LNG Bunkering Market

LNG Bunkering Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_703682 | Last Updated : August 05, 2025 |

Format : ![]()

![]()

![]()

![]()

LNG Bunkering Market Size

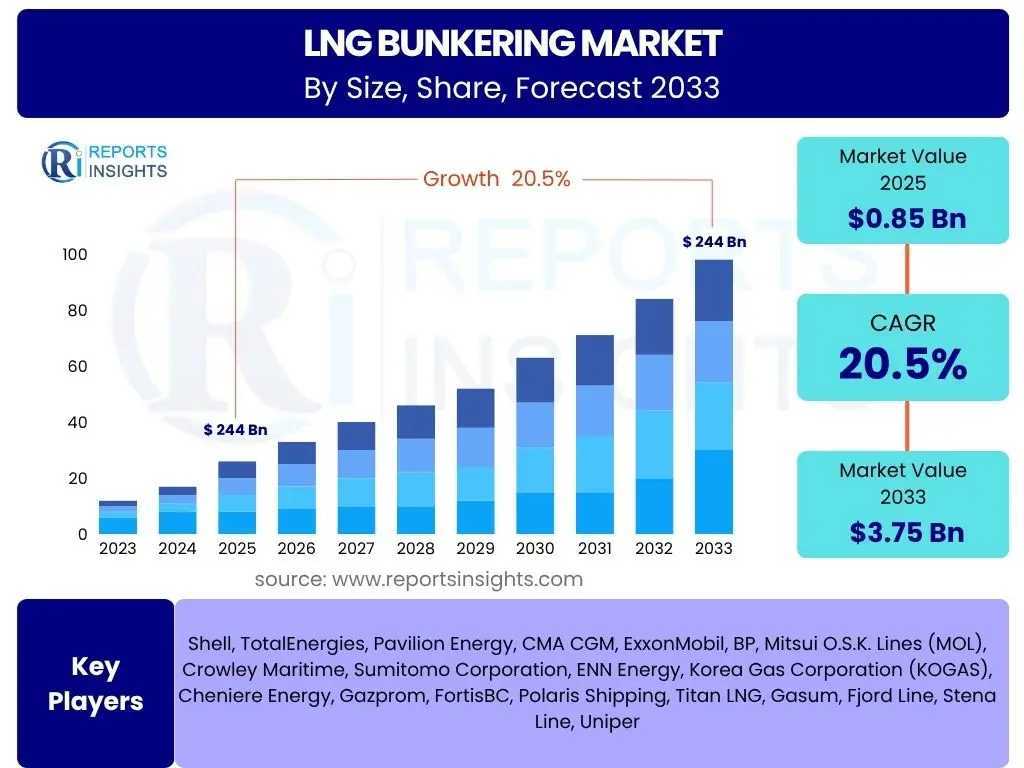

According to Reports Insights Consulting Pvt Ltd, The LNG Bunkering Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 20.5% between 2025 and 2033. The market is estimated at USD 0.85 Billion in 2025 and is projected to reach USD 3.75 Billion by the end of the forecast period in 2033.

Key LNG Bunkering Market Trends & Insights

The LNG Bunkering market is witnessing significant transformation driven by evolving environmental regulations and the maritime industry's commitment to decarbonization. User inquiries frequently center on how global shipping emission mandates, particularly those from the International Maritime Organization (IMO), are shaping fuel choices and infrastructure investments. There is also considerable interest in the expansion of bunkering infrastructure globally and the adoption rates of LNG-fueled vessels, reflecting a broader industry shift towards cleaner energy sources.

Emerging trends indicate a strong focus on enhancing the efficiency and safety of bunkering operations, alongside an exploration of LNG's long-term viability as a transition fuel in the context of even stricter future emissions targets. The market is also tracking advancements in dual-fuel engine technology and the development of new bunkering hubs in strategic maritime corridors, signaling a maturing ecosystem for LNG as a marine fuel. Stakeholders are particularly keen on understanding the interplay between LNG price stability, supply chain robustness, and the overall economic attractiveness of converting to or building new LNG-fueled fleets.

- Stricter environmental regulations, such as IMO 2020 and upcoming IMO GHG reduction targets, are driving the adoption of cleaner marine fuels like LNG.

- Expansion of global LNG bunkering infrastructure, including new terminals, bunkering vessels, and port facilities, is a critical trend facilitating broader adoption.

- Increased ordering and delivery of dual-fuel vessels across various shipping segments (container ships, tankers, bulk carriers, cruise ships) signal a strong industry commitment.

