Automated Test Equipment Market

Automated Test Equipment Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_703548 | Last Updated : August 01, 2025 |

Format : ![]()

![]()

![]()

![]()

Automated Test Equipment Market Size

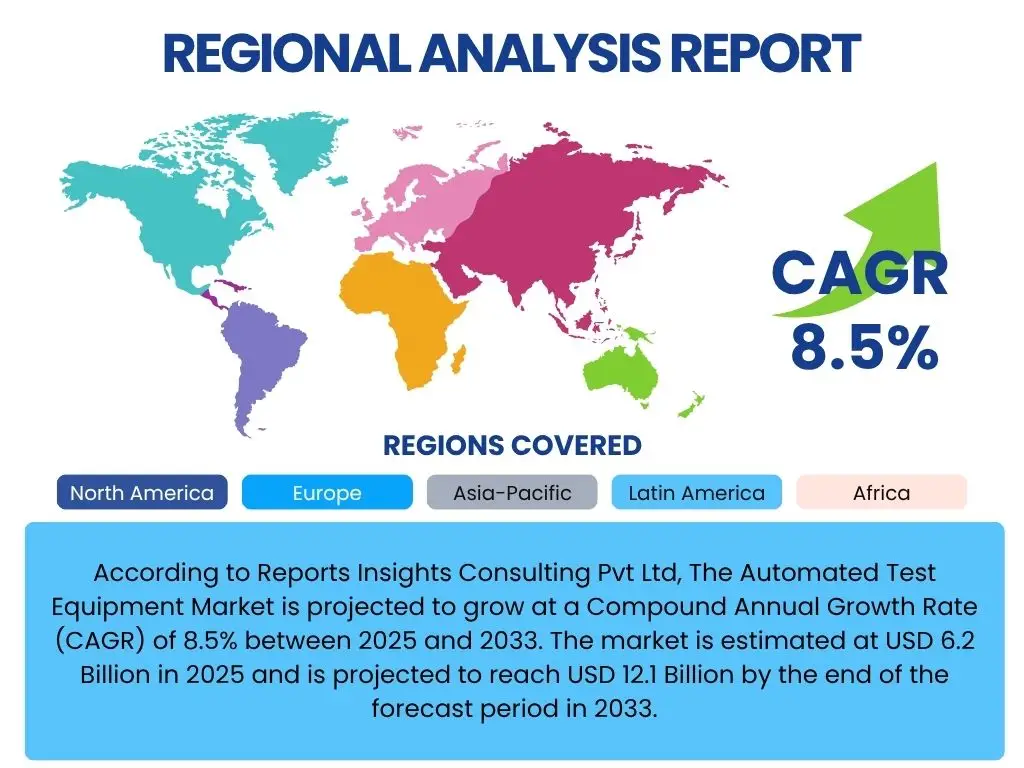

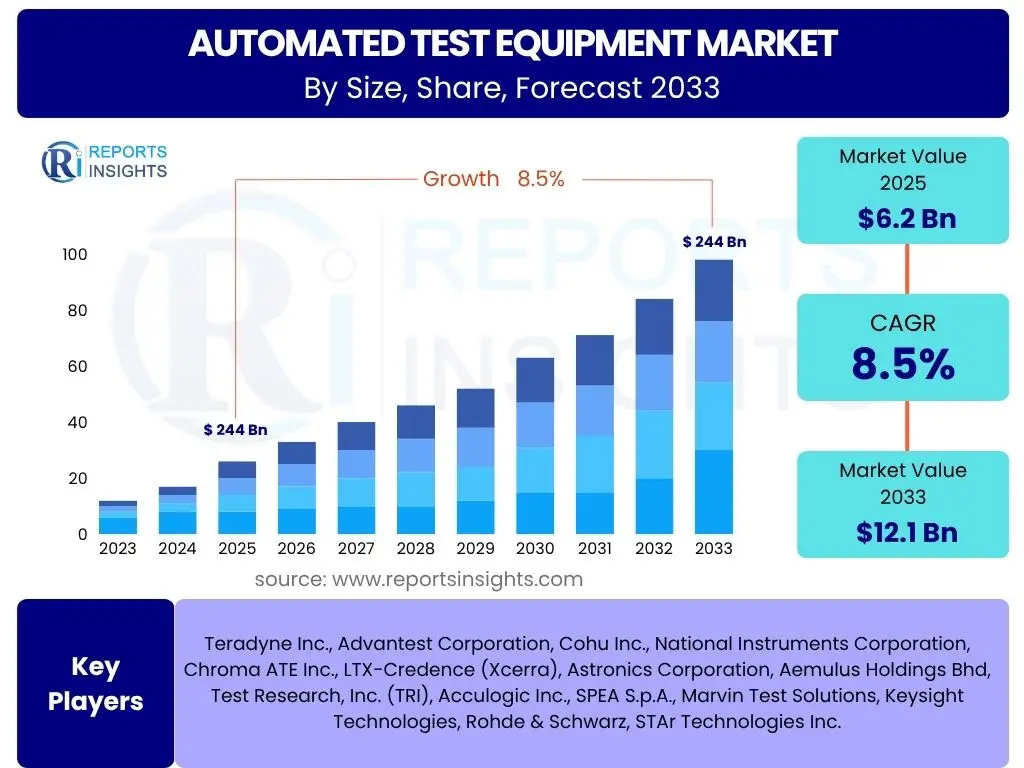

According to Reports Insights Consulting Pvt Ltd, The Automated Test Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2025 and 2033. The market is estimated at USD 6.2 Billion in 2025 and is projected to reach USD 12.1 Billion by the end of the forecast period in 2033.

Key Automated Test Equipment Market Trends & Insights

User queries frequently highlight the evolving landscape of Automated Test Equipment (ATE), seeking information on emerging technologies and paradigm shifts impacting the industry. A significant trend involves the increasing demand for advanced testing solutions driven by the proliferation of complex electronic devices across various sectors, including consumer electronics, automotive, and telecommunications. The integration of high-speed communication technologies, such as 5G, and the burgeoning Internet of Things (IoT) ecosystem are also pivotal, necessitating more sophisticated and adaptable ATE systems capable of handling diverse protocols and higher data rates. Furthermore, there is a clear interest in how ATE can reduce testing costs and improve efficiency, pushing manufacturers towards more integrated, modular, and software-defined test platforms. The shift towards wafer-level testing and the adoption of parallel testing methodologies are also frequently discussed topics, aimed at optimizing production throughput and reducing time-to-market.

- Miniaturization and increasing complexity of electronic components driving demand for advanced ATE.

