Styrene Monomer Market

Styrene Monomer Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_701339 | Last Updated : July 29, 2025 |

Format : ![]()

![]()

![]()

![]()

Styrene Monomer Market Size

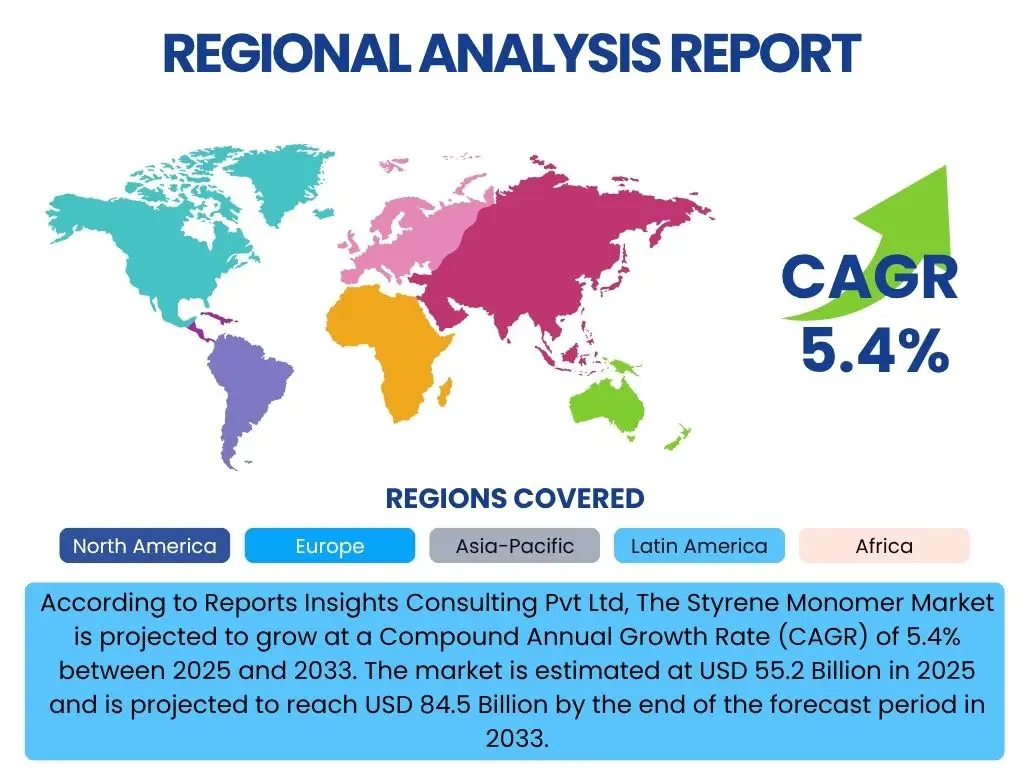

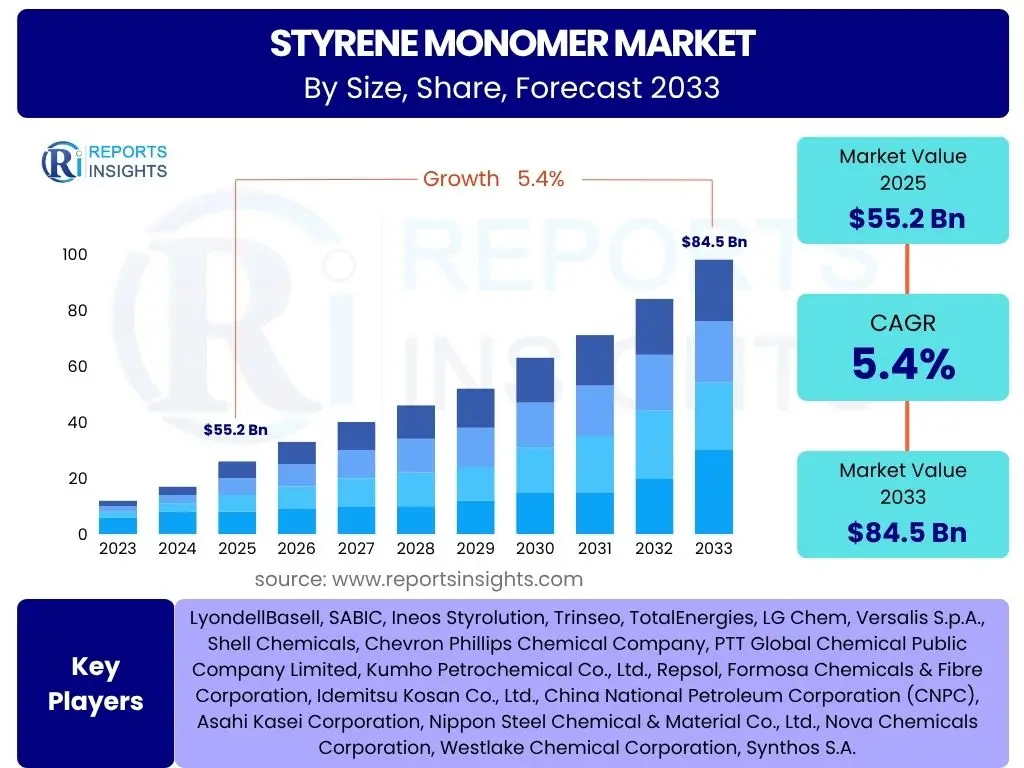

According to Reports Insights Consulting Pvt Ltd, The Styrene Monomer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.4% between 2025 and 2033. The market is estimated at USD 55.2 Billion in 2025 and is projected to reach USD 84.5 Billion by the end of the forecast period in 2033.

The consistent growth in the styrene monomer market is primarily attributed to its indispensable role as a fundamental building block in the production of a wide array of polymers. These derivatives, including polystyrene, acrylonitrile butadiene styrene (ABS), styrene-butadiene rubber (SBR), and unsaturated polyester resins (UPR), find extensive applications across diverse end-use industries such as packaging, automotive, construction, and electronics. The increasing global demand for these end-products, particularly from rapidly industrializing economies, acts as a significant propellant for market expansion.

Furthermore, advancements in manufacturing processes, coupled with growing investments in infrastructure development, contribute to the sustained demand for styrene monomer. While the market navigates challenges such as feedstock price volatility and environmental regulations, the ongoing innovation in material science to develop more sustainable and high-performance styrene-based products is expected to underpin its long-term growth trajectory. This ensures its continued relevance in modern industrial applications, supporting the projected market valuation.

Key Styrene Monomer Market Trends & Insights

The Styrene Monomer market is undergoing significant transformations, driven by evolving industry demands and a heightened focus on sustainability, which are central themes in market discussions. Key trends include the increasing adoption of bio-based styrene production methods and advancements in the recycling of styrene-based polymers, particularly polystyrene, aimed at establishing a circular economy. Furthermore, the market is witnessing shifts in regional production capacities, with a growing emphasis on optimizing supply chains and ensuring feedstock security amidst global geopolitical dynamics. The continuous innovation in derivative applications, such as lightweight automotive components and enhanced insulation materials, also shapes the demand landscape.

