Travel Insurance Market

Travel Insurance Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_704597 | Last Updated : August 11, 2025 |

Format : ![]()

![]()

![]()

![]()

Travel Insurance Market Size

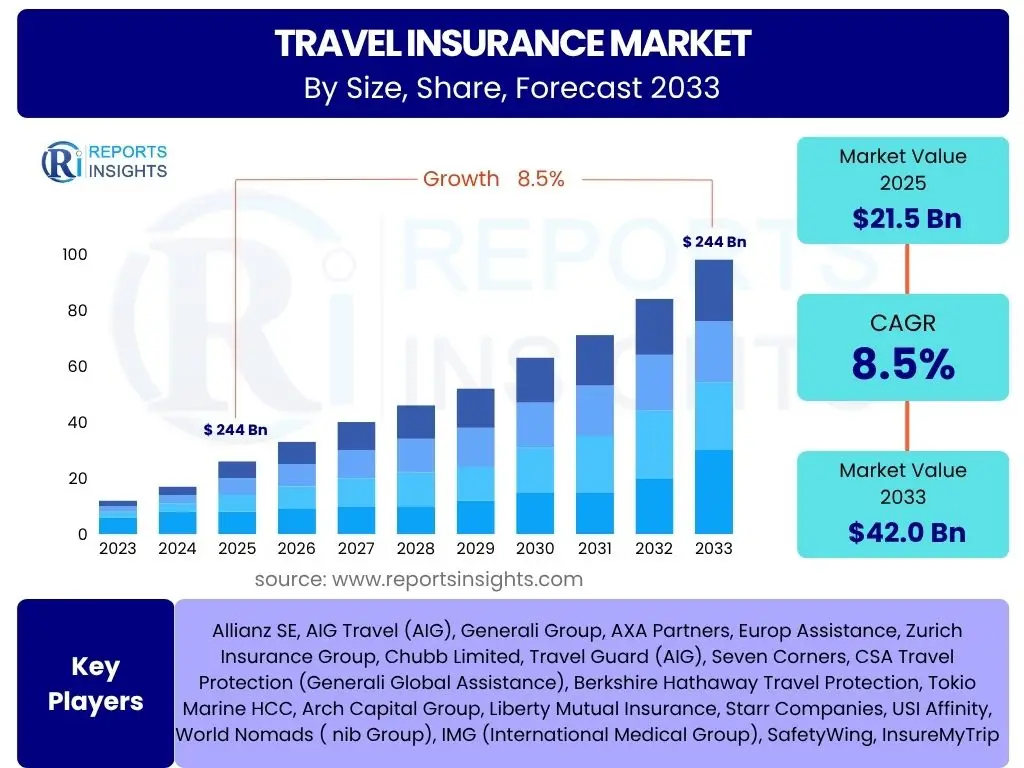

According to Reports Insights Consulting Pvt Ltd, The Travel Insurance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2025 and 2033. The market is estimated at USD 21.5 Billion in 2025 and is projected to reach USD 42.0 Billion by the end of the forecast period in 2033.

Key Travel Insurance Market Trends & Insights

The global travel insurance market is witnessing a significant transformation driven by evolving traveler expectations and technological advancements. Consumers are increasingly seeking personalized and flexible coverage options that cater to specific trip details and potential unforeseen circumstances. This demand is leading to the proliferation of customizable policies, moving away from generic, one-size-fits-all offerings.

Furthermore, the integration of digital platforms and mobile applications is simplifying the purchasing process and enhancing user experience, making travel insurance more accessible. There is also a growing emphasis on health and wellness, with policies increasingly incorporating comprehensive medical coverage, mental health support, and even adventure sports inclusions, reflecting a broader shift in travel patterns and risk perceptions post-global health events.

- Digitalization of sales and claims processes for enhanced convenience.

- Increased demand for personalized and flexible policy options.

- Integration of health and wellness benefits, including mental health support.

- Growth in demand for sustainable and eco-friendly travel insurance products.

- Emergence of embedded insurance solutions at the point of sale.

