Hem Adhesive Market

Hem Adhesive Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_704605 | Last Updated : August 11, 2025 |

Format : ![]()

![]()

![]()

![]()

Hem Adhesive Market Size

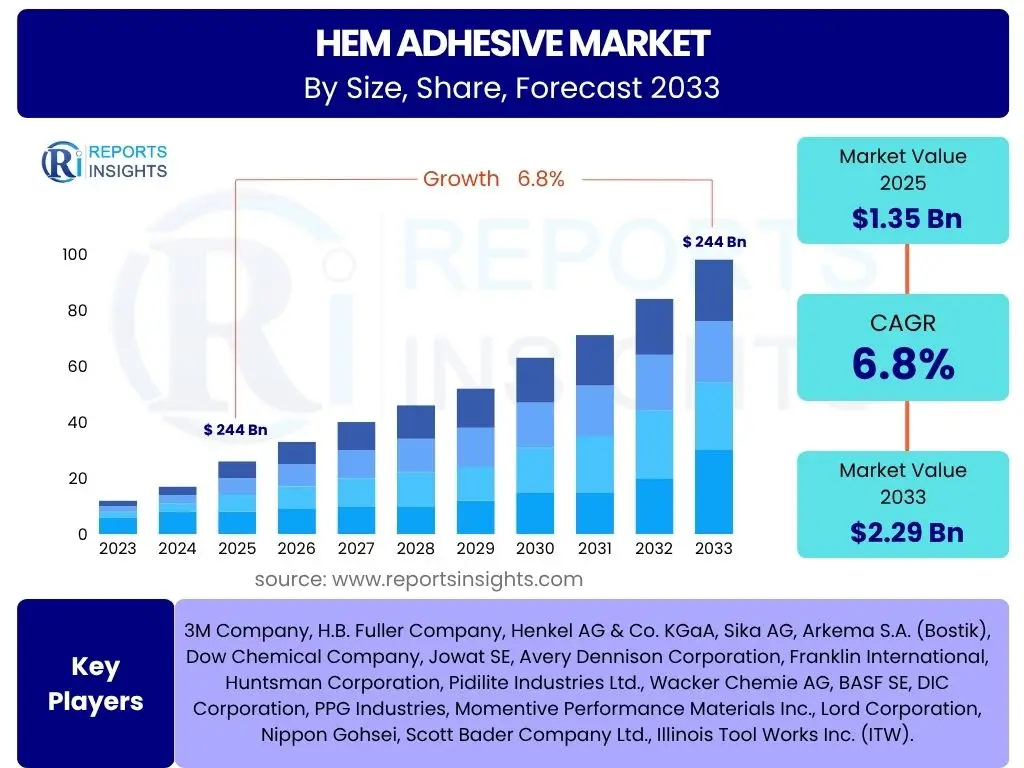

According to Reports Insights Consulting Pvt Ltd, The Hem Adhesive Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2033. The market is estimated at USD 1.35 billion in 2025 and is projected to reach USD 2.29 billion by the end of the forecast period in 2033.

Key Hem Adhesive Market Trends & Insights

The Hem Adhesive market is currently experiencing significant shifts driven by evolving manufacturing processes, increasing demand for sustainable solutions, and the continuous pursuit of enhanced product performance. Manufacturers are focusing on developing innovative adhesive formulations that offer superior bonding strength, flexibility, and durability, catering to a diverse range of applications from textiles to automotive components. This trend is fueled by the need for more efficient and cost-effective alternatives to traditional fastening methods, allowing for greater design freedom and streamlined production lines.

Another prominent trend is the growing emphasis on environmental sustainability. There is a rising preference for eco-friendly hem adhesives, including water-based, bio-based, and solvent-free formulations, driven by stringent environmental regulations and increasing consumer awareness regarding sustainable products. This shift not only aligns with global sustainability goals but also provides manufacturers with a competitive edge by appealing to environmentally conscious industries. The integration of advanced application technologies, such as automated dispensing systems, is further optimizing the use of hem adhesives, ensuring precision and reducing material waste.

- Growing adoption of high-performance and specialty hem adhesives in diverse industries.

- Increasing demand for sustainable, eco-friendly, and bio-based adhesive solutions.

