Credit Insurance Market

Credit Insurance Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_704612 | Last Updated : August 11, 2025 |

Format : ![]()

![]()

![]()

![]()

Credit Insurance Market Size

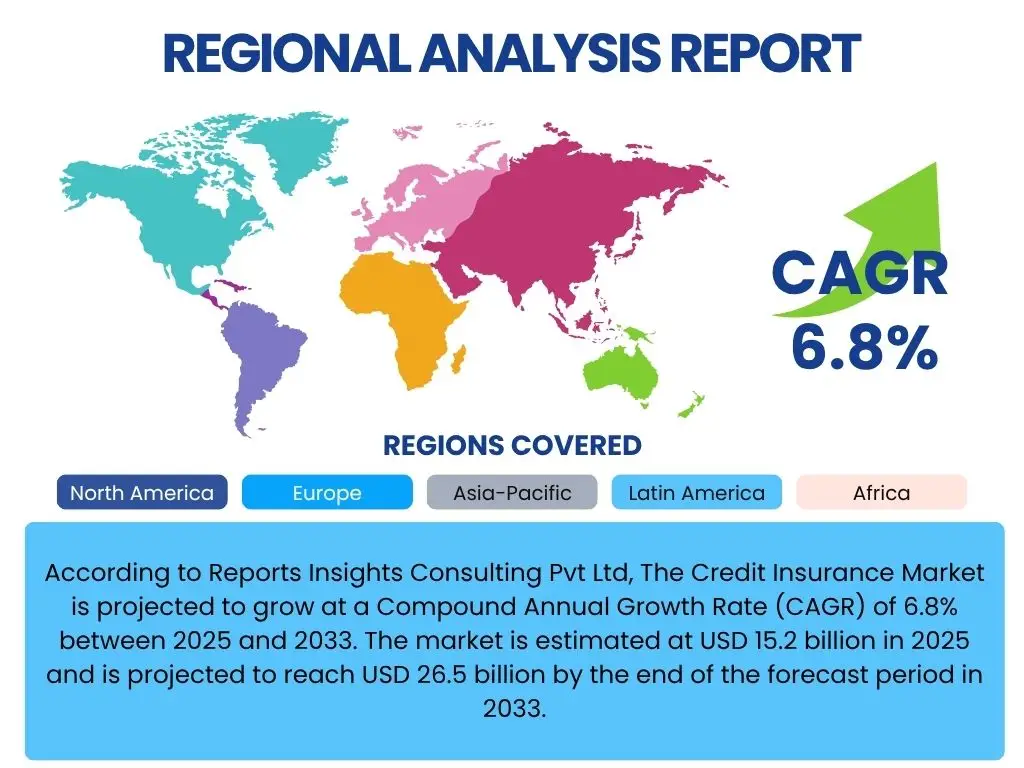

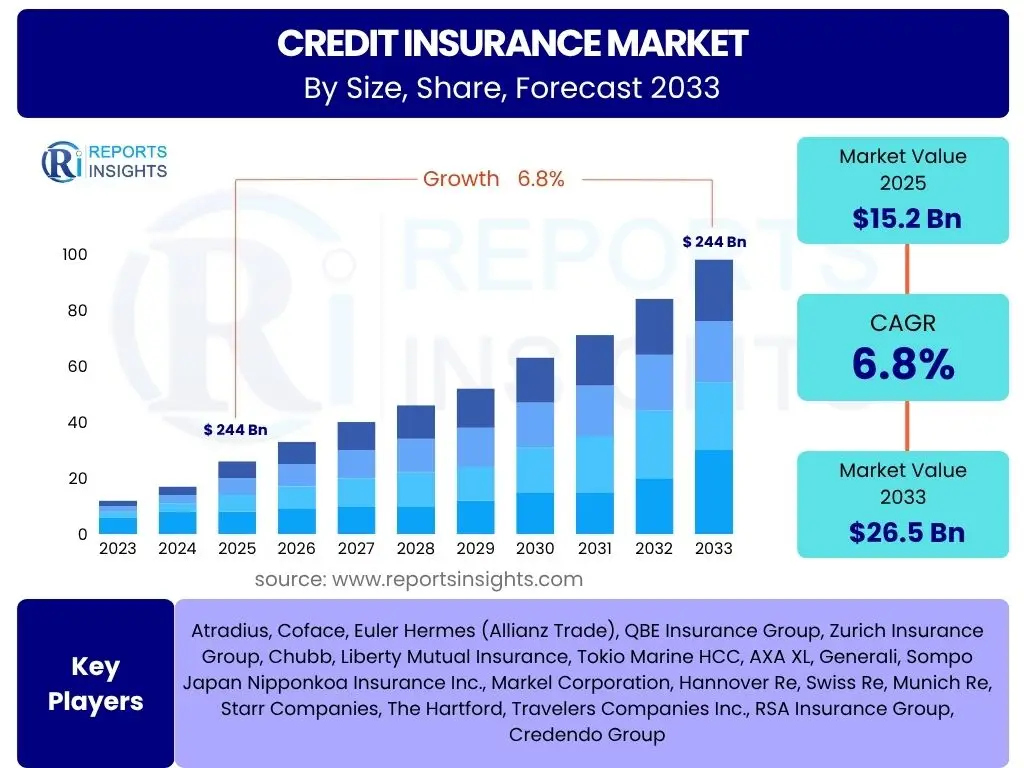

According to Reports Insights Consulting Pvt Ltd, The Credit Insurance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2033. The market is estimated at USD 15.2 billion in 2025 and is projected to reach USD 26.5 billion by the end of the forecast period in 2033.

Key Credit Insurance Market Trends & Insights

The credit insurance market is currently undergoing significant transformation, driven by a confluence of global economic dynamics, technological advancements, and evolving business needs. Key trends indicate a heightened demand for risk mitigation solutions amidst increasing supply chain complexities and geopolitical uncertainties. Businesses, particularly small and medium-sized enterprises (SMEs), are increasingly recognizing the imperative of protecting their trade receivables against unforeseen defaults, insolvency, or political risks, which fuels market expansion.

A notable trend is the accelerated adoption of digital platforms and data analytics for more sophisticated risk assessment and policy management. Insurers are leveraging artificial intelligence and machine learning to enhance underwriting accuracy, expedite claims processing, and offer more personalized solutions. Furthermore, there is a growing emphasis on tailored policies that address specific industry nuances and cross-border trade complexities, moving beyond generic coverage to provide more comprehensive and adaptable protection.

- Digitalization of underwriting and claims processes for efficiency.

- Increased integration of Artificial Intelligence and Machine Learning in risk assessment.

- Growing demand for customized policies addressing industry-specific risks.

