Automotive Wheel Market

Automotive Wheel Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_703476 | Last Updated : August 01, 2025 |

Format : ![]()

![]()

![]()

![]()

Automotive Wheel Market Size

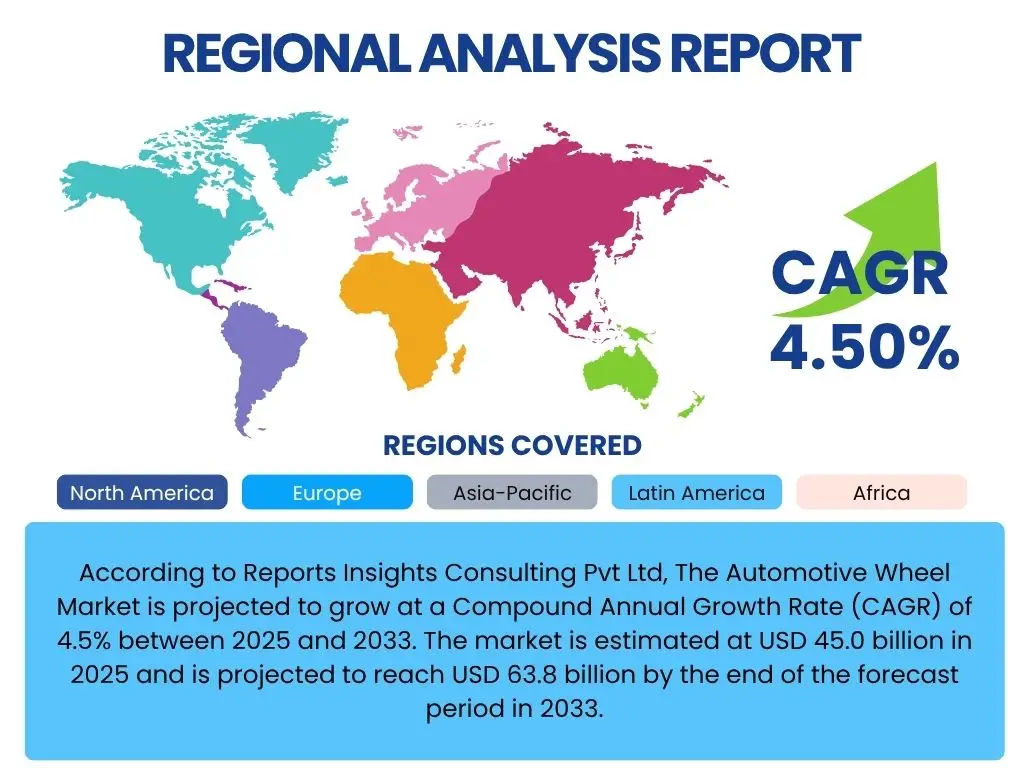

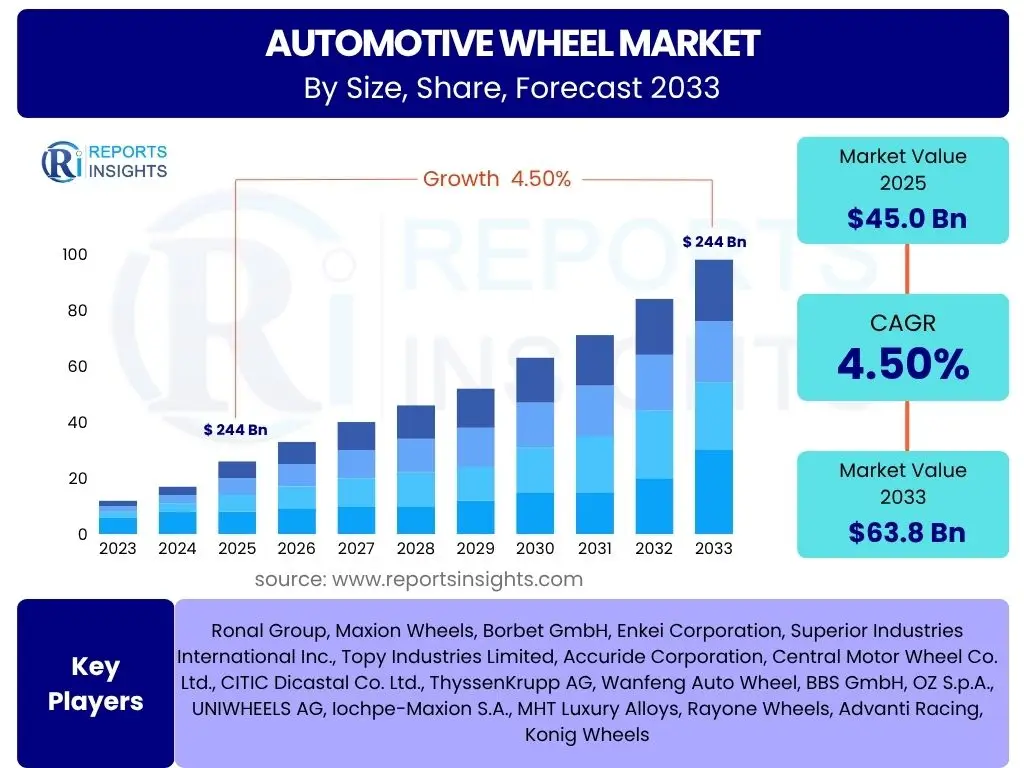

According to Reports Insights Consulting Pvt Ltd, The Automotive Wheel Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2025 and 2033. The market is estimated at USD 45.0 billion in 2025 and is projected to reach USD 63.8 billion by the end of the forecast period in 2033.

Key Automotive Wheel Market Trends & Insights

User queries regarding automotive wheel market trends frequently focus on material innovation, design evolution influenced by electric vehicles, and the increasing demand for customization. There is significant interest in how sustainability initiatives are reshaping manufacturing processes and material choices, alongside the emerging role of digital technologies in both design and consumer experience. Furthermore, the integration of smart functionalities into wheels, though nascent, is a recurring theme, indicating a forward-looking interest in the market's technological trajectory.

- Shift towards lightweight materials like aluminum alloys and carbon fiber to improve fuel efficiency and EV range.

- Rising adoption of larger diameter wheels for enhanced aesthetics and performance.

- Increased demand for customized and aftermarket wheels reflecting personal preferences.

- Growth in sustainable manufacturing practices and recycled material usage.

- Integration of smart wheel technologies for real-time monitoring and connectivity.

- Aerodynamic wheel designs optimized for electric vehicles to reduce drag.

AI Impact Analysis on Automotive Wheel