- Miniaturization and complex designs driving the need for precision adhesive application.

- Shift towards automation and robotic application systems for improved efficiency and consistency.

- Development of smart adhesives with enhanced functional properties, such as conductivity or self-healing.

- Expansion of e-commerce and fast fashion sectors stimulating demand for efficient bonding in textiles.

- Innovation in adhesive formulations for enhanced durability, flexibility, and temperature resistance.

AI Impact Analysis on Hem Adhesive

Artificial intelligence (AI) is poised to revolutionize the Hem Adhesive market by optimizing various stages of the product lifecycle, from research and development to manufacturing and quality control. In the R&D phase, AI algorithms can accelerate the discovery of novel adhesive formulations by predicting material properties and screening vast databases of chemical compounds, significantly reducing development time and costs. This predictive capability enables manufacturers to respond more quickly to market demands for specialized adhesives with tailored characteristics, such as specific curing times, bonding strengths, or environmental resistances.

Within manufacturing, AI-powered systems can enhance operational efficiency and product consistency. Predictive maintenance algorithms can monitor equipment health, preventing costly downtime and ensuring continuous production. AI-driven vision systems can perform real-time quality control, identifying defects in adhesive application or material integrity with unparalleled accuracy, leading to reduced waste and improved product reliability. Furthermore, AI can optimize supply chain management by forecasting demand patterns, managing inventory levels, and streamlining logistics, thereby ensuring timely availability of raw materials and finished products, which is crucial in a dynamic market.

- Accelerated R&D through AI-driven material discovery and property prediction.

- Optimized manufacturing processes using AI for predictive maintenance and operational efficiency.

- Enhanced quality control and defect detection via AI-powered vision systems.

- Improved supply chain management and demand forecasting with AI analytics.

- Customization and personalization of adhesive formulations based on AI-driven insights into specific application needs.

- Potential for autonomous adhesive application systems, integrating AI for precision and consistency.

Key Takeaways Hem Adhesive Market Size & Forecast

The Hem Adhesive market is on a robust growth trajectory, primarily driven by increasing industrialization, technological advancements in adhesive formulations, and a growing preference for advanced bonding solutions across various sectors. The projected CAGR of 6.8% underscores a sustained expansion, indicating strong underlying demand in critical end-use industries. This growth is not merely volumetric but also qualitative, reflecting a shift towards higher-performance, specialized, and more sustainable adhesive products that offer superior functionality compared to traditional methods.

Key market drivers include the expansion of the textile and apparel industry, the automotive sector's continuous integration of lightweight materials and advanced bonding techniques, and the burgeoning demand from construction and packaging industries for efficient and durable sealing solutions. Furthermore, the focus on environmental compliance and product safety is compelling manufacturers to invest in green chemistry, leading to the development and adoption of safer and more eco-friendly hem adhesives. The market's significant valuation in 2025 and substantial projected growth by 2033 highlight its strategic importance within the broader chemical and materials industry, positioning it as a dynamic segment ripe with opportunities for innovation and market penetration.

- Significant growth anticipated, driven by industrial expansion and technological advancements.

- Strong demand from textile, automotive, construction, and packaging sectors.

- Increasing preference for sustainable and eco-friendly adhesive solutions.

- Adoption of advanced bonding techniques replacing traditional fastening methods.

- Market innovation focused on enhanced performance, durability, and application versatility.

- Strategic importance of the hem adhesive sector within the broader materials industry.

- Favorable regulatory landscape encouraging development of safer adhesive products.

Hem Adhesive Market Drivers Analysis

The growth of the Hem Adhesive market is primarily propelled by several key factors, including the increasing adoption of adhesives over traditional fastening methods across diverse industries. The textile and apparel industry, for instance, is increasingly leveraging hem adhesives for seamless bonding, offering aesthetic advantages and production efficiencies. Additionally, the automotive sector's push for lightweight vehicles and enhanced structural integrity necessitates advanced bonding solutions for various components, driving demand for specialized hem adhesives. The robust expansion of the construction, footwear, and packaging industries further contributes to market growth as these sectors seek durable, efficient, and cost-effective bonding solutions for myriad applications.

