Automotive Repair and Maintenance Service Market

Automotive Repair and Maintenance Service Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_704285 | Last Updated : August 05, 2025 |

Format : ![]()

![]()

![]()

![]()

Automotive Repair and Maintenance Service Market Size

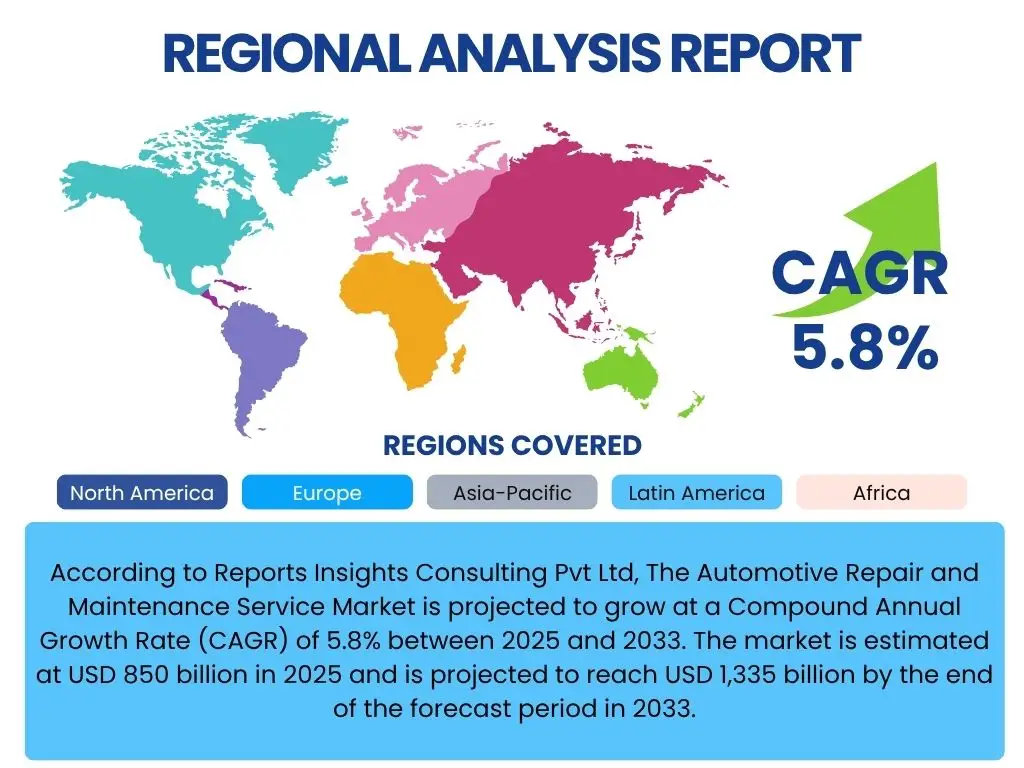

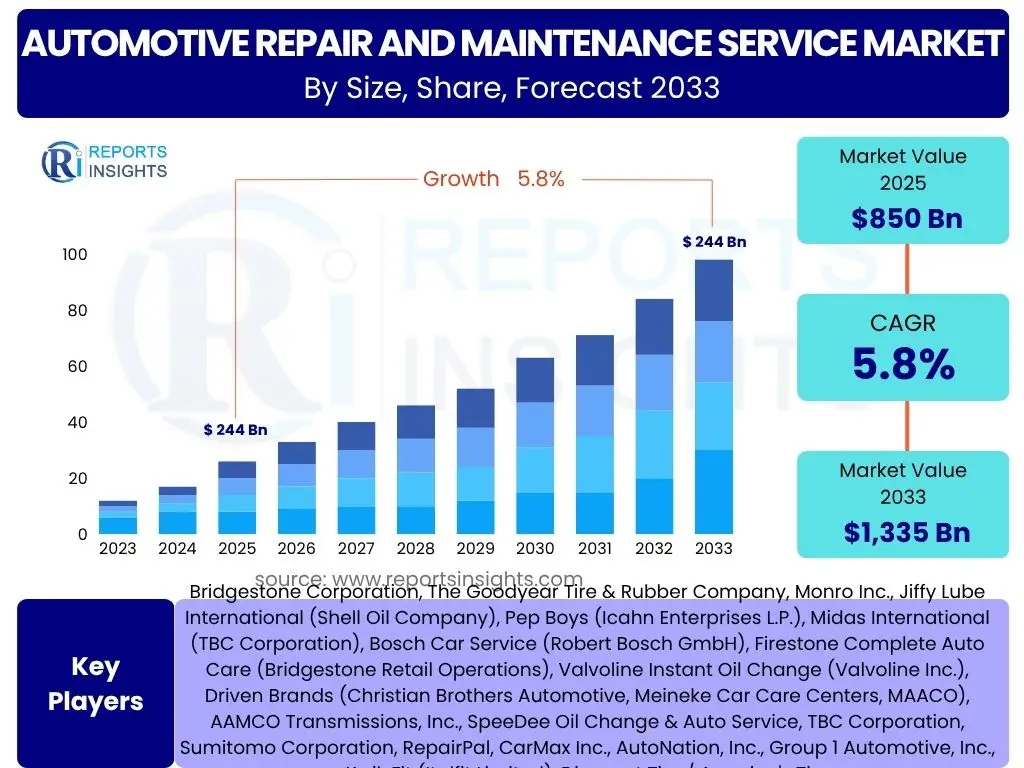

According to Reports Insights Consulting Pvt Ltd, The Automotive Repair and Maintenance Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2033. The market is estimated at USD 850 billion in 2025 and is projected to reach USD 1,335 billion by the end of the forecast period in 2033.

Key Automotive Repair and Maintenance Service Market Trends & Insights

The Automotive Repair and Maintenance Service market is currently undergoing a significant transformation, driven by a confluence of technological advancements, evolving consumer expectations, and increasing environmental consciousness. A primary area of interest for users often revolves around how vehicle technology, particularly electric powertrains and advanced driver-assistance systems (ADAS), is reshaping the service landscape. Furthermore, questions frequently arise regarding the adoption of digital tools and personalized service models, indicating a strong user focus on efficiency and convenience. Insights suggest a pronounced shift towards proactive and predictive maintenance, leveraging data analytics and connected car technologies to optimize vehicle uptime and reduce unexpected breakdowns. This proactive approach not only enhances customer satisfaction but also opens new revenue streams for service providers.

Another prominent trend gaining traction is the heightened emphasis on sustainability within the automotive aftermarket. Consumers are increasingly seeking repair and maintenance services that utilize eco-friendly practices, recycled parts, and energy-efficient operations. This aligns with broader global initiatives aimed at reducing carbon footprints and