Hot Briquetted Iron Market

Hot Briquetted Iron Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_706107 | Last Updated : August 17, 2025 |

Format : ![]()

![]()

![]()

![]()

Hot Briquetted Iron Market Size

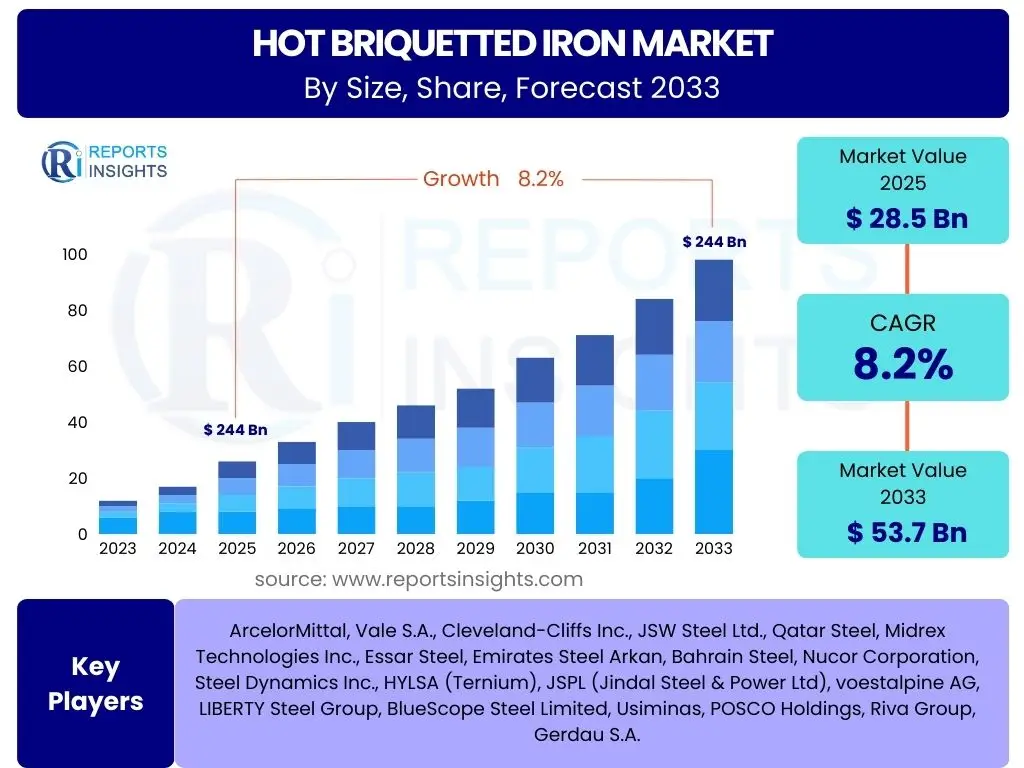

According to Reports Insights Consulting Pvt Ltd, The Hot Briquetted Iron Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.2% between 2025 and 2033. The market is estimated at USD 28.5 Billion in 2025 and is projected to reach USD 53.7 Billion by the end of the forecast period in 2033.

Key Hot Briquetted Iron Market Trends & Insights

The Hot Briquetted Iron (HBI) market is experiencing significant shifts driven by evolving steelmaking practices and growing environmental consciousness. A primary trend involves the increasing adoption of electric arc furnaces (EAFs) for steel production, which prefer high-quality metallic charge materials like HBI over traditional scrap, especially for cleaner steel grades. This preference is amplified by the fluctuating quality and availability of steel scrap, pushing steelmakers towards more consistent and pure inputs.

Furthermore, the global push towards decarbonization and sustainable manufacturing is profoundly impacting the HBI sector. HBI, produced through the direct reduction of iron ore, offers a lower carbon footprint compared to traditional blast furnace iron production, particularly when natural gas or green hydrogen is used as the reductant. This aligns with industry efforts to meet stringent environmental regulations and corporate sustainability goals, fostering investment in direct reduced iron (DRI) and HBI production facilities worldwide. Technological advancements in DRI processes, including the development of hydrogen-based direct reduction, are poised to further accelerate this trend.

- Growing preference for Electric Arc Furnaces (EAFs) in steel production.

- Increasing demand for high-quality, consistent metallic raw materials.

