Lending and Payment Market

Lending and Payment Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_703089 | Last Updated : August 01, 2025 |

Format : ![]()

![]()

![]()

![]()

Lending and Payment Market Size

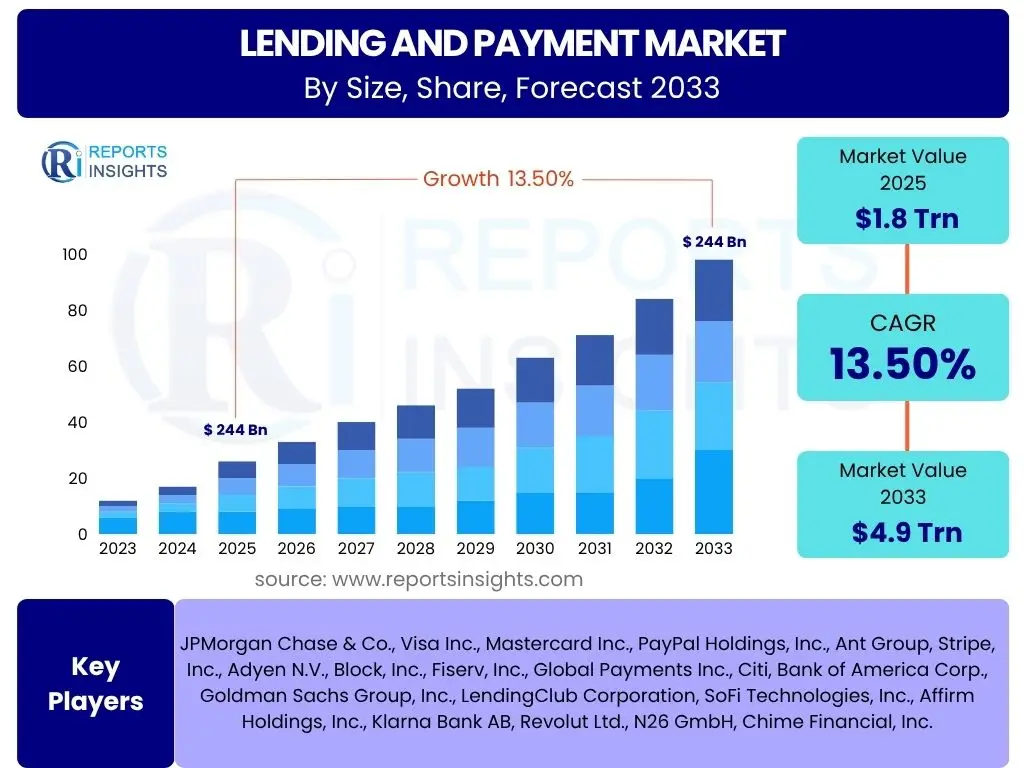

According to Reports Insights Consulting Pvt Ltd, The Lending and Payment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 13.5% between 2025 and 2033. The market is estimated at USD 1.8 Trillion in 2025 and is projected to reach USD 4.9 Trillion by the end of the forecast period in 2033.

Key Lending and Payment Market Trends & Insights

The Lending and Payment market is undergoing a significant transformation driven by technological advancements, evolving consumer expectations, and a dynamic regulatory landscape. Common user inquiries often revolve around the acceleration of digital transformation, the rise of alternative payment methods, and the growing importance of embedded finance. These inquiries indicate a strong interest in understanding how innovation is reshaping traditional financial services and creating new ecosystems for transactions and credit.

Current trends highlight a shift towards more seamless, personalized, and instant financial services. The integration of financial products into non-financial platforms, the increasing adoption of real-time payment rails, and the expansion of Buy Now, Pay Later (BNPL) solutions are paramount. Furthermore, there is a notable emphasis on enhancing user experience through intuitive interfaces and hyper-customized offerings, reflecting a consumer preference for convenience and speed in financial interactions.