AI Impact Analysis on Travel Insurance

Artificial intelligence is profoundly reshaping the travel insurance landscape, primarily by enhancing operational efficiencies and improving customer interactions. AI-powered algorithms are being utilized for advanced data analytics, enabling insurers to gain deeper insights into traveler behavior, risk profiles, and market trends. This capability facilitates more accurate underwriting and pricing, allowing for the creation of highly tailored insurance products that meet individual consumer needs more precisely.

Moreover, AI plays a crucial role in automating various processes, from policy issuance and claims processing to fraud detection. Chatbots and virtual assistants, driven by AI, provide instant customer support, manage inquiries, and even guide users through the claims submission process, significantly reducing response times and operational costs. While improving efficiency, the ethical implications of data privacy and algorithmic bias remain key considerations for industry stakeholders.

- Enhanced personalization of policies through predictive analytics.

- Automation of claims processing and customer support via chatbots and virtual assistants.

- Improved fraud detection and risk assessment capabilities.

- Streamlined underwriting and pricing models for greater accuracy.

- Development of dynamic pricing based on real-time data.

Key Takeaways Travel Insurance Market Size & Forecast

The travel insurance market is poised for robust growth over the forecast period, driven by an increasing propensity for global travel and heightened awareness of potential risks. The expansion of tourism sectors worldwide, coupled with rising disposable incomes in emerging economies, contributes significantly to this positive outlook. Travelers are becoming more risk-averse, understanding the importance of financial protection against unforeseen events such as trip cancellations, medical emergencies, or lost luggage.

Furthermore, the digital transformation within the insurance sector is making policies more accessible and transparent, influencing purchasing decisions. The market is expected to witness continuous innovation in product offerings, including specialized policies for adventure tourism, remote work travel, and long-term stays. This evolution, combined with strategic partnerships between insurers and travel industry players, will be instrumental in sustaining the upward trajectory of the market.

- Market demonstrates robust growth driven by increasing global tourism.

- Digitalization and online distribution channels are primary facilitators of market expansion.

- Heightened awareness of travel risks post-pandemic fuels demand for comprehensive coverage.

- Personalized and flexible insurance products are key to consumer engagement.

- Emerging economies present significant untapped market potential.

Travel Insurance Market Drivers Analysis

The global travel insurance market is significantly propelled by several key drivers that reinforce its growth trajectory. Increasing international tourist arrivals, driven by rising disposable incomes and changing lifestyles, directly translates into a greater need for travel protection. Alongside this, a growing awareness among travelers regarding the potential financial losses and health risks associated with unforeseen events during trips is prompting higher adoption rates of insurance policies. The ease of access to travel insurance through online platforms and the digital distribution revolution have also made purchasing policies more convenient and widespread, further contributing to market expansion.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Global Tourism and Travel Frequency | +1.5% | Global | Long-term |

| Rising Awareness of Travel Risks and Benefits of Coverage | +1.2% | North America, Europe, Asia Pacific | Mid-term |

| Digitalization and Online Distribution Channels | +1.0% | Global | Short-term to Mid-term |

| Growing Demand for Personalized and Customizable Policies | +0.8% | Developed Markets | Mid-term |

| Supportive Government Regulations and Travel Advisories | +0.7% | Europe, Asia Pacific | Short-term |

Travel Insurance Market Restraints Analysis

Despite robust growth prospects, the travel insurance market faces certain restraints that could impede its full potential. Price sensitivity among consumers, particularly in developing economies, remains a significant barrier, as many travelers perceive insurance as an additional, non-essential cost. A lack of comprehensive understanding or awareness about the scope and benefits of travel insurance among a segment of the population also limits its adoption. Furthermore, the complexities associated with filing claims, including extensive documentation requirements and lengthy processing times, can deter potential buyers and reduce customer satisfaction, thereby acting as a significant restraint on market expansion.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Price Sensitivity and Perceived High Cost of Premiums | -0.9% | Developing Markets | Long-term |

| Lack of Awareness and Understanding of Policy Benefits | -0.7% | Global, particularly emerging regions | Mid-term |

| Complexities in Claims Process and Customer Dissatisfaction | -0.6% | Global | Short-term |

| Availability of Free Credit Card Travel Benefits | -0.4% | North America, Europe | Mid-term |

| Economic Downturns Impacting Discretionary Travel | -0.5% | Global | Short-term |

