Mobile Payment Market

Mobile Payment Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_704381 | Last Updated : August 05, 2025 |

Format : ![]()

![]()

![]()

![]()

Mobile Payment Market Size

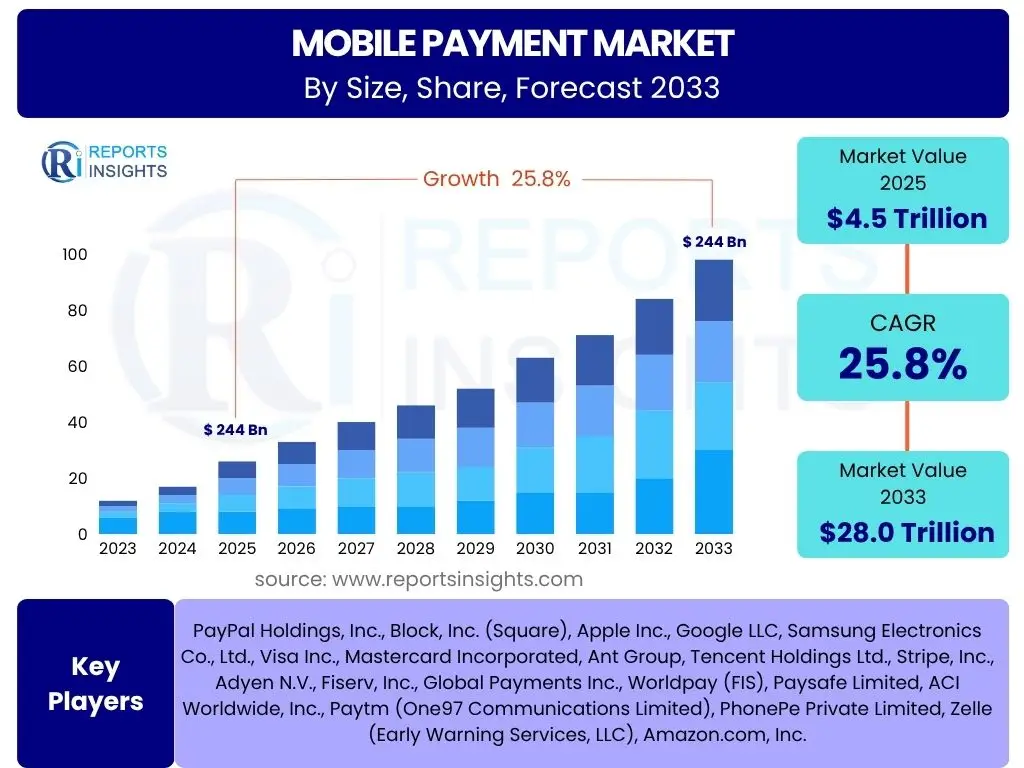

According to Reports Insights Consulting Pvt Ltd, The Mobile Payment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 25.8% between 2025 and 2033. The market is estimated at USD 4.5 Trillion in 2025 and is projected to reach USD 28.0 Trillion by the end of the forecast period in 2033.

Key Mobile Payment Market Trends & Insights

The mobile payment landscape is undergoing rapid transformation, driven by consumer demand for convenience and technological advancements. Key questions from users often revolve around the dominant payment methods, the impact of emerging technologies, and the evolving security measures. The market is increasingly characterized by the widespread adoption of contactless technologies, the proliferation of digital wallets, and the expansion of QR code payments, especially in developing economies. Furthermore, the integration of payment functionalities within super apps and social media platforms is reshaping user habits and expanding the reach of mobile transactions.

There is a growing emphasis on seamless user experiences, leading to innovations such as biometric authentication and one-click payment options. Cross-border mobile payment solutions are also gaining traction, addressing the complexities of international remittances and e-commerce. As mobile devices become central to daily life, the convergence of online and offline payment experiences, supported by loyalty programs and personalized offers, defines the current trajectory of the market. Regulatory frameworks are also adapting to these rapid changes, aiming to balance innovation with consumer protection and financial stability.