Common user questions concerning the impact of AI on the automotive wheel sector revolve around its application in design optimization, manufacturing efficiency, and quality control. Users are keen to understand how AI can reduce development cycles, predict material fatigue, and enhance precision in production. There is also interest in AI's potential to personalize design processes and improve supply chain resilience, indicating a desire for more intelligent and adaptive production systems within the industry. The potential for AI to drive predictive maintenance for wheels in connected vehicles is also a significant area of inquiry.

- AI-driven generative design for optimized wheel structures and weight reduction.

- Enhanced quality control and defect detection in manufacturing processes using AI vision systems.

- Predictive maintenance analytics for wheels in connected vehicles, leveraging AI algorithms.

- Improved supply chain management and demand forecasting through AI-powered analytics.

- Personalized wheel design and customization options facilitated by AI algorithms.

- Robotics and automation, often AI-enhanced, in wheel manufacturing for increased precision and speed.

Key Takeaways Automotive Wheel Market Size & Forecast

Insights into the automotive wheel market's size and forecast frequently highlight the steady growth driven by global automotive production and the rising prominence of electric vehicles. A key takeaway is the consistent demand for lightweight and performance-oriented wheels, which is a major contributor to market expansion. Furthermore, the increasing consumer preference for aesthetic customization and larger wheel diameters significantly influences market dynamics. The integration of advanced materials and manufacturing techniques is crucial for companies to maintain a competitive edge and address evolving consumer and regulatory demands, ensuring sustained market growth over the forecast period.

- The market is poised for consistent growth, driven by expanding vehicle sales globally.

- Increased focus on lightweight materials will be a primary growth accelerator.

- Electric vehicle proliferation is a significant catalyst for innovation and market expansion.