There is a notable trend towards developing high-performance styrene-based materials that offer improved properties like strength, heat resistance, and processability, meeting the stringent requirements of specialized applications in sectors like electric vehicles and advanced electronics. Moreover, increasing regulatory scrutiny on petrochemical emissions and plastic waste is compelling manufacturers to invest in cleaner production technologies and sustainable product designs. This dual focus on performance enhancement and environmental responsibility defines the current trajectory of the styrene monomer market.

- Growing focus on sustainable and bio-based styrene monomer production.

- Advancements in chemical and mechanical recycling technologies for polystyrene.

- Increasing demand for styrene-based polymers in lightweight automotive components.

- Expansion of production capacities in Asia Pacific driven by industrial growth.

- Shift towards high-performance specialty styrene derivatives.

- Emphasis on circular economy principles within the plastics industry.

- Supply chain diversification and regionalization efforts.

AI Impact Analysis on Styrene Monomer

The integration of Artificial intelligence (AI) within the Styrene Monomer industry presents transformative opportunities for enhancing operational efficiency, optimizing production processes, and improving supply chain resilience. Stakeholders are keen to understand how AI can lead to more predictable outcomes in a volatile market. Common concerns and expectations revolve around AI's capacity to minimize production costs, reduce energy consumption, and ensure consistent product quality. The technology's ability to analyze vast datasets from sensors and operational systems is poised to revolutionize process control and predictive maintenance, thereby reducing downtime and increasing overall plant productivity.

