Mono Chloro Acetic Acid Market

Mono Chloro Acetic Acid Market Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_707462 | Last Updated : September 08, 2025 |

Format : ![]()

![]()

![]()

![]()

Mono Chloro Acetic Acid Market Size

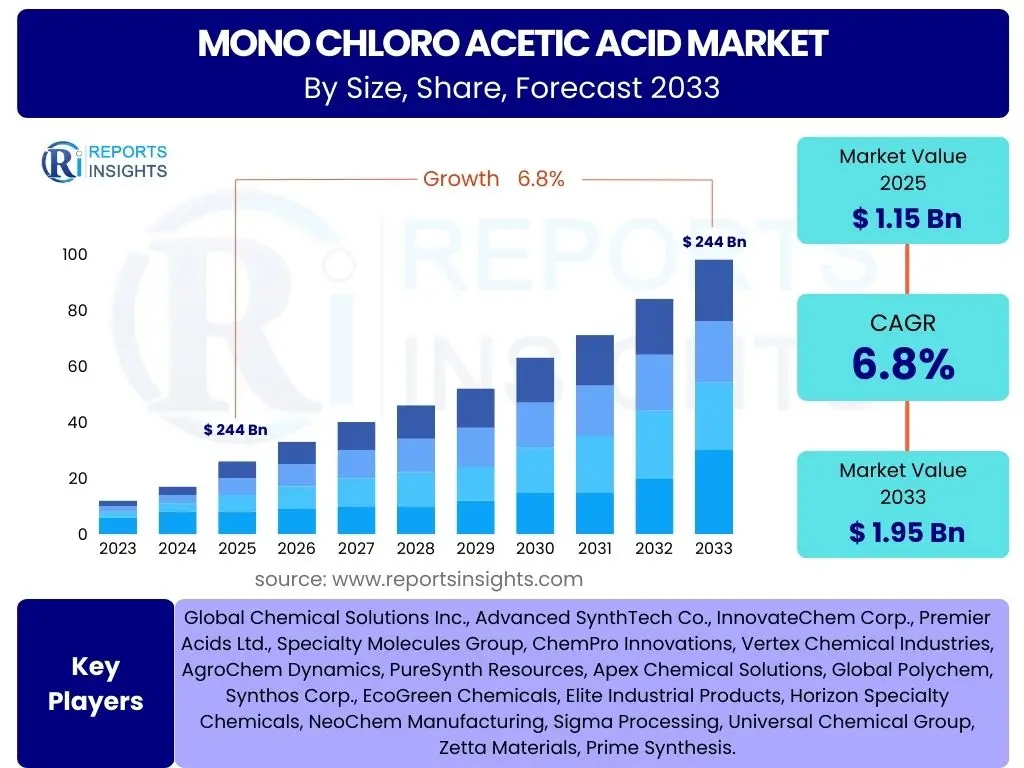

According to Reports Insights Consulting Pvt Ltd, The Mono Chloro Acetic Acid Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2033. The market is estimated at USD 1.15 Billion in 2025 and is projected to reach USD 1.95 Billion by the end of the forecast period in 2033.

Key Mono Chloro Acetic Acid Market Trends & Insights

The Mono Chloro Acetic Acid (MCAA) market is witnessing a dynamic evolution driven by shifting industrial demands and an increasing emphasis on sustainable practices. Key inquiries from stakeholders often revolve around the emerging applications for MCAA, particularly in high-growth sectors, and how environmental regulations are reshaping manufacturing processes and product formulations. There is significant interest in understanding the ongoing research and development efforts aimed at enhancing MCAA production efficiency, reducing its environmental footprint, and exploring novel derivatives.

Furthermore, market participants are keenly observing trends related to supply chain resilience, global trade dynamics, and the impact of geopolitical events on raw material availability and pricing. The drive towards bio-based and green chemistry alternatives also represents a critical trend, influencing investment decisions and strategic partnerships across the value chain. As industries continue to prioritize operational efficiency and product innovation, the adoption of advanced synthesis technologies and process optimization techniques for MCAA production is gaining momentum.

The market is also shaped by a growing focus on product purity and consistency, especially for sensitive applications in pharmaceuticals and specialized chemicals. This necessitates more stringent quality control measures and continuous technological upgrades in manufacturing facilities. The interplay of these factors creates a complex yet opportunity-rich landscape for MCAA manufacturers and consumers alike, pushing the market towards more specialized and high-value applications.

- Growing demand for MCAA in the synthesis of high-performance agrochemicals, particularly herbicides.

- Increased adoption of MCAA derivatives in the pharmaceutical sector for drug synthesis and active pharmaceutical ingredients (APIs).

