EEPROM Memory Chip for Automotive Market

EEPROM Memory Chip for Automotive Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_701160 | Last Updated : July 29, 2025 |

Format : ![]()

![]()

![]()

![]()

EEPROM Memory Chip for Automotive Market Size

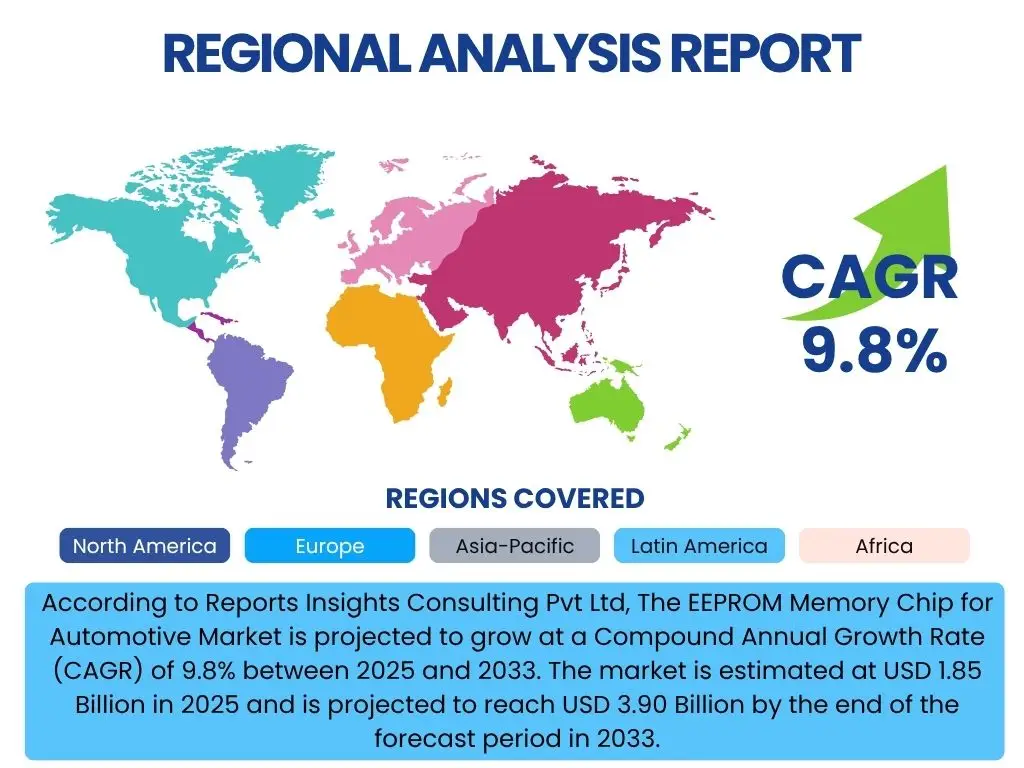

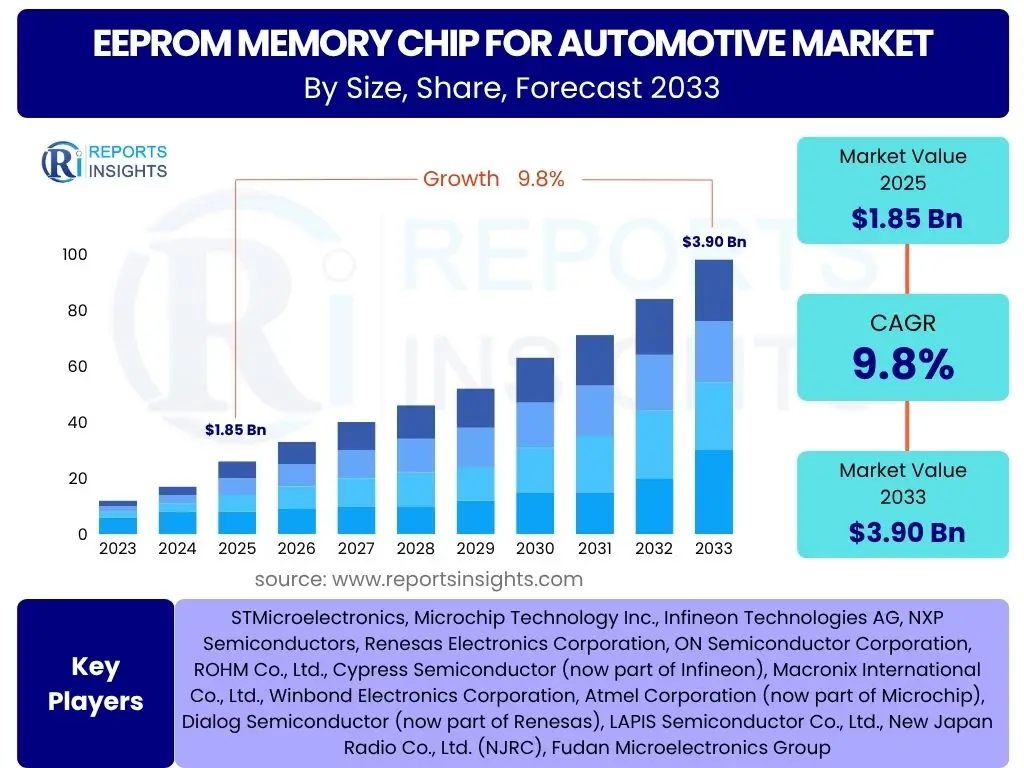

According to Reports Insights Consulting Pvt Ltd, The EEPROM Memory Chip for Automotive Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2025 and 2033. The market is estimated at USD 1.85 Billion in 2025 and is projected to reach USD 3.90 Billion by the end of the forecast period in 2033.

This robust growth is primarily driven by the increasing integration of advanced electronic systems across all vehicle segments, from conventional automobiles to electric and autonomous vehicles. The burgeoning demand for sophisticated safety features, enhanced infotainment systems, and efficient powertrain management solutions necessitates reliable and robust non-volatile memory, positioning EEPROM as a critical component in the automotive electronics ecosystem. The escalating complexity of automotive software and firmware further amplifies the need for secure and durable data storage, directly contributing to the market's expansion.

Furthermore, the automotive industry's shift towards software-defined vehicles and over-the-air (OTA) update capabilities underscores the vital role of EEPROM for storing calibration data, configuration settings, and event logs. Manufacturers are increasingly relying on EEPROM to ensure system stability and facilitate seamless updates throughout a vehicle's lifecycle, thereby