Retail Self Checkout Terminal Market

Retail Self Checkout Terminal Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_703048 | Last Updated : August 01, 2025 |

Format : ![]()

![]()

![]()

![]()

Retail Self Checkout Terminal Market Size

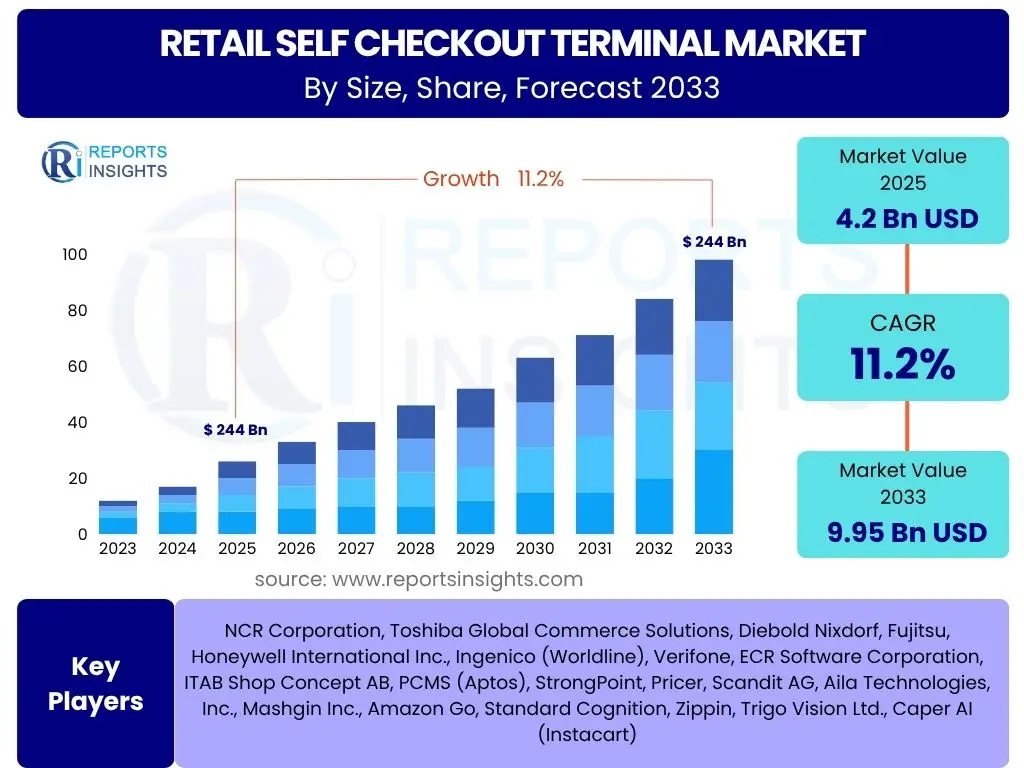

According to Reports Insights Consulting Pvt Ltd, The Retail Self Checkout Terminal Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.2% between 2025 and 2033. The market is estimated at 4.2 Billion USD in 2025 and is projected to reach 9.95 Billion USD by the end of the forecast period in 2033.

Key Retail Self Checkout Terminal Market Trends & Insights

The Retail Self Checkout Terminal market is experiencing robust growth driven by retailers' increasing need for operational efficiency, labor cost optimization, and enhanced customer experience. A significant trend is the accelerating adoption of automated solutions to mitigate rising labor costs and address persistent staffing challenges within the retail sector. This shift allows businesses to maintain service levels while strategically reallocating human resources to value-added activities such as customer service and merchandising.

Another key insight involves the evolution of self-checkout systems from basic transaction points to sophisticated, integrated retail solutions. There is a discernible trend towards contactless payment options, mobile integrations, and personalized shopping experiences, reflecting changing consumer preferences for speed, convenience, and autonomy. Retailers are actively investing in these advanced systems to meet modern consumer expectations and reduce checkout queue times, thereby improving overall store efficiency and customer satisfaction.

Furthermore, the market is profoundly influenced by technological advancements, particularly the incorporation of artificial intelligence, machine learning, and computer vision. These innovations are transforming self-checkout capabilities, enabling more accurate fraud detection, predictive maintenance, and seamless item recognition. This technological integration is not only enhancing the security and reliability of self-checkout terminals but also opening new avenues for data analytics and personalized customer engagement, making these systems more strategic assets for retailers.

- Accelerated adoption driven by labor cost reduction and operational efficiency.

- Increasing consumer preference for convenient, fast, and autonomous shopping experiences.