- Aftermarket and customization trends are crucial revenue streams.

- Technological advancements in manufacturing processes will enhance efficiency and product quality.

Automotive Wheel Market Drivers Analysis

The automotive wheel market is primarily driven by the consistent expansion of global automotive production, including both traditional internal combustion engine (ICE) vehicles and the rapidly growing electric vehicle (EV) segment. The increasing adoption of lightweight materials, such as aluminum alloys and carbon fiber, is a significant driver, as these materials improve fuel efficiency in ICE vehicles and extend range in EVs, meeting evolving consumer preferences and stringent emission regulations. Furthermore, the robust aftermarket demand for replacement, aesthetic upgrades, and performance wheels continues to contribute substantially to market growth, providing consistent revenue opportunities for manufacturers.

Technological advancements also play a critical role, fostering innovation in wheel design, manufacturing processes, and material science, which leads to superior products. The urbanization trend in emerging economies, coupled with rising disposable incomes, boosts vehicle ownership, consequently increasing the demand for automotive wheels. These interconnected factors create a strong foundation for sustained market expansion, pushing manufacturers to innovate and adapt to dynamic market requirements.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Global Vehicle Production | +1.5% | Global (Asia Pacific, Europe) | 2025-2033 |

| Growing Demand for Lightweight Wheels | +1.2% | North America, Europe, Asia Pacific | 2025-2033 |

| Rising Electric Vehicle (EV) Adoption | +1.0% | China, Europe, North America | 2025-2033 |

| Aftermarket Demand for Customization & Replacements | +0.8% | North America, Europe | 2025-2033 |

| Technological Advancements in Wheel Manufacturing | +0.5% | Global | 2025-2033 |

Automotive Wheel Market Restraints Analysis

The automotive wheel market faces several significant restraints that can impede its growth trajectory. One primary concern is the volatility and high cost of raw materials, particularly aluminum, steel, and specialty alloys, which directly impact manufacturing costs and profit margins for wheel producers. These fluctuations can be unpredictable, making long-term planning and pricing strategies challenging for market participants. Furthermore, stringent regulatory frameworks related to vehicle safety, fuel efficiency, and emissions impose additional design and manufacturing complexities, requiring substantial investments in research and development to comply with evolving standards.

Another key restraint is the intense competition within the market, characterized by numerous global and regional players, leading to pricing pressures and reduced profitability. Supply chain disruptions, often stemming from geopolitical events, natural disasters, or pandemics, can severely impact production schedules and material availability, causing delays and increased operational costs. Finally, economic downturns and fluctuations in consumer purchasing power directly affect new vehicle sales and, consequently, the demand for automotive wheels, presenting a significant cyclical challenge for the industry.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Volatility in Raw Material Prices | -0.8% | Global | 2025-2033 |

| Stringent Regulatory & Safety Standards | -0.5% | Europe, North America | 2025-2033 |

| Intense Market Competition | -0.4% | Global | 2025-2033 |

| Supply Chain Disruptions | -0.3% | Global | Short to Medium Term |

| Economic Downturns & Reduced Consumer Spending | -0.2% | Global (Varies by region) | Short to Medium Term |

Automotive Wheel Market Opportunities Analysis

Significant opportunities are emerging within the automotive wheel market, primarily driven by the rapid global shift towards electric vehicles (EVs). EVs necessitate specialized wheel designs that are lighter, more aerodynamic, and capable of handling different torque characteristics, opening new avenues for innovation and product development. Additionally, the expansion into emerging markets, particularly in Asia Pacific and Latin America, presents substantial growth prospects as urbanization and rising disposable incomes fuel increased vehicle ownership and, subsequently, demand for automotive wheels. These regions offer less saturated markets compared to established economies, providing fertile ground for market penetration and expansion.