- Accelerated adoption of digital payment solutions and mobile wallets.

- Proliferation of Buy Now, Pay Later (BNPL) services as a flexible credit option.

- Expansion of Open Banking and API-driven financial services enabling greater interoperability.

- Growth in embedded finance, integrating financial products directly into non-financial platforms.

- Increased demand for real-time payments and cross-border transaction efficiencies.

AI Impact Analysis on Lending and Payment

User questions regarding the impact of Artificial Intelligence (AI) on the Lending and Payment sector frequently address its role in risk assessment, fraud detection, and the personalization of financial products. There is a keen interest in how AI can enhance operational efficiencies, automate complex processes, and provide deeper insights into customer behavior. Concerns often center on data privacy, algorithmic bias, and the potential displacement of human roles, alongside expectations for revolutionary improvements in service delivery and security.

AI is fundamentally reshaping how credit decisions are made and how payments are processed. It enables financial institutions to analyze vast datasets for more accurate credit scoring, detect fraudulent activities with unprecedented speed, and offer highly customized lending and payment solutions tailored to individual needs. The technology's ability to learn and adapt is driving continuous improvements in risk management, operational costs, and customer engagement, leading to a more intelligent and responsive financial ecosystem.

- Enhanced accuracy in credit risk assessment and underwriting through advanced analytics.

- Significant improvements in real-time fraud detection and prevention mechanisms.

- Personalization of financial products and services, leading to tailored customer experiences.

- Automation of routine tasks and back-office operations, increasing operational efficiency.

- Predictive analytics for market trends, customer churn, and optimized pricing strategies.

Key Takeaways Lending and Payment Market Size & Forecast

Common user questions regarding key takeaways from the Lending and Payment market size and forecast reveal a strong focus on growth trajectories, dominant regions, and disruptive innovations. Users frequently seek insights into which segments are poised for the most significant expansion, the long-term viability of digital-first models, and the overall macroeconomic factors influencing market progression. These inquiries underscore the need for a clear understanding of market dynamics and future potential.

The market is poised for robust expansion, primarily fueled by the accelerating shift towards digital platforms and the continuous innovation in payment and lending technologies. Asia Pacific is emerging as a critical growth engine, driven by its large unbanked population, rapid digital adoption, and supportive regulatory environments. While traditional financial institutions adapt through digital transformation, fintech companies continue to drive innovation, fostering a competitive yet collaborative landscape that prioritizes customer experience and efficiency.

- Significant growth expected from digital transformation and fintech innovation across all segments.

- Asia Pacific is forecast to be the fastest-growing region, driven by digital adoption and financial inclusion initiatives.

- Embedded finance and real-time payments are key drivers for future market expansion.

- Regulatory frameworks are evolving globally to support innovation while ensuring consumer protection and financial stability.

- Cybersecurity and data privacy remain critical concerns influencing market development and consumer trust.

Lending and Payment Market Drivers Analysis

The Lending and Payment market's robust growth is propelled by several fundamental drivers, primarily the escalating digital transformation across all economic sectors. The pervasive adoption of smartphones and high-speed internet has enabled the widespread use of digital payment solutions and online lending platforms, democratizing access to financial services. Furthermore, the global rise of e-commerce continues to necessitate efficient and secure payment gateways, creating a strong demand for innovative payment and lending solutions that support rapid online transactions and consumer credit needs.

