Vehicle Telematic Market

Vehicle Telematic Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_703308 | Last Updated : August 01, 2025 |

Format : ![]()

![]()

![]()

![]()

Vehicle Telematic Market Size

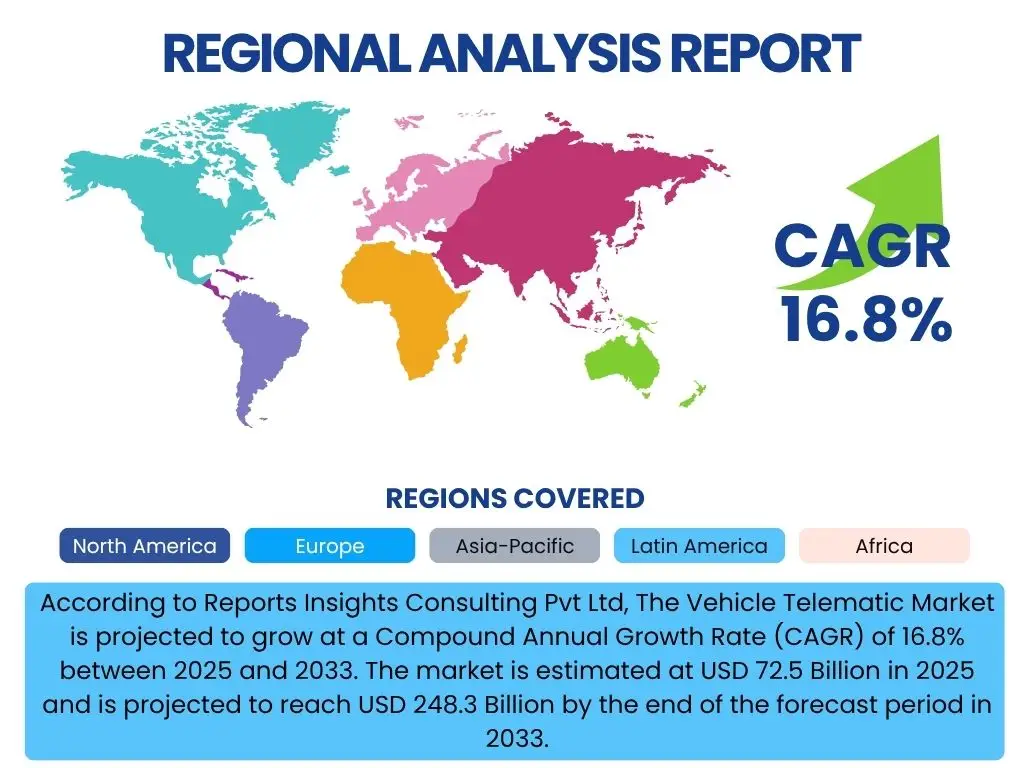

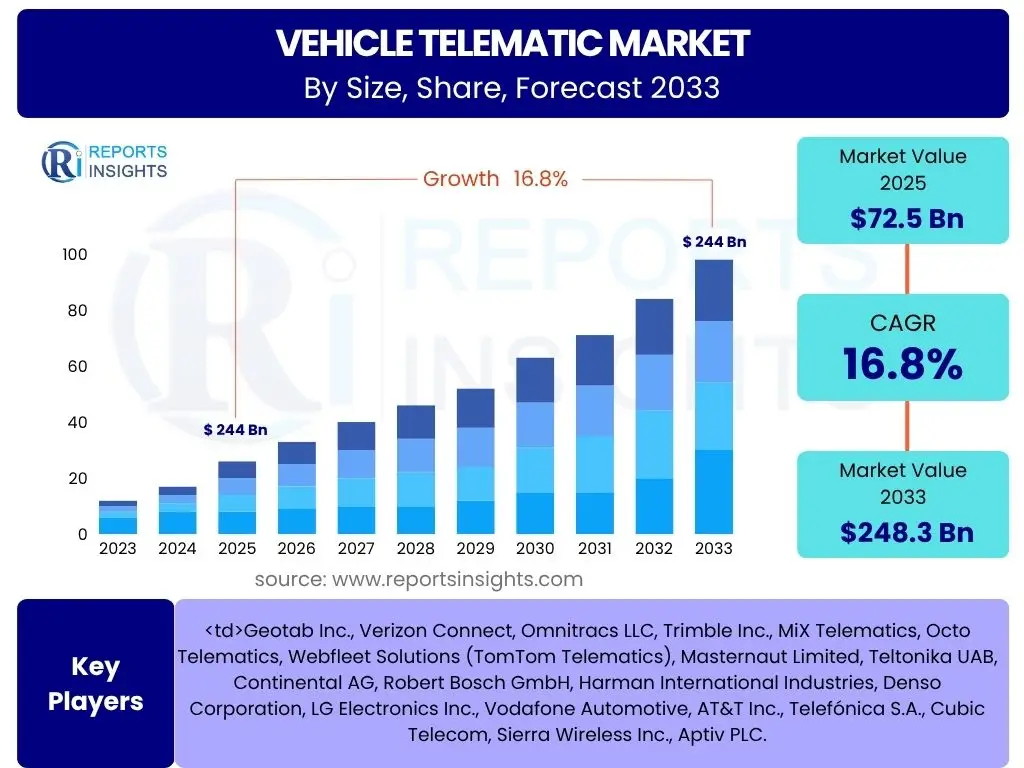

According to Reports Insights Consulting Pvt Ltd, The Vehicle Telematic Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 16.8% between 2025 and 2033. The market is estimated at USD 72.5 Billion in 2025 and is projected to reach USD 248.3 Billion by the end of the forecast period in 2033.

Key Vehicle Telematic Market Trends & Insights

The Vehicle Telematic market is experiencing rapid evolution, driven by advancements in connectivity, data analytics, and the increasing demand for enhanced vehicle safety, efficiency, and convenience. Users frequently inquire about the impact of next-generation cellular technologies like 5G, the role of artificial intelligence in processing vast amounts of vehicular data, and the expansion of telematics applications beyond traditional fleet management to include passenger vehicles and specialized services. Another significant area of interest revolves around the integration of telematics with smart city infrastructure and the burgeoning Electric Vehicle (EV) ecosystem. These trends collectively shape the strategic direction for market players and influence investment decisions across the value chain.

Current trends highlight a shift towards more sophisticated, data-driven solutions that offer predictive capabilities and real-time insights. The convergence of IoT, AI, and robust communication networks is enabling a new era of connected mobility, from optimizing logistics routes to personalizing in-car experiences. The industry is also witnessing a strong emphasis on cybersecurity measures to protect sensitive vehicle and driver