Telematic Market

Telematic Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_700780 | Last Updated : July 28, 2025 |

Format : ![]()

![]()

![]()

![]()

Telematic Market Size

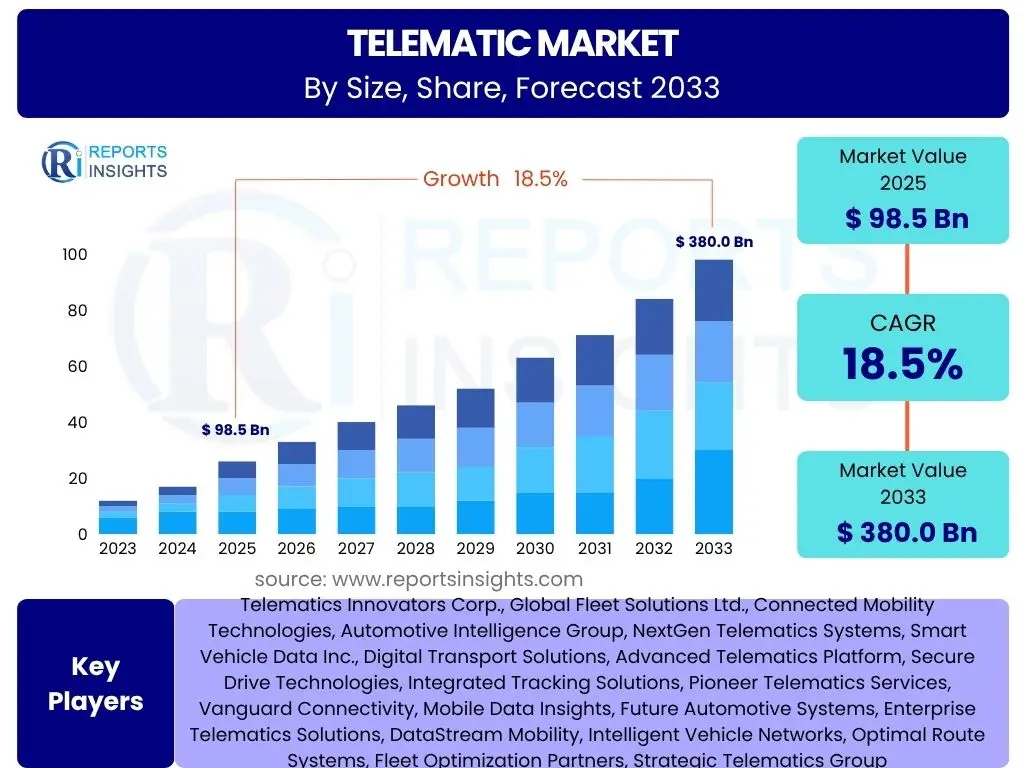

According to Reports Insights Consulting Pvt Ltd, The Telematic Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2025 and 2033. The market is estimated at USD 98.5 Billion in 2025 and is projected to reach USD 380.0 Billion by the end of the forecast period in 2033.

Key Telematic Market Trends & Insights

The Telematic market is experiencing rapid evolution, driven by increasing connectivity and the demand for data-driven insights in the automotive and transportation sectors. Key trends indicate a shift towards more sophisticated, integrated solutions that offer enhanced safety, efficiency, and personalized experiences. User inquiries frequently highlight the growing importance of real-time data analytics for predictive maintenance, the expansion of usage-based insurance models, and the integration of telematics with broader smart city initiatives. Furthermore, the convergence of telematics with electric vehicle (EV) ecosystems and autonomous driving technologies is a significant area of interest, reflecting the market's trajectory towards highly intelligent and interconnected mobility solutions.

There is a strong focus on leveraging advanced analytics to transform raw vehicle data into actionable intelligence, enabling businesses to optimize operations, reduce costs, and improve customer satisfaction. The proliferation of IoT devices and 5G networks is providing the necessary infrastructure for this data-intensive environment, fostering innovation across various telematics applications. Consumer and enterprise users are increasingly looking for solutions that offer seamless integration with existing systems, robust cybersecurity measures, and the flexibility to adapt to evolving technological landscapes. This demand is pushing developers to create more versatile and secure telematics platforms.

