Lactic Acid Market

Lactic Acid Market Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_707696 | Last Updated : September 08, 2025 |

Format : ![]()

![]()

![]()

![]()

Lactic Acid Market Size

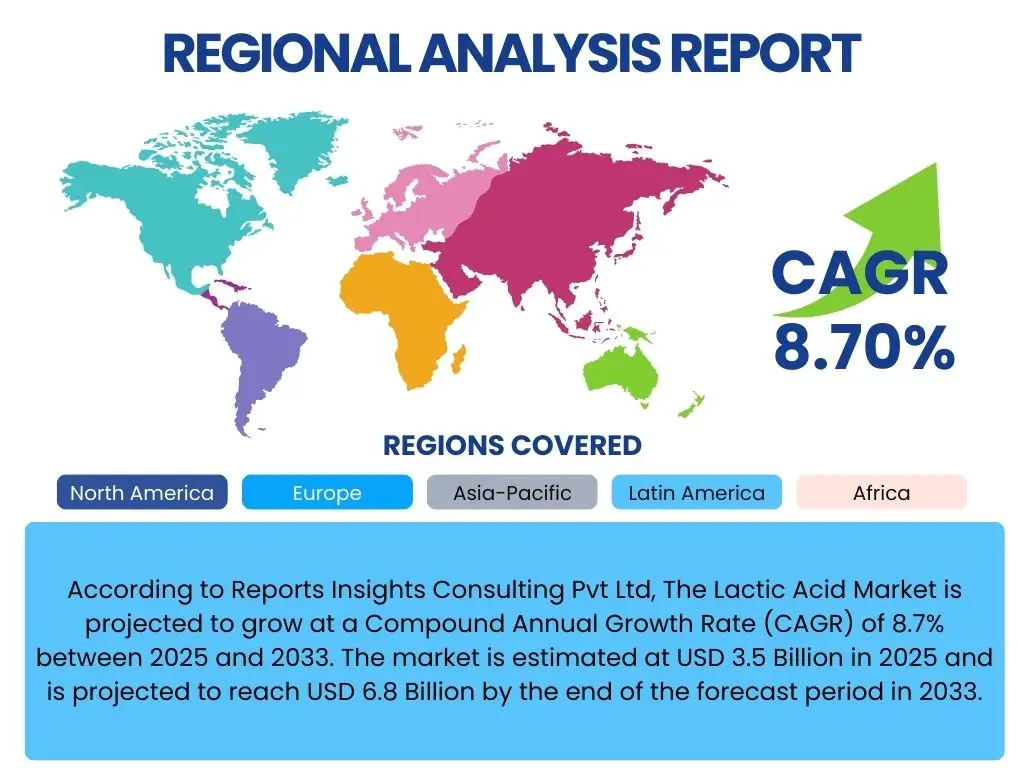

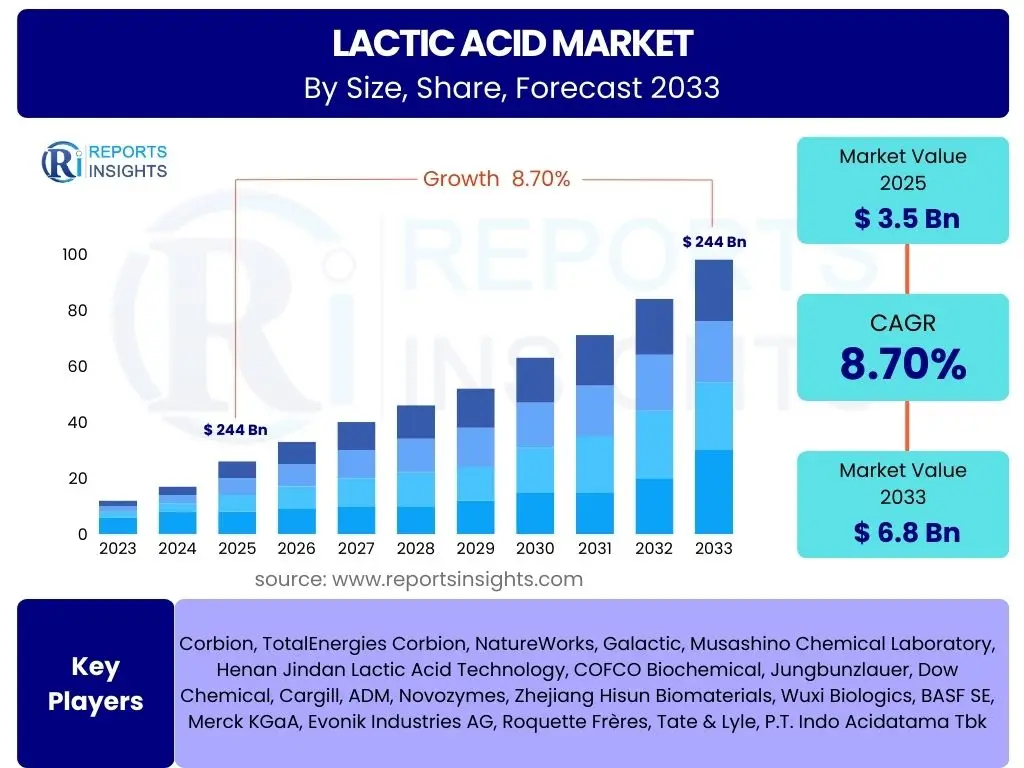

According to Reports Insights Consulting Pvt Ltd, The Lactic Acid Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.7% between 2025 and 2033. The market is estimated at USD 3.5 Billion in 2025 and is projected to reach USD 6.8 Billion by the end of the forecast period in 2033.

Key Lactic Acid Market Trends & Insights

The lactic acid market is undergoing significant transformation, driven by an increasing global emphasis on sustainability and bio-based solutions across various industries. A prominent trend is the burgeoning demand for polylactic acid (PLA), a biodegradable and compostable bioplastic, which is rapidly replacing conventional petroleum-based plastics in packaging, textiles, and automotive components. This shift is propelled by stringent environmental regulations and growing consumer preference for eco-friendly products, directly boosting the consumption of lactic acid as a primary monomer for PLA production. Furthermore, advancements in fermentation technologies are enhancing production efficiency and cost-effectiveness, making bio-based lactic acid more competitive.

Another key insight is the sustained growth in traditional applications, particularly in the food and beverage industry, where lactic acid serves as an acidulant, preservative, and flavor enhancer. The clean label trend and the demand for natural ingredients are reinforcing its importance in this sector. The pharmaceutical and personal care industries also continue to expand their use of lactic acid and its derivatives for skin conditioners, pH regulators, and drug delivery systems, driven by innovation in formulations and a focus on natural ingredients. The convergence of these factors indicates a robust and diversified growth trajectory for the lactic acid market, influenced by both technological advancements and evolving consumer and regulatory landscapes.