data, reflecting growing concerns over privacy and data integrity. Furthermore, the expansion of usage-based insurance (UBI) models and the integration of telematics into electric vehicle platforms are opening new revenue streams and fostering innovation in how vehicles are monitored and managed.

- Proliferation of 5G connectivity for ultra-low latency and high-bandwidth data transmission.

- Increased adoption of AI and Machine Learning for predictive analytics and personalized services.

- Growing demand for cloud-based telematics solutions for scalability and accessibility.

- Expansion of usage-based insurance (UBI) and pay-as-you-drive models.

- Enhanced focus on cybersecurity to protect sensitive vehicle and driver data.

- Integration of telematics into Electric Vehicle (EV) platforms for battery management and range optimization.

- Development of Cellular Vehicle-to-Everything (C-V2X) communication for improved road safety and traffic flow.

- Rise of sophisticated fleet management solutions for real-time tracking, diagnostics, and route optimization.

AI Impact Analysis on Vehicle Telematic

User queries regarding AI's influence on Vehicle Telematics primarily revolve around its capabilities in transforming raw vehicle data into actionable intelligence, enhancing decision-making, and fostering new service models. Key themes include how AI improves predictive maintenance, optimizes route planning, analyzes driver behavior for safety and efficiency, and enables more sophisticated autonomous driving features. There is also significant interest in AI's role in personalizing in-car experiences and its potential to manage complex urban mobility systems. Concerns often surface regarding data privacy, algorithmic bias, and the necessity of robust computing infrastructure to support AI's data processing demands within vehicles and cloud environments.