Travel Insurance Market Opportunities Analysis

The travel insurance market is ripe with opportunities that can accelerate its growth and innovation. The emergence of niche travel segments, such as adventure tourism, medical tourism, and remote work travel, creates demand for highly specialized insurance products tailored to specific risks. Technological advancements, including the adoption of blockchain for secure and transparent claims processing, and the integration of IoT devices for real-time risk assessment, present avenues for product enhancement and operational efficiency. Furthermore, strategic partnerships between insurance providers and travel agencies, airlines, and online travel aggregators offer robust distribution channels, enabling insurers to reach a wider customer base and embed insurance offerings directly into the travel booking process.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Emergence of Niche Travel Segments (e.g., adventure, medical tourism) | +1.1% | Global | Mid-term to Long-term |

| Technological Advancements (AI, Blockchain, IoT) for Product Innovation | +1.0% | Global | Long-term |

| Expansion into Untapped Emerging Markets | +0.9% | Asia Pacific, Latin America, MEA | Long-term |

| Development of Micro-Insurance and On-Demand Policies | +0.8% | Global | Mid-term |

| Strategic Partnerships with Travel Agencies and Airlines | +0.7% | Global | Short-term to Mid-term |

Travel Insurance Market Challenges Impact Analysis

The travel insurance market faces several challenges that require strategic navigation by industry players. Intense competition from a multitude of providers, including traditional insurers, fintech startups, and even credit card companies, leads to price wars and puts pressure on profit margins. Managing the complexities of diverse global regulatory frameworks across different countries and regions presents a significant operational and compliance hurdle. Furthermore, the increasing threat of cyberattacks and data breaches poses a risk to sensitive customer information, undermining trust and potentially leading to significant financial and reputational damages. Adapting to rapidly changing travel patterns and consumer behaviors, often influenced by unpredictable global events, also demands continuous innovation and flexibility from insurers.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Intense Competition and Price Wars | -0.8% | Global | Mid-term |

| Managing Complex Global Regulatory Frameworks | -0.7% | Europe, North America | Long-term |

| Cybersecurity Threats and Data Privacy Concerns | -0.6% | Global | Long-term |

| Adapting to Rapidly Changing Travel Patterns and Risks | -0.5% | Global | Short-term |

| Maintaining Profitability Amidst High Claims Ratios | -0.4% | Global | Mid-term |

Travel Insurance Market - Updated Report Scope

This comprehensive market report delves into the intricate dynamics of the global travel insurance sector, providing an in-depth analysis of market size, trends, drivers, restraints, opportunities, and challenges. It offers a detailed segmentation analysis, exploring various facets of the market including policy types, distribution channels, and end-user demographics. Furthermore, the report provides a thorough regional outlook, highlighting key growth areas and competitive landscapes across major geographic segments. The insights presented are designed to equip stakeholders with a robust understanding of the market's current state and its projected trajectory through 2033, facilitating informed strategic decision-making.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 21.5 Billion |

| Market Forecast in 2033 | USD 42.0 Billion |

| Growth Rate | 8.5% |

| Number of Pages | 250 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Allianz SE, AIG Travel (AIG), Generali Group, AXA Partners, Europ Assistance, Zurich Insurance Group, Chubb Limited, Travel Guard (AIG), Seven Corners, CSA Travel Protection (Generali Global Assistance), Berkshire Hathaway Travel Protection, Tokio Marine HCC, Arch Capital Group, Liberty Mutual Insurance, Starr Companies, USI Affinity, World Nomads ( nib Group), IMG (International Medical Group), SafetyWing, InsureMyTrip |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The travel insurance market is comprehensively segmented to provide granular insights into its diverse components, reflecting various traveler needs and purchasing behaviors. These segmentations are crucial for understanding market dynamics, identifying growth pockets, and developing targeted strategies. The market is primarily categorized by Type, Distribution Channel, End-User, and Coverage Type, each offering a unique perspective on consumer preferences and industry structure.

