Automotive Transmission Market

Automotive Transmission Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_702898 | Last Updated : August 01, 2025 |

Format : ![]()

![]()

![]()

![]()

Automotive Transmission Market Size

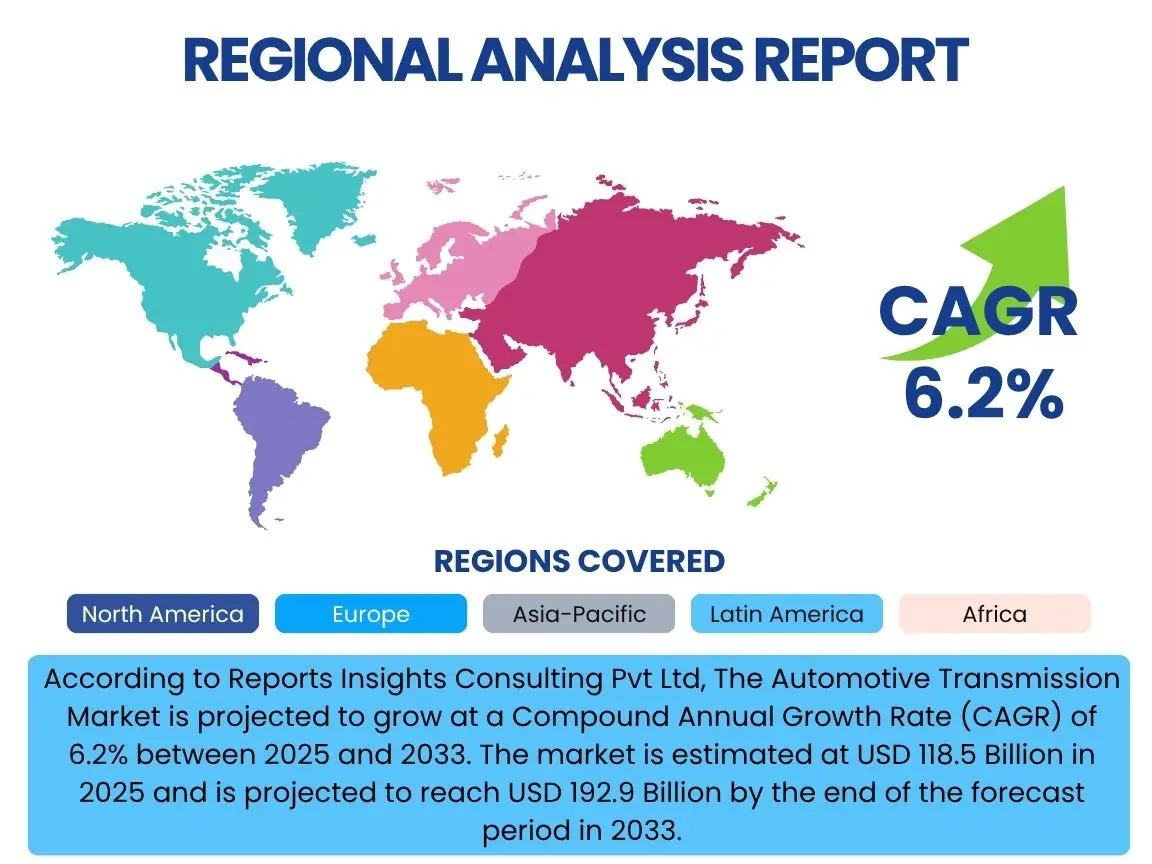

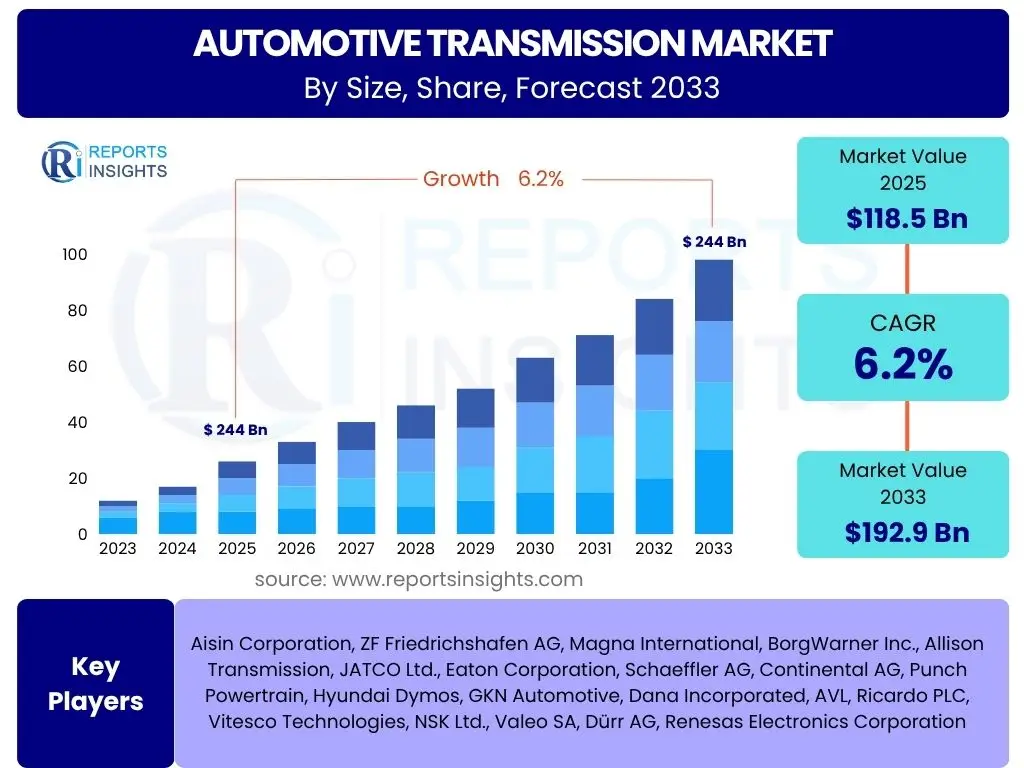

According to Reports Insights Consulting Pvt Ltd, The Automotive Transmission Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.2% between 2025 and 2033. The market is estimated at USD 118.5 Billion in 2025 and is projected to reach USD 192.9 Billion by the end of the forecast period in 2033.

Key Automotive Transmission Market Trends & Insights

The automotive transmission market is undergoing a significant transformation driven by the persistent pursuit of fuel efficiency, enhanced driving experience, and the accelerating shift towards electric vehicles. Key trends indicate a declining emphasis on traditional manual transmissions in many major markets, giving way to advanced automatic solutions such as Continuously Variable Transmissions (CVTs), Dual-Clutch Transmissions (DCTs), and multi-speed automatic transmissions (ATs). Moreover, the emergence of dedicated electric vehicle (EV) transmissions, often simpler single or two-speed units, is reshaping product development. Innovations in lightweight materials and smart control systems are also prominent, aiming to reduce overall vehicle weight and optimize power delivery across diverse propulsion systems.

- Increasing adoption of advanced automatic transmissions (ATs, CVTs, DCTs) over manual transmissions.

- Development of multi-speed transmissions specifically for electric vehicles (EVs) to enhance range and performance.

- Focus on lightweighting transmission components through advanced materials and compact designs.