Moreover, the market is witnessing a trend towards diversification in raw material sources beyond conventional corn-based feedstocks, exploring alternatives such as sugarcane, cassava, and agricultural waste to improve sustainability and reduce reliance on specific crops. This not only addresses concerns about food vs. fuel competition but also enhances supply chain resilience. Regionally, Asia Pacific is emerging as a critical growth hub, propelled by rapid industrialization, increasing disposable incomes, and a growing manufacturing base, particularly in bioplastics and food processing. North America and Europe, while mature markets, are leading in research and development and the adoption of advanced bio-based technologies.

- Surging demand for Polylactic Acid (PLA) in sustainable packaging and textiles.

- Growing consumer preference for natural and biodegradable products.

- Technological advancements in fermentation processes enhancing production efficiency.

- Expansion of applications in food and beverage, pharmaceuticals, and personal care.

- Diversification of feedstock sources to include non-food crops and waste.

- Increasing regulatory support for bio-based materials and sustainable practices.

AI Impact Analysis on Lactic Acid

The integration of Artificial Intelligence (AI) and Machine Learning (ML) technologies is poised to revolutionize the lactic acid market by optimizing production processes, enhancing research and development, and improving supply chain efficiencies. Users frequently inquire about how AI can lead to more efficient fermentation, reduce production costs, and accelerate the discovery of novel applications. AI algorithms can analyze vast datasets from fermentation processes, including microbial growth rates, substrate consumption, and product yields, to identify optimal conditions for maximum lactic acid production. This predictive analytics capability enables real-time adjustments, minimizing waste and improving overall bioreactor performance, addressing key concerns about process variability and energy consumption.