- Growing adoption of connected vehicle technologies across passenger and commercial segments.

- Expansion of Usage-Based Insurance (UBI) models driven by data analytics capabilities.

- Increased demand for advanced fleet management solutions for operational efficiency and cost reduction.

- Integration of telematics with electric vehicle (EV) infrastructure for optimized charging and range management.

- Rise of predictive maintenance and vehicle diagnostics utilizing real-time data.

- Leveraging 5G and IoT for enhanced connectivity, speed, and data processing.

- Focus on cybersecurity and data privacy due to increasing data collection and transmission.

- Development of integrated telematics solutions for smart city and intelligent transportation systems.

AI Impact Analysis on Telematic

The integration of Artificial Intelligence (AI) into telematics systems is profoundly transforming the capabilities and applications within the market. Common user questions revolve around how AI can enhance data processing, improve predictive accuracy, and automate decision-making processes. Users are keen to understand AI's role in advancing autonomous driving, optimizing logistics, and personalizing driver experiences. While there's excitement about the potential for greater efficiency and safety, concerns about data privacy, algorithmic bias, and the complexity of AI implementation are also prevalent themes in user inquiries.

AI is being applied to analyze vast datasets generated by telematics devices, identifying patterns in driver behavior, predicting vehicle faults, and optimizing routes in real-time. This capability moves telematics beyond mere tracking to sophisticated analytical and predictive intelligence. For instance, AI algorithms can detect aggressive driving patterns, provide personalized coaching, or predict maintenance needs before a failure occurs, significantly reducing operational downtime and enhancing safety. The ability of AI to learn and adapt from continuous data streams makes telematics solutions more dynamic and responsive to changing conditions, promising a future of truly intelligent transportation systems.

Furthermore, AI facilitates the development of highly sophisticated navigation systems that adapt to traffic conditions dynamically, and advanced driver assistance systems (ADAS) that contribute to semi-autonomous and fully autonomous vehicles. The ethical implications of AI, particularly concerning data usage, transparency of algorithms, and potential for surveillance, remain critical discussion points. Companies are investing heavily in explainable AI (XAI) and robust data governance frameworks to build trust and ensure responsible AI deployment within telematics applications.

- Enhanced data analysis and pattern recognition from telematics data, improving insights into vehicle performance and driver behavior.

- Predictive analytics for proactive vehicle maintenance, reducing downtime and operational costs.

- Optimized route planning and logistics management through real-time traffic and environmental data processing.

- Advanced driver behavior monitoring and personalized feedback for improved safety and fuel efficiency.

- Development of sophisticated autonomous driving features and intelligent driver assistance systems.

- Fraud detection in insurance telematics by identifying unusual claim patterns.

- Improved personalization of in-car services and infotainment based on user preferences.

- Challenges include ensuring data privacy, ethical AI deployment, and managing computational requirements.

Key Takeaways Telematic Market Size & Forecast

Analysis of user questions regarding the Telematic market size and forecast consistently highlights the immense growth potential and transformative impact of this sector. Users seek clear insights into the primary factors driving such substantial expansion, especially concerning the role of technological advancements and regulatory pressures. There is significant interest in understanding how the market's projected value translates into opportunities for investment, innovation, and strategic partnerships across various industries.

The market is poised for significant expansion, underpinned by the increasing integration of vehicles into the broader digital ecosystem. The forecast indicates that telematics will move beyond conventional tracking and navigation to become a fundamental component of smart mobility, autonomous driving, and advanced fleet management. Stakeholders are keen to understand the specific segments offering the most lucrative opportunities and the regional dynamics influencing market growth. The rapid pace of innovation, coupled with evolving consumer expectations for connectivity and safety, positions telematics as a pivotal technology for the future of transportation.

- The Telematic market is on a robust growth trajectory, projected to nearly quadruple in size by 2033.

- Connected cars and smart fleet solutions are primary catalysts for this exponential growth.

- Technological advancements, including 5G, AI, and IoT, are integral to market expansion.

- Opportunities abound for new entrants and existing players in niche applications like UBI and EV telematics.

