Automotive Head Up Display Market

Automotive Head Up Display Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_703343 | Last Updated : August 01, 2025 |

Format : ![]()

![]()

![]()

![]()

Automotive Head Up Display Market Size

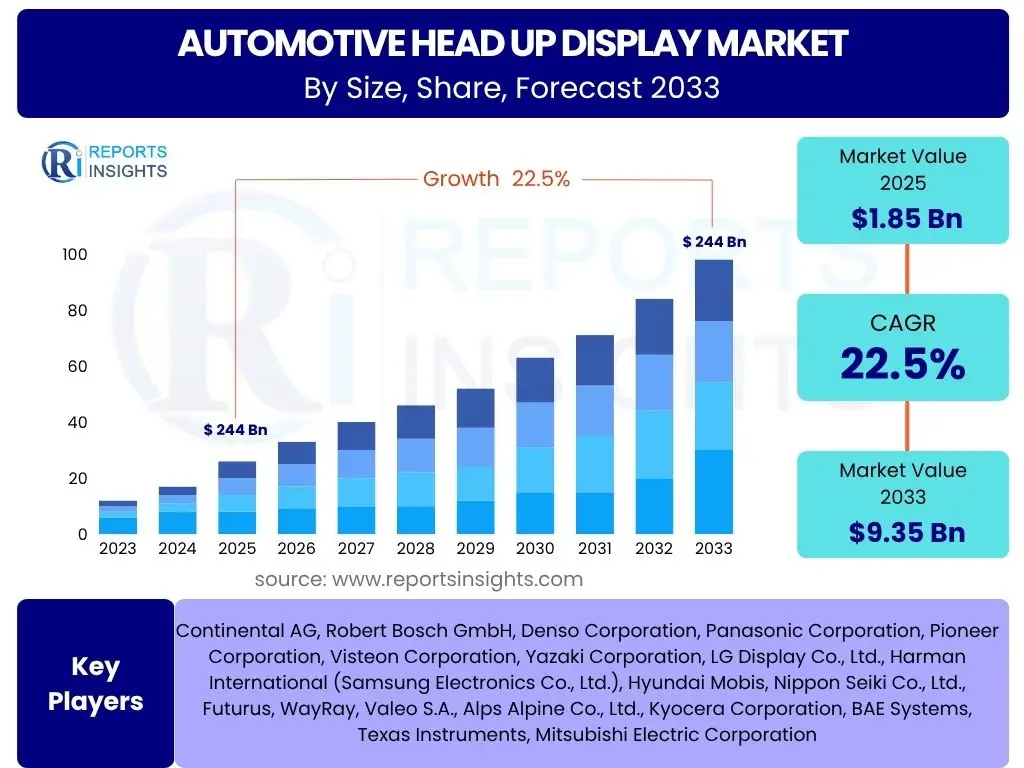

According to Reports Insights Consulting Pvt Ltd, The Automotive Head Up Display Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 22.5% between 2025 and 2033. The market is estimated at USD 1.85 billion in 2025 and is projected to reach USD 9.35 billion by the end of the forecast period in 2033.

Key Automotive Head Up Display Market Trends & Insights

The Automotive Head Up Display (HUD) market is undergoing a significant transformation, driven by advancements in display technology, integration with advanced driver-assistance systems (ADAS), and a growing emphasis on driver safety and convenience. Users frequently inquire about the latest innovations making HUDs more immersive and effective. A prominent trend is the shift from basic informational displays to augmented reality (AR) HUDs, which overlay virtual information directly onto the road, enhancing navigation, hazard warnings, and overall situational awareness without diverting the driver's gaze.

Furthermore, the miniaturization of projection units and the development of more energy-efficient components are enabling broader adoption beyond luxury vehicle segments, making HUD technology accessible to mid-range and even compact car models. Connectivity and personalization are also emerging as critical trends, allowing HUDs to display real-time data from vehicle sensors, cloud services, and personal devices, tailored to individual driver preferences. These developments are collectively shaping a future where HUDs are an integral part of the connected and autonomous driving experience, providing critical information intuitively and safely.

