Managed Security Service Market

Managed Security Service Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_703250 | Last Updated : August 01, 2025 |

Format : ![]()

![]()

![]()

![]()

Managed Security Service Market Size

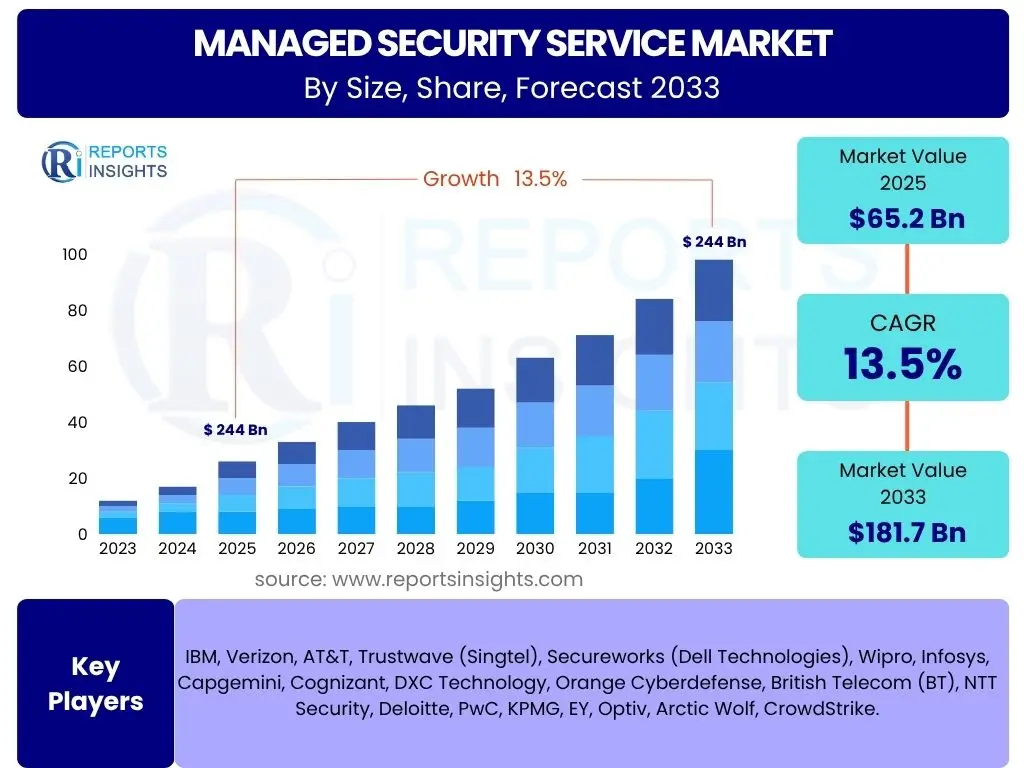

According to Reports Insights Consulting Pvt Ltd, The Managed Security Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 13.5% between 2025 and 2033. The market is estimated at USD 65.2 Billion in 2025 and is projected to reach USD 181.7 Billion by the end of the forecast period in 2033.

Key Managed Security Service Market Trends & Insights

User inquiries frequently center on the evolving landscape of cyber threats, the increasing complexity of regulatory frameworks, and the critical need for specialized security expertise. A key trend emerging is the shift towards proactive threat hunting and continuous monitoring, moving beyond traditional reactive security measures. Organizations are increasingly seeking integrated security solutions that offer comprehensive visibility across hybrid and multi-cloud environments, recognizing that fragmented security approaches lead to vulnerabilities. Furthermore, there is a growing demand for managed security services that can effectively address the unique security challenges posed by remote workforces and the proliferation of IoT devices, highlighting the need for adaptive and scalable security models.