AI's impact extends across the entire telematics value chain, moving beyond mere data collection to intelligent data interpretation. It empowers telematics systems to learn from historical data, identify patterns, and make proactive recommendations, thereby significantly improving operational efficiency and safety. For instance, AI algorithms can predict equipment failures, identify risky driving habits, and dynamically adjust routes based on real-time traffic and weather conditions. This analytical prowess is critical for fleet operators aiming to reduce operational costs and enhance asset utilization. Moreover, AI is foundational to the development of advanced driver-assistance systems (ADAS) and eventually fully autonomous vehicles, leveraging telematics data to perceive environments and navigate intelligently.

- Enables advanced predictive maintenance by analyzing vehicle performance data to anticipate failures.

- Optimizes logistics and route planning through real-time traffic analysis and dynamic adjustments.

- Enhances driver behavior monitoring, providing insights for improved safety and fuel efficiency.

- Supports the development and refinement of Advanced Driver-Assistance Systems (ADAS) and autonomous driving.

- Facilitates personalized in-car experiences and tailored services for occupants.

- Improves fraud detection in insurance telematics by analyzing driving patterns and accident scenarios.

- Automates data processing and anomaly detection, reducing the need for manual intervention.

Key Takeaways Vehicle Telematic Market Size & Forecast

The Vehicle Telematic market is poised for substantial growth, driven by an escalating demand for connectivity, advanced safety features, and operational efficiency across both passenger and commercial vehicle segments. Common user inquiries about key takeaways frequently highlight the robust growth trajectory, the increasing integration of innovative technologies like AI and 5G, and the broadening scope of telematics applications beyond traditional use cases. Insights reveal that the market's expansion is not only quantitative, in terms of market size and CAGR, but also qualitative, reflecting a deeper penetration into various industry verticals and a shift towards more value-added services. The forecast underscores the critical role telematics will play in the future of transportation and mobility.

A significant takeaway from the market forecast is the pivotal role of regulatory mandates in accelerating telematics adoption, particularly concerning safety and emissions standards. Furthermore, the burgeoning logistics and e-commerce sectors are major catalysts, necessitating sophisticated fleet management solutions for optimized operations. The market is also benefiting from the rapid digital transformation occurring globally, pushing automotive stakeholders to embrace connected technologies for competitive advantage. The long-term outlook remains highly positive, with continuous innovation in data analytics, sensor technology, and communication protocols expected to unlock new opportunities and sustain growth well into the next decade.

- The market is projected for robust growth, driven by increasing adoption across various vehicle types and applications.

- Technological advancements, including 5G, AI, and IoT, are critical accelerators for market expansion.

- Commercial vehicles and fleet management applications are significant growth contributors, alongside evolving passenger vehicle services.

- Regulatory support for vehicle safety and emissions standards continues to be a key market driver.

- The shift towards data-driven decision-making and value-added services is redefining market offerings.

Vehicle Telematic Market Drivers Analysis

The Vehicle Telematic market is primarily propelled by the escalating demand for connected vehicle solutions, offering enhanced safety, convenience, and operational efficiency. Regulatory mandates globally, such as eCall in Europe and similar initiatives for vehicle tracking and safety, play a crucial role in accelerating adoption. The increasing awareness among consumers and fleet operators about the benefits of telematics, including improved asset utilization, reduced operational costs, and enhanced driver safety, further fuels market growth. The rapid expansion of the e-commerce and logistics sectors, necessitating advanced fleet management and asset tracking capabilities, also serves as a significant driver for this market.