- Integration of advanced technologies like AI, machine learning, and computer vision for enhanced functionality.

- Expansion of self-checkout solutions into diverse retail formats beyond traditional supermarkets.

- Focus on seamless payment processing, including mobile and contactless options.

AI Impact Analysis on Retail Self Checkout Terminal

The integration of Artificial Intelligence (AI) is fundamentally transforming the retail self-checkout terminal landscape, addressing long-standing concerns while unlocking new efficiencies. Common user questions often revolve around how AI can mitigate shrinkage and improve security in self-checkout environments. AI-powered computer vision and machine learning algorithms are now capable of real-time monitoring, identifying un-scanned items, detecting suspicious behaviors, and verifying product weights against scanned items, thereby significantly reducing instances of theft and accidental non-scans. This enhanced vigilance provides retailers with greater confidence in widespread self-checkout deployment.

Beyond security, users are keen to understand how AI enhances the customer experience and operational workflow. AI enables more intuitive and user-friendly interfaces, offering voice-guided instructions, personalized recommendations based on purchase history, and even automated recognition of produce items without requiring manual input. This streamlines the transaction process, reduces customer frustration, and minimizes the need for staff intervention, ultimately leading to a faster and more satisfying checkout experience for shoppers. For retailers, AI facilitates predictive maintenance, allowing systems to flag potential issues before they cause downtime, ensuring high availability.

Furthermore, AI's analytical capabilities are providing retailers with deeper insights into checkout patterns, customer behavior, and inventory management. By processing vast amounts of transaction data, AI can help optimize staffing levels during peak hours, identify popular items, and inform merchandising strategies. While some concerns exist regarding job displacement, the prevailing expectation is that AI in self-checkout will augment human capabilities, allowing staff to focus on higher-value customer interactions rather than routine scanning, thereby creating more efficient and customer-centric retail environments.

- Enhanced fraud detection and shrinkage prevention through computer vision and anomaly detection.

- Improved customer experience via intuitive interfaces, voice assistance, and personalized interactions.

- Streamlined operations through predictive maintenance and real-time performance monitoring.

- Better data analytics for understanding customer behavior and optimizing store operations.

- Potential for dynamic pricing and personalized promotions at the point of sale.

Key Takeaways Retail Self Checkout Terminal Market Size & Forecast

The retail self-checkout terminal market is poised for significant and sustained growth, driven by a convergence of technological advancements, evolving consumer preferences, and critical operational imperatives for retailers. The market's projected expansion underscores its strategic importance as a foundational element of modern retail infrastructure. Retailers are increasingly recognizing self-checkout as not merely an efficiency tool but a key component in optimizing their physical store footprints and improving overall financial performance, reflecting a broader industry shift towards intelligent automation and customer-centric solutions.

A crucial takeaway is the imperative for retailers to invest in sophisticated self-checkout solutions that offer more than just transaction processing. The future of self-checkout lies in integrated systems that leverage AI for enhanced security, provide seamless payment options, and contribute to a personalized shopping journey. This proactive investment is essential for maintaining competitive advantage, reducing operational costs, and addressing the persistent challenges of labor availability and customer service expectations in a dynamic retail landscape.

Moreover, the market's forecast highlights a continuous evolution in self-checkout technology, particularly with the deeper integration of artificial intelligence, IoT, and advanced analytics. This suggests a future where self-checkout terminals act as intelligent hubs, capable of real-time inventory updates, personalized marketing, and proactive maintenance. The ability to harness rich data from these systems will become a differentiator, allowing retailers to refine strategies, optimize store layouts, and deliver increasingly tailored and friction-less shopping experiences, securing the market's long-term growth trajectory.

- The market exhibits robust growth, validating self-checkout as a core retail modernization strategy.

- Significant opportunity for retailers to reduce labor costs and enhance operational efficiency.

- Technological advancements, especially AI integration, are pivotal for future market expansion and system capabilities.

- Improved customer experience and convenience are driving consumer acceptance and demand.

- Investment in self-checkout is critical for competitive advantage and adapting to evolving retail dynamics.

Retail Self Checkout Terminal Market Drivers Analysis

The primary driver for the retail self-checkout terminal market is the escalating cost of labor and the persistent challenge of labor shortages within the retail sector. Retailers are increasingly adopting automated solutions to mitigate these operational expenses and ensure consistent staffing levels, thereby maintaining service efficiency. Self-checkout systems provide a compelling alternative, allowing stores to process more transactions with fewer staff, thus directly impacting profitability. This economic incentive is a powerful catalyst for widespread adoption across various retail formats.