Another significant area of interest involves the integration of advanced technologies like Artificial Intelligence (AI) and Machine Learning (ML) into Managed Security Services (MSS), aiming to enhance threat detection capabilities and automate response actions. Users are keen to understand how these technologies contribute to reducing alert fatigue and improving the efficiency of security operations centers (SOCs). The convergence of IT and Operational Technology (OT) security is also gaining traction, particularly in critical infrastructure sectors, as businesses strive for holistic protection across all operational layers. This holistic approach extends to a greater emphasis on compliance and governance, with businesses seeking MSS providers who can help navigate complex global and industry-specific regulations, ensuring data integrity and privacy.

- Shift from reactive to proactive threat hunting and continuous monitoring.

- Increased demand for comprehensive visibility across hybrid and multi-cloud environments.

- Growing need for security solutions adapted to remote work and IoT proliferation.

- Integration of advanced AI and ML for enhanced threat detection and automated response.

- Convergence of IT and Operational Technology (OT) security for holistic protection.

- Emphasis on regulatory compliance and governance as a core service offering.

- Expansion of specialized services such as dark web monitoring and digital risk protection.

AI Impact Analysis on Managed Security Service

User questions regarding AI's impact on Managed Security Services frequently revolve around its potential to revolutionize threat detection, response automation, and overall operational efficiency. There is significant interest in how AI can move beyond simple anomaly detection to predictive analytics, identifying nascent attack patterns before they fully materialize. Users are also keen to understand the extent to which AI can alleviate the persistent cybersecurity talent shortage by automating routine tasks, thereby freeing human analysts to focus on complex investigations and strategic initiatives. Concerns often include the potential for AI-driven systems to generate false positives, the need for robust data governance to train AI models effectively, and the ethical implications of autonomous decision-making in security contexts.

AI's influence is evident in its capacity to process vast volumes of security data at speeds impossible for human analysts, leading to more rapid identification of sophisticated threats like zero-day exploits and advanced persistent threats (APTs). It enables more intelligent orchestration of security tools, streamlining workflows and reducing response times from hours to minutes or even seconds. The application of AI extends to user and entity behavior analytics (UEBA), providing deeper insights into anomalous activities within an organization's network. Furthermore, AI-powered systems are enhancing vulnerability management by prioritizing patches based on predictive risk assessments and improving security posture management through continuous assessment and automated recommendations. This transformative impact positions AI as a core enabler for the next generation of managed security services.

- Enhanced threat detection through rapid analysis of vast data volumes.

- Automated incident response and remediation workflows, reducing mean time to detect (MTTD) and mean time to respond (MTTR).

- Improved predictive analytics for identifying emerging attack patterns and zero-day threats.

- Reduction in alert fatigue for security analysts through intelligent prioritization and correlation.

- Advanced User and Entity Behavior Analytics (UEBA) for identifying insider threats and anomalous activities.

- Optimization of security posture management and vulnerability prioritization.

- Alleviation of cybersecurity talent shortages by automating routine and repetitive tasks.

Key Takeaways Managed Security Service Market Size & Forecast

Common user questions about the Managed Security Service market size and forecast highlight a strong interest in understanding the core growth drivers and the long-term viability of the sector. Insights suggest that the market's substantial projected growth is fundamentally driven by the escalating volume and sophistication of cyberattacks, compelling organizations across all sectors to seek external expertise. The increasing adoption of cloud computing, coupled with the rapid expansion of digital transformation initiatives, further necessitates robust and scalable security solutions that MSS providers are uniquely positioned to deliver. The persistent global shortage of skilled cybersecurity professionals is another critical factor compelling businesses to outsource their security operations, ensuring continuous monitoring and expert incident response capabilities.

The forecast indicates sustained expansion, with opportunities arising from niche industry requirements and the integration of emerging technologies. This growth trajectory underscores the transition of cybersecurity from a mere IT function to a strategic business imperative, with MSS playing a pivotal role in maintaining operational resilience and brand reputation. Businesses are increasingly recognizing the cost-effectiveness and efficiency benefits of leveraging external security providers, allowing them to focus on core competencies while ensuring their digital assets are protected by dedicated specialists. The robust market size and forecast reflect a fundamental shift in how organizations approach cybersecurity, moving towards a comprehensive, managed, and perpetually evolving defense strategy.