Technological advancements in adhesive formulations are also significant drivers. Innovations in hot melt, water-based, and reactive adhesives have led to products with improved performance characteristics, such as higher bond strength, flexibility, temperature resistance, and faster curing times. These enhanced properties make hem adhesives suitable for more challenging applications and offer manufacturers greater design freedom. Moreover, the rising global population and increasing disposable incomes, particularly in emerging economies, are fueling demand for consumer goods like apparel and footwear, consequently boosting the consumption of hem adhesives. This confluence of industrial demand, technological innovation, and demographic shifts creates a strong positive outlook for the market.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing demand from textile and apparel industries for seamless bonding | +1.2% | Asia Pacific (China, India), Europe | Short to Medium Term (2025-2029) |

| Growing adoption in automotive sector for lightweighting and component assembly | +1.0% | North America, Europe, Asia Pacific (Japan, South Korea) | Medium to Long Term (2027-2033) |

| Technological advancements in adhesive formulations for enhanced performance | +0.8% | Global | Short to Medium Term (2025-2030) |

| Expansion of construction and packaging sectors requiring efficient bonding solutions | +0.7% | North America, Europe, Latin America | Medium Term (2026-2031) |

| Preference for adhesives over traditional fastening methods due to cost-efficiency and aesthetics | +0.6% | Global | Short to Medium Term (2025-2028) |

Hem Adhesive Market Restraints Analysis

Despite robust growth, the Hem Adhesive market faces certain restraints that could impede its expansion. One significant challenge is the volatility in raw material prices. Adhesives are petroleum-derivative products, making them susceptible to fluctuations in crude oil prices, as well as the costs of various chemicals and polymers. Such price instability can lead to increased manufacturing costs, impacting profit margins for adhesive producers and potentially increasing end-product prices, which might deter adoption in price-sensitive applications or regions. This unpredictability necessitates careful supply chain management and strategic procurement.

Another restraint is the increasing stringency of environmental regulations concerning volatile organic compounds (VOCs) and hazardous substances in adhesive formulations. Regulatory bodies worldwide are imposing stricter limits on VOC emissions, pushing manufacturers to invest heavily in research and development for eco-friendly alternatives like water-based or hot melt adhesives. While this drives innovation towards sustainable solutions, it also adds to the development costs and time-to-market, potentially limiting the rapid introduction of new products. Furthermore, competition from traditional fastening methods, while diminishing, still poses a challenge in certain legacy industries or regions where capital investment in new adhesive application equipment is prohibitive.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Volatility in raw material prices, impacting production costs | -0.9% | Global | Short to Medium Term (2025-2029) |

| Stringent environmental regulations regarding VOC emissions and hazardous substances | -0.7% | Europe, North America | Medium to Long Term (2027-2033) |

| Competition from traditional fastening methods in certain applications | -0.5% | Emerging Economies, Niche Markets | Short to Medium Term (2025-2030) |

| Performance limitations in extreme temperature or moisture conditions for some adhesive types | -0.4% | Specific Industrial Applications | Short to Medium Term (2025-2028) |

| Lack of awareness or technical expertise in proper adhesive selection and application in some regions | -0.3% | Developing Regions | Medium Term (2026-2031) |

Hem Adhesive Market Opportunities Analysis

The Hem Adhesive market presents numerous opportunities for growth and innovation. One significant area lies in the increasing demand for sustainable and bio-based adhesive solutions. As environmental concerns escalate and regulations tighten, the development and commercialization of adhesives derived from renewable resources, or those with reduced environmental footprints, offer a substantial competitive advantage. This includes water-based formulations, hot melts with lower energy consumption, and adhesives free from harmful solvents, catering to a growing segment of environmentally conscious consumers and industries.