promoting circular economy principles. Additionally, the proliferation of specialized repair centers catering to specific vehicle types, such as electric vehicles or luxury cars, highlights the market's increasing segmentation and the need for highly specialized technical expertise. The ongoing evolution of vehicle ownership models, including subscription services and ride-sharing, also necessitates adaptive maintenance strategies that prioritize fleet management and longevity.

- Electrification of vehicles driving demand for specialized EV maintenance and battery services.

- Integration of Advanced Driver-Assistance Systems (ADAS) requiring precise calibration and diagnostic expertise.

- Increased adoption of telematics and connected car technologies enabling predictive maintenance and remote diagnostics.

- Growth in mobile repair and maintenance services offering convenience and flexibility to consumers.

- Rising demand for personalized customer experiences and digital service platforms.

- Emphasis on sustainable practices, including recycling and proper disposal of automotive waste.

- Evolution of DDIY (Do-It-Yourself) to DIO (Do-It-Online) with virtual diagnostics and parts ordering.

AI Impact Analysis on Automotive Repair and Maintenance Service

Common user questions regarding AI's influence on the Automotive Repair and Maintenance Service sector frequently explore its potential to revolutionize diagnostic processes, optimize workshop operations, and enhance the overall customer experience. Users are keen to understand if AI will lead to more accurate and faster problem identification, reduce human error, and streamline inventory management. Concerns often surface about job displacement for traditional mechanics versus the creation of new roles requiring advanced technical skills. The consensus derived from these inquiries points towards AI acting as an augmentative technology, empowering technicians with intelligent tools rather than entirely replacing human expertise.