- Expansion of the cellulose ethers market, including carboxymethyl cellulose (CMC), for various industrial applications.

- Rising focus on sustainable production methods and bio-based raw materials for MCAA.

- Technological advancements in MCAA manufacturing processes aimed at improving yield and reducing waste.

AI Impact Analysis on Mono Chloro Acetic Acid

The integration of Artificial intelligence (AI) within the Mono Chloro Acetic Acid (MCAA) industry is a topic of growing interest, with common user questions focusing on its potential to revolutionize production efficiency, quality control, and supply chain management. Stakeholders are exploring how AI can optimize complex chemical reactions, predict equipment failures through predictive maintenance, and enhance overall operational safety in MCAA manufacturing plants. The ability of AI to process vast amounts of data from sensors and historical production logs is seen as a crucial step towards achieving higher yields and reducing energy consumption.

Moreover, inquiries often touch upon AI's role in market forecasting and demand prediction, which can significantly improve inventory management and strategic planning for MCAA producers. AI-driven analytics can identify subtle patterns in market data, enabling companies to anticipate shifts in demand from end-use industries like agrochemicals or pharmaceuticals. While the benefits are substantial, concerns also exist regarding the initial investment required for AI implementation, the need for specialized data scientists, and the potential impact on workforce dynamics, necessitating comprehensive training programs for existing personnel.

The long-term vision for AI in the MCAA sector extends to accelerating research and development (R&D) of new MCAA derivatives and applications through AI-powered molecular modeling and simulation. This could drastically reduce the time and cost associated with traditional R&D cycles. Furthermore, AI's capacity for real-time monitoring and anomaly detection is poised to bolster environmental compliance and safety protocols, mitigating risks associated with hazardous material handling and waste management, ultimately contributing to more sustainable and resilient production ecosystems.

- Optimization of MCAA synthesis processes through AI-driven predictive analytics, leading to improved yield and reduced energy consumption.

- Enhanced quality control and impurity detection using machine learning algorithms to analyze real-time sensor data from production lines.

- Predictive maintenance for MCAA manufacturing equipment, minimizing downtime and operational costs by forecasting potential failures.

- Improved supply chain efficiency and logistics through AI-powered demand forecasting and inventory optimization.

- Acceleration of R&D for new MCAA applications and greener production methods via AI-driven molecular simulation and data analysis.

Key Takeaways Mono Chloro Acetic Acid Market Size & Forecast

The Mono Chloro Acetic Acid (MCAA) market is poised for significant growth over the forecast period, driven by a confluence of expanding end-use industries and continuous innovation in production processes. Key takeaways from the market size and forecast analysis frequently highlight the robust demand originating from the agrochemical sector, particularly for herbicides, which remains a primary growth engine. Additionally, the increasing utilization of MCAA in the production of cellulose ethers and its critical role in pharmaceutical synthesis are crucial factors contributing to the market's upward trajectory, underscoring its versatile industrial applications.

Furthermore, the market's long-term outlook appears positive, supported by ongoing research into sustainable MCAA production methods and the exploration of new, high-value applications. Stakeholders are keen to understand the primary regions contributing to this growth, with Asia Pacific expected to maintain its dominance due to rapid industrialization and agricultural expansion. The forecast also indicates a shift towards more specialized and higher-purity grades of MCAA, reflecting the evolving requirements of sophisticated end-user industries and a growing emphasis on product quality and safety standards.

Strategic investments in capacity expansion, technological upgrades, and R&D activities are anticipated to be critical for market players to capitalize on emerging opportunities and maintain competitive advantage. The interplay between regulatory frameworks, raw material availability, and technological advancements will continue to shape the market landscape, pushing manufacturers towards more efficient and environmentally conscious operations. Overall, the MCAA market is characterized by steady growth, diverse applications, and an increasing focus on innovation and sustainability.

- The MCAA market exhibits robust growth potential, primarily fueled by the agrochemical and pharmaceutical industries.

- Asia Pacific is projected to remain the dominant and fastest-growing region, driven by industrial expansion and agricultural demand.

- Increasing adoption of cellulose ethers and the emergence of new MCAA derivatives will sustain market expansion.

- Technological advancements and a focus on sustainable production are critical for future market opportunities.

- Volatility in raw material prices and stringent environmental regulations remain key factors influencing market dynamics.