- Integration of sophisticated electronic control units (ECUs) for optimized shifting and fuel efficiency.

- Growing demand for hybrid and plug-in hybrid vehicle (PHEV) transmissions tailored for blended power delivery.

- Emphasis on noise, vibration, and harshness (NVH) reduction for improved driving comfort.

- Modular transmission designs to facilitate easier adaptation across different vehicle platforms.

AI Impact Analysis on Automotive Transmission

Artificial Intelligence (AI) is set to profoundly impact the automotive transmission market by revolutionizing design, manufacturing, and operational performance. Users are increasingly interested in how AI can optimize transmission efficiency, predict maintenance needs, and enhance the overall driving experience. AI algorithms can analyze vast datasets from vehicle operations to refine shifting strategies, leading to improved fuel economy and smoother acceleration. Furthermore, AI-driven predictive analytics can identify potential component failures before they occur, enabling proactive maintenance and reducing downtime. The integration of AI also extends to the manufacturing process, where AI-powered robotics and quality control systems can improve precision and reduce production costs, addressing user expectations for more reliable and high-performing transmission systems.

- Predictive Maintenance: AI algorithms analyze sensor data to predict transmission failures, enabling proactive servicing and reducing downtime.

- Optimized Shifting Algorithms: AI dynamically adjusts gear shift points based on driving conditions, driver behavior, and traffic, maximizing fuel efficiency and performance.

- Enhanced Thermal Management: AI-controlled systems can optimize fluid flow and cooling within the transmission, preventing overheating and extending lifespan.