- Regulatory mandates for vehicle safety and emissions are a consistent driver of adoption.

- North America and Europe currently dominate, but Asia Pacific is emerging as a high-growth region.

- Data privacy and cybersecurity will remain critical considerations for market development and adoption.

Telematic Market Drivers Analysis

The global Telematic market is significantly propelled by several key drivers, reflecting a confluence of technological advancements, evolving consumer demands, and stringent regulatory frameworks. The increasing integration of telematics systems into vehicles for enhanced safety, security, and connectivity is a primary catalyst. Furthermore, the growing adoption of fleet management solutions by commercial entities aiming to optimize operations and reduce costs is providing substantial momentum. These drivers collectively foster an environment conducive to sustained market expansion and innovation across various applications.

The proliferation of smartphones and widespread internet access has enabled the development of sophisticated mobile-based telematics solutions, making these technologies more accessible and affordable. Governments worldwide are also implementing regulations mandating the inclusion of certain telematics features, such as eCall systems in Europe, which further stimulates market growth. Additionally, the rising consumer awareness regarding vehicle diagnostics, predictive maintenance, and usage-based insurance (UBI) schemes is contributing to the increased demand for telematics services, as these offer tangible benefits in terms of cost savings and improved vehicle longevity.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing adoption of connected cars and smart vehicles | +3% | Global (North America, Europe, Asia Pacific) | Long-term (5+ years) |

| Growing demand for fleet management and logistics optimization | +2.5% | Global (All major economies) | Mid-term (3-5 years) |

| Stringent government regulations for vehicle safety and emissions | +2% | Europe, North America, Emerging Asia (China, India) | Short-term (1-3 years) |

| Expansion of usage-based insurance (UBI) models | +1.5% | North America, Europe | Mid-term (3-5 years) |

| Advancements in IoT, AI, and 5G network infrastructure | +3% | Global (Technologically advanced regions) | Long-term (5+ years) |

Telematic Market Restraints Analysis

Despite the robust growth trajectory, the Telematic market faces several significant restraints that could impede its full potential. One of the primary concerns revolves around data security and privacy. As telematics systems collect vast amounts of sensitive personal and vehicular data, the risk of breaches and misuse remains a major deterrent for both consumers and businesses. This concern necessitates robust cybersecurity frameworks and transparent data handling policies, which are often complex and expensive to implement.

Another critical restraint is the high initial investment required for implementing sophisticated telematics solutions, particularly for smaller businesses and individual consumers. The cost of hardware, software, installation, and ongoing subscription fees can be prohibitive, especially in price-sensitive markets. Furthermore, the lack of standardized protocols and interoperability between different telematics systems and vehicle manufacturers poses a significant challenge, creating integration complexities and limiting widespread adoption. This fragmentation can lead to vendor lock-in and complicate efforts to build a truly interconnected transportation ecosystem.

Moreover, user resistance to monitoring, particularly concerning privacy implications of driver behavior tracking, can act as a psychological barrier to adoption. In some regions, regulatory uncertainties and varying legal frameworks across different countries regarding data ownership and cross-border data transfer also add layers of complexity, making it challenging for global telematics providers to scale their operations effectively.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Data security and privacy concerns | -1.5% | Global | Long-term (5+ years) |

| High initial investment costs and subscription fees | -1% | Developing Regions (APAC, Latin America, MEA) | Mid-term (3-5 years) |

| Lack of standardization and interoperability issues | -0.8% | Global | Long-term (5+ years) |

| User resistance to monitoring and behavioral tracking | -0.5% | North America, Europe | Mid-term (3-5 years) |

Telematic Market Opportunities Analysis

The Telematic market is ripe with opportunities, primarily driven by the ongoing digital transformation across industries and the emergence of new technological paradigms. The rapid growth of the electric vehicle (EV) market presents a significant avenue for specialized telematics solutions focusing on battery management, charging infrastructure optimization, and range prediction. As EVs become mainstream, the demand for integrated telematics that supports their unique operational requirements will surge, offering substantial revenue streams for innovators in this space.