The integration of artificial intelligence is fundamentally transforming how automotive repair and maintenance services are delivered. AI-powered diagnostic systems, for instance, can analyze vast datasets of vehicle performance, fault codes, and historical repair records to pinpoint issues with unprecedented accuracy and speed, significantly reducing diagnostic time and improving first-time fix rates. Furthermore, AI algorithms are being deployed to optimize inventory management by predicting part demand, minimizing stockouts, and reducing holding costs. This not only enhances operational efficiency but also contributes to greater customer satisfaction by ensuring parts availability. The impact extends to customer service, with AI-driven chatbots and virtual assistants providing instant support, scheduling appointments, and offering preliminary troubleshooting guidance, thereby improving accessibility and convenience for vehicle owners.

- Enhanced diagnostics and troubleshooting through AI-powered predictive analytics.

- Optimization of service schedules and workshop efficiency using AI algorithms.

- Automated inventory management and parts ordering, reducing waste and improving availability.

- Personalized customer engagement and support via AI chatbots and virtual assistants.

- Development of autonomous repair capabilities for routine maintenance tasks.

- Advanced technician training and augmented reality (AR) support tools for complex repairs.

- Improved quality control and failure analysis through machine learning pattern recognition.

Key Takeaways Automotive Repair and Maintenance Service Market Size & Forecast

Analyzing common user questions about the Automotive Repair and Maintenance Service market size and forecast reveals a strong interest in understanding the underlying drivers of growth, the impact of new vehicle technologies, and the resilience of the aftermarket sector against economic fluctuations. Users frequently inquire about which segments will experience the most significant expansion and the long-term viability of traditional repair models in an increasingly electrified and connected automotive landscape. The primary insight is that the market is poised for steady expansion, largely driven by the increasing complexity and technological sophistication of modern vehicles, which necessitates professional servicing and specialized diagnostic tools. This growth is also underpinned by a growing global vehicle parc and the increasing average age of vehicles in operation, creating a consistent demand for maintenance and repair.

Furthermore, a significant takeaway is the pivotal role of technological adoption by service providers in capturing market share and ensuring future relevance. Workshops that invest in training for electric vehicle (EV) maintenance, ADAS calibration, and advanced diagnostic software are better positioned for sustained growth. The forecast indicates that while new vehicle sales cycles can influence demand, the aftermarket's essential nature ensures its robustness. The emergence of new business models, such as mobile repair services and subscription-based maintenance plans, also contributes to the market's adaptability and expansion. Overall, the market is characterized by a dynamic interplay of innovation, consumer demand for convenience, and the fundamental requirement for vehicle safety and longevity.

- Steady growth projected for the Automotive Repair and Maintenance Service market, driven by increasing vehicle complexity and parc size.

- Technological advancements, particularly in EV and ADAS, are creating new service opportunities and specialized demand.

- The market demonstrates resilience against economic downturns due to the essential nature of vehicle maintenance.

- Digitalization and personalized service models are crucial for enhancing customer experience and operational efficiency.

- Investments in technician training and advanced diagnostic equipment are critical success factors for service providers.

Automotive Repair and Maintenance Service Market Drivers Analysis

The Automotive Repair and Maintenance Service market is significantly propelled by several key drivers that collectively contribute to its robust growth trajectory. A fundamental factor is the continuous expansion of the global vehicle parc, meaning more cars are on the roads, directly translating to a greater need for regular servicing and occasional repairs. Concurrently, the rising average age of vehicles in operation in many regions necessitates more frequent and comprehensive maintenance, as older vehicles tend to require more upkeep to remain roadworthy and efficient. These demographic shifts in the vehicle fleet provide a stable base demand for aftermarket services, regardless of new vehicle sales fluctuations.

Technological advancements in vehicles, while presenting new challenges, also act as a potent driver. Modern cars equipped with complex electronics, Advanced Driver-Assistance Systems (ADAS), and increasingly, electric powertrains, require specialized tools, diagnostics, and highly trained technicians for servicing. This complexity pushes car owners away from Do-It-Yourself (DIY) repairs towards professional service centers. Furthermore, stringent government regulations concerning vehicle emissions, safety standards, and roadworthiness mandates regular inspections and maintenance, thereby ensuring a baseline demand for professional repair services across various regions. The increasing disposable income in developing economies also allows vehicle owners to afford better and more consistent maintenance, contributing to market expansion.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Vehicle Parc | +1.2% | Global | Long-term |

| Rising Average Age of Vehicles | +1.0% | North America, Europe, Asia Pacific | Medium-term to Long-term |

| Technological Advancements in Vehicles | +0.8% | Global | Short-term to Long-term |

| Stringent Vehicle Regulations | +0.7% | Europe, North America, Asia Pacific | Medium-term |

| Growth in Disposable Income | +0.5% | Asia Pacific, Latin America, Middle East & Africa | Long-term |

