Automotive Usage based Insurance Market

Automotive Usage based Insurance Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_704432 | Last Updated : August 05, 2025 |

Format : ![]()

![]()

![]()

![]()

Automotive Usage based Insurance Market Size

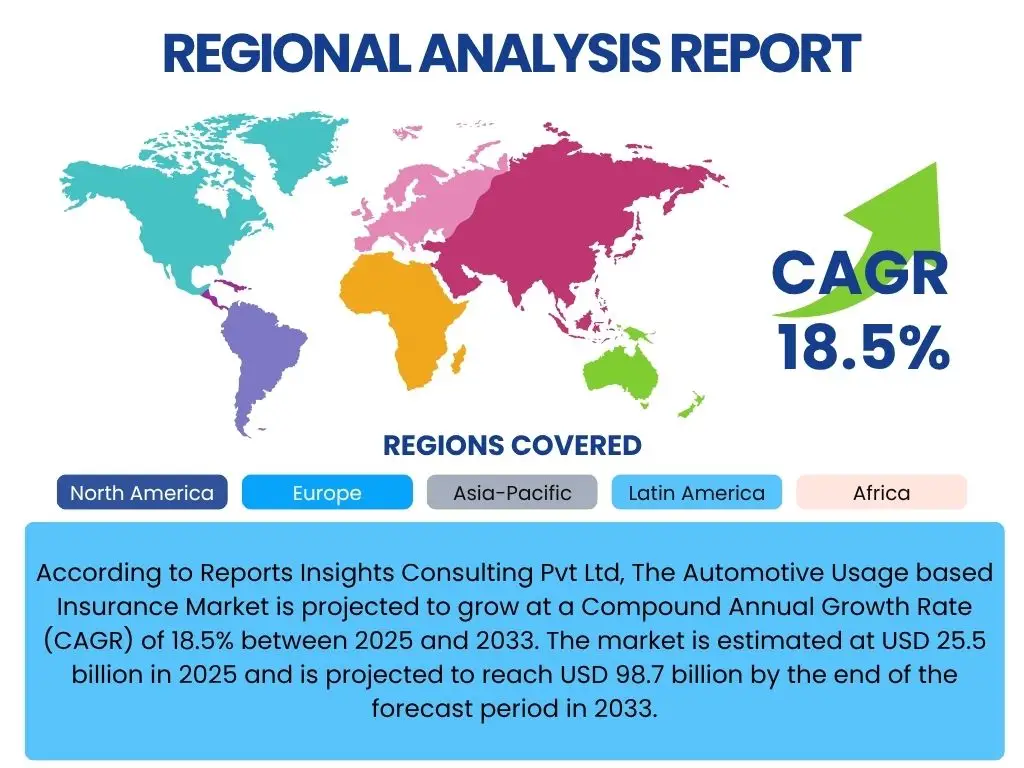

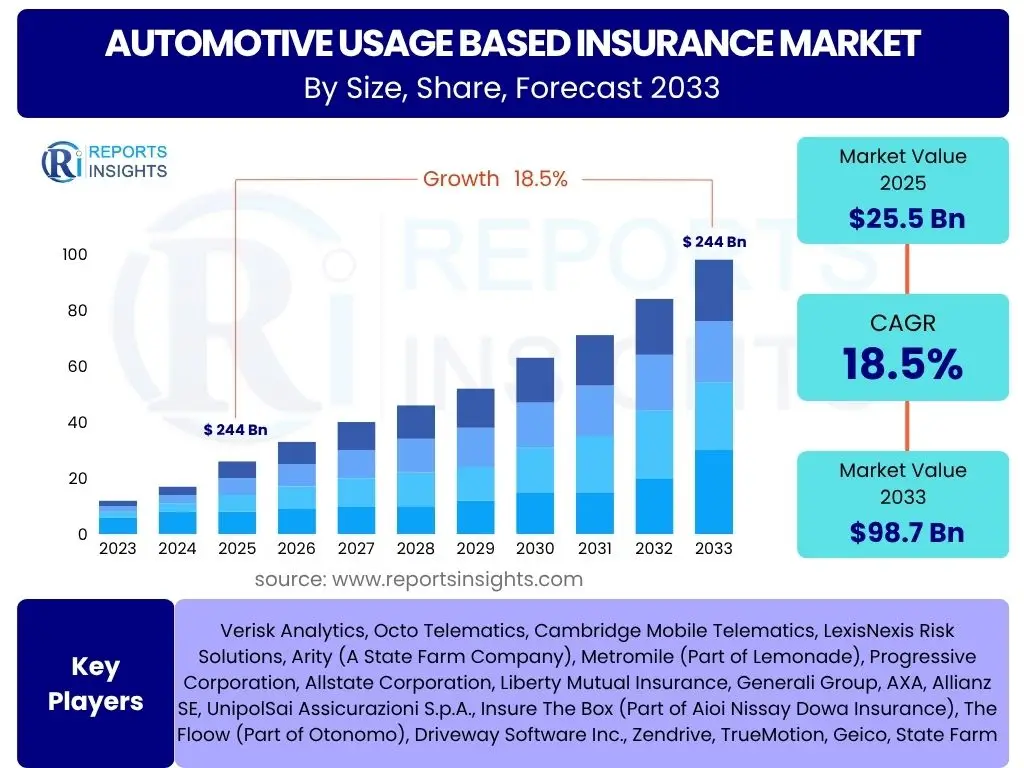

According to Reports Insights Consulting Pvt Ltd, The Automotive Usage based Insurance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2025 and 2033. The market is estimated at USD 25.5 billion in 2025 and is projected to reach USD 98.7 billion by the end of the forecast period in 2033.

Key Automotive Usage based Insurance Market Trends & Insights

User inquiries regarding the Automotive Usage based Insurance (UBI) market frequently focus on its evolving landscape, particularly the impact of technological advancements and changing consumer behaviors. Common questions revolve around the primary drivers of growth, emerging technologies shaping product offerings, and the overall shift from traditional insurance models to more dynamic, data-driven approaches. There is a clear interest in understanding how UBI is becoming more personalized and integrated with broader automotive ecosystems, alongside the increasing emphasis on data security and privacy.

The market is currently witnessing a significant pivot towards sophisticated data analytics and real-time risk assessment, moving beyond simple mileage tracking. This evolution is driven by advancements in telematics, artificial intelligence, and the proliferation of connected vehicles, enabling insurers to offer highly customized premiums based on actual driving behavior. Furthermore, the growing demand for fairer, more transparent insurance pricing and the potential for reduced premiums for safe drivers are compelling factors influencing widespread adoption. Regulatory frameworks are also slowly adapting to support these innovative models, fostering an environment conducive to market expansion.

