Automotive 6 Axi IMU Market

Automotive 6 Axi IMU Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_701460 | Last Updated : July 30, 2025 |

Format : ![]()

![]()

![]()

![]()

Automotive 6 Axi IMU Market Size

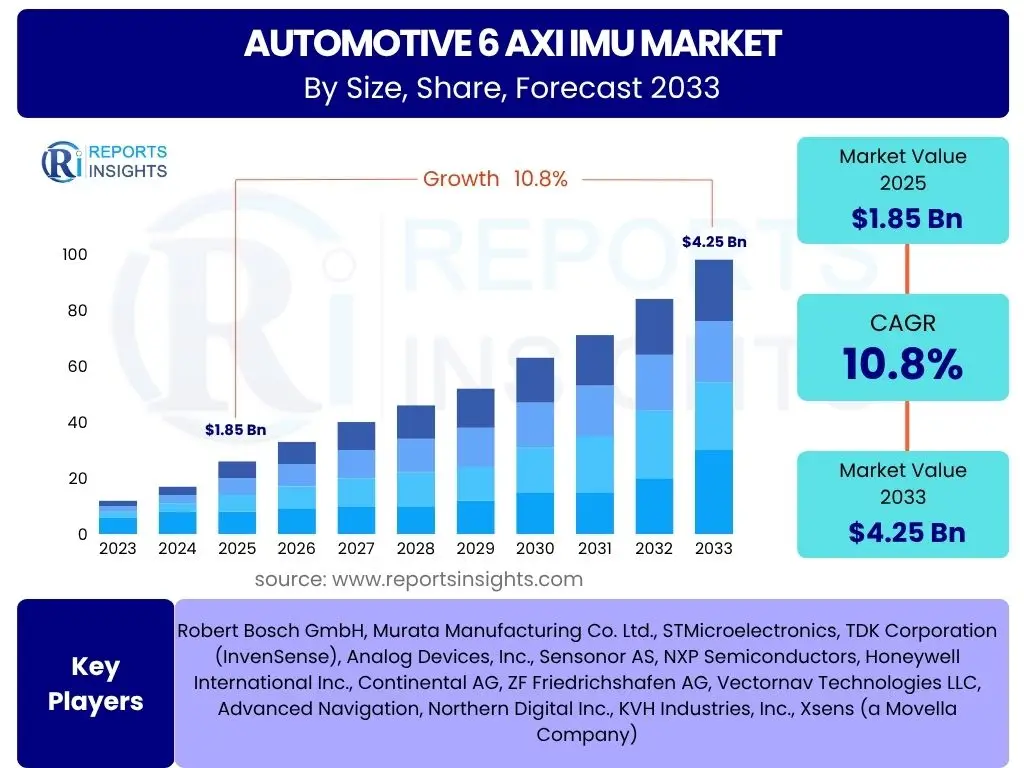

According to Reports Insights Consulting Pvt Ltd, The Automotive 6 Axi IMU Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.8% between 2025 and 2033. The market is estimated at USD 1.85 Billion in 2025 and is projected to reach USD 4.25 Billion by the end of the forecast period in 2033.

Key Automotive 6 Axi IMU Market Trends & Insights

Users frequently inquire about the evolving landscape of the Automotive 6 Axis IMU market, seeking to understand the underlying forces shaping its development and adoption. Common questions revolve around the primary technological shifts, the influence of emerging vehicle architectures, and the increasing demand for enhanced safety and autonomous functionalities. These inquiries highlight a collective interest in identifying the strategic drivers that will sustain market expansion and innovation over the coming years.

The market for Automotive 6 Axis IMUs is currently characterized by several pivotal trends, reflecting both technological advancements and shifting industry demands. Miniaturization and the increasing integration of multiple sensors are key, allowing for more compact and efficient systems within vehicles. Furthermore, there is a growing emphasis on high-precision and robust IMUs that can perform reliably under diverse and challenging environmental conditions, crucial for safety-critical applications.

Another significant trend involves the development of IMUs that offer enhanced communication interfaces and compatibility with advanced sensor fusion algorithms. This facilitates seamless data integration with other vehicle sensors, such as radar, lidar, and cameras, to create a more comprehensive environmental perception for autonomous driving systems. The drive towards software-defined vehicles also necessitates more flexible and upgradeable IMU solutions, capable of adapting to future functional enhancements via over-the-air updates.