- Market demonstrates robust growth, driven by increasing cyber threat landscape complexity.

- Significant expansion attributed to accelerated digital transformation and cloud adoption across industries.

- Persistent global cybersecurity talent gap is a primary catalyst for MSS adoption.

- MSS offers a cost-effective and efficient alternative to in-house security operations.

- Future growth fueled by integration of advanced technologies like AI/ML and specialized service offerings.

- Cybersecurity is transitioning into a strategic business imperative, with MSS as a key enabler.

Managed Security Service Market Drivers Analysis

The Managed Security Service (MSS) market is propelled by a confluence of critical factors that necessitate outsourced cybersecurity expertise. The unprecedented increase in the frequency, sophistication, and impact of cyberattacks, including ransomware, phishing, and supply chain attacks, forces organizations to seek advanced defensive capabilities. Simultaneously, the global shortage of qualified cybersecurity professionals makes it increasingly challenging for businesses to build and maintain in-house security operations centers (SOCs) capable of 24/7 monitoring and rapid incident response. This talent gap directly boosts the appeal of MSS providers who offer access to specialized skills and round-the-clock coverage without the overhead of internal recruitment and training.

Furthermore, the accelerating pace of digital transformation across industries, marked by widespread cloud adoption, IoT proliferation, and remote work models, expands the attack surface significantly. Organizations struggle to secure these diverse and dynamic environments with traditional perimeter defenses, driving demand for comprehensive, cloud-native, and endpoint-agnostic security solutions that MSS providers can deliver. The ever-tightening web of regulatory compliance mandates, such as GDPR, CCPA, HIPAA, and industry-specific standards, also plays a crucial role. Businesses often lack the expertise and resources to continuously adapt to evolving compliance requirements, making MSS providers invaluable partners in maintaining adherence and avoiding hefty penalties. These drivers collectively create a compelling case for the sustained growth of the managed security services market.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Escalating Volume and Sophistication of Cyberattacks | +3.5% | Global, particularly North America, Europe, APAC | Short to Long Term (2025-2033) |

| Persistent Global Cybersecurity Talent Shortage | +3.0% | Global, acute in developed economies | Mid to Long Term (2026-2033) |

| Rapid Digital Transformation and Cloud Adoption | +2.8% | Global, high in emerging economies | Short to Mid Term (2025-2030) |

| Increasing Stringency of Regulatory Compliance Mandates | +2.2% | Europe (GDPR), North America (CCPA, HIPAA), Asia Pacific (various data privacy laws) | Short to Mid Term (2025-2030) |

| Cost-Effectiveness and Operational Efficiency of Outsourcing Security | +2.0% | Global, especially SMEs and enterprises seeking optimized budgets | Mid to Long Term (2026-2033) |

Managed Security Service Market Restraints Analysis

Despite the strong growth drivers, the Managed Security Service (MSS) market faces certain restraints that could temper its expansion. One significant challenge is the inherent concern over data privacy and control. Organizations, particularly those handling sensitive customer data or intellectual property, may be hesitant to entrust their entire security posture to a third-party provider due to perceived risks of data breaches or lack of direct oversight. This concern is often amplified by fragmented data residency laws and varying international regulations, creating complexities for global enterprises seeking a unified MSS solution.

Another restraint is the high initial cost of transitioning to an MSS model, especially for smaller organizations or those with existing legacy security infrastructure. While MSS promises long-term cost savings, the upfront investment in assessment, integration, and potential upgrades can be a barrier. Furthermore, the complexity of integrating MSS solutions with diverse existing IT environments, which often comprise multiple vendors and proprietary systems, can lead to deployment challenges and extended onboarding periods. The potential for vendor lock-in, where switching providers becomes costly and disruptive due to deep integration with specific security technologies, also acts as a deterrent for some organizations, limiting market agility and competition. These factors collectively require MSS providers to offer flexible, transparent, and highly secure services to alleviate client concerns.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Data Privacy and Control Concerns | -1.5% | Global, particularly in highly regulated industries | Long Term (2028-2033) |