- Expansion into new geographical markets, particularly emerging economies.

- Focus on providing credit insurance solutions for Small and Medium-sized Enterprises (SMEs).

- Rising awareness among businesses about the critical role of trade credit protection.

- Development of policies to cover supply chain disruptions and political risks.

AI Impact Analysis on Credit Insurance

Artificial intelligence (AI) is fundamentally reshaping the credit insurance landscape, offering transformative capabilities that enhance traditional processes and unlock new opportunities. Users frequently inquire about how AI improves risk prediction, automates operations, and contributes to more precise pricing models. AI-powered algorithms can analyze vast datasets, including financial statements, macroeconomic indicators, social sentiment, and historical payment behaviors, to generate highly accurate credit risk scores. This capability allows insurers to move from reactive claims management to proactive risk prevention, identifying potential defaults much earlier.

Beyond risk assessment, AI's impact extends to automating various aspects of the credit insurance workflow. This includes streamlining policy issuance, claims processing, and fraud detection, thereby significantly reducing operational costs and improving efficiency. However, common concerns also revolve around data privacy, the transparency of AI decision-making processes (the 'black box' problem), and the potential for algorithmic bias. Insurers are actively working to build ethical AI frameworks and ensure data security to foster trust and maximize the benefits of these advanced technologies.

- Enhanced Risk Assessment: AI analyzes large datasets to predict insolvency and payment defaults with greater accuracy.

- Automated Underwriting: Streamlines policy approval processes, reducing manual effort and turnaround times.