- Augmented Reality (AR) HUDs: Integration of virtual objects onto the real-world view for enhanced navigation and safety.

- Miniaturization and Cost Reduction: Smaller, more affordable HUD units facilitating adoption in broader vehicle segments.

- Seamless ADAS Integration: Displaying critical ADAS warnings, lane departure alerts, and collision avoidance information directly in the driver's line of sight.

- Enhanced Connectivity: Real-time data feeds from vehicle systems, cloud, and external sources for dynamic information display.

- Personalization and Customization: Driver-specific profiles and configurable display layouts for individual preferences.

- Holographic and Laser-based HUDs: Emerging technologies offering brighter, clearer, and more vibrant projections with deeper field of view.

- Integration with Electric Vehicles (EVs): Displaying critical EV-specific information like battery range, charging station locations, and power consumption.

AI Impact Analysis on Automotive Head Up Display

The integration of Artificial Intelligence (AI) is set to profoundly transform the Automotive Head Up Display market, addressing common user questions about the intelligence and adaptability of these systems. AI algorithms enable HUDs to move beyond static information displays, facilitating dynamic, context-aware content delivery. This includes predictive warnings based on real-time traffic analysis, adaptive content adjustments based on driver attention and cognitive load, and personalized information streams that anticipate driver needs. Users are keenly interested in how AI can make HUDs more intuitive and less distracting, improving overall safety and the driving experience by presenting information precisely when and where it is most needed.

Concerns often revolve around data privacy, system reliability, and the seamless integration of AI without overwhelming the driver with too much information. However, the potential benefits, such as enhanced ADAS capabilities through AI-powered object recognition and threat assessment, or natural language processing for voice-controlled HUD functions, outweigh these concerns. AI promises to evolve HUDs into proactive co-pilots, intelligently filtering and prioritizing information to reduce cognitive burden, optimize navigation, and offer a truly immersive and intelligent in-car experience that adapts to ever-changing driving conditions and driver behavior.

- Context-Aware Information Delivery: AI analyzes driving conditions, vehicle state, and driver behavior to prioritize and display relevant information dynamically.

- Predictive Warnings and Recommendations: Utilizes AI to analyze sensor data and predict potential hazards, offering proactive alerts or optimal navigation suggestions.

- Personalized User Experience: AI learns driver preferences, routes, and habits to customize display content and layout, minimizing distractions.

- Enhanced ADAS Functionality: AI-powered object detection and classification improve the accuracy and relevance of augmented reality overlays for ADAS features.

- Natural Language Processing (NLP) Integration: Enables voice control and conversational interaction with the HUD system for hands-free operation.

- Gaze Tracking and Attention Monitoring: AI assesses driver attention levels to adjust information presentation, ensuring optimal awareness without cognitive overload.

- Optimized Display Brightness and Contrast: AI algorithms adapt display parameters in real-time based on ambient light conditions for optimal visibility.

Key Takeaways Automotive Head Up Display Market Size & Forecast

The Automotive Head Up Display market is poised for robust expansion, driven by a confluence of technological advancements, increasing consumer demand for in-vehicle safety features, and regulatory emphasis on driver assistance systems. A significant takeaway is the market's rapid transition towards augmented reality (AR) functionalities, moving beyond simple projections to immersive, context-aware information displays. This evolution is central to improving driver awareness and reducing response times, addressing key user priorities for safety and convenience in modern vehicles. The forecasted growth underscores a broader industry shift towards intelligent cockpits where information is intuitively presented to minimize distraction and enhance the overall driving experience.