Another significant driver is the growing consumer preference for convenience, speed, and autonomy in their shopping experience. Modern shoppers, particularly younger demographics, value the ability to quickly complete purchases without waiting in long queues. The proliferation of cashless payment options and mobile payment technologies further accelerates this trend, making self-checkout a seamless and preferred method for many. This shift in consumer behavior directly encourages retailers to expand their self-checkout offerings to meet evolving expectations and enhance customer satisfaction, reinforcing the value proposition of these systems.

Furthermore, technological advancements in self-checkout hardware and software, coupled with the integration of artificial intelligence and machine learning, are continuously enhancing the efficiency and security of these systems. Innovations such as improved fraud detection, intuitive user interfaces, and robust system integration capabilities are making self-checkout terminals more reliable and appealing to retailers. The ability to collect valuable customer data for analytics and personalize the shopping experience also adds a strategic advantage, contributing to the market's expansion by providing deeper insights into consumer purchasing patterns and overall store performance.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Rising Labor Costs & Shortages | +3.5% | Global, particularly North America, Europe | Short-term to Long-term |

| Increasing Consumer Preference for Convenience & Speed | +2.8% | Global, particularly developed economies | Short-term to Mid-term |

| Technological Advancements (AI, ML, Contactless Payments) | +2.5% | Global | Mid-term to Long-term |

| Need for Operational Efficiency & Space Optimization | +1.7% | Global | Short-term to Mid-term |

| Growing Adoption of Cashless & Mobile Payments | +0.7% | Global | Short-term to Long-term |

Retail Self Checkout Terminal Market Restraints Analysis

One of the primary restraints impacting the retail self-checkout terminal market is the significant initial capital investment required for procurement and installation. Retailers, especially smaller and independent businesses, may find the upfront cost of purchasing and deploying a sufficient number of self-checkout units prohibitive. This financial barrier can hinder broader adoption, particularly when considering the additional expenses associated with software licensing, system integration, and staff training, which further increase the total cost of ownership, making the return on investment less immediate for some operators.

Another critical restraint is the persistent issue of shrinkage and theft, which remains a substantial concern for retailers utilizing self-checkout systems. While technological advancements like AI-powered fraud detection are emerging, instances of deliberate theft, accidental non-scans, or "slip-through" items continue to pose a financial risk. Retailers often weigh the benefits of reduced labor costs against potential increases in inventory loss, leading to a cautious approach to widespread self-checkout implementation. Customer frustration stemming from technical glitches, scanning errors, or the need for constant staff intervention also detracts from the perceived efficiency and user experience, thereby limiting full market potential.

Additionally, a segment of the consumer base expresses a strong preference for traditional cashier-led checkouts, citing reasons such as a desire for human interaction, difficulty with the technology, or a perception that self-checkout shifts labor onto the customer. This resistance, coupled with potential integration complexities with existing store infrastructure and potential negative impacts on overall customer satisfaction if the systems are not robust or well-managed, serves as a significant impediment to seamless market expansion. Addressing these user experience and integration challenges is crucial for overcoming this restraint and ensuring wider market acceptance.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Initial Investment & Maintenance Costs | -2.0% | Global, particularly emerging markets | Short-term to Mid-term |

| Concerns over Shrinkage and Theft | -1.5% | Global | Short-term to Long-term |

| Customer Dissatisfaction / Technical Glitches | -1.0% | Global | Short-term |

| Integration Complexities with Legacy Systems | -0.8% | Global | Short-term to Mid-term |

| Resistance from Labor Unions & Public Perception | -0.5% | North America, Europe | Mid-term |

Retail Self Checkout Terminal Market Opportunities Analysis

A significant opportunity lies in the continuous integration of advanced technologies such as artificial intelligence, machine learning, and computer vision within self-checkout terminals. These advancements can lead to more intuitive user interfaces, enhanced fraud detection capabilities, and personalized customer experiences. For instance, AI can facilitate voice-guided assistance, recognize produce items without manual input, and flag suspicious activities more effectively, thereby reducing operational friction and improving system reliability. This technological evolution opens avenues for new service offerings and value propositions for retailers, positioning self-checkout as a data-rich, intelligent hub.

The expansion into new retail formats and emerging markets presents another substantial growth opportunity. While supermarkets and hypermarkets have been primary adopters, there is increasing potential in convenience stores, specialty retail, department stores, and even non-traditional retail environments like airports or pharmacies, which seek to optimize their smaller footprints and manage transaction flows efficiently. Furthermore, developing economies in regions such as Asia Pacific and Latin America, which are experiencing rapid urbanization and growth in organized retail, offer fertile ground for self-checkout adoption as retailers seek to modernize operations and manage rising labor costs.

