Lane Departure Warning System Market

Lane Departure Warning System Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_701539 | Last Updated : July 30, 2025 |

Format : ![]()

![]()

![]()

![]()

Lane Departure Warning System Market Size

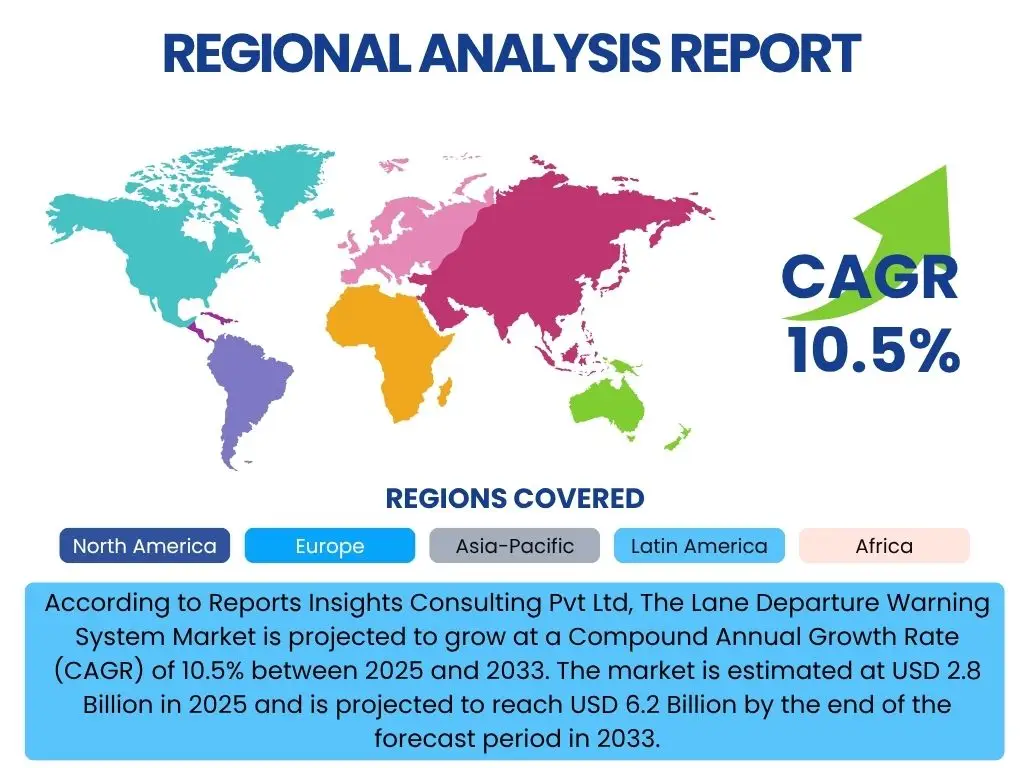

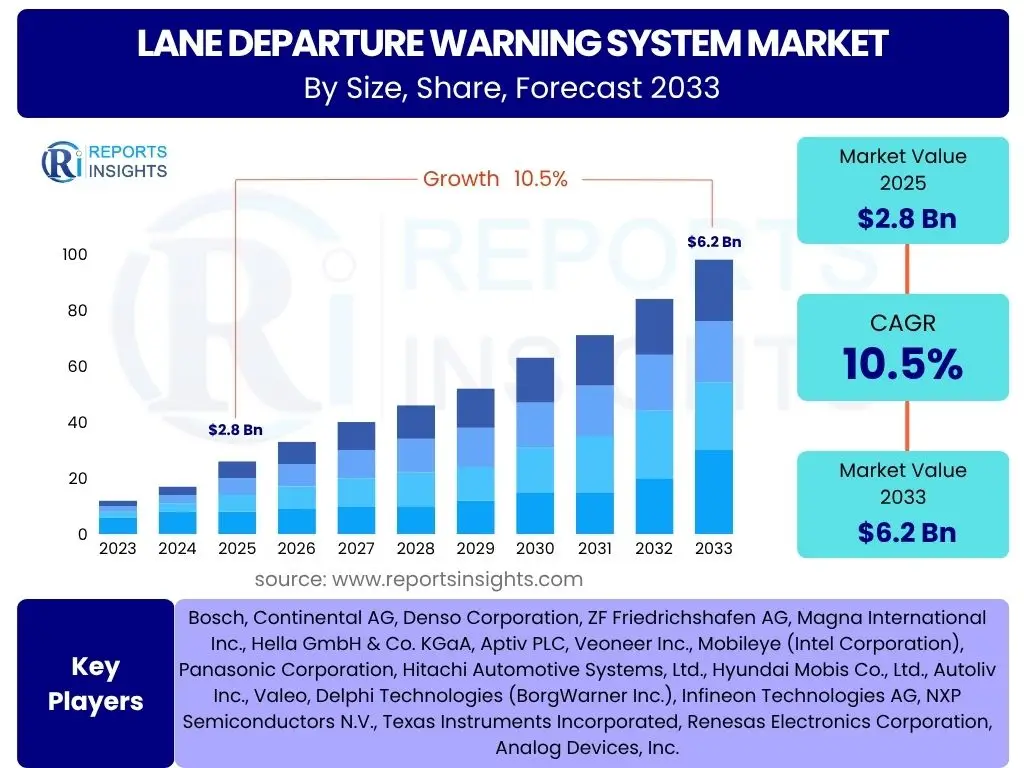

According to Reports Insights Consulting Pvt Ltd, The Lane Departure Warning System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2025 and 2033. The market is estimated at USD 2.8 Billion in 2025 and is projected to reach USD 6.2 Billion by the end of the forecast period in 2033.

Key Lane Departure Warning System Market Trends & Insights

The Lane Departure Warning System (LDWS) market is currently witnessing a transformative phase, driven by escalating consumer demand for vehicle safety and stringent regulatory mandates across major automotive markets. A primary trend involves the rapid integration of advanced sensor technologies, including high-resolution cameras, radar, and LiDAR, which enhance the accuracy and reliability of lane detection. This technological evolution is moving beyond simple warnings to proactive interventions, such as Lane Keeping Assist (LKA) and Lane Centering systems, marking a significant shift from passive safety to active driver assistance. Furthermore, the convergence of LDWS with other Advanced Driver-Assistance Systems (ADAS) like adaptive cruise control and blind-spot monitoring is creating more holistic and integrated safety solutions, significantly improving overall vehicle intelligence and occupant protection.

Another prominent trend is the increasing adoption of LDWS as a standard feature, even in entry-level vehicle segments, rather than an exclusive option for premium models. This democratization of safety technology is being fueled by falling sensor costs, economies of scale in manufacturing, and growing public awareness regarding