Furthermore, the ongoing advancements in communication technologies, particularly the rollout of 5G networks, are enabling more sophisticated telematics applications with higher data transfer speeds and lower latency, unlocking new possibilities for real-time services and autonomous vehicle integration. The integration of artificial intelligence and machine learning algorithms allows for more intelligent data processing, predictive analytics, and personalized user experiences, adding substantial value to telematics offerings. These technological leaps, coupled with a growing focus on sustainable transportation and optimized resource management, position telematics as a foundational technology for future mobility solutions.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Demand for Connected Car Services and Features | +3.5% | North America, Europe, Asia Pacific | 2025-2033 |

| Stringent Government Regulations and Mandates for Vehicle Safety and Emissions | +3.0% | Europe, North America, Japan | 2025-2030 |

| Growth in E-commerce and Logistics Sector Driving Fleet Management Adoption | +2.8% | Asia Pacific, North America, Europe | 2025-2033 |

| Advancements in IoT, 5G Connectivity, and AI Integration | +2.5% | Global | 2025-2033 |

| Rising Popularity of Usage-Based Insurance (UBI) | +2.0% | North America, Europe | 2025-2033 |

Vehicle Telematic Market Restraints Analysis

Despite its significant growth potential, the Vehicle Telematic market faces several notable restraints that could temper its expansion. One primary concern is data privacy and security. The collection and transmission of sensitive vehicle and driver data raise considerable privacy issues, leading to skepticism among consumers and stringent data protection regulations, such as GDPR. Ensuring the robust security of this data against cyber threats and unauthorized access is a complex challenge that requires continuous investment and advanced cryptographic measures, posing a significant hurdle for widespread adoption and trust.

Another major restraint is the high initial investment cost associated with implementing comprehensive telematics solutions, especially for smaller businesses and individual consumers. The cost of hardware, software, installation, and ongoing subscription fees can be prohibitive. Furthermore, interoperability issues stemming from a lack of standardized communication protocols and data formats across different telematics providers and vehicle manufacturers create integration complexities. This fragmentation can hinder seamless data exchange and limit the full potential of telematics ecosystems, making it difficult for users to switch providers or integrate new functionalities. Lastly, resistance to data sharing from drivers or employees, due to perceived surveillance, can also impede the adoption of telematics solutions within organizations.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Data Privacy and Security Concerns | -2.2% | Europe, North America | 2025-2033 |

| High Initial Investment and Subscription Costs | -1.8% | Emerging Economies, SMBs Globally | 2025-2030 |

| Lack of Standardization and Interoperability Issues | -1.5% | Global | 2025-2030 |

| Complexity of Integrating Telematics with Legacy Systems | -1.3% | Mature Markets, Large Enterprises | 2025-2028 |

Vehicle Telematic Market Opportunities Analysis

The Vehicle Telematic market is characterized by numerous growth opportunities, particularly in the expansion of usage-based insurance (UBI) models. As insurers increasingly leverage telematics data to offer personalized premiums based on actual driving behavior, this segment presents a significant avenue for market growth, benefiting both insurers and careful drivers. The continuous innovation in sensor technology and data analytics is enabling more sophisticated risk assessments and tailored insurance products, driving wider adoption of telematics in the automotive insurance sector globally.

Furthermore, the rapid growth of electric vehicles (EVs) creates a distinct opportunity for specialized telematics solutions. EV telematics can monitor battery health, optimize charging schedules, manage range anxiety, and provide insights into energy consumption, which are crucial for both individual EV owners and commercial EV fleets. The untapped potential in emerging economies, where vehicle ownership and digital infrastructure are expanding rapidly, also offers substantial market opportunities for telematics providers. These regions represent greenfield markets for fleet management, asset tracking, and basic connectivity services, with increasing demand for solutions that improve logistics efficiency and vehicle security. Lastly, the integration of telematics with smart city infrastructure, enabling intelligent traffic management, smart parking, and emergency response optimization, represents a long-term strategic opportunity for market expansion and value creation.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Emergence and Expansion of Usage-Based Insurance (UBI) | +2.5% | North America, Europe, Asia Pacific (developing) | 2025-2033 |

| Development of Advanced Telematics Solutions for Electric Vehicles (EVs) | +2.0% | Global, particularly EV-heavy markets | 2025-2033 |

| Expansion into New Geographical Markets and Emerging Economies | +1.8% | Asia Pacific (excl. China/Japan), Latin America, MEA | 2026-2033 |

| Integration with Smart City and Intelligent Transportation Systems (ITS) | +1.5% | Global Urban Centers | 2027-2033 |

