Fitness Equipment Market

Fitness Equipment Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_702380 | Last Updated : July 31, 2025 |

Format : ![]()

![]()

![]()

![]()

Fitness Equipment Market Size

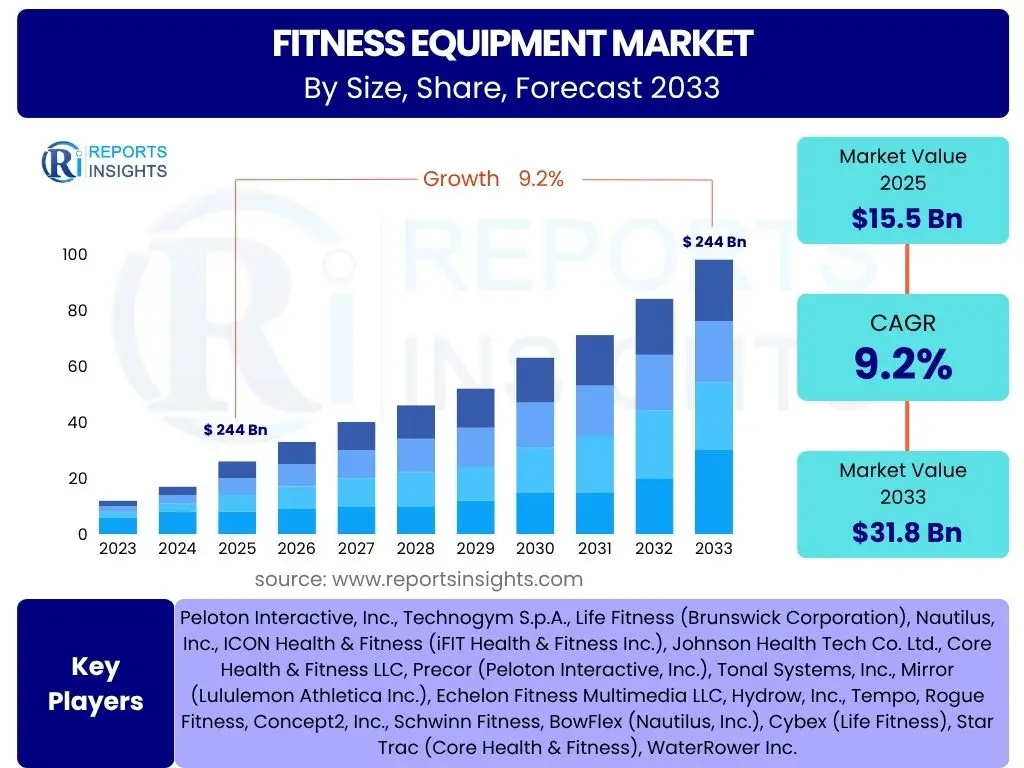

According to Reports Insights Consulting Pvt Ltd, The Fitness Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.2% between 2025 and 2033. The market is estimated at USD 15.5 Billion in 2025 and is projected to reach USD 31.8 Billion by the end of the forecast period in 2033.

Key Fitness Equipment Market Trends & Insights

The fitness equipment market is undergoing significant transformation, driven by evolving consumer preferences and technological advancements. Key insights indicate a robust shift towards personalized and connected fitness solutions, reflecting a desire for more engaging and effective workout experiences. The post-pandemic emphasis on home fitness has solidified its position, compelling manufacturers to innovate with compact, multi-functional, and digitally integrated equipment. Furthermore, there is a growing demand for sustainable and durable products, aligning with broader environmental consciousness.

User inquiries frequently revolve around the sustainability of the home fitness boom, the integration of smart technologies, and the rise of boutique fitness concepts. These trends suggest a market that values convenience, data-driven performance tracking, and a holistic approach to well-being. The industry is responding by developing ecosystems that combine hardware, software, and content, providing comprehensive fitness solutions beyond standalone equipment.

- Increased adoption of connected fitness equipment with interactive platforms and live classes.

- Rising demand for compact, multi-functional, and space-saving home gym solutions.