- Proliferation of 5G, IoT, and AI-enabled devices requiring high-speed and versatile testing capabilities.

- Shift towards software-defined test platforms and modular ATE for enhanced flexibility and cost-efficiency.

- Growing adoption of parallel testing and in-line testing for improved manufacturing throughput.

- Emphasis on predictive maintenance and self-calibration features in ATE systems.

- Rising demand for ATE in electric vehicles (EVs) and autonomous driving systems.

AI Impact Analysis on Automated Test Equipment

User inquiries concerning AI's influence on Automated Test Equipment often revolve around its potential to enhance test efficiency, reduce false positives, and improve diagnostic capabilities. The integration of Artificial intelligence (AI) and machine learning (ML) algorithms is revolutionizing ATE by enabling predictive analytics for equipment maintenance, optimizing test sequences, and performing complex data analysis for defect detection. Users are keen to understand how AI can lead to smarter, more adaptive testing processes that learn from historical data to identify subtle anomalies and anticipate potential failures, thereby moving beyond traditional pass/fail criteria. While the benefits in terms of accuracy and throughput are evident, concerns also emerge regarding the initial investment required for AI integration, the need for specialized data scientists, and the potential complexities in validating AI-driven test results. Nevertheless, the consensus indicates that AI is poised to significantly elevate the intelligence and autonomy of ATE systems, making them more resilient and efficient.

- Enhanced test optimization and sequence generation through AI algorithms.

- Predictive maintenance for ATE systems, reducing downtime and operational costs.

- Improved defect detection and classification accuracy using machine learning.

