Corrugating Paperboard Market

Corrugating Paperboard Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_705038 | Last Updated : August 11, 2025 |

Format : ![]()

![]()

![]()

![]()

Corrugating Paperboard Market Size

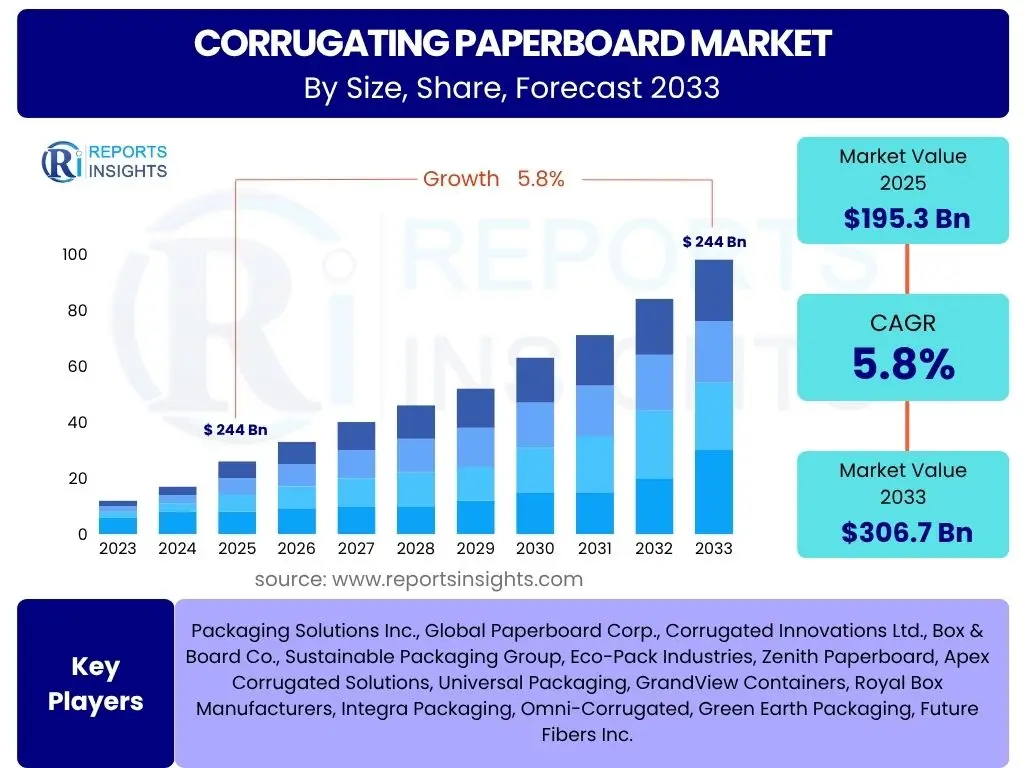

According to Reports Insights Consulting Pvt Ltd, The Corrugating Paperboard Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2033. The market is estimated at USD 195.3 billion in 2025 and is projected to reach USD 306.7 billion by the end of the forecast period in 2033.

Key Corrugating Paperboard Market Trends & Insights

The corrugating paperboard market is currently experiencing dynamic shifts driven by evolving consumer demands, technological advancements, and a heightened focus on environmental sustainability. A primary trend involves the escalating demand for sustainable packaging solutions, as both consumers and businesses prioritize eco-friendly alternatives to plastics. This has led to increased innovation in recyclable and biodegradable paperboard products, pushing manufacturers to adopt more responsible production practices and source materials from certified sustainable forests. Furthermore, the rapid expansion of e-commerce continues to be a significant catalyst, necessitating robust and lightweight packaging that can withstand complex logistics chains while ensuring product integrity during transit. This surge in online retail has spurred demand for custom-sized and protective corrugating solutions, often incorporating advanced design features for enhanced cushioning and branding.