- Growing popularity of smart wearables integrating with fitness equipment for data tracking.

- Emphasis on eco-friendly and sustainable manufacturing practices for fitness products.

- Personalization of workout routines and equipment features through data analytics.

AI Impact Analysis on Fitness Equipment

Artificial intelligence is profoundly reshaping the fitness equipment landscape, addressing common user questions regarding personalized training, performance optimization, and injury prevention. AI-driven algorithms are now capable of analyzing user performance data in real-time, offering dynamic feedback and adjusting workout intensities to maximize effectiveness. This ensures that fitness routines are not generic but tailored to individual progress and goals, significantly enhancing user engagement and results.

Concerns about the potential for AI to replace human trainers are balanced by the understanding that AI often augments their capabilities, providing data-backed insights that lead to more informed coaching. Users expect AI to offer intelligent guidance, such as form correction, predictive maintenance alerts for equipment, and adaptive programming that responds to fatigue or progress. The integration of AI extends to creating immersive virtual environments, making workouts more entertaining and challenging, and transforming traditional equipment into intelligent personal trainers.

- Personalized workout recommendations and adaptive training programs based on user data.

- Real-time form correction and posture guidance through computer vision and motion sensors.

- Predictive maintenance for equipment, anticipating wear and tear to prevent breakdowns.

- AI-powered virtual coaching providing motivation and structured training guidance.

- Enhanced data analytics for performance tracking, progress reporting, and goal setting.

Key Takeaways Fitness Equipment Market Size & Forecast

The fitness equipment market is poised for sustained expansion, driven by a global focus on health and wellness and the continuous evolution of fitness technology. Key takeaways from market size and forecast analyses reveal a robust trajectory, with significant growth projected across various segments, including both home and commercial applications. The market's resilience, even amidst economic fluctuations, underscores the fundamental and increasing consumer commitment to physical health.

Common user questions about the future of fitness equipment often highlight curiosity about technological integration and the longevity of current trends. The forecast indicates that smart, connected, and personalized equipment will be central to future growth, moving beyond simple exercise machines to become integral components of a holistic wellness ecosystem. Furthermore, emerging economies are expected to contribute substantially to market expansion, fueled by rising disposable incomes and increasing health awareness.

- Significant and consistent growth projected, driven by global health consciousness.

- Technology integration, particularly AI and IoT, will be a primary growth catalyst.

- The home fitness segment is expected to retain its elevated demand post-pandemic.

- Commercial gyms and health clubs will increasingly invest in high-tech and specialized equipment.

- Emerging markets present substantial opportunities for expansion and adoption.

Fitness Equipment Market Drivers Analysis

The fitness equipment market is propelled by a confluence of macroeconomic and socio-cultural factors that underscore a global shift towards proactive health management. A primary driver is the escalating awareness regarding chronic lifestyle diseases such as obesity, diabetes, and cardiovascular conditions, prompting individuals to invest in physical activity and related equipment. This health consciousness is further amplified by government initiatives and public health campaigns promoting active lifestyles, which directly stimulate demand for diverse fitness solutions.

Technological advancements also serve as a crucial driver, with the integration of smart features, connectivity, and artificial intelligence transforming traditional equipment into sophisticated personal training tools. The rise of connected fitness platforms, virtual reality workouts, and gamified exercise experiences has made fitness more engaging and accessible, attracting a broader demographic. Moreover, increasing disposable incomes in developing regions enable greater consumer spending on premium and technologically advanced fitness equipment, expanding the market's reach beyond traditional geographies.