road safety. The expansion into new vehicle categories, including commercial vehicles and even two-wheelers in some regions, highlights the versatility and broad applicability of these systems. Furthermore, software advancements, particularly in image processing and machine learning algorithms, are enabling LDWS to perform effectively under diverse environmental conditions, such as adverse weather or poorly marked roads, thereby expanding their operational envelopes and enhancing user confidence in their efficacy.

- Integration of advanced sensor fusion for enhanced accuracy and reliability.

- Shift from passive warning systems to active lane keeping and centering functionalities.

- Standardization of LDWS across a wider range of vehicle segments, including entry-level and commercial vehicles.

- Development of sophisticated algorithms for improved performance in varied environmental conditions.

- Convergence of LDWS with other ADAS features for comprehensive safety suites.

AI Impact Analysis on Lane Departure Warning System

Artificial Intelligence (AI) is fundamentally reshaping the capabilities and performance of Lane Departure Warning Systems, addressing previous limitations and ushering in a new era of proactive safety. AI-driven computer vision algorithms significantly improve the system's ability to accurately detect lane markings, even those that are faded, obscured by adverse weather, or encountered during complex driving scenarios like construction zones or sharp turns. This enhanced perception allows LDWS to distinguish between intentional lane changes and unintentional drifts more reliably, reducing false positives and improving the user experience. Moreover, AI enables predictive capabilities, where the system can anticipate a potential lane departure based on driver behavior, vehicle dynamics, and road conditions, providing more timely and context-aware warnings or interventions.

