Lithium Battery Manufacturing equipment Market

Lithium Battery Manufacturing equipment Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_702522 | Last Updated : July 31, 2025 |

Format : ![]()

![]()

![]()

![]()

Lithium Battery Manufacturing equipment Market Size

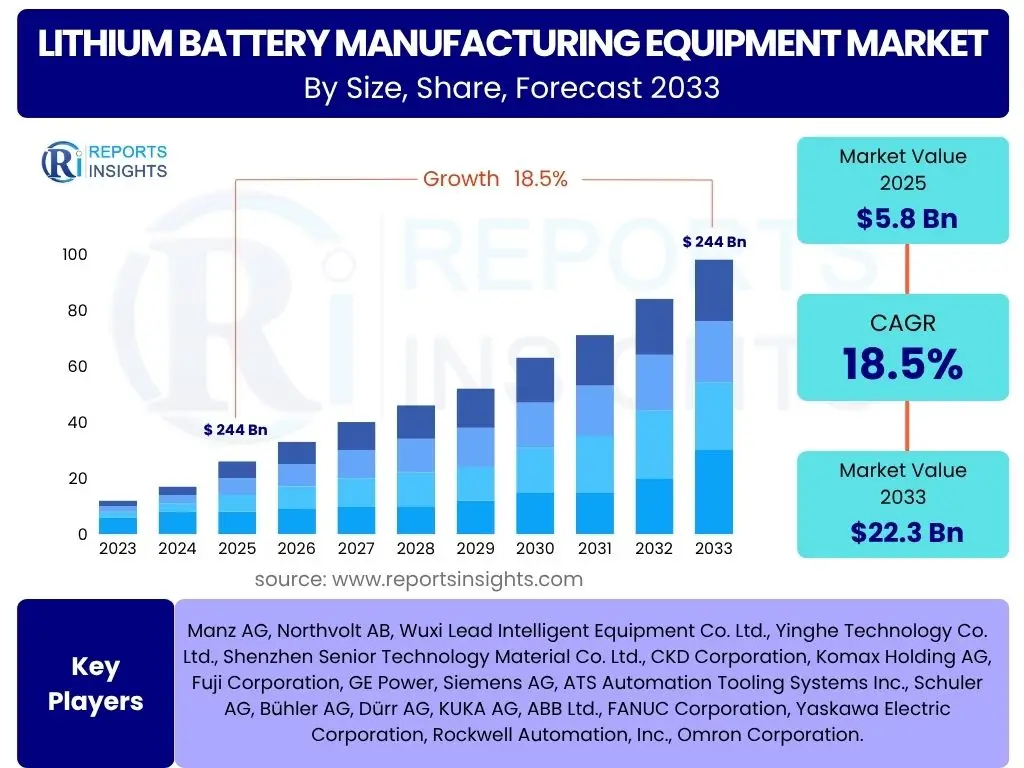

According to Reports Insights Consulting Pvt Ltd, The Lithium Battery Manufacturing equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2025 and 2033. The market is estimated at USD 5.8 Billion in 2025 and is projected to reach USD 22.3 Billion by the end of the forecast period in 2033.

Key Lithium Battery Manufacturing equipment Market Trends & Insights

User inquiries frequently highlight the rapid advancements and strategic shifts occurring within the Lithium Battery Manufacturing equipment market. A predominant theme is the increasing demand for high-efficiency, high-throughput manufacturing solutions driven by the burgeoning electric vehicle (EV) sector and the expansion of grid-scale energy storage systems. Manufacturers are keenly interested in understanding how process automation, digital twins, and advanced materials handling systems are reshaping the production landscape to meet ambitious global output targets.

Another significant area of interest revolves around sustainability and cost reduction in battery production. This includes trends towards more environmentally friendly manufacturing processes, such as dry electrode coating and solvent-free techniques, as well as innovations aimed at reducing overall production costs per kilowatt-hour. The push for higher energy density and improved safety in battery cells is directly influencing the design and capabilities of new manufacturing equipment, prompting significant R&D investments across the value chain. Global geopolitical factors and the race for energy independence are also accelerating investments in domestic battery production capabilities, particularly in North America and Europe, further influencing equipment demand and technological trends.

