Distribution Feeder Automation Market

Distribution Feeder Automation Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_705832 | Last Updated : August 17, 2025 |

Format : ![]()

![]()

![]()

![]()

Distribution Feeder Automation Market Size

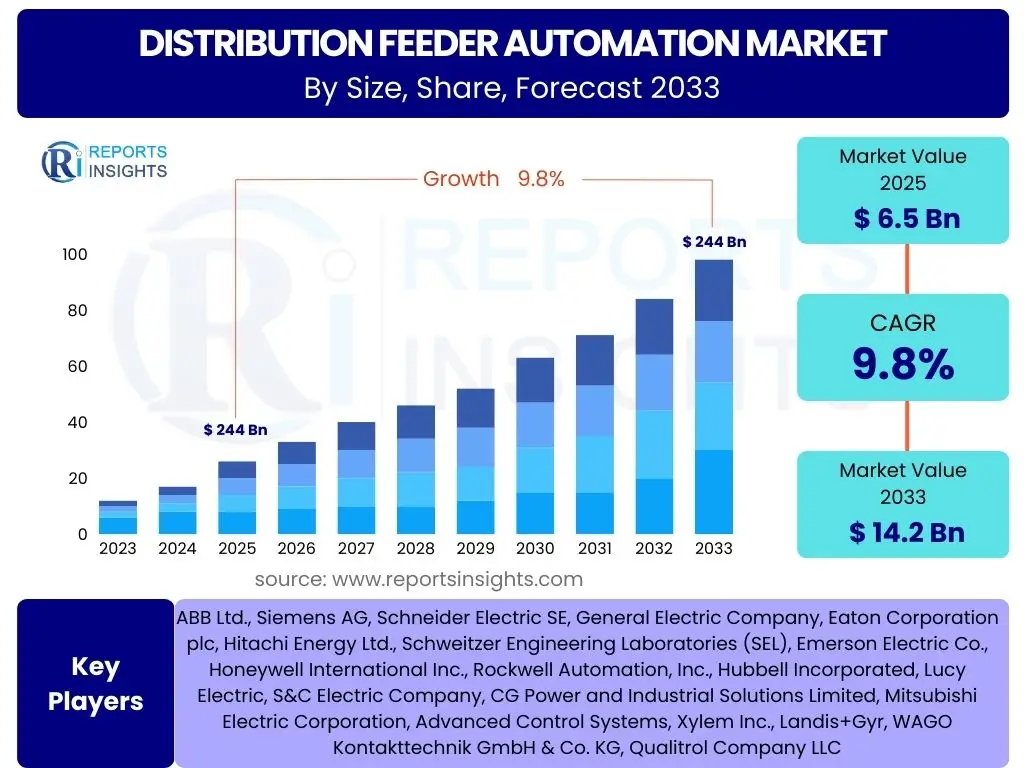

According to Reports Insights Consulting Pvt Ltd, The Distribution Feeder Automation Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2025 and 2033. The market is estimated at USD 6.5 billion in 2025 and is projected to reach USD 14.2 billion by the end of the forecast period in 2033.

Key Distribution Feeder Automation Market Trends & Insights

User inquiries frequently focus on understanding the transformative forces shaping the distribution feeder automation landscape. A significant theme revolves around grid modernization initiatives, particularly the integration of smart grid technologies aimed at enhancing reliability, efficiency, and resilience. Another area of common interest concerns the increasing adoption of renewable energy sources and the subsequent need for more dynamic and automated feeder management to accommodate variable generation and bidirectional power flow. Furthermore, there is considerable curiosity about the role of advanced communication technologies and data analytics in enabling real-time monitoring and control within distribution networks.

The market is witnessing a strong trend towards decentralization and the proliferation of Distributed Energy Resources (DERs), which necessitates sophisticated automation solutions for seamless integration and optimized operation. There is also a growing emphasis on cybersecurity within automation systems, as utilities seek to protect critical infrastructure from evolving digital threats. Additionally, the development of more standardized and interoperable platforms is emerging as a key trend, facilitating easier deployment and integration of diverse automation components from various vendors.

- Increased integration of Distributed Energy Resources (DERs) and microgrids.

- Growing adoption of advanced communication technologies like 5G and IoT for real-time data exchange.

- Emphasis on predictive maintenance and fault location, isolation, and service restoration (FLISR) capabilities.