- Proliferation of Advanced Driver-Assistance Systems (ADAS) and autonomous driving levels.

- Increasing demand for miniaturized and highly accurate sensor solutions.

- Integration of Inertial Measurement Units (IMUs) with other vehicle sensors for robust sensor fusion.

- Rising adoption of electric vehicles (EVs) necessitating precise motion tracking for regenerative braking and stability control.

- Development of IMUs with enhanced resilience to harsh automotive environments.

- Emphasis on cost-effectiveness and mass production capabilities for wider market penetration.

AI Impact Analysis on Automotive 6 Axi IMU

Users frequently pose questions regarding the transformative impact of Artificial Intelligence on the Automotive 6 Axis IMU market, keen to understand how AI enhances the capabilities and applications of these critical sensors. Common inquiries often delve into how AI contributes to improved data processing, sensor fusion algorithms, and the overall intelligence of vehicle control systems. There is a clear interest in the practical implications for autonomous navigation, predictive maintenance, and vehicle dynamics, with users seeking to identify the specific advantages AI integration offers in real-world automotive scenarios.

Artificial Intelligence significantly augments the functionality and performance of Automotive 6 Axis IMUs by enabling more sophisticated data interpretation and decision-making. AI algorithms can process raw IMU data with greater efficiency, filtering out noise and compensating for biases to deliver highly accurate motion and orientation information. This enhanced data fidelity is crucial for complex tasks like precise localization, real-time vehicle dynamics control, and the seamless integration of IMU data with input from other vehicle sensors, forming a more coherent environmental model.

Moreover, AI facilitates predictive capabilities for IMUs, allowing systems to anticipate future motion states or potential component failures based on historical data patterns. This is invaluable for predictive maintenance, optimizing vehicle performance, and improving the safety of autonomous driving systems. The application of machine learning techniques also enables IMUs to adapt and learn from diverse driving conditions, continually refining their accuracy and responsiveness over time, thereby ensuring more robust and reliable operation across a broader range of automotive applications.

- Enhanced sensor fusion: AI algorithms combine IMU data with inputs from radar, lidar, and cameras for a more accurate and robust perception of the vehicle's state and surroundings.

- Improved accuracy and stability: Machine learning models can compensate for sensor drift, noise, and environmental factors, leading to more precise and reliable measurements.

- Predictive capabilities: AI enables IMUs to contribute to predictive maintenance by identifying anomalies in vehicle motion that may indicate impending mechanical issues.

- Adaptive calibration: AI-driven systems can dynamically calibrate IMUs in real-time, optimizing performance under varying operational conditions.

- Advanced navigation and localization: AI algorithms process IMU data to improve GPS-denied navigation, enhance lane-keeping, and support high-definition mapping for autonomous vehicles.

- Optimization of vehicle dynamics: AI assists in leveraging IMU data for sophisticated chassis control, electronic stability programs, and anti-lock braking systems, improving handling and safety.

Key Takeaways Automotive 6 Axi IMU Market Size & Forecast

Users frequently seek concise summaries of the Automotive 6 Axis IMU market's trajectory, focusing on the most critical insights derived from its projected size and growth. Key questions often center around understanding the primary drivers of this expansion, the dominant application areas, and the overarching implications for automotive innovation and safety. This indicates a strong demand for high-level conclusions that distill complex market data into actionable intelligence, highlighting what truly matters for stakeholders and future market participants.

The Automotive 6 Axis IMU market is poised for substantial growth, driven by an accelerating trend towards enhanced vehicle autonomy and safety features across the global automotive industry. This expansion is not merely incremental but represents a fundamental shift in how vehicle motion and orientation are perceived and controlled, with IMUs becoming indispensable components in advanced driver-assistance systems and future self-driving cars. The market's robust CAGR underscores the increasing investment and technological advancements in this domain.

A significant takeaway is the critical role of these sensors in enabling the next generation of automotive technology. From precise navigation in challenging environments to ensuring vehicle stability during dynamic maneuvers, 6 Axis IMUs are foundational. The market forecast indicates a sustained demand for higher performance, greater reliability, and more cost-effective solutions, pushing manufacturers to innovate continuously and integrate these systems more deeply into the vehicle's core architecture.