- Increased adoption of Industry 4.0 principles, including automation, robotics, and IoT integration, for enhanced precision and efficiency.

- Development and deployment of equipment for next-generation battery technologies, such as solid-state batteries and lithium-sulfur batteries.

- Growing emphasis on sustainable manufacturing processes, including dry electrode production and improved solvent recovery systems.

- Expansion of Giga-factories globally, necessitating large-scale, high-volume production equipment.

- Focus on modular and flexible manufacturing lines to adapt to diverse battery chemistries and form factors.

- Rising demand for advanced quality control and inspection systems utilizing AI and machine vision.

AI Impact Analysis on Lithium Battery Manufacturing equipment

Common user questions regarding AI's impact on Lithium Battery Manufacturing equipment reveal a strong focus on operational efficiency, quality assurance, and predictive capabilities. Users are interested in how AI can optimize complex production lines, minimize defects, and reduce downtime. The integration of AI algorithms with manufacturing equipment holds the promise of transforming traditional processes into highly intelligent and adaptive systems, addressing critical challenges related to yield rates, material waste, and overall production costs.

Furthermore, there is significant curiosity about AI's role in the entire lifecycle of battery manufacturing equipment, from design and simulation to post-deployment maintenance. AI-driven predictive maintenance can analyze equipment performance data to foresee potential failures, scheduling proactive interventions and thus extending machine lifespan while preventing costly interruptions. In quality control, AI-powered vision systems can detect microscopic defects faster and more accurately than human inspection, ensuring higher product reliability. The potential for AI to optimize resource allocation, manage complex supply chains for raw materials, and even simulate new battery designs and manufacturing processes is a key area of strategic development and investment.

- Enhanced predictive maintenance and anomaly detection for manufacturing equipment, minimizing downtime and optimizing operational lifespan.

- AI-powered quality control and inspection systems, improving defect detection accuracy and reducing material waste.

- Optimization of manufacturing parameters and processes through machine learning algorithms, leading to higher yield rates and energy efficiency.

- Development of digital twins for simulating and optimizing entire battery production lines, improving throughput and reducing time-to-market.

- Intelligent automation and robotic control for increased precision and flexibility in complex assembly tasks.

- Supply chain optimization and inventory management for raw materials, leveraging AI to predict demand and manage logistics.

Key Takeaways Lithium Battery Manufacturing equipment Market Size & Forecast

Analysis of user queries regarding key takeaways from the Lithium Battery Manufacturing equipment market size and forecast consistently points to the unprecedented growth driven by the global energy transition. The projected surge in market value underscores the critical need for advanced, efficient, and scalable manufacturing solutions to meet the escalating demand for lithium-ion batteries across various applications. This rapid expansion presents substantial investment opportunities for equipment manufacturers, technology providers, and ancillary service companies, highlighting a robust long-term growth trajectory.

A significant insight derived from forecast-related questions is the strategic imperative for manufacturers to innovate continuously, particularly in areas like automation, data analytics, and sustainable production methods. The market is not merely growing in volume but also evolving in complexity, with a strong emphasis on achieving higher energy densities, faster charging capabilities, and improved safety profiles for batteries. These advancements necessitate a corresponding evolution in manufacturing equipment, making technological leadership a key differentiator. Furthermore, the forecast indicates a geographical shift in manufacturing capacity, with significant investments in North America and Europe aiming to build resilient, localized supply chains, diversifying away from traditional production hubs.

- The market is poised for significant expansion, driven primarily by the escalating demand for electric vehicles and large-scale energy storage systems.

- Technological innovation in manufacturing processes and equipment will be crucial for competitive advantage and addressing emerging battery chemistries.

- Investments in highly automated and efficient production lines are accelerating to meet ambitious global battery production targets.

- The push for sustainable and environmentally conscious manufacturing methods is influencing equipment design and material choices.