- Increased integration of telematics devices (OBD-II, smartphone apps, embedded systems) for granular data collection.

- Rising adoption of Artificial Intelligence and Machine Learning for advanced risk assessment and predictive modeling.

- Shift from Pay-As-You-Drive (PAYD) to more sophisticated Pay-How-You-Drive (PHYD) and Manage-How-You-Drive (MHYD) models.

- Growing consumer demand for personalized insurance premiums based on actual driving behavior.

- Expansion of UBI offerings beyond traditional passenger vehicles to commercial fleets.

- Partnerships between insurance providers, automotive OEMs, and technology companies to enhance UBI platforms.

- Focus on data privacy, security, and transparent data usage policies to build consumer trust.

- Development of value-added services beyond premium calculation, such as roadside assistance, vehicle health monitoring, and accident reconstruction.

- Emergence of behavior-based loyalty programs and incentives for safe driving.

AI Impact Analysis on Automotive Usage based Insurance

User queries concerning the impact of Artificial Intelligence (AI) on Automotive Usage based Insurance frequently highlight its transformative potential in areas such as precision underwriting, fraud detection, and customer engagement. Users are keen to understand how AI algorithms can process vast amounts of telematics data to generate more accurate risk profiles, predict future claim probabilities, and personalize insurance products to an unprecedented degree. There is also interest in the efficiency gains AI offers to insurers in automating processes and enhancing operational capabilities, alongside discussions about the ethical implications and data biases that may arise from extensive AI deployment.