- Proliferation of Contactless and QR Code Payments

- Increased Adoption of Digital Wallets and Super Apps

- Rise of Cross-Border Mobile Payment Solutions

- Integration of Biometric Authentication for Enhanced Security

- Convergence of Online and Offline Payment Experiences

- Growth in Embedded Finance and Buy Now Pay Later (BNPL) Integration

AI Impact Analysis on Mobile Payment

User inquiries about AI's impact on mobile payments frequently focus on its role in enhancing security, personalizing user experiences, and improving operational efficiencies. Artificial intelligence is fundamentally transforming the mobile payment ecosystem by providing sophisticated tools for fraud detection and prevention. Machine learning algorithms analyze vast datasets of transaction patterns to identify anomalies in real-time, significantly reducing the incidence of fraudulent activities and bolstering consumer trust in mobile payment platforms. This capability is crucial in mitigating risks associated with the increasing volume and complexity of digital transactions.

Beyond security, AI plays a pivotal role in personalizing the user experience, leading to higher engagement and customer satisfaction. AI-driven analytics enable payment providers to understand individual spending habits, preferences, and creditworthiness, facilitating the offering of tailored financial products, targeted promotions, and predictive assistance. This personalization extends to dynamic pricing, loyalty programs, and even proactive customer support through AI-powered chatbots. Furthermore, AI optimizes backend operations, from automating reconciliation processes to streamlining customer service, thereby reducing operational costs and improving overall service delivery within the mobile payment industry.

- Enhanced Fraud Detection and Prevention through Machine Learning

- Personalized User Experiences and Product Recommendations

- Predictive Analytics for Risk Assessment and Credit Scoring

- Automated Customer Support via AI-Powered Chatbots

- Optimization of Payment Routing and Transaction Processing

- Improved Operational Efficiency and Cost Reduction for Providers

Key Takeaways Mobile Payment Market Size & Forecast

Common questions concerning the mobile payment market size and forecast typically center on the scale of growth, the primary factors sustaining this expansion, and the long-term viability of mobile-first financial solutions. The most significant takeaway is the market's exceptionally robust growth trajectory, projecting an almost six-fold increase in valuation over the next eight years. This exponential expansion underscores a fundamental shift in consumer behavior towards digital and mobile-centric financial transactions, moving away from traditional payment methods. The forecast reflects an accelerating global digital transformation, with mobile devices becoming the primary interface for an increasing array of financial activities, from peer-to-peer transfers to complex e-commerce purchases.

This sustained growth is driven by a confluence of factors including escalating smartphone penetration, expanding internet connectivity, and the rapid adoption of digital commerce across various sectors. Furthermore, supportive government initiatives promoting financial inclusion and digital economies, coupled with continuous innovations in payment technologies, are critical enablers. The projected market size signifies not just a change in how people pay, but a fundamental restructuring of the financial services landscape, with mobile payment providers emerging as central figures in the global economy. The market's resilience against potential challenges, largely due to ongoing security enhancements and regulatory adaptations, further solidifies its positive long-term outlook.

- Exceptional Growth Trajectory: Market projected to grow from USD 4.5 Trillion in 2025 to USD 28.0 Trillion by 2033.

- Digital Transformation Catalyst: Mobile payments are a primary driver and beneficiary of global digital transformation.

- Consumer Behavior Shift: Indicative of a permanent transition from traditional to mobile-first payment methods.

- Key Enablers: Fueled by high smartphone penetration, e-commerce expansion, and favorable regulatory environments.

- Market Dominance: Mobile payment solutions are set to become the predominant form of transaction globally.

Mobile Payment Market Drivers Analysis

The mobile payment market's significant growth is primarily propelled by several synergistic factors. The increasing global penetration of smartphones, coupled with expanding internet accessibility, forms the foundational infrastructure for mobile payment adoption. As more individuals gain access to mobile devices and reliable connectivity, the potential user base for mobile payment services naturally expands. This technological ubiquity makes mobile payments a convenient and accessible option for a vast and diverse consumer demographic, irrespective of geographical location.