Concurrently, increasing demand for financial inclusion, particularly in developing economies, is driving the expansion of mobile money and micro-lending services, reaching previously underserved populations. Supportive government initiatives and evolving regulatory frameworks that foster innovation, such as Open Banking mandates, are also playing a crucial role by encouraging competition and enabling greater data sharing among financial entities, thereby spurring new product development and service delivery models.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Rapid Digital Transformation & Smartphone Penetration | +3.5% | Global, particularly Asia Pacific & Africa | Short to Mid-term (2025-2030) |

| Growth of E-commerce & Online Transactions | +2.8% | North America, Europe, Asia Pacific | Mid-term (2025-2033) |

| Increasing Demand for Financial Inclusion & Digital Access | +2.5% | Developing Economies (MEA, Latin America, South East Asia) | Long-term (2025-2033) |

| Supportive Regulatory Initiatives (e.g., Open Banking) | +2.0% | Europe, UK, Australia, Brazil | Mid-term (2025-2030) |

| Technological Advancements in AI, Blockchain & Cloud | +2.7% | Global | Long-term (2025-2033) |

Lending and Payment Market Restraints Analysis

Despite significant growth prospects, the Lending and Payment market faces several notable restraints that could temper its expansion. Regulatory complexities and inconsistencies across different jurisdictions pose a substantial challenge, as financial service providers must navigate diverse compliance requirements, licensing procedures, and data protection laws. This fragmented regulatory landscape can hinder market entry for new players and increase operational costs for existing ones, particularly for those operating internationally.

Furthermore, persistent cybersecurity threats and concerns regarding data privacy represent a critical restraint. The increasing digitization of financial transactions makes the industry a prime target for cyberattacks, leading to potential financial losses, reputational damage, and erosion of consumer trust. Managing and mitigating these risks requires continuous investment in robust security infrastructure and adherence to evolving data protection regulations, which can be resource-intensive for market participants.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Complex & Evolving Regulatory Landscape | -1.5% | Global, particularly EU & emerging markets | Mid to Long-term (2025-2033) |

| Increasing Cybersecurity Threats & Data Privacy Concerns | -1.2% | Global | Continuous |

| Lack of Interoperability & Legacy Infrastructure | -0.8% | Mature Markets (North America, Europe) | Long-term (2025-2033) |

| Economic Volatility & Credit Risk Fluctuations | -1.0% | Global, particularly vulnerable economies | Short-term (2025-2027) |

| High Competition & Pricing Pressure | -0.7% | Global | Continuous |

Lending and Payment Market Opportunities Analysis

Significant opportunities abound within the Lending and Payment market, largely stemming from the expanding digital economy and the maturation of nascent technologies. The untapped potential in emerging markets, characterized by large underserved populations and increasing smartphone penetration, presents a vast frontier for innovative mobile-first lending and payment solutions. These regions are often leapfrogging traditional financial infrastructure, directly adopting digital services.

Moreover, the continuous advancements in blockchain and Distributed Ledger Technology (DLT) offer avenues for enhanced security, transparency, and efficiency in cross-border payments and lending processes. The rise of embedded finance also creates a symbiotic relationship between financial services and other industries, allowing for the seamless integration of lending and payment functionalities into e-commerce platforms, software solutions, and consumer applications. This integration enhances user experience and expands the reach of financial products beyond traditional banking channels, fostering new revenue streams and partnerships.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Expansion into Emerging & Underserved Markets | +3.0% | Asia Pacific, Africa, Latin America | Long-term (2025-2033) |

| Integration of Blockchain & DLT for Cross-Border Payments | +2.5% | Global | Mid to Long-term (2027-2033) |

| Growth of Embedded Finance & Banking-as-a-Service (BaaS) | +2.2% | North America, Europe, Asia Pacific | Mid-term (2025-2030) |

| Focus on Personalized Financial Products & Services | +1.8% | Global | Continuous |

| Strategic Partnerships & Collaborations (Fintech-TradFi) | +1.5% | Global | Continuous |

Lending and Payment Market Challenges Impact Analysis

The Lending and Payment market faces several significant challenges that require strategic navigation for sustained growth. One primary challenge is the escalating competition from both traditional financial institutions adapting to digital trends and innovative fintech startups, as well as the entry of large technology companies leveraging their vast user bases. This intensified competition often leads to pricing pressures and a race to innovate, demanding continuous investment in technology and customer experience.

