R600a Refrigerant Market

R600a Refrigerant Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_700899 | Last Updated : July 28, 2025 |

Format : ![]()

![]()

![]()

![]()

R600a Refrigerant Market Size

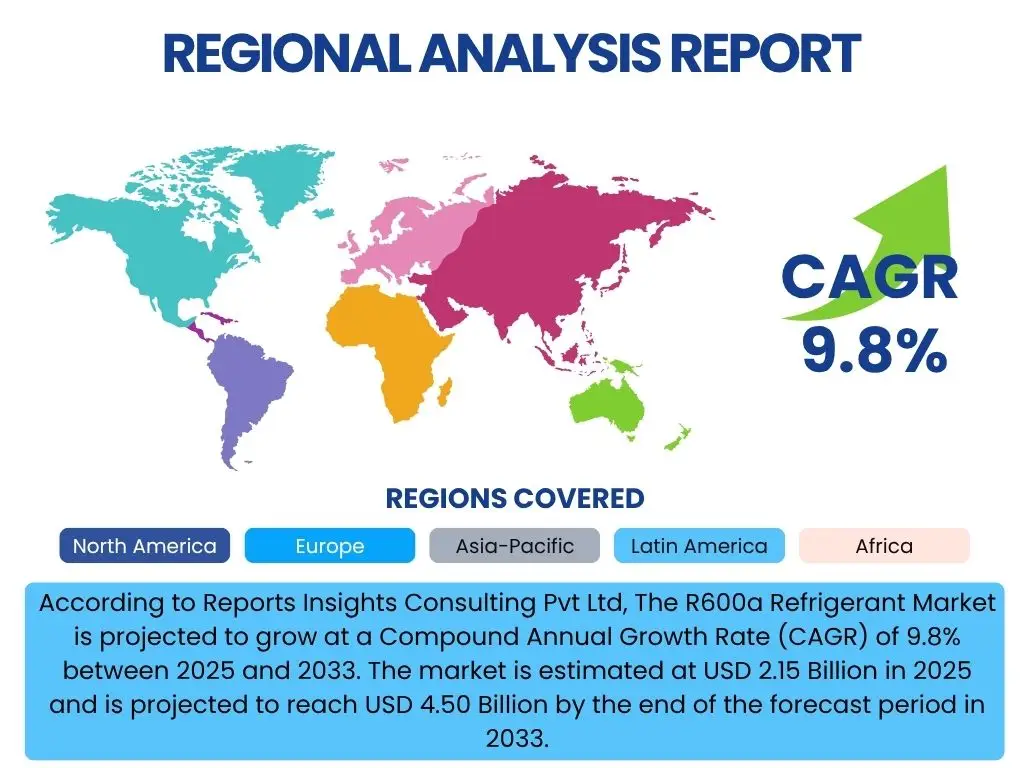

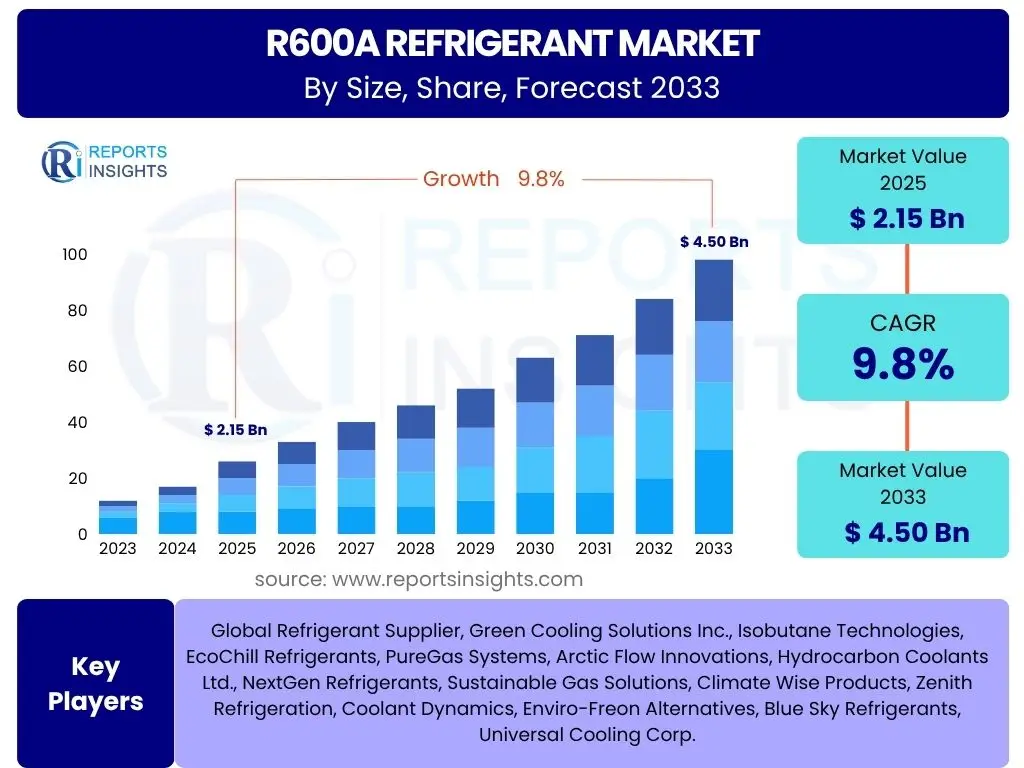

According to Reports Insights Consulting Pvt Ltd, The R600a Refrigerant Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2025 and 2033. The market is estimated at USD 2.15 Billion in 2025 and is projected to reach USD 4.50 Billion by the end of the forecast period in 2033.

Key R600a Refrigerant Market Trends & Insights

User inquiries frequently focus on the primary forces shaping the R600a refrigerant market, seeking to understand shifts in adoption, technological advancements, and regulatory impacts. A significant insight is the escalating global emphasis on environmental sustainability, driving a pronounced shift from synthetic refrigerants to natural alternatives like R600a (isobutane) due to its ultra-low Global Warming Potential (GWP) and zero Ozone Depletion Potential (ODP). This regulatory push, particularly from international agreements and national legislations, is accelerating its integration into various refrigeration and air conditioning applications, especially within the domestic sector.

Another prominent trend observed is the continuous innovation in appliance design and manufacturing processes to safely and efficiently accommodate R600a. Manufacturers are investing in research and development to mitigate the flammability concerns associated with R600a, enhancing safety standards, and improving the energy efficiency of appliances. This includes developing advanced leak detection systems, improving component sealing, and designing smaller charge systems. Furthermore, there is a growing consumer preference for eco-friendly products, which further incentivizes manufacturers to adopt R600a, making it a key selling point in the competitive consumer appliance market.

