Chemical Distribution Market

Chemical Distribution Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_703153 | Last Updated : August 01, 2025 |

Format : ![]()

![]()

![]()

![]()

Chemical Distribution Market Size

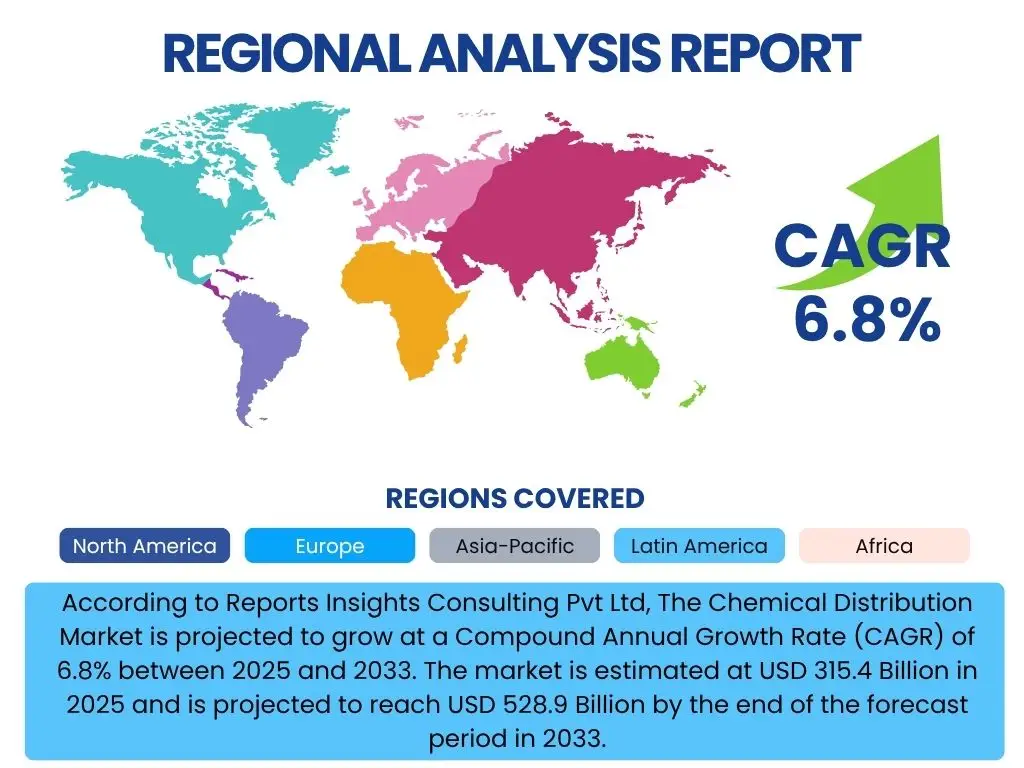

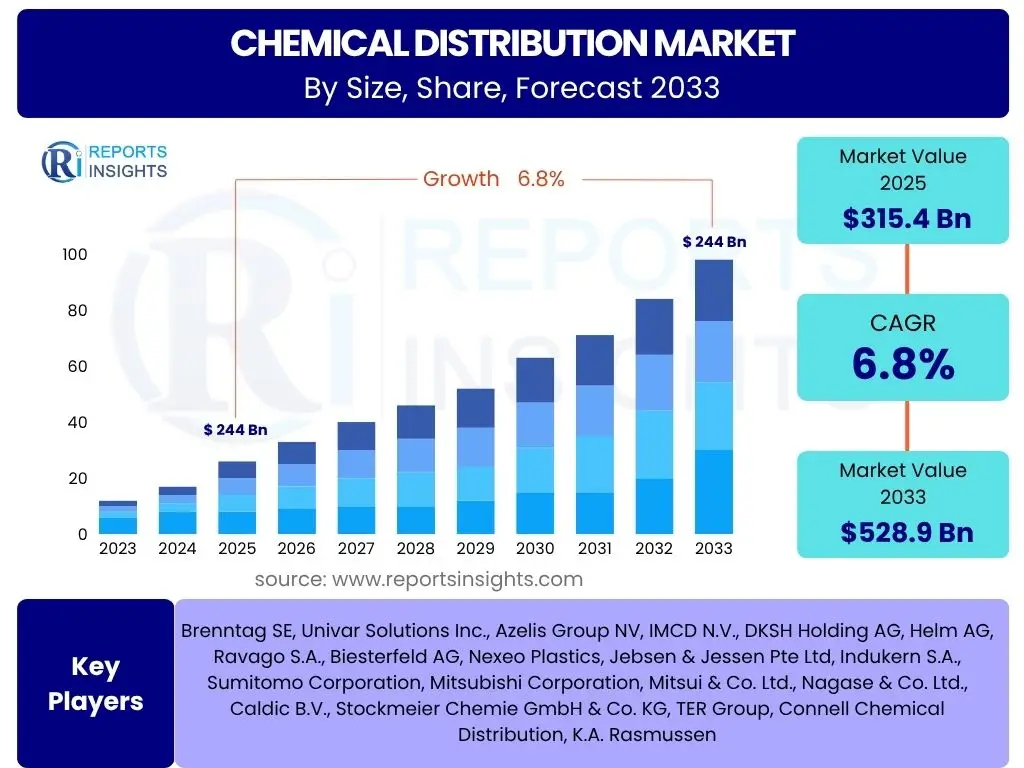

According to Reports Insights Consulting Pvt Ltd, The Chemical Distribution Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2033. The market is estimated at USD 315.4 Billion in 2025 and is projected to reach USD 528.9 Billion by the end of the forecast period in 2033.

Key Chemical Distribution Market Trends & Insights

The Chemical Distribution Market is undergoing significant transformation, driven by a confluence of technological advancements, evolving regulatory landscapes, and shifting customer expectations. Common user inquiries often revolve around the modernization of traditional distribution models, the increasing importance of environmental sustainability, and the strategies distributors are employing to enhance supply chain resilience. The market is witnessing a profound shift towards digitalization, encompassing everything from e-commerce platforms to advanced data analytics, which are optimizing operational efficiencies and fostering greater transparency.

Furthermore, the demand for value-added services is escalating as end-users seek more than just logistics from their chemical partners. Distributors are expanding their offerings to include custom blending, formulation, technical support, and comprehensive inventory management solutions, moving beyond transactional relationships to become strategic partners. This evolution is crucial for navigating the complexities of modern chemical supply chains, providing a competitive edge, and responding effectively to dynamic market conditions and specialized customer needs. The emphasis on tailored solutions is reshaping the distributor's role within the chemical value chain.