Another major opportunity stems from the expansion into new and niche applications. While textiles and automotive remain core markets, there is untapped potential in areas such as medical and hygiene products, flexible electronics, and advanced composites. The customization of adhesive properties to meet specific performance requirements for these specialized applications can unlock new revenue streams. Furthermore, the growth of smart textiles and wearables creates a demand for innovative conductive or stretchable hem adhesives, pushing the boundaries of traditional bonding. Companies that invest in R&D to address these emerging needs, alongside strategic partnerships to penetrate new markets, are well-positioned for substantial long-term growth.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Development and commercialization of sustainable and bio-based adhesive solutions | +1.1% | Europe, North America, Asia Pacific | Medium to Long Term (2027-2033) |

| Expansion into new application areas such as medical, hygiene, and flexible electronics | +0.9% | Global | Medium Term (2026-2031) |

| Growing demand for high-performance adhesives in emerging economies and industrialization | +0.8% | Asia Pacific (China, India), Latin America | Short to Medium Term (2025-2029) |

| Technological integration and development of smart or functional adhesives (e.g., conductive) | +0.7% | North America, Europe, East Asia | Long Term (2028-2033) |

| Strategic partnerships and collaborations to enhance R&D and market reach | +0.6% | Global | Short to Medium Term (2025-2030) |

Hem Adhesive Market Challenges Impact Analysis

The Hem Adhesive market faces several notable challenges that require strategic navigation from manufacturers and stakeholders. One primary challenge is the continuous need for product innovation to meet diverse and evolving industrial requirements. Customers increasingly demand specialized adhesives that offer precise performance characteristics, such as specific curing times, flexibility, temperature resistance, and compatibility with new substrates. This necessitates significant investment in research and development, which can be capital-intensive and time-consuming, posing a barrier for smaller players or those with limited R&D budgets. The rapid pace of technological change in end-use industries, particularly in automotive and electronics, constantly pushes the boundaries for adhesive performance.

Another critical challenge is maintaining consistent product quality and performance across different batches and under varying application conditions. Any inconsistencies can lead to product failures, reputational damage, and financial losses for both adhesive manufacturers and their customers. Adhering to stringent quality control standards and ensuring robust supply chain management for raw materials are crucial but complex tasks. Furthermore, managing the end-of-life cycle for products bonded with adhesives, particularly regarding recycling and material separation, presents an environmental challenge that requires collaborative efforts across the value chain. Addressing these complexities effectively will be vital for sustained market leadership and growth.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Need for continuous R&D and product innovation to meet evolving industry demands | -0.8% | Global | Ongoing |

| Maintaining consistent product quality and performance across diverse applications | -0.7% | Global | Ongoing |

| Compliance with complex and evolving international regulatory standards | -0.6% | Europe, North America, Asia Pacific | Medium to Long Term (2027-2033) |

| High initial investment costs for advanced adhesive application equipment | -0.5% | Emerging Markets | Short to Medium Term (2025-2030) |

| Managing the environmental impact of adhesive production and disposal | -0.4% | Global | Long Term (2028-2033) |

Hem Adhesive Market - Updated Report Scope

This comprehensive report provides an in-depth analysis of the Hem Adhesive market, covering historical trends from 2019 to 2023, base year estimates for 2024, and detailed forecasts up to 2033. It examines market dynamics, growth drivers, restraints, opportunities, and challenges influencing the industry landscape. The study meticulously segments the market by resin type, application, and end-use industry, offering granular insights into each category's performance and future potential. Furthermore, the report includes a thorough regional analysis, identifying key growth regions and their respective market highlights, along with profiles of top market players, providing a holistic view of the global hem adhesive ecosystem.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 1.35 billion |

| Market Forecast in 2033 | USD 2.29 billion |

| Growth Rate | 6.8% |

| Number of Pages | 247 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, H.B. Fuller Company, Henkel AG & Co. KGaA, Sika AG, Arkema S.A. (Bostik), Dow Chemical Company, Jowat SE, Avery Dennison Corporation, Franklin International, Huntsman Corporation, Pidilite Industries Ltd., Wacker Chemie AG, BASF SE, DIC Corporation, PPG Industries, Momentive Performance Materials Inc., Lord Corporation, Nippon Gohsei, Scott Bader Company Ltd., Illinois Tool Works Inc. (ITW). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Hem Adhesive market is broadly segmented based on resin type, application, and end-use industry, reflecting the diverse range of product formulations and their varied uses across numerous sectors. This granular segmentation provides a detailed understanding of market dynamics, identifying specific growth pockets and areas of innovation. Each segment plays a crucial role in the overall market landscape, driven by unique technological requirements, regulatory frameworks, and consumer preferences.