Beyond perception, AI's influence extends to the intelligence and adaptability of LDWS. Machine learning models, trained on vast datasets of real-world driving scenarios, allow the system to continuously learn and refine its performance over time. This adaptive learning capability is crucial for handling the immense variability in road infrastructure, driving styles, and environmental factors across different regions. AI also facilitates the seamless integration of LDWS with higher levels of autonomous driving, serving as a critical foundational layer for features like highway pilot or traffic jam assist. The development of deep learning architectures is leading to more robust and generalized LDWS solutions that can operate effectively without explicit programming for every possible scenario, making these systems more reliable and universally applicable across diverse driving environments.

- Enhanced lane detection accuracy through AI-powered computer vision algorithms.

- Reduced false positives by distinguishing intentional from unintentional lane changes.

- Predictive capabilities to anticipate lane departures based on driving context.

- Adaptive learning through machine learning models for continuous performance improvement.

- Foundation for higher levels of autonomous driving capabilities.

Key Takeaways Lane Departure Warning System Market Size & Forecast

The Lane Departure Warning System market is poised for robust expansion, reflecting a global shift towards enhanced vehicle safety and the increasing adoption of advanced driver-assistance technologies. A significant takeaway is the strong positive correlation between regulatory pressure and market growth; governments worldwide are increasingly mandating or incentivizing the inclusion of ADAS features, including LDWS, in new vehicles, which directly fuels demand. This regulatory push, combined with rising consumer awareness regarding the life-saving potential of these systems, is creating a fertile ground for market penetration, transforming LDWS from a luxury feature into a mainstream safety standard. The continuous innovation in sensor technology and AI-driven algorithms is further bolstering this growth, promising more accurate and reliable systems that instill greater confidence in drivers.

Another crucial insight is the dynamic interplay between technological advancement and cost reduction. As the underlying components like cameras, radar, and processing units become more affordable through economies of scale and manufacturing efficiencies, LDWS becomes accessible to a broader consumer base. This accessibility is key to accelerating market expansion, particularly in emerging economies where safety features are gaining traction. Furthermore, the integration of LDWS into comprehensive ADAS suites is a strategic move by automakers to offer holistic safety packages, enhancing vehicle value and differentiating products in a competitive market. The aftermarket segment also presents a substantial, albeit challenging, opportunity for retrofitting older vehicles with these critical safety features, contributing to overall road safety improvements.

- Substantial market growth driven by safety regulations and consumer awareness.

- Technological advancements, particularly in AI and sensor fusion, are key enablers.

- Increasing affordability of components is democratizing access to LDWS.

- Integration into broader ADAS suites enhances overall vehicle safety appeal.

- Significant opportunities exist in both OEM and aftermarket segments globally.

Lane Departure Warning System Market Drivers Analysis

The global increase in road accidents and fatalities has significantly propelled the demand for active safety systems like Lane Departure Warning Systems. Governments and automotive safety organizations worldwide are implementing stringent regulations and mandates, making ADAS features, including LDWS, either compulsory or highly recommended for new vehicles. This regulatory push, exemplified by initiatives from the National Highway Traffic Safety Administration (NHTSA) in the US and Euro NCAP in Europe, directly translates into increased OEM adoption. Consumers are also becoming more safety-conscious, prioritizing vehicles equipped with advanced safety features, which in turn influences purchasing decisions and drives market growth.

Technological advancements in sensor technology, such as high-resolution cameras, robust radar systems, and emerging LiDAR applications, coupled with sophisticated image processing and artificial intelligence algorithms, have dramatically improved the accuracy and reliability of LDWS. These innovations enable systems to function effectively in diverse driving conditions, including varying light, weather, and road marking quality. The continuous reduction in the cost of these components due to economies of scale and increased competition among suppliers makes it economically viable for automakers to integrate LDWS into a wider range of vehicle segments, from premium to entry-level models, thereby expanding the market reach considerably.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Road Fatalities & Safety Regulations | +1.8% | Global, particularly North America, Europe, Asia Pacific | Mid-term to Long-term |

| Advancements in Sensor & AI Technologies | +1.5% | Global | Short-term to Mid-term |

| Growing Consumer Awareness & Demand for Safety Features | +1.2% | Global, especially developed economies | Mid-term |

| Lowering Cost of ADAS Components | +0.9% | Global | Short-term |

| Integration with Higher Levels of Autonomous Driving | +0.7% | North America, Europe, China | Mid-term to Long-term |