Furthermore, AI is anticipated to play a crucial role in managing the complex logistics of styrene monomer supply, from raw material procurement to product distribution. It can optimize inventory levels, forecast demand more accurately, and even predict potential disruptions, allowing for proactive adjustments. Beyond operational aspects, there is an expectation that AI will accelerate research and development efforts, enabling the discovery of new catalysts or more sustainable production pathways for styrene monomer. While the potential for job displacement due to automation is a consideration, the overarching sentiment is one of cautious optimism regarding AI's potential to drive innovation and competitive advantage in the chemical sector.

- Process Optimization: AI algorithms enhance reaction conditions, leading to improved yields and reduced energy consumption.

- Predictive Maintenance: AI analyzes equipment data to predict failures, minimizing unplanned downtime and maintenance costs.

- Supply Chain Management: AI optimizes logistics, inventory, and demand forecasting, improving efficiency and resilience.

- Quality Control: AI-powered vision systems and data analysis ensure consistent product quality by detecting anomalies.

- Research and Development: AI accelerates material discovery and process innovation for sustainable styrene production.

- Safety Enhancement: AI monitors operational parameters to identify potential safety hazards and prevent incidents.

- Energy Management: AI optimizes energy usage across production facilities, contributing to sustainability goals.

Key Takeaways Styrene Monomer Market Size & Forecast

The Styrene Monomer market is poised for robust expansion over the forecast period, driven primarily by the sustained demand from its diverse downstream applications. A critical takeaway is the increasing importance of the Asia Pacific region, particularly emerging economies, which are expected to be the primary growth engines due to rapid industrialization, urbanization, and expanding manufacturing sectors. The market's growth trajectory is intricately linked to the overall health of industries like packaging, construction, and automotive, indicating a broad-based demand rather than reliance on a single sector.

Another significant insight is the growing imperative for sustainability, which is increasingly influencing production methods and product development within the styrene monomer ecosystem. Efforts towards bio-based alternatives and enhanced recycling capabilities for polystyrene are not merely regulatory responses but emerging competitive advantages. While feedstock volatility and environmental regulations present ongoing challenges, the market demonstrates resilience through technological innovation and a strategic focus on efficiency and circularity. The forecast highlights a stable, albeit evolving, market landscape where innovation and sustainable practices will be key differentiators for future success.

- Consistent growth projected at a CAGR of 5.4%, reaching USD 84.5 Billion by 2033.

- Asia Pacific region will remain the dominant growth hub due to strong industrial and consumer demand.

- Polystyrene, ABS, and SBR applications will continue to drive the majority of demand.

- Sustainability initiatives, including bio-based production and recycling, are critical for long-term viability.

- Market resilience despite feedstock price volatility and environmental regulations.

- Technological advancements in production efficiency and product performance will be key.

Styrene Monomer Market Drivers Analysis

The Styrene Monomer market is propelled by a confluence of factors, prominently including the escalating demand from the packaging industry, where polystyrene and expandable polystyrene (EPS) are extensively used for food packaging, protective packaging, and disposable consumer goods. This demand is further amplified by global urbanization trends and the growth of e-commerce, necessitating efficient and safe packaging solutions. Additionally, the automotive sector's increasing production, particularly the growing adoption of ABS and SBR for lightweight components and tires, acts as a significant driver, contributing to fuel efficiency and vehicle performance.

Furthermore, the robust expansion of the construction sector globally fuels the demand for styrene monomer derivatives such as EPS for insulation and building materials, owing to their excellent thermal properties and cost-effectiveness. The rising disposable incomes in emerging economies also contribute to the increased consumption of consumer goods and appliances, which extensively utilize styrene-based plastics. These factors collectively create a strong foundation for sustained market growth, with continuous innovation in end-use applications further expanding the market's reach.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growing demand from packaging industry | +0.6% | Global, particularly Asia Pacific, North America | Medium-to-Long Term (2025-2033) |

| Increasing automotive production and lightweighting trends | +0.5% | Asia Pacific, Europe, North America | Medium-to-Long Term (2025-2033) |

| Expansion of the construction sector and insulation needs | +0.4% | Asia Pacific, Middle East & Africa | Medium-to-Long Term (2025-2033) |

| Rising disposable incomes and consumer goods consumption | +0.3% | Emerging Economies (China, India, Southeast Asia) | Medium-to-Long Term (2025-2033) |