- Manufacturing Process Optimization: AI-powered robots and vision systems improve precision, efficiency, and quality control in transmission assembly.

- Design and Simulation: AI assists in simulating complex transmission designs, accelerating R&D cycles and identifying optimal material usage and structural integrity.

- Integration with ADAS: AI enables seamless communication between transmission control units and Advanced Driver-Assistance Systems for predictive driving scenarios.

Key Takeaways Automotive Transmission Market Size & Forecast

The automotive transmission market is poised for robust growth, driven primarily by the escalating demand for vehicles in emerging economies and the continuous innovation in transmission technologies for both internal combustion engine (ICE) and hybrid vehicles. A significant takeaway is the ongoing shift from manual to automatic transmissions, particularly in regions like Asia Pacific, which contributes significantly to market expansion due to rising disposable incomes and changing consumer preferences. While the long-term outlook acknowledges the disruptive potential of electric vehicles, the current forecast indicates sustained investment in sophisticated transmission solutions for hybrid and advanced ICE vehicles, focusing on efficiency, compact design, and integration with vehicle intelligence systems. The market will see a bifurcation, with traditional transmission advancements coexisting with the rapid evolution of EV-specific driveline components.

- The market is experiencing strong growth, largely propelled by increasing vehicle production in developing nations.

- Automatic transmissions, including CVTs and DCTs, are gaining significant market share, driving revenue growth.

- Efficiency improvements and lightweighting remain critical focal points for manufacturers to meet stringent emission norms.

- Hybrid and plug-in hybrid electric vehicles (PHEVs) are creating new demand for specialized transmission systems.

- While electric vehicles (EVs) present a long-term challenge to traditional transmissions, their short to medium-term impact is mitigated by continued ICE and hybrid vehicle sales.

- Asia Pacific is expected to be a dominant region for market expansion due to rapid urbanization and economic growth.

- Research and development is heavily concentrated on smart control systems and seamless integration with vehicle electronics.

Automotive Transmission Market Drivers Analysis

The global automotive transmission market is significantly influenced by several key drivers that are propelling its growth and evolution. A primary driver is the increasing consumer preference for automatic transmissions over manual ones, particularly in regions experiencing rapid urbanization and a growing emphasis on driving comfort and convenience. This trend is amplified by the continuous technological advancements in transmission systems, leading to more fuel-efficient and performance-optimized solutions. Furthermore, the stringent fuel efficiency and emission regulations imposed by governments worldwide are compelling manufacturers to invest in advanced transmission technologies that minimize environmental impact. The expansion of the automotive industry in emerging economies, coupled with a rising disposable income and demand for passenger and commercial vehicles, also serves as a substantial market driver, creating a fertile ground for the adoption of modern transmission systems.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Consumer Preference for Automatic Transmissions | +1.5% | Global, particularly North America, Asia Pacific (China, India) | Short to Mid-term (2025-2030) |

| Technological Advancements in Transmission Systems (e.g., Multi-speed ATs, DCTs, CVTs) | +1.2% | Global, especially developed markets (Europe, Japan) | Mid to Long-term (2027-2033) |

| Rising Demand for Fuel-Efficient Vehicles and Lower Emissions | +1.0% | Global, driven by regulatory bodies (EU, EPA, CAFE) | Throughout Forecast Period (2025-2033) |

| Growth in Vehicle Production, especially in Emerging Economies | +0.8% | Asia Pacific (China, India, ASEAN), Latin America | Short to Mid-term (2025-2029) |

| Integration of Transmissions with Hybrid and Mild-Hybrid Powertrains | +0.7% | Global, particularly Europe and North America | Mid to Long-term (2027-2033) |

Automotive Transmission Market Restraints Analysis

Despite the positive growth trajectory, the automotive transmission market faces notable restraints that could temper its expansion. The most significant long-term restraint is the accelerating global shift towards Battery Electric Vehicles (BEVs), which typically utilize single-speed or simpler two-speed reduction gears instead of complex multi-gear transmissions. This paradigm shift directly reduces the demand for traditional multi-speed transmissions used in ICE vehicles. Additionally, the high manufacturing costs associated with advanced transmission technologies, such as DCTs and multi-speed ATs, can limit their adoption in cost-sensitive segments. Supply chain disruptions, often exacerbated by geopolitical tensions or global health crises, also pose a significant challenge, impacting production volumes and increasing material costs. Furthermore, the increasing complexity of integrating advanced electronic controls and software into modern transmissions requires significant R&D investment and specialized expertise, adding to the overall cost and development timeline.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Rapid Shift Towards Electric Vehicles (EVs) and Simplification of Drivelines | -1.8% | Global, particularly Europe, China, North America | Mid to Long-term (2028-2033) |