- Geographic diversification of battery production facilities, particularly in North America and Europe, will create new regional market opportunities for equipment suppliers.

- Quality control, safety, and yield optimization remain paramount, driving demand for advanced inspection and AI-integrated systems.

Lithium Battery Manufacturing equipment Market Drivers Analysis

The global Lithium Battery Manufacturing equipment market is experiencing robust growth, primarily propelled by the accelerating adoption of Electric Vehicles (EVs) worldwide. Governments across various regions are implementing stringent emission standards and offering lucrative incentives for EV purchases, which in turn necessitates a massive scale-up in battery production capacity. This directly translates into heightened demand for sophisticated and high-throughput manufacturing equipment capable of producing millions of battery cells annually. The automotive industry's pivot towards electrification is arguably the single most influential driver, fostering multi-billion-dollar investments in new giga-factories and expanding existing production lines, creating a consistent need for advanced machinery for every stage of battery cell and pack assembly.

Beyond the automotive sector, the burgeoning renewable energy landscape significantly contributes to market expansion. The increasing integration of intermittent renewable energy sources like solar and wind power necessitates robust and efficient energy storage systems (ESS) to ensure grid stability and reliability. Lithium-ion batteries are central to these ESS solutions, ranging from residential battery backups to large-scale grid-level installations. The global push for decarbonization and energy independence is accelerating the deployment of these storage solutions, thereby driving demand for the equipment required to manufacture the underlying battery technologies. Furthermore, the continuous growth in consumer electronics and the increasing industrial application of lithium batteries in e-bikes, forklifts, and power tools further bolster the market, creating a diversified demand base for manufacturing equipment. This broad range of applications ensures sustained growth beyond any single sector.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Rapid Growth of Electric Vehicle (EV) Adoption | +5.5% | Global, particularly China, Europe, North America | 2025-2033 (Long-term) |

| Increasing Demand for Energy Storage Systems (ESS) | +4.0% | Global, with strong growth in developed economies | 2025-2033 (Long-term) |

| Technological Advancements in Battery Manufacturing | +3.0% | Key manufacturing hubs (Asia, Europe, North America) | 2025-2030 (Mid-term) |

| Government Incentives & Favorable Policies | +2.5% | North America (IRA), Europe (Green Deal), China | 2025-2028 (Short to Mid-term) |

| Expansion of Giga-factories & Production Capacity | +3.5% | Global, with new facilities in all major regions | 2025-2033 (Long-term) |

Lithium Battery Manufacturing equipment Market Restraints Analysis

Despite the robust growth trajectory, the Lithium Battery Manufacturing equipment market faces several significant restraints that could impede its full potential. One primary challenge is the exceedingly high initial capital expenditure required for setting up battery manufacturing facilities. The cost of advanced equipment, coupled with infrastructure development and cleanroom requirements, can be prohibitive for new entrants and can limit expansion for existing players. This substantial upfront investment often necessitates significant financial backing or government subsidies, making market entry challenging and potentially slowing down the overall pace of global capacity build-out, especially in regions with less favorable investment climates.

Another major restraint pertains to the volatility and secure supply of critical raw materials such as lithium, cobalt, nickel, and graphite. Fluctuations in the prices of these commodities, coupled with geopolitical tensions and supply chain bottlenecks, can directly impact the cost and feasibility of battery production. This uncertainty trickles down to equipment manufacturers, as disruptions in raw material supply can lead to production delays for battery cells, subsequently affecting the demand for new manufacturing equipment. Furthermore, the complex and proprietary nature of battery manufacturing processes, along with the rapid pace of technological obsolescence, also poses a restraint. Manufacturers must constantly invest in R&D to keep their equipment at the forefront of innovation, which adds to operational costs and increases the risk of existing equipment becoming outdated quickly, potentially delaying large-scale investments until new, more efficient technologies are proven.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Capital Expenditure for Facility Setup | -2.0% | Global, particularly emerging economies | 2025-2033 (Long-term) |

| Volatility in Raw Material Prices & Supply Chain | -1.5% | Global | 2025-2030 (Mid-term) |

| Complex & Evolving Manufacturing Processes | -1.0% | Global | 2025-2033 (Long-term) |

| Stringent Environmental Regulations | -0.8% | Europe, North America, parts of Asia | 2025-2030 (Mid-term) |

| Skilled Labor Shortage | -0.7% | Global, particularly developed nations with expanding production | 2025-2033 (Long-term) |