| High Initial Cost of Transition and Integration Complexity | -1.2% | Global, more pronounced for SMEs | Short to Mid Term (2025-2030) |

| Perception of Vendor Lock-in and Loss of Direct Control | -1.0% | Global, especially large enterprises | Mid Term (2026-2031) |

| Lack of Standardization in Service Offerings and SLAs | -0.8% | Global, affects buyer decision-making | Short to Mid Term (2025-2029) |

| Reliance on Trust and Reputation of Third-Party Providers | -0.7% | Global, critical for new market entrants | Long Term (2028-2033) |

Managed Security Service Market Opportunities Analysis

Significant opportunities exist within the Managed Security Service (MSS) market, stemming from the evolving digital landscape and increasing enterprise complexity. The rapid proliferation of advanced technologies like 5G, IoT, and Operational Technology (OT) in critical infrastructure and industrial settings creates new attack vectors and distinct security challenges. MSS providers capable of offering specialized security services for these nascent areas, including dedicated IoT/OT security monitoring and incident response, stand to gain substantial market share. This specialization extends to emerging threat landscapes such as quantum computing risks and evolving cyber-physical system vulnerabilities, demanding proactive and innovative security solutions.

Another major opportunity lies in the expansion of niche vertical market offerings. While MSS has traditionally served broad enterprise needs, there is growing demand for highly tailored security services that address the specific regulatory, compliance, and threat profiles of sectors like healthcare (e.g., medical device security), finance (e.g., anti-fraud services), and manufacturing (e.g., supply chain security). The integration of cutting-edge technologies like advanced AI-driven threat intelligence, Security Orchestration, Automation, and Response (SOAR) platforms, and extended detection and response (XDR) into MSS offerings presents further avenues for growth. These technologies enable MSS providers to deliver more efficient, effective, and proactive security outcomes, enhancing their value proposition. Furthermore, the increasing adoption of cloud-native security postures and the demand for managed detection and response (MDR) services represent substantial growth areas as organizations prioritize advanced threat hunting and rapid incident containment.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Expansion into IoT and OT Security Services | +2.5% | Global, particularly industrial and critical infrastructure sectors | Mid to Long Term (2026-2033) |

| Specialization in Niche Vertical Markets (e.g., Healthcare, Manufacturing) | +2.0% | Global, tailored to specific regional regulations | Mid Term (2026-2031) |

| Integration of Advanced AI, SOAR, and XDR Capabilities | +1.8% | Global, driven by technological advancements | Short to Mid Term (2025-2030) |

| Growing Demand for Managed Detection and Response (MDR) | +1.5% | Global, especially North America and Europe | Short Term (2025-2029) |

| Addressing Supply Chain Security and Third-Party Risk Management | +1.2% | Global, critical for interconnected enterprises | Mid to Long Term (2027-2033) |

Managed Security Service Market Challenges Impact Analysis

The Managed Security Service (MSS) market faces several significant challenges that could impede its growth and complicate service delivery. The continuously evolving and increasingly sophisticated cyber threat landscape poses a perpetual challenge for MSS providers. New attack vectors, polymorphic malware, and state-sponsored threats require constant innovation in defensive strategies and significant investment in threat intelligence, making it difficult to stay ahead without substantial R&D. This relentless pace of evolution demands that MSS providers continuously update their toolsets, methodologies, and expertise, which can be resource-intensive.