Vehicle Telematic Market Challenges Impact Analysis

The Vehicle Telematic market faces significant challenges, notably the ever-present threat of cybersecurity breaches and data privacy violations. As telematics systems collect and transmit vast amounts of sensitive data, including location, driving behavior, and personal information, they become attractive targets for cyberattacks. A single breach can lead to substantial financial losses, reputational damage, and erosion of consumer trust, necessitating continuous investment in advanced security protocols and real-time threat detection systems, which adds to operational complexities and costs for providers.

Another key challenge is the rapid pace of technological advancements, which can lead to rapid obsolescence of existing hardware and software solutions. Telematics providers must continuously innovate and adapt their offerings to incorporate new communication standards (e.g., 5G, C-V2X), advanced sensors, and sophisticated data analytics tools. This requires significant R&D investment and can shorten product lifecycles, putting pressure on profit margins and requiring agility in product development. Furthermore, navigating a fragmented and evolving regulatory landscape across different countries and regions poses a significant hurdle, particularly concerning data residency, cross-border data transfer, and varying safety standards, which complicates global market expansion for telematics solution providers.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Cybersecurity Threats and Data Breaches | -2.0% | Global | 2025-2033 |

| Rapid Technological Obsolescence and Need for Continuous Updates | -1.7% | Global | 2025-2030 |

| Fragmented Regulatory Landscape and Compliance Complexities | -1.5% | Global | 2025-2033 |

| Consumer Resistance to Data Sharing and Privacy Concerns | -1.2% | Europe, North America | 2025-2030 |

Vehicle Telematic Market - Updated Report Scope

This report provides an in-depth analysis of the global Vehicle Telematic market, offering comprehensive insights into market size, growth drivers, restraints, opportunities, and challenges. It covers detailed segmentation analysis based on type, application, technology, vehicle type, and connectivity, alongside a thorough regional assessment. The report also includes competitive landscape analysis, profiling key players and their strategic initiatives, enabling stakeholders to make informed decisions and identify potential growth avenues within the dynamic Vehicle Telematic industry landscape. The scope extends to a forecast period up to 2033, providing long-term market projections and trends.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 72.5 Billion |

| Market Forecast in 2033 | USD 248.3 Billion |

| Growth Rate | 16.8% |

| Number of Pages | 247 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Geotab Inc., Verizon Connect, Omnitracs LLC, Trimble Inc., MiX Telematics, Octo Telematics, Webfleet Solutions (TomTom Telematics), Masternaut Limited, Teltonika UAB, Continental AG, Robert Bosch GmbH, Harman International Industries, Denso Corporation, LG Electronics Inc., Vodafone Automotive, AT&T Inc., Telefónica S.A., Cubic Telecom, Sierra Wireless Inc., Aptiv PLC. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Vehicle Telematic market is extensively segmented to provide a granular understanding of its diverse applications and technological deployments. This segmentation helps in identifying specific growth pockets and tailoring solutions to various end-user requirements. The market's structure reflects the different ways telematics solutions are integrated into vehicles and utilized across various sectors, from personal mobility to large-scale commercial operations. Analyzing these segments reveals distinct market dynamics, adoption rates, and competitive landscapes, offering a comprehensive view of the industry's intricate ecosystem.

Further analysis within these segments highlights the dominance of certain categories, such as fleet management within the application segment, driven by the logistics and transportation industries' need for efficiency and cost reduction. The OEM segment is witnessing significant growth as vehicle manufacturers increasingly embed telematics capabilities directly into new vehicles, offering seamless integration and enhanced functionality from the point of sale. Understanding these interdependencies and growth patterns across segments is crucial for strategic planning and identifying lucrative investment opportunities within the Vehicle Telematic market.