AI's influence extends deeply into the core operations of UBI, enabling insurers to move beyond traditional demographic-based risk assessment to dynamic, behavior-based models. Machine learning algorithms can identify subtle patterns in driving data that human analysts might miss, leading to more equitable and precise premium calculations. Furthermore, AI facilitates real-time feedback mechanisms for drivers, promoting safer driving habits by offering immediate insights and coaching. This not only benefits policyholders through potential premium reductions but also contributes to overall road safety, making AI a cornerstone of the future UBI landscape.

- Enhanced risk assessment and dynamic pricing models through machine learning algorithms analyzing driving data.

- Improved fraud detection by identifying suspicious patterns in claims data and accident reconstruction.

- Personalized premium calculation based on individual driving behavior, promoting fairness and transparency.

- Predictive analytics for claims management, enabling proactive intervention and efficient resource allocation.

- Real-time feedback mechanisms for drivers, encouraging safer driving habits and reducing accident frequency.

- Automation of underwriting processes, leading to faster policy issuance and reduced operational costs.

- Development of new product offerings, such as micro-insurance or on-demand insurance, tailored by AI insights.

- Integration with connected car data for more comprehensive insights into vehicle usage and condition.

- Optimization of customer engagement through AI-powered chatbots and personalized recommendations.

Key Takeaways Automotive Usage based Insurance Market Size & Forecast

Common user questions regarding the key takeaways from the Automotive Usage based Insurance market size and forecast reveal a strong interest in understanding the overall growth trajectory and the underlying factors driving this expansion. Users typically seek confirmation of the market's robust growth potential, the primary technological enablers, and the evolving consumer landscape that supports the shift towards UBI. The insights provided indicate a market poised for significant expansion, fundamentally reshaped by advancements in data science and digital integration, promising a more personalized and risk-reflective insurance paradigm.

The forecast underscores a profound transformation within the automotive insurance sector, moving towards models that reward safe driving and provide greater transparency in pricing. The substantial projected Compound Annual Growth Rate (CAGR) highlights not only the increasing acceptance of telematics technology but also the growing consumer demand for insurance solutions that offer greater control and responsiveness. This growth is intrinsically linked to the continuous innovation in data collection, processing, and analytical capabilities, making UBI a critical component of the future of automotive risk management and a significant area of focus for insurers globally.

- The Automotive Usage based Insurance market is set for robust growth, with nearly a four-fold increase in value projected between 2025 and 2033.

- Technological advancements, particularly in telematics and AI, are pivotal enablers driving market expansion and innovation.

- Increasing consumer acceptance of data-driven insurance models, driven by potential cost savings and personalized offerings, is a key growth factor.

- The market's future will be characterized by sophisticated behavioral analytics, moving beyond simple mileage tracking to comprehensive driving habit assessment.

- Emerging regulatory support and the development of standardized data protocols will further accelerate market adoption and interoperability.

Automotive Usage based Insurance Market Drivers Analysis

The Automotive Usage based Insurance market is primarily driven by a confluence of technological advancements, evolving consumer expectations, and increasing awareness regarding the benefits of personalized insurance. The proliferation of connected devices, including smartphones and in-vehicle telematics, has made data collection more accessible and cost-effective for insurers. This technological backbone enables the creation of highly granular risk profiles, allowing for more accurate and fair premium calculations, which in turn attracts price-sensitive consumers seeking to reduce their insurance costs based on their actual driving behavior rather than broad demographic assumptions.

Furthermore, the growing emphasis on road safety and the desire for proactive risk management tools also contribute significantly to market growth. UBI models offer real-time feedback and insights into driving habits, potentially leading to safer roads and fewer accidents. Regulatory bodies in various regions are beginning to recognize the potential societal benefits of UBI, fostering an environment that supports its adoption. This combination of technological readiness, consumer demand for fairness, and supportive regulatory trends forms a strong foundation for sustained market expansion.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing penetration of smartphones and telematics devices | +4.2% | Global, particularly North America, Europe, Asia Pacific | Short to Medium Term (2025-2029) |

| Growing demand for personalized and transparent insurance premiums | +3.8% | Global | Medium to Long Term (2027-2033) |

| Advancements in data analytics and Artificial Intelligence (AI) | +3.5% | Global | Short to Long Term (2025-2033) |

| Potential for reduced insurance premiums for safe drivers | +3.0% | Global | Short to Medium Term (2025-2030) |

| Regulatory support and initiatives promoting road safety | +2.0% | Europe, parts of North America, emerging Asia Pacific markets | Medium Term (2026-2031) |