- Robust market expansion: The Automotive 6 Axis IMU market is projected for significant growth, driven by increasing adoption in safety and autonomous systems.

- Indispensable technology for ADAS and autonomous vehicles: IMUs are foundational for functionalities like lane keeping, adaptive cruise control, and self-parking, essential for higher levels of autonomy.

- Technological advancements are key: Ongoing innovation in sensor accuracy, miniaturization, and integration capabilities is pivotal for market penetration.

- Dominance of specific applications: Navigation, vehicle stability control, and infotainment systems are major contributors to market demand.

- Regional growth disparities: While global, growth will be particularly pronounced in regions with strong automotive manufacturing bases and aggressive autonomous vehicle development programs.

Automotive 6 Axi IMU Market Drivers Analysis

The Automotive 6 Axis IMU market is propelled by a confluence of factors, primarily centered around the automotive industry's transformative shift towards enhanced safety, automation, and electrification. Strict regulatory mandates for vehicle safety, coupled with surging consumer demand for sophisticated driver-assistance features, are compelling automakers to integrate advanced sensor technologies. The rapid development and anticipated deployment of autonomous vehicles further solidify the necessity for highly accurate and reliable motion and orientation sensing, making 6 Axis IMUs an indispensable component.

The global increase in electric vehicle (EV) production also acts as a significant driver. EVs leverage IMUs for critical functions such as regenerative braking optimization, battery management system integrity, and refined vehicle stability control, which is often more complex due to unique weight distribution and power delivery characteristics. Furthermore, advancements in MEMS technology have led to smaller, more power-efficient, and increasingly cost-effective IMUs, making their widespread adoption economically viable for a broader range of vehicle segments.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Proliferation of ADAS and Autonomous Driving | +3.5% | Global, particularly North America, Europe, Asia Pacific | Long-term (2025-2033) |

| Increasing Focus on Vehicle Safety and Regulatory Compliance | +2.8% | Global | Mid to Long-term (2025-2033) |

| Growth in Electric Vehicle (EV) Production and Adoption | +2.3% | Global, especially China, Europe, USA | Mid to Long-term (2025-2033) |

| Advancements in MEMS Technology and Miniaturization | +1.7% | Global | Short to Mid-term (2025-2029) |

Automotive 6 Axi IMU Market Restraints Analysis

Despite the robust growth trajectory, the Automotive 6 Axis IMU market faces several notable restraints that could temper its expansion. One significant challenge is the relatively high cost associated with high-precision IMUs, particularly for integration into mass-market vehicle segments. This cost can impact adoption rates, especially in price-sensitive emerging markets where affordability is a key purchasing factor for consumers and a production concern for manufacturers. Balancing performance with cost-effectiveness remains a critical hurdle for market players.

Another restraint involves the complex integration process of IMUs into existing vehicle architectures and their interaction with other sensor systems. Ensuring seamless data fusion, calibration accuracy, and robustness across diverse operating conditions requires significant engineering effort and specialized expertise. Furthermore, the automotive industry's stringent qualification processes and long product development cycles can delay the widespread adoption of new IMU technologies, hindering market agility and innovation speed.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Initial Cost of Advanced IMU Systems | -1.5% | Global, particularly Emerging Economies | Mid-term (2025-2030) |

| Complexity of Integration and Calibration | -1.2% | Global | Long-term (2025-2033) |

| Supply Chain Vulnerabilities and Component Shortages | -0.8% | Global | Short to Mid-term (2025-2028) |

| Stringent Reliability and Durability Requirements | -0.7% | Global | Long-term (2025-2033) |

Automotive 6 Axi IMU Market Opportunities Analysis

Significant opportunities exist within the Automotive 6 Axis IMU market, largely stemming from the continuous evolution of vehicle technology and emerging automotive paradigms. The ongoing research and development into advanced sensor fusion platforms, which integrate IMU data with inputs from lidar, radar, and cameras, presents a vast opportunity. This integration promises to unlock higher levels of autonomous driving capability and enhance overall vehicle intelligence, leading to safer and more efficient transportation systems.