- Technological advancements in bunkering operations, focusing on safety, efficiency, and digitalization, are streamlining the supply process.

- Growing collaboration among energy companies, ports, and shipping lines to establish comprehensive LNG supply chains and bunkering hubs.

AI Impact Analysis on LNG Bunkering

Common user questions regarding AI's impact on LNG bunkering predominantly revolve around its potential to enhance operational efficiency, safety, and supply chain optimization. Users frequently inquire about how AI algorithms can be utilized for precise demand forecasting, optimizing bunkering schedules to minimize vessel downtime, and improving route planning to reduce fuel consumption. The expectation is that AI will introduce unprecedented levels of automation and data-driven decision-making into complex bunkering logistics, addressing inefficiencies inherent in traditional methods.

Furthermore, there is significant interest in AI's role in predictive maintenance for bunkering equipment and vessels, potentially reducing unexpected failures and improving asset longevity. Safety is another key concern, with users keen to understand how AI-powered monitoring systems can detect anomalies, prevent incidents, and ensure compliance with stringent safety protocols during bunkering operations. Overall, the collective inquiries point towards a vision where AI acts as a transformative force, enabling smarter, safer, and more cost-effective LNG bunkering processes.

- AI-driven optimization of bunkering schedules and logistics, leading to reduced vessel waiting times and improved port efficiency.

- Predictive maintenance analytics for LNG bunkering vessels and equipment, minimizing operational downtime and extending asset life.

- Enhanced safety protocols through AI-powered monitoring systems for leak detection, anomaly identification, and real-time risk assessment during transfers.

- Improved demand forecasting for LNG supply, enabling more efficient inventory management and stable pricing for marine fuel.

- Route optimization for LNG-fueled vessels utilizing AI to select the most fuel-efficient paths and opportune bunkering locations, reducing emissions and operational costs.

Key Takeaways LNG Bunkering Market Size & Forecast

User inquiries concerning the key takeaways from the LNG bunkering market size and forecast consistently highlight the market's robust growth trajectory and its critical role in maritime decarbonization. Stakeholders are keen to understand the primary drivers behind this expansion, particularly the influence of environmental regulations and the increasing global fleet of LNG-powered vessels. The forecast indicates a sustained period of high growth, underscoring LNG's position as a leading transitional fuel for the shipping industry as it navigates stringent emissions standards.

Another crucial takeaway frequently sought by users pertains to the indispensable role of infrastructure development in unlocking the market's full potential. The market's future growth is intrinsically linked to the expansion of bunkering facilities in key maritime regions and the establishment of reliable, competitive supply chains. Furthermore, the analysis points towards a segment-specific growth, with significant uptake observed in sectors like container shipping and cruise lines, reflecting varying paces of adoption across the maritime domain.

- The LNG bunkering market is poised for significant expansion, driven primarily by tightening global environmental regulations for shipping.

- Increased adoption of dual-fuel engines across various vessel types is a fundamental growth driver, signaling long-term commitment to LNG as a marine fuel.

- Critical to market growth is the continuous development and expansion of global LNG bunkering infrastructure, addressing supply chain gaps.

- Asia Pacific and Europe are anticipated to remain leading regions in terms of LNG bunkering adoption and infrastructure development due to proactive regulatory frameworks and high maritime traffic.

- The market's long-term viability is strengthened by LNG's position as a cleaner alternative to traditional marine fuels, offering immediate emissions reduction benefits.

LNG Bunkering Market Drivers Analysis

The LNG Bunkering market is primarily propelled by a confluence of regulatory pressures and economic incentives pushing the maritime industry towards cleaner fuel alternatives. International mandates, particularly those from the International Maritime Organization (IMO) aimed at reducing greenhouse gas emissions and sulfur oxide (SOx) emissions, are compelling shipping companies to adopt fuels like LNG. This regulatory push is complemented by the growing availability of LNG as a marine fuel, supported by expanding global infrastructure and competitive pricing relative to conventional bunkers, especially amidst volatility in crude oil markets.

