LNG Regasification Terminal Market

LNG Regasification Terminal Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_702034 | Last Updated : July 31, 2025 |

Format : ![]()

![]()

![]()

![]()

LNG Regasification Terminal Market Size

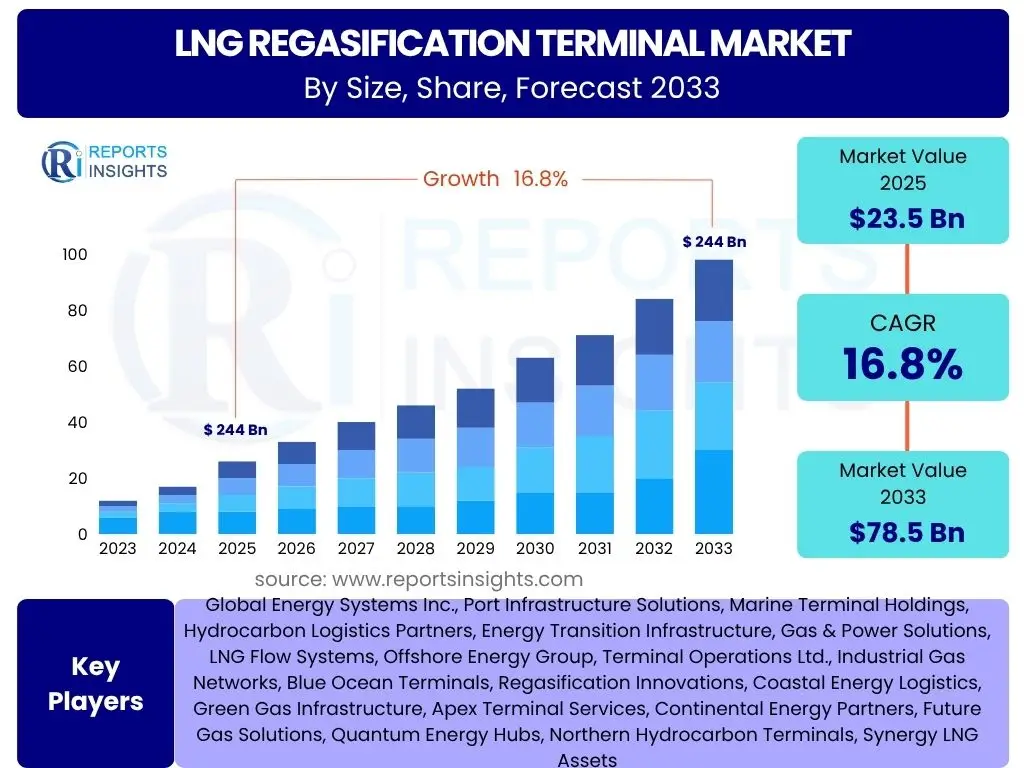

According to Reports Insights Consulting Pvt Ltd, The LNG Regasification Terminal Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 16.8% between 2025 and 2033. The market is estimated at USD 23.5 billion in 2025 and is projected to reach USD 78.5 billion by the end of the forecast period in 2033. This robust growth trajectory is primarily driven by the increasing global demand for natural gas as a cleaner transitional fuel, coupled with strategic imperatives for energy security and diversification of supply sources across various regions worldwide. The expansion of existing facilities and the development of new terminals, particularly Floating Storage and Regasification Units (FSRUs), are significant contributors to this market's impressive valuation and sustained expansion.

The market's considerable expansion reflects a global shift towards natural gas, which is seen as a crucial bridge fuel in the transition from coal to renewable energy sources. This transition is further accelerated by geopolitical factors that highlight the importance of secure and flexible energy supply chains. Investments in regasification infrastructure are becoming a national priority for many countries aiming to enhance their energy independence and integrate more diverse energy portfolios, ensuring stable and reliable power generation amidst fluctuating global energy dynamics. The forecasted growth underscores the strategic importance of LNG regasification terminals in the evolving global energy landscape.

Key LNG Regasification Terminal Market Trends & Insights

The LNG Regasification Terminal market is shaped by several dynamic trends, reflecting global energy transitions, geopolitical shifts, and technological advancements. Key user questions frequently revolve around the impact of energy security concerns, the rising adoption of flexible infrastructure, and the integration of sustainable practices. The market is increasingly witnessing a focus on energy independence, leading nations to invest in diversified gas supply capabilities. This investment often manifests in the form of accelerated deployment of offshore solutions like FSRUs due to their rapid deployment time and operational flexibility. Additionally, the drive towards decarbonization is influencing terminal design and operations, prompting discussions around integrating carbon capture technologies and exploring hydrogen blending capabilities to future-proof infrastructure.