enhancing vehicle performance and user experience. This foundational requirement for persistent memory, capable of enduring harsh automotive environments and frequent read/write cycles, underpins the consistent growth trajectory of the EEPROM memory chip market within the automotive sector.

Key EEPROM Memory Chip for Automotive Market Trends & Insights

The EEPROM Memory Chip for Automotive market is experiencing significant shifts driven by technological advancements and evolving automotive demands. Users frequently inquire about the trajectory of non-volatile memory in next-generation vehicles, particularly concerning reliability, density, and integration. Key insights reveal a growing emphasis on high-endurance EEPROMs, tighter integration with microcontrollers, and enhanced security features, reflecting the industry's pivot towards connected, autonomous, shared, and electric (CASE) vehicle architectures. Furthermore, the push for miniaturization and cost-efficiency remains a constant driver for innovation in this segment, shaping product development and market strategies.

- Increasing demand for high-endurance and high-density EEPROMs for advanced driver-assistance systems (ADAS) and infotainment.

- Growing integration of EEPROM with microcontroller units (MCUs) to optimize space and performance in automotive electronic control units (ECUs).

- Emphasis on enhanced security features within EEPROM chips to protect sensitive vehicle data and prevent unauthorized access.

- Rising adoption of EEPROM in electric vehicles (EVs) for battery management systems (BMS), power electronics, and charging infrastructure.