Mono Chloro Acetic Acid Market Drivers Analysis

The Mono Chloro Acetic Acid (MCAA) market is propelled by several robust drivers stemming from its versatile applications across diverse industries. Significant growth in the agrochemical sector, particularly the rising demand for herbicides, remains a primary impetus, as MCAA is a crucial intermediate in their production. Concurrently, the expanding cellulose ethers market, driven by applications in construction, food & beverage, and personal care, further fuels the demand for MCAA. The pharmaceutical industry's continuous growth and its reliance on MCAA for synthesizing various active pharmaceutical ingredients (APIs) also serve as a substantial market driver.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Demand for Herbicides in Agriculture | +1.2% | Asia Pacific, Latin America | Mid-term to Long-term |

| Growing Applications in Cellulose Ethers Production | +0.9% | Asia Pacific, North America, Europe | Mid-term |

| Expansion of Pharmaceutical Industry | +0.8% | North America, Europe, Asia Pacific | Long-term |

| Rising Demand in Detergents & Surfactants Manufacturing | +0.7% | Asia Pacific, Middle East & Africa | Short-term to Mid-term |

Mono Chloro Acetic Acid Market Restraints Analysis

Despite its broad applications, the Mono Chloro Acetic Acid (MCAA) market faces several notable restraints that can impede its growth trajectory. The volatility of raw material prices, particularly for acetic acid and chlorine, directly impacts production costs and profit margins for manufacturers. Moreover, the stringent environmental regulations governing the production, handling, and disposal of hazardous chemicals like MCAA pose significant challenges, often necessitating costly compliance measures and advanced waste treatment facilities. Health and safety concerns associated with its corrosive and toxic nature also contribute to operational complexities and require rigorous safety protocols.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Volatility in Raw Material Prices (Acetic Acid, Chlorine) | -1.0% | Global | Short-term |

| Stringent Environmental Regulations | -1.2% | Europe, North America, China | Mid-term to Long-term |

| Health and Safety Concerns Associated with Handling | -0.8% | Global | Ongoing |

| Competition from Substitute Products (Limited, but niche areas) | -0.5% | Specific application regions | Long-term |

Mono Chloro Acetic Acid Market Opportunities Analysis

The Mono Chloro Acetic Acid (MCAA) market presents several promising opportunities for growth and innovation. Significant potential lies in the development and adoption of greener, bio-based MCAA production processes, aligning with global sustainability initiatives and reducing reliance on fossil-based feedstocks. Emerging markets in developing economies, particularly in Asia Pacific and Latin America, offer untapped potential due to their expanding agricultural and industrial bases. Furthermore, diversification into novel application areas, such as specialized polymers, advanced materials, and niche chemicals, opens new revenue streams for MCAA manufacturers. Continuous technological advancements aimed at improving production efficiency, reducing energy consumption, and enhancing product purity will also create competitive advantages.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Development of Bio-based MCAA and Sustainable Production | +1.5% | Europe, North America, Asia Pacific | Long-term |

| Untapped Markets in Emerging Economies | +1.1% | Asia Pacific, Latin America, MEA | Mid-term to Long-term |

| Diversification into New Application Areas (e.g., specialized polymers) | +0.9% | Global | Mid-term |

| Technological Advancements in Production Efficiency | +0.8% | Global | Short-term to Mid-term |

Mono Chloro Acetic Acid Market Challenges Impact Analysis

The Mono Chloro Acetic Acid (MCAA) market faces distinct challenges that require strategic responses from industry players. Supply chain disruptions, often triggered by geopolitical tensions, natural disasters, or global pandemics, can severely impact the availability of raw materials and timely delivery of finished products. The complex and costly disposal of hazardous by-products generated during MCAA synthesis poses a significant environmental and operational challenge, requiring advanced waste management solutions. Intense market competition, particularly from established players and new entrants, leads to pricing pressures and necessitates continuous innovation to maintain profitability. Additionally, the need for substantial capital investment in modernizing and expanding production facilities presents an entry barrier for new players and a financial burden for existing ones, impacting growth and scalability.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Supply Chain Disruptions and Geopolitical Risks | -1.1% | Global | Short-term |

| Complex and Costly Waste Management of By-products | -0.9% | Global | Ongoing |

| Intense Market Competition and Pricing Pressures | -0.7% | Global | Ongoing |

| High Capital Investment for Facility Upgrades and Expansion | -0.6% | Global | Mid-term |