A significant insight into the market is the pivot towards greater agility and resilience in energy infrastructure. Traditional onshore terminals, while crucial, are complemented by the growing preference for FSRUs, which offer quicker deployment and adaptability to evolving demand patterns. Furthermore, the market is experiencing a push for regional energy hubs, where strategically located regasification terminals serve as distribution points for surrounding areas, enhancing regional energy security and fostering economic cooperation. The ongoing energy transition also necessitates an emphasis on environmental considerations, driving innovations in terminal efficiency and emissions reduction, making sustainability a core component of new project development.

- Increased adoption of Floating Storage and Regasification Units (FSRUs) due to their flexibility, faster deployment, and lower capital expenditure compared to traditional onshore terminals.

- Growing emphasis on energy security and diversification of natural gas supply, driven by geopolitical instability and the need to reduce reliance on single-source suppliers.

- Development of small-scale LNG terminals and bunkering infrastructure to support regional distribution, industrial applications, and marine fuel demands.

- Integration of advanced digital technologies, including IoT, AI, and predictive analytics, for optimizing terminal operations, enhancing safety, and improving supply chain efficiency.

- Focus on environmental sustainability, including efforts to reduce methane emissions, explore carbon capture and storage (CCS) integration, and assess hydrogen readiness for future energy blends.

- Rise of demand from emerging economies in Asia Pacific and Latin America, driven by industrialization, urbanization, and increasing power generation needs.

- Strategic investments in existing terminal expansions and upgrades to meet escalating demand and accommodate larger LNG carriers.

AI Impact Analysis on LNG Regasification Terminal

User inquiries concerning AI's impact on LNG regasification terminals often center on operational efficiency, safety improvements, and predictive capabilities. The overarching theme is how artificial intelligence can optimize complex processes, from gas flow management to predictive maintenance, thereby reducing operational costs and enhancing throughput. Users are keen to understand AI's potential in identifying anomalies, preventing equipment failures, and ensuring a safer working environment. Furthermore, there is significant interest in how AI can contribute to better energy management and environmental compliance within these critical infrastructure facilities.

AI's influence extends across various facets of LNG regasification, offering transformative potential for efficiency and resilience. Its application in predictive maintenance models allows operators to anticipate equipment failures, schedule maintenance proactively, and minimize downtime, significantly improving asset reliability. AI-powered analytics can optimize gas send-out rates based on real-time demand and market prices, leading to more cost-effective operations. Moreover, AI enhances safety protocols through intelligent monitoring systems that detect potential hazards, manage emergency responses, and optimize human-machine interfaces. The integration of AI also supports environmental sustainability by enabling precise control of emissions and optimizing energy consumption within the terminal. This technological adoption promises a more intelligent, safer, and economically viable future for LNG regasification.

- Predictive Maintenance and Asset Optimization: AI algorithms analyze sensor data from terminal equipment (pumps, compressors, heat exchangers) to predict potential failures, enabling proactive maintenance, reducing unscheduled downtime, and extending asset lifespan.

- Operational Efficiency and Throughput Optimization: AI-driven models can optimize gas send-out rates, adjust processes based on real-time market demand, weather conditions, and energy prices, leading to more efficient resource utilization and increased throughput.

- Enhanced Safety and Risk Management: AI-powered surveillance systems, anomaly detection, and process control can identify potential safety hazards, predict abnormal operating conditions, and automate responses, significantly improving overall terminal safety.

- Supply Chain and Logistics Optimization: AI can optimize LNG vessel scheduling, inventory management, and port logistics, ensuring timely deliveries and reducing demurrage costs through intelligent forecasting and route optimization.

- Environmental Monitoring and Compliance: AI can monitor emissions, identify leaks, and optimize energy consumption within the terminal, assisting in compliance with environmental regulations and supporting decarbonization efforts.

- Process Control and Automation: AI integration allows for more precise and autonomous control of regasification processes, adjusting parameters in real-time to maintain optimal performance and energy efficiency.