Opportunities also arise from the ability to leverage self-checkout data for enhanced business intelligence and personalized marketing. Integrating self-checkout systems with loyalty programs, inventory management, and customer relationship management (CRM) systems can provide retailers with invaluable insights into purchasing patterns, peak hours, and customer preferences. This data can then be used to optimize store layouts, refine product assortments, tailor promotions, and ultimately drive higher sales and customer loyalty, transforming self-checkout from a mere transaction point into a strategic data collection and marketing activation hub. The ability to derive actionable insights from transaction data represents a significant value addition.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Enhanced AI & ML Integration for Security & UX | +2.3% | Global | Mid-term to Long-term |

| Expansion into New Retail Formats & Emerging Markets | +2.0% | Asia Pacific, Latin America, Specialty Stores | Mid-term |

| Leveraging Data for Business Intelligence & Personalization | +1.5% | Global | Mid-term to Long-term |

| Development of Modular & Flexible SCO Solutions | +1.0% | Global | Short-term to Mid-term |

| Growth of Contactless & Mobile Payment Ecosystems | +0.7% | Global | Short-term to Mid-term |

Retail Self Checkout Terminal Market Challenges Impact Analysis

One of the foremost challenges facing the retail self-checkout terminal market is the pervasive issue of shrinkage and theft, often termed "shrinkage." While self-checkout offers operational efficiencies, it can inadvertently create opportunities for customers to bypass payment for items, either intentionally or accidentally. This necessitates significant investment in advanced security features, surveillance, and staff oversight, which can offset some of the labor cost savings and increase overall operational complexity for retailers. The ongoing battle against theft requires continuous innovation in detection technologies and robust store policies to minimize financial losses.

Ensuring a seamless and positive customer experience remains a critical challenge. Technical glitches, payment processing failures, difficult-to-scan items, and complex user interfaces can lead to customer frustration, long queues due to interventions, and a negative perception of the self-checkout process. Balancing automation with the need for intuitive design and responsive assistance is crucial for maintaining customer satisfaction. Furthermore, integrating self-checkout systems with existing diverse retail IT infrastructures can be complex and costly, requiring significant IT resources and potential downtime during implementation, which can disrupt daily operations.

Finally, public perception and potential resistance from labor unions present an enduring challenge. Concerns about job displacement due to automation can lead to public backlash or organized opposition, impacting the pace of self-checkout adoption in certain regions. Additionally, the challenge of maintaining and servicing a growing fleet of self-checkout terminals, ensuring high uptime, and addressing technical issues promptly, adds to the operational burden for retailers. Cybersecurity threats and data privacy concerns associated with handling sensitive payment information also necessitate robust security protocols and compliance measures, adding layers of complexity and cost to system management.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Managing Shrinkage & Theft Risks | -1.8% | Global | Ongoing |

| Ensuring Seamless User Experience & System Reliability | -1.2% | Global | Ongoing |

| Complex Integration with Existing Retail Systems | -0.9% | Global | Short-term to Mid-term |

| Public Perception & Labor Union Resistance | -0.6% | North America, Europe | Mid-term |

| Cybersecurity & Data Privacy Concerns | -0.5% | Global | Long-term |

Retail Self Checkout Terminal Market - Updated Report Scope

This comprehensive report provides an in-depth analysis of the Retail Self Checkout Terminal Market, covering historical performance, current market dynamics, and future growth projections. It offers detailed insights into market size, key trends, drivers, restraints, opportunities, and challenges influencing market expansion. The scope encompasses various segmentation analyses, regional breakdowns, and profiles of leading market players, delivering a holistic view for stakeholders to make informed strategic decisions.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | 4.2 Billion USD |

| Market Forecast in 2033 | 9.95 Billion USD |

| Growth Rate | 11.2% |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | NCR Corporation, Toshiba Global Commerce Solutions, Diebold Nixdorf, Fujitsu, Honeywell International Inc., Ingenico (Worldline), Verifone, ECR Software Corporation, ITAB Shop Concept AB, PCMS (Aptos), StrongPoint, Pricer, Scandit AG, Aila Technologies, Inc., Mashgin Inc., Amazon Go, Standard Cognition, Zippin, Trigo Vision Ltd., Caper AI (Instacart) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Retail Self Checkout Terminal Market is comprehensively segmented to provide granular insights into its diverse components and applications. This segmentation allows for a detailed analysis of market dynamics across various dimensions, including the type of transaction capabilities, the constituent parts of the systems, the specific retail environments where they are deployed, and their integration methods. Understanding these segments is crucial for identifying key growth areas, market saturation points, and strategic opportunities for different market participants.