Styrene Monomer Market Restraints Analysis

Despite its growth potential, the Styrene Monomer market faces notable restraints, primarily centered around the volatility of raw material prices. Benzene and ethylene, key feedstocks for styrene monomer production, are petrochemical derivatives whose prices are directly influenced by crude oil fluctuations. This volatility introduces significant cost uncertainties for manufacturers, impacting profit margins and investment decisions. Furthermore, stringent environmental regulations globally, particularly concerning volatile organic compound (VOC) emissions during production and the management of plastic waste, pose considerable challenges. These regulations often necessitate costly upgrades to production facilities and investments in cleaner technologies, which can hinder market expansion.

The increasing public and regulatory scrutiny on single-use plastics and the broader issue of plastic pollution also present a significant restraint. This has led to calls for bans or restrictions on polystyrene products in various regions, prompting industries to explore alternative materials. While efforts towards recycling and bio-based styrene are underway, the current infrastructure and economic viability of these solutions are still developing, creating a bottleneck for sustainable growth. The availability of substitute materials for styrene-based polymers in certain applications further limits market expansion, compelling manufacturers to innovate and adapt.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Volatile raw material (benzene, ethylene) prices | -0.4% | Global | Short-to-Medium Term (2025-2029) |

| Stringent environmental regulations and emissions control | -0.3% | Europe, North America, parts of Asia Pacific | Medium-to-Long Term (2025-2033) |

| Growing concerns over plastic waste and single-use plastic bans | -0.2% | Global, particularly Europe, Asia Pacific | Medium-to-Long Term (2025-2033) |

| Availability of alternative materials in certain applications | -0.1% | Global | Medium-to-Long Term (2025-2033) |

Styrene Monomer Market Opportunities Analysis

Significant opportunities in the Styrene Monomer market are emerging from advancements in sustainability and the demand for specialized applications. The development of bio-based styrene monomer, derived from renewable resources such as biomass, offers a promising avenue for reducing the industry's carbon footprint and dependence on fossil fuels. This innovation is attracting increasing investment and research, aligning with global environmental goals and consumer preferences for sustainable products. Concurrently, the proliferation of advanced recycling technologies, including chemical recycling methods like depolymerization, presents a substantial opportunity to close the loop for polystyrene and other styrene-based plastics, transforming waste into valuable resources and addressing plastic pollution concerns.

Furthermore, the growing demand for high-performance plastics in emerging sectors, such as electric vehicles (EVs), renewable energy infrastructure, and advanced electronics, opens new market niches for styrene derivatives. These applications often require materials with superior strength-to-weight ratios, electrical insulation properties, and chemical resistance. Strategic investments in new production capacities in high-growth regions, particularly in Southeast Asia and parts of the Middle East, can also capitalize on expanding industrial bases and consumer markets. These opportunities collectively signify a pivot towards a more sustainable, innovative, and diversified future for the styrene monomer industry.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Development of bio-based styrene monomer production | +0.7% | Global, particularly Europe, North America, Japan | Long Term (2028-2033) |

| Advancements in chemical recycling technologies for polystyrene | +0.6% | Global, particularly Europe, North America, Asia Pacific | Medium-to-Long Term (2026-2033) |

| Growing demand for high-performance plastics in new applications (e.g., EVs) | +0.5% | Global | Medium-to-Long Term (2025-2033) |

| Investment in new production capacities in strategic growth regions | +0.4% | Asia Pacific, Middle East & Africa | Medium Term (2025-2029) |

Styrene Monomer Market Challenges Impact Analysis

The Styrene Monomer market faces several significant challenges that require strategic responses from industry players. A primary challenge is achieving true circularity for polystyrene and other styrene-based plastics, moving beyond traditional recycling methods to more advanced, economically viable solutions. This involves overcoming technical hurdles in chemical recycling and developing robust collection and sorting infrastructures. Another critical challenge is managing the carbon footprint associated with styrene monomer production, as the industry is energy-intensive and heavily reliant on fossil fuels. Companies are under increasing pressure to adopt more sustainable energy sources and reduce greenhouse gas emissions, which often entail substantial capital investments.