Beyond traditional passenger and commercial vehicles, new application areas for 6 Axis IMUs are emerging, such as in specialized autonomous mobile robots for logistics, drone delivery systems, and smart city infrastructure elements that interact with vehicles. The shift towards software-defined vehicles also opens avenues for IMUs that can be remotely updated and customized, offering manufacturers and consumers greater flexibility and functionality over the vehicle's lifespan. Furthermore, the development of more robust, smaller, and cost-effective IMU solutions through material science and manufacturing innovation will broaden their applicability and market reach.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Development of Advanced Sensor Fusion Platforms | +2.0% | Global | Long-term (2026-2033) |

| Expansion into New Mobility and Niche Automotive Applications | +1.8% | Global, particularly Urban Centers | Mid to Long-term (2027-2033) |

| Growth of Software-Defined Vehicles and Over-the-Air Updates | +1.5% | Global | Mid to Long-term (2026-2033) |

| Miniaturization and Cost Reduction through Material Innovation | +1.2% | Global | Short to Mid-term (2025-2030) |

Automotive 6 Axi IMU Market Challenges Impact Analysis

The Automotive 6 Axis IMU market, while promising, contends with several significant challenges that necessitate strategic solutions. Achieving and maintaining high levels of accuracy and robustness across extreme environmental conditions (e.g., severe vibrations, temperature fluctuations, and electromagnetic interference) remains a persistent technical challenge. The reliability of IMUs in these demanding automotive scenarios is paramount for safety-critical applications, pushing manufacturers to invest heavily in advanced testing and validation protocols.

Another major challenge is the intense competitive landscape, characterized by numerous established players and agile startups vying for market share. This fierce competition often leads to pricing pressures, particularly as IMUs become more commoditized in certain applications. Furthermore, the rapid pace of technological evolution, particularly in adjacent sensor technologies and AI algorithms, demands continuous innovation from IMU manufacturers to avoid obsolescence and maintain relevance within the evolving automotive ecosystem.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Achieving High Accuracy and Robustness in Harsh Environments | -1.0% | Global | Long-term (2025-2033) |

| Intense Competition and Pricing Pressures | -0.9% | Global | Mid-term (2025-2030) |

| Data Latency and Processing Demands for Real-time Applications | -0.6% | Global | Mid to Long-term (2025-2033) |

| Cybersecurity Vulnerabilities in Connected IMU Systems | -0.5% | Global | Long-term (2026-2033) |

Automotive 6 Axi IMU Market - Updated Report Scope

This report offers an in-depth analysis of the Automotive 6 Axis IMU Market, providing comprehensive insights into its historical performance, current dynamics, and future projections. It meticulously examines market size, growth drivers, restraints, opportunities, and challenges across various segments and key geographical regions. The scope encompasses detailed technological trends, competitive landscapes, and the impact of emerging innovations like Artificial Intelligence on market evolution, offering a robust foundation for strategic decision-making within the automotive sensor industry.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 4.25 Billion |

| Growth Rate | 10.8% |

| Number of Pages | 247 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Robert Bosch GmbH, Murata Manufacturing Co. Ltd., STMicroelectronics, TDK Corporation (InvenSense), Analog Devices, Inc., Sensonor AS, NXP Semiconductors, Honeywell International Inc., Continental AG, ZF Friedrichshafen AG, Vectornav Technologies LLC, Advanced Navigation, Northern Digital Inc., KVH Industries, Inc., Xsens (a Movella Company) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Automotive 6 Axis IMU market is meticulously segmented to provide a granular understanding of its diverse components and their respective contributions to overall market dynamics. This segmentation is crucial for identifying specific growth pockets, understanding regional preferences, and tailoring product development strategies. The market is primarily categorized by technology, application, vehicle type, and sales channel, each offering unique insights into the demand and supply landscape of IMUs within the automotive sector.

Technological segmentation highlights the prevalence of MEMS-based IMUs due to their compact size, cost-effectiveness, and improving performance, while also considering other niche technologies. Application-wise, the market is driven by critical safety and comfort features such as ADAS, navigation, and vehicle stability systems, which are becoming standard across a wider range of vehicles. Furthermore, distinguishing between passenger vehicles, commercial vehicles, and electric vehicles provides a clear picture of varying IMU requirements and adoption rates across different automotive categories, influencing design and production priorities for manufacturers.