- Proliferation of over-the-air (OTA) update capabilities in modern vehicles, requiring robust and reliable memory solutions for firmware storage and configuration.

AI Impact Analysis on EEPROM Memory Chip for Automotive

Common user questions regarding AI's influence on the EEPROM Memory Chip for Automotive market center on how artificial intelligence applications, particularly in autonomous driving and advanced ADAS, will affect memory requirements. Users are concerned about the implications for data logging, parameter storage, and the secure operation of AI models. Analysis indicates that while AI processing heavily relies on high-speed volatile memory like DRAM and high-bandwidth non-volatile memory such as NAND flash, EEPROM plays a crucial, complementary role. It is indispensable for storing critical boot-up sequences, configuration parameters for AI algorithms, fault codes, calibration data, and event logs essential for AI system integrity and diagnostics. This makes EEPROM a foundational element for the robust and secure deployment of AI capabilities within vehicles.

The integration of AI also necessitates extremely reliable and resilient memory for critical operational data, where even minor corruption could have significant safety implications. EEPROM’s proven endurance and data retention capabilities make it suitable for these persistent storage needs in AI-driven automotive systems. As AI applications in vehicles become more sophisticated, requiring continuous learning and adaptation, the need for secure and frequently updated configuration data will grow. This directly translates into an increased demand for EEPROM that can facilitate numerous write cycles and offer robust data integrity, even in challenging automotive environments. The ongoing evolution of AI algorithms and their increasing complexity will further drive the demand for higher-density and faster EEPROM solutions capable of supporting advanced functionalities.

- EEPROM serves as a critical component for storing persistent configuration data, boot-up parameters, and calibration settings for AI-powered ADAS and autonomous driving systems.

- Enhanced data logging capabilities for AI system diagnostics and black box functionalities increase the demand for reliable EEPROM for event recording.

- Secure boot and trusted execution environments for AI processors rely on EEPROM to store cryptographic keys and security policies, ensuring system integrity.

- The need for robust memory to support over-the-air (OTA) updates for AI models and associated firmware drives demand for high-endurance EEPROM.

- EEPROM's role in storing adaptive learning parameters and sensor fusion configurations for real-time AI processing ensures system stability and responsiveness.

Key Takeaways EEPROM Memory Chip for Automotive Market Size & Forecast

Key user questions about the EEPROM Memory Chip for Automotive market size and forecast frequently inquire about the primary growth drivers, the impact of emerging vehicle technologies, and the long-term sustainability of demand. The core takeaway is a significant and sustained growth trajectory, driven by the pervasive digitalization of vehicles and the increasing complexity of in-car electronic systems. The market is not merely expanding in volume but also in the sophistication and density of EEPROM required, adapting to stringent automotive standards and the demands of connected and autonomous vehicle architectures. This indicates a resilient market with continuous innovation.

- The market is poised for robust growth, driven by the escalating electronic content in modern vehicles and the widespread adoption of advanced automotive technologies.

- Significant opportunities lie in the electric vehicle (EV) and autonomous driving segments, which demand high-endurance and secure non-volatile memory solutions.

- Technological advancements are focused on higher density, improved endurance, and enhanced security features to meet evolving automotive requirements.

- The shift towards software-defined vehicles and over-the-air (OTA) updates solidifies EEPROM's role as a fundamental component for persistent data storage.

- Asia Pacific is expected to remain the dominant market due to high automotive production and rapid adoption of advanced vehicle technologies.

EEPROM Memory Chip for Automotive Market Drivers Analysis

The EEPROM Memory Chip for Automotive market is propelled by several fundamental drivers that reflect the ongoing transformation of the automotive industry. A primary driver is the pervasive integration of electronic control units (ECUs) across various vehicle functions, ranging from engine management and transmission control to advanced safety and convenience features. Each additional ECU and sensor demands dedicated non-volatile memory for configuration, calibration, and operational data storage, directly increasing the demand for EEPROM chips. This exponential growth in electronic content per vehicle forms the bedrock of market expansion.