Automotive Usage based Insurance Market Restraints Analysis

Despite the significant growth potential, the Automotive Usage based Insurance market faces several notable restraints that could temper its expansion. Prominent among these are persistent data privacy concerns and a general lack of consumer awareness regarding the benefits and mechanics of UBI. Many potential policyholders are hesitant to share their driving data due to privacy worries, fear of increased premiums for less-than-perfect driving, or a misunderstanding of how the data is used and protected. This skepticism represents a significant hurdle that requires concerted efforts from insurers to build trust and educate the market.

Furthermore, the initial costs associated with implementing telematics infrastructure, particularly for smaller insurers or in regions with less developed technological ecosystems, can be substantial. This includes the investment in hardware (e.g., OBD-II devices, embedded systems), software for data processing and analytics, and the expertise required to manage these complex systems. Regulatory complexities, especially across diverse international markets, also pose a challenge, as varying data protection laws and insurance regulations can hinder the development of standardized UBI products and global scalability for providers.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Data privacy and security concerns among consumers | -2.8% | Global, particularly GDPR-sensitive regions (Europe) | Short to Long Term (2025-2033) |

| Lack of consumer awareness and understanding of UBI benefits | -2.5% | Global, particularly emerging markets | Short to Medium Term (2025-2030) |

| High initial setup costs for telematics infrastructure and data platforms | -1.5% | Emerging markets, smaller insurers globally | Short to Medium Term (2025-2029) |

| Regulatory complexities and varying data governance frameworks across regions | -1.2% | Global, especially fragmented regulatory landscapes | Medium Term (2026-2031) |

Automotive Usage based Insurance Market Opportunities Analysis

Significant opportunities abound within the Automotive Usage based Insurance market, primarily driven by the ongoing evolution of connected car technologies and the expansion into new vehicle segments. The deep integration of UBI solutions with in-vehicle infotainment systems and manufacturer-embedded telematics units presents a seamless data collection mechanism, enhancing user experience and reducing the need for aftermarket devices. This integration paves the way for advanced services that extend beyond basic insurance, such as predictive maintenance and emergency assistance, adding substantial value for both drivers and insurers. Furthermore, the burgeoning electric vehicle (EV) market offers a distinct opportunity for UBI, as EVs often generate unique driving data that can be leveraged for specialized insurance products.

Beyond passenger vehicles, the commercial fleet sector represents a largely untapped yet highly promising segment for UBI adoption. Fleet managers can leverage UBI data to optimize operational efficiency, monitor driver behavior for safety and compliance, and significantly reduce overall insurance costs through tailored policies. The continuous development of sophisticated data analytics and AI tools further empowers insurers to innovate their offerings, identify new risk parameters, and create highly granular products that cater to niche markets. As consumer attitudes towards data sharing continue to mature and trust in digital solutions grows, the potential for widespread adoption of these advanced UBI solutions will only increase, unlocking substantial new revenue streams for market players.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Integration with connected car ecosystems and automotive OEMs | +3.5% | North America, Europe, developed Asia Pacific | Medium to Long Term (2027-2033) |

| Expansion into commercial fleet insurance and logistics sectors | +3.0% | Global | Short to Medium Term (2025-2030) |

| Development of advanced data analytics and AI-driven personalized products | +2.8% | Global | Short to Long Term (2025-2033) |

| Penetration into emerging markets with growing automotive sales | +2.5% | Asia Pacific (e.g., India, China), Latin America, MEA | Medium to Long Term (2028-2033) |

| Leveraging new data sources (e.g., smart city data, environmental data) | +1.8% | Globally, particularly urbanized areas | Long Term (2030-2033) |

Automotive Usage based Insurance Market Challenges Impact Analysis

The Automotive Usage based Insurance market, while promising, grapples with several significant challenges that necessitate strategic navigation for sustained growth. One primary hurdle is the establishment of standardized data protocols and ensuring interoperability across diverse telematics devices and platforms. Without common standards, integrating data from various sources can be complex and expensive, hindering the seamless exchange of information between vehicles, insurers, and other service providers. This fragmentation can limit the scalability of UBI programs and increase operational overhead for companies attempting to consolidate data from multiple vendors.