Another major opportunity lies in the expansion of telematics into untapped geographical markets, particularly in developing economies across Asia Pacific, Latin America, and Africa. These regions are experiencing rapid urbanization and infrastructure development, coupled with increasing vehicle sales and a growing need for efficient transportation and logistics solutions. Early movers can establish strong market positions by offering localized, cost-effective telematics services tailored to the specific needs of these emerging markets.

Furthermore, the convergence of telematics with smart city initiatives and autonomous driving technologies offers immense potential. Telematics data can feed into intelligent transportation systems, optimizing traffic flow, managing public transport, and enabling vehicle-to-everything (V2X) communication. The development of advanced analytics and AI-powered platforms also presents opportunities for new data monetization models, where insights derived from telematics data can be sold to urban planners, insurance providers, and automotive manufacturers for strategic decision-making and product development.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growth in electric vehicle (EV) telematics and charging optimization | +2% | Global (Especially North America, Europe, China) | Long-term (5+ years) |

| Expansion into emerging economies and untapped markets | +1.8% | Asia Pacific, Latin America, MEA | Mid-term (3-5 years) |

| Integration with smart city and intelligent transportation systems (ITS) | +1.5% | Global (Urban centers) | Long-term (5+ years) |

| Development of advanced analytics and AI-driven predictive services | +2.5% | Global | Mid-term (3-5 years) |

| Emergence of new data monetization models and value-added services | +1.2% | Global | Long-term (5+ years) |

Telematic Market Challenges Impact Analysis

The Telematic market, while promising, grapples with several formidable challenges that demand strategic attention from industry stakeholders. Managing the sheer volume and velocity of data generated by telematics devices presents a significant hurdle. Processing, storing, and analyzing this big data in real-time requires robust infrastructure and advanced analytics capabilities, which can be costly and technically complex. Ensuring the quality, accuracy, and security of this data is also a continuous challenge, as even minor discrepancies can lead to faulty insights or compromised privacy.

Cybersecurity threats represent an ever-present challenge, given the increasing connectivity of vehicles and the sensitivity of the data they transmit. Telematics systems are vulnerable to hacking, malware, and other cyberattacks, which could compromise vehicle functionality, user privacy, or even lead to safety incidents. Developing and maintaining impenetrable security protocols, especially as attack methods evolve, requires continuous investment and expertise. This ongoing battle against cyber threats places a significant burden on telematics providers to protect their systems and user data effectively.

Furthermore, achieving seamless interoperability among diverse vehicle models, telematics hardware, software platforms, and mobile network operators remains a complex technical and business challenge. The lack of universal standards for data formats and communication protocols hinders widespread adoption and creates fragmented ecosystems. Navigating the varied and often conflicting regulatory landscapes across different regions concerning data privacy, vehicle safety, and telematics deployment adds another layer of complexity, requiring providers to adapt their solutions to specific national and regional requirements. Lastly, the rapid pace of technological change necessitates continuous innovation and adaptation, putting pressure on companies to stay ahead of the curve.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Managing vast data volumes and ensuring data quality | -0.8% | Global | Long-term (5+ years) |

| Ensuring robust cybersecurity against evolving threats | -1.2% | Global | Mid-term (3-5 years) |

| Addressing interoperability and standardization issues | -0.7% | Global | Long-term (5+ years) |

| Navigating complex and varied regulatory landscapes | -0.6% | Global (Regional specifics) | Short-term (1-3 years) |

Telematic Market - Updated Report Scope

This comprehensive report provides an in-depth analysis of the global Telematic market, offering crucial insights into its size, growth trends, drivers, restraints, opportunities, and challenges. The scope encompasses detailed segmentation across various types, technologies, vehicle categories, solutions, and end-use industries, providing a holistic view of the market dynamics from 2019 to 2033. The report also highlights key regional insights and profiles leading market players, aiding stakeholders in strategic decision-making and competitive landscaping.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 98.5 Billion |