Another critical challenge is maintaining profitability amidst evolving business models and increasing customer expectations for lower fees and instant services. The high cost of compliance with stringent anti-money laundering (AML) and know-your-customer (KYC) regulations, coupled with the need for robust fraud prevention systems, adds significant operational overhead. Additionally, the rapid pace of technological change necessitates continuous upskilling of the workforce and investment in scalable, future-proof infrastructure, presenting a significant financial and operational hurdle for many market participants.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Regulatory Compliance & Anti-Fraud Measures | -1.3% | Global | Continuous |

| Intense Competition from Fintechs & Big Tech | -1.0% | Global | Continuous |

| Talent Shortage & Skill Gap in Digital Finance | -0.7% | North America, Europe | Long-term (2025-2033) |

| Ensuring Interoperability Across Diverse Systems | -0.5% | Global | Long-term (2025-2033) |

| Building & Maintaining Consumer Trust in Digital Platforms | -0.8% | Global | Continuous |

Lending and Payment Market - Updated Report Scope

This report offers an in-depth analysis of the global Lending and Payment market, providing a comprehensive overview of market size, trends, drivers, restraints, opportunities, and challenges. It delves into the impact of emerging technologies, particularly Artificial Intelligence, on the industry's landscape. The scope includes a detailed segmentation analysis, regional insights, and profiles of key market players, aiming to provide stakeholders with actionable intelligence for strategic decision-making and future growth planning within this dynamic financial sector.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 1.8 Trillion |

| Market Forecast in 2033 | USD 4.9 Trillion |

| Growth Rate | 13.5% CAGR |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | JPMorgan Chase & Co., Visa Inc., Mastercard Inc., PayPal Holdings, Inc., Ant Group, Stripe, Inc., Adyen N.V., Block, Inc., Fiserv, Inc., Global Payments Inc., Citi, Bank of America Corp., Goldman Sachs Group, Inc., LendingClub Corporation, SoFi Technologies, Inc., Affirm Holdings, Inc., Klarna Bank AB, Revolut Ltd., N26 GmbH, Chime Financial, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Lending and Payment market is segmented across various dimensions to provide a granular understanding of its diverse components and dynamics. This segmentation facilitates a detailed analysis of specific market niches, technological adoption patterns, and end-user preferences. Understanding these segments is crucial for identifying key growth areas, competitive landscapes, and strategic opportunities for market participants, enabling them to tailor products and services to specific demands and capitalize on emerging trends. The market's complexity necessitates a multi-faceted approach to segmentation, covering types of lending, payment methods, underlying technologies, and target end-users.

The comprehensive segmentation highlights the shift from traditional financial models to more agile, technology-driven solutions. The increasing preference for digital payment methods over conventional cash or card transactions, coupled with the rising demand for flexible lending products like Buy Now, Pay Later, underscores a fundamental change in consumer behavior. Furthermore, the distinction between on-premise and cloud-based deployment models reflects the industry's move towards scalable and cost-efficient infrastructure, with cloud solutions gaining significant traction due to their flexibility and accessibility.

- By Component: Software (Platform Solutions, Analytics & Reporting Tools, Security & Fraud Management, APIs), Services (Consulting, Implementation, Support & Maintenance, Managed Services)

- By Lending Type: Consumer Lending (Personal Loans, Mortgage Loans, Auto Loans, Student Loans, Buy Now, Pay Later (BNPL)), Business Lending (SME Loans, Corporate Loans, Working Capital Loans, Equipment Financing), Peer-to-Peer (P2P) Lending

- By Payment Method: Digital Payments (Mobile Wallets, Online Bank Transfers, QR Code Payments, Wearable Payments, Contactless Payments), Card Payments (Credit Cards, Debit Cards, Prepaid Cards), Bank Transfers (ACH, Wire Transfers, RTGS), Cash Payments

- By End-User: Retail & E-commerce, Financial Institutions (Banks, Credit Unions, Fintechs), Healthcare, Travel & Hospitality, Other Industries