- By Technology:

- MEMS (Micro-Electro-Mechanical Systems)

- FOG (Fiber Optic Gyroscope)

- Others

- By Application:

- ADAS (Advanced Driver Assistance Systems)

- Navigation and Positioning

- Electronic Stability Control (ESC)

- Chassis Control

- Active Suspension

- Roll-over Detection

- Automotive Infotainment

- Others

- By Vehicle Type:

- Passenger Vehicles

- Commercial Vehicles

- Electric Vehicles (EVs)

- By Sales Channel:

- OEM (Original Equipment Manufacturer)

- Aftermarket

Regional Highlights

- North America: This region demonstrates robust growth, primarily driven by the early adoption of advanced automotive technologies, significant investments in autonomous vehicle research and development, and stringent safety regulations. The presence of major automotive OEMs and technology innovators contributes to its market leadership, particularly in premium vehicle segments and autonomous fleet testing.

- Europe: Europe is a mature market for automotive IMUs, characterized by strong regulatory emphasis on vehicle safety and environmental performance. Countries like Germany, France, and the UK are at the forefront of automotive innovation, with a high demand for sophisticated ADAS features and a growing electric vehicle market. The region’s focus on high-quality engineering and safety standards fuels the adoption of high-precision IMUs.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, largely due to the burgeoning automotive manufacturing hubs in China, Japan, South Korea, and India. Rapid urbanization, increasing disposable incomes, and the swift adoption of electric vehicles and smart transportation initiatives are propelling market expansion. China, in particular, leads in EV production and autonomous vehicle pilots, creating immense demand for IMUs.

- Latin America: This region exhibits steady growth, primarily influenced by increasing vehicle production volumes and a gradual integration of advanced safety features in new models. While not as advanced as North America or Europe in autonomous driving adoption, the market for basic ADAS functionalities and vehicle stability systems is expanding, driven by improving economic conditions and consumer awareness.

- Middle East and Africa (MEA): The MEA market for automotive IMUs is emerging, with growth driven by infrastructure development projects, increasing vehicle parc, and governmental initiatives to enhance road safety. Investment in smart city projects and the gradual shift towards electric and autonomous vehicle technologies in certain countries like UAE and Saudi Arabia are creating nascent opportunities for IMU deployment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive 6 Axi IMU Market.- Robert Bosch GmbH

- Murata Manufacturing Co. Ltd.

- STMicroelectronics

- TDK Corporation (InvenSense)

- Analog Devices, Inc.

- Sensonor AS

- NXP Semiconductors

- Honeywell International Inc.

- Continental AG

- ZF Friedrichshafen AG

- Vectornav Technologies LLC

- Advanced Navigation

- Northern Digital Inc.

- KVH Industries, Inc.

- Xsens (a Movella Company)

Frequently Asked Questions

Analyze common user questions about the Automotive 6 Axi IMU market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is a 6 Axis IMU in automotive applications?

A 6 Axis Inertial Measurement Unit (IMU) in automotive applications is a sensor package that combines a 3-axis accelerometer and a 3-axis gyroscope to measure a vehicle's motion and orientation in three-dimensional space. It provides data on acceleration (linear movement) and angular velocity (rotational movement), which is crucial for vehicle stability, navigation, and advanced driver-assistance systems (ADAS).

What are the primary drivers for the growth of the Automotive 6 Axis IMU market?

The primary drivers include the escalating demand for ADAS and autonomous driving features, increasing regulatory mandates for vehicle safety, the rapid growth in electric vehicle production, and continuous advancements in MEMS technology leading to more compact and cost-effective sensor solutions.

How does AI impact the performance of Automotive 6 Axis IMUs?

AI significantly enhances IMU performance by enabling more accurate sensor fusion with other vehicle sensors, improving data filtering to reduce noise and drift, and supporting predictive capabilities for maintenance and adaptive calibration, leading to more robust and reliable real-time vehicle dynamics control.

Which regions are leading in the adoption of Automotive 6 Axis IMUs?

North America and Europe are significant markets due to early technology adoption and stringent safety regulations. However, the Asia Pacific region, particularly China and South Korea, is projected to show the fastest growth driven by high volume automotive manufacturing, rapid EV adoption, and aggressive autonomous vehicle development.

What are the key challenges in the Automotive 6 Axis IMU market?

Key challenges include maintaining high accuracy and robustness under harsh automotive environmental conditions (vibration, temperature extremes), managing the high initial cost of advanced systems, dealing with complex integration and calibration processes, and navigating an intensely competitive landscape with pricing pressures.