Furthermore, the increasing number of newbuild and converted vessels equipped with LNG dual-fuel engines underscores a strong commitment from ship owners and operators towards sustainable shipping. This technological readiness, combined with the proven environmental benefits of LNG in reducing SOx, nitrogen oxides (NOx), and particulate matter, positions LNG as a viable and attractive solution for meeting environmental compliance while maintaining operational efficiency. The industry's pursuit of a greener image and corporate social responsibility also contributes significantly to this shift.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Stricter IMO Emissions Regulations (SOx, NOx, GHG) | +4.2% | Global, particularly Europe and Asia-Pacific | Long-term (2025-2033) |

| Growing Global Fleet of LNG-Fueled Vessels | +3.8% | Global, major shipping hubs | Mid-to-Long-term (2027-2033) |

| Expansion of LNG Bunkering Infrastructure Network | +3.5% | Global, key port regions (e.g., Singapore, Rotterdam, Fujairah) | Mid-term (2025-2030) |

| Favorable Price Competitiveness of LNG vs. Traditional Fuels | +2.9% | Global, sensitive to energy markets | Short-to-Mid-term (2025-2028) |

LNG Bunkering Market Restraints Analysis

Despite its significant growth prospects, the LNG Bunkering market faces several notable restraints that could temper its expansion. A primary constraint is the substantial upfront capital expenditure required for establishing new bunkering infrastructure, including specialized terminals, storage facilities, and bunkering vessels. This high initial investment can be a deterrent for new entrants and can slow down the pace of infrastructure development, particularly in regions with nascent maritime fuel markets. The economics of converting existing vessels to LNG or building new LNG-fueled ships also present a financial hurdle for many shipping companies.

Another significant restraint is the relatively limited global coverage of LNG bunkering facilities compared to conventional marine fuels. While major ports are increasingly equipped, the lack of widespread availability across all maritime routes can complicate route planning and restrict the operational flexibility of LNG-fueled vessels. Furthermore, the perception of LNG's volatility in pricing, linked to natural gas market fluctuations, and ongoing concerns regarding safety perceptions, despite industry efforts to demonstrate its safety record, continue to pose challenges for broader adoption.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Capital Expenditure for Infrastructure and Vessels | -3.7% | Global, particularly developing maritime regions | Long-term (2025-2033) |

| Limited Global Bunkering Port Coverage and Infrastructure Gaps | -3.1% | Global, excluding major established hubs | Mid-to-Long-term (2027-2033) |

| Perceived Safety Concerns and Complex Regulatory Approvals | -2.8% | Global, especially in crowded ports | Short-to-Mid-term (2025-2029) |

| Price Volatility of LNG and Supply Chain Uncertainties | -2.5% | Global, influenced by energy markets | Short-term (2025-2027) |

LNG Bunkering Market Opportunities Analysis

The LNG Bunkering market is rich with opportunities, driven by the global imperative for sustainable shipping and technological advancements. A significant opportunity lies in the development of new bunkering hubs along emerging trade routes and in regions currently underserved by LNG infrastructure. This expansion can unlock new markets and provide greater operational flexibility for LNG-fueled vessels, thereby accelerating adoption across the global fleet. The increasing focus on establishing "green corridors" for maritime shipping further accentuates the demand for clean fuels like LNG, presenting a direct pathway for market growth.

Technological innovations in bunkering solutions, such as smaller-scale LNG bunkering systems for coastal and inland waterways, and advancements in bunkering vessel design to enhance efficiency and safety, also represent key opportunities. Furthermore, supportive government policies, incentives, and funding initiatives aimed at decarbonizing the maritime sector are creating a conducive environment for investments in LNG infrastructure and vessel conversions. The potential for LNG to serve as a bridge fuel towards future zero-carbon alternatives, offering immediate emissions reductions, positions it favorably in the long-term energy transition strategy of the shipping industry.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Development of New Bunkering Hubs in Emerging Maritime Routes | +4.5% | Asia-Pacific, Latin America, Africa | Mid-to-Long-term (2027-2033) |

| Technological Advancements in Bunkering Solutions and Vessels | +3.9% | Global | Long-term (2028-2033) |

| Government Incentives and Green Shipping Initiatives | +3.3% | Europe, North America, Japan, South Korea | Mid-term (2025-2030) |

| Increased Adoption of LNG for Inland Waterways and Short Sea Shipping | +2.7% | Europe, China, North America | Short-to-Mid-term (2025-2029) |

LNG Bunkering Market Challenges Impact Analysis

The LNG Bunkering market, while promising, faces inherent challenges that demand strategic solutions. One significant challenge is overcoming the financial hurdles associated with infrastructure development and vessel conversion. Securing adequate financing and demonstrating a clear return on investment for large-scale LNG bunkering projects can be complex, especially in a market where the long-term role of LNG amidst a diverse array of alternative fuels is still evolving. This financing challenge is compounded by the global economic climate and competing investment priorities within the shipping industry.