Another prominent trend is the integration of smart packaging technologies, albeit in nascent stages, which allows for features like QR codes for traceability, anti-tampering measures, and enhanced customer engagement. While still developing, this trend signals a future where packaging is not merely a protective shell but an interactive tool. The industry is also witnessing a greater emphasis on automation and digitalization across the manufacturing process, from design to production, aimed at improving efficiency, reducing waste, and increasing production capacity to meet growing global demand. This technological adoption helps in optimizing material usage and streamlining supply chain operations, addressing cost pressures and operational complexities inherent in large-scale production.

Moreover, the shift towards lighter yet stronger corrugating materials reflects ongoing efforts to optimize shipping costs and reduce the carbon footprint associated with transportation. Manufacturers are investing in research and development to create paperboard with superior strength-to-weight ratios, ensuring adequate protection without excessive material use. Customization and personalization are also emerging as vital trends, particularly for premium and branded products, where unique packaging designs and printing capabilities offer a competitive edge. This trend caters to a diverse range of industries, from food and beverages to electronics, each requiring specific packaging attributes that corrugating paperboard can effectively provide.

- Growing demand for sustainable and recyclable packaging solutions.

- Rapid expansion of e-commerce driving demand for protective and lightweight packaging.

- Increased focus on automation and digitalization in manufacturing processes.

- Development of lighter yet stronger corrugating materials for optimized logistics.

- Rise in customization and personalized packaging solutions across industries.

AI Impact Analysis on Corrugating Paperboard

The integration of Artificial Intelligence (AI) across the corrugating paperboard value chain is poised to revolutionize traditional manufacturing and operational paradigms. Users frequently inquire about AI's potential to optimize production efficiency, enhance quality control, and streamline supply chain management. AI algorithms can analyze vast datasets from manufacturing lines, identifying patterns that lead to inefficiencies or defects, thereby enabling predictive maintenance and real-time process adjustments. This proactive approach significantly reduces downtime, minimizes material waste, and ensures consistent product quality, addressing critical industry pain points. Furthermore, AI-powered systems can optimize material usage by precisely calculating the required paperboard for specific packaging designs, leading to cost savings and improved sustainability by minimizing excess material consumption.

In the realm of supply chain and logistics, AI is expected to provide advanced forecasting capabilities, predicting demand fluctuations and optimizing inventory levels more accurately than traditional methods. This allows manufacturers to manage raw material procurement and finished product distribution with greater precision, reducing lead times and improving responsiveness to market changes. AI-driven logistics platforms can also optimize transportation routes and schedules, lowering fuel consumption and transportation costs, which are substantial factors in the overall cost structure of paperboard products. The ability of AI to process and learn from complex logistical data enables more resilient and efficient supply chains, crucial for a global industry facing increasing volatility.

Beyond operational improvements, AI also holds promise in enhancing product design and innovation within the corrugating paperboard sector. AI tools can analyze consumer preferences and market trends to suggest novel packaging designs that meet specific functional and aesthetic requirements, accelerating the product development cycle. For instance, generative design AI could explore thousands of design variations to optimize for strength, weight, or stackability. Additionally, AI can support improved customer service by automating responses to common queries and providing personalized insights, further solidifying customer relationships. While the full scope of AI's impact is still unfolding, its transformative potential across production, logistics, and innovation within the corrugating paperboard market is substantial, promising a more efficient, agile, and data-driven future.

- Enhanced production efficiency through predictive maintenance and process optimization.

- Improved quality control by real-time defect detection and material usage optimization.

- Streamlined supply chain management via advanced demand forecasting and inventory optimization.

- Logistics optimization, including route planning and reduced transportation costs.

- Accelerated product design and innovation through AI-powered generative design and consumer trend analysis.

Key Takeaways Corrugating Paperboard Market Size & Forecast

The corrugating paperboard market is poised for robust growth, underpinned by fundamental shifts in global consumption patterns and an increasing emphasis on sustainable practices. A key takeaway from the market size and forecast analysis is the undeniable correlation between e-commerce expansion and the escalating demand for corrugated packaging. As online retail continues its upward trajectory globally, the need for protective, lightweight, and customizable shipping materials becomes paramount, directly fueling market growth. This trend is not confined to developed economies but is rapidly accelerating in emerging markets, presenting substantial new opportunities for market players. The market's resilience is further demonstrated by its capacity to adapt to evolving logistical challenges and consumer expectations for safe and efficient product delivery.