The resin type segmentation highlights the prevalent adhesive technologies, including hot melts, water-based, solvent-based, and reactive adhesives, each offering distinct performance advantages for different bonding needs. Application-wise, the market spans traditional uses like textiles and footwear to highly specialized areas such as automotive, medical, and electronics, showcasing the versatility and indispensable nature of hem adhesives. Furthermore, the end-use industry breakdown provides insights into the primary sectors consuming these adhesives, indicating the market's reliance on broader economic and industrial trends.

- By Resin Type:

- Hot Melt Adhesives: Widely used for fast bonding and high production speeds in textiles, packaging, and footwear. Sub-segments include Thermoplastic Hot Melt Adhesives (e.g., EVA, APAO, Polyolefin) known for their versatility, and Reactive Hot Melt Adhesives (e.g., PUR) offering superior bond strength and heat resistance.

- Water-Based Adhesives: Preferred for their environmental benefits and safety, utilized in textiles, paper, and hygiene products. Includes Acrylic Emulsions for good adhesion and flexibility, and Polyurethane Dispersions (PUDs) for enhanced durability and chemical resistance.

- Solvent-Based Adhesives: Valued for their strong adhesion and quick drying, though usage is declining due to VOC regulations. Comprises Rubber-Based (e.g., Neoprene, SBR) for high initial tack, and Polyurethane-Based for strong, flexible bonds in demanding applications.

- Reactive Adhesives: Known for high performance and strong bonds through chemical reactions. Key types are Polyurethane Reactive (PUR) for moisture-curing strength and flexibility, Epoxy Adhesives for structural bonding and chemical resistance, and Cyanoacrylate Adhesives (super glue) for rapid setting.

- Others: Includes Pressure Sensitive Adhesives (PSAs) for temporary or permanent adhesion without heat or solvent, and emerging Bio-based Adhesives driven by sustainability trends.

- By Application:

- Textile & Apparel: Essential for clothing hems, seam bonding, and functional textiles. This includes general Clothing & Garments, Technical Textiles (e.g., sportswear, protective wear), and Non-Woven Fabrics (e.g., interlinings, hygiene products).

- Automotive: Crucial for interior assembly, offering lightweighting and sound dampening. Applications range from Interior Trims and Headliners to Seating and Carpet Bonding, ensuring structural integrity and aesthetic finish.

- Footwear: Used for bonding various components like Uppers, Soles, and Linings, providing durability and flexibility.

- Construction: Applied in flooring installations, insulation attachment, and roofing membranes for secure and long-lasting bonds.

- Packaging: Essential for flexible packaging, carton sealing, and laminations, providing robust and efficient closures.

- Medical & Hygiene: Critical for disposable products such as Disposable Diapers, sanitary napkins, and Surgical Drapes, requiring skin-friendly and secure adhesion.

- Electronics: Used for Component Bonding, wire tacking, and Encapsulation of sensitive parts, ensuring protection and reliability.

- Others: Includes Furniture assembly, Bookbinding, and various Craft applications, showcasing broad utility.

- By End-Use Industry:

- Consumer Goods: Encompasses a wide array of products including apparel, footwear, and household items.

- Industrial: Covers manufacturing, assembly, and maintenance applications across various sectors.

- Automotive & Transportation: Focuses on vehicle manufacturing, repairs, and components.

- Building & Construction: Pertains to residential, commercial, and infrastructure projects.

- Healthcare: Includes medical devices, hygiene products, and pharmaceutical packaging.

- Electronics & Electrical: Involves assembly of electronic components, devices, and wiring.

- Packaging: Relates to primary, secondary, and tertiary packaging solutions for diverse products.

Regional Highlights

- North America: This region demonstrates a mature market for hem adhesives, characterized by advanced manufacturing technologies and stringent quality standards. The automotive sector's emphasis on lightweighting and the robust growth of technical textiles drive demand. Innovation in sustainable and high-performance adhesives is a key focus, with strong R&D investments by leading players. The U.S. and Canada are significant contributors, particularly in specialized industrial and consumer applications, showing a steady adoption of new adhesive technologies.