Another significant driver is the rapid advancement and adoption of electric vehicles (EVs) and autonomous driving (AD) technologies. EVs require sophisticated battery management systems (BMS), power electronics, and charging interfaces, all of which rely on EEPROM for parameter storage and system monitoring. Similarly, AD systems, with their intricate sensor fusion, perception algorithms, and decision-making capabilities, necessitate robust and reliable memory for persistent data storage, fault logging, and secure boot processes. The increasing computational complexity and data intensity of these next-generation vehicle architectures inherently boost the demand for high-performance and high-endurance EEPROM solutions.

Furthermore, stringent global automotive safety standards, such as ISO 26262, mandate the use of highly reliable components with robust data integrity features. EEPROM, with its proven track record for data retention and write endurance in harsh environments, meets these critical safety requirements. The growing trend of in-car connectivity, infotainment systems, and over-the-air (OTA) updates also contributes significantly. These features require reliable non-volatile memory for storing user profiles, navigation data, and updating vehicle firmware, ensuring a seamless and secure digital experience for vehicle occupants.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Electronic Content Per Vehicle | +2.5% | Global | 2025-2033 |

| Proliferation of ADAS and Autonomous Driving Technologies | +2.0% | North America, Europe, Asia Pacific | 2026-2033 |

| Growth in Electric Vehicle (EV) Production | +1.8% | Asia Pacific, Europe | 2025-2033 |

| Stringent Automotive Safety and Reliability Standards | +1.5% | Global | 2025-2030 |

| Demand for In-car Connectivity and Infotainment Systems | +1.0% | Global | 2025-2033 |

EEPROM Memory Chip for Automotive Market Restraints Analysis

Despite the robust growth, the EEPROM Memory Chip for Automotive market faces several restraints that could impede its full potential. One significant challenge is the intense price competition within the semiconductor industry, particularly for memory components. As EEPROM technology matures, the market experiences downward pressure on pricing, impacting profit margins for manufacturers. This forces companies to continuously innovate and optimize production processes to remain competitive, potentially limiting investment in new, higher-cost research and development initiatives for niche automotive applications.

Another restraint is the emergence and growing adoption of alternative non-volatile memory technologies, such as NOR Flash, MRAM (Magnetoresistive Random-Access Memory), and FRAM (Ferroelectric Random Access Memory). While EEPROM offers specific advantages like bit-level addressability and high endurance for certain applications, these alternative technologies are gaining traction for applications requiring higher density, faster write speeds, or superior radiation hardness. For instance, NOR Flash is often preferred for code storage, while MRAM and FRAM offer faster writes and theoretically infinite endurance, posing a long-term competitive threat to EEPROM in specific automotive use cases.

Furthermore, the automotive industry's notoriously long product development cycles and rigorous qualification processes act as a barrier to rapid market entry and adoption for new EEPROM technologies. The need for extensive testing and validation to meet AEC-Q100 standards and ensure reliability in harsh automotive environments can delay the introduction of innovative solutions. This conservative approach, while ensuring safety, can slow down the integration of cutting-edge memory technologies, making it challenging for smaller or newer players to penetrate the established supply chains dominated by incumbent suppliers.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Intense Price Competition and Margin Pressure | -0.8% | Global | 2025-2033 |

| Emergence of Alternative Memory Technologies | -0.7% | Global | 2027-2033 |

| Long Product Development and Qualification Cycles | -0.5% | Global | 2025-2030 |

EEPROM Memory Chip for Automotive Market Opportunities Analysis

The EEPROM Memory Chip for Automotive market presents significant growth opportunities driven by evolving technological landscapes and increasing automotive sophistication. One key opportunity lies in the burgeoning market for autonomous vehicles (AVs) and advanced driver-assistance systems (ADAS). As these systems become more complex, they require extensive data logging for training AI models, storing detailed maps, and recording critical event data for safety and liability purposes. High-density, high-endurance EEPROMs are ideally suited for these applications, offering persistent and reliable storage for constantly evolving algorithms and vast datasets, thereby creating a sustained demand for advanced memory solutions.