The urbanization trend, often associated with sedentary lifestyles, paradoxically drives the need for convenient fitness solutions, including home gyms and easily accessible commercial fitness centers. This, coupled with the growing demand for personalized wellness experiences, fuels innovation in equipment design and functionality. The market benefits from a positive feedback loop where increased adoption leads to more technological development, making fitness more appealing and effective for consumers worldwide.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growing Health and Wellness Awareness | +2.5% | Global, particularly North America, Europe, APAC | Long-term (2025-2033) |

| Technological Advancements & Smart Equipment | +2.0% | North America, Europe, East Asia | Mid to Long-term (2025-2033) |

| Rising Disposable Incomes in Emerging Economies | +1.5% | Asia Pacific, Latin America, Middle East & Africa | Mid to Long-term (2026-2033) |

| Growth of Home Fitness and Virtual Workouts | +1.2% | Global, especially urban centers | Mid-term (2025-2030) |

| Increasing Incidence of Lifestyle Diseases | +1.0% | Global | Long-term (2025-2033) |

Fitness Equipment Market Restraints Analysis

Despite robust growth prospects, the fitness equipment market faces several significant restraints that could impede its expansion. One primary concern is the high initial cost associated with premium and technologically advanced fitness equipment, which can be a barrier for a significant portion of the consumer base, particularly in price-sensitive markets or for individuals with limited disposable income. This cost factor extends to the maintenance and subscription fees often associated with connected fitness platforms, adding to the long-term expenditure for users.

Another restraint stems from market saturation in mature economies, where a high penetration of basic fitness equipment already exists. This necessitates continuous innovation and differentiation for manufacturers, increasing research and development costs. Additionally, the availability of alternative fitness options, such as outdoor activities, public parks, and budget-friendly gym memberships, presents competition that diverts potential customers from investing in personal fitness equipment.

Furthermore, concerns regarding injury risk associated with improper use of equipment or intense workout regimes can deter potential buyers. The economic volatility and uncertainty in various regions also impact consumer discretionary spending, making large purchases like fitness equipment less prioritized. Supply chain disruptions, often exacerbated by global events, can lead to increased manufacturing costs and delays, ultimately affecting product availability and pricing strategies.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Initial Cost of Advanced Equipment | -1.8% | Global, particularly emerging markets | Long-term (2025-2033) |

| Market Saturation in Developed Regions | -1.5% | North America, Western Europe | Mid to Long-term (2025-2033) |

| Availability of Low-Cost Alternatives & Outdoor Fitness | -1.0% | Global | Long-term (2025-2033) |

| Economic Volatility and Fluctuations in Disposable Income | -0.8% | Varies by region, impactful on discretionary spending | Short to Mid-term (2025-2028) |

| Perceived Risk of Injury and Safety Concerns | -0.5% | Global | Long-term (2025-2033) |

Fitness Equipment Market Opportunities Analysis

The fitness equipment market is replete with significant opportunities stemming from evolving consumer demands and technological convergence. The growing trend of personalized health and wellness, propelled by data from wearables and smart devices, creates a strong demand for equipment that integrates seamlessly with these ecosystems. This allows for hyper-customized workout experiences, progress tracking, and professional guidance, offering a value proposition beyond traditional exercise machines.

The expansion into corporate wellness programs and healthcare facilities represents another substantial avenue for growth. Companies are increasingly investing in employee well-being, providing on-site fitness facilities, while rehabilitation centers and hospitals recognize the therapeutic benefits of specialized fitness equipment. This broadens the end-user base beyond individual consumers and commercial gyms, tapping into institutional markets with specific requirements for durability, precision, and medical compatibility.

Furthermore, the development of virtual reality (VR) and augmented reality (AR) fitness experiences presents a transformative opportunity. These technologies can make workouts more immersive, entertaining, and motivating, attracting new demographics and retaining existing users through novel engagement methods. The rise of subscription-based models for connected fitness content also offers recurring revenue streams, shifting the market from a one-time product purchase to an ongoing service relationship, fostering customer loyalty and lifetime value.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Integration with Wearable Technology & Health Apps | +2.0% | Global, high adoption in North America, Europe, East Asia | Mid to Long-term (2025-2033) |

| Expansion into Corporate Wellness & Healthcare Sectors | +1.8% | North America, Europe, parts of APAC | Long-term (2026-2033) |

| Development of VR/AR & Gamified Fitness Experiences | +1.5% | Global innovators, early adopters in developed markets | Mid-term (2025-2030) |

| Growth in Subscription-Based Connected Fitness Services | +1.2% | Global, strong in developed internet-savvy markets | Mid to Long-term (2025-2033) |

| Emergence of Niche and Specialized Fitness Segments (e.g., adaptive fitness) | +0.8% | Global, driven by specific demographic needs | Long-term (2027-2033) |

Fitness Equipment Market Challenges Impact Analysis

The fitness equipment market faces a complex array of challenges that require strategic navigation for sustained growth. One significant hurdle is intense market competition, characterized by a proliferation of established brands and new entrants, leading to price wars and the need for continuous differentiation. This competitive pressure can erode profit margins and make it difficult for smaller players to gain traction, demanding constant innovation and effective marketing strategies.