Sustainability and regulatory compliance represent another critical trend, with growing pressure from consumers, regulators, and investors for more environmentally responsible practices. Companies are investing in green chemistry products, optimizing their logistics for reduced carbon footprints, and ensuring strict adherence to global chemical regulations such as REACH and TSCA. This focus not only addresses ethical considerations but also opens new market opportunities and enhances brand reputation, aligning distribution strategies with global sustainability goals. The integration of robust environmental, social, and governance (ESG) frameworks is becoming a standard expectation.

- Digitalization and E-commerce Adoption: Expanding online platforms and digital marketplaces for enhanced transaction efficiency and customer reach.

- Increased Focus on Sustainability: Growing demand for green chemicals, circular economy practices, and eco-friendly logistics solutions.

- Supply Chain Resilience and Diversification: Strategies to mitigate disruptions through robust supplier networks and regionalized distribution hubs.

- Expansion of Value-Added Services (VAS): Offering custom blending, repackaging, technical support, and comprehensive inventory management.

- Market Consolidation and Specialization: Strategic mergers, acquisitions, and distributors focusing on niche markets or specialized chemical segments.

- Predictive Analytics and Data-Driven Operations: Utilizing advanced analytics for demand forecasting, inventory optimization, and logistics planning.

- Stringent Regulatory Compliance: Navigating complex and evolving global chemical regulations (e.g., REACH, TSCA) and safety standards.

AI Impact Analysis on Chemical Distribution

The integration of Artificial Intelligence (AI) is fundamentally transforming the chemical distribution landscape, addressing common user questions regarding efficiency gains, predictive capabilities, and automation in operations. AI's capacity to analyze vast datasets is enabling distributors to move from reactive to proactive strategies, particularly in areas like demand forecasting and inventory management. By leveraging machine learning algorithms, companies can predict market fluctuations, anticipate customer needs, and optimize stock levels with unprecedented accuracy, significantly reducing waste and improving fulfillment rates. This intelligent approach minimizes carrying costs and ensures product availability, directly impacting profitability and customer satisfaction.