Another substantial opportunity is the continued expansion of the electric vehicle (EV) market. EVs rely heavily on sophisticated battery management systems (BMS), power control units, and charging infrastructure, all of which require robust non-volatile memory for parameters, configuration settings, and fault logs. As EV adoption accelerates globally, the demand for EEPROM tailored to the unique power and thermal requirements of these vehicles is expected to surge. Furthermore, the integration of smart charging features and vehicle-to-grid (V2G) capabilities will necessitate even more sophisticated memory solutions to manage complex data flows and ensure system integrity.

Moreover, the increasing demand for enhanced cybersecurity in connected cars presents a lucrative opportunity for secure EEPROM solutions. With vehicles becoming increasingly connected to external networks, protecting sensitive data and preventing unauthorized access to critical systems is paramount. EEPROMs with integrated security features, such as secure boot, cryptographic storage, and tamper detection, can provide a robust foundation for automotive cybersecurity. This growing need for secure persistent memory, coupled with the ongoing development of advanced in-car infotainment and connectivity systems requiring reliable configuration storage, opens new avenues for market expansion and innovation for EEPROM manufacturers.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growth in Autonomous Vehicle and ADAS Applications | +1.5% | North America, Europe, Asia Pacific | 2026-2033 |

| Expansion of Electric Vehicle (EV) Market | +1.2% | Asia Pacific, Europe | 2025-2033 |

| Increasing Demand for Automotive Cybersecurity Solutions | +1.0% | Global | 2025-2032 |

| Development of Next-Generation Infotainment and Connectivity | +0.8% | Global | 2025-2033 |

EEPROM Memory Chip for Automotive Market Challenges Impact Analysis

The EEPROM Memory Chip for Automotive market faces several inherent challenges that demand continuous innovation and strategic adaptation from manufacturers. One significant challenge is the ongoing pressure for miniaturization and integration within limited vehicle space. As the number of electronic components in vehicles grows, there is a constant demand for smaller form factors and higher integration levels for EEPROM chips, often alongside other components like microcontrollers. This necessitates advanced packaging technologies and design complexities, which can increase manufacturing costs and development timelines, posing an engineering hurdle for achieving higher densities in compact packages without compromising performance or reliability.

Another critical challenge is ensuring the long-term reliability and endurance of EEPROM in the extreme environmental conditions prevalent in automotive applications. Vehicle electronics are exposed to wide temperature fluctuations, vibrations, electromagnetic interference, and humidity, all of which can degrade memory performance over time. EEPROM chips must maintain data integrity and withstand millions of read/write cycles throughout a vehicle's lifespan, often exceeding 15-20 years. Meeting the stringent AEC-Q100 automotive qualification standards requires robust chip design, advanced manufacturing processes, and rigorous testing, which adds to the cost and complexity of development.

Furthermore, managing the supply chain volatility for semiconductor components, including EEPROM, presents an ongoing challenge. Geopolitical tensions, natural disasters, and unexpected shifts in demand can lead to significant disruptions, impacting production schedules and material availability. The automotive industry's lean manufacturing practices make it particularly vulnerable to these disruptions, emphasizing the need for robust supply chain management, diversified sourcing strategies, and effective inventory planning to mitigate risks and ensure consistent supply of critical EEPROM chips for automotive production lines.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Miniaturization and High Integration Demands | -0.6% | Global | 2025-2030 |

| Ensuring Long-Term Reliability in Harsh Environments | -0.5% | Global | 2025-2033 |

| Supply Chain Volatility and Geopolitical Risks | -0.4% | Global | 2025-2028 |

EEPROM Memory Chip for Automotive Market - Updated Report Scope

This report provides an in-depth analysis of the EEPROM Memory Chip for Automotive market, offering a comprehensive overview of its current state, historical performance, and future growth prospects. It delves into market dynamics by analyzing key trends, drivers, restraints, opportunities, and challenges influencing the sector. The report also provides detailed segmentation analysis, regional insights, and profiles of leading market players, aiming to equip stakeholders with actionable intelligence for strategic decision-making and market positioning.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 3.90 Billion |