- By Type:

- OEM (Original Equipment Manufacturer)

- Aftermarket

- By Application:

- Fleet Management

- Asset Tracking

- Navigation & Infotainment

- Insurance Telematics

- Emergency & Breakdown Services

- Passenger Car Telematics

- Remote Diagnostics

- By Technology:

- Cellular

- Satellite

- By Vehicle Type:

- Passenger Vehicles

- Commercial Vehicles

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Buses & Coaches

- By Connectivity:

- Embedded

- Tethered

- Smartphone Integrated

Regional Highlights

- North America: This region is a leading market for Vehicle Telematic due to high adoption rates of connected car technologies, significant presence of key market players, robust infrastructure, and strong demand for advanced fleet management solutions across diverse industries like logistics, construction, and utilities. Regulatory support for vehicle safety and emissions also drives market growth.

- Europe: Europe holds a substantial share in the telematics market, primarily driven by stringent government mandates such as the eCall system, increasing consumer awareness regarding vehicle safety and security, and the rising penetration of usage-based insurance. The region's focus on smart mobility and sustainable transportation further fuels the adoption of telematics solutions.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, attributed to the booming automotive manufacturing sector, rapid urbanization, increasing vehicle sales, and burgeoning e-commerce and logistics industries. Countries like China, India, Japan, and South Korea are investing heavily in smart infrastructure and connected vehicle technologies, creating immense opportunities for telematics providers.

- Latin America: This region is an emerging market for vehicle telematics, characterized by growing concerns over vehicle theft and a rising demand for fleet management solutions to improve operational efficiency in a developing logistics sector. Increasing government initiatives to enhance road safety and security also contribute to market expansion.

- Middle East and Africa (MEA): The MEA region is witnessing steady growth in the telematics market, primarily driven by investments in smart city projects, infrastructure development, and an increasing focus on improving transportation and logistics efficiency. Demand for vehicle tracking and security solutions, particularly in commercial fleets, is a key growth factor.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Vehicle Telematic Market.- Geotab Inc.

- Verizon Connect

- Omnitracs LLC

- Trimble Inc.

- MiX Telematics

- Octo Telematics

- Webfleet Solutions (TomTom Telematics)

- Masternaut Limited

- Teltonika UAB

- Continental AG

- Robert Bosch GmbH

- Harman International Industries

- Denso Corporation

- LG Electronics Inc.

- Vodafone Automotive

- AT&T Inc.

- Telefónica S.A.

- Cubic Telecom

- Sierra Wireless Inc.

- Aptiv PLC.

Frequently Asked Questions

What is Vehicle Telematic and its primary purpose?

Vehicle Telematics involves the integration of telecommunications and informatics to send, receive, and store information about remote objects, primarily vehicles. Its main purpose is to monitor vehicle location, movement, status, and behavior, enhancing safety, efficiency, and connectivity for both passenger and commercial vehicles.

What are the key drivers of growth in the Vehicle Telematic market?

Key drivers include increasing demand for connected car services, stringent government regulations for vehicle safety and emissions, the rapid growth of the e-commerce and logistics sectors requiring advanced fleet management, and continuous advancements in IoT, 5G connectivity, and AI integration.

How is AI impacting the Vehicle Telematic market?

AI significantly impacts telematics by enabling advanced predictive maintenance, optimizing logistics and route planning, enhancing driver behavior monitoring, supporting autonomous driving systems, and personalizing in-car experiences through intelligent data analysis.

Which regions are leading the Vehicle Telematic market, and why?

North America and Europe currently lead the market due to high adoption of connected car technologies, robust regulatory frameworks, and strong demand for advanced fleet management solutions. Asia Pacific is projected to be the fastest-growing region, driven by its booming automotive industry and urbanization.

What are the main challenges faced by the Vehicle Telematic market?

Primary challenges include cybersecurity threats and data privacy concerns associated with sensitive vehicle data, rapid technological obsolescence requiring continuous updates, and navigating a fragmented and evolving global regulatory landscape.