Another crucial insight is the expanding addressable market, moving beyond luxury and premium vehicle segments into mid-range and even entry-level cars. This democratization of technology is largely facilitated by cost-effective manufacturing techniques and miniaturization, making HUDs a standard feature rather than a premium add-on. Furthermore, the increasing penetration of electric vehicles (EVs) and connected car technologies provides new avenues for HUD innovation, allowing for the display of EV-specific data, charging infrastructure, and real-time connectivity information. These factors collectively highlight a future where HUDs are indispensable for safe, intelligent, and personalized mobility solutions.

- Significant Market Growth: The Automotive HUD market is projected for substantial growth, driven by technological evolution and increasing adoption across vehicle segments.

- AR HUD as a Game Changer: Augmented reality capabilities are transforming HUDs from simple displays to immersive, real-world interactive interfaces.

- Safety and Convenience Focus: HUDs are becoming critical components for enhancing driver safety, reducing distraction, and improving situational awareness.

- Broadening Market Adoption: Technology advancements and cost reductions are enabling HUD penetration into mid-segment and economy vehicles.

- Synergy with ADAS and Autonomous Driving: HUDs are vital for effectively conveying information from advanced driver-assistance systems and future autonomous functionalities.

- EV Integration: The rise of electric vehicles creates new demand and specific information display requirements for HUD systems.

- Technological Miniaturization: Smaller form factors and improved efficiency are key to widespread integration and design flexibility in vehicle cabins.

Automotive Head Up Display Market Drivers Analysis

The Automotive Head Up Display market is primarily driven by the escalating demand for advanced driver-assistance systems (ADAS) and a global focus on enhancing road safety. As ADAS features like adaptive cruise control, lane-keeping assist, and automatic emergency braking become standard or mandatory in new vehicles, HUDs offer an intuitive and non-distracting way to convey critical alerts and information directly into the driver's line of sight. This integration significantly improves reaction times and reduces the cognitive load on drivers, making the driving experience safer and more comfortable. The increasing complexity of traffic environments further accentuates the need for such technologies, which provide essential data without requiring drivers to divert their gaze from the road.

Another significant driver is the growing consumer preference for connected and intelligent vehicle cockpits. Modern consumers seek sophisticated infotainment and information systems that integrate seamlessly with their digital lives. HUDs, especially those with augmented reality capabilities, align perfectly with this trend by projecting navigation, multimedia information, and smartphone data directly onto the windshield. This desire for advanced in-car technology, coupled with the rising disposable incomes in emerging economies and the expanding luxury vehicle segment, is propelling the adoption of HUDs as a premium and essential feature. Furthermore, the ongoing efforts by automotive manufacturers to differentiate their offerings through innovative technological integrations contribute substantially to market expansion.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Demand for Advanced Driver Assistance Systems (ADAS) | +5.5% | North America, Europe, Asia Pacific | Short-term to Long-term |

| Growing Focus on Driver Safety and Convenience | +4.8% | Global | Short-term to Long-term |

| Rising Adoption of Connected and Smart Cars | +4.2% | Asia Pacific, North America, Europe | Mid-term to Long-term |

| Technological Advancements in Display and Projection | +3.9% | Global | Short-term to Mid-term |

| Growing Demand for Premium and Luxury Vehicles | +3.0% | North America, Europe, China | Short-term to Mid-term |

Automotive Head Up Display Market Restraints Analysis

Despite the strong growth trajectory, the Automotive Head Up Display market faces several notable restraints, primarily concerning the high manufacturing costs and the inherent complexity of integrating these systems into diverse vehicle architectures. The sophisticated optical components, projection mechanisms, and advanced software required for high-quality HUDs, especially augmented reality variants, drive up production costs significantly. This cost factor acts as a barrier to widespread adoption, particularly in budget-sensitive vehicle segments and emerging markets where price competitiveness is paramount. Automakers must balance the added value of HUDs with the overall vehicle price, which can limit their inclusion in mass-market models.