Lithium Battery Manufacturing equipment Market Opportunities Analysis

The Lithium Battery Manufacturing equipment market is brimming with opportunities, particularly driven by the emergence of next-generation battery technologies. The ongoing research and development in solid-state batteries, lithium-sulfur, and other advanced chemistries present a significant avenue for equipment manufacturers to develop specialized machinery. As these technologies mature from laboratory scale to mass production, there will be a substantial demand for entirely new types of manufacturing equipment tailored to their unique material properties and assembly processes. Companies that invest early in R&D for such equipment will be well-positioned to capture a significant share of this evolving market segment, particularly as traditional lithium-ion batteries approach their theoretical performance limits.

Another compelling opportunity lies in the expansion of battery recycling and second-life applications. As millions of EV batteries reach their end-of-life, the need for efficient and environmentally sound recycling processes will surge. This creates a new market for equipment designed for battery dismantling, material separation, and refining. Furthermore, the repurposing of used EV batteries for stationary energy storage or other less demanding applications ("second-life batteries") also presents an opportunity for equipment that can efficiently sort, test, and recondition these cells. This circular economy approach not only offers sustainability benefits but also opens up new revenue streams for equipment manufacturers. Additionally, the increasing focus on localized supply chains and regional battery production hubs in North America and Europe, supported by government incentives, offers significant opportunities for equipment suppliers to establish or expand their presence in these rapidly developing markets, moving beyond the traditional dominance of Asian manufacturers.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Emergence of Next-Generation Battery Technologies (e.g., Solid-State) | +4.0% | Global R&D centers, future production hubs | 2028-2033 (Long-term) |

| Growth in Battery Recycling & Second-Life Applications | +3.5% | Europe, North America, Asia | 2027-2033 (Long-term) |

| Localization of Battery Production Capacities | +3.0% | North America (USA, Canada), Europe (Germany, France, UK) | 2025-2030 (Mid-term) |

| Integration of AI, IoT, & Robotics for Smart Manufacturing | +2.5% | Global, particularly advanced manufacturing regions | 2025-2033 (Long-term) |

| Development of Advanced Dry Electrode Manufacturing Techniques | +2.0% | Global, led by key innovators | 2026-2032 (Mid to Long-term) |

Lithium Battery Manufacturing equipment Market Challenges Impact Analysis

The Lithium Battery Manufacturing equipment market faces several critical challenges that demand strategic responses from industry participants. One significant challenge is the rapid pace of technological change and the associated risk of equipment obsolescence. As battery chemistries and form factors evolve, and as manufacturers strive for higher energy densities and faster charging capabilities, the underlying production processes and required equipment can change dramatically. This necessitates continuous investment in research and development by equipment manufacturers to ensure their offerings remain relevant and competitive. For battery producers, this means a constant need to upgrade or replace machinery, leading to significant capital outlay and potential disruption to production cycles if upgrades are not seamlessly integrated.

Another substantial challenge is the increasing complexity of manufacturing processes and the need for highly skilled labor. Modern battery production lines are highly automated and integrated, requiring specialized expertise in robotics, automation, data analytics, and material science for their operation, maintenance, and optimization. There is a growing shortage of such skilled professionals globally, which can impede the efficient scale-up of battery manufacturing facilities and the effective utilization of advanced equipment. This labor gap not only affects the day-to-day operations but also impacts the ability to innovate and implement new manufacturing techniques. Furthermore, intellectual property protection remains a major concern, as proprietary technologies and manufacturing know-how are critical for competitive advantage, leading to complex licensing agreements and potential disputes, especially in a rapidly globalizing market with diverse regulatory and legal frameworks.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Technological Obsolescence & High R&D Costs | -1.8% | Global | 2025-2033 (Long-term) |

| Shortage of Skilled Workforce | -1.5% | Global, particularly Europe and North America | 2025-2033 (Long-term) |

| Intense Competition & Pricing Pressure | -1.2% | Global, especially Asia-Pacific | 2025-2030 (Mid-term) |

| Intellectual Property Protection Concerns | -1.0% | Global, with emphasis on emerging manufacturing hubs | 2025-2033 (Long-term) |

| Maintaining High Quality & Safety Standards | -0.9% | Global | 2025-2033 (Long-term) |