- Automated test data analysis and anomaly detection for faster troubleshooting.

- Development of self-learning ATE systems adapting to new test requirements.

- Reduced human intervention and potential for fully autonomous testing environments.

Key Takeaways Automated Test Equipment Market Size & Forecast

Common user questions regarding the Automated Test Equipment market size and forecast consistently point towards an industry on a strong growth trajectory, primarily fueled by the relentless innovation in the electronics sector. A key takeaway is the consistent expansion driven by the increasing complexity and demand for semiconductors, especially in areas like high-performance computing, automotive electronics, and connected devices. The market's robust Compound Annual Growth Rate (CAGR) signifies a continuous investment in advanced testing solutions to ensure product quality and reliability in these rapidly evolving domains. Furthermore, the forecast indicates a substantial increase in market valuation, highlighting the critical role ATE plays in the global technology supply chain. The insights suggest that future growth will be heavily influenced by technological advancements, regulatory requirements for quality assurance, and the expansion of manufacturing capabilities in emerging economies. This sustained growth underscores ATE as a vital component for the development and mass production of next-generation electronic products.

- Significant market expansion driven by surging demand for advanced semiconductors.

- Sustained high CAGR indicating strong growth potential through the forecast period.

- Critical role of ATE in ensuring quality and reliability of complex electronic devices.

- Technological advancements and automation driving market innovation.

- Emerging economies presenting new opportunities for ATE market penetration.

- Growing integration of ATE in diverse end-use industries like automotive and telecommunications.

Automated Test Equipment Market Drivers Analysis

The Automated Test Equipment (ATE) market is propelled by a confluence of technological advancements and industrial demands. The escalating complexity and miniaturization of electronic components, particularly semiconductors, necessitate increasingly sophisticated and precise testing solutions to ensure functionality and reliability. This fundamental driver is further amplified by the rapid proliferation of advanced technologies such as 5G networks, Artificial Intelligence (AI), Machine Learning (ML), and the Internet of Things (IoT), all of which rely on high-performance and fault-tolerant integrated circuits. The automotive industry's pivot towards electric vehicles (EVs) and autonomous driving systems also acts as a significant catalyst, demanding rigorous testing of power electronics, sensors, and communication modules. Additionally, the need for higher production yields, reduced time-to-market, and lower overall testing costs in a competitive global landscape incentivizes manufacturers to invest in efficient automated testing solutions.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growing Demand for Semiconductors | +2.5% | Global, particularly APAC (China, Taiwan, South Korea) | 2025-2033 |

| Advancements in 5G, AI, IoT Technologies | +2.0% | North America, APAC, Europe | 2025-2030 |

| Rise of Electric Vehicles & Autonomous Driving | +1.5% | Europe, North America, APAC (China, Japan) | 2026-2033 |

| Need for Reduced Time-to-Market & Cost Efficiency | +1.0% | Global | 2025-2033 |

| Increasing Complexity of Electronic Devices | +1.5% | Global | 2025-2033 |

Automated Test Equipment Market Restraints Analysis

Despite robust growth drivers, the Automated Test Equipment market faces several restraints that could temper its expansion. One significant hurdle is the high initial capital investment required for purchasing and implementing advanced ATE systems. This can be particularly challenging for small and medium-sized enterprises (SMEs) or new entrants into the semiconductor manufacturing space. The complexity of programming and operating sophisticated ATE systems also necessitates a highly skilled workforce, and a shortage of such expertise can hinder adoption and efficient utilization. Furthermore, the rapid pace of technological change in the electronics industry means that ATE systems can quickly become obsolete, requiring frequent upgrades or replacements, which adds to the total cost of ownership. Economic uncertainties and fluctuations in global semiconductor demand can also lead to delayed investments in new ATE infrastructure, impacting market growth. Geopolitical tensions affecting global supply chains for critical components also pose a risk.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Initial Capital Investment | -1.2% | Global, particularly emerging economies | 2025-2030 |

| Shortage of Skilled Workforce | -0.8% | North America, Europe, parts of APAC | 2025-2033 |