Beyond forecasting, AI is revolutionizing logistics and supply chain optimization. User interest often centers on how AI can enhance operational speed and reduce costs. AI-powered systems can dynamically optimize delivery routes, considering real-time traffic, weather conditions, and delivery urgency, leading to substantial reductions in fuel consumption and transit times. Furthermore, AI facilitates automated warehouse management through robotics and intelligent automation, streamlining processes such as picking, packing, and sorting. This level of automation not only boosts efficiency but also enhances safety within chemical handling environments by minimizing human intervention in hazardous tasks.

The impact of AI extends to improving customer engagement and compliance management, areas frequently highlighted in user queries about AI's broader implications. AI-driven chatbots and virtual assistants provide 24/7 customer support, offering instant responses to inquiries, processing orders, and providing personalized product recommendations. Moreover, AI can assist in navigating the complex web of chemical regulations by identifying potential compliance issues, monitoring changes in legislation, and ensuring accurate documentation. This comprehensive application of AI contributes to a more intelligent, agile, and resilient chemical distribution ecosystem, addressing critical challenges and unlocking new avenues for growth and competitive advantage.

- Predictive Demand Forecasting: AI algorithms analyze historical data, market trends, and external factors to forecast chemical demand with enhanced accuracy, optimizing inventory.

- Optimized Logistics and Route Planning: AI-powered systems dynamically determine the most efficient delivery routes, reducing transit times, fuel consumption, and operational costs.

- Automated Warehousing and Inventory Management: AI-driven robotics and intelligent systems manage stock levels, optimize storage layouts, and streamline order fulfillment processes.

- Enhanced Quality Control and Safety: AI vision systems and sensors detect impurities, monitor chemical properties, and ensure adherence to safety protocols during handling and storage.

- Personalized Customer Engagement: AI chatbots and recommendation engines provide 24/7 customer support, address inquiries, and offer tailored product suggestions.

- Supply Chain Risk Management: AI analyzes geopolitical events, economic indicators, and supplier performance to identify and mitigate potential supply chain disruptions.

- Regulatory Compliance Assistance: AI tools can monitor changes in chemical regulations, identify compliance gaps, and ensure accurate documentation and reporting.

Key Takeaways Chemical Distribution Market Size & Forecast

Common user questions often seek a concise summary of the market's trajectory and the core implications for stakeholders. The Chemical Distribution Market is set for robust expansion, reflecting its integral role in various industrial sectors globally. The significant projected growth from USD 315.4 Billion in 2025 to USD 528.9 Billion by 2033, at a CAGR of 6.8%, underscores a dynamic and evolving industry. This growth is not merely volumetric but also qualitative, driven by the increasing complexity of chemical supply chains, the imperative for efficiency, and the rising demand for specialized products and services across diverse end-use industries. Stakeholders should recognize this as a period of significant investment and innovation.

Digital transformation and sustainability are not just trends but fundamental pillars for future success. The market's resilience will increasingly depend on the adoption of advanced technologies such as AI, IoT, and sophisticated e-commerce platforms to optimize operations, enhance customer experience, and navigate logistical challenges. Furthermore, the global shift towards greener chemistry and circular economy principles means that distributors must prioritize environmentally responsible practices, offering sustainable product portfolios and optimizing their carbon footprint. Companies that fail to adapt to these technological and environmental shifts risk obsolescence in a rapidly evolving competitive landscape.

Ultimately, the forecast highlights a market where value-added services and strategic partnerships will differentiate leaders. Beyond the traditional role of transporting chemicals, distributors are becoming critical partners in their clients' supply chains, offering services like custom blending, technical support, and sophisticated inventory management. This shift necessitates a deeper understanding of client needs and a proactive approach to problem-solving. Success in this growing market will hinge on agility, technological prowess, a strong commitment to sustainability, and the ability to forge robust, long-term relationships through comprehensive service offerings.

- Robust Growth Trajectory: The market is projected for substantial expansion, indicating strong underlying demand across various industrial sectors.

- Digital Transformation Imperative: Adoption of advanced technologies like AI, IoT, and e-commerce platforms is crucial for operational efficiency and competitive advantage.

- Sustainability as a Core Differentiator: Environmental, social, and governance (ESG) factors are increasingly influencing purchasing decisions and operational strategies.