The increasing consumer desire for vehicle customization, encompassing both aesthetic and performance enhancements, creates a booming aftermarket segment for specialized and designer wheels. This trend encourages manufacturers to offer a wider array of products, catering to diverse consumer preferences. Furthermore, advancements in manufacturing technologies, such as additive manufacturing and smart production lines, offer opportunities for greater design flexibility, reduced lead times, and enhanced product quality. The push towards sustainable manufacturing practices and the use of recycled materials also present an opportunity for companies to differentiate themselves and appeal to environmentally conscious consumers, driving innovation in material science and production methods.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Rising Demand for Wheels in Electric Vehicles | +1.3% | Global | 2025-2033 |

| Expansion in Emerging Markets | +1.0% | Asia Pacific, Latin America | 2025-2033 |

| Growing Consumer Preference for Customization | +0.9% | North America, Europe | 2025-2033 |

| Technological Advancements in Manufacturing | +0.7% | Global | 2025-2033 |

| Focus on Sustainable & Recycled Materials | +0.5% | Europe, North America | 2025-2033 |

Automotive Wheel Market Challenges Impact Analysis

The automotive wheel market faces several critical challenges that can impede its operational efficiency and profitability. One significant hurdle is the continuous fluctuation in raw material prices, particularly for metals like aluminum and steel, which directly impacts production costs and profit margins. Managing these volatile costs requires sophisticated hedging strategies and flexible supply chain management. Additionally, the industry is confronted with the complex task of adapting to stringent environmental regulations and emission standards globally, which necessitate significant investments in cleaner production processes and the development of more sustainable materials. This regulatory pressure adds complexity and cost to manufacturing operations.

Another major challenge is maintaining high-quality standards and product reliability amidst increasing demand for lightweight and performance-oriented wheels. The intricate balance between reducing weight, ensuring structural integrity, and meeting aesthetic demands requires advanced engineering and rigorous testing. Furthermore, intensifying global competition from both established players and emerging manufacturers puts constant pressure on pricing and innovation. Finally, disruptions in the global supply chain, whether due to geopolitical events, trade disputes, or natural disasters, can severely impact production schedules, material availability, and distribution networks, leading to operational inefficiencies and revenue losses.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Raw Material Price Volatility | -0.7% | Global | 2025-2033 |

| Adherence to Environmental Regulations | -0.6% | Europe, North America, Asia Pacific | 2025-2033 |

| Maintaining High Quality & Reliability | -0.5% | Global | 2025-2033 |

| Intensifying Global Competition | -0.4% | Global | 2025-2033 |

| Supply Chain Vulnerabilities | -0.3% | Global | Short to Medium Term |

Automotive Wheel Market - Updated Report Scope

This comprehensive market research report provides an in-depth analysis of the automotive wheel market, offering valuable insights into its current size, historical performance, and future growth projections. It delineates key market trends, identifies driving forces, and highlights potential restraints, opportunities, and challenges influencing the industry landscape. The report also details the market's segmentation by various parameters, providing a granular view of different product categories and their respective market dynamics. Furthermore, it outlines regional highlights and profiles leading market players, offering a holistic understanding for stakeholders and strategic decision-makers.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 45.0 billion |

| Market Forecast in 2033 | USD 63.8 billion |

| Growth Rate | 4.5% CAGR |

| Number of Pages | 250 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Ronal Group, Maxion Wheels, Borbet GmbH, Enkei Corporation, Superior Industries International Inc., Topy Industries Limited, Accuride Corporation, Central Motor Wheel Co. Ltd., CITIC Dicastal Co. Ltd., ThyssenKrupp AG, Wanfeng Auto Wheel, BBS GmbH, OZ S.p.A., UNIWHEELS AG, Iochpe-Maxion S.A., MHT Luxury Alloys, Rayone Wheels, Advanti Racing, Konig Wheels |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The automotive wheel market is comprehensively segmented to provide a detailed understanding of its various components and their respective contributions to the overall market. These segmentations are crucial for identifying specific growth areas, understanding consumer preferences, and developing targeted marketing strategies. The analysis spans across different material types, vehicle applications, manufacturing processes, and end-use sectors, offering a multifaceted view of the market's structure and dynamics.

Each segment is influenced by distinct factors such as technological advancements, regulatory mandates, and consumer purchasing power, necessitating a granular examination to uncover specific trends and opportunities. Understanding these segments allows market players to optimize their product portfolios, align with emerging industry standards, and effectively respond to the evolving demands of the global automotive sector. This detailed breakdown aids in forecasting future trends and assessing competitive landscapes within each niche.