Automotive Repair and Maintenance Service Market Restraints Analysis

Despite the positive growth outlook, the Automotive Repair and Maintenance Service market faces several significant restraints that could impede its expansion. One prominent challenge is the increasing reliability and durability of modern vehicles, which are manufactured with higher quality components and longer service intervals. This enhanced vehicle lifespan and reduced need for frequent repairs can naturally dampen demand for certain maintenance services over time. Furthermore, the rising cost of automotive parts and specialized labor, particularly for technologically advanced systems like ADAS or EV powertrains, can deter consumers from undertaking necessary repairs, potentially leading to delayed maintenance or an increased preference for DDIY (Do-It-Yourself) solutions for simpler tasks, though this trend is somewhat offset by vehicle complexity.

Another crucial restraint is the persistent shortage of skilled technicians qualified to work on sophisticated modern vehicles. The rapid pace of technological change often outstrips the rate at which the workforce can be trained, leading to a talent gap that affects service quality and availability, especially in specialized areas. Economic downturns or inflationary pressures can also significantly impact consumer spending on non-essential or delayed maintenance, as households prioritize other expenditures. Moreover, the increasing adoption of public transportation, ride-sharing services, and autonomous vehicles in urban centers could, in the long run, reduce individual car ownership rates, thereby marginally impacting the overall demand for personal vehicle maintenance services.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increased Vehicle Reliability and Longer Service Intervals | -0.8% | Global | Long-term |

| High Cost of Parts and Labor | -0.7% | Global | Short-term to Medium-term |

| Shortage of Skilled Technicians | -0.6% | North America, Europe | Medium-term |

| Economic Volatility and Inflationary Pressures | -0.5% | Global | Short-term |

| Growing DDIY (Do-It-Yourself) Trend for Simple Repairs | -0.3% | North America, Europe | Short-term |

Automotive Repair and Maintenance Service Market Opportunities Analysis

The Automotive Repair and Maintenance Service market presents numerous lucrative opportunities driven by evolving automotive technologies and changing consumer behaviors. The rapid global shift towards electric vehicles (EVs) represents a significant new frontier, as EVs require different maintenance procedures and specialized services for battery health, electric powertrain diagnostics, and charging infrastructure, distinct from traditional internal combustion engine vehicles. This transition opens up substantial avenues for service providers who invest in the necessary equipment and training to cater to the burgeoning EV fleet. Furthermore, the proliferation of Advanced Driver-Assistance Systems (ADAS) and connectivity features in modern cars creates a consistent demand for precise calibration, software updates, and complex diagnostic services, areas that often cannot be addressed by general mechanics without specialized tools.

The increasing digitalization of consumer interactions offers another immense opportunity. Developing and implementing online booking platforms, telematics-driven predictive maintenance solutions, and mobile service units can significantly enhance customer convenience and operational efficiency, attracting a broader customer base. Data analytics and Artificial Intelligence (AI) can further optimize service offerings by identifying common issues, predicting failures, and personalizing maintenance recommendations. Additionally, the growing popularity of vehicle subscription models and fleet management services necessitates comprehensive and proactive maintenance solutions, presenting a consistent revenue stream for specialized service providers. Collaborations between independent workshops and technology providers, as well as the expansion into underserved rural areas, also represent untapped market potential.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Electric Vehicle (EV) Maintenance and Servicing | +1.5% | Global | Long-term |

| ADAS Calibration and Software Updates | +1.0% | North America, Europe, Asia Pacific | Medium-term to Long-term |

| Development of Digital and Mobile Service Platforms | +0.9% | Global | Short-term to Medium-term |

| Leveraging Data Analytics and AI for Predictive Maintenance | +0.8% | North America, Europe | Medium-term |

| Expansion into Fleet Management and Subscription Models | +0.6% | Global | Long-term |