| High Manufacturing and R&D Costs for Advanced Transmissions | -0.9% | Global, affecting market competitiveness | Throughout Forecast Period (2025-2033) |

| Supply Chain Disruptions and Raw Material Price Volatility | -0.6% | Global, affecting all manufacturing regions | Short to Mid-term (2025-2028) |

| Increasing Complexity of Transmission Systems and Integration Challenges | -0.4% | Developed markets with stringent performance requirements | Throughout Forecast Period (2025-2033) |

| Economic Downturns and Reduced Consumer Spending on New Vehicles | -0.5% | Global, depending on economic cycles | Short-term (2025-2026) |

Automotive Transmission Market Opportunities Analysis

Significant opportunities are emerging within the automotive transmission market, driven by the ongoing evolution of vehicle powertrains and global sustainability efforts. A prominent opportunity lies in the development of highly efficient, multi-speed transmissions specifically engineered for electric vehicles (EVs) and hybrid vehicles, which can optimize battery range and motor performance beyond single-speed units. The increasing demand for advanced driver-assistance systems (ADAS) and autonomous driving functionalities also presents an opportunity for transmissions with seamless and precise shifting capabilities, essential for vehicle control and safety. Furthermore, the aftermarket segment for transmission components and servicing, particularly for complex automatic systems, offers substantial growth potential. Investments in lightweight materials and advanced manufacturing techniques, such as additive manufacturing, can lead to more compact, durable, and cost-effective transmission solutions, opening new avenues for innovation and market penetration in both traditional and electrified vehicle segments.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Development of Multi-Speed Transmissions for Electric Vehicles (EVs) | +1.3% | Global, particularly Europe, China, North America | Mid to Long-term (2028-2033) |

| Expansion of Hybrid and Plug-in Hybrid Transmission Solutions | +1.0% | Global, especially Europe, North America, Asia Pacific | Throughout Forecast Period (2025-2033) |

| Growth in Aftermarket Services and Replacement Parts for Complex Transmissions | +0.8% | Global, high mileage regions (North America, Europe) | Throughout Forecast Period (2025-2033) |

| Adoption of Lightweight Materials and Advanced Manufacturing Techniques | +0.7% | Global, particularly developed markets (Germany, Japan) | Mid to Long-term (2027-2033) |

| Integration with Advanced Driver-Assistance Systems (ADAS) and Autonomous Driving | +0.6% | Global, focused on premium vehicle segments | Mid to Long-term (2027-2033) |

Automotive Transmission Market Challenges Impact Analysis

The automotive transmission market is grappling with several significant challenges that demand strategic responses from manufacturers. The most pressing challenge stems from the accelerating transition to electric vehicles (EVs), which fundamentally alters the demand landscape for traditional multi-speed transmissions, potentially leading to reduced volumes for ICE-specific components. This shift necessitates substantial re-tooling and investment in new EV-centric driveline technologies. Another formidable challenge is the increasing complexity of integrating highly sophisticated electronic control units (ECUs) and software into modern transmissions, requiring specialized engineering talent and robust cybersecurity measures. Additionally, volatile raw material prices, particularly for critical metals and alloys, and persistent supply chain vulnerabilities continue to pose threats to production costs and delivery timelines. Furthermore, the intense competition within the market, coupled with the need to balance cost-effectiveness with performance and efficiency, forces manufacturers to innovate constantly while managing tight margins.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Disruption from Electric Vehicle (EV) Powertrain Simplification | -1.5% | Global, affecting established transmission manufacturers | Mid to Long-term (2028-2033) |

| Stringent Regulatory Compliance and Emission Standards | -0.8% | Europe, North America, China | Throughout Forecast Period (2025-2033) |

| Rapid Pace of Technological Change and Need for Constant Innovation | -0.6% | Global, impacting R&D budgets | Throughout Forecast Period (2025-2033) |

| Talent Shortage in Software Engineering and Mechatronics | -0.5% | Developed markets, impacting R&D and production | Throughout Forecast Period (2025-2033) |

| Intense Competition and Pricing Pressure from Global Suppliers | -0.4% | Global, particularly in high-volume segments | Short to Mid-term (2025-2028) |