- Rising demand for enhanced cybersecurity measures in grid automation systems.

- Shift towards software-defined automation and cloud-based platforms.

AI Impact Analysis on Distribution Feeder Automation

Common user questions regarding AI's impact on Distribution Feeder Automation often center on its potential to revolutionize operational efficiency, predictive capabilities, and decision-making processes. Users are keen to understand how AI can move beyond traditional automation to enable more intelligent, self-healing grids. Specific concerns include the ability of AI to process vast amounts of real-time data from smart sensors, identify complex patterns, and predict potential faults before they occur, thereby significantly reducing outage durations and improving grid stability. There is also interest in AI's role in optimizing energy flow, managing distributed generation more effectively, and enhancing asset management through condition-based monitoring.

AI is poised to transform distribution feeder automation by introducing unprecedented levels of intelligence and adaptability. It enables advanced analytics for load forecasting, anomaly detection, and proactive network reconfigurations, which are crucial for managing modern, dynamic grids. Furthermore, AI-powered systems can learn from operational data, continuously improving their performance in areas such as fault diagnosis, resource allocation, and grid optimization. While the initial investment and data infrastructure requirements pose challenges, the long-term benefits in terms of operational cost reduction, enhanced reliability, and improved service quality are substantial, positioning AI as a critical enabler for the next generation of smart grids.

- Enhanced predictive maintenance and fault detection through machine learning algorithms.

- Optimized grid performance and energy flow management using AI-driven analytics.

- Improved real-time decision-making for fault location, isolation, and service restoration (FLISR).

- Advanced load forecasting and demand-side management capabilities.

- Automated anomaly detection and cybersecurity threat identification.

Key Takeaways Distribution Feeder Automation Market Size & Forecast

User inquiries frequently aim to distill the most critical insights from the Distribution Feeder Automation market size and forecast, focusing on the core drivers of growth and the long-term strategic implications. A recurring theme is the impact of global digitalization efforts and the imperative for utilities to modernize aging infrastructure to meet evolving energy demands and regulatory requirements. Stakeholders are particularly interested in understanding how investment in automation aligns with broader sustainability goals and the transition to a more resilient, distributed energy system. The market's robust growth trajectory underscores the essential role of automation in achieving these objectives, emphasizing its foundational importance for future grid evolution.

The consistent expansion of the Distribution Feeder Automation market highlights a clear industry consensus on the necessity of smart grid technologies to address operational challenges and capitalize on new opportunities. The forecast indicates sustained growth, driven by both technological advancements and increasing regulatory pressure for improved grid reliability and efficiency. Key takeaways include the growing importance of seamless integration of renewable energy, the increasing complexity of grid management, and the indispensable role of automation in mitigating outage risks and enhancing service continuity. This market is not merely about incremental improvements but represents a fundamental shift towards an intelligent, self-optimizing energy distribution ecosystem.

- Significant market growth driven by global smart grid initiatives and infrastructure modernization.

- Increasing necessity for automation to integrate Distributed Energy Resources (DERs) effectively.

- Strong focus on enhancing grid reliability, resilience, and operational efficiency to reduce outages.

- Technological advancements in communication and data analytics are propelling market expansion.

- Sustained investment expected from utilities worldwide to meet evolving energy demands and regulatory standards.

Distribution Feeder Automation Market Drivers Analysis

The Distribution Feeder Automation market is propelled by several robust drivers, primarily the escalating demand for grid modernization and the imperative for enhanced reliability. Aging infrastructure in many developed and developing nations necessitates significant investment in smart technologies to prevent widespread outages and improve operational efficiency. Furthermore, the increasing integration of renewable energy sources, such as solar and wind power, into the grid requires advanced automation to manage their intermittency and ensure stable power delivery. This transition towards a more distributed energy landscape intrinsically boosts the demand for sophisticated feeder automation solutions capable of real-time monitoring and control.