| Market Forecast in 2033 | USD 380.0 Billion |

| Growth Rate | 18.5% |

| Number of Pages | 265 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Telematics Innovators Corp., Global Fleet Solutions Ltd., Connected Mobility Technologies, Automotive Intelligence Group, NextGen Telematics Systems, Smart Vehicle Data Inc., Digital Transport Solutions, Advanced Telematics Platform, Secure Drive Technologies, Integrated Tracking Solutions, Pioneer Telematics Services, Vanguard Connectivity, Mobile Data Insights, Future Automotive Systems, Enterprise Telematics Solutions, DataStream Mobility, Intelligent Vehicle Networks, Optimal Route Systems, Fleet Optimization Partners, Strategic Telematics Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Telematic market is broadly segmented to provide a detailed understanding of its diverse applications and technological underpinnings. This segmentation allows for a granular analysis of market dynamics, identifying key growth areas and niche opportunities within the broader telematics ecosystem. Understanding these segments is crucial for businesses looking to tailor solutions to specific needs and for investors seeking to identify high-potential sectors.

The market is primarily segmented by type, differentiating between embedded systems, tethered solutions, and smartphone-integrated applications, each catering to distinct user preferences and vehicle capabilities. Further segmentation by technology highlights the reliance on cellular, satellite, Bluetooth, Wi-Fi, and NFC for connectivity. Vehicle type segmentation, separating passenger and commercial vehicles, underscores the varied requirements and regulatory landscapes for different automotive categories. The solution/application segment is particularly rich, covering a wide array of services from fleet management and navigation to safety, security, and the increasingly popular insurance telematics. Lastly, end-use industry segmentation reveals the cross-sectoral applicability of telematics, extending beyond traditional automotive into logistics, healthcare, construction, and more.

- By Type:

- Embedded Telematics: Factory-installed systems offering deep vehicle integration and robust functionality.

- Tethered Telematics: Solutions utilizing a smartphone's connectivity, often through a vehicle's infotainment system.

- Smartphone Integrated Telematics: App-based solutions leveraging smartphone sensors and connectivity for basic telematics functions.

- By Technology:

- Cellular: Dominant technology for real-time data transmission leveraging 2G, 3G, 4G, and 5G networks.

- Satellite: Utilized in remote areas or for specific applications where cellular coverage is limited.

- Bluetooth: Primarily for short-range communication within the vehicle or with nearby devices.

- Wi-Fi: Used for in-car connectivity, software updates, and data offloading.

- NFC (Near Field Communication): Emerging for secure authentication and short-range data exchange.

- By Vehicle Type:

- Passenger Vehicles: Focus on safety, infotainment, navigation, and personalized services.

- Commercial Vehicles: Emphasis on fleet management, logistics, tracking, and compliance (including Light Commercial Vehicles and Heavy Commercial Vehicles).

- By Solution/Application:

- Fleet Management: Encompasses asset tracking, driver management, fuel management, compliance management, and operations management.

- Navigation & Location-based Services: Real-time mapping, traffic updates, and point-of-interest information.

- Infotainment: In-car entertainment and information systems.

- Safety & Security: Emergency call (eCall), stolen vehicle recovery, and crash notification services.

- Insurance Telematics (Usage-Based Insurance - UBI): Premiums based on driving behavior and mileage.

- Vehicle Diagnostics: Remote monitoring of vehicle health and performance.

- Remote Monitoring: Tracking vehicle status, location, and condition from a distance.

- Predictive Maintenance: Using data to forecast and schedule vehicle servicing.

- By End-Use Industry:

- Automotive (OEMs, Aftermarket)

- Transportation & Logistics

- Insurance

- Healthcare (Emergency services, patient transport)

- Construction (Equipment tracking, fleet management)

- Government & Utilities (Public transport, emergency services, infrastructure maintenance)

- Agriculture (Precision farming, equipment tracking)

Regional Highlights

The global Telematic market exhibits diverse growth patterns across different regions, influenced by varying levels of technological adoption, regulatory frameworks, economic development, and consumer preferences. Each region presents unique opportunities and challenges for telematics providers, necessitating tailored strategies for market penetration and expansion. Understanding these regional dynamics is critical for a comprehensive market assessment.

- North America: This region is a leading market for telematics, characterized by early adoption of connected car technologies, significant investment in fleet management solutions, and a strong presence of key automotive and technology players. Stringent safety regulations and high consumer awareness regarding advanced in-car features drive consistent growth. The U.S. and Canada are at the forefront, particularly in usage-based insurance and advanced navigation systems.