Another significant restraint is the physical space constraint and design challenges within the vehicle dashboard and windshield. Integrating a projection unit that provides a clear, stable, and large field of view without obstructing the driver's vision or conflicting with existing interior components can be complex. Different vehicle models have varying dashboard designs and windshield angles, necessitating custom solutions that add to development time and cost. Furthermore, maintaining consistent image quality and brightness under varying ambient light conditions (e.g., direct sunlight vs. night driving) requires advanced light management systems, adding another layer of engineering complexity and potential for performance issues if not optimally designed. These technical and economic hurdles present ongoing challenges for market penetration.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Manufacturing and Integration Costs | -4.5% | Global, particularly developing markets | Short-term to Mid-term |

| Space Constraints and Packaging Challenges in Vehicle Interior | -3.8% | Global | Short-term to Mid-term |

| Potential for Driver Distraction if Not Optimally Designed | -2.5% | Global, regulatory scrutiny | Short-term |

| Limited Awareness and Adoption in Certain Regions | -1.5% | Latin America, Middle East, Africa | Mid-term |

| Complex Regulatory Compliance for Advanced Features | -1.0% | Europe, North America | Short-term to Mid-term |

Automotive Head Up Display Market Opportunities Analysis

Significant opportunities in the Automotive Head Up Display market are emerging from the ongoing revolution in augmented reality (AR) and the expansion into new vehicle segments. The development of advanced AR HUDs that seamlessly overlay virtual information, such as navigation arrows, pedestrian warnings, or points of interest directly onto the road ahead, represents a transformative leap. This capability not only enhances driver safety by reducing eye movement but also enriches the driving experience with intuitive, contextual information. As AR technology matures and becomes more cost-effective, its integration into HUDs offers a compelling value proposition that can drive substantial market growth and adoption across a wider range of vehicle models.

Moreover, the increasing demand for electric vehicles (EVs) and the growth of shared mobility services present new avenues for HUD market expansion. EVs have unique information display requirements, such as real-time battery status, charging station locations, and range optimization, which can be optimally presented via a HUD without cluttering the traditional instrument cluster. Similarly, in shared mobility, a personalized and quick setup through a HUD can enhance the user experience. The development of more robust, scalable, and customizable HUD solutions that cater to these evolving automotive trends will unlock new revenue streams and market segments, pushing the boundaries of in-car information display and fostering innovation in user interaction.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Integration with Augmented Reality (AR) Features | +6.0% | Global, particularly technologically advanced regions | Mid-term to Long-term |

| Expansion into Mid-Range and Compact Vehicle Segments | +5.2% | Asia Pacific, Europe, North America | Mid-term to Long-term |

| Growing Adoption of Electric Vehicles (EVs) | +4.0% | Europe, China, North America | Mid-term to Long-term |

| Development of Holographic and Laser-based HUDs | +3.5% | Global | Long-term |

| Personalization and Customization for Driver Preferences | +2.8% | Global | Short-term to Mid-term |

Automotive Head Up Display Market Challenges Impact Analysis

The Automotive Head Up Display market faces significant challenges related to ensuring optimal image quality and visibility across diverse environmental conditions. Maintaining consistent brightness, contrast, and color fidelity in a projection that can be affected by ambient light, direct sunlight, polarized sunglasses, or varying windshield tints is a complex engineering feat. Poor image quality can not only diminish the user experience but also compromise the safety benefits of the HUD by making crucial information difficult to discern. Overcoming these optical and environmental challenges requires substantial research and development investment in advanced display materials, projection technologies, and adaptive algorithms, which can prolong development cycles and increase manufacturing costs.