Another crucial driver is the growing emphasis on improving customer satisfaction through reduced outage durations and more resilient power supply. Regulatory bodies worldwide are imposing stricter reliability standards on utilities, incentivizing the adoption of automation technologies like Fault Location, Isolation, and Service Restoration (FLISR) systems. The decreasing cost of communication technologies and sensor deployment also makes advanced automation more accessible and economically viable for utilities. These factors collectively create a compelling business case for utilities to invest in distribution feeder automation, recognizing its long-term benefits in terms of operational cost savings, asset optimization, and improved grid performance.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Aging Grid Infrastructure Modernization | +2.5% | North America, Europe, Asia Pacific | 2025-2033 |

| Rising Demand for Grid Reliability & Efficiency | +2.0% | Global | 2025-2033 |

| Integration of Renewable Energy Sources | +1.8% | Europe, Asia Pacific, North America | 2025-2033 |

| Supportive Government Regulations & Initiatives | +1.5% | North America, Europe, China, India | 2025-2030 |

| Growth in Smart Grid Deployments | +1.0% | Global | 2025-2033 |

Distribution Feeder Automation Market Restraints Analysis

Despite the strong growth drivers, the Distribution Feeder Automation market faces several significant restraints that could impede its full potential. A primary challenge is the high upfront capital expenditure required for implementing advanced automation systems. Utilities, particularly smaller or publicly owned ones, may struggle with the substantial initial investment in equipment, software, and communication infrastructure. This financial burden can prolong decision-making processes and defer adoption, especially in regions with limited funding or uncertain regulatory support for grid modernization projects.

Another major restraint is the complexity associated with the integration of new automation technologies with legacy grid infrastructure. Many existing power grids rely on outdated systems that are not inherently compatible with modern digital automation solutions, leading to significant integration challenges, interoperability issues, and increased project timelines. Furthermore, the lack of skilled personnel capable of deploying, operating, and maintaining these sophisticated systems poses a workforce challenge. Cybersecurity concerns also represent a considerable restraint, as increasing automation creates new attack vectors, requiring robust and continuous investment in security measures to protect critical infrastructure from cyber threats.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Upfront Capital Expenditure | -1.2% | Global, particularly developing regions | 2025-2033 |

| Integration Challenges with Legacy Infrastructure | -0.9% | North America, Europe | 2025-2030 |

| Concerns Regarding Cybersecurity Threats | -0.7% | Global | 2025-2033 |

| Lack of Skilled Workforce | -0.6% | Global | 2025-2033 |

| Regulatory and Standardization Hurdles | -0.5% | Varying by Region | 2025-2028 |

Distribution Feeder Automation Market Opportunities Analysis

The Distribution Feeder Automation market presents significant growth opportunities, primarily driven by the increasing global focus on smart city initiatives and the development of sustainable energy ecosystems. As cities strive to become more efficient and environmentally friendly, investments in intelligent grid infrastructure, including advanced feeder automation, become paramount. This creates a fertile ground for market expansion, particularly in emerging economies that are building new infrastructure from the ground up or modernizing rapidly. Furthermore, the continuous advancements in communication technologies, such as 5G and IoT, offer opportunities for more robust, real-time, and cost-effective data exchange within distribution networks, enhancing the capabilities of automation systems.

The rise of Distributed Energy Resources (DERs) and the proliferation of electric vehicles (EVs) represent substantial opportunities for feeder automation. Effective management of DERs, including bidirectional power flow and grid stabilization, relies heavily on sophisticated automation solutions. The growing EV charging infrastructure also demands intelligent grid management to prevent overload and optimize power distribution. Moreover, the increasing adoption of cloud-based platforms and Software-as-a-Service (SaaS) models for grid management can reduce upfront costs for utilities, making automation solutions more accessible and fostering innovation in deployment and maintenance services. The transition towards energy as a service and the development of more personalized energy solutions further open doors for advanced automation systems.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growth of Smart City & Sustainable Energy Initiatives | +1.8% | Asia Pacific, Europe, Middle East | 2025-2033 |

| Advancements in Communication Technologies (5G, IoT) | +1.5% | Global | 2025-2033 |

| Expansion of Distributed Energy Resources (DERs) | +1.3% | North America, Europe, Asia Pacific | 2025-2033 |

| Increased Adoption of Electric Vehicles (EVs) | +1.0% | Global | 2025-2033 |

| Emergence of Cloud-Based & SaaS Solutions | +0.8% | Global | 2025-2030 |

Distribution Feeder Automation Market Challenges Impact Analysis

The Distribution Feeder Automation market faces several critical challenges that require strategic navigation for sustained growth. One significant hurdle is the inherent complexity of integrating diverse automation components and software from multiple vendors into a cohesive and interoperable system. Achieving seamless communication and data exchange across various devices and platforms can be technically demanding and costly, leading to deployment delays and potential system inefficiencies. This complexity is often compounded by the need to ensure backward compatibility with existing legacy infrastructure, which was not designed for modern digital integration.