Furthermore, the styrene monomer supply chain is susceptible to disruptions, as evidenced by recent global events such as pandemics, geopolitical conflicts, and extreme weather conditions. These disruptions can lead to raw material shortages, logistics bottlenecks, and price spikes, impacting production schedules and profitability. The market also experiences intense competition, particularly in regions with overcapacity, leading to price erosion and reduced profit margins. Navigating these multifaceted challenges requires continuous innovation, collaborative efforts across the value chain, and adaptability to evolving regulatory landscapes and market dynamics to ensure long-term stability and growth.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Achieving economic viability and scale for polystyrene circularity | -0.5% | Global | Long Term (2028-2033) |

| Managing and reducing the carbon footprint of production processes | -0.4% | Europe, North America, Japan | Medium-to-Long Term (2025-2033) |

| Supply chain disruptions and geopolitical instabilities | -0.3% | Global | Short-to-Medium Term (2025-2029) |

| Intense competition and potential overcapacity in certain regions | -0.2% | Asia Pacific | Medium Term (2025-2029) |

Styrene Monomer Market - Updated Report Scope

This comprehensive market research report provides an in-depth analysis of the global Styrene Monomer market, covering historical data, current market dynamics, and future projections. The report offers a detailed examination of market size, growth drivers, restraints, opportunities, and challenges affecting the industry. It segments the market extensively by application, end-use industry, and region, providing granular insights into key trends and competitive landscapes. The updated scope includes an AI impact analysis, reflecting the growing influence of artificial intelligence on chemical manufacturing processes and supply chain optimization, alongside detailed competitive profiling of leading market participants. This report aims to equip stakeholders with actionable intelligence for strategic decision-making in the evolving styrene monomer sector.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 55.2 Billion |

| Market Forecast in 2033 | USD 84.5 Billion |

| Growth Rate | 5.4% |

| Number of Pages | 267 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | LyondellBasell, SABIC, Ineos Styrolution, Trinseo, TotalEnergies, LG Chem, Versalis S.p.A., Shell Chemicals, Chevron Phillips Chemical Company, PTT Global Chemical Public Company Limited, Kumho Petrochemical Co., Ltd., Repsol, Formosa Chemicals & Fibre Corporation, Idemitsu Kosan Co., Ltd., China National Petroleum Corporation (CNPC), Asahi Kasei Corporation, Nippon Steel Chemical & Material Co., Ltd., Nova Chemicals Corporation, Westlake Chemical Corporation, Synthos S.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Styrene Monomer market is extensively segmented to provide a detailed understanding of its diverse applications and end-use sectors, reflecting its fundamental role across various industries. The primary segmentation is by application, where polystyrene (PS) remains the largest consumer, utilized across packaging, consumer goods, and insulation. Acrylonitrile Butadiene Styrene (ABS) is another significant segment, highly valued for its strength and impact resistance in automotive parts, electronic casings, and consumer appliances. Styrene-butadiene rubber (SBR) holds a crucial share, predominantly used in tire manufacturing and other rubber products, while unsaturated polyester resins (UPR) are vital for fiberglass composites in construction, marine, and automotive industries. Expandable polystyrene (EPS) is specifically utilized for insulation, protective packaging, and geofoam in construction.

Further segmentation by end-use industry clarifies the demand drivers. The packaging sector stands out as the dominant end-use, driven by global consumption patterns and the proliferation of e-commerce. The automotive industry is a critical growth area, with styrene-based materials contributing to lightweighting initiatives and enhanced performance. The construction sector's demand stems from the need for insulation, pipes, and other building materials. Electronics and consumer goods industries also represent substantial markets, relying on styrene polymers for components, casings, and various everyday products. This comprehensive segmentation allows for precise market analysis and strategic planning tailored to specific industry needs.

- By Application:

- Polystyrene (PS): Dominant application, used in packaging, consumer goods, and insulation.

- Acrylonitrile Butadiene Styrene (ABS): Key for automotive, electronics, and appliance casings due to high impact resistance.

- Styrene-Butadiene Rubber (SBR): Primarily used in tire manufacturing and other rubber applications.

- Unsaturated Polyester Resins (UPR): Essential for composites in construction, marine, and wind energy.