| Rapid Technological Obsolescence | -0.7% | Global | 2025-2033 |

| Global Economic Volatility | -0.5% | Global | Short-term, 2025-2026 |

Automated Test Equipment Market Opportunities Analysis

Significant opportunities abound in the Automated Test Equipment market, driven by evolving technological landscapes and expanding application areas. The advent of new materials and advanced packaging technologies for semiconductors creates a demand for innovative testing methodologies that current ATE systems may not fully support, opening avenues for R&D and new product development. The burgeoning markets for specialized electronics, such as those used in augmented reality (AR), virtual reality (VR), and advanced medical devices, present niche yet high-growth opportunities for tailored ATE solutions. Furthermore, the increasing adoption of Industry 4.0 principles and smart manufacturing initiatives encourages the integration of ATE with broader factory automation systems, enhancing data analytics and predictive capabilities. Developing modular and reconfigurable ATE platforms capable of addressing diverse testing needs with minimal retooling can also capture new market segments. Lastly, geographic expansion into rapidly industrializing regions with growing electronics manufacturing bases offers substantial untapped potential.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Emerging Technologies (AR/VR, Quantum Computing) | +1.8% | North America, Europe, parts of APAC | 2027-2033 |

| Increased Adoption of Smart Manufacturing/Industry 4.0 | +1.5% | Global | 2025-2033 |

| Development of Modular & Reconfigurable ATE | +1.3% | Global | 2025-2033 |

| Expansion into New Geographic Markets | +1.0% | Southeast Asia, Latin America, Middle East | 2026-2033 |

Automated Test Equipment Market Challenges Impact Analysis

The Automated Test Equipment market faces distinct challenges that require strategic navigation. One primary challenge is the continuous pressure to reduce testing costs while simultaneously increasing test coverage and speed, especially as product lifecycles shorten. This drives ATE manufacturers to innovate constantly, balancing performance with affordability. Another significant challenge stems from the ever-increasing complexity of System-on-Chip (SoC) designs and heterogeneous integration, which demand more intricate and multifaceted testing protocols that traditional ATE systems may struggle to accommodate. The integration of diverse technologies within ATE, such as optical, RF, and power testing, also poses technical hurdles. Furthermore, ensuring robust cybersecurity measures for interconnected ATE systems and managing vast amounts of test data generated are growing concerns. Adapting to fluctuating supply chains for specialized components and maintaining global service capabilities across diverse regulatory environments also present ongoing operational difficulties for ATE providers.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Complexity of SoCs & Heterogeneous Integration | -1.0% | Global | 2025-2033 |

| Pressure to Reduce Cost while Increasing Test Coverage | -0.9% | Global | 2025-2033 |

| Integration of Diverse Test Technologies (RF, Optical, Power) | -0.7% | Global | 2025-2033 |

| Cybersecurity Risks & Data Management | -0.5% | Global | 2026-2033 |

Automated Test Equipment Market - Updated Report Scope

This comprehensive report provides an in-depth analysis of the Automated Test Equipment (ATE) market, offering detailed insights into market dynamics, segmentation, regional trends, and competitive landscape. It covers historical data from 2019 to 2023, provides current market valuations for 2024 and 2025, and presents robust forecasts through 2033. The scope encompasses various product types, applications, and end-use industries, identifying key drivers, restraints, opportunities, and challenges influencing market growth. The report also highlights the impact of emerging technologies like AI and 5G on the ATE sector, delivering actionable intelligence for stakeholders.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 6.2 Billion |