Furthermore, the rapid growth of e-commerce and m-commerce (mobile commerce) is a crucial driver. As consumers increasingly shop online via their mobile devices, seamless and secure mobile payment options become indispensable. This trend is complemented by supportive government initiatives and regulatory frameworks aimed at fostering financial inclusion and promoting cashless transactions. Such policies, often driven by a desire for greater transparency and economic efficiency, actively encourage the shift towards digital payment methods, providing a conducive environment for the mobile payment market to flourish. The inherent convenience, speed, and security features of modern mobile payment solutions also play a vital role in consumer adoption.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Rising Smartphone Penetration | +5.5% | Global, particularly Asia Pacific, Africa | Short to Mid-term (2025-2030) |

| Rapid Growth of E-commerce and M-commerce | +4.8% | Global, prominently North America, Europe, Asia Pacific | Short to Long-term (2025-2033) |

| Increasing Consumer Demand for Convenience and Speed | +3.2% | Global | Short to Long-term (2025-2033) |

| Government Initiatives and Financial Inclusion Programs | +2.7% | Asia Pacific (India, China), Latin America, Africa | Mid-term (2027-2033) |

| Technological Advancements (NFC, QR Codes, Biometrics) | +2.5% | Global | Short to Mid-term (2025-2030) |

Mobile Payment Market Restraints Analysis

Despite its robust growth, the mobile payment market faces several significant restraints that could impede its full potential. A primary concern for consumers remains security and data privacy. High-profile data breaches and incidents of fraud create consumer apprehension, leading to reluctance in adopting or fully trusting mobile payment solutions. While providers invest heavily in security measures, the perception of risk persists, particularly among less digitally native demographics, thereby slowing down broader adoption rates. Building and maintaining consumer trust is an ongoing challenge in this dynamic environment.

Another substantial restraint is the complexity and fragmentation of regulatory frameworks across different jurisdictions. As mobile payments often transcend national borders, varying laws concerning data protection, anti-money laundering (AML), and consumer rights create compliance hurdles for service providers. This regulatory maze can increase operational costs, limit market entry for new players, and slow down the expansion of services into new regions. Furthermore, a lack of interoperability between different payment systems, coupled with insufficient digital infrastructure in certain undeveloped regions, can hinder seamless transactions and limit the reach of mobile payment services, especially in rural or underserved areas where internet connectivity and smartphone ownership may still be low.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Security Concerns and Data Privacy Issues | -3.0% | Global | Short to Long-term (2025-2033) |

| Regulatory Complexities and Varying Compliance Requirements | -2.2% | Europe, Asia Pacific (cross-border) | Mid-term (2027-2033) |

| Lack of Digital Infrastructure in Emerging Regions | -1.8% | Parts of Africa, Latin America, Southeast Asia | Mid to Long-term (2028-2033) |

| Low Digital Literacy and Resistance to Change in Traditional Markets | -1.5% | Rural areas globally, older demographics | Long-term (2030-2033) |

Mobile Payment Market Opportunities Analysis

The mobile payment market is ripe with opportunities that can further accelerate its growth and expand its reach. A significant opportunity lies in tapping into unbanked and underbanked populations, particularly in emerging economies where traditional financial services are scarce but mobile phone penetration is high. Mobile money solutions offer these segments access to essential financial services, driving financial inclusion and opening vast new customer bases for payment providers. This demographic shift presents a substantial long-term growth avenue, transforming economies from the ground up.

The burgeoning market for cross-border mobile payments also represents a major opportunity. As global trade and international remittances increase, there is a growing demand for cost-effective, fast, and secure ways to transfer money across borders using mobile devices. Innovating in this space, particularly by reducing fees and improving transaction speeds, can capture a large share of the global remittance market. Furthermore, the integration of mobile payments with the Internet of Things (IoT) and emerging technologies like Buy Now Pay Later (BNPL) schemes offers novel applications and revenue streams. Payments embedded in smart devices or offering flexible financing options enhance convenience and expand transactional possibilities, creating new ecosystems for mobile payment services and pushing the boundaries of traditional commerce.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Tapping into Unbanked and Underbanked Populations | +4.0% | Africa, Latin America, Southeast Asia | Mid to Long-term (2027-2033) |

| Expansion of Cross-Border Mobile Payment Solutions | +3.5% | Global | Short to Long-term (2025-2033) |

| Integration with IoT and Wearable Devices | +2.8% | North America, Europe, Asia Pacific | Mid to Long-term (2028-2033) |

| Growth of Buy Now Pay Later (BNPL) Services within Mobile Wallets | +2.0% | Global, particularly North America, Europe | Short to Mid-term (2025-2030) |