Another critical challenge involves cybersecurity threats and the imperative to protect sensitive driving data from breaches or misuse. As UBI relies heavily on personal driving habits, any compromise of this data could erode consumer trust and lead to severe reputational damage for insurers. Ensuring robust data encryption, secure storage, and compliance with evolving data protection regulations worldwide is paramount. Furthermore, overcoming consumer resistance to monitoring, often stemming from concerns about privacy or the potential for increased premiums, remains a persistent challenge that requires effective communication strategies and clear demonstrations of the value proposition of UBI.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Data standardization and interoperability across devices and platforms | -2.0% | Global | Short to Medium Term (2025-2030) |

| Cybersecurity threats and ensuring robust data protection | -1.8% | Global | Short to Long Term (2025-2033) |

| Consumer resistance to monitoring and privacy concerns | -1.5% | Global | Short to Medium Term (2025-2030) |

| Maintaining equitable pricing for all drivers and avoiding adverse selection | -1.0% | Global | Medium to Long Term (2027-2033) |

Automotive Usage based Insurance Market - Updated Report Scope

This market insights report provides a comprehensive analysis of the Automotive Usage based Insurance (UBI) market, offering a detailed examination of its size, growth trends, and future projections from 2025 to 2033. It delves into the key drivers, restraints, opportunities, and challenges shaping the industry, incorporating a thorough impact analysis of these factors on market dynamics. The report also highlights the transformative influence of Artificial Intelligence and advanced telematics technologies, presenting a strategic overview for stakeholders seeking to understand the evolving landscape of automotive risk assessment and personalized insurance solutions.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 25.5 Billion |

| Market Forecast in 2033 | USD 98.7 Billion |

| Growth Rate | 18.5% |

| Number of Pages | 250 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Verisk Analytics, Octo Telematics, Cambridge Mobile Telematics, LexisNexis Risk Solutions, Arity (A State Farm Company), Metromile (Part of Lemonade), Progressive Corporation, Allstate Corporation, Liberty Mutual Insurance, Generali Group, AXA, Allianz SE, UnipolSai Assicurazioni S.p.A., Insure The Box (Part of Aioi Nissay Dowa Insurance), The Floow (Part of Otonomo), Driveway Software Inc., Zendrive, TrueMotion, Geico, State Farm |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Automotive Usage based Insurance market is segmented across several key dimensions, providing a granular view of its structure and dynamics. These segmentations enable a detailed understanding of how different technological approaches, vehicle types, and policy structures contribute to the overall market landscape. Analyzing these segments helps in identifying specific growth opportunities and understanding the preferences of various end-user groups, from individual drivers seeking personalized rates to commercial fleets optimizing their operational efficiency and risk management strategies.

The primary segmentation by policy type delineates between basic Pay-As-You-Drive models, which focus on mileage, and more advanced Pay-How-You-Drive and Manage-How-You-Drive models that incorporate driving behavior, offering increasingly sophisticated risk assessment. Technology segmentation highlights the various data collection methods, from dedicated black boxes and OBD-II devices to smartphone applications and embedded vehicle systems. These distinctions are crucial for comprehending the diverse ecosystem of UBI solutions and their varying levels of data granularity and cost-effectiveness. Furthermore, the market is differentiated by vehicle type and end-user, illustrating the specific needs and adoption patterns within passenger and commercial vehicle segments, and between individual policyholders and large fleet operations.

- Policy Type: Categorized into Pay-As-You-Drive (PAYD), Pay-How-You-Drive (PHYD), and Manage-How-You-Drive (MHYD), reflecting varying levels of behavioral data integration.