The expansion of its application scope beyond domestic refrigerators into commercial refrigeration, small chillers, and even automotive air conditioning systems signifies a broadening market base. This diversification is supported by increasing awareness among businesses about the long-term benefits of transitioning to natural refrigerants, including compliance with future regulations and reduced operational costs through improved energy performance. The market is also experiencing a trend of regional growth disparities, with strong adoption in regions like Europe and Asia-Pacific leading the way due to early regulatory interventions and robust manufacturing capabilities.

- Increasing global adoption due to stringent environmental regulations (F-gas, Kigali Amendment).

- Growing consumer preference for eco-friendly and energy-efficient refrigeration solutions.

- Technological advancements in appliance design to enhance safety and efficiency of R600a systems.

- Expansion of R600a applications into commercial refrigeration and small chillers.

- Regional disparities in adoption rates, with Europe and Asia-Pacific as frontrunners.

- Focus on cost-effectiveness and operational efficiency for manufacturers and end-users.

AI Impact Analysis on R600a Refrigerant

Common user questions regarding AI's impact on the R600a refrigerant domain typically revolve around its role in optimizing production, enhancing system efficiency, and improving safety protocols. Users are keen to understand how artificial intelligence can streamline the complex processes involved in refrigerant manufacturing and distribution, given the specific handling requirements of R600a. AI algorithms can be employed to optimize chemical synthesis processes, ensuring higher purity and consistency in R600a production, leading to reduced waste and improved cost-efficiency. Furthermore, predictive analytics driven by AI can forecast demand patterns, aiding in better inventory management and supply chain logistics, which is crucial for a product with specific storage and transport considerations.