- Global push for decarbonization and sustainable steelmaking.

- Technological advancements in direct reduction processes, including hydrogen-based DRI.

- Fluctuations in steel scrap quality and availability driving HBI adoption.

- Integration of HBI into blast furnace charges to enhance efficiency and reduce emissions.

- Regionalization of HBI production to mitigate logistics costs and ensure supply security.

AI Impact Analysis on Hot Briquetted Iron

Users frequently inquire about the transformative potential of Artificial intelligence (AI) within the Hot Briquetted Iron (HBI) industry, particularly concerning operational efficiency, quality control, and supply chain optimization. The expectation is that AI can significantly enhance productivity, reduce energy consumption, and minimize waste across the HBI production lifecycle. Concerns often revolve around the initial investment costs, the complexity of data integration from legacy systems, and the need for specialized skills to deploy and manage AI-driven solutions effectively.

AI's influence is anticipated to manifest in several key areas, from predictive maintenance of machinery to optimizing natural gas consumption in direct reduction plants. Machine learning algorithms can analyze vast datasets from sensors and operational parameters to forecast equipment failures, schedule maintenance proactively, and fine-tune process variables for optimal yield and energy efficiency. Furthermore, AI can play a crucial role in supply chain management by predicting demand fluctuations, optimizing logistics, and improving raw material procurement, thereby enhancing overall market responsiveness and resilience for HBI producers.

- Predictive maintenance for HBI production equipment, reducing downtime.

- Optimization of energy consumption in direct reduction processes through AI algorithms.

- Enhanced quality control and consistency of HBI product through real-time data analysis.

- Improved supply chain visibility and logistics optimization for raw materials and finished HBI.

- Data-driven decision-making for production scheduling and inventory management.

- Development of autonomous or semi-autonomous operations in HBI plants.

- Analysis of market trends and raw material price fluctuations for strategic procurement.

Key Takeaways Hot Briquetted Iron Market Size & Forecast

Common user inquiries regarding the Hot Briquetted Iron (HBI) market size and forecast primarily focus on understanding the trajectory of growth, the underlying factors driving this expansion, and the long-term viability of HBI as a crucial metallic input for steelmaking. There is a strong interest in how HBI’s demand correlates with the global steel industry’s shift towards greener production methods and the increasing reliance on Electric Arc Furnaces. Users seek clarity on the market’s resilience to economic fluctuations and the impact of raw material price volatility on its projected growth.

The market is poised for robust expansion, driven significantly by the global steel industry's decarbonization efforts and the escalating adoption of EAF technology. HBI's role as a high-quality, low-residual metallic charge material positions it favorably in an environment where consistent steel quality and reduced carbon footprints are paramount. The forecasted growth underscores a strategic shift away from traditional blast furnace production in certain regions, coupled with continued integration of HBI as a supplement to scrap in EAFs, ensuring a steady and increasing demand throughout the forecast period.

- The HBI market is projected for substantial growth, driven by environmental mandates and EAF expansion.

- Demand for high-purity metallic inputs remains a core driver for HBI adoption.

- Green steel initiatives globally will significantly bolster HBI’s market position.

- Regional production shifts and supply chain resilience are becoming increasingly important.

- Technological advancements in HBI production contribute to its long-term market viability.

Hot Briquetted Iron Market Drivers Analysis

The Hot Briquetted Iron (HBI) market is propelled by a confluence of factors, primarily the global steel industry's increasing emphasis on sustainable practices and the rising preference for Electric Arc Furnaces (EAFs). As steel producers strive to reduce their carbon footprint and adhere to stricter environmental regulations, HBI emerges as a preferred raw material due to its lower CO2 emissions compared to traditional blast furnace routes. Its high metallic content and consistent quality also make it an ideal charge material for EAFs, which are gaining prominence in steel production worldwide, especially for specialty and high-grade steels.