Mobile Payment Market Challenges Impact Analysis

The mobile payment market faces several inherent challenges that require continuous innovation and strategic adaptation. One significant hurdle is the persistent issue of data privacy and the evolving landscape of cyber threats. As mobile payment systems handle sensitive financial and personal information, they are prime targets for cyberattacks, phishing, and malware. Maintaining the highest standards of data security and privacy compliance, especially with stringent regulations like GDPR and CCPA, is a complex and ongoing battle that necessitates substantial investment in advanced security technologies and robust data governance frameworks. This challenge is critical for sustaining consumer trust and avoiding punitive regulatory actions.

Another major challenge revolves around interoperability and standardization across various payment systems, devices, and platforms. The fragmented nature of the mobile payment ecosystem, with numerous providers, technologies, and regional preferences, often leads to compatibility issues, limiting seamless user experiences and hindering widespread adoption. Establishing universally accepted standards and fostering collaboration among industry players is essential to overcome these barriers. Additionally, intense competition from traditional payment methods, along with the rapid emergence of new fintech solutions, necessitates constant innovation and differentiation for mobile payment providers to maintain market share and attract new users in an increasingly crowded and competitive financial landscape.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Evolving Cyber Threats and Data Breaches | -2.5% | Global | Short to Long-term (2025-2033) |

| Interoperability and Standardization Issues | -1.9% | Global | Mid to Long-term (2027-2033) |

| Intense Competition from Traditional and New Payment Methods | -1.7% | Global | Short to Mid-term (2025-2030) |

| Consumer Reluctance Due to Lack of Trust or Understanding | -1.2% | Certain demographics, less digitally mature markets | Mid to Long-term (2028-2033) |

Mobile Payment Market - Updated Report Scope

This report provides an in-depth analysis of the global Mobile Payment market, covering historical data from 2019 to 2023, current market estimations for 2025, and future projections through 2033. It offers a comprehensive overview of market size, growth drivers, restraints, opportunities, and challenges, along with detailed segmentation analysis by payment type, technology, end-user, and transaction type. The report also highlights regional market dynamics and profiles key industry players, offering strategic insights for stakeholders to navigate the evolving market landscape. It aims to deliver a holistic understanding of the market's trajectory and competitive environment.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 4.5 Trillion |

| Market Forecast in 2033 | USD 28.0 Trillion |

| Growth Rate | 25.8% |

| Number of Pages | 255 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | PayPal Holdings, Inc., Block, Inc. (Square), Apple Inc., Google LLC, Samsung Electronics Co., Ltd., Visa Inc., Mastercard Incorporated, Ant Group, Tencent Holdings Ltd., Stripe, Inc., Adyen N.V., Fiserv, Inc., Global Payments Inc., Worldpay (FIS), Paysafe Limited, ACI Worldwide, Inc., Paytm (One97 Communications Limited), PhonePe Private Limited, Zelle (Early Warning Services, LLC), Amazon.com, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The mobile payment market is meticulously segmented to provide a granular understanding of its diverse components and dynamics. This segmentation helps identify specific growth areas, competitive landscapes within sub-markets, and the varying adoption patterns across different user groups and technologies. By breaking down the market, stakeholders can gain precise insights into where growth is most concentrated and identify underserved niches, allowing for targeted product development and marketing strategies. This detailed analysis covers various dimensions of how mobile payments are categorized and utilized globally.

The market is primarily segmented by the type of payment technology employed, such as Near Field Communication (NFC) and QR code payments, reflecting the underlying infrastructure and user interaction methods. Further segmentation by the technology platform, including in-app and browser-based payments, highlights the digital channels driving transactions. End-user industries, ranging from retail and e-commerce to healthcare and transportation, provide insights into vertical adoption, while transaction types like person-to-person (P2P) and person-to-merchant (P2M) reveal the prevalent use cases. Each segment demonstrates unique growth drivers, challenges, and opportunities, contributing to the overall complexity and potential of the mobile payment ecosystem.