Technological obsolescence also poses a substantial challenge. With rapid advancements in smart features, AI integration, and connectivity, equipment purchased today may become outdated quickly, shortening product lifecycles and impacting consumer willingness to invest in high-cost items. This necessitates significant R&D investment and agile product development to keep pace with evolving consumer expectations and technological frontiers.

Furthermore, supply chain disruptions, influenced by geopolitical events, trade policies, and global health crises, can severely impact manufacturing schedules, increase logistics costs, and lead to product shortages. Counterfeit products and intellectual property theft represent another challenge, undermining brand integrity and reducing legitimate sales. Lastly, ensuring data privacy and cybersecurity for connected fitness equipment and platforms is paramount, as breaches can erode consumer trust and lead to regulatory penalties, creating complex compliance requirements for manufacturers.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Intense Market Competition & Price Sensitivity | -1.7% | Global | Long-term (2025-2033) |

| Rapid Technological Obsolescence | -1.4% | Global, impacts high-tech segments | Mid to Long-term (2025-2033) |

| Supply Chain Vulnerabilities & Raw Material Fluctuations | -1.0% | Global, particularly manufacturing hubs | Short to Mid-term (2025-2028) |

| Data Privacy and Cybersecurity Concerns for Connected Devices | -0.7% | Global, especially in data-sensitive regions (EU, US) | Long-term (2025-2033) |

| Changing Consumer Preferences and Fitness Fads | -0.5% | Global | Mid-term (2025-2030) |

Fitness Equipment Market - Updated Report Scope

This comprehensive report provides an in-depth analysis of the Fitness Equipment Market, offering a detailed segmentation of market dynamics, competitive landscape, and regional insights. The scope encompasses current market size, historical trends, and an eight-year forecast, reflecting the latest industry shifts and technological integrations. It aims to provide stakeholders with actionable intelligence to navigate the evolving market and capitalize on emerging opportunities.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 15.5 Billion |

| Market Forecast in 2033 | USD 31.8 Billion |

| Growth Rate | 9.2% CAGR |

| Number of Pages | 247 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Peloton Interactive, Inc., Technogym S.p.A., Life Fitness (Brunswick Corporation), Nautilus, Inc., ICON Health & Fitness (iFIT Health & Fitness Inc.), Johnson Health Tech Co. Ltd., Core Health & Fitness LLC, Precor (Peloton Interactive, Inc.), Tonal Systems, Inc., Mirror (Lululemon Athletica Inc.), Echelon Fitness Multimedia LLC, Hydrow, Inc., Tempo, Rogue Fitness, Concept2, Inc., Schwinn Fitness, BowFlex (Nautilus, Inc.), Cybex (Life Fitness), Star Trac (Core Health & Fitness), WaterRower Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The fitness equipment market is meticulously segmented to provide a granular understanding of its diverse components and consumer bases. These segmentations allow for a detailed analysis of market dynamics, identifying specific growth drivers, emerging trends, and areas of high potential within each category. The breakdown by product type, end-user, and distribution channel helps stakeholders tailor strategies for targeted audiences and optimize market penetration.

The product type segmentation differentiates between cardiovascular and strength training equipment, alongside a growing category for 'other' equipment which includes smart home gyms and wearables, reflecting the market's technological evolution. The end-user segmentation highlights the shift from predominantly commercial gyms to a significant home consumer segment, bolstered by corporate wellness programs and specialized institutional demand. Distribution channels illustrate the increasing importance of online retail alongside traditional brick-and-mortar stores, indicating varied consumer purchasing behaviors.