- By Material Type: Focuses on the composition of wheels, including aluminum alloy, steel, carbon fiber, and other advanced materials. Aluminum alloys dominate due to their lightweight properties and design flexibility.

- By Vehicle Type: Categorizes wheels based on the vehicle they are designed for, such as passenger cars, commercial vehicles (light, medium, heavy), and the increasingly significant electric vehicle segment. Each type has specific requirements regarding load-bearing capacity, durability, and aesthetics.

- By Manufacturing Process: Examines the methods used to produce wheels, including forged, cast, and flow-formed processes. Each process offers distinct advantages in terms of strength, weight, and cost.

- By End-Use: Differentiates between Original Equipment Manufacturer (OEM) sales, where wheels are supplied directly to vehicle manufacturers for new car assembly, and the Aftermarket, which includes replacement wheels and customization options for existing vehicles.

- By Wheel Size: Segments the market based on the diameter of the wheel, commonly categorized into up to 17 inches, 18-20 inches, and above 20 inches. Larger wheel sizes are gaining popularity due to aesthetic appeal and performance characteristics.

Regional Highlights

- North America: This region is characterized by a strong aftermarket segment driven by customization trends and a high demand for larger diameter wheels. The increasing production of light trucks and SUVs also significantly contributes to wheel demand. Regulatory pushes for fuel efficiency further encourage the adoption of lightweight aluminum wheels.

- Europe: Europe is a hub for advanced automotive manufacturing and boasts a significant demand for premium and high-performance wheels. Strict emission regulations drive the adoption of lightweight materials and innovative wheel designs to improve vehicle efficiency. The growing electric vehicle market in countries like Germany, Norway, and the UK is also a key driver.

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market due to robust automotive production in countries like China, India, Japan, and South Korea. Rising disposable incomes, rapid urbanization, and increasing vehicle penetration contribute significantly to market expansion. China, in particular, leads in both vehicle production and EV adoption, making it a pivotal market for automotive wheels.

- Latin America: This region demonstrates steady growth, primarily driven by increasing vehicle sales and expanding automotive manufacturing bases in Brazil and Mexico. Economic stability and growing middle-class populations are boosting demand for both OEM and aftermarket wheels.

- Middle East and Africa (MEA): The MEA region is experiencing gradual growth, influenced by infrastructure development, rising vehicle ownership, and increasing demand for commercial vehicles. Investment in local automotive assembly plants in countries like South Africa is also contributing to market expansion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Wheel Market.- Ronal Group

- Maxion Wheels

- Borbet GmbH

- Enkei Corporation

- Superior Industries International Inc.

- Topy Industries Limited

- Accuride Corporation

- Central Motor Wheel Co. Ltd.

- CITIC Dicastal Co. Ltd.

- ThyssenKrupp AG

- Wanfeng Auto Wheel

- BBS GmbH

- OZ S.p.A.

- UNIWHEELS AG

- Iochpe-Maxion S.A.

- MHT Luxury Alloys

- Rayone Wheels

- Advanti Racing

- Konig Wheels

Frequently Asked Questions

Analyze common user questions about the Automotive Wheel market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate of the automotive wheel market?

The automotive wheel market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% from 2025 to 2033, reaching USD 63.8 billion by the end of the forecast period.

What are the primary drivers for the automotive wheel market?

Key drivers include increasing global vehicle production, the growing demand for lightweight wheels due to fuel efficiency and EV range requirements, and strong aftermarket demand for customization and replacements.

How is the rise of electric vehicles impacting the automotive wheel market?

The rise of electric vehicles is significantly impacting the market by driving demand for lighter, more aerodynamic wheel designs and pushing innovation in materials and manufacturing processes to optimize EV range and performance.

What are the key materials used in automotive wheel manufacturing?

The primary materials used in automotive wheel manufacturing include aluminum alloys (most common for lightweight and design flexibility), steel (for durability and cost-effectiveness), and increasingly, carbon fiber for high-performance and luxury vehicles.

Which regions are significant in the automotive wheel market?

Asia Pacific is the largest and fastest-growing region due to high vehicle production and EV adoption. North America and Europe are also significant, driven by strong aftermarket demand, premium vehicle segments, and stringent regulatory standards.