Furthermore, the fluctuating availability and quality of steel scrap, a traditional input for EAFs, create a persistent demand for alternative, high-quality metallic sources like HBI. HBI provides a consistent chemical composition and low impurity levels, which helps steelmakers produce higher quality products with greater predictability. The ongoing urbanization and industrialization in emerging economies, particularly in Asia Pacific, continue to fuel demand for steel, indirectly boosting the need for key inputs such as HBI to support expanded steel production capacities.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Adoption of Electric Arc Furnaces (EAFs) | +1.8% | Global, particularly North America, Europe, Asia Pacific | Mid to Long-term (2025-2033) |

| Growing Demand for High-Quality Steel Products | +1.5% | Global, focused on developed and rapidly industrializing economies | Mid to Long-term (2025-2033) |

| Focus on Decarbonization and Green Steel Production | +2.0% | Europe, North America, Japan, South Korea | Mid to Long-term (2025-2033) |

| Fluctuating Quality and Availability of Scrap Steel | +1.2% | Global, especially markets reliant on scrap imports | Short to Mid-term (2025-2029) |

| Urbanization and Infrastructure Development in Emerging Economies | +0.9% | Asia Pacific, Latin America, Middle East & Africa | Long-term (2025-2033) |

Hot Briquetted Iron Market Restraints Analysis

The Hot Briquetted Iron (HBI) market faces several notable restraints that could temper its growth trajectory. One of the primary concerns is the volatility of raw material prices, particularly iron ore and natural gas. Natural gas serves as the primary reductant in most direct reduction processes, and its price fluctuations, often influenced by geopolitical factors and supply-demand imbalances, can significantly impact the production costs and profitability of HBI manufacturers. Similarly, the cost of high-grade iron ore pellets, essential for HBI production, also directly influences market pricing and competitiveness.

Another significant restraint is the substantial capital investment required for establishing and operating HBI production facilities. These plants are complex and entail high initial expenditures, which can be a barrier to entry for new players and limit expansion plans for existing ones, especially in regions with economic uncertainties. Furthermore, the energy-intensive nature of HBI production means that rising energy costs beyond natural gas, including electricity for plant operations, pose a continuous challenge, directly affecting the operational viability and competitive pricing of HBI in the global market.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Volatility of Raw Material Prices (Iron Ore, Natural Gas) | -1.5% | Global, particularly Europe and Asia where natural gas prices are high | Short to Mid-term (2025-2029) |

| High Capital Investment for HBI Production Plants | -1.0% | Global, impacts new entrants and expansion in all regions | Long-term (2025-2033) |

| Energy-Intensive Production Process and Rising Energy Costs | -1.2% | Europe, Asia Pacific (import-dependent regions) | Mid to Long-term (2025-2033) |

| Logistical Challenges and Transportation Costs | -0.8% | Regions far from production hubs, e.g., landlocked countries | Mid-term (2025-2029) |

Hot Briquetted Iron Market Opportunities Analysis

The Hot Briquetted Iron (HBI) market is presented with compelling opportunities driven by the global transition towards a low-carbon economy and advancements in steelmaking technology. A significant opportunity lies in the burgeoning "green steel" initiatives worldwide. As nations and industries commit to aggressive decarbonization targets, the demand for cleaner metallic inputs like HBI, especially HBI produced using hydrogen as a reductant, is set to surge. This represents a transformative shift from traditional carbon-intensive processes, offering a substantial avenue for market expansion and innovation for HBI producers.

Furthermore, the continuous development of Electric Arc Furnace (EAF) technology and its increasing capacity to produce a wider range of steel grades opens up new applications for HBI. As EAFs become more sophisticated, their reliance on consistent, high-quality charge materials like HBI, which allows for precise chemistry control and reduced slag volumes, will grow. Opportunities also arise from the strategic establishment of HBI plants in regions with abundant natural gas reserves or proximity to iron ore mines, reducing transportation costs and enhancing supply chain resilience. Emerging economies with burgeoning infrastructure needs and a desire for modern, efficient steel production facilities also present fertile ground for HBI market penetration.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Development of Green Hydrogen-based DRI/HBI Production | +2.5% | Europe, North America, Australia, Middle East | Long-term (2028-2033) |

| Expansion of EAF-based Steel Production Capacity Globally | +1.8% | Asia Pacific, North America, Europe | Mid to Long-term (2025-2033) |

| Strategic Investment in HBI Plants in Resource-Rich Regions | +1.0% | Middle East, Latin America, North Africa | Mid to Long-term (2025-2033) |

| Increasing Demand for High-Quality, Low-Residual Steel | +1.3% | Global, particularly automotive and construction sectors | Mid to Long-term (2025-2033) |

| Circular Economy Initiatives Promoting Material Efficiency | +0.7% | Europe, Japan, South Korea | Mid to Long-term (2025-2033) |

