2033) |

Cathode Material Market - Updated Report Scope

This comprehensive market research report provides an in-depth analysis of the global cathode material market, encompassing historical data, current market trends, and future growth projections. The scope includes a detailed examination of market size, segmentation by material type, application, and end-use industry, as well as a thorough regional analysis. It also covers the competitive landscape, identifying key market players and their strategic initiatives, alongside an assessment of market drivers, restraints, opportunities, and challenges. The report aims to offer actionable insights to stakeholders, enabling informed decision-making in this rapidly evolving industry.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 25.0 Billion |

| Market Forecast in 2033 | USD 85.0 Billion |

| Growth Rate | 16.5% |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | LG Energy Solution, Samsung SDI, SK On, CATL, Panasonic, Umicore, BASF SE, POSCO Future M, L&F, Sumitomo Metal Mining Co., Ltd., Xiamen Tungsten Co., Ltd., Toda Kogyo Corporation, Mitsubishi Chemical Corporation, Nichia Corporation, Johnson Matthey, Ecopro BM Co., Ltd., Beijing Shanshan Technology Co., Ltd., Guoxuan Hi-Tech Co., Ltd., Ganfeng Lithium Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The cathode material market is meticulously segmented to provide a granular understanding of its diverse components and drivers. This segmentation allows for precise analysis of market dynamics across different material chemistries, applications, and end-use industries. The distinctions in material types, such as the energy-dense NMC versus the cost-effective LFP, are crucial as they cater to varied performance requirements and cost sensitivities across the market. This detailed breakdown highlights the evolving preferences and technological advancements shaping different market niches.

Further segmentation by application and end-use industry provides insights into the primary demand generators for cathode materials. The electric vehicle sector remains a dominant application, driving significant innovation and volume demand. However, the rapidly expanding energy storage systems market and established consumer electronics sector also contribute substantially, each with unique requirements for battery performance and longevity. Understanding these segmentations is vital for stakeholders to identify lucrative opportunities and tailor their strategies to specific market needs.

- By Material Type:

- Lithium Iron Phosphate (LFP)

- Lithium Nickel Manganese Cobalt (NMC)

- Lithium Cobalt Oxide (LCO)

- Lithium Manganese Oxide (LMO)

- Nickel Cobalt Aluminum (NCA)

- Others (e.g., Lithium Nickel Oxide (LNO), Lithium Sulfur)

- By Application:

- Electric Vehicles (EVs)

- Passenger EVs

- Commercial EVs (Buses, Trucks)

- Consumer Electronics

- Smartphones

- Laptops

- Wearable Devices

- Power Tools

- Energy Storage Systems (ESS)

- Grid-scale Energy Storage

- Residential Energy Storage

- Commercial & Industrial Energy Storage

- Industrial Applications

- Forklifts

- Automated Guided Vehicles (AGVs)

- Backup Power Systems

- Electric Vehicles (EVs)

- By End-Use Industry:

- Automotive

- Consumer Electronics

- Grid Energy Storage

- Industrial

- Medical

- Aerospace & Defense

- By Form:

- Powder

- Slurry

Regional Highlights

- Asia Pacific (APAC): Dominates the cathode material market, primarily driven by the robust growth of EV manufacturing and battery production hubs in China, South Korea, and Japan. The region benefits from established supply chains and significant government support for the electric vehicle industry, making it a critical market for both production and consumption.

- Europe: Exhibits significant growth due to stringent emission regulations, substantial government incentives for EV adoption, and increasing investments in localized battery cell and cathode material production. Countries like Germany, France, and the UK are at the forefront of this regional expansion, aiming to reduce reliance on Asian imports.

- North America: Witnessing accelerated growth fueled by the expansion of EV production facilities and the rising demand for energy storage systems. The region benefits from supportive policies such as tax credits and infrastructure development initiatives, encouraging domestic manufacturing and raw material processing.

- Latin America: An emerging market with increasing interest in electric mobility and renewable energy projects. While currently a smaller share, the region holds potential for future growth as EV adoption gains momentum and energy storage solutions become more widespread, particularly in countries with significant raw material reserves.

- Middle East and Africa (MEA): Shows nascent but growing demand for cathode materials, driven by increasing adoption of electric vehicles in urban centers and a strategic shift towards renewable energy projects. Investments in sustainable technologies and infrastructure development are key factors influencing market expansion in this region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cathode Material Market.- LG Energy Solution

- Samsung SDI

- SK On

- CATL

- Panasonic

- Umicore

- BASF SE

- POSCO Future M

- L&F Co., Ltd.

- Sumitomo Metal Mining Co., Ltd.

- Xiamen Tungsten Co., Ltd.

- Toda Kogyo Corporation

- Mitsubishi Chemical Corporation

- Nichia Corporation

- Johnson Matthey PLC

- Ecopro BM Co., Ltd.

- Beijing Shanshan Technology Co., Ltd.

- Guoxuan Hi-Tech Co., Ltd.

- Ganfeng Lithium Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Cathode Material market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is a cathode material and why is it important in batteries?

A cathode material is the positive electrode in a lithium-ion battery, responsible for storing and releasing lithium ions during charging and discharging cycles. It is critical because its composition directly determines the battery's energy density, power output, lifespan, and safety characteristics.

What are the major types of cathode materials currently in use?

The primary types include Lithium Iron Phosphate (LFP) known for its safety and cost-effectiveness, and Lithium Nickel Manganese Cobalt (NMC) and Nickel Cobalt Aluminum (NCA) which offer higher energy density for longer-range applications. Lithium Cobalt Oxide (LCO) is common in consumer electronics.

How does the growth of electric vehicles impact the cathode material market?

The rapid global adoption of electric vehicles (EVs) is the most significant driver for the cathode material market. EVs demand high-performance, long-lasting batteries, leading to immense demand for advanced cathode materials and driving innovation in energy density and cost reduction.

What are the key challenges facing the cathode material market?

Major challenges include the volatility of raw material prices, geopolitical risks impacting supply chain stability, the complexity and capital intensity of manufacturing processes, and the increasing demand for sustainable and ethically sourced materials, particularly cobalt.

What emerging technologies are influencing cathode material development?

Emerging technologies include the research and development of solid-state battery compatible cathode materials, advancements in dry electrode manufacturing processes, and the growing importance of battery recycling technologies to recover valuable cathode components from end-of-life batteries.