Another key challenge involves the intense competition from other emerging alternative marine fuels, such as methanol, ammonia, and hydrogen, which are also vying for market share in the long-term decarbonization landscape. While LNG offers immediate benefits, the perception of it as a "transition fuel" might deter some long-term investments in favor of future zero-carbon options. Furthermore, establishing a harmonized global regulatory framework for LNG bunkering and ensuring public confidence in its safety, particularly in densely populated port areas, continues to be an ongoing endeavor requiring coordinated international effort.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Infrastructure Financing and Investment Hurdles | -4.0% | Global, particularly emerging markets | Long-term (2025-2033) |

| Competition from Other Alternative Marine Fuels (Methanol, Ammonia) | -3.5% | Global, particularly advanced maritime economies | Mid-to-Long-term (2027-2033) |

| Public and Port Authority Perception of Safety Risks | -2.9% | Global, port cities and coastal areas | Short-to-Mid-term (2025-2029) |

| Complexity of Establishing Robust and Resilient LNG Supply Chains | -2.6% | Global, particularly new bunkering locations | Short-to-Mid-term (2025-2028) |

LNG Bunkering Market - Updated Report Scope

This comprehensive report delves into the dynamics of the global LNG Bunkering Market, providing a detailed analysis of its size, growth trajectory, key trends, and future outlook. It examines the market through various segmentations including vessel type, supply mode, and end-use application, alongside an in-depth regional analysis. The report also highlights the influential roles of market drivers, restraints, opportunities, and challenges, offering strategic insights for stakeholders. Furthermore, it incorporates an AI impact analysis, assessing how artificial intelligence is transforming operational efficiencies and safety within the bunkering ecosystem. The scope is designed to equip businesses with actionable intelligence for informed decision-making in this evolving market.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 0.85 Billion |

| Market Forecast in 2033 | USD 3.75 Billion |

| Growth Rate | 20.5% |

| Number of Pages | 257 |

| Key Trends | |

| Segments Covered | |

| Key Companies Covered | Shell, TotalEnergies, Pavilion Energy, CMA CGM, ExxonMobil, BP, Mitsui O.S.K. Lines (MOL), Crowley Maritime, Sumitomo Corporation, ENN Energy, Korea Gas Corporation (KOGAS), Cheniere Energy, Gazprom, FortisBC, Polaris Shipping, Titan LNG, Gasum, Fjord Line, Stena Line, Uniper |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The LNG Bunkering market is segmented across multiple dimensions to provide a granular understanding of its diverse landscape and growth drivers. These segmentations allow for a detailed analysis of how different vessel types, supply methodologies, and end-use applications contribute to the overall market dynamics. Understanding these distinct segments is crucial for stakeholders to identify specific growth areas, tailor investment strategies, and develop targeted solutions within the evolving maritime fuel industry.

Each segment reflects unique operational requirements, investment patterns, and regulatory considerations, influencing their adoption rates of LNG as a marine fuel. For instance, the growth in container ships and cruise lines opting for LNG is often driven by stricter emission control area regulations and public image, while the choice of supply mode (e.g., ship-to-ship vs. truck-to-ship) depends heavily on port infrastructure and operational flexibility. This detailed segmentation analysis aids in forecasting demand shifts and technological advancements across the value chain.

- By Vessel Type:

- Container Ships: Large capacity vessels driven by global trade and strict environmental regulations on key routes.

- Tankers: Includes oil, chemical, and gas tankers; adoption driven by operational efficiency and compliance.

- Bulk Carriers: Large ships transporting raw materials; demand influenced by global commodity trade and cost efficiency.

- Cruise Ships: High public visibility drives early adoption of cleaner fuels for environmental branding and passenger comfort.

- Ferries: Often operate in Emission Control Areas (ECAs) and environmentally sensitive coastal regions, making LNG attractive.

- Ro-Ro Vessels: Roll-on/roll-off ships, often serving fixed routes with regular port calls, simplifying bunkering logistics.

- Offshore Support Vessels: Operating in sensitive offshore environments, requiring cleaner operations.

- Others: Includes tugs, dredgers, and specialized vessels.

- By Supply Mode:

- Ship-to-Ship: The most common and efficient method for larger vessels, offering flexibility in bunkering locations within port limits.

- Truck-to-Ship: Suitable for smaller vessels or ports with limited infrastructure, offering flexibility and lower initial investment.