Lane Departure Warning System Market Restraints Analysis

Despite the strong growth trajectory, the Lane Departure Warning System market faces certain restraints that could impede its full potential. The primary challenge remains the relatively high initial cost of integrating sophisticated ADAS features, including LDWS, especially for vehicle manufacturers targeting price-sensitive markets. While component costs are declining, the overall investment in research and development, integration complexities, and validation processes can still elevate the final vehicle price, potentially limiting adoption in budget-conscious segments or emerging economies. This economic barrier can slow down the widespread proliferation of these systems beyond premium vehicles, impacting the overall market size.

Technical limitations and reliability issues also pose a restraint. LDWS can sometimes suffer from false warnings or failures to detect lanes under challenging environmental conditions, such as heavy rain, snow, poor lighting, or poorly maintained road markings. Such inconsistencies can lead to driver frustration and a lack of trust in the system, potentially causing drivers to disable the feature or disregard its warnings. Furthermore, the patchwork nature of road infrastructure globally, with varying standards for lane markings and signage, can limit the universal effectiveness of LDWS. Regulatory harmonization and standardization across different regions are still evolving, which can create design complexities for global automakers and impact cross-border functionality and consumer acceptance.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Initial Cost of Integration | -0.8% | Global, particularly emerging economies | Short-term to Mid-term |

| Technical Limitations & False Alarms | -0.6% | Global | Short-term |

| Lack of Standardized Road Infrastructure | -0.4% | Global, particularly developing nations | Mid-term to Long-term |

| Data Privacy and Cybersecurity Concerns | -0.3% | Europe, North America | Mid-term |

| Consumer Reluctance/Misunderstanding of Technology | -0.2% | Global | Short-term |

Lane Departure Warning System Market Opportunities Analysis

The Lane Departure Warning System market is ripe with significant opportunities for innovation and expansion. A key opportunity lies in the continued development and refinement of sensor fusion technologies, combining data from cameras, radar, and LiDAR to create a more robust and accurate understanding of the vehicle's environment. This multi-sensor approach enhances the system's reliability in adverse conditions and reduces false positives, thereby improving driver trust and paving the way for more sophisticated functionalities. Furthermore, the integration of advanced machine learning and artificial intelligence capabilities will allow LDWS to evolve beyond simple warnings, enabling predictive analysis of driver behavior and road conditions for more intelligent and proactive interventions, aligning with the broader trend towards highly automated driving.

Another substantial opportunity exists in the expansion of LDWS into untapped market segments, particularly commercial vehicles and aftermarket solutions. Commercial fleets, including trucks and buses, are increasingly adopting ADAS to enhance safety, reduce accident-related costs, and improve operational efficiency, creating a significant demand for robust LDWS tailored to heavy-duty applications. The aftermarket segment, offering retrofitting solutions for older vehicles that lack integrated LDWS, represents a vast potential for market penetration and road safety improvement, particularly as these systems become more affordable and easier to install. Moreover, strategic collaborations between sensor manufacturers, software developers, and automotive OEMs can accelerate the pace of innovation, bring down costs, and facilitate the rapid deployment of next-generation LDWS solutions across diverse vehicle platforms globally, capitalizing on the growing consumer and regulatory emphasis on active safety features.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Expansion into Commercial Vehicle Fleets | +1.5% | Global, particularly North America, Europe, Asia Pacific | Mid-term to Long-term |

| Growth of Aftermarket LDWS Solutions | +1.2% | Global, especially emerging markets | Mid-term |

| Advanced Sensor Fusion & AI Integration | +1.0% | Global | Short-term to Mid-term |

| Strategic Partnerships & Collaborations | +0.8% | Global | Short-term |

| Development of Region-Specific Solutions | +0.6% | Asia Pacific, Latin America, MEA | Mid-term |

Lane Departure Warning System Market Challenges Impact Analysis

The Lane Departure Warning System market, while promising, faces several challenges that require strategic navigation. One significant challenge is ensuring consistent performance and reliability across highly diverse global road conditions. Lane markings vary widely in visibility, color, and design across countries and even within regions, making it difficult for a single system to perform optimally everywhere. Environmental factors such as heavy rain, snow, fog, or direct sunlight can severely impair sensor performance, leading to system degradation or temporary disengagement. Overcoming these real-world variances necessitates advanced, adaptive algorithms and robust sensor technologies capable of functioning effectively under sub-optimal conditions, adding complexity and cost to development.