Another major challenge is managing the sheer volume of security alerts and avoiding alert fatigue for analysts. Despite automation and AI, the deluge of security data can overwhelm SOC teams, potentially leading to missed critical alerts or delayed responses. This requires sophisticated correlation engines and highly skilled human oversight, which are costly resources. Furthermore, establishing clear Service Level Agreements (SLAs) and demonstrating tangible Return on Investment (ROI) for complex security services can be difficult. Clients often struggle to quantify the value of preventing an attack, leading to skepticism about the ongoing investment. The challenge of integrating MSS with diverse and often proprietary client IT infrastructures, ensuring seamless data flow and operational efficiency, also persists. These challenges necessitate robust operational frameworks, continuous skill development, and clear communication with clients to build and maintain trust and demonstrate value.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Rapidly Evolving Cyber Threat Landscape | -1.8% | Global | Ongoing (2025-2033) |

| Managing Alert Fatigue and False Positives | -1.5% | Global, impacts operational efficiency | Ongoing (2025-2033) |

| Difficulty in Demonstrating Tangible ROI and Value | -1.2% | Global, affects client acquisition and retention | Mid to Long Term (2026-2033) |

| Integration Complexities with Diverse Client IT Infrastructures | -1.0% | Global, especially for large enterprises with legacy systems | Short to Mid Term (2025-2030) |

| Ensuring Data Privacy and Compliance Across Jurisdictions | -0.9% | Global, particularly cross-border operations | Ongoing (2025-2033) |

Managed Security Service Market - Updated Report Scope

This report provides a comprehensive analysis of the Managed Security Service market, offering an in-depth examination of market size, growth trends, key drivers, restraints, opportunities, and challenges. It covers the period from 2019 to 2033, with 2024 as the base year and forecasts extending to 2033. The scope includes detailed segmentation analysis by service type, organization size, industry vertical, and deployment model, alongside a robust regional analysis covering major geographies. Furthermore, the report identifies the competitive landscape, profiling key players and their strategic initiatives, to provide a holistic view of the market's current state and future trajectory.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 65.2 Billion |

| Market Forecast in 2033 | USD 181.7 Billion |

| Growth Rate | 13.5% |

| Number of Pages | 267 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | IBM, Verizon, AT&T, Trustwave (Singtel), Secureworks (Dell Technologies), Wipro, Infosys, Capgemini, Cognizant, DXC Technology, Orange Cyberdefense, British Telecom (BT), NTT Security, Deloitte, PwC, KPMG, EY, Optiv, Arctic Wolf, CrowdStrike. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Managed Security Service market is meticulously segmented to provide granular insights into its diverse components and their respective growth trajectories. These segments reflect the various ways organizations consume security services, the scale of their operations, and their specific industry requirements. Understanding these segmentations is crucial for identifying targeted opportunities and tailoring service offerings to meet specific market demands. The market is primarily broken down by the type of security service offered, distinguishing between foundational elements like SIEM and more advanced capabilities such as MDR or SOC-as-a-Service, reflecting the increasing sophistication required to combat modern cyber threats.

Further segmentation by organization size highlights the varying security needs and budget constraints between Small and Medium-sized Enterprises (SMEs) and Large Enterprises, with MSS providers often offering tiered services. The industry vertical segmentation underscores the specialized compliance and threat landscape requirements unique to sectors such as BFSI, Healthcare, and Government. Finally, the deployment model segmentation (On-Premise, Cloud, Hybrid) illustrates the prevalent infrastructure preferences of organizations and the adaptability of MSS solutions to diverse IT environments. This comprehensive segmentation allows for a nuanced understanding of market dynamics and future growth pockets within the Managed Security Service ecosystem.

- By Service Type:

- Security Information and Event Management (SIEM)

- Endpoint Security

- Network Security

- Cloud Security

- Incident Response

- Vulnerability Management

- Compliance Management

- Threat Intelligence

- Identity and Access Management (IAM)

- Security Device Management

- Distributed Denial-of-Service (DDoS) Mitigation

- Managed Detection and Response (MDR)

- Security Operations Center (SOC)-as-a-Service

- Risk and Compliance Management

- Security Consulting

- By Organization Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

- By Industry Vertical:

- BFSI (Banking, Financial Services, and Insurance)

- IT and Telecom

- Healthcare

- Retail and E-commerce

- Manufacturing

- Government and Public Sector

- Energy and Utilities

- Education

- Others

- By Deployment:

- On-Premise

- Cloud

- Hybrid

Regional Highlights

- North America: Dominates the Managed Security Service market due to early adoption of advanced security technologies, the presence of major security vendors, stringent regulatory frameworks, and a high incidence of sophisticated cyberattacks. The region benefits from significant investments in cybersecurity infrastructure across large enterprises and government agencies, driving robust demand for comprehensive managed security solutions. The high concentration of IT and telecom companies and a mature cloud adoption rate further contribute to its market leadership.