- Technology: Encompasses diverse data collection methods such as Black Box devices, Smartphone applications, OBD-II dongles, and embedded vehicle systems, each with unique deployment and data capture capabilities.

- Vehicle Type: Segmented into Passenger Vehicles and Commercial Vehicles, recognizing the distinct insurance needs and usage patterns across these automotive categories.

- End-User: Divided into Individuals and Fleets, highlighting the tailored solutions and benefits offered to personal vehicle owners versus commercial operators.

- Region: Market analysis is conducted across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, considering regional regulatory frameworks, technological adoption rates, and market maturity.

Regional Highlights

- North America: This region holds a significant market share, driven by high consumer adoption of connected car technologies, a mature insurance market, and the presence of key telematics providers and innovative insurers. The United States and Canada are leading the charge with strong regulatory support and increasing consumer awareness regarding UBI benefits.

- Europe: Europe is a pioneering market for UBI, particularly in countries like Italy and the UK, where early adoption was significant. Stringent data protection regulations (like GDPR) have necessitated robust privacy frameworks, pushing innovation in secure data handling. The region is characterized by diverse market maturities, with Western Europe showing higher penetration compared to Eastern Europe.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by rapid urbanization, increasing vehicle sales, and rising disposable incomes in emerging economies like China and India. Government initiatives promoting road safety and smart city developments are also contributing to UBI adoption. The market here is still evolving but offers immense growth potential.

- Latin America: This region is an emerging market for UBI, with countries like Brazil and Mexico showing nascent but growing interest. Challenges include lower telematics penetration and economic volatility, but opportunities arise from improving infrastructure and a rising demand for risk-mitigating insurance products.

- Middle East and Africa (MEA): The MEA region is in its early stages of UBI adoption, primarily driven by increasing digitalization and government efforts to modernize infrastructure and improve road safety. Opportunities exist in the Gulf Cooperation Council (GCC) countries due to high per capita income and a focus on smart technologies, though the broader African market presents unique challenges and long-term potential.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Usage based Insurance Market.- Verisk Analytics

- Octo Telematics

- Cambridge Mobile Telematics

- LexisNexis Risk Solutions

- Arity (A State Farm Company)

- Metromile (Part of Lemonade)

- Progressive Corporation

- Allstate Corporation

- Liberty Mutual Insurance

- Generali Group

- AXA

- Allianz SE

- UnipolSai Assicurazioni S.p.A.

- Insure The Box (Part of Aioi Nissay Dowa Insurance)

- The Floow (Part of Otonomo)

- Driveway Software Inc.

- Zendrive

- TrueMotion

- Geico

- State Farm

Frequently Asked Questions

What is Usage-Based Insurance (UBI)?

Usage-Based Insurance (UBI) is an automobile insurance model that calculates premiums based on an individual's actual driving behavior and vehicle usage, collected through telematics devices. Unlike traditional insurance, which relies on demographic data, UBI policies offer personalized rates, often rewarding safer drivers with lower premiums.

How does UBI calculate premiums?

UBI premiums are calculated by analyzing various driving data points such as mileage driven, speed, braking habits, acceleration, time of day driving, and geographic location. This data is collected via telematics devices like OBD-II dongles, smartphone apps, or embedded vehicle systems, and then processed using advanced analytics and AI to assess individual risk profiles.

What are the benefits of UBI for drivers?

For drivers, UBI offers several benefits, including the potential for significant premium reductions based on safe driving, greater transparency in pricing, personalized feedback on driving habits to encourage safer behavior, and the possibility of value-added services such as roadside assistance or vehicle health alerts.

What are the primary data privacy concerns with UBI?

Key data privacy concerns with UBI involve the collection and storage of sensitive driving data. Users often worry about how their data is used, who has access to it, and the potential for misuse or breaches. Insurers address these concerns through robust cybersecurity measures, transparent data usage policies, and compliance with data protection regulations.

How is AI impacting the UBI market?

AI is profoundly impacting the UBI market by enabling more precise risk assessment, enhancing fraud detection, and facilitating highly personalized premium calculations. AI algorithms can analyze complex driving patterns, predict claims, and provide real-time feedback, leading to more efficient operations for insurers and more tailored products for consumers.