Another prominent challenge pertains to the increasing threat landscape posed by cyberattacks on critical infrastructure. As distribution networks become more automated and interconnected, they present larger attack surfaces, making them vulnerable to sophisticated cyber threats. Ensuring the security and resilience of these systems against data breaches, operational disruptions, and malicious control is paramount, requiring continuous investment in advanced cybersecurity measures and skilled personnel. Additionally, the fragmented regulatory landscape across different regions and countries can create inconsistencies in adoption standards and incentives, complicating global market expansion and the widespread deployment of standardized solutions. Addressing these challenges effectively will be crucial for unlocking the full potential of distribution feeder automation.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Interoperability & Integration Complexities | -1.0% | Global | 2025-2033 |

| Rising Cybersecurity Risks | -0.8% | Global | 2025-2033 |

| Data Management & Analytics Challenges | -0.6% | Global | 2025-2030 |

| Regulatory & Policy Inconsistencies | -0.5% | Varying by Region | 2025-2028 |

| Resistance to Change within Utilities | -0.4% | Global | 2025-2027 |

Distribution Feeder Automation Market - Updated Report Scope

This comprehensive report provides an in-depth analysis of the global Distribution Feeder Automation market, offering critical insights into its size, growth trajectory, key trends, drivers, restraints, opportunities, and challenges. It encompasses a detailed segmentation analysis across various components, applications, types, and end-users, along with a thorough regional assessment to highlight market dynamics in key geographical areas. The report also profiles leading market players, offering strategic intelligence for stakeholders to make informed business decisions and capitalize on emerging market opportunities. The scope aims to provide a holistic view of the market's current landscape and its projected evolution over the forecast period, emphasizing the strategic importance of automation in modernizing electricity distribution grids and enhancing their efficiency and resilience.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 6.5 billion |

| Market Forecast in 2033 | USD 14.2 billion |

| Growth Rate | 9.8% |

| Number of Pages | 247 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd., Siemens AG, Schneider Electric SE, General Electric Company, Eaton Corporation plc, Hitachi Energy Ltd., Schweitzer Engineering Laboratories (SEL), Emerson Electric Co., Honeywell International Inc., Rockwell Automation, Inc., Hubbell Incorporated, Lucy Electric, S&C Electric Company, CG Power and Industrial Solutions Limited, Mitsubishi Electric Corporation, Advanced Control Systems, Xylem Inc., Landis+Gyr, WAGO Kontakttechnik GmbH & Co. KG, Qualitrol Company LLC |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Distribution Feeder Automation market is comprehensively segmented to provide granular insights into its various facets, enabling a detailed understanding of market dynamics and opportunities across different categories. This segmentation is crucial for stakeholders to identify specific growth areas, tailor strategies, and address the unique requirements of diverse applications and end-users. The market's components, including hardware, software, and services, are analyzed to understand their individual contributions and growth trajectories, reflecting the evolving technological landscape and service delivery models within the sector. Each segment offers distinct opportunities for innovation and market penetration.

Further segmentation by application highlights the specific functionalities driving demand, such as Fault Location, Isolation, and Service Restoration (FLISR) for enhanced grid reliability, and Volt/VAR Optimization (VVO) for energy efficiency. The classification by type, encompassing overhead and underground systems, reflects the prevalent infrastructure configurations globally, while the end-user segmentation across industrial, commercial, and residential sectors illustrates the diverse customer base benefiting from automation solutions. Moreover, segmentation by communication technology (wired vs. wireless) and voltage level (medium vs. high voltage) provides insights into the technological preferences and deployment scenarios shaping the market. This detailed breakdown facilitates targeted market analysis and strategic planning for various industry participants.