- By Payment Type: Near Field Communication (NFC), QR Code Payments, SMS/Direct Carrier Billing, Mobile Wallets, Others (e.g., Sound-based)

- By Technology: In-app Payments, Browser-based Payments, Proximity Payments

- By End-User: Retail and E-commerce, Hospitality and Tourism, BFSI (Banking, Financial Services, and Insurance), Telecommunications, Healthcare, Transportation, Utilities, Others

- By Transaction Type: Person-to-Person (P2P), Person-to-Merchant (P2M), Business-to-Business (B2B), Business-to-Consumer (B2C)

Regional Highlights

- North America: Characterized by high adoption of digital wallets and contactless payments, driven by strong technological infrastructure and consumer readiness for innovation. The U.S. and Canada lead in transaction value and technological advancements, with significant investments in payment security and user experience.

- Europe: Experiencing rapid growth propelled by regulatory initiatives like PSD2, fostering open banking and increased competition. Countries like the U.K., Germany, and France are seeing widespread adoption of mobile banking apps and digital payment methods, with a focus on seamless cross-border transactions within the Eurozone.

- Asia Pacific (APAC): The dominant region in terms of transaction volume and user base, led by mobile-first economies like China and India. The region benefits from massive smartphone penetration, the proliferation of QR code payments, and the emergence of super apps, driving financial inclusion and digital commerce at an unprecedented scale.

- Latin America: A rapidly emerging market for mobile payments, driven by increasing smartphone adoption, a large unbanked population seeking financial access, and supportive fintech innovation. Brazil and Mexico are at the forefront, with mobile money and digital wallets providing essential services and fostering economic growth.

- Middle East and Africa (MEA): Witnessing significant growth, particularly in mobile money services, which are crucial for financial inclusion in many African nations. The Gulf Cooperation Council (GCC) countries in the Middle East are also rapidly adopting advanced mobile payment solutions, supported by government-led digital transformation agendas and high internet penetration.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mobile Payment Market.- PayPal Holdings, Inc.

- Block, Inc.

- Apple Inc.

- Google LLC

- Samsung Electronics Co., Ltd.

- Visa Inc.

- Mastercard Incorporated

- Ant Group

- Tencent Holdings Ltd.

- Stripe, Inc.

- Adyen N.V.

- Fiserv, Inc.

- Global Payments Inc.

- Worldpay (FIS)

- Paysafe Limited

- ACI Worldwide, Inc.

- Paytm

- PhonePe Private Limited

- Zelle

- Amazon.com, Inc.

Frequently Asked Questions

What are mobile payments?

Mobile payments refer to financial transactions conducted using a mobile device, such as a smartphone or tablet, instead of traditional methods like cash, checks, or physical credit cards. These payments can occur in various forms, including in-app purchases, mobile wallet transactions (e.g., Apple Pay, Google Pay), QR code scans, and direct carrier billing, offering convenience and speed for consumers.

How secure are mobile payments?

Mobile payments are designed with multiple layers of security, often utilizing encryption, tokenization, and biometric authentication (fingerprint, facial recognition) to protect sensitive data. While no system is entirely foolproof, continuous advancements in fraud detection, real-time transaction monitoring, and secure element technologies make mobile payments highly secure, often exceeding the security of traditional card transactions.

What are the main types of mobile payments?

The primary types of mobile payments include Near Field Communication (NFC) payments (tap-to-pay), QR code payments, in-app payments, SMS or direct carrier billing, and peer-to-peer (P2P) transfers. Mobile wallets serve as platforms to consolidate various payment methods and loyalty programs, facilitating seamless transactions across these types.

Which regions are leading in mobile payment adoption?

Asia Pacific, particularly countries like China and India, leads globally in mobile payment adoption due to high smartphone penetration and the widespread use of QR codes and super apps. North America and Europe also demonstrate significant adoption rates, driven by contactless technology and robust digital banking infrastructure, while Latin America and MEA are rapidly catching up, especially through mobile money services.

What is the future outlook for the mobile payment market?

The future outlook for the mobile payment market is exceptionally positive, driven by continued technological innovation, increasing consumer demand for convenience, and global efforts towards financial inclusion. It is anticipated to expand significantly, integrating further with IoT devices, supporting flexible financing options like BNPL, and becoming an indispensable part of both online and offline commerce globally.