Lithium Battery Manufacturing equipment Market - Updated Report Scope

This report provides a comprehensive analysis of the global Lithium Battery Manufacturing equipment market, offering detailed insights into its current size, historical performance, and future growth projections. It delineates key market trends, analyzes the impact of artificial intelligence, and examines the drivers, restraints, opportunities, and challenges shaping the industry landscape. The scope encompasses a detailed segmentation by equipment type, battery type, and application, alongside a thorough regional analysis and profiles of leading market players, designed to provide a strategic overview for stakeholders.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 5.8 Billion |

| Market Forecast in 2033 | USD 22.3 Billion |

| Growth Rate | 18.5% |

| Number of Pages | 250 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Manz AG, Northvolt AB, Wuxi Lead Intelligent Equipment Co. Ltd., Yinghe Technology Co. Ltd., Shenzhen Senior Technology Material Co. Ltd., CKD Corporation, Komax Holding AG, Fuji Corporation, GE Power, Siemens AG, ATS Automation Tooling Systems Inc., Schuler AG, Bühler AG, Dürr AG, KUKA AG, ABB Ltd., FANUC Corporation, Yaskawa Electric Corporation, Rockwell Automation, Inc., Omron Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Lithium Battery Manufacturing equipment market is intricately segmented to provide a granular view of its diverse components and applications. This segmentation allows for a comprehensive understanding of specific market niches, enabling stakeholders to identify high-growth areas and tailor their strategies accordingly. The primary segmentation categories include equipment type, battery type, and application, each comprising several sub-segments that reflect the complexities and specific needs of the battery manufacturing ecosystem. This detailed breakdown highlights the specialized machinery required at each stage of the production process, from raw material handling to final cell testing and packaging.

Analyzing the market through these segments reveals insights into technological preferences, investment patterns, and regional demand dynamics. For instance, the "Equipment Type" segment differentiates between electrode manufacturing, cell assembly, and formation & testing, showing where innovation and capital expenditure are most concentrated. The "Battery Type" segment reflects the industry's shift towards advanced chemistries like solid-state, indicating future equipment requirements. Lastly, the "Application" segment underscores the dominant role of the automotive sector, while also recognizing the significant contributions of consumer electronics, energy storage, and industrial uses. This multi-faceted segmentation is crucial for accurate market forecasting and strategic planning.

- By Equipment Type:

- Electrode Manufacturing Equipment: Includes machinery for mixing active materials, coating them onto current collectors, calendering or pressing, and precise slitting or cutting of electrodes.

- Cell Assembly Equipment: Encompasses winding or stacking machines for cell formation, welding equipment for internal connections, electrolyte filling systems, and sealing machines to encapsulate the cell.

- Formation & Testing Equipment: Crucial for the initial charging/discharging cycles (formation) to activate battery materials, followed by grading and comprehensive testing to ensure performance and safety.

- Other Equipment: Covers auxiliary systems like recycling equipment for end-of-life batteries, advanced quality control and inspection systems (e.g., X-ray, vision systems), and sophisticated material handling and automation systems.

- By Battery Type:

- Lithium-ion Battery Manufacturing Equipment: The largest segment, covering standard liquid electrolyte Li-ion batteries used in most current applications.

- Lithium Polymer Battery Manufacturing Equipment: Specialized equipment for batteries utilizing a polymer electrolyte, often preferred for flexible designs and certain consumer electronics.

- Solid-State Battery Manufacturing Equipment: Emerging segment for next-generation batteries using solid electrolytes, requiring entirely new or significantly modified production lines.