Automotive Transmission Market - Updated Report Scope

This comprehensive market research report meticulously analyzes the Automotive Transmission Market, providing a detailed assessment of its current landscape, historical performance, and future growth trajectories. The report encompasses a thorough examination of market dynamics, including key drivers, restraints, opportunities, and challenges that influence the industry. It offers in-depth segmentation analysis by transmission type, vehicle type, and fuel type, providing granular insights into market trends across various categories. Furthermore, the report provides a robust regional analysis, highlighting market performance and significant developments across major geographies. The scope extends to competitive profiling of leading companies, offering strategic insights into their market positioning and operational strategies, ultimately aiming to equip stakeholders with actionable intelligence for informed decision-making in this evolving market.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 118.5 Billion |

| Market Forecast in 2033 | USD 192.9 Billion |

| Growth Rate | 6.2% |

| Number of Pages | 247 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Aisin Corporation, ZF Friedrichshafen AG, Magna International, BorgWarner Inc., Allison Transmission, JATCO Ltd., Eaton Corporation, Schaeffler AG, Continental AG, Punch Powertrain, Hyundai Dymos, GKN Automotive, Dana Incorporated, AVL, Ricardo PLC, Vitesco Technologies, NSK Ltd., Valeo SA, Dürr AG, Renesas Electronics Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The automotive transmission market is intricately segmented to provide a granular understanding of its diverse components and evolving dynamics. These segments allow for a detailed analysis of market share, growth potential, and emerging trends across different technology types, vehicle applications, and fuel categories. The shift in consumer preferences, technological advancements, and regulatory environments significantly influence the performance of each segment. Understanding these distinctions is crucial for stakeholders to identify lucrative opportunities and tailor their strategies to specific market needs, whether focusing on traditional gasoline or diesel powertrains, or adapting to the rapid expansion of hybrid and electric vehicle segments.

- By Transmission Type:

- Manual Transmission (MT): Traditional manual gearboxes, seeing declining market share in many developed regions.

- Automatic Transmission (AT): Conventional automatics with torque converters, continuously evolving with more gear ratios.

- Automated Manual Transmission (AMT): Manual gearboxes with automated clutch and shifting, offering cost-effectiveness.

- Continuously Variable Transmission (CVT): Providing seamless acceleration and fuel efficiency, popular in smaller passenger vehicles.

- Dual-Clutch Transmission (DCT): Offering fast and smooth shifts, commonly found in performance-oriented and premium vehicles.

- Other (e.g., EV-specific reduction gears, multi-speed EV transmissions): Emerging solutions for electric and fuel cell vehicles.

- By Vehicle Type:

- Passenger Vehicles (PV): Comprising sedans, SUVs, hatchbacks, and other personal transport vehicles, the largest segment by volume.

- Commercial Vehicles (CV): Including light commercial vehicles (LCVs) and heavy commercial vehicles (HCVs), demanding robust and durable transmissions.

- By Fuel Type:

- Gasoline: Traditional internal combustion engine vehicles powered by gasoline.

- Diesel: Vehicles utilizing diesel engines, dominant in heavy commercial vehicles and certain passenger car segments.

- Hybrid: Vehicles combining an ICE with an electric motor, requiring specialized hybrid transmission systems.

- Electric: Battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) driving demand for simpler or multi-speed EV transmissions.

- Others (e.g., CNG, LPG): Alternative fuel vehicles with specific transmission requirements.

Regional Highlights

- North America: This region is characterized by a strong consumer preference for automatic transmissions, with a high adoption rate of multi-speed ATs and DCTs in both passenger and light commercial vehicles. The market is driven by robust vehicle sales and an increasing focus on vehicle performance and comfort. The United States leads in R&D for advanced transmission technologies, though the accelerating shift towards EVs presents a long-term challenge to traditional transmission demand.

- Europe: Europe exhibits a diverse market, historically strong in manual transmissions, but now rapidly transitioning towards advanced automatics and hybrid transmission solutions. Stringent emission regulations drive innovation in fuel-efficient designs and lightweight materials. Germany, France, and the UK are key markets, with significant investment in both conventional and electrified powertrain technologies, including multi-speed solutions for EVs.

- Asia Pacific (APAC): This region represents the largest and fastest-growing market for automotive transmissions, fueled by rapid industrialization, urbanization, and a burgeoning middle class in countries like China and India. The increasing vehicle production and rising disposable incomes are boosting demand for automatic transmissions. China, in particular, is a major hub for both manufacturing and consumption, with significant investments in EV-related driveline components.