- Supply Chain Agility and Resilience: Building robust and diversified supply chains is paramount for mitigating geopolitical, economic, and logistical shocks.

- Value-Added Services Drive Profitability: Beyond mere logistics, specialized services offer new revenue streams and strengthen customer relationships.

Chemical Distribution Market Drivers Analysis

The Chemical Distribution Market is propelled by several robust drivers that underpin its consistent growth and expansion. These drivers reflect the evolving global industrial landscape, the increasing complexity of supply chains, and the imperative for efficiency and specialization. The overarching theme is the growing global demand for a diverse range of chemicals, necessitating sophisticated distribution networks capable of handling varied products with precision and adherence to strict safety standards. As industries worldwide expand and innovate, the reliance on an efficient and reliable chemical distribution sector intensifies, driving further investments and technological advancements within the market.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growth in End-Use Industries (Automotive, Construction, Pharmaceuticals, Agriculture) | +1.5% | Global, particularly APAC (China, India) | Long-term |

| Increasing Demand for Specialty Chemicals | +1.2% | Global, particularly Europe and North America | Medium-term to Long-term |

| Rise of Outsourcing in Chemical Manufacturing and Distribution | +1.0% | Global | Medium-term |

| Globalization of Supply Chains and Trade Liberalization | +0.8% | Global | Long-term |

| Technological Advancements in Logistics and Supply Chain Management | +0.7% | Global | Short-term to Medium-term |

| Development of Bio-based and Sustainable Chemicals | +0.6% | Europe, North America | Medium-term to Long-term |

Chemical Distribution Market Restraints Analysis

Despite its significant growth potential, the Chemical Distribution Market faces several notable restraints that can impede its expansion and challenge operational efficiency. These limiting factors often stem from inherent industry characteristics, external economic volatility, and the increasing stringency of regulatory environments. The market's sensitivity to macroeconomic conditions, coupled with the capital-intensive nature of logistics infrastructure, creates hurdles that distributors must navigate carefully. Addressing these restraints requires strategic planning, robust risk management, and continuous adaptation to market dynamics to sustain growth and maintain profitability.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Volatile Raw Material Prices and Geopolitical Instability | -0.8% | Global | Short-term to Medium-term |

| Stringent Environmental and Safety Regulations | -0.7% | Europe, North America, specific Asian countries | Long-term |

| High Logistics and Transportation Costs | -0.6% | Global, particularly regions with poor infrastructure | Ongoing |

| Supply Chain Disruptions (Pandemics, Natural Disasters) | -0.5% | Global | Short-term |

| Intense Competition and Price Pressure from Direct Sales | -0.4% | Global | Ongoing |

| Lack of Standardized Infrastructure in Emerging Markets | -0.3% | Africa, parts of Latin America and Asia | Long-term |

Chemical Distribution Market Opportunities Analysis

The Chemical Distribution Market is rich with untapped potential, presenting numerous opportunities for growth, innovation, and strategic differentiation. These opportunities arise from emerging technological advancements, evolving customer demands, the shift towards sustainable practices, and the expansion into new geographic and product segments. Leveraging these opportunities requires forward-thinking strategies, agility, and a willingness to invest in new capabilities and partnerships. Distributors who can proactively identify and capitalize on these areas will gain a significant competitive advantage and unlock new revenue streams, fostering long-term market leadership and resilience.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Expansion of E-commerce Platforms for Chemical Sales | +1.3% | Global | Medium-term |

| Growing Demand for Sustainable and Bio-based Chemicals | +1.1% | Europe, North America, parts of APAC | Long-term |

| Strategic Partnerships and Mergers and Acquisitions (M&A) | +0.9% | Global | Short-term to Medium-term |

| Development of Niche Market Segments and Specialized Services | +0.8% | Global | Medium-term |

| Digital Transformation and Automation in Operations | +0.7% | Global | Short-term to Medium-term |

| Increased Focus on Value-Added Services (e.g., Blending, Repackaging) | +0.6% | Global | Ongoing |