Beyond manufacturing, AI significantly impacts the operational efficiency and safety of refrigeration systems utilizing R600a. AI-powered diagnostic systems can monitor refrigerant levels, detect minute leaks early, and predict potential component failures, thereby enabling proactive maintenance and preventing costly system downtimes. This is particularly vital for R600a systems where leak detection is paramount due to its flammability. Machine learning models can analyze vast datasets from refrigeration units, optimizing compressor cycles, fan speeds, and defrost schedules, leading to substantial energy savings and extended equipment lifespan. Such optimization not only reduces operational costs but also enhances the environmental footprint of the refrigeration equipment.

Moreover, AI contributes to safety and training within the R600a ecosystem. Virtual reality (VR) and augmented reality (AR) platforms, often powered by AI, can simulate maintenance and repair scenarios, providing immersive and safe training environments for technicians handling R600a systems. This advanced training helps to mitigate risks associated with flammability and ensures adherence to best practices. In a broader sense, AI can also aid in regulatory compliance by automatically tracking and reporting refrigerant usage and emissions, simplifying adherence to evolving environmental standards. The integration of AI capabilities across the R600a value chain promises enhanced efficiency, safety, and sustainability.

- AI-driven optimization of R600a production processes, enhancing purity and reducing waste.

- Predictive analytics for demand forecasting and supply chain optimization, improving logistics.

- AI-powered systems for real-time monitoring, leak detection, and predictive maintenance in R600a appliances.

- Machine learning algorithms optimizing energy efficiency and performance of refrigeration units.

- AI-enabled VR/AR simulations for technician training, enhancing safety and handling protocols.

- Automated compliance tracking and reporting for refrigerant usage and emissions.

Key Takeaways R600a Refrigerant Market Size & Forecast

Users are keen to extract the most critical insights from the R600a Refrigerant market size and forecast, often seeking concise summaries of future growth potential and the underlying factors. The primary takeaway is the robust and sustained growth trajectory of the R600a market, driven predominantly by global environmental regulations mandating the phase-out of high-GWP refrigerants. This regulatory impetus, combined with a growing awareness of climate change, positions R600a as a key component in the transition towards more sustainable refrigeration solutions. The forecast indicates a significant expansion of market value over the next decade, signaling strong confidence in its long-term viability and increasing adoption across various applications.

Another crucial insight is the dual emphasis on environmental benefits and energy efficiency as core market drivers. R600a's excellent thermodynamic properties contribute to the design of highly energy-efficient refrigeration systems, appealing to both consumers seeking lower electricity bills and manufacturers aiming for eco-friendly product differentiation. While safety concerns related to its flammability remain a consideration, continuous technological advancements in appliance design and stringent safety standards are effectively mitigating these risks, thereby boosting confidence in its widespread application. This dynamic interplay of regulatory push, technological innovation, and market demand underpins the positive forecast.

Furthermore, the market forecast highlights the increasing diversification of R600a applications beyond its traditional stronghold in domestic refrigerators. Opportunities are emerging in commercial refrigeration, small-scale industrial units, and specialized cooling solutions, indicating a broadening utility and market reach. The growth is not uniform across all regions, with Asia-Pacific and Europe demonstrating leading adoption rates due to established manufacturing bases and progressive environmental policies. The market's future will largely be shaped by ongoing regulatory developments, continued investment in safer and more efficient R600a systems, and expansion into new geographical and application segments, ensuring its pivotal role in the future of sustainable cooling.

- The R600a market is projected for substantial growth (nearly doubling by 2033), driven by environmental regulations.

- Its ultra-low GWP and high energy efficiency are primary factors fueling adoption.

- Technological advancements are successfully mitigating flammability concerns, enhancing market acceptance.

- Application scope is expanding beyond domestic refrigeration to commercial and specialized cooling.

- Asia-Pacific and Europe are leading regions in R600a adoption and manufacturing.

- Continued regulatory support and innovation are critical for sustained market expansion.