Beyond process optimization, AI is expected to play a crucial role in accelerating innovation within the lactic acid industry. Researchers are exploring AI for designing new microbial strains with enhanced lactic acid production capabilities or for identifying novel enzymes that can improve conversion efficiency from diverse feedstocks. This can significantly shorten development cycles for new bio-based materials and chemical intermediates. Furthermore, AI can assist in predicting market demand, optimizing logistics, and managing inventory, thereby creating a more responsive and resilient supply chain for lactic acid producers and consumers. The collective expectation is that AI will drive a new wave of efficiency, sustainability, and innovation across the entire lactic acid value chain, leading to a more competitive and technologically advanced market.

Concerns often center on the initial investment required for AI infrastructure, data privacy, and the need for a skilled workforce capable of implementing and managing these advanced systems. However, the long-term benefits in terms of cost reduction, quality improvement, and accelerated time-to-market are expected to outweigh these challenges. AI-powered quality control systems can monitor product purity and consistency, reducing batch variations and ensuring compliance with stringent industry standards, particularly in food and pharmaceutical applications. Moreover, AI can facilitate predictive maintenance for production equipment, minimizing downtime and increasing operational reliability. The ability of AI to model complex biological and chemical interactions also opens doors for personalized nutrition and advanced drug delivery systems where lactic acid derivatives are key components, expanding future market opportunities.

- Enhanced fermentation efficiency through real-time data analysis and predictive modeling.

- Accelerated research and development for new microbial strains and production pathways.

- Optimized supply chain management, including demand forecasting and logistics.

- Improved quality control and consistency of lactic acid products.

- Reduced operational costs and energy consumption in production.

- Potential for new application discovery and personalized product development.

Key Takeaways Lactic Acid Market Size & Forecast

The lactic acid market is poised for substantial growth through 2033, driven primarily by escalating demand for sustainable and biodegradable materials. A key takeaway is the significant shift towards Polylactic Acid (PLA) applications, which are expected to be a major catalyst for market expansion. This transition reflects global efforts to reduce reliance on fossil fuel-derived plastics and addresses mounting environmental concerns regarding plastic waste. The forecast indicates that industrial applications, particularly bioplastics, will increasingly dominate market share, while traditional uses in food and beverages and personal care will maintain steady, robust growth, reinforcing the versatile utility of lactic acid across diverse sectors.

Another crucial insight is the dynamic interplay between technological advancements and market growth. Innovations in fermentation processes, purification techniques, and the exploration of novel, cost-effective feedstocks are making lactic acid production more efficient and economically viable, thereby lowering entry barriers for new applications. Furthermore, the market's resilience is bolstered by strong regulatory support for bio-based products in many regions, incentivizing investment and adoption. Companies that strategically invest in research and development, sustainable sourcing, and efficient production methodologies are expected to gain a competitive edge, positioning themselves favorably within this evolving landscape.

The regional growth patterns also present important takeaways. Asia Pacific is projected to be the fastest-growing region, fueled by rapid industrialization, expanding consumer markets, and increasing adoption of sustainable practices, particularly in China and India. This regional dynamism, coupled with ongoing sustainability initiatives globally, underscores a positive long-term outlook for the lactic acid market. Stakeholders should focus on strategic partnerships, supply chain optimization, and product diversification to capitalize on these growth opportunities, ensuring readiness for future market demands shaped by environmental consciousness and technological progression.

- Strong growth trajectory primarily fueled by the increasing demand for Polylactic Acid (PLA).

- Industrial applications, especially bioplastics, are becoming the dominant market segment.

- Ongoing technological advancements are critical for enhancing production efficiency and cost-effectiveness.

- Regulatory support for bio-based materials and environmental sustainability drives market adoption.

- Asia Pacific is anticipated to be the fastest-growing regional market.

