Marine Liability Insurance Market

Marine Liability Insurance Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_705512 | Last Updated : August 14, 2025 |

Format : ![]()

![]()

![]()

![]()

Marine Liability Insurance Market Size

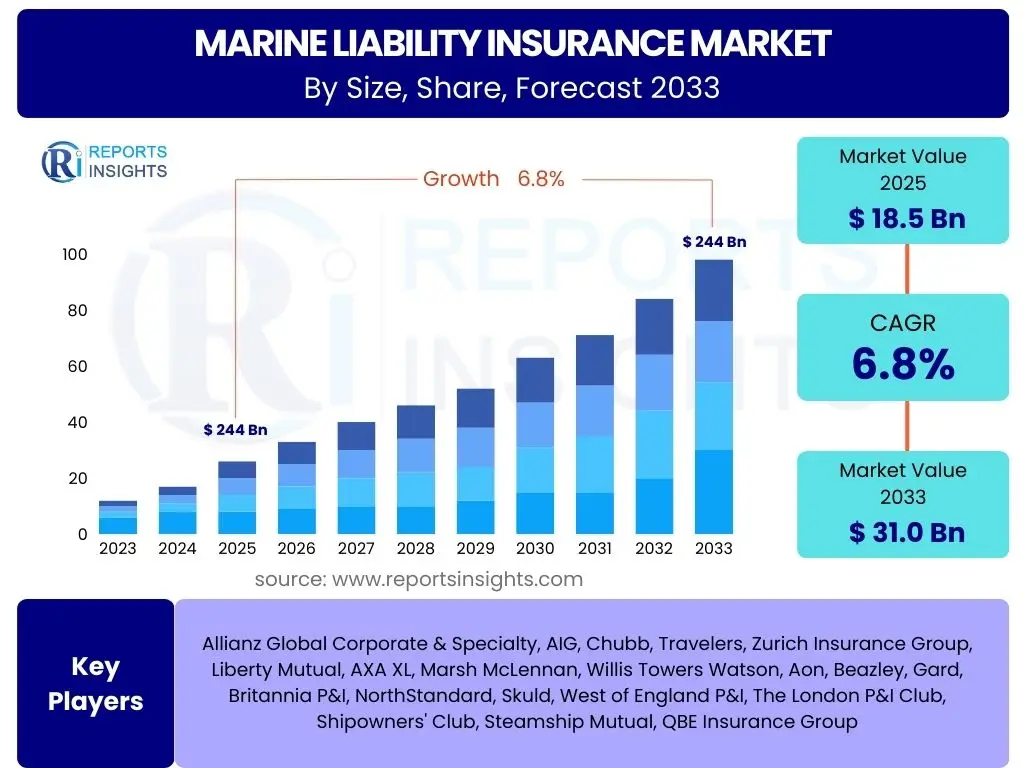

According to Reports Insights Consulting Pvt Ltd, The Marine Liability Insurance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2033. The market is estimated at USD 18.5 Billion in 2025 and is projected to reach USD 31.0 Billion by the end of the forecast period in 2033.

Key Marine Liability Insurance Market Trends & Insights

The Marine Liability Insurance market is undergoing significant transformation, driven by evolving maritime risks, technological advancements, and increasing regulatory scrutiny. Users frequently inquire about the impact of climate change, digitalization, and geopolitical shifts on insurance policies and premiums. There is a clear interest in understanding how insurers are adapting to new forms of risk, such as cyber threats to maritime operations, and the role of data analytics in underwriting and claims management. The demand for more customized and flexible insurance products that cater to specialized vessel types and operational profiles is also a recurring theme.

Furthermore, discussions often revolve around the implications of increased vessel automation, the expansion of global trade routes, and the rising complexity of supply chains. Stakeholders are keen to learn about strategies employed by insurers to maintain profitability amidst fluctuating economic conditions and a highly competitive landscape. The emphasis is shifting towards proactive risk management and partnerships that extend beyond traditional indemnity, encompassing advisory services and loss prevention initiatives. This holistic approach aims to mitigate liabilities before they occur, reflecting a growing maturity in the marine insurance ecosystem.

- Rising adoption of data analytics and predictive modeling for enhanced risk assessment and pricing.

- Increasing demand for specialized coverages for offshore wind farms, autonomous vessels, and cyber risks.

- Greater emphasis on environmental, social, and governance (ESG) factors in underwriting and claims.