R600a Refrigerant Market Drivers Analysis

The R600a refrigerant market is propelled by a confluence of powerful drivers, primarily stemming from a global imperative to mitigate climate change and enhance energy efficiency across refrigeration and air conditioning sectors. International environmental agreements, such as the Kigali Amendment to the Montreal Protocol and regional legislations like the European F-Gas Regulation, are systematically phasing down high Global Warming Potential (GWP) hydrofluorocarbons (HFCs). This regulatory pressure creates a compelling mandate for industries to transition to low-GWP alternatives, positioning R600a (isobutane) as a highly favorable natural refrigerant with a GWP of 3, significantly lower than traditional HFCs like R134a.

Beyond regulatory compliance, the inherent energy efficiency of R600a plays a pivotal role in its market expansion. R600a possesses excellent thermodynamic properties, including high latent heat of vaporization and low liquid density, which allows for smaller compressor sizes and reduced refrigerant charge in systems. This translates directly into lower energy consumption for refrigeration units, offering significant operational cost savings for both manufacturers and end-users. As energy costs continue to rise and environmental consciousness grows among consumers, the energy-saving advantage of R600a-based appliances becomes a strong selling point, further accelerating its adoption in domestic and light commercial refrigeration sectors.

The increasing consumer awareness and demand for eco-friendly products also serve as a substantial market driver. Consumers are increasingly seeking appliances that align with sustainability principles, viewing environmental certifications and energy efficiency ratings as key purchasing criteria. Manufacturers are responding by marketing their R600a-enabled products as "green" alternatives, differentiating themselves in a competitive market. Furthermore, the relatively low cost of R600a compared to many synthetic refrigerants, combined with its widespread availability, makes it an economically attractive option for appliance manufacturers, contributing to its growing market share globally, especially in emerging economies.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Stringent Environmental Regulations | +3.5% | Europe, North America, Asia Pacific (China, India) | Short to Medium Term (2025-2030) |

| High Energy Efficiency of R600a | +2.8% | Global, particularly Europe & Asia Pacific | Medium to Long Term (2025-2033) |

| Growing Consumer Demand for Eco-friendly Products | +2.0% | Global, particularly developed economies | Medium Term (2027-2033) |

| Cost-Effectiveness and Availability | +1.5% | Asia Pacific, Latin America, MEA | Short Term (2025-2028) |

| Technological Advancements in Appliances | +1.0% | Global | Medium to Long Term (2025-2033) |

R600a Refrigerant Market Restraints Analysis

Despite its significant advantages, the R600a refrigerant market faces several restraints that could impede its growth trajectory. The most prominent concern is the flammability of isobutane. As a highly flammable hydrocarbon, R600a poses safety risks during manufacturing, transportation, installation, and servicing if not handled properly. This inherent characteristic necessitates stringent safety protocols, specialized equipment, and extensive technician training, which can add to the overall cost and complexity for manufacturers and service providers. While technological advancements have mitigated these risks to a significant extent, the perception of flammability can still act as a barrier to wider adoption, especially in certain commercial or industrial applications where safety regulations are exceptionally rigorous or where large charge sizes might be required.

Another key restraint is the relatively lower volumetric cooling capacity of R600a compared to some synthetic refrigerants like R134a. This means that for a given cooling load, an R600a system might require a larger compressor or a higher refrigerant charge volume, potentially leading to a larger system footprint or design modifications. While this is often manageable in domestic appliances where charge sizes are small, it can present challenges for larger commercial or industrial refrigeration systems that demand higher cooling capacities within limited spaces. The need for larger components can sometimes offset the energy efficiency gains in certain applications, and it requires manufacturers to redesign their product lines, incurring initial investment costs.