Another significant insight is the critical role of sustainability as a primary growth driver, rather than merely a regulatory compliance issue. Consumers and businesses alike are actively seeking packaging solutions with reduced environmental impact, driving the transition away from less sustainable alternatives. This societal shift is compelling manufacturers to innovate in areas such as recyclable content, biodegradable coatings, and responsible forestry sourcing, thereby creating a competitive advantage for companies that prioritize eco-friendly practices. The market forecast reflects this strong demand for green packaging, indicating that investment in sustainable R&D and production will yield significant returns and bolster market share in the coming years. This emphasis on environmental responsibility is reshaping the competitive landscape and influencing investment decisions across the industry.

Furthermore, the market's growth trajectory highlights the continuous innovation in material science and manufacturing processes within the corrugating paperboard sector. The development of lighter yet stronger paperboard grades, coupled with advancements in printing and customization technologies, is expanding the utility and appeal of corrugated packaging across a diverse range of end-use industries. From specialized food packaging to robust industrial containers, the versatility of corrugating paperboard is being continually enhanced. The forecast underscores that companies capable of offering tailored, high-performance, and cost-effective solutions will capture greater market share, emphasizing the importance of adaptability and a customer-centric approach in this evolving industry. The interplay of these factors solidifies the market's promising outlook and its strategic importance in the global packaging landscape.

- E-commerce expansion is a primary driver, fostering consistent demand for protective packaging.

- Sustainability initiatives are critical for market growth, with increasing demand for eco-friendly solutions.

- Innovation in material science and manufacturing processes is enhancing product versatility and performance.

- Emerging markets present significant growth opportunities due to rising disposable incomes and changing retail landscapes.

- The market is resilient and adaptable, continuously evolving to meet dynamic consumer and industry needs.

Corrugating Paperboard Market Drivers Analysis

The corrugating paperboard market is significantly propelled by several robust drivers, fundamentally transforming global packaging consumption. A primary driver is the pervasive growth of the e-commerce sector, which necessitates a continuous supply of durable, lightweight, and cost-effective packaging solutions to ensure products arrive safely at their destinations. As online shopping continues to expand across both developed and emerging economies, the demand for corrugated boxes for shipping, protection, and branding purposes surges exponentially. This digital retail revolution has fundamentally reshaped logistics and supply chain demands, placing corrugated paperboard at the forefront of packaging solutions due to its structural integrity and recyclability.

Another crucial driver is the increasing global emphasis on environmental sustainability and the widespread consumer preference for eco-friendly packaging alternatives. With growing concerns about plastic pollution and non-biodegradable waste, corrugating paperboard offers a highly recyclable, renewable, and often biodegradable solution. This societal and regulatory shift, particularly evident in bans or restrictions on single-use plastics, significantly boosts the adoption of paper-based packaging across various industries, including food and beverage, consumer goods, and industrial sectors. Manufacturers are responding by investing in sustainable sourcing, closed-loop recycling systems, and innovative paperboard compositions, aligning with corporate social responsibility goals and consumer values.

Furthermore, the expansion of the manufacturing sector and consumer goods industries globally directly translates into higher demand for packaging. As economies develop and consumer purchasing power increases, so does the production and distribution of packaged goods, from electronics to processed foods. Corrugating paperboard is an indispensable component in the packaging of these diverse products, providing essential protection, ease of handling, and brand visibility. This robust industrial activity, coupled with urbanization and changing lifestyles, ensures a sustained and growing market for corrugating paperboard, particularly as businesses seek efficient and reliable packaging solutions for their expanding product lines and distribution networks.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| E-commerce Growth | +1.8% | Global, particularly North America, APAC, Europe | Short to Long-term |

| Sustainability & Plastic Ban | +1.5% | Europe, North America, parts of APAC | Medium to Long-term |

| Growth in Consumer Goods Manufacturing | +1.2% | APAC, Latin America, Middle East | Medium-term |

| Demand for Protective & Lightweight Packaging | +1.0% | Global | Short to Medium-term |

| Urbanization & Changing Lifestyles | +0.8% | Emerging Economies (APAC, Africa) | Long-term |