- Fraud Detection: Identifies suspicious patterns and anomalies in claims, minimizing fraudulent losses.

- Personalized Policy Customization: Enables insurers to offer tailored coverage based on granular risk profiles.

- Operational Efficiency: Automates routine tasks, leading to cost reductions and faster service delivery.

- Predictive Analytics: Provides early warnings of market shifts or sector-specific vulnerabilities.

- Data Security Concerns: Raises questions about the protection and ethical use of sensitive financial data.

- Algorithmic Bias: Challenges related to ensuring fairness and preventing discriminatory outcomes in AI models.

Key Takeaways Credit Insurance Market Size & Forecast

The Credit Insurance market is poised for a period of sustained and robust growth over the forecast horizon, driven primarily by the escalating need for businesses to mitigate commercial risks in an increasingly interconnected and volatile global economy. The substantial projected increase in market value reflects a fundamental shift in corporate risk management strategies, wherein credit insurance is no longer viewed as a discretionary expense but rather as an essential tool for protecting balance sheets and facilitating secure trade. This growth trajectory is supported by rising global trade volumes, coupled with a growing awareness among companies of all sizes regarding the financial vulnerabilities associated with unpaid invoices and buyer insolvency.

Technological advancements, particularly in data analytics and artificial intelligence, are acting as powerful accelerators, enabling insurers to offer more precise, efficient, and accessible solutions. This digital transformation is expanding the market reach, especially to historically underserved segments like Small and Medium-sized Enterprises (SMEs), who are increasingly seeking protection against bad debts. Furthermore, geopolitical uncertainties and macroeconomic fluctuations are prompting businesses to seek greater financial stability, making credit insurance an indispensable part of their risk management toolkit and ensuring the market's positive outlook.

- The market exhibits a strong growth trajectory, driven by increasing global trade and economic uncertainty.

- Credit insurance is becoming an indispensable tool for businesses to mitigate commercial risks.

- Digital transformation and AI integration are key enablers for market expansion and efficiency.

- SME segment represents a significant untapped growth opportunity for insurers.

- Increased awareness and understanding of credit insurance benefits are crucial for market penetration.

- Geopolitical and macroeconomic factors continue to underpin the demand for robust risk protection.

Credit Insurance Market Drivers Analysis

The global credit insurance market is propelled by a confluence of interconnected drivers that underscore its increasing importance in the modern commercial landscape. One primary driver is the accelerating pace of globalization and the corresponding increase in cross-border trade. As businesses expand their operations into diverse international markets, they face heightened risks associated with buyer insolvency, political instability, and currency fluctuations. Credit insurance provides a vital safeguard against these complex and unpredictable commercial risks, enabling companies to trade with greater confidence and expand their customer base without undue financial exposure.

Another significant driver is the growing reliance on trade credit as a common financing mechanism in B2B transactions. While extending credit facilitates sales and strengthens business relationships, it also exposes sellers to the risk of non-payment. Credit insurance directly addresses this vulnerability, allowing businesses to offer competitive credit terms while protecting their accounts receivable. Furthermore, the persistent economic volatility and geopolitical uncertainties seen across various regions necessitate robust risk management strategies, making credit insurance an attractive and practical solution for businesses seeking to stabilize their cash flow and protect their working capital from unforeseen defaults.

Finally, the rising awareness among businesses, especially SMEs, about the benefits of credit insurance contributes substantially to market growth. Historically, many smaller enterprises may have been unaware of this risk mitigation tool or perceived it as too complex or costly. However, increased educational efforts by insurers, combined with simplified product offerings and digital distribution channels, are making credit insurance more accessible and understandable, thereby expanding its adoption across a broader spectrum of businesses and industries.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Global Trade and Cross-Border Transactions | +1.2% | Global, especially Asia Pacific and Europe | Long-term |

| Growing Demand for Trade Credit Protection | +0.9% | Developed and Emerging Economies | Medium-term |

| Economic Volatility and Geopolitical Risks | +1.0% | Global, particularly regions with political instability | Ongoing |

| Digitalization and E-commerce Growth | +0.8% | Global, significant in North America and Europe | Medium-term |

| Regulatory Support and Awareness Campaigns | +0.6% | Europe, North America, parts of Asia Pacific | Short-to-Medium term |