- Latin America: The automotive transmission market in Latin America is experiencing steady growth, primarily driven by increasing vehicle sales and a gradual shift from manual to automatic transmissions, particularly in passenger vehicles. Brazil and Mexico are the dominant markets, benefiting from foreign investments in manufacturing facilities and growing consumer demand for more comfortable driving experiences, although economic volatility can impact market expansion.

- Middle East & Africa (MEA): This region is an emerging market for automotive transmissions, with growth influenced by increasing vehicle ownership and infrastructure development. The market is still heavily reliant on imports of vehicles and components, but there is a growing demand for automatic transmissions driven by rising incomes and a preference for convenience, especially in the GCC countries. South Africa also plays a crucial role as a regional automotive manufacturing hub.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Transmission Market.- Aisin Corporation

- ZF Friedrichshafen AG

- Magna International

- BorgWarner Inc.

- Allison Transmission

- JATCO Ltd.

- Eaton Corporation

- Schaeffler AG

- Continental AG

- Punch Powertrain

- Hyundai Dymos

- GKN Automotive

- Dana Incorporated

- AVL

- Ricardo PLC

- Vitesco Technologies

- NSK Ltd.

- Valeo SA

- Dürr AG

- Renesas Electronics Corporation

Frequently Asked Questions

What are the primary types of automotive transmissions currently dominating the market?

The market is predominantly led by various types of automatic transmissions. These include traditional Automatic Transmissions (ATs) with multiple gear ratios, Continuously Variable Transmissions (CVTs) known for seamless acceleration and fuel efficiency, and Dual-Clutch Transmissions (DCTs) favored for their rapid and smooth gear changes, often found in performance and premium vehicles. While manual transmissions still hold a share in certain markets, their overall dominance is waning globally as consumers increasingly prefer the convenience and efficiency offered by automatic counterparts.

How is the global shift towards electric vehicles (EVs) impacting the automotive transmission market?

The transition to electric vehicles (EVs) presents a significant long-term disruptive force to the traditional automotive transmission market. Battery Electric Vehicles (BEVs) typically use simplified single-speed reduction gears rather than complex multi-speed transmissions found in Internal Combustion Engine (ICE) vehicles. This shift is reducing demand for conventional transmission components. However, the market is adapting by developing specialized multi-speed transmissions for EVs to optimize range and performance, and by innovating hybrid transmission systems that blend ICE and electric power. This signals a market evolution rather than outright disappearance for transmission manufacturers.

What role do advanced materials and manufacturing techniques play in modern automotive transmissions?

Advanced materials and manufacturing techniques are crucial for enhancing the efficiency, durability, and performance of modern automotive transmissions. Manufacturers are increasingly utilizing lightweight materials such as aluminum alloys, magnesium, and advanced composites to reduce the overall weight of transmission components, thereby improving fuel economy and reducing emissions. Techniques like precision casting, advanced forging, and even additive manufacturing (3D printing) are enabling the creation of more complex, compact, and structurally optimized designs, contributing to improved power density, reduced noise, vibration, and harshness (NVH), and longer operational lifespan for transmission systems.

Which regions are exhibiting the strongest growth in the automotive transmission market, and why?

The Asia Pacific (APAC) region, particularly countries like China and India, is demonstrating the strongest growth in the automotive transmission market. This growth is primarily driven by rapid urbanization, significant economic development, a burgeoning middle class, and subsequently, a surge in vehicle production and sales. Rising disposable incomes are fueling a greater consumer preference for advanced and more comfortable automatic transmissions over manual ones. Additionally, substantial investments in automotive manufacturing infrastructure and the rapid adoption of electric and hybrid vehicles further contribute to the dynamic expansion of the transmission market across APAC.

What are the key technological advancements driving innovation in automotive transmission systems?

Key technological advancements are centered on improving efficiency, performance, and integration with modern vehicle systems. This includes the development of more gear ratios in automatic transmissions (e.g., 8-speed, 9-speed, 10-speed ATs) to optimize engine operation across various speeds. Continuously Variable Transmissions (CVTs) are seeing innovations for improved durability and feel. Dual-Clutch Transmissions (DCTs) are becoming more widespread due to their quick shifts. Furthermore, intelligent electronic control units (ECUs) are increasingly utilizing AI and machine learning to optimize shifting patterns based on real-time driving conditions, enhancing both fuel economy and driving dynamics. Lastly, multi-speed transmissions specifically for electric vehicles are emerging to extend range and improve acceleration.