- Diversification of applications and feedstock sources will ensure market resilience and expansion.

Lactic Acid Market Drivers Analysis

The global lactic acid market is experiencing robust growth propelled by several key drivers. A primary force is the escalating demand for Polylactic Acid (PLA), a biodegradable polymer that serves as a sustainable alternative to conventional plastics across various industries, including packaging, textiles, and automotive. This demand is underpinned by increasing environmental awareness, stringent regulations on single-use plastics, and a strong consumer preference for eco-friendly products. As industries commit to reducing their carbon footprint, the adoption of PLA and consequently, lactic acid, is expected to surge, driving significant market expansion globally.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Demand for Biodegradable Polymers (PLA) | +2.5% | Global, particularly Europe, North America, APAC | Long-term (2025-2033) |

| Growing Applications in Food & Beverage Industry | +1.8% | Global, particularly Asia Pacific, North America | Mid-term (2028-2031) |

| Rising Consumer Awareness of Sustainable Products | +1.5% | Developed Economies (Europe, North America) | Mid-term (2028-2031) |

| Advancements in Fermentation Technologies | +1.2% | Global | Short-term (2025-2028) |

Lactic Acid Market Restraints Analysis

Despite its significant growth prospects, the lactic acid market faces several restraints that could impede its expansion. One major challenge is the volatility of raw material prices, particularly for agricultural feedstocks like corn and sugarcane. Fluctuations in crop yields, geopolitical factors, and global commodity prices can directly impact the cost of lactic acid production, affecting profit margins for manufacturers and potentially deterring new investments. This instability creates uncertainty in the supply chain and can lead to increased production costs, making bio-based lactic acid less competitive compared to its synthetic counterparts in certain applications.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Volatility in Raw Material Prices | -1.3% | Global, particularly regions reliant on specific crops | Short-term to Mid-term (2025-2031) |

| Competition from Synthetic Alternatives | -1.0% | Global, particularly cost-sensitive industries | Mid-term (2028-2031) |

| Complex Production and Purification Processes | -0.8% | Global, impacting new entrants | Long-term (2025-2033) |

| High Energy Consumption in Production | -0.6% | Global, impacting operational costs | Short-term (2025-2028) |

Lactic Acid Market Opportunities Analysis

The lactic acid market is ripe with opportunities that can significantly contribute to its future growth. A key opportunity lies in the continuous research and development of advanced fermentation technologies. Innovations in microbial strains, bioreactor design, and downstream processing are poised to enhance production efficiency, reduce costs, and enable the use of a wider range of sustainable, non-food feedstocks. These technological advancements can unlock new avenues for lactic acid production, making it more competitive and environmentally friendly, thus broadening its market appeal and accessibility.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Research & Development in Advanced Fermentation Technologies | +1.9% | Global | Long-term (2028-2033) |

| Emerging Applications in New Industries (e.g., Electronics, Healthcare) | +1.7% | Global, particularly developed economies | Long-term (2028-2033) |

| Circular Economy Initiatives and Waste Valorization | +1.4% | Europe, North America, parts of Asia Pacific | Mid-term (2028-2031) |

| Growing Investment in Biorefineries | +1.1% | Global | Short-term (2025-2028) |

Lactic Acid Market Challenges Impact Analysis

Despite its promising growth trajectory, the lactic acid market confronts several significant challenges that necessitate strategic navigation. One primary hurdle is the relatively high capital investment required for setting up large-scale lactic acid production facilities, particularly those employing advanced bio-based processes. This high initial cost can deter new entrants and limit expansion plans for existing players, creating a barrier to broader market penetration. Additionally, the complexity of scaling up laboratory-level fermentation processes to industrial capacities while maintaining efficiency and purity standards poses a considerable technical challenge for manufacturers seeking to meet increasing demand for lactic acid and its derivatives like PLA.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Capital Investment for Production Facilities | -1.2% | Global | Short-term to Mid-term (2025-2031) |

| Complexity of Scaling Up Bio-based Production | -1.0% | Global, particularly for new technologies | Mid-term (2028-2031) |

| Waste Management and Disposal of By-products | -0.7% | Global, especially in regions with strict environmental regulations | Long-term (2025-2033) |

| Market Saturation in Mature Applications | -0.5% | Developed Markets (North America, Europe) | Mid-term (2028-2031) |