Furthermore, the existing infrastructure for synthetic refrigerants and the entrenched expertise within the HVAC&R industry present a inertia that R600a adoption must overcome. A significant portion of the global installed base of refrigeration and air conditioning equipment still relies on HFCs, and a complete transition requires not only new equipment but also a retraining of a vast workforce of technicians and installers. The upfront investment in new tools, safety equipment, and comprehensive training programs for handling flammable refrigerants can be substantial for service companies. This resistance to change, coupled with the availability of other natural refrigerant alternatives like CO2 and ammonia for specific large-scale applications, contributes to a diversified natural refrigerant landscape, potentially fragmenting the market and limiting R600a's dominance in all sectors.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Flammability Concerns and Safety Regulations | -2.5% | Global, particularly North America & certain commercial sectors | Medium to Long Term (2025-2033) |

| Lower Volumetric Cooling Capacity | -1.8% | Global, especially in larger commercial/industrial applications | Medium Term (2027-2033) |

| Need for Specialized Handling & Training | -1.2% | Global, particularly developing regions | Short to Medium Term (2025-2030) |

| Competition from other Natural Refrigerants | -0.8% | Global (CO2, Ammonia for specific applications) | Medium to Long Term (2025-2033) |

| Infrastructure and Conversion Costs | -0.5% | Global | Short Term (2025-2028) |

R600a Refrigerant Market Opportunities Analysis

The R600a refrigerant market is poised for significant opportunities, primarily driven by the ongoing global transition towards sustainable cooling solutions. The most prominent opportunity lies in the expanding scope of its application beyond traditional domestic refrigeration. As manufacturers gain confidence in handling R600a and safety technologies improve, there is a substantial opening for its increased adoption in light commercial refrigeration units, such as display cases, vending machines, and small chillers. This diversification allows R600a to capture a larger share of the overall refrigeration market, moving beyond its established niche and serving a broader range of business needs.

Another crucial opportunity arises from the robust growth in emerging economies, particularly in Asia Pacific, Latin America, and Africa. Rapid urbanization, increasing disposable incomes, and expanding populations in these regions are fueling a surge in demand for new refrigeration appliances, both domestic and commercial. These markets often present an opportunity to leapfrog older, HFC-based technologies directly to more environmentally friendly and energy-efficient R600a solutions, without the burden of extensive legacy infrastructure conversion. Governments in these regions are also increasingly implementing environmental policies, aligning with global efforts and further stimulating the demand for natural refrigerants like R600a.

Furthermore, continuous innovation in refrigeration technology presents a fertile ground for R600a. Advances in compressor design, heat exchanger efficiency, and system integration are making R600a systems even more compact, safer, and energy-efficient. The development of advanced safety features, such as enhanced leak detection and mitigation systems, coupled with improved manufacturing processes, helps address the flammability concerns and broadens the acceptance of R600a. There is also an opportunity for market players to invest in comprehensive training and certification programs for technicians, which not only addresses a key restraint but also establishes expertise and trust in handling R600a, paving the way for wider acceptance and market penetration.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Expansion into Light Commercial Refrigeration | +2.0% | Global, particularly Asia Pacific & Europe | Medium to Long Term (2025-2033) |

| Growth in Emerging Economies | +1.5% | Asia Pacific (India, Southeast Asia), Latin America, MEA | Short to Medium Term (2025-2030) |

| Technological Advancements & Safety Innovations | +1.2% | Global | Medium to Long Term (2027-2033) |

| Government Incentives for Green Technologies | +1.0% | Europe, North America, select Asian countries | Short to Medium Term (2025-2030) |

| Retrofit and Replacement Market | +0.8% | Developed countries with existing HFC systems | Long Term (2028-2033) |

R600a Refrigerant Market Challenges Impact Analysis

The R600a refrigerant market, while promising, faces several challenges that require strategic navigation. A primary challenge is managing the persistent public and industry perception of R600a's flammability. Despite advancements in safety and design, the inherent flammability of isobutane can generate apprehension among end-users, retailers, and even some technicians, potentially slowing down its adoption rate in new applications. Overcoming this perception requires extensive public education campaigns, robust safety certifications, and demonstrable track records of safe operation, which represents a significant marketing and regulatory hurdle for market players.