Key Takeaways LNG Regasification Terminal Market Size & Forecast

Common user questions regarding key takeaways from the LNG Regasification Terminal market forecast often highlight the drivers of growth, the role of specific technologies like FSRUs, and the regional dynamics influencing market expansion. The primary insight is the market's robust and consistent growth, propelled by the urgent need for energy security and the ongoing global energy transition. This growth is significantly underpinned by the increasing adoption of flexible and rapidly deployable FSRUs, which cater to immediate energy needs and offer a strategic advantage in volatile energy landscapes. The market is not just expanding in size but also evolving in its operational modalities and strategic importance.

Another crucial takeaway is the strategic shift towards natural gas as a critical component of national energy portfolios, particularly in regions phasing out coal or seeking to diversify away from pipeline gas. The forecast indicates sustained investment in both greenfield projects and the expansion of existing infrastructure, reflecting long-term confidence in LNG's role. Furthermore, the market's resilience against geopolitical fluctuations and its adaptability to varied demands underscore its foundational importance in global energy supply. The emphasis on advanced technologies and sustainable practices within new projects highlights a forward-looking approach to meet future energy and environmental challenges.

- The LNG Regasification Terminal market is poised for significant growth, driven by escalating global energy demand, energy security imperatives, and the role of natural gas as a transitional fuel.

- Floating Storage and Regasification Units (FSRUs) are key enablers of market growth due to their cost-effectiveness, rapid deployment capabilities, and operational flexibility, making them attractive for emerging markets and urgent supply needs.

- Geopolitical factors and the pursuit of energy independence are accelerating investments in regasification infrastructure, particularly in Europe and Asia, to diversify energy sources.

- Technological advancements in terminal design, automation, and environmental performance are enhancing efficiency, reducing operational costs, and supporting sustainability goals.

- The market will witness continued investments in both new project developments and the expansion/upgrading of existing terminals to meet rising demand and accommodate larger vessels.

LNG Regasification Terminal Market Drivers Analysis

The LNG Regasification Terminal market is propelled by a confluence of powerful drivers stemming from global energy dynamics, environmental policies, and strategic national interests. A primary catalyst is the escalating global demand for natural gas, driven by industrialization, urbanization, and increasing power generation requirements, particularly in Asia. Simultaneously, the imperative for enhanced energy security and supply diversification has become paramount for many nations. Geopolitical events underscore the vulnerability of relying on single-source energy supplies, prompting significant investment in LNG import capabilities to ensure a stable and flexible energy portfolio. This strategic shift is further supported by the advantages of natural gas as a cleaner burning fossil fuel compared to coal or oil, aligning with environmental objectives to reduce greenhouse gas emissions while still meeting baseload power demands during the energy transition.

The flexibility and rapid deployment of Floating Storage and Regasification Units (FSRUs) also serve as a significant market driver. These offshore solutions offer a quicker and often more cost-effective alternative to traditional onshore terminals, making them particularly attractive for countries with urgent energy needs or those seeking interim solutions. Furthermore, the expansion of the global LNG trade, enabled by new liquefaction projects and larger, more efficient LNG carriers, provides a robust supply chain that encourages investment in import infrastructure. The increasing liquefaction capacity worldwide directly correlates with the need for more regasification facilities to absorb and distribute this growing supply, creating a synergistic growth cycle within the entire LNG value chain.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Global Demand for Natural Gas | +5.5% | Asia Pacific, Europe, Latin America | 2025-2033 |

| Heightened Energy Security Concerns | +4.8% | Europe, Asia (Japan, South Korea, China) | 2025-2030 |

| Advantages of Floating Storage and Regasification Units (FSRUs) | +3.2% | Emerging Markets, Island Nations, Europe | 2025-2033 |

| Transition towards Cleaner Energy Sources | +2.7% | Global, North America, Europe, Asia | 2025-2033 |

| Expansion of Global LNG Liquefaction Capacity | +2.1% | Global | 2025-2030 |

LNG Regasification Terminal Market Restraints Analysis

Despite the strong growth drivers, the LNG Regasification Terminal market faces several significant restraints that could temper its expansion. One of the foremost challenges is the extremely high capital expenditure required for developing and constructing traditional onshore regasification terminals. These multi-billion-dollar projects necessitate substantial financial commitments, often spanning several years, which can deter potential investors or delay project timelines, particularly in regions with limited access to financing or unstable economic conditions. The complexity of regulatory frameworks and the lengthy permitting processes also pose considerable hurdles, as environmental impact assessments, land acquisition, and adherence to various safety standards can prolong project development by years, increasing costs and market uncertainty.