Automotive Repair and Maintenance Service Market Challenges Impact Analysis

The Automotive Repair and Maintenance Service market faces several significant challenges that demand strategic responses from industry players. One of the primary obstacles is the rapid pace of technological evolution in vehicles, which constantly requires service providers to update their diagnostic tools, equipment, and, most critically, the skills of their technical staff. Keeping up with advancements such as complex ADAS, hybrid, and electric powertrains, and integrated software systems demands continuous investment in training and infrastructure, which can be a substantial burden for smaller independent workshops. This technological complexity also contributes to the challenge of acquiring and retaining highly skilled technicians, a persistent issue across many regions. The talent pipeline often struggles to meet the demand for professionals proficient in modern vehicle technologies.

Moreover, intense competition from Original Equipment Manufacturers (OEMs) and authorized dealerships, which often possess proprietary diagnostic tools and factory-trained technicians, poses a significant challenge to independent repair shops. OEM dealerships frequently offer bundled service plans and warranty-backed repairs, making them an attractive option for newer vehicles. Supply chain disruptions, as experienced recently with global events, can also severely impact the availability of parts, leading to repair delays and increased costs, which directly affect customer satisfaction and workshop profitability. Cybersecurity risks related to connected car systems and digital service platforms represent another emerging challenge, requiring robust data protection measures to maintain consumer trust and comply with privacy regulations. Addressing these multifaceted challenges requires adaptability, strategic investment, and a focus on specialized service offerings.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Rapid Technological Advancements in Vehicles | -0.7% | Global | Long-term |

| Shortage of Skilled Technicians and Training Costs | -0.6% | North America, Europe, Asia Pacific | Medium-term |

| Competition from OEMs and Authorized Dealerships | -0.5% | Global | Medium-term |

| Supply Chain Disruptions and Parts Availability | -0.4% | Global | Short-term |

| Cybersecurity Risks in Connected Vehicle Ecosystems | -0.3% | Global | Medium-term to Long-term |

Automotive Repair and Maintenance Service Market - Updated Report Scope

This comprehensive market research report on the Automotive Repair and Maintenance Service market provides an in-depth analysis of current industry trends, growth drivers, restraints, opportunities, and challenges. It encompasses a detailed segmentation of the market by service type, vehicle type, and service provider type, offering a granular view of market dynamics. The report also provides a robust regional analysis, highlighting key market performances and growth potentials across major geographies, thereby equipping stakeholders with actionable insights for strategic decision-making and competitive positioning in a rapidly evolving automotive aftermarket landscape.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 850 billion |

| Market Forecast in 2033 | USD 1,335 billion |

| Growth Rate | 5.8% |

| Number of Pages | 245 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Bridgestone Corporation, The Goodyear Tire & Rubber Company, Monro Inc., Jiffy Lube International (Shell Oil Company), Pep Boys (Icahn Enterprises L.P.), Midas International (TBC Corporation), Bosch Car Service (Robert Bosch GmbH), Firestone Complete Auto Care (Bridgestone Retail Operations), Valvoline Instant Oil Change (Valvoline Inc.), Driven Brands (Christian Brothers Automotive, Meineke Car Care Centers, MAACO), AAMCO Transmissions, Inc., SpeeDee Oil Change & Auto Service, TBC Corporation, Sumitomo Corporation, RepairPal, CarMax Inc., AutoNation, Inc., Group 1 Automotive, Inc., Kwik Fit (Italfit Limited), Discount Tire / America's Tire |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Automotive Repair and Maintenance Service market is comprehensively segmented to provide a granular understanding of its diverse components and dynamics. This segmentation facilitates a deeper analysis of market trends, consumer preferences, and competitive landscapes across various service offerings, vehicle types, and service provider models. Understanding these distinct segments is crucial for stakeholders to identify niche opportunities, tailor their service portfolios, and develop targeted marketing strategies. The market can be broadly categorized by the nature of the service performed, the type of vehicle being serviced, and the operational structure of the service provider.