Another critical challenge involves regulatory compliance and standardization, particularly for ADAS-integrated AR HUDs. As HUDs become more sophisticated and display safety-critical information, governments and industry bodies are developing guidelines and regulations regarding their placement, content, and potential for distraction. Ensuring that HUD designs meet varying global safety standards and obtain necessary certifications adds complexity and cost to the development process. Furthermore, consumer acceptance and trust in new and evolving HUD technologies, especially those incorporating AR, require sustained education and demonstrations of their reliability and benefits. Overcoming these technical, regulatory, and perceptual barriers is crucial for the sustained growth and widespread adoption of automotive HUDs.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Ensuring Consistent Image Quality Across Varying Light Conditions | -3.5% | Global | Short-term to Mid-term |

| Compliance with Evolving Safety Regulations and Standards | -2.8% | Europe, North America, Japan | Short-term to Mid-term |

| Cybersecurity Risks for Connected HUD Systems | -2.0% | Global | Mid-term to Long-term |

| Managing Perceptual and Cognitive Load on Drivers | -1.5% | Global | Short-term |

| Supply Chain Vulnerabilities and Component Availability | -1.0% | Global | Short-term |

Automotive Head Up Display Market - Updated Report Scope

This comprehensive market research report provides an in-depth analysis of the Automotive Head Up Display market, covering historical data, current market dynamics, and future projections. The report offers detailed insights into market size, growth drivers, restraints, opportunities, and challenges, along with a thorough segmentation analysis. It aims to equip stakeholders with critical information for strategic decision-making in this rapidly evolving sector.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 9.35 Billion |

| Growth Rate | 22.5% |

| Number of Pages | 250 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Continental AG, Robert Bosch GmbH, Denso Corporation, Panasonic Corporation, Pioneer Corporation, Visteon Corporation, Yazaki Corporation, LG Display Co., Ltd., Harman International (Samsung Electronics Co., Ltd.), Hyundai Mobis, Nippon Seiki Co., Ltd., Futurus, WayRay, Valeo S.A., Alps Alpine Co., Ltd., Kyocera Corporation, BAE Systems, Texas Instruments, Mitsubishi Electric Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Automotive Head Up Display market is comprehensively segmented based on various critical attributes, reflecting the diverse applications and technological advancements within the industry. This segmentation allows for a granular analysis of market dynamics, identifying specific growth areas and competitive landscapes across different product types, technologies, vehicle categories, and end-use applications. Understanding these segments is crucial for stakeholders to pinpoint opportunities and tailor strategies effectively, leveraging the unique demands and characteristics of each sub-market.

The core segments include the type of projection, underlying display technology, the vehicle type in which HUDs are installed, the display dimension (2D vs. 3D/AR), and the end-use vehicle segment. Each segment exhibits distinct market drivers and adoption rates. For instance, windshield-projected HUDs dominate due to their immersive experience, while Digital Light Processing (DLP) is a leading technology. The passenger car segment is the primary adopter, but commercial vehicles are also showing increased interest. The rapid evolution towards augmented reality (AR) 3D HUDs signals a significant shift in technological focus, catering to the growing demand for highly interactive and contextual information delivery within vehicle cockpits.

- By Type:

- Combiner-Projected HUD

- Windshield-Projected HUD

- By Technology:

- Digital Light Processing (DLP)

- Laser Beam Scanning (LBS)

- Liquid Crystal Display (LCD)

- Light Emitting Diode (LED)

- By Vehicle Type:

- Passenger Cars

- Sedans

- SUVs

- Hatchbacks

- Commercial Vehicles

- Light Commercial Vehicles (LCV)

- Heavy Commercial Vehicles (HCV)

- Passenger Cars

- By Display Type:

- 2D HUD

- 3D HUD (AR HUD)

- By End-Use Vertical:

- Luxury and Premium Vehicles

- Mid-Segment Vehicles

- Economy Vehicles

- By Fuel Type:

- Internal Combustion Engine (ICE) Vehicles

- Electric Vehicles (EVs)

- Hybrid Electric Vehicles (HEVs)

- By Sales Channel:

- Original Equipment Manufacturers (OEMs)

- Aftermarket

Regional Highlights

- North America: This region is a leading market for Automotive HUDs, primarily driven by early adoption of advanced automotive technologies, strong consumer preference for luxury and high-tech vehicles, and stringent safety regulations. The presence of major automotive manufacturers and a robust aftermarket further contribute to its dominance. Significant investments in connected car technologies and autonomous driving research also fuel growth.