- Other Advanced Battery Manufacturing Equipment: Includes machinery for developing and producing other novel battery chemistries and designs.

- By Application:

- Automotive: Dominant segment, primarily for Electric Vehicles (BEVs, PHEVs) and Hybrid Electric Vehicles, driving the largest volume demand for manufacturing equipment.

- Consumer Electronics: Equipment for batteries used in smartphones, laptops, tablets, wearables, and other portable electronic devices.

- Energy Storage Systems (ESS): Machinery for grid-scale energy storage, residential backup systems, and commercial battery solutions.

- Industrial: Applications include e-bikes, forklifts, power tools, robotics, and other industrial machinery.

- Medical Devices: Specialized equipment for batteries in medical implants, portable diagnostic tools, and other healthcare applications.

- Aerospace & Defense: High-performance and reliable battery manufacturing equipment for drones, aerospace vehicles, and military applications.

Regional Highlights

- Asia Pacific (APAC): This region, particularly China, South Korea, and Japan, remains the largest market for Lithium Battery Manufacturing equipment due to its established leadership in battery production and a high concentration of giga-factories. China dominates in terms of production capacity and raw material processing, driving substantial demand for advanced and automated equipment. South Korea and Japan are key innovators in battery technology and equipment, consistently pushing boundaries in efficiency and quality. The region's extensive consumer electronics and electric vehicle manufacturing bases ensure sustained investment in battery production infrastructure.

- Europe: Europe is emerging as a significant growth hub, propelled by ambitious climate targets, the European Green Deal, and substantial investments in domestic battery production. Countries like Germany, France, Sweden, and Norway are actively developing large-scale battery factories (e.g., Northvolt, ACC), aiming to localize the EV battery supply chain. This strategic shift is generating immense demand for sophisticated, often highly automated, manufacturing equipment, with a strong emphasis on sustainable production methods and energy efficiency.

- North America: Driven by government initiatives such as the Inflation Reduction Act (IRA) in the United States, North America is experiencing a surge in battery manufacturing investments. This region is witnessing the construction of numerous new battery plants by major automotive OEMs and battery manufacturers. The focus is on creating resilient, localized supply chains for EVs and energy storage, leading to a rapid increase in demand for advanced battery manufacturing equipment and associated automation technologies.

- Latin America, Middle East, and Africa (MEA): While smaller in market share compared to the leading regions, these areas present nascent opportunities. Latin America, particularly countries with significant lithium reserves, may see future investments in local processing and battery production. The MEA region is exploring renewable energy integration and EV adoption, which could incrementally drive demand for battery manufacturing capabilities over the long term. These regions are likely to import advanced equipment as their industrial base develops.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Lithium Battery Manufacturing equipment Market.- Manz AG

- Northvolt AB

- Wuxi Lead Intelligent Equipment Co. Ltd.

- Yinghe Technology Co. Ltd.

- Shenzhen Senior Technology Material Co. Ltd.

- CKD Corporation

- Komax Holding AG

- Fuji Corporation

- GE Power

- Siemens AG

- ATS Automation Tooling Systems Inc.

- Schuler AG

- Bühler AG

- Dürr AG

- KUKA AG

- ABB Ltd.

- FANUC Corporation

- Yaskawa Electric Corporation

- Rockwell Automation, Inc.

- Omron Corporation

Frequently Asked Questions

What is the current size and projected growth of the Lithium Battery Manufacturing equipment market?

The Lithium Battery Manufacturing equipment market was estimated at USD 5.8 Billion in 2025 and is projected for substantial growth. It is expected to reach USD 22.3 Billion by 2033, demonstrating a Compound Annual Growth Rate (CAGR) of 18.5% over the forecast period. This robust growth is primarily driven by the escalating global demand for electric vehicles and large-scale energy storage systems, necessitating significant investments in advanced battery production infrastructure worldwide.