Within the Service Type segment, a wide array of specialized services contribute to the overall market. Routine maintenance services such as oil changes and tire rotations form the bedrock, while more complex repairs like engine overhauls, transmission servicing, and electrical system diagnostics represent higher value propositions requiring specialized expertise. Collision repair and bodywork also constitute a significant portion, driven by accidents and wear-and-tear. The Vehicle Type segmentation highlights the differing maintenance needs and service volumes for passenger cars, light commercial vehicles (LCVs), heavy commercial vehicles (HCVs), and the rapidly growing segment of electric vehicles (EVs), each demanding unique technical skills and infrastructure. The burgeoning EV segment, in particular, requires specific competencies related to battery management, charging systems, and electric powertrain components.

The Service Provider Type segmentation illustrates the varied landscape of maintenance facilities. Franchise general repair centers and independent garages form the backbone of the aftermarket, offering a broad range of services. Authorized dealerships typically cater to newer vehicles under warranty, providing brand-specific expertise. Specialty shops focus on particular vehicle systems (e.g., brakes, tires, transmissions), while mobile service providers offer convenient, on-site repairs, a growing trend catering to consumer demand for flexibility. This diverse ecosystem of service providers ensures that a wide spectrum of consumer needs and vehicle requirements are met, fostering a competitive and innovation-driven market environment.

- By Service Type:

- Engine & Exhaust System: Comprehensive diagnostics, repair, and emission control services.

- Transmission & Drivetrain: Maintenance and repair of manual, automatic, and hybrid transmissions.

- Brake System: Inspection, repair, and replacement of brake components for safety.

- Suspension & Steering: Services ensuring vehicle handling, ride comfort, and alignment.

- Electrical System: Diagnostics and repair of vehicle wiring, lighting, and electronic controls.

- HVAC System: Maintenance and repair of heating, ventilation, and air conditioning systems.

- Body & Paint Repair: Services related to exterior damage repair, dent removal, and painting.

- Tires & Wheels: Tire sales, rotation, balancing, alignment, and puncture repair.

- Oil Change & Lubrication: Essential routine maintenance for engine longevity.

- Collision Repair: Extensive restoration services post-accident.

- Other Services: Includes detailing, vehicle inspections, and ancillary services.

- By Vehicle Type:

- Passenger Cars: Sedans, SUVs, hatchbacks, coupes, etc., accounting for the largest volume.

- Light Commercial Vehicles (LCVs): Vans, pickups, and light trucks used for business.

- Heavy Commercial Vehicles (HCVs): Large trucks, buses, and specialized commercial vehicles requiring heavy-duty maintenance.

- Electric Vehicles (EVs): Battery electric vehicles (BEVs), plug-in hybrids (PHEVs), and mild hybrids (MHEVs).

- By Service Provider Type:

- Franchise General Repair: Nationally recognized chains offering a range of services.

- Independent Garages: Locally owned and operated repair shops.

- Authorized Dealerships: Manufacturer-affiliated service centers for specific brands.

- Specialty Shops: Businesses focusing on specific services like auto glass, transmissions, or mufflers.

- Tire & Lube Shops: Quick service centers primarily for tire and oil-related maintenance.

- Mobile Service Providers: Services performed at the customer's location.

Regional Highlights

The Automotive Repair and Maintenance Service market exhibits distinct characteristics and growth trajectories across various geographic regions, influenced by factors such as vehicle parc size, average vehicle age, economic development, regulatory frameworks, and technological adoption rates. North America, for instance, represents a mature market characterized by a large and aging vehicle fleet, high consumer disposable income, and a strong preference for convenience-driven services, including mobile repairs and digital booking platforms. The region is also at the forefront of ADAS integration and EV adoption, necessitating continuous investment in specialized diagnostic equipment and technician training.

Europe’s market is shaped by stringent emission regulations, a strong emphasis on vehicle safety, and a growing penetration of electric and hybrid vehicles. Countries like Germany, France, and the UK boast well-established aftermarket networks, with a significant shift towards independent garages adopting advanced diagnostic tools to compete with authorized dealerships. The region is witnessing an increase in demand for sustainable repair practices and digital service solutions. Asia Pacific (APAC) emerges as the fastest-growing market, primarily driven by expanding vehicle ownership, particularly in emerging economies like China and India, alongside a burgeoning middle class with increasing spending power on vehicle maintenance. Rapid urbanization and improving road infrastructure also contribute to sustained growth, although challenges related to skilled labor and widespread digital adoption persist in some sub-regions.