Lactic Acid Market - Updated Report Scope

The updated report on the Lactic Acid Market provides a comprehensive analysis of market dynamics, growth drivers, restraints, opportunities, and challenges. It covers detailed market sizing and forecasts from 2025 to 2033, building upon historical data from 2019 to 2023. The scope encompasses an in-depth segmentation analysis by application, raw material, and grade, offering granular insights into key market segments. Furthermore, the report includes a thorough regional analysis spanning North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa, highlighting country-specific market trends and growth prospects. It also profiles key industry players, offering insights into their competitive strategies and market positioning. This report serves as a vital resource for stakeholders seeking to understand the evolving landscape and strategic imperatives within the global lactic acid industry.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 6.8 Billion |

| Growth Rate | 8.7% CAGR |

| Number of Pages | 267 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Corbion, TotalEnergies Corbion, NatureWorks, Galactic, Musashino Chemical Laboratory, Henan Jindan Lactic Acid Technology, COFCO Biochemical, Jungbunzlauer, Dow Chemical, Cargill, ADM, Novozymes, Zhejiang Hisun Biomaterials, Wuxi Biologics, BASF SE, Merck KGaA, Evonik Industries AG, Roquette Frères, Tate & Lyle, P.T. Indo Acidatama Tbk |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The lactic acid market is comprehensively segmented to provide a detailed understanding of its diverse applications, raw material sources, and purity grades, reflecting the versatility and broad utility of this organic acid. This granular segmentation allows for a precise analysis of growth drivers and market dynamics within each specific category, enabling stakeholders to identify high-growth areas and tailor their strategies accordingly. The primary segments include applications such as Polylactic Acid (PLA), which is a major growth engine, alongside traditional and emerging uses in food and beverages, personal care, pharmaceuticals, and various industrial processes. Each application segment exhibits unique growth patterns influenced by regulatory frameworks, consumer preferences, and technological innovations.

Further segmentation by raw material categorizes the market based on the feedstock used for lactic acid production, including corn, sugarcane, cassava, and other agricultural sources. The shift towards sustainable and non-food-based feedstocks is a significant trend within this segment, driven by environmental concerns and a desire for reduced reliance on specific crops. Lastly, the market is differentiated by grade, encompassing food-grade, pharma-grade, and industrial-grade lactic acid. Each grade adheres to specific purity standards and regulatory requirements, catering to the distinct needs of various end-use industries. This multi-dimensional segmentation provides a robust framework for market analysis, enabling a deeper understanding of the factors influencing supply, demand, and pricing across the global lactic acid landscape.

- By Application:

- Polylactic Acid (PLA): The dominant and fastest-growing segment due to increasing demand for biodegradable plastics in packaging, textiles, and automotive.

- Food & Beverages: Used as an acidulant, preservative, flavor enhancer in dairy, bakery, meat, and beverage products.

- Personal Care: Employed in cosmetics, skincare, and hair care for pH regulation, moisturizing, and exfoliation.

- Pharmaceuticals: Utilized in drug formulation, surgical sutures, and drug delivery systems.

- Industrial: Applications in detergents, adhesives, solvents, and other chemical processes.

- Others: Includes animal feed, electronic chemicals, and medical implants.

- By Raw Material:

- Sugarcane: A significant feedstock, particularly in Asia Pacific and Latin America, due to its high sugar content and availability.

- Corn: Historically a major source, widely used in North America, but facing scrutiny due to food vs. fuel debates.

- Cassava: An emerging feedstock, especially in Southeast Asia, offering cost-effectiveness and sustainability benefits.

- Other Agricultural Feedstocks: Includes sweet sorghum, cellulosic biomass, and agricultural waste, representing future growth areas for sustainable production.

- By Grade:

- Food-grade: High-purity lactic acid for human consumption, adhering to strict food safety standards.

- Pharma-grade: Ultra-high purity lactic acid suitable for pharmaceutical applications, meeting rigorous quality control.