Credit Insurance Market Restraints Analysis

Despite its significant growth potential, the credit insurance market faces several restraints that could impede its expansion. One prominent restraint is the perceived high cost of premiums, particularly for small and medium-sized enterprises (SMEs). For businesses operating on thin margins, the upfront cost of credit insurance can be seen as a significant expenditure, leading some to opt for self-insurance or other less comprehensive risk mitigation strategies. This perception of high cost often outweighs the long-term benefits of protection, especially in price-sensitive markets or during periods of economic downturns when businesses are focused on immediate cost reduction.

Another challenge stems from the lack of widespread awareness and understanding of credit insurance, particularly in developing economies and among smaller businesses. Many potential clients may not fully grasp the scope of protection offered, the benefits of proactive risk management, or how credit insurance can improve their access to finance. This knowledge gap requires significant educational efforts from insurers, which can be resource-intensive and slow to yield results. Furthermore, the availability of alternative risk mitigation tools, such as factoring, letters of credit, or robust internal credit management systems, provides businesses with options that might sometimes be preferred over formal credit insurance, thereby limiting market penetration.

Lastly, severe global economic downturns or widespread crises, such as pandemics or deep recessions, can act as significant restraints. While such events initially increase demand for risk protection, they can simultaneously lead to a surge in claims and a contraction in insurable trade volumes. Insurers may become more cautious in their underwriting, leading to stricter terms, reduced coverage, or even withdrawal from certain high-risk sectors or geographies, thereby limiting the overall market's capacity and growth during such periods.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Premium Costs and Perceived Value | -0.7% | Emerging Markets, SMEs across all regions | Short-to-Medium term |

| Lack of Awareness and Understanding of Benefits | -0.5% | Developing Economies, Micro and Small Enterprises | Medium-term |

| Availability of Alternative Risk Mitigation Tools | -0.4% | Developed Markets, Large Corporates | Long-term |

| Severe Economic Downturns Limiting Insurable Trade | -0.8% | Global, particularly recession-hit regions | Short-term |

Credit Insurance Market Opportunities Analysis

The credit insurance market is rich with opportunities for innovation and expansion, driven by evolving global economic structures and technological advancements. One significant area of opportunity lies in penetrating the vast and often underserved Small and Medium-sized Enterprise (SME) segment. SMEs typically face greater vulnerability to buyer insolvency due to limited financial reserves and less diversified customer bases. Developing simplified, modular, and affordable credit insurance products tailored specifically for SMEs, coupled with digital distribution channels, can unlock substantial market growth, particularly in regions where this segment forms the backbone of the economy.

Another key opportunity emerges from the rapid economic development and increasing trade activities in emerging economies, particularly in Asia Pacific, Latin America, and parts of Africa. As businesses in these regions expand their domestic and international trade, the need for robust credit risk management becomes paramount. Insurers who can establish a strong local presence, adapt their offerings to regional specificities, and educate local businesses about the value of credit insurance stand to gain significant market share in these high-growth areas. The expansion of digital trade and e-commerce further amplifies this opportunity, creating new avenues for cross-border transactions that inherently carry credit risk.

Furthermore, the integration of advanced technologies like Artificial Intelligence, blockchain, and big data analytics presents a transformative opportunity for the credit insurance industry. These technologies enable insurers to enhance their risk assessment capabilities, offer more dynamic and responsive policies, and streamline claims processing. By leveraging predictive analytics, insurers can move towards more proactive risk management, offering clients insights and tools to prevent defaults rather than just covering losses. Moreover, the growing emphasis on supply chain resilience globally also provides an opportunity for credit insurers to develop solutions that protect against the ripple effects of defaults across complex, interconnected supply chains, extending their value proposition beyond traditional bad debt coverage.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Untapped Small and Medium-sized Enterprise (SME) Market Penetration | +1.1% | Global, particularly Asia Pacific and Latin America | Long-term |

| Expansion into Emerging Economies | +0.9% | Asia Pacific, Latin America, Middle East & Africa | Long-term |

| Development of Customized and Specialized Policies | +0.7% | Global, relevant across various industries | Medium-term |

| Integration of Advanced Technologies (AI, Blockchain, Big Data) | +0.6% | Global, significant for enhancing competitiveness | Medium-to-Long term |

| Growing Demand for Supply Chain Risk Mitigation | +0.5% | Global, especially for manufacturing and retail sectors | Medium-term |