Latin America and the Middle East & Africa (MEA) regions present considerable growth potential, albeit with varying levels of market maturity and infrastructure development. In Latin America, the market is influenced by economic stability and the rising vehicle parc, leading to an increasing demand for affordable and accessible repair services. MEA, particularly the GCC countries, is witnessing growth spurred by infrastructure development and rising vehicle sales, alongside a growing demand for premium vehicle services. However, both regions face challenges related to the informal sector, supply chain complexities, and the need for significant investment in modern workshop equipment and skilled workforce development. Overall, each region offers unique market dynamics and opportunities for strategic expansion.

- North America: Large, aging vehicle parc, high disposable income, rapid adoption of advanced vehicle technologies (EVs, ADAS), strong demand for convenience and digital services.

- Europe: Strict environmental and safety regulations, growing EV and hybrid vehicle penetration, emphasis on specialized diagnostic services, well-established independent garage networks.

- Asia Pacific (APAC): Fastest-growing market driven by increasing vehicle ownership in emerging economies (China, India), rising disposable income, and urbanization; growing demand for formal service channels.

- Latin America: Expanding vehicle parc, economic growth driving demand for basic to advanced repairs, informal sector competition, increasing investment in modern workshops.

- Middle East and Africa (MEA): Growing vehicle sales and infrastructure development, increasing demand for quality repair services, focus on premium and specialized vehicle maintenance in certain sub-regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Repair and Maintenance Service Market.- Bridgestone Corporation

- The Goodyear Tire & Rubber Company

- Monro Inc.

- Jiffy Lube International (Shell Oil Company)

- Pep Boys (Icahn Enterprises L.P.)

- Midas International (TBC Corporation)

- Bosch Car Service (Robert Bosch GmbH)

- Firestone Complete Auto Care (Bridgestone Retail Operations)

- Valvoline Instant Oil Change (Valvoline Inc.)

- Driven Brands (Christian Brothers Automotive, Meineke Car Care Centers, MAACO)

- AAMCO Transmissions, Inc.

- SpeeDee Oil Change & Auto Service

- TBC Corporation

- Sumitomo Corporation

- RepairPal

- CarMax Inc.

- AutoNation, Inc.

- Group 1 Automotive, Inc.

- Kwik Fit (Italfit Limited)

- Discount Tire / America's Tire

Frequently Asked Questions

What is the projected growth rate for the Automotive Repair and Maintenance Service Market?

The Automotive Repair and Maintenance Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2033. This consistent growth is primarily driven by the increasing global vehicle parc, the rising average age of vehicles, and the growing technological complexity of modern automobiles requiring specialized repair and maintenance services.

How is electric vehicle (EV) adoption impacting the automotive service industry?

EV adoption is significantly reshaping the automotive service industry by creating new demands for specialized maintenance. Unlike traditional internal combustion engine vehicles, EVs require expertise in battery diagnostics, electric motor servicing, and charging system repairs. This shift necessitates substantial investment in new tools, infrastructure, and advanced training for technicians, opening up lucrative opportunities for service providers who adapt quickly.

What are the key technological trends influencing vehicle maintenance?

Key technological trends influencing vehicle maintenance include the widespread integration of Advanced Driver-Assistance Systems (ADAS), which require precise calibration post-repair; the rise of connected car technologies enabling predictive maintenance and remote diagnostics; and the increasing use of artificial intelligence (AI) for enhanced diagnostics, optimized inventory management, and personalized customer interactions, streamlining overall service operations.

What challenges do independent repair shops face in the current market?

Independent repair shops face challenges such as keeping pace with rapid technological advancements in vehicles, which demands continuous investment in specialized equipment and technician training. They also encounter intense competition from Original Equipment Manufacturers (OEMs) and authorized dealerships, who often have proprietary diagnostic tools and factory-trained staff, making it crucial for independents to specialize or offer unique value propositions.

How important is digitalization in the future of automotive repair services?

Digitalization is critically important for the future of automotive repair services, driving efficiency, customer convenience, and market competitiveness. This includes the adoption of online booking platforms, digital vehicle health reports, telematics-driven predictive maintenance, and mobile service applications. Embracing digital tools allows service providers to enhance customer engagement, optimize workshop operations, and streamline workflows, meeting evolving consumer expectations for seamless service experiences.