- Expandable Polystyrene (EPS): Crucial for insulation, protective packaging, and construction materials.

- Styrene-Acrylonitrile (SAN): Employed in household appliances, automotive parts, and packaging films.

- Others: Includes styrene copolymers and specialty applications.

- By End-use Industry:

- Packaging: Largest segment, driven by food packaging, protective packaging, and disposable items.

- Automotive: Growing demand for lightweight components and interior parts.

- Construction: Used for insulation, pipes, flooring, and other building materials.

- Electronics: Applications in electrical components, casings, and consumer electronics.

- Consumer Goods: Broad usage in toys, appliances, and household items.

- Marine: For boat hulls and other composite structures.

- Healthcare: Specific medical device components and packaging.

- Others: Including paints, coatings, and adhesives.

Regional Highlights

- Asia Pacific: This region is the largest and fastest-growing market for styrene monomer, driven by rapid industrialization, urbanization, and a booming manufacturing sector, particularly in China and India. The robust growth in end-use industries such as packaging, automotive, and construction, coupled with significant investments in new production capacities, positions APAC as the primary engine for global market expansion.

- North America: A mature market characterized by stable demand from established industries and a focus on specialty applications and sustainable production. The region benefits from technological advancements in recycling and bio-based materials, alongside consistent demand from the automotive and construction sectors.

- Europe: The European market is highly influenced by stringent environmental regulations and a strong emphasis on sustainability and circular economy initiatives. While growth rates may be modest compared to APAC, the region leads in developing advanced recycling technologies and bio-based styrene, driving innovation and demand for high-performance materials.

- Latin America: This region presents emerging opportunities, with growing demand from the packaging and construction industries, particularly in Brazil and Mexico. Economic development and increasing disposable incomes contribute to market expansion, albeit with greater susceptibility to economic fluctuations and political instability.

- Middle East and Africa (MEA): Characterized by significant petrochemical investments, especially in Saudi Arabia and the UAE, which are major producers of feedstock. The region is witnessing growing domestic demand from infrastructure projects and developing manufacturing capabilities, offering long-term growth potential and export opportunities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Styrene Monomer Market.- LyondellBasell

- SABIC

- Ineos Styrolution

- Trinseo

- TotalEnergies

- LG Chem

- Versalis S.p.A.

- Shell Chemicals

- Chevron Phillips Chemical Company

- PTT Global Chemical Public Company Limited

- Kumho Petrochemical Co., Ltd.

- Repsol

- Formosa Chemicals & Fibre Corporation

- Idemitsu Kosan Co., Ltd.

- China National Petroleum Corporation (CNPC)

- Asahi Kasei Corporation

- Nippon Steel Chemical & Material Co., Ltd.

- Nova Chemicals Corporation

- Westlake Chemical Corporation

- Synthos S.A.

Frequently Asked Questions

What is styrene monomer primarily used for?

Styrene monomer is primarily used as a chemical intermediate in the production of various polymers, including polystyrene (PS), acrylonitrile butadiene styrene (ABS), styrene-butadiene rubber (SBR), and unsaturated polyester resins (UPR). These derivatives find extensive applications in packaging, automotive components, construction materials, and consumer goods.

How is styrene monomer produced?

Styrene monomer is predominantly produced through the catalytic dehydrogenation of ethylbenzene, which is itself derived from benzene and ethylene. This process typically occurs at high temperatures over an iron oxide catalyst, converting ethylbenzene into styrene and hydrogen.

What are the key drivers for the styrene monomer market growth?

The key drivers for the styrene monomer market include the increasing demand from the packaging industry, the expanding automotive sector's need for lightweight materials, growth in the construction industry for insulation and building materials, and rising consumer goods consumption, especially in emerging economies.

What are the major environmental concerns associated with styrene monomer?

Major environmental concerns related to styrene monomer include volatile organic compound (VOC) emissions during its production, which contribute to air pollution, and the challenge of managing plastic waste from styrene-based polymers like polystyrene, which often ends up in landfills or the environment.

Which regions are leading in styrene monomer production and consumption?

The Asia Pacific region, particularly China, is the leading producer and consumer of styrene monomer due to its robust manufacturing sector and high demand from downstream industries. North America and Europe are also significant regions, with a growing focus on sustainable production methods and recycling initiatives.