- By Product Type: This segment includes cardiovascular training equipment (such as treadmills, ellipticals, stationary bikes, and rowers), strength training equipment (including weight machines, free weights, benches, and multi-station gyms), and other fitness equipment (encompassing accessories, wearables, yoga and Pilates equipment, and smart home gyms).

- By End-User: Key end-users comprise home consumers, commercial fitness centers (gyms and health clubs), corporate wellness programs, hospitals and medical centers, hotels and resorts, and educational institutions, each with distinct needs and procurement patterns.

- By Distribution Channel: The market is segmented into online retail, which includes e-commerce platforms and brand websites, and offline retail, which covers specialty stores, department stores, and hypermarkets, reflecting diverse purchasing preferences.

Regional Highlights

- North America: This region dominates the fitness equipment market, primarily driven by high health consciousness, significant disposable incomes, and early adoption of advanced fitness technologies. The United States and Canada are leading the adoption of connected fitness solutions and home gym setups, coupled with a robust presence of commercial fitness centers. Innovation in AI-powered equipment and personalized training platforms is particularly strong here, setting global trends.

- Europe: Europe represents a mature and stable market for fitness equipment, characterized by a strong emphasis on health and well-being, supported by government initiatives promoting physical activity. Countries like Germany, the UK, and France are key contributors, demonstrating consistent demand for both commercial and home-use equipment. The region is also increasingly focused on sustainable and eco-friendly fitness solutions, influencing product development.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by rapid urbanization, rising disposable incomes, and a burgeoning middle class in countries like China, India, and Japan. Increased awareness of lifestyle diseases and a growing youth population are driving significant demand for fitness equipment. The region is witnessing a surge in new gym establishments and a growing appetite for technologically integrated home fitness solutions.

- Latin America: This region exhibits promising growth potential, driven by improving economic conditions, increasing awareness of health benefits, and the expansion of fitness clubs and wellness centers. Brazil and Mexico are leading the adoption of fitness equipment, with a growing interest in both basic and mid-range products. Government efforts to promote public health also contribute to market expansion.

- Middle East and Africa (MEA): The MEA market is experiencing gradual growth, primarily due to increasing investments in health infrastructure, a rising expatriate population, and growing urbanization. Countries like UAE and Saudi Arabia are investing in state-of-the-art fitness facilities, while health consciousness is slowly but steadily increasing across the region, driving demand for a wider range of fitness equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fitness Equipment Market.- Peloton Interactive, Inc.

- Technogym S.p.A.

- Life Fitness

- Nautilus, Inc.

- ICON Health & Fitness

- Johnson Health Tech Co. Ltd.

- Core Health & Fitness LLC

- Precor

- Tonal Systems, Inc.

- Mirror

- Echelon Fitness Multimedia LLC

- Hydrow, Inc.

- Tempo

- Rogue Fitness

- Concept2, Inc.

- Schwinn Fitness

- BowFlex

- Cybex

- Star Trac

- WaterRower Inc.

Frequently Asked Questions

What is the projected growth rate of the Fitness Equipment Market?

The Fitness Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.2% between 2025 and 2033, reflecting robust demand and technological integration.

How is AI impacting fitness equipment?

AI is significantly impacting fitness equipment by enabling personalized workout recommendations, real-time form correction, predictive maintenance, and creating immersive virtual coaching experiences.

What are the primary drivers of the Fitness Equipment Market?

Key drivers include increasing global health and wellness awareness, rapid technological advancements, rising disposable incomes in emerging economies, and the sustained growth of the home fitness segment.

Which region holds the largest market share in fitness equipment?

North America currently holds the largest market share in the fitness equipment market, driven by high health consciousness, strong purchasing power, and early adoption of innovative fitness technologies.

What types of fitness equipment are included in the market analysis?

The market analysis includes cardiovascular training equipment (e.g., treadmills, ellipticals), strength training equipment (e.g., weights, machines), and other fitness equipment such as accessories, wearables, and smart home gym systems.