Analyzing these segments allows stakeholders to discern which policy structures are gaining traction, how different distribution methods are performing, and which demographic groups represent the most significant opportunities. This detailed breakdown highlights the evolving landscape of travel insurance, from traditional offerings to specialized, on-demand solutions, ensuring a holistic understanding of the market's intricacies and future potential.

- By Type:

- Single Trip

- Annual Multi-Trip

- Long Stay

- By Distribution Channel:

- Insurance Brokers

- Insurance Agents

- Banks

- Insurance Companies

- Online Travel Agencies (OTAs)

- Others

- By End-User:

- Senior Citizens

- Education Travelers

- Business Travelers

- Family Travelers

- Others

- By Coverage Type:

- Medical Expenses

- Trip Cancellation

- Trip Interruption

- Baggage Loss

- Personal Liability

- Others

Regional Highlights

- North America: This region holds a significant share in the travel insurance market, characterized by high consumer awareness, robust economic activity, and a well-developed tourism infrastructure. The presence of major insurance providers and advanced digital adoption contribute to a mature market with high penetration rates.

- Europe: Europe represents a strong market, driven by extensive international travel within the Schengen Area and beyond, along with a high emphasis on health and safety regulations. Countries like the UK, Germany, and France are key contributors, benefiting from strong outbound tourism and a diverse range of policy offerings.

- Asia Pacific (APAC): The APAC region is projected to be the fastest-growing market, fueled by rising disposable incomes, expanding middle-class populations, and increasing outbound tourism from countries like China and India. Growing awareness of travel risks and the rapid adoption of online travel booking platforms are significant catalysts for market expansion in this region.

- Latin America: This region shows promising growth, primarily driven by increasing tourism activities and growing recognition among travelers about the necessity of insurance. Economic development and improving internet penetration are gradually enhancing market accessibility and product adoption.

- Middle East and Africa (MEA): The MEA market is developing, with growth stimulated by increasing inbound and outbound tourism, particularly from Gulf Cooperation Council (GCC) countries. Infrastructure development in tourism and a rising awareness of travel safety are contributing to the slow but steady expansion of the travel insurance sector here.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Travel Insurance Market.- Allianz SE

- AIG Travel (AIG)

- Generali Group

- AXA Partners

- Europ Assistance

- Zurich Insurance Group

- Chubb Limited

- Travel Guard (AIG)

- Seven Corners

- CSA Travel Protection (Generali Global Assistance)

- Berkshire Hathaway Travel Protection

- Tokio Marine HCC

- Arch Capital Group

- Liberty Mutual Insurance

- Starr Companies

- USI Affinity

- World Nomads ( nib Group)

- IMG (International Medical Group)

- SafetyWing

- InsureMyTrip

Frequently Asked Questions

The following frequently asked questions address common inquiries regarding the travel insurance market, providing concise and informative answers for stakeholders and general users seeking to understand this dynamic industry.

What is travel insurance?

Travel insurance is a plan designed to protect travelers from financial losses and health emergencies that can occur before or during a trip. It typically covers expenses related to trip cancellations, medical emergencies, lost luggage, and other unforeseen events.

Who needs travel insurance?

Anyone traveling, especially internationally, can benefit from travel insurance. It is particularly recommended for those with significant non-refundable trip expenses, individuals with pre-existing medical conditions, or those participating in adventure activities. Business travelers and families also find it highly beneficial.

What does travel insurance typically cover?

Typical coverage includes medical emergencies and evacuation, trip cancellation or interruption, baggage loss or delay, and travel delays. Some policies offer additional benefits like rental car damage, personal liability, or coverage for specific high-risk activities.

How has COVID-19 impacted the travel insurance market?

COVID-19 significantly increased awareness of travel risks, leading to higher demand for comprehensive policies that include pandemic-related coverage. It also accelerated the shift towards flexible, cancel-for-any-reason policies and digital claims processing, reshaping consumer expectations and product offerings.

How is technology influencing travel insurance?

Technology, especially AI and mobile applications, is transforming travel insurance by enabling personalized policy recommendations, automating claims processing, improving fraud detection, and offering real-time customer support. This leads to greater efficiency, accessibility, and tailored customer experiences.