- Development of parametric insurance solutions for specific climate-related perils.

- Consolidation among P&I Clubs and commercial insurers to achieve scale and market reach.

AI Impact Analysis on Marine Liability Insurance

The integration of Artificial Intelligence (AI) within the Marine Liability Insurance sector is a prominent area of user inquiry, focusing on its potential to revolutionize risk assessment, claims processing, and fraud detection. Users frequently question how AI can improve the accuracy of underwriting by analyzing vast datasets, including historical claims, weather patterns, vessel tracking data, and port congestion information. Concerns often arise regarding data privacy, algorithmic bias, and the ethical implications of using AI in critical decision-making processes, alongside the potential for job displacement within the industry.

AI's influence extends to enhancing operational efficiency through automation of routine tasks, enabling insurers to allocate human resources to more complex cases requiring expert judgment. There is significant interest in AI's ability to identify fraudulent claims patterns, optimize subrogation processes, and even provide real-time risk warnings to vessel operators. While the transformative potential of AI is widely acknowledged, stakeholders emphasize the need for robust regulatory frameworks, transparent AI models, and continuous training for personnel to effectively leverage these advanced technologies while maintaining human oversight and accountability in marine insurance operations.

- Enhanced risk prediction and pricing through advanced data analysis of vessel telemetry, weather, and historical claims.

- Automated claims processing and fraud detection, improving efficiency and reducing settlement times.

- Development of intelligent underwriting platforms that offer dynamic policy adjustments based on real-time risk profiles.

- Support for proactive risk management and loss prevention through AI-powered predictive alerts.

- Potential for personalized premium calculation based on individual vessel performance and safety records.

Key Takeaways Marine Liability Insurance Market Size & Forecast

The Marine Liability Insurance market is poised for robust growth, driven by an expanding global maritime trade and an increasing awareness of the multifaceted risks associated with marine operations. Key inquiries often center on the primary factors contributing to this growth, the resilience of the market against economic fluctuations, and the strategic opportunities for market participants. The forecast indicates a steady upward trajectory, highlighting the indispensable role of marine liability coverage in facilitating global commerce and mitigating unforeseen liabilities for shipowners, operators, and other stakeholders.

Furthermore, the market's future is intrinsically linked to advancements in maritime technology, evolving international regulations, and the proactive adoption of digital solutions by insurers. Stakeholders are keen to understand how market players are leveraging data and analytics to refine their offerings and maintain competitive advantage. The sustained growth projection underscores a fundamental need for comprehensive risk transfer mechanisms within the dynamic and inherently risky maritime sector, positioning marine liability insurance as a critical enabler of safe and efficient global shipping.

- The market is projected for substantial growth, reaching USD 31.0 Billion by 2033, driven by global trade expansion.

- Technological integration, particularly AI and data analytics, will be pivotal in shaping future market dynamics and service offerings.

- Evolving regulatory landscapes and increasing environmental concerns are compelling factors driving demand for comprehensive liability coverage.

- Specialized and customized insurance solutions are becoming increasingly important to address diverse and complex maritime risks.

- Strategic partnerships and mergers within the insurance sector are expected to enhance capacity and market reach.

Marine Liability Insurance Market Drivers Analysis

The Marine Liability Insurance market is propelled by several robust drivers that reflect the dynamic nature of global maritime activities. The continuous expansion of international trade, coupled with increasing seaborne traffic, inherently elevates the potential for accidents, environmental damage, and third-party liabilities, thereby creating a sustained demand for comprehensive insurance solutions. Furthermore, the global fleet continues to expand and diversify, incorporating more sophisticated and larger vessels, which in turn introduces new complexities and higher potential liabilities for insurers to cover.

Technological advancements in shipping, such as the gradual introduction of autonomous vessels and advanced navigation systems, while aiming to reduce risks, also introduce novel liabilities that necessitate specialized insurance products. Concurrently, a heightened global awareness regarding environmental protection and increasingly stringent international regulations, such as those related to pollution prevention and wreck removal, compel marine operators to secure adequate liability coverage to meet compliance requirements and mitigate substantial financial penalties. These drivers collectively foster an environment of consistent demand and innovation within the marine liability insurance sector.

| Drivers | (~) Impact on % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growth in Global Maritime Trade

×

Download a Free Sample

Marine Liability Insurance Market

|