- Europe: Europe represents another significant market, characterized by stringent automotive safety standards and a strong emphasis on premium vehicle segments. The region's focus on reducing road fatalities and improving driver assistance systems propels the adoption of HUDs. Countries like Germany, France, and the UK are at the forefront of implementing advanced vehicle technologies, including AR HUDs.

- Asia Pacific (APAC): The APAC region is projected to be the fastest-growing market for Automotive HUDs, driven by rapid urbanization, increasing disposable incomes, and the burgeoning automotive manufacturing base in countries like China, Japan, South Korea, and India. The rising demand for passenger vehicles equipped with advanced features, coupled with government initiatives promoting road safety, are key growth catalysts. The region's large volume production capacity also supports competitive pricing.

- Latin America: This region is an emerging market for Automotive HUDs, with growth primarily influenced by the expanding automotive sector and increasing consumer awareness regarding vehicle safety and advanced features. While currently smaller in market share, the gradual economic development and rising vehicle sales are expected to create new opportunities, particularly in countries like Brazil and Mexico.

- Middle East and Africa (MEA): The MEA region is experiencing gradual adoption of Automotive HUDs, predominantly in the luxury and high-end vehicle segments. Growth is driven by increasing infrastructure development, a rise in affluent consumers, and the import of technologically advanced vehicles. However, market penetration is slower compared to other regions due to varying economic conditions and regulatory frameworks.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Head Up Display Market.- Continental AG

- Robert Bosch GmbH

- Denso Corporation

- Panasonic Corporation

- Pioneer Corporation

- Visteon Corporation

- Yazaki Corporation

- LG Display Co., Ltd.

- Harman International (Samsung Electronics Co., Ltd.)

- Hyundai Mobis

- Nippon Seiki Co., Ltd.

- Futurus

- WayRay

- Valeo S.A.

- Alps Alpine Co., Ltd.

- Kyocera Corporation

- BAE Systems

- Texas Instruments

- Mitsubishi Electric Corporation

Frequently Asked Questions

What is an Automotive Head Up Display (HUD)?

An Automotive Head Up Display (HUD) is a transparent display that presents data without requiring users to look away from their usual viewpoints. In vehicles, HUDs project vital information like speed, navigation directions, and warning signals directly onto the windshield or a combiner glass within the driver's line of sight, aiming to enhance safety and reduce distraction.

How do Augmented Reality (AR) HUDs differ from traditional HUDs?

Traditional HUDs project static or semi-static information onto the windshield. Augmented Reality (AR) HUDs, in contrast, overlay virtual information directly onto the real-world view outside the vehicle, making digital content appear as if it's part of the physical environment. This allows for immersive navigation arrows seemingly painted on the road or warnings highlighting specific objects, significantly enhancing realism and contextual awareness.

What are the primary benefits of using a HUD in a vehicle?

The primary benefits of using a HUD include enhanced driver safety by keeping the driver's eyes on the road, reduced cognitive load and eye strain by minimizing the need to refocus, and improved reaction times to critical information. HUDs provide immediate access to essential driving data, navigation, and ADAS alerts, contributing to a more comfortable and secure driving experience.

Which factors are driving the growth of the Automotive HUD market?

The growth of the Automotive HUD market is primarily driven by the increasing demand for advanced driver-assistance systems (ADAS), stringent global safety regulations, rising consumer preference for connected and smart vehicle cockpits, and continuous technological advancements in display and projection systems. The expansion into mid-range and compact vehicle segments also plays a significant role.

What are the key challenges facing the Automotive HUD market?

Key challenges for the Automotive HUD market include high manufacturing and integration costs, the technical complexity of maintaining consistent image quality across varying light conditions, physical space constraints within vehicle interiors, and the need to comply with evolving safety regulations. Potential for driver distraction if not optimally designed and cybersecurity risks for connected systems also pose challenges.