Credit Insurance Market Challenges Impact Analysis

The credit insurance market faces a range of challenges that require strategic responses from industry players to sustain growth and stability. One significant challenge is the inherent volatility and unpredictability of the global economic environment. Rapid shifts in macroeconomic indicators, interest rates, inflation, and geopolitical conflicts can quickly alter the creditworthiness of buyers and entire sectors. This makes accurate risk assessment and pricing exceptionally complex for insurers, potentially leading to mispriced policies or unexpected surges in claims, impacting profitability and solvency.

Another crucial challenge revolves around data security and privacy concerns, especially with the increasing reliance on big data analytics and AI for risk modeling. The collection, storage, and processing of sensitive financial and commercial data expose insurers to cybersecurity threats and necessitate stringent compliance with evolving data protection regulations (e.g., GDPR, CCPA). Maintaining client trust and preventing data breaches are paramount, as any failure can result in significant financial penalties, reputational damage, and loss of business, thereby hindering the adoption of advanced digital solutions.

Furthermore, the market faces intense competition not only from established players but also from alternative financing and risk management solutions. Businesses have various options to manage trade credit risk, including self-insurance, letters of credit, and factoring services. Credit insurers must continuously innovate their product offerings, provide superior customer service, and clearly articulate their unique value proposition to remain competitive. Regulatory complexity across different jurisdictions also presents a significant hurdle, as insurers must navigate diverse legal frameworks, licensing requirements, and compliance obligations, adding to operational costs and market entry barriers in new regions.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Volatility in Global Economic Conditions and Geopolitical Instability | -0.8% | Global, particularly in politically sensitive regions | Ongoing |

| Data Security and Privacy Concerns | -0.6% | Global, critical for digital transformation | Ongoing |

| Intense Competition from Alternative Financing and Risk Solutions | -0.5% | Developed Markets, where options are diverse | Long-term |

| Regulatory Complexity and Compliance Across Jurisdictions | -0.4% | Europe, North America, emerging markets with evolving regulations | Ongoing |

Credit Insurance Market - Updated Report Scope

This comprehensive market research report provides an in-depth analysis of the Credit Insurance Market, offering critical insights into its current landscape and future growth trajectory. It meticulously covers market size estimations, historical data, and forward-looking projections, alongside a detailed examination of key trends, influential drivers, significant restraints, emerging opportunities, and prevailing challenges. The report also features a thorough segmentation analysis, breaking down the market by various dimensions to provide a granular understanding of its dynamics, and includes profiles of leading market participants to offer a complete competitive overview.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 15.2 Billion |

| Market Forecast in 2033 | USD 26.5 Billion |

| Growth Rate | 6.8% CAGR |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Atradius, Coface, Euler Hermes (Allianz Trade), QBE Insurance Group, Zurich Insurance Group, Chubb, Liberty Mutual Insurance, Tokio Marine HCC, AXA XL, Generali, Sompo Japan Nipponkoa Insurance Inc., Markel Corporation, Hannover Re, Swiss Re, Munich Re, Starr Companies, The Hartford, Travelers Companies Inc., RSA Insurance Group, Credendo Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Credit Insurance market is meticulously segmented to provide a comprehensive and granular understanding of its diverse components and dynamics. This segmentation allows for precise analysis of market trends, opportunities, and challenges within specific categories, enabling businesses to identify niche markets and tailor their strategies effectively. By breaking down the market across various parameters such as component, policy type, industry vertical, buyer size, and distribution channel, this analysis offers deep insights into consumer behavior, product preferences, and competitive landscapes across different segments.