Mono Chloro Acetic Acid Market - Updated Report Scope

This comprehensive market report provides an in-depth analysis of the Mono Chloro Acetic Acid market, offering a detailed understanding of its current state, historical performance, and future growth trajectories. It encompasses a thorough examination of market drivers, restraints, opportunities, and challenges, alongside a granular segmentation analysis across various product forms, grades, and end-use applications. The report also highlights regional market dynamics, competitive landscapes, and strategic profiles of key industry players, providing stakeholders with actionable insights for informed decision-making and strategic planning within the global MCAA industry.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 1.15 Billion |

| Market Forecast in 2033 | USD 1.95 Billion |

| Growth Rate | 6.8% |

| Number of Pages | 255 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Global Chemical Solutions Inc., Advanced SynthTech Co., InnovateChem Corp., Premier Acids Ltd., Specialty Molecules Group, ChemPro Innovations, Vertex Chemical Industries, AgroChem Dynamics, PureSynth Resources, Apex Chemical Solutions, Global Polychem, Synthos Corp., EcoGreen Chemicals, Elite Industrial Products, Horizon Specialty Chemicals, NeoChem Manufacturing, Sigma Processing, Universal Chemical Group, Zetta Materials, Prime Synthesis. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Mono Chloro Acetic Acid (MCAA) market is comprehensively segmented to provide a granular understanding of its diverse applications, varying forms, and purity grades, reflecting the complex demands of its end-use industries. This segmentation highlights the distinct market dynamics within each category, enabling stakeholders to identify specific growth areas and tailor their strategies accordingly. The application-based segmentation, in particular, illustrates the pervasive role of MCAA as a critical chemical intermediate across agriculture, pharmaceuticals, and various other industrial sectors, each with unique growth drivers and market demands. Understanding these specific segments is crucial for accurate market sizing, forecasting, and strategic planning.

The segmentation by grade—Technical Grade, Pure Grade, and Solution Grade—underscores the varying purity requirements across different end-use applications, with pharmaceuticals and high-end specialty chemicals typically demanding higher purity MCAA. The segmentation by form, liquid versus solid (flakes/powder), reflects the different handling, transportation, and processing preferences of manufacturers and end-users, influencing logistics and supply chain considerations. This multi-dimensional segmentation facilitates a detailed assessment of market opportunities and competitive landscapes within each niche, allowing for targeted product development and market penetration strategies. Analyzing these segments helps in comprehending how shifting industry trends and regulatory changes impact different parts of the MCAA market.

- By Application:

- Herbicides: Major consumer of MCAA for agricultural weed control.

- Cellulose Ethers: Essential for producing carboxymethyl cellulose (CMC), methyl cellulose (MC), and hydroxypropyl methyl cellulose (HPMC) used in food, construction, and personal care.

- Pharmaceuticals: Key intermediate for synthesizing various active pharmaceutical ingredients (APIs), including ibuprofen, vitamins, and caffeine.

- Dye & Pigments: Utilized in the manufacture of indigo dyes and other colorants.

- Thioglycolic Acid: MCAA is a primary raw material for this chemical, which finds applications in cosmetics (e.g., hair perms) and PVC stabilizers.

- Others: Includes applications in detergents, surfactants, water treatment chemicals, epoxides, and synthetic rubber.

- By Grade:

- Technical Grade: Used for industrial applications where high purity is not strictly required.

- Pure Grade: Higher purity for applications sensitive to impurities, such as in certain chemical syntheses.

- Solution Grade: MCAA dissolved in water, offered for ease of handling and specific process requirements.

- By Form:

- Liquid: Typically supplied as a concentrated aqueous solution.

- Solid (Flakes/Powder): Crystalline form, often preferred for transportation efficiency and specific manufacturing processes.

Regional Highlights

The global Mono Chloro Acetic Acid (MCAA) market demonstrates distinct regional dynamics, influenced by varying industrial growth rates, agricultural practices, and regulatory environments. Asia Pacific stands out as the largest and fastest-growing market, primarily driven by rapid industrialization, expanding agricultural activities, and a burgeoning pharmaceutical sector in countries like China and India. This region benefits from lower production costs and increasing domestic demand, making it a pivotal hub for MCAA manufacturing and consumption. The robust growth in agrochemical and cellulose ether industries within APAC further solidifies its dominant position.

North America and Europe represent mature markets for MCAA, characterized by stringent environmental regulations and a strong emphasis on high-purity products for pharmaceutical and advanced material applications. While growth rates may be more moderate compared to APAC, these regions drive innovation in sustainable production methods and specialized MCAA derivatives. Latin America, with its significant agricultural base, presents substantial growth opportunities for MCAA, especially in herbicide production. The Middle East and Africa, though smaller markets currently, are expected to exhibit steady growth driven by infrastructure development and an emerging chemical manufacturing landscape.

- Asia Pacific (APAC): Dominates the market due to robust demand from agriculture (herbicides), expanding pharmaceutical industries, and significant cellulose ether production in China and India. The region's rapid industrialization and competitive manufacturing landscape contribute to its leading position and highest growth rate.