Hot Briquetted Iron Market Challenges Impact Analysis

The Hot Briquetted Iron (HBI) market faces distinct challenges that require strategic navigation for sustained growth. A significant challenge is the inherent volatility of natural gas prices, which are a primary cost component for HBI production. Geopolitical events, supply chain disruptions, and global energy market dynamics can cause sudden and unpredictable swings in natural gas prices, directly impacting the profitability and competitiveness of HBI compared to alternative iron sources. This fluctuating cost base makes long-term planning and investment decisions more complex for producers.

Another key challenge is the stringent environmental regulations and carbon emission targets imposed on the steel industry. While HBI offers a lower carbon footprint than traditional blast furnace iron, existing HBI plants that rely on natural gas still produce CO2 emissions. Meeting increasingly ambitious decarbonization goals will require significant investment in breakthrough technologies like hydrogen-based direct reduction, which involves high research and development costs and the need for scalable green hydrogen infrastructure. The logistical complexity of transporting HBI, given its density and specific storage requirements, also presents a challenge, particularly for producers serving distant markets, adding to overall costs and potentially limiting market reach.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Fluctuating Natural Gas Prices and Energy Costs | -1.8% | Global, with higher impact on gas-importing regions | Short to Mid-term (2025-2029) |

| High Capital and Operational Costs for Hydrogen-based DRI/HBI | -1.5% | Global, particularly early adopters in developed economies | Long-term (2028-2033) |

| Intensified Competition from Scrap Steel and Pig Iron | -1.0% | Global, varying by regional scrap availability and quality | Mid to Long-term (2025-2033) |

| Logistical Constraints and High Transportation Costs | -0.7% | Regions lacking coastal access or developed infrastructure | Mid-term (2025-2029) |

| Technological Gaps in Scaling Green Hydrogen Production | -0.5% | Global, impacts the pace of full decarbonization in HBI | Long-term (2030-2033) |

Hot Briquetted Iron Market - Updated Report Scope

This report offers an in-depth analysis of the Hot Briquetted Iron market, providing a comprehensive overview of its size, growth trajectory, and key dynamics from 2019 to 2033. It meticulously examines market drivers, restraints, opportunities, and challenges, offering strategic insights for stakeholders. The report segments the market by product type, application, end-use industry, and region, facilitating a granular understanding of market trends and competitive landscapes. It also includes profiles of leading market participants and an assessment of emerging trends, including the impact of AI and green steel initiatives, ensuring a forward-looking perspective on the market's evolution.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 28.5 Billion |

| Market Forecast in 2033 | USD 53.7 Billion |

| Growth Rate | 8.2% |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | ArcelorMittal, Vale S.A., Cleveland-Cliffs Inc., JSW Steel Ltd., Qatar Steel, Midrex Technologies Inc., Essar Steel, Emirates Steel Arkan, Bahrain Steel, Nucor Corporation, Steel Dynamics Inc., HYLSA (Ternium), JSPL (Jindal Steel & Power Ltd), voestalpine AG, LIBERTY Steel Group, BlueScope Steel Limited, Usiminas, POSCO Holdings, Riva Group, Gerdau S.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Hot Briquetted Iron market is comprehensively segmented to provide a detailed understanding of its diverse facets, allowing for precise market analysis and strategic planning. These segments are primarily defined by the type of HBI based on its carbon content, the production process employed, its varied applications in steelmaking, and the specific end-use industries it serves. This granular breakdown helps in identifying niche opportunities, understanding regional preferences, and assessing competitive landscapes within each category.

Understanding these segmentations is critical for stakeholders to tailor their product offerings, optimize production methods, and target specific market demands effectively. For instance, the shift towards cleaner steel production directly influences the demand for low-carbon HBI and HBI produced through hydrogen-based processes. Similarly, the expanding use of EAFs globally drives the demand for HBI as a key application. Each segment offers unique insights into market dynamics, growth potential, and the technological advancements influencing HBI adoption across various industries.