Furthermore, volatile natural gas prices introduce an element of financial risk for terminal operators and off-takers. Significant fluctuations in global gas prices can undermine the economic viability of long-term LNG import contracts, affecting investment decisions and the overall profitability of regasification projects. Environmental concerns and public opposition also represent a notable restraint. Local communities and environmental groups often raise objections regarding the potential ecological impact of large-scale industrial infrastructure, including concerns about greenhouse gas emissions, marine life disruption, and safety risks. Such opposition can lead to project delays, legal challenges, and even cancellations, particularly in densely populated or environmentally sensitive areas, thereby impeding market growth and sustainability efforts within the sector.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Capital Expenditure and Project Financing Challenges | -3.5% | Emerging Economies, Developing Regions | 2025-2033 |

| Lengthy and Complex Regulatory Approvals and Permitting | -2.8% | Europe, North America, Developed Asia | 2025-2030 |

| Volatile Natural Gas Prices and Market Fluctuations | -2.0% | Global | 2025-2033 |

| Environmental Concerns and Public Opposition | -1.5% | Europe, North America, Coastal Regions | 2025-2033 |

| Competition from Renewable Energy Sources | -1.2% | Developed Countries, Europe, North America | 2028-2033 |

LNG Regasification Terminal Market Opportunities Analysis

Opportunities within the LNG Regasification Terminal market are emerging from various strategic avenues, reflecting the evolving global energy landscape and technological advancements. One significant area of opportunity lies in the burgeoning demand from emerging economies, particularly in Southeast Asia, Latin America, and Africa. These regions are experiencing rapid industrialization and population growth, leading to an escalating need for reliable and cleaner energy sources to fuel economic development. Many of these nations lack extensive pipeline infrastructure and see LNG imports, especially via FSRUs, as a viable and swift solution to meet their energy deficits, bypassing the complexities of long-distance pipeline development and directly addressing their energy security concerns. This demographic and economic shift presents substantial new market entry points and expansion prospects for terminal developers and operators.

Furthermore, the market presents opportunities for technological innovation and integration. The increasing focus on decarbonization and energy transition opens pathways for regasification terminals to evolve into multi-energy hubs. This involves exploring the integration of carbon capture, utilization, and storage (CCUS) technologies to mitigate emissions from natural gas consumption. Additionally, terminals can be designed or retrofitted to accommodate future energy blends, such as hydrogen or ammonia, transforming them into vital components of a future low-carbon energy system. The growth of small-scale LNG solutions also creates opportunities for serving niche markets, including remote industrial sites, off-grid power generation, and marine bunkering, broadening the application scope and geographic reach of regasified natural gas. These innovative approaches not only address environmental concerns but also unlock new revenue streams and enhance the long-term viability of regasification infrastructure.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Rising Demand from Emerging Economies | +4.0% | Southeast Asia, Latin America, Africa | 2025-2033 |

| Development of Small-Scale LNG Solutions | +3.0% | Global, Remote Regions, Marine Sector | 2025-2033 |

| Integration with Carbon Capture and Storage (CCS) | +2.5% | Developed Countries, Europe, North America | 2028-2033 |

| Potential for Hydrogen Blending and Ammonia Co-firing | +2.0% | Global, Europe, Japan, South Korea | 2030-2033 |

| Strategic Development of Regional Energy Hubs | +1.5% | Europe, Asia Pacific | 2025-2030 |

LNG Regasification Terminal Market Challenges Impact Analysis

The LNG Regasification Terminal market, while promising, faces a unique set of challenges that demand strategic foresight and robust mitigation measures. Geopolitical instability and trade disputes present a significant hurdle, as disruptions in global energy supply chains or shifts in international relations can directly impact LNG availability, pricing, and the viability of long-term contracts. Such uncertainties can deter investment and introduce volatility into the market, making project planning and financing more complex. Additionally, the increasing competition from renewable energy sources like solar and wind power, which are becoming more cost-competitive and widely adopted, poses a long-term challenge to natural gas's market share, particularly in developed economies committed to aggressive decarbonization targets. This competition necessitates a continuous reassessment of natural gas's role in the future energy mix and how regasification terminals can adapt.