Corrugating Paperboard Market Restraints Analysis

Despite its significant growth drivers, the corrugating paperboard market faces several inherent restraints that can temper its expansion. One of the primary challenges is the volatility of raw material prices, particularly pulp and recycled paper fiber. These prices are influenced by factors such as timber availability, energy costs for processing, and global supply-demand dynamics, which can be highly unpredictable. Fluctuations in raw material costs directly impact the production expenses for corrugating paperboard manufacturers, often leading to increased product prices and potentially eroding profit margins. This unpredictability makes long-term planning and stable pricing structures difficult for market players, requiring continuous adaptation to market conditions.

Another significant restraint is the increasing competition from alternative packaging materials. While corrugating paperboard offers numerous advantages, other materials like flexible plastics, rigid plastics, glass, metal, and even emerging bio-based materials are constantly evolving and competing for market share. For specific applications where properties like moisture resistance, visibility, or extreme durability are paramount, these alternatives might offer perceived advantages. The packaging industry is highly innovative, with continuous research into new materials and designs, presenting a persistent competitive pressure on the corrugating paperboard sector to innovate and differentiate its offerings to maintain relevance across diverse end-use applications.

Furthermore, stringent environmental regulations, while simultaneously acting as a driver for sustainable paperboard, can also pose a restraint. Compliance with various international and national environmental standards regarding emissions, water usage, waste disposal, and sustainable forestry practices adds to operational complexities and costs for manufacturers. Investing in new technologies for compliance, obtaining necessary certifications, and adhering to strict sourcing guidelines can be capital-intensive and time-consuming. These regulatory hurdles, though essential for environmental protection, can create barriers to entry for new players and increase operational burdens for existing ones, potentially slowing down market expansion in regions with very strict environmental frameworks.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Volatility of Raw Material Prices | -1.5% | Global | Short to Medium-term |

| Competition from Alternative Packaging Materials | -1.2% | Global, especially in niche applications | Medium-term |

| Stringent Environmental Regulations (Production) | -0.9% | Europe, North America, developed APAC | Long-term |

| High Logistics & Transportation Costs | -0.7% | Global, particularly for bulky orders | Short to Medium-term |

| Market Saturation in Developed Regions | -0.5% | North America, Western Europe | Long-term |

Corrugating Paperboard Market Opportunities Analysis

The corrugating paperboard market is presented with significant opportunities for growth and innovation, driven by evolving consumer preferences and technological advancements. One key opportunity lies in the continuous innovation of sustainable and bio-based packaging solutions. As the global push towards a circular economy gains momentum, there is increasing demand for paperboard products that are not only recyclable but also compostable or made from 100% recycled content. Developing advanced barrier coatings from natural materials can expand corrugating paperboard's applicability to moisture-sensitive or perishable goods, previously dominated by plastics, thereby opening new market segments and bolstering its appeal as a versatile and eco-friendly option. This focus on material science advancements can create premium product categories and attract environmentally conscious brands.

Another substantial opportunity is the untapped potential within emerging economies. Regions in Asia Pacific, Latin America, and Africa are experiencing rapid economic development, urbanization, and a burgeoning middle class, leading to increased consumption of packaged goods and a nascent but growing e-commerce infrastructure. As these regions adopt modern retail practices and logistics, the demand for reliable and cost-effective packaging like corrugating paperboard will surge. Investing in production capacities, distribution networks, and localized product offerings in these regions can yield significant returns, as market penetration rates for sophisticated packaging are still relatively low compared to developed markets, offering a first-mover advantage for strategic players.