The market expansion is also fueled by continuous technological advancements in battery chemistry and manufacturing processes, requiring specialized and efficient equipment for high-volume production. As more giga-factories are established across North America, Europe, and Asia, the demand for sophisticated electrode manufacturing, cell assembly, and formation & testing equipment is set to increase proportionally. This growth trajectory signifies a dynamic market with abundant opportunities for equipment suppliers and technology innovators.

What are the primary drivers propelling the Lithium Battery Manufacturing equipment market?

The primary drivers of the Lithium Battery Manufacturing equipment market include the rapid global adoption of Electric Vehicles (EVs), which necessitates a massive increase in battery production capacity. Government incentives and supportive policies aimed at promoting EVs and renewable energy storage solutions further stimulate this demand. The expanding deployment of grid-scale and residential energy storage systems (ESS) to balance renewable energy sources also contributes significantly to market growth, as lithium-ion batteries are central to these applications.

Additionally, continuous technological advancements in battery design and manufacturing processes, such as the development of more energy-dense and safer battery cells, drive the need for new and upgraded production equipment. The ongoing establishment of large-scale battery manufacturing facilities, often referred to as "giga-factories," across various regions globally further amplifies the demand for high-throughput, automated equipment. These factors collectively create a strong impetus for sustained market expansion.

What challenges does the Lithium Battery Manufacturing equipment market face?

The Lithium Battery Manufacturing equipment market encounters several notable challenges. One significant hurdle is the high initial capital expenditure required for setting up and expanding battery manufacturing facilities. The cost of acquiring advanced machinery, coupled with the need for specialized infrastructure, can be prohibitive for many potential investors.

Another key challenge is the volatility in the prices of critical raw materials like lithium, cobalt, and nickel, along with potential supply chain disruptions. Such instability can impact production costs and schedules for battery manufacturers, subsequently affecting their investment in new equipment. Furthermore, the rapid pace of technological advancements in battery chemistry means that manufacturing equipment can quickly become obsolete, necessitating continuous R&D investment and posing risks for equipment manufacturers. Finally, a global shortage of skilled labor proficient in operating and maintaining complex, highly automated battery production lines also presents a substantial operational challenge, potentially limiting the efficiency and scalability of new facilities.

How is Artificial Intelligence (AI) impacting the Lithium Battery Manufacturing equipment market?

Artificial Intelligence (AI) is significantly transforming the Lithium Battery Manufacturing equipment market by enhancing efficiency, quality, and predictive capabilities across the production lifecycle. AI-driven solutions are being integrated into manufacturing equipment to enable advanced predictive maintenance, allowing for the anticipation of equipment failures and proactive interventions, thereby reducing downtime and extending machine lifespan. This optimizes operational continuity and lowers maintenance costs.

Furthermore, AI-powered vision systems and machine learning algorithms are revolutionizing quality control by enabling highly accurate and rapid detection of defects at various stages of battery production, from electrode coating to cell assembly and testing. AI also plays a crucial role in optimizing complex manufacturing parameters, leading to improved yield rates, reduced energy consumption, and enhanced overall process efficiency. The development of digital twins, facilitated by AI, allows for virtual simulation and optimization of entire production lines, accelerating new product development and operational scalability.

Which regions are key contributors to the Lithium Battery Manufacturing equipment market, and why?

The Asia Pacific (APAC) region is the dominant contributor to the Lithium Battery Manufacturing equipment market, primarily due to the presence of leading battery manufacturers and the extensive adoption of electric vehicles and consumer electronics in countries like China, South Korea, and Japan. This region boasts the largest concentration of battery production capacity and technological innovation.

Europe is rapidly emerging as a significant market, driven by ambitious decarbonization goals, the establishment of numerous new giga-factories, and strong government support for local battery production initiatives. Countries such as Germany, France, and Sweden are investing heavily to create a domestic battery supply chain. North America is also experiencing substantial growth, largely propelled by supportive policies like the Inflation Reduction Act (IRA) in the United States, which is incentivizing the localization of EV battery manufacturing and fostering the construction of new large-scale battery plants to build a resilient regional supply chain. These regions are characterized by robust investment in advanced, highly automated, and sustainable manufacturing equipment.