Another significant challenge involves the variability in regulatory frameworks and enforcement across different regions and countries. While global agreements advocate for HFC phase-down, the specific timelines, charge limits, and safety standards for flammable refrigerants like R600a can differ substantially. This patchwork of regulations complicates manufacturing, distribution, and product compliance for global companies, necessitating tailored approaches for different markets. Furthermore, in some developing regions, the lack of well-established safety infrastructure, certified technicians, and robust enforcement mechanisms can hinder the safe and widespread deployment of R600a systems, posing a challenge to market growth.

Moreover, competition from other low-GWP alternatives, including other natural refrigerants like CO2 (R744) and ammonia (R717), as well as certain synthetic low-GWP HFO blends, presents a competitive challenge. While R600a excels in specific applications, particularly domestic and light commercial refrigeration, CO2 is favored for transcritical systems and supermarket refrigeration, and ammonia for large-scale industrial plants. This specialization means R600a must continually differentiate itself based on its unique benefits (energy efficiency, low cost, ultra-low GWP) within its optimal application range. The ongoing research and development into new synthetic options also adds pressure, requiring continuous innovation in R600a system design to maintain its competitive edge.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Public and Industry Perception of Flammability | -1.5% | Global | Long Term (2025-2033) |

| Varying Global Regulatory Frameworks | -1.0% | Global, particularly developing markets | Medium to Long Term (2027-2033) |

| Competition from Alternative Refrigerants | -0.7% | Global | Medium Term (2025-2030) |

| High Initial Investment for Manufacturers | -0.5% | Global | Short Term (2025-2028) |

| Skilled Workforce and Training Deficit | -0.3% | Developing regions | Short to Medium Term (2025-2030) |

R600a Refrigerant Market - Updated Report Scope

This updated report provides a comprehensive analysis of the R600a Refrigerant Market, examining its historical performance, current dynamics, and future projections from 2025 to 2033. It offers deep insights into market size, growth drivers, restraints, opportunities, and challenges, alongside detailed segmentation across various applications and purity grades. The report also highlights regional market trends and profiles key industry players, offering a holistic view for strategic decision-making and market intelligence.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 2.15 Billion |

| Market Forecast in 2033 | USD 4.50 Billion |

| Growth Rate | 9.8% |

| Number of Pages | 245 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Global Refrigerant Supplier, Green Cooling Solutions Inc., Isobutane Technologies, EcoChill Refrigerants, PureGas Systems, Arctic Flow Innovations, Hydrocarbon Coolants Ltd., NextGen Refrigerants, Sustainable Gas Solutions, Climate Wise Products, Zenith Refrigeration, Coolant Dynamics, Enviro-Freon Alternatives, Blue Sky Refrigerants, Universal Cooling Corp. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The R600a refrigerant market is meticulously segmented to provide a granular understanding of its diverse applications and quality variations. This segmentation allows for a detailed analysis of market dynamics within specific sectors, identifying key growth areas and niche opportunities. The primary segmentation is by application, reflecting the varied end-uses of R600a across different cooling demands, from household appliances to specialized industrial systems. Each application segment presents unique regulatory landscapes, technological requirements, and market penetration levels, influencing the adoption rate of R600a.

Further segmentation by purity grade is crucial as the performance and safety of R600a in refrigeration systems are directly tied to its purity levels. Higher purity grades are often required for sensitive or high-performance applications to prevent system contamination and ensure optimal thermodynamic efficiency. Understanding the demand for different purity levels helps manufacturers align their production with market needs and provides insights into the technological sophistication required for various applications. This layered segmentation provides a comprehensive framework for assessing the current market structure and projecting future shifts based on evolving industry standards and consumer preferences.

- By Application

- Domestic Refrigeration: Encompasses household refrigerators, freezers, and wine coolers, representing the largest and most mature segment for R600a due to its widespread adoption and small charge sizes.

- Commercial Refrigeration: Includes supermarket display cases, professional kitchens, beverage coolers, and vending machines. This segment is rapidly growing as businesses seek energy-efficient and environmentally compliant solutions.

- Industrial Refrigeration: Covers larger-scale cooling needs in manufacturing plants, cold storage warehouses, and processing facilities, where R600a might be used in specialized or smaller-scale systems.

- Chillers: Pertains to liquid chillers used for comfort cooling or process cooling in commercial and industrial settings.