- By Technology: Artificial Intelligence (AI) & Machine Learning (ML), Blockchain & Distributed Ledger Technology (DLT), Cloud Computing, Application Programming Interfaces (APIs), Biometrics

- By Deployment Model: On-Premise, Cloud-Based

Regional Highlights

Geographically, the Lending and Payment market exhibits distinct growth patterns and maturity levels across different regions. North America and Europe represent mature markets characterized by high digital adoption rates, robust regulatory frameworks, and significant innovation in fintech. These regions are witnessing increased integration of advanced technologies like AI and blockchain into existing financial infrastructures, driving efficiency and new product development. The focus here is often on enhancing user experience, cross-border payment efficiency, and sophisticated risk management.

Asia Pacific (APAC) is projected to be the fastest-growing region, propelled by its large unbanked and underbanked populations, rapid smartphone penetration, and a burgeoning e-commerce sector. Countries like China and India lead in mobile payments and digital lending, demonstrating massive scale and rapid innovation. Latin America, the Middle East, and Africa (MEA) are also emerging as high-growth markets, driven by increasing financial inclusion initiatives, remittances, and the leapfrogging of traditional banking infrastructure directly to mobile-centric solutions. These regions present significant opportunities for mobile money, micro-lending, and innovative payment solutions tailored to local needs.

- North America: Dominant market share attributed to high technological adoption, robust financial infrastructure, and early embrace of fintech innovations.

- Europe: Strong growth driven by Open Banking initiatives, PSD2 regulations, and a competitive landscape fostering digital transformation in both traditional banks and fintechs.

- Asia Pacific (APAC): Expected to be the fastest-growing region due to vast untapped markets, rapid smartphone penetration, booming e-commerce, and government-backed digital payment initiatives.

- Latin America: Emerging market with significant potential, fueled by increasing digital literacy, mobile money adoption, and a rising middle class driving demand for accessible financial services.

- Middle East and Africa (MEA): Growth spurred by high remittance volumes, increasing financial inclusion efforts, and mobile-first payment solutions addressing infrastructure gaps.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Lending and Payment Market.- JPMorgan Chase & Co.

- Visa Inc.

- Mastercard Inc.

- PayPal Holdings, Inc.

- Ant Group

- Stripe, Inc.

- Adyen N.V.

- Block, Inc.

- Fiserv, Inc.

- Global Payments Inc.

- Citi

- Bank of America Corp.

- Goldman Sachs Group, Inc.

- LendingClub Corporation

- SoFi Technologies, Inc.

- Affirm Holdings, Inc.

- Klarna Bank AB

- Revolut Ltd.

- N26 GmbH

- Chime Financial, Inc.

Frequently Asked Questions

Analyze common user questions about the Lending and Payment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver of growth in the Lending and Payment market?

The primary driver is the accelerating digital transformation across industries, coupled with widespread smartphone adoption, which facilitates seamless digital payment methods and accessible online lending platforms globally.

How is AI impacting credit assessment and fraud detection in the market?

AI significantly enhances credit assessment by enabling real-time analysis of vast datasets for more accurate risk profiling, and it revolutionizes fraud detection with predictive analytics that identify suspicious activities much faster than traditional methods.

What are the key opportunities in emerging markets for Lending and Payment solutions?

Emerging markets offer substantial opportunities due to large unbanked populations, increasing digital literacy, and the potential for direct adoption of mobile-first lending and payment solutions, bypassing traditional financial infrastructure.

What role does embedded finance play in the future of lending and payments?

Embedded finance is crucial as it integrates financial services directly into non-financial platforms and applications, making lending and payment processes seamless and contextually relevant, thereby expanding market reach and enhancing user convenience.

What are the main challenges facing the Lending and Payment industry?

Key challenges include navigating complex and evolving regulatory landscapes, mitigating persistent cybersecurity threats and data privacy concerns, managing intense competition, and addressing the need for continuous technological upgrades and skilled talent.