- By Component:

- Hardware (Sensors, Reclosers, Sectionalizers, Smart Meters, RTUs/FRTUs, Fault Indicators)

- Software (SCADA, DMS, OMS, EMS, Analytics Software)

- Services (Consulting, Implementation, Maintenance, Training)

- By Application:

- Fault Location, Isolation, and Restoration (FLISR)

- Volt/VAR Optimization (VVO)

- Load Management

- Grid Monitoring and Control

- Asset Management and Predictive Maintenance

- By Type:

- Overhead Systems

- Underground Systems

- By End-user:

- Industrial

- Commercial

- Residential

- Utilities

- By Communication Technology:

- Wired Communication (Fiber Optic, Ethernet, DSL)

- Wireless Communication (Cellular, RF Mesh, Satellite, Wi-Fi)

- By Voltage Level:

- Medium Voltage (1 kV to 69 kV)

- High Voltage (Above 69 kV)

Regional Highlights

- North America: This region is a leading market, driven by significant investments in smart grid infrastructure modernization, increasing demand for renewable energy integration, and stringent regulatory mandates for grid reliability. The presence of key technology providers and ongoing research and development initiatives further bolster market growth. The focus on aging infrastructure replacement and resilience enhancement against extreme weather events also contributes significantly.

- Europe: Europe exhibits robust growth owing to ambitious renewable energy targets, a strong push for grid digitalization, and supportive government policies promoting smart grid deployments. Countries like Germany, the UK, and France are at the forefront of adopting advanced feeder automation technologies to manage complex energy flows and enhance energy efficiency.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market, primarily due to rapid industrialization, urbanization, and increasing electricity demand in countries like China, India, and Japan. Massive investments in new power infrastructure and smart city projects, coupled with the need to reduce transmission and distribution losses, are driving the adoption of feeder automation solutions across the region.

- Latin America: This region is experiencing steady growth, fueled by efforts to expand electricity access, improve grid stability, and integrate renewable energy. While adoption rates may vary by country, there's a growing recognition of the benefits of automation in addressing power quality issues and reducing outages.

- Middle East and Africa (MEA): The MEA region is witnessing emerging opportunities, particularly in Gulf Cooperation Council (GCC) countries, driven by large-scale infrastructure projects, smart city developments, and a push towards diversifying energy sources. Investments in grid modernization to support economic growth and reduce reliance on fossil fuels are key drivers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Distribution Feeder Automation Market.- ABB Ltd.

- Siemens AG

- Schneider Electric SE

- General Electric Company

- Eaton Corporation plc

- Hitachi Energy Ltd.

- Schweitzer Engineering Laboratories (SEL)

- Emerson Electric Co.

- Honeywell International Inc.

- Rockwell Automation, Inc.

- Hubbell Incorporated

- Lucy Electric

- S&C Electric Company

- CG Power and Industrial Solutions Limited

- Mitsubishi Electric Corporation

- Advanced Control Systems

- Xylem Inc.

- Landis+Gyr

- WAGO Kontakttechnik GmbH & Co. KG

- Qualitrol Company LLC

Frequently Asked Questions

What is Distribution Feeder Automation?

Distribution Feeder Automation refers to the application of intelligent electronic devices, communication systems, and control software to monitor, control, and operate distribution feeders in real-time. Its primary goal is to enhance grid reliability, efficiency, and resilience by quickly detecting and isolating faults, restoring power, and optimizing power flow.

Why is Distribution Feeder Automation important for modern grids?

It is crucial for modern grids because it enables faster fault detection and restoration, reduces outage durations, improves grid stability with increased integration of renewable energy, and optimizes power quality and efficiency. It transforms traditional grids into self-healing, intelligent networks capable of managing dynamic energy demands and distributed resources.

What are the key components of a Distribution Feeder Automation system?

Key components include intelligent electronic devices (IEDs) such as reclosers, sectionalizers, smart meters, and fault indicators; communication infrastructure (wired or wireless); supervisory control and data acquisition (SCADA) systems; and advanced distribution management systems (ADMS) software that integrates various functionalities like FLISR and VVO.

How does AI contribute to Distribution Feeder Automation?

AI significantly enhances feeder automation by enabling predictive maintenance, advanced fault diagnosis, and optimized real-time decision-making. AI algorithms can analyze vast datasets to anticipate equipment failures, manage complex energy flows more efficiently, and continuously improve grid performance through machine learning, making the grid more autonomous and resilient.

What are the main challenges in adopting Distribution Feeder Automation?

The primary challenges include high upfront capital investment, complexities in integrating new systems with existing legacy infrastructure, ensuring robust cybersecurity against evolving threats, and addressing the shortage of skilled personnel required for deployment and maintenance. Regulatory and standardization inconsistencies across regions can also pose hurdles to widespread adoption.