Another substantial challenge involves the complex integration of LDWS into existing vehicle architectures and ensuring seamless interoperability with other ADAS features. As vehicles become more technologically advanced, the sheer number of sensors, ECUs, and software layers increases, leading to potential data conflicts, latency issues, and cybersecurity vulnerabilities. Ensuring that LDWS functions harmoniously without interfering with or being hindered by other systems requires meticulous engineering and rigorous testing, which can be time-consuming and expensive. Furthermore, consumer perception and trust remain critical; false positives or irritating warnings can lead to drivers disabling the system, negating its safety benefits. Educating consumers on the proper use and limitations of LDWS, alongside continuous improvement in user experience, is crucial for widespread acceptance and effective utilization of this life-saving technology.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Performance Consistency in Diverse Road & Weather Conditions | -0.7% | Global | Short-term to Mid-term |

| Complex Integration with Vehicle Architecture & Other ADAS | -0.5% | Global | Short-term |

| Cybersecurity Risks & Data Privacy Concerns | -0.4% | North America, Europe | Mid-term to Long-term |

| Consumer Acceptance & Driver Education | -0.3% | Global | Short-term |

| Regulatory Harmonization Across Regions | -0.2% | Global | Mid-term to Long-term |

Lane Departure Warning System Market - Updated Report Scope

This comprehensive market research report provides an in-depth analysis of the Lane Departure Warning System (LDWS) market, offering a detailed overview of its current size, historical performance, and future growth projections. It meticulously examines key market drivers, restraints, opportunities, and challenges that are shaping the industry landscape. The report segments the market by component, vehicle type, technology, sales channel, and application, providing granular insights into each segment's dynamics and contribution to the overall market. Furthermore, it delves into the regional analysis, highlighting growth trends and competitive landscapes across major geographical areas. The objective is to equip stakeholders with actionable intelligence for strategic decision-making and investment planning within the evolving LDWS market.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 2.8 Billion |

| Market Forecast in 2033 | USD 6.2 Billion |

| Growth Rate | 10.5% |

| Number of Pages | 250 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Bosch, Continental AG, Denso Corporation, ZF Friedrichshafen AG, Magna International Inc., Hella GmbH & Co. KGaA, Aptiv PLC, Veoneer Inc., Mobileye (Intel Corporation), Panasonic Corporation, Hitachi Automotive Systems, Ltd., Hyundai Mobis Co., Ltd., Autoliv Inc., Valeo, Delphi Technologies (BorgWarner Inc.), Infineon Technologies AG, NXP Semiconductors N.V., Texas Instruments Incorporated, Renesas Electronics Corporation, Analog Devices, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Lane Departure Warning System market is meticulously segmented to provide a granular view of its diverse dynamics and identify key areas of growth and opportunity. These segmentations allow for a detailed examination of how different components, vehicle types, technologies, sales channels, and applications contribute to the overall market landscape and their respective growth trajectories. Understanding these segments is crucial for stakeholders to tailor strategies, identify niche markets, and allocate resources effectively. The distinctions within each segment highlight varying demands, technological preferences, and market maturity levels across the industry.

For instance, the segmentation by component reveals the evolving reliance on different sensor types, with cameras being foundational and radar/LiDAR increasingly contributing to sensor fusion for enhanced accuracy. Vehicle type segmentation differentiates demand and integration complexities between passenger cars and commercial vehicles, recognizing their distinct usage patterns and safety requirements. Similarly, technology segmentation distinguishes between simpler camera-based systems and more advanced sensor fusion approaches, indicating the market's progression towards higher levels of reliability and functionality. This comprehensive segmentation framework provides a holistic understanding of the market's structure and its future evolution, aiding in precise market forecasting and strategic planning for all involved stakeholders, from component suppliers to end-vehicle manufacturers and aftermarket service providers.