| Market Forecast in 2033 | USD 12.1 Billion |

| Growth Rate | 8.5% |

| Number of Pages | 255 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Teradyne Inc., Advantest Corporation, Cohu Inc., National Instruments Corporation, Chroma ATE Inc., LTX-Credence (Xcerra), Astronics Corporation, Aemulus Holdings Bhd, Test Research, Inc. (TRI), Acculogic Inc., SPEA S.p.A., Marvin Test Solutions, Keysight Technologies, Rohde & Schwarz, STAr Technologies Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Automated Test Equipment (ATE) market is meticulously segmented to provide a granular understanding of its diverse components and applications. This segmentation allows for precise analysis of market dynamics, identifying specific areas of growth, dominance, and emerging opportunities. The primary segmentations include product type, which differentiates between specialized ATE for memory, non-memory, and discrete devices; application, highlighting critical end-use industries like consumer electronics, automotive, and telecommunications; and component, detailing the various parts that constitute an ATE system such as handlers, probers, and software. Furthermore, the market is segmented by end-use industry, distinguishing between integrated device manufacturers (IDMs), outsourced semiconductor assembly and test (OSAT) companies, and foundries, each with unique testing requirements and investment patterns. This multi-dimensional segmentation is crucial for understanding the intricate supply and demand forces within the ATE ecosystem.

- By Product Type: Memory ATE, Non-Memory ATE, Discrete ATE

- By Application: Consumer Electronics, Automotive, Telecommunications, Aerospace & Defense, Medical, Industrial, Others

- By Component: Handlers/Probers, Device Interface Instruments, Test Scanners, Software

- By End-Use Industry: Integrated Device Manufacturers (IDMs), Outsourced Semiconductor Assembly and Test (OSAT), Foundries

Regional Highlights

- Asia Pacific (APAC): Dominates the ATE market due to the presence of major semiconductor manufacturing hubs in countries like China, Taiwan, South Korea, and Japan. Strong growth in consumer electronics, telecommunications, and automotive sectors drives demand. The region benefits from significant investments in new fabrication plants and R&D activities.

- North America: A significant market characterized by strong R&D capabilities, a robust presence of leading ATE manufacturers, and demand from advanced industries such as aerospace & defense, high-performance computing, and AI development. Early adoption of advanced technologies and substantial investments in innovation contribute to its market share.

- Europe: Exhibits steady growth, driven by the strong automotive electronics industry, industrial automation, and specialized semiconductor manufacturing. Countries like Germany, France, and the UK are key contributors, focusing on high-precision testing and industry 4.0 integration.

- Latin America, Middle East, and Africa (MEA): Emerging markets with nascent but growing electronics manufacturing capabilities. These regions present opportunities for ATE adoption as industrialization and technological infrastructure improve, particularly in sectors like telecommunications and consumer electronics assembly.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automated Test Equipment Market.- Teradyne Inc.

- Advantest Corporation

- Cohu Inc.

- National Instruments Corporation

- Chroma ATE Inc.

- LTX-Credence (Xcerra)

- Astronics Corporation

- Aemulus Holdings Bhd

- Test Research, Inc. (TRI)

- Acculogic Inc.

- SPEA S.p.A.

- Marvin Test Solutions

- Keysight Technologies

- Rohde & Schwarz

- STAr Technologies Inc.

Frequently Asked Questions

Analyze common user questions about the Automated Test Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Automated Test Equipment (ATE)?

Automated Test Equipment (ATE) refers to computer-controlled systems designed to perform rapid, high-volume testing of electronic components, integrated circuits, and printed circuit boards to ensure their functionality, performance, and reliability during manufacturing processes.

Why is ATE important in semiconductor manufacturing?

ATE is crucial in semiconductor manufacturing to detect defects, verify design specifications, and ensure the quality of integrated circuits before they are integrated into final products, thereby reducing production costs, improving yields, and enhancing product reliability.

What are the main types of ATE systems?

The main types of ATE systems include Memory ATE (for memory chips), Non-Memory ATE (for microprocessors, ASICs, mixed-signal chips), and Discrete ATE (for individual components like transistors and diodes), each specialized for different device characteristics.

Which industries primarily utilize Automated Test Equipment?

ATE is primarily utilized in industries such as consumer electronics, automotive (especially for EVs and autonomous systems), telecommunications (5G devices), aerospace and defense, medical devices, and industrial automation, wherever electronic component quality assurance is critical.

How is AI impacting the future of ATE?

AI is transforming ATE by enabling smarter test methodologies, predictive maintenance for equipment, enhanced defect detection through machine learning, and optimizing test processes for greater efficiency and accuracy, moving towards more autonomous and adaptive testing solutions.