- Europe: Europe is a significant market, largely influenced by strict environmental regulations promoting the use of eco-friendly and low-VOC adhesives. Countries like Germany, France, and Italy are leading in the automotive, textile, and construction industries, where hem adhesives find extensive use. The region is witnessing a shift towards water-based and bio-based formulations, coupled with a strong emphasis on automation in application processes to enhance efficiency and reduce environmental impact.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market for hem adhesives, fueled by rapid industrialization, urbanization, and a burgeoning manufacturing sector, particularly in China, India, Japan, and South Korea. The expanding textile and apparel industries, coupled with a robust automotive production base, contribute significantly to market growth. Increasing disposable incomes and growing consumer goods production further amplify demand, making it a highly attractive region for adhesive manufacturers.

- Latin America: This region exhibits steady growth, primarily driven by the expanding construction and automotive industries in countries like Brazil and Mexico. The market is also influenced by increasing foreign investments in manufacturing and a rising demand for consumer goods. While still developing in terms of advanced adhesive technologies, there is a growing awareness and adoption of modern bonding solutions, opening avenues for market expansion.

- Middle East and Africa (MEA): The MEA region is experiencing gradual growth in the hem adhesive market, largely attributed to ongoing infrastructure development projects and growth in the packaging and construction sectors, particularly in Gulf Cooperation Council (GCC) countries. The demand for industrial and specialized adhesives is on the rise. However, market growth is often influenced by economic diversification efforts and the adoption of modern manufacturing techniques.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hem Adhesive Market.- 3M Company

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Sika AG

- Arkema S.A. (Bostik)

- Dow Chemical Company

- Jowat SE

- Avery Dennison Corporation

- Franklin International

- Huntsman Corporation

- Pidilite Industries Ltd.

- Wacker Chemie AG

- BASF SE

- DIC Corporation

- PPG Industries

- Momentive Performance Materials Inc.

- Lord Corporation

- Nippon Gohsei

- Scott Bader Company Ltd.

- Illinois Tool Works Inc. (ITW)

Frequently Asked Questions

What are hem adhesives primarily used for?

Hem adhesives are specialized bonding agents primarily used for securing fabric edges and seams, particularly in the textile and apparel industry. Beyond clothing, they are extensively applied in automotive interiors, footwear manufacturing, construction, packaging, medical and hygiene products, and electronics for durable, flexible, and aesthetically pleasing bonds that often replace traditional stitching or mechanical fasteners.

What types of hem adhesives are available in the market?

The market offers various types of hem adhesives, categorized by their chemical composition and curing mechanisms. Common types include hot melt adhesives (thermoplastic and reactive PUR), water-based adhesives (acrylic emulsions, polyurethane dispersions), solvent-based adhesives (rubber-based, polyurethane-based), and other reactive adhesives (epoxy, cyanoacrylate). Each type offers distinct advantages in terms of bond strength, flexibility, curing time, and environmental impact, catering to specific application needs.

How do hem adhesives contribute to manufacturing efficiency?

Hem adhesives significantly enhance manufacturing efficiency by enabling faster production speeds and reducing labor costs compared to traditional methods like stitching. They allow for automation and continuous processes, minimize material waste, and offer greater design flexibility, leading to streamlined production lines and improved overall throughput. Their rapid curing properties and versatility also contribute to quicker assembly and delivery times across various industries.

What are the key trends influencing the hem adhesive market?

Key trends in the hem adhesive market include a growing demand for sustainable and eco-friendly formulations, such as water-based and bio-based adhesives, driven by environmental regulations and consumer preferences. There is also a strong focus on high-performance and specialty adhesives for demanding applications, advancements in automated application technologies, and increasing adoption in emerging industries like smart textiles and flexible electronics.

What is the future outlook for the hem adhesive market?

The hem adhesive market is projected for robust growth, driven by continued industrial expansion, technological innovations in adhesive chemistry, and increasing adoption across diverse end-use industries. The market is expected to reach USD 2.29 billion by 2033, with significant opportunities in sustainable solutions, new application areas, and integration with advanced manufacturing processes. The shift towards durable, efficient, and aesthetically superior bonding solutions will sustain its upward trajectory.