| Growth Rate | 9.8% |

| Number of Pages | 267 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | STMicroelectronics, Microchip Technology Inc., Infineon Technologies AG, NXP Semiconductors, Renesas Electronics Corporation, ON Semiconductor Corporation, ROHM Co., Ltd., Cypress Semiconductor (now part of Infineon), Macronix International Co., Ltd., Winbond Electronics Corporation, Atmel Corporation (now part of Microchip), Dialog Semiconductor (now part of Renesas), LAPIS Semiconductor Co., Ltd., New Japan Radio Co., Ltd. (NJRC), Fudan Microelectronics Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The EEPROM Memory Chip for Automotive market is meticulously segmented to provide a granular view of its diverse applications and technological variations, enabling stakeholders to identify precise growth opportunities. This comprehensive segmentation allows for a detailed understanding of market dynamics across different product types, memory densities, functional applications within vehicles, and distinct vehicle categories. Analyzing these segments helps in pinpointing specific areas of high growth and strategic investment, aligning product development with evolving automotive industry needs.

Understanding the contribution of each segment is crucial for market participants to tailor their offerings and penetrate niche markets effectively. For instance, the demand for high-density EEPROMs is closely tied to the advancement of ADAS and autonomous driving systems, while specific applications like powertrain management may prioritize high endurance. Similarly, the rapid expansion of the electric vehicle market has created a distinct demand profile for EEPROM in battery management and power electronics, differing from traditional internal combustion engine vehicle applications. This multi-dimensional segmentation provides a robust framework for competitive analysis and strategic planning within the automotive EEPROM landscape.

- By Type: This segment differentiates between Serial EEPROM and Parallel EEPROM based on their interface protocols. Serial EEPROMs, due to their simplicity and fewer pins, dominate the automotive market for their efficiency in space-constrained ECUs.

- By Density: Categorized into Low Density (Up to 128 Kbit), Medium Density (256 Kbit to 1 Mbit), and High Density (Over 1 Mbit). The trend indicates a growing demand for medium to high-density EEPROMs, driven by increasing software complexity and data logging requirements in advanced vehicles.

- By Application: Encompasses key automotive systems including ADAS & Safety, Infotainment & Telematics, Body Electronics, Powertrain & Chassis, and Industrial & Others. ADAS and Infotainment applications are experiencing rapid growth, necessitating robust EEPROM for configuration and operational data.

- By Vehicle Type: Divided into Passenger Vehicles and Commercial Vehicles (Light Commercial Vehicles, Heavy Commercial Vehicles). Passenger vehicles hold the larger market share, but commercial vehicles are increasingly adopting advanced electronics, fostering growth in this segment.

Regional Highlights

- Asia Pacific (APAC): Dominates the EEPROM Memory Chip for Automotive market due to its position as the largest automotive manufacturing hub globally, particularly in countries like China, Japan, South Korea, and India. Rapid adoption of electric vehicles and government initiatives promoting advanced automotive technologies significantly drive regional demand. The presence of key semiconductor manufacturers and a robust supply chain further solidifies APAC's market leadership. This region is witnessing substantial investments in smart mobility and autonomous driving research, translating into high demand for sophisticated EEPROM solutions for next-generation vehicles.

- Europe: Represents a significant market share, characterized by stringent automotive safety standards and a strong focus on premium and luxury vehicle segments. Countries like Germany, France, and the UK are at the forefront of automotive innovation, emphasizing advanced ADAS, connected car technologies, and electric vehicle development. The region's emphasis on vehicle cybersecurity also fuels the demand for secure EEPROM solutions. European manufacturers are keen on integrating high-reliability components to meet rigorous performance and environmental criteria, ensuring consistent market growth.