Furthermore, the integration of smart packaging technologies offers a futuristic avenue for market expansion. While nascent, the development of corrugating paperboard with embedded RFID tags, NFC chips, or printable electronics could revolutionize supply chain traceability, product authentication, and consumer engagement. Such innovations could provide real-time data on package location, temperature, or tamper detection, adding significant value for high-value goods, pharmaceuticals, or cold chain logistics. Beyond functionality, smart packaging can also enhance brand interaction through augmented reality features or personalized digital content accessible via QR codes, transforming the unboxing experience and creating a competitive differentiation in a crowded market. These technological integrations can elevate corrugating paperboard from a basic commodity to a high-tech solution.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Development of Advanced Sustainable & Bio-based Coatings | +1.5% | Global | Medium to Long-term |

| Expansion into Emerging Economies (e.g., APAC, LATAM) | +1.3% | Asia Pacific, Latin America, Africa | Medium to Long-term |

| Integration of Smart Packaging Technologies | +1.0% | Developed Regions (North America, Europe) | Long-term |

| Demand for Customized & High-Graphics Packaging | +0.8% | Global | Short to Medium-term |

| Strategic Partnerships & Collaborations for Innovation | +0.7% | Global | Medium-term |

Corrugating Paperboard Market Challenges Impact Analysis

The corrugating paperboard market faces several critical challenges that require strategic navigation for sustained growth. One significant challenge pertains to disruptions in the global supply chain, which can severely impact raw material availability and distribution of finished products. Events such as geopolitical instability, natural disasters, or pandemics can cause bottlenecks in pulp and recycled fiber supply, leading to material shortages and price spikes. Furthermore, disruptions in international shipping and land transport networks can delay deliveries and increase logistics costs, directly affecting manufacturing schedules and the ability to meet market demand. These vulnerabilities necessitate diversified sourcing strategies and robust inventory management to mitigate risks and maintain operational continuity in an increasingly interconnected global economy.

Another pressing challenge is the escalating cost of energy, which forms a substantial portion of the operational expenses for paperboard manufacturing. The energy-intensive nature of pulp and paper production means that fluctuations in electricity, natural gas, and fuel prices have a direct and considerable impact on profitability. Higher energy costs can reduce profit margins, especially for manufacturers operating on thin margins, and may necessitate passing on increased costs to consumers, which could affect competitiveness. This challenge is further exacerbated by global efforts towards decarbonization, which may require significant capital expenditure in energy-efficient technologies or renewable energy sources, adding to the financial burden on manufacturers in the short term.

Moreover, intense market competition and pricing pressures pose a constant challenge for corrugating paperboard manufacturers. The market is characterized by a mix of large integrated players and numerous smaller regional companies, leading to a highly competitive environment. This competition often results in price wars and reduced profit margins, particularly for standardized products. To counteract this, companies are compelled to continuously innovate, differentiate their products through specialized features, advanced printing, or superior structural designs, and optimize their operational efficiencies. The need to balance competitive pricing with investment in sustainability and technology presents a complex strategic dilemma for market participants seeking to maintain or expand their market share.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Supply Chain Disruptions & Raw Material Shortages | -1.8% | Global | Short to Medium-term |

| Fluctuating Energy Costs | -1.4% | Global | Short to Medium-term |

| Intense Market Competition & Pricing Pressures | -1.1% | Global | Medium-term |

| Waste Management & Recycling Infrastructure Limitations | -0.9% | Developing Regions | Long-term |

| Labor Shortages & Skill Gap in Manufacturing | -0.6% | Developed Regions | Medium-term |

Corrugating Paperboard Market - Updated Report Scope

This report offers a comprehensive analysis of the global Corrugating Paperboard Market, detailing market size, growth projections, key trends, drivers, restraints, opportunities, and challenges. It provides an in-depth segmentation analysis by product type, basis weight, and end-use application, alongside a thorough regional assessment to identify prominent growth areas. The competitive landscape is also examined, featuring profiles of leading market players and their strategic initiatives, providing stakeholders with critical insights for informed decision-making and strategic planning within the industry.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 195.3 Billion |

| Market Forecast in 2033 | USD 306.7 Billion |

| Growth Rate | 5.8% |

| Number of Pages | 267 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Packaging Solutions Inc., Global Paperboard Corp., Corrugated Innovations Ltd., Box & Board Co., Sustainable Packaging Group, Eco-Pack Industries, Zenith Paperboard, Apex Corrugated Solutions, Universal Packaging, GrandView Containers, Royal Box Manufacturers, Integra Packaging, Omni-Corrugated, Green Earth Packaging, Future Fibers Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The corrugating paperboard market is extensively segmented to reflect its diverse product offerings and widespread applications across various industries. Understanding these segments provides critical insights into the market’s structure and the specific demands driving different sectors. The primary segmentation includes distinctions based on product type, which differentiates between the various layers of a corrugated board; basis weight, which refers to the material’s thickness and strength; and end-use application, highlighting the diverse industries that rely on corrugated packaging for their operational needs. This granular segmentation helps in identifying specific growth pockets and tailoring strategies for optimal market penetration, reflecting the versatility and adaptability of corrugating paperboard in meeting specialized packaging requirements.