Another critical challenge lies in managing the complex logistics and infrastructure requirements inherent in LNG projects. Securing reliable and efficient supply chains, from liquefaction to shipping and regasification, requires significant coordination and investment. Any bottlenecks or disruptions in this chain can have cascading effects on terminal operations and profitability. Furthermore, the inherent safety risks associated with handling cryogenic liquefied natural gas require stringent safety protocols, extensive training, and advanced technologies to prevent accidents. While the industry has an excellent safety record, the perception of risk can fuel public opposition and contribute to regulatory delays. Addressing these challenges effectively will be crucial for sustainable growth, requiring innovation, international cooperation, and proactive engagement with stakeholders to ensure the continued expansion and operational integrity of LNG regasification infrastructure globally.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Geopolitical Instability and Trade Disputes | -2.0% | Global | 2025-2030 |

| Intensifying Competition from Renewable Energy Sources | -1.8% | Europe, North America, Developed Asia | 2028-2033 |

| Supply Chain Disruptions and Logistics Complexities | -1.5% | Global | 2025-2028 |

| Technological Obsolescence and Need for Continuous Upgrade | -1.0% | Global | 2025-2033 |

| Stringent Environmental Regulations and Emission Standards | -0.8% | Europe, North America | 2025-2033 |

LNG Regasification Terminal Market - Updated Report Scope

This comprehensive market research report offers an in-depth analysis of the global LNG Regasification Terminal market, providing critical insights into its current size, historical performance, and future growth projections. The report meticulously dissects market dynamics by examining key drivers, restraints, opportunities, and challenges that shape the industry landscape. It also details the impact of emerging technologies, such as Artificial Intelligence, on operational efficiencies and strategic decision-making within the sector. Furthermore, a detailed segmentation analysis by type, capacity, and application offers a granular view of market composition and potential growth areas, while a comprehensive regional analysis provides nuanced insights into country-specific market trends and competitive landscapes.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 23.5 Billion |

| Market Forecast in 2033 | USD 78.5 Billion |

| Growth Rate | 16.8% |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Global Energy Systems Inc., Port Infrastructure Solutions, Marine Terminal Holdings, Hydrocarbon Logistics Partners, Energy Transition Infrastructure, Gas & Power Solutions, LNG Flow Systems, Offshore Energy Group, Terminal Operations Ltd., Industrial Gas Networks, Blue Ocean Terminals, Regasification Innovations, Coastal Energy Logistics, Green Gas Infrastructure, Apex Terminal Services, Continental Energy Partners, Future Gas Solutions, Quantum Energy Hubs, Northern Hydrocarbon Terminals, Synergy LNG Assets |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The LNG Regasification Terminal market is comprehensively segmented to provide a granular understanding of its diverse components and growth avenues. This segmentation allows for a detailed analysis of market performance across different types of terminals, varying capacities, and a broad range of applications. Understanding these segments is crucial for stakeholders to identify specific growth areas, optimize investment strategies, and tailor solutions to meet distinct market needs, reflecting the varied demands and operational contexts globally.

- By Type:

- Onshore Regasification Terminals: Traditional land-based facilities offering high capacity and long-term stability, often requiring significant land area and extensive construction periods. These are typically chosen for consistent, large-scale supply requirements.

- Floating Storage and Regasification Units (FSRUs): Ship-based solutions providing flexibility, rapid deployment, and lower upfront capital costs. FSRUs are increasingly preferred for urgent energy needs, interim solutions, or in locations where onshore development is challenging.

- Floating Storage Units (FSUs) with Onshore Regasification: A hybrid model where an FSU stores LNG offshore, which is then transferred to an onshore facility for regasification. This offers a balance between storage capacity and land-based processing.

- By Capacity:

- Small-Scale (Below 1 MTPA): Designed to serve localized demand, remote communities, industrial parks, or specific transportation needs like bunkering and small-scale power generation.

- Medium-Scale (1-5 MTPA): Caters to moderate regional demand, supporting medium-sized industrial clusters or city gas distribution networks.

- Large-Scale (Above 5 MTPA): Major import terminals handling significant volumes of LNG for national power grids, large industrial complexes, and widespread residential distribution.

- By Application:

- Power Generation: The largest application segment, where regasified natural gas fuels power plants to generate electricity, especially crucial in countries phasing out coal.

- Industrial Use: Supplies natural gas to various industries for manufacturing processes, heating, and as a feedstock.

- Residential and Commercial Use: Provides gas for heating, cooking, and other energy needs in urban and suburban areas through city gas distribution networks.