Chemical Distribution Market Challenges Impact Analysis

The Chemical Distribution Market, while experiencing growth, is simultaneously navigating a complex array of challenges that demand strategic responses from industry players. These challenges range from intricate regulatory frameworks and the constant pressure of maintaining high safety standards to the practical hurdles of talent acquisition and cybersecurity. Successfully overcoming these obstacles requires significant investment in compliance, technology, and human capital development. Distributors must adopt adaptive strategies to mitigate risks, ensure operational continuity, and maintain their competitive edge in a dynamic global environment.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Complex Regulatory Landscape and Compliance Burden | -0.6% | Global, particularly Europe and North America | Ongoing |

| Maintaining Product Quality and Safety Standards | -0.5% | Global | Ongoing |

| Talent Shortage and Skill Gap in Logistics and Chemical Handling | -0.4% | Global | Medium-term |

| Cybersecurity Threats to Digital Infrastructure and Data | -0.3% | Global | Ongoing |

| Infrastructure Limitations and Connectivity Issues in Emerging Markets | -0.2% | Africa, parts of Latin America and Asia | Long-term |

| Fluctuations in Fuel and Energy Prices | -0.2% | Global | Short-term |

Chemical Distribution Market - Updated Report Scope

This comprehensive report provides an in-depth analysis of the Chemical Distribution Market, offering critical insights into its current size, historical performance, and future growth projections. It delineates key market trends, analyzes the impact of emerging technologies such as Artificial Intelligence, and identifies pivotal drivers, restraints, opportunities, and challenges shaping the industry. The scope encompasses detailed segmentation analysis by product type, end-use industry, and service, alongside a thorough regional assessment to provide a holistic view of the market dynamics from 2019 to 2033, with 2024 as the base year.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 315.4 Billion |

| Market Forecast in 2033 | USD 528.9 Billion |

| Growth Rate | 6.8% |

| Number of Pages | 245 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Brenntag SE, Univar Solutions Inc., Azelis Group NV, IMCD N.V., DKSH Holding AG, Helm AG, Ravago S.A., Biesterfeld AG, Nexeo Plastics, Jebsen & Jessen Pte Ltd, Indukern S.A., Sumitomo Corporation, Mitsubishi Corporation, Mitsui & Co. Ltd., Nagase & Co. Ltd., Caldic B.V., Stockmeier Chemie GmbH & Co. KG, TER Group, Connell Chemical Distribution, K.A. Rasmussen |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Chemical Distribution Market is intricately segmented across various dimensions to reflect the diverse nature of chemical products, their applications, and the specialized services required for their efficient movement. This segmentation provides a granular view of market dynamics, highlighting areas of high growth, specific customer needs, and strategic opportunities. Understanding these segments is crucial for distributors to tailor their offerings, optimize their supply chains, and effectively serve the distinct requirements of different industries and chemical types. The market's complexity necessitates a nuanced approach to distribution strategies, moving beyond a one-size-fits-all model.

By product type, the market is broadly divided into commodity chemicals and specialty chemicals, each with unique handling, storage, and regulatory considerations. Commodity chemicals, characterized by high volume and lower margins, require efficient bulk logistics, while specialty chemicals often demand precise blending, stringent quality control, and technical expertise due to their specific functionalities and applications. The end-use industry segmentation further refines this, revealing how sectors like automotive, pharmaceuticals, and agriculture each have distinct chemical needs, impacting demand patterns and service expectations. This granular breakdown helps distributors identify key growth sectors and tailor their product portfolios accordingly.

Service segmentation highlights the evolving role of chemical distributors beyond mere logistics providers. The increasing demand for value-added services such as blending, repackaging, and technical support transforms distributors into essential partners in the chemical value chain. This shift enables them to offer more comprehensive solutions, enhance customer loyalty, and capture higher margins. Furthermore, the segmentation by transportation mode and storage type (e.g., bulk vs. packaged, temperature-controlled) underscores the operational complexities and specialized infrastructure required to safely and efficiently distribute a vast array of chemical products across global supply chains. These detailed segments collectively provide a roadmap for strategic market penetration and operational excellence.

- By Product Type:

- Commodity Chemicals: Solvents, Acids & Bases, Petrochemicals, Polymers & Plastics, Fertilizers, others.

- Specialty Chemicals: Adhesives & Sealants, Coatings & Paints, Construction Chemicals, Personal Care Chemicals, Electronic Chemicals, Agrochemicals, Water Treatment Chemicals, Food & Beverage Additives, Lubricants & Greases, Textile Chemicals, others.