- Industrial-grade: Used in various industrial processes, including PLA production, with specific technical purity requirements.

Regional Highlights

- North America: This region represents a mature yet innovative market for lactic acid, driven by growing demand for bioplastics, particularly in packaging and consumer goods. Strong regulatory support for sustainable practices and a high level of consumer awareness regarding eco-friendly products are propelling market expansion. The United States and Canada are at the forefront of adopting advanced fermentation technologies and investing in research and development for new applications, contributing significantly to market value.

- Europe: Europe is a key market for lactic acid, characterized by stringent environmental regulations and a strong commitment to the circular economy. The region is a pioneer in the adoption of biodegradable plastics and sustainable packaging solutions, which directly fuels the demand for PLA. Germany, France, and the UK are leading countries, emphasizing bio-based materials in various industries and promoting investments in green technologies and biorefineries.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region in the lactic acid market, attributed to rapid industrialization, expanding manufacturing bases, and increasing disposable incomes. Countries like China, India, and Japan are experiencing a surge in demand from the food and beverage, personal care, and bioplastics sectors. Government initiatives promoting sustainable industrial development and rising awareness about environmental protection are accelerating the adoption of lactic acid across diverse applications.

- Latin America: This region shows significant growth potential, driven by the abundant availability of agricultural feedstocks like sugarcane and cassava, which are ideal for lactic acid production. Brazil and Argentina are emerging as key players, with growing investments in bio-based industries and increasing applications in food preservation and industrial sectors. The rising focus on economic development and sustainable resource utilization contributes to market expansion.

- Middle East and Africa (MEA): The MEA region is a nascent but developing market for lactic acid. Growth is primarily driven by increasing investments in the food and beverage industry, rising consumer awareness regarding food safety and preservation, and nascent adoption of sustainable packaging solutions. While currently a smaller market share, the region's long-term potential is linked to economic diversification, industrial growth, and increasing environmental consciousness.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Lactic Acid Market.- Corbion

- TotalEnergies Corbion

- NatureWorks

- Galactic

- Musashino Chemical Laboratory

- Henan Jindan Lactic Acid Technology

- COFCO Biochemical

- Jungbunzlauer

- Dow Chemical

- Cargill

- ADM

- Novozymes

- Zhejiang Hisun Biomaterials

- Wuxi Biologics

- BASF SE

- Merck KGaA

- Evonik Industries AG

- Roquette Frères

- Tate & Lyle

- P.T. Indo Acidatama Tbk

Frequently Asked Questions

What is lactic acid primarily used for?

Lactic acid is primarily used as an acidulant, preservative, and flavor enhancer in the food and beverage industry. Increasingly, its major application is as a monomer for producing Polylactic Acid (PLA), a biodegradable polymer used in bioplastics for packaging, textiles, and other sustainable materials.

How is lactic acid produced?

Lactic acid is predominantly produced through the fermentation of carbohydrates, such as glucose or sucrose, by various bacterial strains, primarily from the Lactobacillus genus. These bacteria convert sugars from raw materials like corn, sugarcane, or cassava into lactic acid under controlled conditions. Chemical synthesis is also an alternative but less common method.

What are the main drivers of the lactic acid market growth?

The primary drivers of lactic acid market growth include the surging global demand for biodegradable polymers like PLA, increasing consumer preference for natural and sustainable products, and expanding applications in the food and beverage, personal care, and pharmaceutical industries. Advancements in fermentation technologies further enhance production efficiency and cost-effectiveness.

What is the role of sustainability in the lactic acid market?

Sustainability is a central theme in the lactic acid market. Lactic acid, being a bio-based chemical, is crucial for producing biodegradable plastics (PLA), reducing reliance on fossil fuels. Its production methods are becoming more sustainable through the use of renewable feedstocks and optimized processes, aligning with global efforts to promote circular economy principles and reduce environmental impact.

Which region is expected to lead the lactic acid market growth?

Asia Pacific (APAC) is projected to be the fastest-growing region in the lactic acid market. This growth is driven by rapid industrialization, expanding manufacturing sectors, particularly in bioplastics and food processing, and increasing adoption of sustainable practices across countries like China, India, and Japan.