- North America: Exhibits substantial growth, driven by technological advancements in autonomous driving, electric vehicles, and sophisticated infotainment systems, particularly in the United States. Investments in automotive R&D, coupled with a growing consumer demand for feature-rich vehicles, contribute to the robust adoption of EEPROM chips. The region's focus on innovative vehicle architectures and software-defined vehicles creates a continuous need for advanced memory solutions for persistent data storage, diagnostics, and over-the-air updates.

- Latin America: Expected to show steady growth, albeit at a slower pace compared to developed regions. The market here is primarily driven by increasing vehicle production, particularly in Brazil and Mexico, and the gradual adoption of basic electronic features in entry-level and mid-range vehicles. While advanced applications are still nascent, the expanding automotive manufacturing base and growing consumer electronics integration in vehicles will support consistent demand for EEPROM.

- Middle East and Africa (MEA): Emerging as a market with long-term potential. Growth is stimulated by increasing investments in automotive infrastructure, economic diversification, and a growing consumer base for modern vehicles in countries like Saudi Arabia, UAE, and South Africa. The region's focus on smart city initiatives and vehicle electrification efforts will gradually contribute to the demand for EEPROM in automotive applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the EEPROM Memory Chip for Automotive Market.- STMicroelectronics

- Microchip Technology Inc.

- Infineon Technologies AG

- NXP Semiconductors

- Renesas Electronics Corporation

- ON Semiconductor Corporation

- ROHM Co., Ltd.

- Cypress Semiconductor (now part of Infineon)

- Macronix International Co., Ltd.

- Winbond Electronics Corporation

- Atmel Corporation (now part of Microchip)

- Dialog Semiconductor (now part of Renesas)

- LAPIS Semiconductor Co., Ltd. (ROHM Group)

- New Japan Radio Co., Ltd. (NJRC)

- Fudan Microelectronics Group

Frequently Asked Questions

Analyze common user questions about the EEPROM Memory Chip for Automotive market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is an EEPROM Memory Chip, and why is it essential for automotive applications?

An EEPROM (Electrically Erasable Programmable Read-Only Memory) chip is a type of non-volatile memory that retains data even without power, and can be electrically erased and reprogrammed. In automotive applications, EEPROM is essential for storing critical, persistent data such as calibration settings, fault codes, configuration parameters for electronic control units (ECUs), and vehicle identification numbers (VINs), ensuring system integrity and reliability throughout the vehicle's lifespan.

What are the primary drivers for the growth of the EEPROM Memory Chip for Automotive Market?

The market's growth is primarily driven by the increasing electronic content per vehicle, the rapid proliferation of advanced driver-assistance systems (ADAS) and autonomous driving technologies, and the significant expansion of the electric vehicle (EV) market. Additionally, stringent automotive safety standards and the growing demand for in-car connectivity and infotainment systems are key accelerators.

How do electric vehicles (EVs) and autonomous driving (AD) systems impact the demand for automotive EEPROM?

EVs and AD systems significantly boost EEPROM demand. EVs require robust EEPROM for battery management systems (BMS), power electronics, and charging control. AD systems utilize EEPROM for storing critical boot-up sequences, configuration parameters for AI algorithms, event logs, and map data, ensuring reliable and secure operation in complex environments.

What are the key technological trends shaping the automotive EEPROM market?

Key trends include the development of higher-density and higher-endurance EEPROMs to meet increasing data storage demands, enhanced integration with microcontrollers for optimized ECU design, and the incorporation of advanced security features to protect sensitive vehicle data. There is also a growing focus on solutions supporting over-the-air (OTA) updates and miniaturization for space-constrained applications.

What challenges does the EEPROM Memory Chip for Automotive market face?

The market faces challenges such as intense price competition, the emergence of alternative non-volatile memory technologies (like NOR Flash or MRAM) that offer different performance advantages, and the requirement for extremely long product development and qualification cycles to meet rigorous automotive reliability standards. Maintaining supply chain stability amidst global disruptions is also a constant challenge.