- Europe: Europe holds a substantial market share, largely propelled by mandatory regulations such as the eCall system for all new cars and the increasing focus on reducing road fatalities and emissions. Germany, the UK, France, and Italy are key contributors, with robust adoption in fleet management, insurance telematics, and intelligent transport systems. Strong privacy regulations also shape the development of telematics solutions here.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, driven by rapid urbanization, increasing vehicle sales, improving road infrastructure, and supportive government initiatives for smart cities and logistics. Countries like China, India, Japan, and South Korea are witnessing surging demand for embedded telematics, fleet management, and infotainment solutions. The expanding automotive manufacturing base and growing disposable incomes further fuel market growth in this region.

- Latin America: This region is an emerging market for telematics, with increasing adoption primarily in commercial fleet management for security, logistics optimization, and asset tracking. Brazil and Mexico are leading the charge, driven by the need to combat vehicle theft and enhance supply chain efficiency. Economic development and improving internet infrastructure are key factors facilitating market expansion.

- Middle East and Africa (MEA): The MEA region is experiencing gradual growth in the telematics market, mainly influenced by infrastructure development projects, rising investment in smart city initiatives, and the demand for efficient fleet operations in the oil & gas and logistics sectors. The UAE, Saudi Arabia, and South Africa are notable markets, focusing on security, tracking, and basic fleet management solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Telematic Market.- Telematics Innovators Corp.

- Global Fleet Solutions Ltd.

- Connected Mobility Technologies

- Automotive Intelligence Group

- NextGen Telematics Systems

- Smart Vehicle Data Inc.

- Digital Transport Solutions

- Advanced Telematics Platform

- Secure Drive Technologies

- Integrated Tracking Solutions

- Pioneer Telematics Services

- Vanguard Connectivity

- Mobile Data Insights

- Future Automotive Systems

- Enterprise Telematics Solutions

- DataStream Mobility

- Intelligent Vehicle Networks

- Optimal Route Systems

- Fleet Optimization Partners

- Strategic Telematics Group

Frequently Asked Questions

What is telematics and how does it work?

Telematics is a multidisciplinary field encompassing telecommunications, vehicular technologies, road safety, and information technology. It involves sending, receiving, and storing information via telecommunication devices in conjunction with vehicular assets. Typically, a telematics device installed in a vehicle collects data such as GPS location, speed, engine diagnostics, and driving behavior, which is then transmitted wirelessly to a central system for analysis and reporting. This data helps in fleet management, navigation, safety, and insurance applications.

What are the primary applications of telematics?

The primary applications of telematics include fleet management for optimizing logistics and operations, usage-based insurance (UBI) for personalized premiums, vehicle tracking and navigation, enhancing vehicle safety and security features like eCall and stolen vehicle recovery, remote diagnostics for predictive maintenance, and in-car infotainment systems. Telematics also plays a crucial role in smart city initiatives and the development of autonomous driving technologies.

How is AI impacting the telematics market?

AI significantly impacts telematics by enabling advanced data analysis, predictive modeling, and automation. It allows for more precise insights into driver behavior, proactive vehicle maintenance, optimized route planning, and enhanced fraud detection in insurance. AI is also critical for the development of sophisticated autonomous driving systems and personalized in-car experiences, transforming raw telematics data into actionable intelligence.

What are the main drivers of growth in the telematics market?

Key growth drivers for the telematics market include the increasing adoption of connected vehicles, the rising demand for efficient fleet management solutions to reduce operational costs, stringent government regulations mandating vehicle safety and tracking features, the expansion of usage-based insurance models, and rapid advancements in IoT and 5G network infrastructure that enhance connectivity and data capabilities.

What are the major challenges faced by the telematics industry?

The telematics industry faces significant challenges such as ensuring robust data security and privacy for sensitive vehicular and personal information, managing the immense volume of data generated, addressing interoperability issues and the lack of standardization across different systems, overcoming high initial investment costs for implementation, and navigating complex and varied regulatory landscapes across different geographical regions.