- Europe: Exhibits substantial growth, driven by stringent data protection regulations such as GDPR, which compel organizations to enhance their security postures. Increasing awareness about cyber risks among SMEs and a growing focus on digital transformation initiatives across industries also fuel the demand for MSS. Western European countries, particularly the UK, Germany, and France, are key contributors, emphasizing compliance and resilience.

- Asia Pacific (APAC): Emerging as the fastest-growing region, propelled by rapid digital transformation, increasing internet penetration, and a burgeoning number of cyber threats across developing economies like India, China, and Southeast Asian nations. Governments and businesses in this region are making significant investments in cybersecurity infrastructure, recognizing the economic impact of cyberattacks. The region's large and diverse industrial base also drives demand for tailored MSS.

- Latin America: Demonstrates steady growth, influenced by expanding digital economies, increasing cloud adoption, and a rising awareness of cybersecurity risks. While budget constraints can be a factor, the escalating threat landscape and the need for specialized expertise are driving organizations to adopt managed security services, particularly in countries like Brazil and Mexico.

- Middle East and Africa (MEA): Expected to experience considerable growth, primarily due to significant government investments in critical infrastructure protection, smart city initiatives, and economic diversification efforts. The region's reliance on oil and gas industries also drives demand for specialized OT security services. Increased foreign investments and digital transformation projects are further catalyzing the adoption of MSS across various sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Managed Security Service Market.- IBM

- Verizon

- AT&T

- Trustwave (Singtel)

- Secureworks (Dell Technologies)

- Wipro

- Infosys

- Capgemini

- Cognizant

- DXC Technology

- Orange Cyberdefense

- British Telecom (BT)

- NTT Security

- Deloitte

- PwC

- KPMG

- EY

- Optiv

- Arctic Wolf

- CrowdStrike

Frequently Asked Questions

Analyze common user questions about the Managed Security Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is a Managed Security Service (MSS)?

Managed Security Service (MSS) involves the outsourcing of an organization's security operations and functions to a third-party service provider. This typically includes 24/7 monitoring, threat detection, incident response, vulnerability management, compliance management, and security device management, leveraging specialized expertise and advanced technologies to protect digital assets.

Why are organizations adopting Managed Security Services?

Organizations adopt MSS primarily due to the escalating volume and sophistication of cyber threats, the global shortage of skilled cybersecurity professionals, and the increasing complexity of regulatory compliance. MSS provides access to expert capabilities, round-the-clock protection, and often proves more cost-effective than building and maintaining an in-house security operations center.

How does AI impact the Managed Security Service market?

AI significantly enhances MSS by enabling faster and more accurate threat detection, automating routine security tasks, improving predictive analytics, and reducing false positives. It empowers MSS providers to process vast amounts of data, identify complex attack patterns, and orchestrate rapid responses, ultimately increasing the efficiency and effectiveness of security operations.

What are the key drivers for growth in the Managed Security Service market?

Key drivers include the dramatic rise in cyberattacks, the persistent cybersecurity talent gap, the acceleration of digital transformation and cloud adoption, and the increasing stringency of global and industry-specific regulatory compliance mandates. These factors compel businesses to seek external, specialized security expertise.

What are the primary challenges faced by the MSS market?

The primary challenges include the rapidly evolving cyber threat landscape, the difficulty in managing alert fatigue and false positives, the complexities of integrating MSS with diverse client IT infrastructures, and demonstrating tangible Return on Investment (ROI) for security services. Ensuring data privacy and compliance across multiple jurisdictions also remains a significant hurdle.