- By Component: Camera Sensors, Radar Sensors, Ultrasonic Sensors, LiDAR Sensors, Electronic Control Unit (ECU), Software

- By Vehicle Type: Passenger Cars (Hatchback, Sedan, SUV), Commercial Vehicles (Light Commercial Vehicles (LCV), Heavy Commercial Vehicles (HCV), Buses and Coaches)

- By Technology: Camera-based LDWS, Sensor Fusion LDWS

- By Sales Channel: Original Equipment Manufacturers (OEMs), Aftermarket

- By Application: Safety & Security, Traffic Jam Assist, Autonomous Driving Features

Regional Highlights

- North America: A leading market driven by stringent safety regulations, high consumer awareness, and the presence of major automotive OEMs and technology developers. The region benefits from early adoption of advanced ADAS features and a robust infrastructure for autonomous vehicle testing.

- Europe: Characterized by strong regulatory mandates from Euro NCAP and the European Union for vehicle safety features, which significantly boost LDWS adoption. High penetration of premium vehicles and continuous innovation in ADAS technologies contribute to substantial market growth.

- Asia Pacific (APAC): The fastest-growing region, propelled by increasing vehicle production, rising disposable incomes, and growing concerns about road safety, particularly in countries like China, India, Japan, and South Korea. Government initiatives promoting smart mobility and safety are key drivers.

- Latin America: An emerging market with growing automotive production and increasing demand for modern safety features. The region presents significant long-term opportunities as regulatory frameworks evolve and consumer awareness improves, albeit from a lower base compared to developed regions.

- Middle East and Africa (MEA): Currently a nascent market but with promising growth potential, particularly in the GCC countries due to significant investments in smart city initiatives and an expanding automotive market. Safety feature adoption is gradually increasing alongside urbanization and infrastructure development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Lane Departure Warning System Market.- Bosch

- Continental AG

- Denso Corporation

- ZF Friedrichshafen AG

- Magna International Inc.

- Hella GmbH & Co. KGaA

- Aptiv PLC

- Veoneer Inc.

- Mobileye (Intel Corporation)

- Panasonic Corporation

- Hitachi Automotive Systems, Ltd.

- Hyundai Mobis Co., Ltd.

- Autoliv Inc.

- Valeo

- Delphi Technologies (BorgWarner Inc.)

- Infineon Technologies AG

- NXP Semiconductors N.V.

- Texas Instruments Incorporated

- Renesas Electronics Corporation

- Analog Devices, Inc.

Frequently Asked Questions

Analyze common user questions about the Lane Departure Warning System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is a Lane Departure Warning System (LDWS)?

A Lane Departure Warning System (LDWS) is a safety feature designed to alert drivers when their vehicle begins to drift out of its lane unintentionally. It typically uses a camera mounted on the windshield to monitor lane markings and provides visual, audible, or haptic warnings to the driver to prevent potential accidents caused by lane departure.

How does AI impact the performance of LDWS?

AI significantly enhances LDWS performance by enabling more accurate lane detection through advanced computer vision, even in challenging conditions like poor lighting or faded markings. AI also facilitates predictive capabilities, anticipating unintentional lane drifts based on driver behavior and road conditions, and allows for continuous system improvement through machine learning, leading to fewer false alarms and greater reliability.

What are the primary drivers of growth in the LDWS market?

The key drivers for LDWS market growth include increasing global road accidents, stringent safety regulations and mandates from governments and safety organizations, growing consumer awareness and demand for advanced safety features in vehicles, and continuous technological advancements in sensors and AI that improve system performance and reliability while reducing costs.

Can LDWS be installed in older vehicles (aftermarket)?

Yes, Lane Departure Warning Systems can be installed in older vehicles through aftermarket solutions. These systems typically consist of a dash-mounted camera and a processing unit, providing a cost-effective way to enhance the safety of vehicles not originally equipped with integrated LDWS from the factory. The aftermarket segment represents a significant growth opportunity for LDWS.

What are the main challenges facing the LDWS market?

Major challenges for the LDWS market include ensuring consistent performance across diverse global road conditions and varying lane markings, managing the complexity of integrating LDWS with other in-vehicle systems, addressing cybersecurity risks, and overcoming consumer skepticism or lack of understanding regarding the technology's capabilities and limitations.