- By Product Type: Linerboard (Kraftliner, Testliner), Corrugating Medium / Fluting

- By Basis Weight: Below 100 GSM, 100-175 GSM, Above 175 GSM

- By End-Use Application: Food & Beverages, E-commerce Packaging, Industrial Packaging, Personal & Home Care, Consumer Durables, Healthcare & Pharmaceuticals, Others (Automotive, Chemicals)

Regional Highlights

- North America: This region maintains a significant market share, driven by a well-established e-commerce sector, robust industrial activity, and a strong emphasis on sustainable packaging solutions. Strict environmental regulations and consumer preferences for eco-friendly products are accelerating the shift towards recyclable paperboard, particularly in the United States and Canada.

- Europe: Europe is a mature market characterized by stringent environmental policies and a high adoption rate of recycled content in packaging. The region exhibits steady growth, fueled by strong e-commerce penetration, increasing demand for sustainable food packaging, and innovative approaches to design and manufacturing, especially in countries like Germany, France, and the UK.

- Asia Pacific (APAC): APAC represents the fastest-growing market for corrugating paperboard, primarily due to rapid industrialization, burgeoning e-commerce platforms, and rising disposable incomes. Countries such as China, India, and Japan are leading the expansion, driven by massive manufacturing output, growing consumer goods markets, and increasing urbanization.

- Latin America: This region showcases promising growth potential, supported by expanding retail sectors, rising consumer awareness regarding sustainable packaging, and developing e-commerce infrastructures. Countries like Brazil and Mexico are key contributors, experiencing increased demand from the food and beverage industry and a growing logistics sector.

- Middle East and Africa (MEA): The MEA region is experiencing gradual growth, primarily influenced by increasing investments in manufacturing, infrastructure development, and growing international trade. While currently smaller, the demand for packaged goods and developing e-commerce penetration in countries like Saudi Arabia, UAE, and South Africa are expected to drive future market expansion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Corrugating Paperboard Market.- Packaging Solutions Inc.

- Global Paperboard Corp.

- Corrugated Innovations Ltd.

- Box & Board Co.

- Sustainable Packaging Group

- Eco-Pack Industries

- Zenith Paperboard

- Apex Corrugated Solutions

- Universal Packaging

- GrandView Containers

- Royal Box Manufacturers

- Integra Packaging

- Omni-Corrugated

- Green Earth Packaging

- Future Fibers Inc.

Frequently Asked Questions

Analyze common user questions about the Corrugating Paperboard market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate of the Corrugating Paperboard Market?

The Corrugating Paperboard Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2033, reaching an estimated value of USD 306.7 billion by 2033.

Which key factors are driving the Corrugating Paperboard Market growth?

The primary drivers include the exponential growth of e-commerce, the increasing global demand for sustainable and recyclable packaging solutions, and the expansion of the consumer goods and manufacturing sectors worldwide.

How is AI impacting the Corrugating Paperboard industry?

AI is set to impact the industry by optimizing production efficiency, enhancing quality control through predictive analysis, streamlining supply chain management, and accelerating product design innovation.

What are the main challenges faced by the Corrugating Paperboard Market?

Key challenges include the volatility of raw material prices, intense competition from alternative packaging materials, frequent supply chain disruptions, and fluctuating energy costs impacting operational expenses.

Which region is expected to lead the growth in the Corrugating Paperboard Market?

The Asia Pacific (APAC) region is anticipated to exhibit the fastest growth, driven by rapid industrialization, burgeoning e-commerce platforms, and increasing consumer demand in countries like China and India.