- By Type:

- Cash

- Cashless

- Hybrid

- By Component:

- Hardware

- Scanners

- Payment Terminals

- Touchscreens

- Bagging Areas

- Receipt Printers

- Scales

- Software

- Self-checkout Software

- Backend Management Systems

- Analytics Modules

- Services

- Installation

- Maintenance

- Support

- Consulting

- Hardware

- By Application/End-User:

- Supermarkets & Hypermarkets

- Convenience Stores

- Department Stores

- Specialty Stores

- Others (e.g., QSRs, Pharmacies, Airports)

- By Deployment:

- Standalone

- Integrated

Regional Highlights

- North America: This region is a mature market for retail self-checkout terminals, characterized by early and high adoption rates, driven by escalating labor costs and a strong focus on enhancing customer convenience. The presence of major retail chains and a technologically advanced consumer base contributes significantly to market growth. Innovation in AI-powered systems and seamless payment solutions are prevalent here.

- Europe: Europe exhibits robust adoption of self-checkout, propelled by the demand for operational efficiency, diverse retail landscapes, and increasing digitalization. Western European countries lead in implementing advanced self-checkout solutions, with a growing emphasis on hybrid models and solutions that comply with varying regional regulations and consumer preferences regarding payment methods.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, driven by rapid urbanization, the expansion of organized retail, and a burgeoning middle class. Countries like China, India, Japan, and Australia are experiencing significant investments in retail infrastructure modernization, with a strong inclination towards cashless transactions and technologically advanced self-checkout systems to manage high transaction volumes and optimize store space.

- Latin America: The Latin American market for self-checkout terminals is in a nascent but rapidly expanding phase. Growth is primarily fueled by increasing disposable incomes, modernization of retail environments, and the adoption of digital payment methods. Retailers are increasingly exploring self-checkout solutions to improve efficiency and enhance the shopping experience in competitive markets.

- Middle East and Africa (MEA): This region is witnessing gradual adoption, influenced by investments in smart city initiatives and the development of large-scale retail projects. While still emerging, the MEA market presents considerable opportunities as retailers seek to improve operational efficiency and cater to evolving consumer expectations, particularly in urban centers within the GCC countries and South Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Retail Self Checkout Terminal Market.- NCR Corporation

- Toshiba Global Commerce Solutions

- Diebold Nixdorf

- Fujitsu

- Honeywell International Inc.

- Ingenico (Worldline)

- Verifone

- ECR Software Corporation

- ITAB Shop Concept AB

- PCMS (Aptos)

- StrongPoint

- Pricer

- Scandit AG

- Aila Technologies, Inc.

- Mashgin Inc.

- Amazon Go

- Standard Cognition

- Zippin

- Trigo Vision Ltd.

- Caper AI (Instacart)

Frequently Asked Questions

Analyze common user questions about the Retail Self Checkout Terminal market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is a retail self-checkout terminal?

A retail self-checkout terminal is an electronic point-of-sale system that allows customers to scan, bag, and pay for their purchases without the direct assistance of a cashier. These systems are designed to enhance store efficiency and offer customer convenience.

What are the primary benefits of self-checkout for retailers?

Retailers benefit from self-checkout primarily through reduced labor costs, increased operational efficiency, faster checkout times, and optimized store space. It also contributes to an improved customer experience by offering speed and autonomy.

What are the main challenges associated with self-checkout systems?

Key challenges includemanaging shrinkage and theft, ensuring a consistently positive customer experience, the high initial investment cost, and complexities in integrating with existing store systems. Addressing customer resistance and technical glitches is also crucial.

How does Artificial Intelligence (AI) impact self-checkout terminals?

AI significantly impacts self-checkout by enhancing security through advanced fraud detection and item recognition, improving user interfaces with voice assistance and intuitive design, and providing valuable data analytics for operational optimization and personalized marketing. AI makes systems smarter and more efficient.

What is the future outlook for the retail self-checkout market?

The future outlook is robust, with significant growth projected. The market is expected to evolve with deeper AI integration, expansion into new retail formats, and continuous innovation in user experience and payment technologies, making self-checkout an increasingly integral and intelligent component of modern retail operations.