- Transportation (Bunkering): Growing application where LNG is used as a cleaner marine fuel for ships, reducing emissions in the shipping industry.

- Other Applications: Includes niche uses such as feedstock for petrochemicals, cooling, and specialized industrial processes.

Regional Highlights

- Asia Pacific (APAC): Dominates the market driven by surging energy demand from rapidly industrializing economies like China, India, and Southeast Asian countries. The region is witnessing significant investments in both onshore and FSRU projects to support power generation, industrial growth, and city gas distribution. Japan, South Korea, and India remain major importers, while new demand centers are emerging in Vietnam, Philippines, and Bangladesh.

- Europe: Experiencing a strategic shift towards energy security and diversification following geopolitical events. This has led to accelerated development of new regasification terminals, particularly FSRUs, and expansion of existing capacities to reduce reliance on pipeline gas. Countries like Germany, France, and the Netherlands are leading new infrastructure development to ensure stable energy supply.

- North America: Primarily a net exporter of LNG, but with existing regasification infrastructure that plays a role in regional energy security and balancing supply. Investment in the region often focuses on optimizing existing terminals and exploring potential export capabilities, though some import capacity is maintained for flexibility.

- Latin America: A growing market driven by increasing energy demand, particularly in countries like Brazil, Argentina, and Chile, which utilize LNG to complement hydropower during droughts or to meet industrial power needs. FSRUs are particularly popular due to their cost-effectiveness and adaptability in this region.

- Middle East and Africa (MEA): While the Middle East is a significant LNG producer, countries in Africa are increasingly investing in regasification terminals to address energy deficits, improve access to electricity, and support industrial development. Countries like South Africa, Egypt, and Morocco are key areas for future growth.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the LNG Regasification Terminal Market.- Global Energy Systems Inc.

- Port Infrastructure Solutions

- Marine Terminal Holdings

- Hydrocarbon Logistics Partners

- Energy Transition Infrastructure

- Gas & Power Solutions

- LNG Flow Systems

- Offshore Energy Group

- Terminal Operations Ltd.

- Industrial Gas Networks

- Blue Ocean Terminals

- Regasification Innovations

- Coastal Energy Logistics

- Green Gas Infrastructure

- Apex Terminal Services

- Continental Energy Partners

- Future Gas Solutions

- Quantum Energy Hubs

- Northern Hydrocarbon Terminals

- Synergy LNG Assets

Frequently Asked Questions

What is LNG regasification and why is it important?

LNG regasification is the process of converting liquefied natural gas (LNG), which is natural gas cooled to a liquid state for transport, back into its gaseous form. This process is crucial because it allows countries without direct pipeline access to natural gas resources to import and utilize this cleaner-burning fossil fuel for power generation, industrial use, and residential consumption, enhancing energy security and diversification.

What are the primary drivers of growth in the LNG Regasification Terminal market?

The key drivers include increasing global demand for natural gas as a transitional fuel, heightened energy security concerns driving diversification of supply, the cost-effectiveness and rapid deployment of Floating Storage and Regasification Units (FSRUs), and the global shift towards cleaner energy sources to meet environmental targets.

How do Floating Storage and Regasification Units (FSRUs) differ from traditional onshore terminals?

FSRUs are ship-based facilities that offer significant advantages over traditional onshore terminals due to their mobility, faster deployment times (often 1-2 years versus 3-5+ years for onshore), and lower upfront capital expenditure. They provide operational flexibility, making them ideal for urgent energy needs or temporary solutions, whereas onshore terminals offer larger capacity and long-term stability but require extensive land, complex civil engineering, and longer construction periods.

What role does Artificial Intelligence (AI) play in the LNG Regasification Terminal market?

AI is increasingly used to optimize terminal operations, enhance safety, and improve efficiency. This includes applications in predictive maintenance to prevent equipment failures, real-time process optimization for improved throughput, intelligent monitoring for safety and risk management, and smart logistics for supply chain efficiency. AI helps reduce operational costs, minimize downtime, and ensures more reliable and safer operations.

What are the main challenges facing the LNG Regasification Terminal market?

Key challenges include the high capital investment required for new projects, lengthy and complex regulatory approval processes, volatility in global natural gas prices, environmental concerns and potential public opposition to large infrastructure projects, and increasing competition from renewable energy sources as countries accelerate their decarbonization efforts.