- Automotive HVAC: Explores the potential for R600a in vehicle air conditioning systems, an emerging but nascent application given flammability concerns and existing alternatives.

- Others: Includes niche applications like portable cooling devices, medical refrigeration, and specialized scientific equipment.

- By Purity Grade

- >99.5% Purity: Standard industrial grade, suitable for most domestic and light commercial applications.

- >99.9% Purity: High-grade R600a, often required for more sensitive systems or those demanding peak performance and longevity.

- Others: Includes specific blends or lower purity grades for non-refrigeration applications or where specific properties are desired.

Regional Highlights

- Europe: A pioneering region in R600a adoption, driven by stringent F-Gas regulations and early phase-down initiatives for HFCs. Countries like Germany, France, and the UK have high penetration of R600a in domestic refrigeration. The region continues to lead in research and development for R600a application in light commercial and heat pump systems.

- Asia Pacific (APAC): The largest and fastest-growing market, primarily due to robust manufacturing capabilities in China, India, and South Korea, coupled with rapidly expanding domestic and commercial refrigeration markets. Increasing environmental awareness and government initiatives to reduce carbon emissions are accelerating R600a adoption across the region.

- North America: Showing increasing adoption, particularly in the United States, as regulations like the AIM Act promote the transition to low-GWP refrigerants. While historical preference for synthetic refrigerants exists, the market is steadily shifting towards R600a in domestic appliances and some commercial equipment.

- Latin America: Experiencing gradual growth as environmental regulations become more pervasive and energy efficiency gains are prioritized. Brazil and Mexico are key markets, driven by growing consumer appliance demand and increasing awareness of sustainable technologies.

- Middle East and Africa (MEA): An emerging market for R600a, influenced by growing urbanization, rising temperatures necessitating efficient cooling, and the slow but steady adoption of international environmental standards. Economic diversification and infrastructure development are creating new opportunities for R600a.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the R600a Refrigerant Market.- Global Refrigerant Supplier

- Green Cooling Solutions Inc.

- Isobutane Technologies

- EcoChill Refrigerants

- PureGas Systems

- Arctic Flow Innovations

- Hydrocarbon Coolants Ltd.

- NextGen Refrigerants

- Sustainable Gas Solutions

- Climate Wise Products

- Zenith Refrigeration

- Coolant Dynamics

- Enviro-Freon Alternatives

- Blue Sky Refrigerants

- Universal Cooling Corp.

- Cooling Innovation Labs

- Frontier Refrigerants

- Purity Gas Solutions

- Environmental Cooling Systems

- EcoChill Innovations

Frequently Asked Questions

Analyze common user questions about the R600a Refrigerant market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is R600a Refrigerant?

R600a, or isobutane, is a natural hydrocarbon refrigerant widely used in domestic and light commercial refrigeration. It possesses an ultra-low Global Warming Potential (GWP) of 3 and zero Ozone Depletion Potential (ODP), making it an environmentally friendly alternative to traditional synthetic refrigerants.

Why is R600a gaining popularity in the market?

R600a's growing popularity stems primarily from its superior environmental performance (low GWP, zero ODP) and high energy efficiency. Global regulations mandating the phase-down of high-GWP refrigerants, coupled with increasing consumer demand for eco-friendly appliances, are significant drivers for its adoption.

Is R600a safe to use, given its flammability?

While R600a is flammable, it is considered safe for use in refrigeration systems when handled properly. Modern appliances are designed with stringent safety features, including small charge sizes and enhanced containment, to mitigate risks. Proper training for technicians is essential for safe installation and servicing.

What are the main applications of R600a?

R600a is predominantly used in domestic refrigerators and freezers. Its applications are expanding into light commercial refrigeration, such as display cases and vending machines, and it is also being explored for smaller chillers and specialized cooling equipment.

How do global environmental regulations impact the R600a market?

Global environmental regulations, particularly the Kigali Amendment and regional F-gas regulations, are a major catalyst for the R600a market. These policies mandate the phase-down of high-GWP refrigerants, creating a strong market imperative for manufacturers to adopt low-GWP alternatives like R600a, thereby accelerating its market growth.