- By End-Use Industry:

- Automotive & Transportation

- Building & Construction

- Pharmaceuticals & Healthcare

- Food & Beverage

- Agriculture

- Water Treatment

- Personal Care & Cosmetics

- Industrial Manufacturing

- Textiles

- Others

- By Service:

- Transportation & Logistics: Road, Rail, Sea, Air

- Storage & Warehousing: Bulk, Packaged, Temperature-Controlled

- Blending & Mixing

- Packaging & Repackaging

- Inventory Management

- Technical Support & Consultation

- Supply Chain Optimization

- Custom Formulation

Regional Highlights

Regional dynamics play a pivotal role in shaping the Chemical Distribution Market, with each major geographic area presenting unique characteristics, growth drivers, and regulatory environments. Understanding these regional nuances is essential for market players to develop localized strategies, optimize supply chains, and identify key investment opportunities. From mature markets with stringent regulations to rapidly industrializing economies, the regional landscape reflects a diverse tapestry of demand patterns and distribution infrastructure requirements. This geographic breakdown provides a crucial perspective on the global market's multifaceted nature and its response to various economic and political influences.

- North America: Characterized by a highly developed chemical industry, a strong focus on specialty chemicals, and significant investments in research and development. The region benefits from robust industrial infrastructure and a growing emphasis on sustainable and bio-based chemical solutions. Stringent environmental regulations drive innovation in safe handling and disposal.

- Europe: A mature market with a strong emphasis on sustainability, circular economy principles, and advanced chemical manufacturing capabilities. Strict regulatory frameworks, such as REACH, significantly influence distribution practices, pushing for greater transparency and environmental responsibility. Demand for high-performance and specialty chemicals remains strong across various industries.

- Asia Pacific (APAC): Emerging as the fastest-growing region due to rapid industrialization, increasing manufacturing activities, and a burgeoning middle class in countries like China, India, and Southeast Asia. The region is a major production hub for both commodity and specialty chemicals, driving significant demand for efficient distribution networks. Infrastructure development and increasing foreign investments are key growth facilitators.

- Latin America: Exhibiting growth fueled by expanding industrial sectors, particularly agriculture, automotive, and construction. The region often relies on imports for a wide range of chemicals, making efficient distribution and logistics crucial. Developing infrastructure and fluctuating economic conditions present both opportunities and challenges for distributors.

- Middle East and Africa (MEA): Marked by significant investments in petrochemical production and a strategic geographical location for global trade routes. Countries in the Middle East are expanding their chemical manufacturing capabilities, creating new distribution hubs. Africa presents long-term growth potential driven by industrialization and urbanization, though it faces challenges related to infrastructure and regulatory complexities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Chemical Distribution Market.

- Brenntag SE

- Univar Solutions Inc.

- Azelis Group NV

- IMCD N.V.

- DKSH Holding AG

- Helm AG

- Ravago S.A.

- Biesterfeld AG

- Nexeo Plastics

- Jebsen & Jessen Pte Ltd

- Indukern S.A.

- Sumitomo Corporation

- Mitsubishi Corporation

- Mitsui & Co. Ltd.

- Nagase & Co. Ltd.

- Caldic B.V.

- Stockmeier Chemie GmbH & Co. KG

- TER Group

- Connell Chemical Distribution

- K.A. Rasmussen

Frequently Asked Questions

What is the projected growth rate for the Chemical Distribution Market?

The Chemical Distribution Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2033, reaching an estimated USD 528.9 Billion by the end of the forecast period.

How significant are sustainability trends in the Chemical Distribution Market?

Sustainability is a crucial trend, driving demand for green chemicals, circular economy practices, and eco-friendly logistics. Companies are increasingly focusing on ESG factors to meet regulatory compliance and consumer demand, enhancing their competitive position.

Which key technologies are impacting chemical distribution operations?

Key technologies include Artificial Intelligence (AI) for predictive analytics and optimization, IoT for real-time tracking, and advanced e-commerce platforms. These technologies enhance efficiency, reduce costs, and improve supply chain resilience.

What are the primary challenges faced by chemical distributors globally?

Challenges include navigating complex and stringent regulatory landscapes, managing volatile raw material prices, ensuring product quality and safety, addressing talent shortages, and mitigating cybersecurity threats to digital infrastructure.

Which regions are key contributors to the Chemical Distribution Market's growth?

Asia Pacific (APAC) is the fastest-growing region due to rapid industrialization. North America and Europe remain significant, driven by specialty chemical demand and advanced infrastructure, while Latin America and MEA offer emerging opportunities.