- By Component: Premiums, Services

- By Policy Type: Whole Turnover, Specific Policy, Excess of Loss, Single Risk

- By Industry Vertical: Manufacturing, Automotive, BFSI (Banking, Financial Services, and Insurance), ICT (Information and Communication Technology), Food & Beverage, Construction, Others (e.g., Retail, Chemicals)

- By Buyer: Large Enterprises, Small & Medium-sized Enterprises (SMEs)

- By Distribution Channel: Brokers, Agents, Banks, Direct Sales

Regional Highlights

- North America: This region represents a mature and technologically advanced market for credit insurance. It is characterized by high adoption rates among large corporations, particularly in the manufacturing, automotive, and IT sectors. The market here benefits from a well-developed regulatory framework and a strong emphasis on risk management. Digital transformation and the increasing use of data analytics for underwriting are prominent trends, driven by the presence of key industry players and a focus on operational efficiency.

- Europe: Europe holds the largest share of the global credit insurance market, propelled by its extensive cross-border trade, robust regulatory environment, and high awareness among businesses regarding trade credit risks. Countries such as France, Germany, and the UK are major contributors to market revenue. The region is at the forefront of adopting advanced credit assessment methodologies and tailored policy solutions, with a strong emphasis on supporting SMEs and ensuring supply chain stability across the Eurozone and beyond.

- Asia Pacific (APAC): The APAC region is projected to be the fastest-growing market for credit insurance, driven by rapid economic development, increasing intra-regional trade, and growing industrialization. Emerging economies like China, India, and Southeast Asian nations are witnessing significant growth in exports and imports, leading to a heightened demand for credit risk protection. Rising awareness among SMEs and government initiatives supporting trade are key factors contributing to the market's expansion in this dynamic region.

- Latin America: This region is experiencing emerging growth in the credit insurance market, influenced by economic reforms, increasing foreign direct investment, and diversification of trade partners. Countries such as Brazil and Mexico are leading the adoption, as businesses seek to mitigate risks associated with economic volatility and political uncertainties. While still relatively nascent compared to developed markets, the increasing formalization of trade and greater integration into global supply chains present significant opportunities for market development.

- Middle East and Africa (MEA): The MEA region represents a nascent but steadily growing market for credit insurance. Growth is primarily driven by diversification efforts away from oil-dependent economies, significant infrastructure projects, and increasing intra-regional trade. Greater awareness among businesses about managing trade receivables, coupled with efforts to attract foreign investment, is fostering the adoption of credit insurance solutions. Challenges include lower awareness and developing regulatory frameworks, yet the long-term potential remains significant.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Credit Insurance Market.- Atradius

- Coface

- Euler Hermes (Allianz Trade)

- QBE Insurance Group

- Zurich Insurance Group

- Chubb

- Liberty Mutual Insurance

- Tokio Marine HCC

- AXA XL

- Generali

- Sompo Japan Nipponkoa Insurance Inc.

- Markel Corporation

- Hannover Re

- Swiss Re

- Munich Re

- Starr Companies

- The Hartford

- Travelers Companies Inc.

- RSA Insurance Group

- Credendo Group

Frequently Asked Questions

What is credit insurance and how does it function?

Credit insurance is a financial tool that protects businesses against the risk of non-payment of commercial debts. It acts as a safeguard for accounts receivable, compensating the policyholder for losses incurred when a buyer fails to pay for goods or services purchased on credit due to insolvency, bankruptcy, or protracted default. The insurer assesses the creditworthiness of the policyholder's customers and provides coverage up to a specified limit. If a covered event occurs, the insurer pays a percentage of the outstanding invoice value, typically between 80% and 90%, thereby helping businesses maintain cash flow and solvency even when facing buyer defaults.

Its function extends beyond mere compensation; credit insurance also serves as a comprehensive risk management tool. Insurers provide ongoing monitoring of buyers' creditworthiness, offering valuable insights into market conditions and potential risks. This proactive approach helps policyholders identify deteriorating financial health among their customers early on, enabling them to adjust credit terms or cease trading before significant losses accrue. This dual role of financial protection and risk intelligence makes credit insurance an integral part of modern trade finance.

Who benefits most from acquiring credit insurance?