- By Type:

- Low Carbon HBI

- Medium Carbon HBI

- High Carbon HBI

- By Process:

- Natural Gas-based HBI

- Coal-based HBI

- Hydrogen-based HBI (Emerging)

- By Application:

- Electric Arc Furnace (EAF)

- Blast Furnace (BF)

- Basic Oxygen Furnace (BOF)

- Foundry

- Others

- By End-Use Industry:

- Construction

- Automotive

- Machinery

- Shipbuilding

- Appliances

- Others

Regional Highlights

- Asia Pacific (APAC): Dominates the HBI market due to robust steel production, especially in China, India, and Japan, driven by infrastructure development and rapid industrialization. The region is witnessing significant investments in both traditional and green steelmaking technologies.

- Europe: A key region for HBI demand, propelled by stringent environmental regulations and aggressive decarbonization goals. European steelmakers are increasingly adopting EAFs and exploring hydrogen-based direct reduction, positioning Europe as a leader in green steel initiatives and a major consumer of HBI.

- North America: Exhibits significant HBI consumption, primarily driven by the expansion of EAF-based steel production. The region benefits from abundant natural gas resources, supporting cost-effective HBI production, and a strong emphasis on domestic supply chains.

- Middle East and Africa (MEA): Emerging as a crucial HBI production hub, particularly due to rich natural gas reserves and iron ore deposits. Countries like Qatar, Saudi Arabia, and UAE are major HBI exporters, leveraging competitive energy costs and strategic geographical locations.

- Latin America: Holds potential for HBI market growth, with countries like Brazil being major iron ore producers. The region is developing its steel sector, though market dynamics are influenced by economic stability and investment in modern steelmaking processes.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hot Briquetted Iron Market.- ArcelorMittal

- Vale S.A.

- Cleveland-Cliffs Inc.

- JSW Steel Ltd.

- Qatar Steel

- Midrex Technologies Inc.

- Essar Steel

- Emirates Steel Arkan

- Bahrain Steel

- Nucor Corporation

- Steel Dynamics Inc.

- HYLSA (Ternium)

- JSPL (Jindal Steel & Power Ltd)

- voestalpine AG

- LIBERTY Steel Group

- BlueScope Steel Limited

- Usiminas

- POSCO Holdings

- Riva Group

- Gerdau S.A.

Frequently Asked Questions

What is Hot Briquetted Iron (HBI) and its primary use?

Hot Briquetted Iron (HBI) is a compacted form of direct reduced iron (DRI) produced from iron ore. Its primary use is as a high-quality metallic raw material for steelmaking, particularly in Electric Arc Furnaces (EAFs) and as a supplementary charge in Blast Furnaces (BFs) and Basic Oxygen Furnaces (BOFs), due to its high metallic content and low impurity levels.

Why is the demand for HBI increasing in the steel industry?

The demand for HBI is increasing due to the global steel industry's shift towards Electric Arc Furnaces (EAFs) for cleaner steel production, which require high-quality, consistent metallic inputs. HBI's low residual element content and consistent chemistry make it ideal for EAFs, especially amidst fluctuating quality and availability of steel scrap. Additionally, its lower carbon footprint, particularly when produced with natural gas or hydrogen, aligns with global decarbonization efforts.

How do natural gas prices impact the HBI market?

Natural gas is a crucial reductant in most HBI production processes. Therefore, fluctuations in natural gas prices directly impact the production costs and overall profitability of HBI manufacturers. High and volatile natural gas prices can increase HBI production costs, potentially making it less competitive compared to alternative raw materials like scrap or pig iron, influencing market supply and demand dynamics.

What role does HBI play in green steel production?

HBI plays a significant role in green steel production as it enables steelmakers to reduce their carbon emissions. Traditional HBI processes using natural gas already have a lower carbon footprint than integrated steel mills. Furthermore, the development of hydrogen-based direct reduction technologies, which produce HBI using green hydrogen as a reductant, offers a pathway to near-zero carbon steel production, aligning with ambitious environmental targets.

Which regions are key players in HBI production and consumption?

Key regions for HBI production include the Middle East (e.g., Qatar, Saudi Arabia) and Latin America (e.g., Brazil), owing to abundant natural gas reserves and iron ore. Major consumption regions include Asia Pacific (especially China, India, Japan), Europe, and North America, driven by their large steel industries and increasing adoption of EAF technology and green steel initiatives.