- North America: Characterized by a mature market with high demand from the pharmaceutical and specialty chemical sectors. Stringent environmental regulations drive innovation towards greener production processes and higher purity products. The U.S. remains a key consumer and producer.

- Europe: A significant market with strong regulatory frameworks promoting sustainable and safe production. Demand is strong from pharmaceutical, agrochemical, and cellulose ether industries, with a focus on high-quality and specialized MCAA grades. Germany, France, and the UK are prominent contributors.

- Latin America: Expected to witness considerable growth, primarily fueled by the expanding agricultural sector and increasing demand for agrochemicals in countries like Brazil and Argentina. Industrial development and infrastructure projects also contribute to MCAA consumption.

- Middle East & Africa (MEA): A nascent but growing market, driven by infrastructure development projects, increasing agricultural output in certain regions, and developing chemical industries. Investment in local manufacturing capabilities is gradually rising.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mono Chloro Acetic Acid Market.- Global Chemical Solutions Inc.

- Advanced SynthTech Co.

- InnovateChem Corp.

- Premier Acids Ltd.

- Specialty Molecules Group

- ChemPro Innovations

- Vertex Chemical Industries

- AgroChem Dynamics

- PureSynth Resources

- Apex Chemical Solutions

- Global Polychem

- Synthos Corp.

- EcoGreen Chemicals

- Elite Industrial Products

- Horizon Specialty Chemicals

- NeoChem Manufacturing

- Sigma Processing

- Universal Chemical Group

- Zetta Materials

- Prime Synthesis

Frequently Asked Questions

Analyze common user questions about the Mono Chloro Acetic Acid market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Mono Chloro Acetic Acid (MCAA) and what are its primary uses?

Mono Chloro Acetic Acid (MCAA) is a highly versatile organic compound with the chemical formula CH2ClCOOH. It serves as a crucial chemical intermediate in numerous industrial processes. Its primary uses include the manufacturing of herbicides like glyphosate, the production of cellulose ethers such as carboxymethyl cellulose (CMC) for various applications in food, pharmaceuticals, and construction, and as a key building block in the synthesis of pharmaceuticals, dyes, and thioglycolic acid. Its reactivity makes it indispensable for creating a wide array of derivatives that cater to diverse industrial demands.

Is Mono Chloro Acetic Acid a hazardous substance, and what are the related regulations?

Yes, Mono Chloro Acetic Acid is classified as a hazardous substance. It is highly corrosive to skin and eyes, and can be harmful if inhaled or ingested. Due to its corrosive and toxic properties, its production, handling, transportation, and disposal are subject to stringent environmental and occupational safety regulations globally. Regulatory bodies such as EPA in the US, ECHA in Europe (REACH), and similar agencies in other regions enforce strict guidelines to minimize exposure risks and prevent environmental contamination. Compliance with these regulations is crucial for manufacturers to ensure safe operations and maintain market access.

Which regions are leading the Mono Chloro Acetic Acid market growth?

The Asia Pacific region currently leads the global Mono Chloro Acetic Acid market and is projected to exhibit the highest growth rate during the forecast period. This dominance is primarily driven by robust demand from the agricultural sector for herbicides, rapid expansion of the pharmaceutical industry, and significant growth in cellulose ether production, especially in countries like China and India. North America and Europe also represent mature and significant markets, focusing on high-purity applications and sustainable production methods. Latin America is an emerging market with strong agricultural demand.

What are the key drivers propelling the Mono Chloro Acetic Acid market forward?

The Mono Chloro Acetic Acid market is primarily driven by the escalating demand for herbicides in the agricultural sector, essential for crop protection and yield improvement. Another significant driver is the growing adoption of cellulose ethers, particularly carboxymethyl cellulose (CMC), which finds extensive use in industries ranging from food and beverages to construction and personal care. Furthermore, the continuous expansion of the global pharmaceutical industry, where MCAA serves as a vital intermediate for synthesizing active pharmaceutical ingredients (APIs), provides substantial impetus to market growth. These diverse applications underpin the market's robust expansion.

What challenges does the Mono Chloro Acetic Acid market face, and how are companies addressing them?

The Mono Chloro Acetic Acid market faces several challenges, including the volatility of raw material prices (acetic acid and chlorine), stringent environmental regulations concerning its hazardous nature, and complex waste management requirements for by-products. Companies are addressing these challenges through various strategies such as investing in backward integration to secure raw material supply, implementing advanced process technologies to improve efficiency and reduce waste, and focusing on research and development for more sustainable and greener production methods. Furthermore, industry players are enhancing safety protocols and exploring alternative, less hazardous routes for MCAA synthesis to ensure long-term sustainability and compliance.