Businesses that extend credit terms to their customers, regardless of size or industry, can significantly benefit from credit insurance. This includes manufacturers, distributors, service providers, and exporters. Companies with a large number of customers, a high volume of credit sales, or those operating in volatile economic environments are particularly susceptible to trade credit risks and find credit insurance indispensable. Exporters dealing with cross-border transactions face additional risks like political instability and currency fluctuations, making credit insurance a vital protective measure.

Small and Medium-sized Enterprises (SMEs) often benefit disproportionately from credit insurance. Unlike larger corporations, SMEs typically have fewer financial reserves to absorb significant bad debts, and a single major default can severely impact their cash flow and even lead to insolvency. Credit insurance provides SMEs with the financial stability and confidence to offer competitive credit terms, expand into new markets, and secure financing, as it demonstrates a robust approach to risk management to banks and lenders. It acts as an enabler for growth, allowing them to trade more boldly without undue fear of non-payment.

How does credit insurance protect a company's balance sheet and cash flow?

Credit insurance directly protects a company's balance sheet by safeguarding its accounts receivable, which often represent a significant asset. In the event of buyer insolvency or protracted default, without credit insurance, the unpaid invoices would typically become bad debts, requiring a write-off against revenue or assets. This direct financial loss can significantly erode profits, deplete working capital, and weaken the company's financial position. Credit insurance mitigates this by converting a potential loss into an insured claim, ensuring that a substantial portion of the outstanding amount is recovered, thereby preserving the integrity of the balance sheet.

Regarding cash flow, credit insurance provides essential stability. When a customer fails to pay, it creates a gap in expected cash inflows, which can disrupt operational expenses, investment plans, and liquidity. By compensating for a high percentage of the unpaid debt, credit insurance ensures a more predictable cash flow, preventing liquidity crises and allowing the company to meet its financial obligations. This stability also improves a company's ability to obtain bank financing, as insured receivables are often viewed more favorably by lenders, leading to better loan terms and increased borrowing capacity, further bolstering cash flow management.

What are the key factors influencing credit insurance premiums?

Credit insurance premiums are determined by a multitude of factors, reflecting the insurer's assessment of the risk involved. One primary factor is the overall creditworthiness and financial stability of the policyholder's customer base. Insurers will analyze the industry, payment history, and financial health of the buyers being covered. A portfolio with a higher concentration of lower-rated or financially struggling customers will generally result in higher premiums due to the elevated risk of default. Conversely, a diverse portfolio of highly rated buyers typically leads to more favorable rates.

Other significant factors include the policyholder's industry, the total volume of insurable turnover, and the chosen level of coverage. Certain industries inherently carry higher risks due to their economic sensitivity or volatility, which can influence premium rates. The total annual sales volume that the policyholder wishes to cover also plays a role, as higher turnover generally implies greater aggregate risk. Furthermore, the deductible (first loss percentage), the percentage of coverage (e.g., 85% or 90%), and the specific terms and conditions of the policy, such as exclusions for certain risks or countries, all directly impact the final premium. The insurer's administrative costs and profit margins also contribute to the overall pricing structure.

Is credit insurance necessary for Small and Medium-sized Enterprises (SMEs)?

While often perceived as a tool for large corporations, credit insurance is arguably even more necessary for Small and Medium-sized Enterprises (SMEs). SMEs typically operate with tighter cash flows and less diverse customer bases than larger companies. A single significant unpaid invoice or a major customer's insolvency can represent a substantial portion of their annual revenue, potentially leading to severe liquidity issues, delayed supplier payments, inability to meet payroll, or even bankruptcy. Credit insurance provides a crucial safety net, protecting these vulnerable businesses from catastrophic losses and ensuring their financial continuity.

Beyond direct financial protection, credit insurance empowers SMEs to pursue growth opportunities with greater confidence. It enables them to offer competitive credit terms to new or existing clients, even those with whom they have limited payment history, without fear of losing capital. This confidence can facilitate market expansion, increase sales, and improve competitive positioning. Additionally, having credit insurance can enhance an SME's credibility with banks and lenders, potentially leading to better access to working capital financing, as insured receivables are considered a lower risk asset. Thus, for SMEs, credit insurance is not just a risk mitigation tool but a strategic enabler for sustainable growth and stability.