- Port-to-Ship (Shore-to-Ship): Bunkering directly from a terminal or jetty, often used for vessels with fixed routes or in early stages of infrastructure development.

- Container-to-Ship: Uses ISO tanks to deliver LNG, suitable for remote locations or smaller volumes.

- Others: Includes pipeline-to-ship or specialized mobile solutions.

- By End-Use Application:

- Commercial Vessels: Encompasses the vast majority of the global merchant fleet, primarily focused on cargo transportation.

- Offshore Vessels: Support offshore oil and gas operations, increasingly adopting LNG for environmental compliance and operational efficiency.

- Inland Waterways Vessels: Barges and river cruise ships operating in environmentally sensitive inland areas.

- Passenger Vessels: Includes cruise ships and ferries, prioritizing environmental performance and passenger experience.

Regional Highlights

- Europe: Leading the global LNG bunkering market due to stringent environmental regulations (e.g., EU MRV, national emissions targets), established Emission Control Areas (ECAs), and strong government support for green shipping initiatives. Countries like Norway, the Netherlands, Germany, and Spain are at the forefront of infrastructure development and LNG-fueled vessel adoption, with major bunkering hubs in Rotterdam, Amsterdam, and the Baltic Sea.

- Asia Pacific (APAC): Emerging as a critical growth region driven by rapid economic expansion, increasing maritime trade volumes, and growing awareness of environmental sustainability. Countries like Singapore, China, South Korea, and Japan are heavily investing in LNG bunkering infrastructure, with Singapore positioning itself as a major global bunkering hub. Regulatory developments and the sheer volume of shipping traffic in the region are key catalysts for market expansion.

- North America: Showing steady growth, primarily influenced by the North American Emission Control Area (NAECA) and rising demand for cleaner fuels on inland waterways (e.g., Great Lakes, Mississippi River). The U.S. Gulf Coast, particularly along the LNG export terminals, is becoming a key supply source, with ports like Jacksonville and Port Fourchon developing bunkering capabilities.

- Middle East and Africa (MEA): Represents a nascent but promising market, driven by strategic geographic locations along major trade routes and increasing focus on diversifying economies. Countries like the UAE (Fujairah) are exploring LNG bunkering capabilities to cater to the significant maritime traffic passing through the region.

- Latin America: Gradual adoption is observed, primarily driven by domestic energy policies and the need to reduce emissions from maritime transport in specific coastal and inland areas. Developments are typically linked to specific projects or major port initiatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the LNG Bunkering Market.- Shell

- TotalEnergies

- Pavilion Energy

- CMA CGM

- ExxonMobil

- BP

- Mitsui O.S.K. Lines (MOL)

- Crowley Maritime

- Sumitomo Corporation

- ENN Energy

- Korea Gas Corporation (KOGAS)

- Cheniere Energy

- Gazprom

- FortisBC

- Polaris Shipping

- Titan LNG

- Gasum

- Fjord Line

- Stena Line

- Uniper

Frequently Asked Questions

What is LNG bunkering?

LNG bunkering refers to the process of supplying Liquefied Natural Gas to ships for use as marine fuel. It involves transferring LNG from a supply source, such as a dedicated bunkering vessel, truck, or terminal, directly to a receiving vessel's fuel tanks.

Why is LNG used as a marine fuel?

LNG is used as a marine fuel primarily due to its environmental benefits. It significantly reduces sulfur oxide (SOx) and particulate matter emissions to virtually zero, nitrogen oxide (NOx) emissions by up to 85%, and greenhouse gas (GHG) emissions by up to 25% compared to conventional marine fuels, helping ships comply with international emission regulations.

What are the main challenges in LNG bunkering?

Key challenges include the high initial capital expenditure for bunkering infrastructure and LNG-fueled vessels, limited global availability of bunkering facilities, perceived safety concerns related to cryogenic fuel handling, and competition from other emerging alternative marine fuels like methanol or ammonia.

Which regions are leading in LNG bunkering adoption?

Europe, particularly the North Sea and Baltic Sea regions, along with key ports in Asia Pacific such as Singapore, China, South Korea, and Japan, are leading in LNG bunkering adoption. These regions benefit from stringent environmental regulations, extensive maritime traffic, and proactive infrastructure development.

How does LNG bunkering contribute to sustainability?

LNG bunkering contributes to sustainability by enabling significant reductions in harmful air pollutants and greenhouse gas emissions from maritime transport, directly aligning with global efforts to decarbonize the shipping industry and improve air quality in port cities and coastal areas.