Construction Equipment Market

Construction Equipment Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_703397 | Last Updated : August 01, 2025 |

Format : ![]()

![]()

![]()

![]()

Construction Equipment Market Size

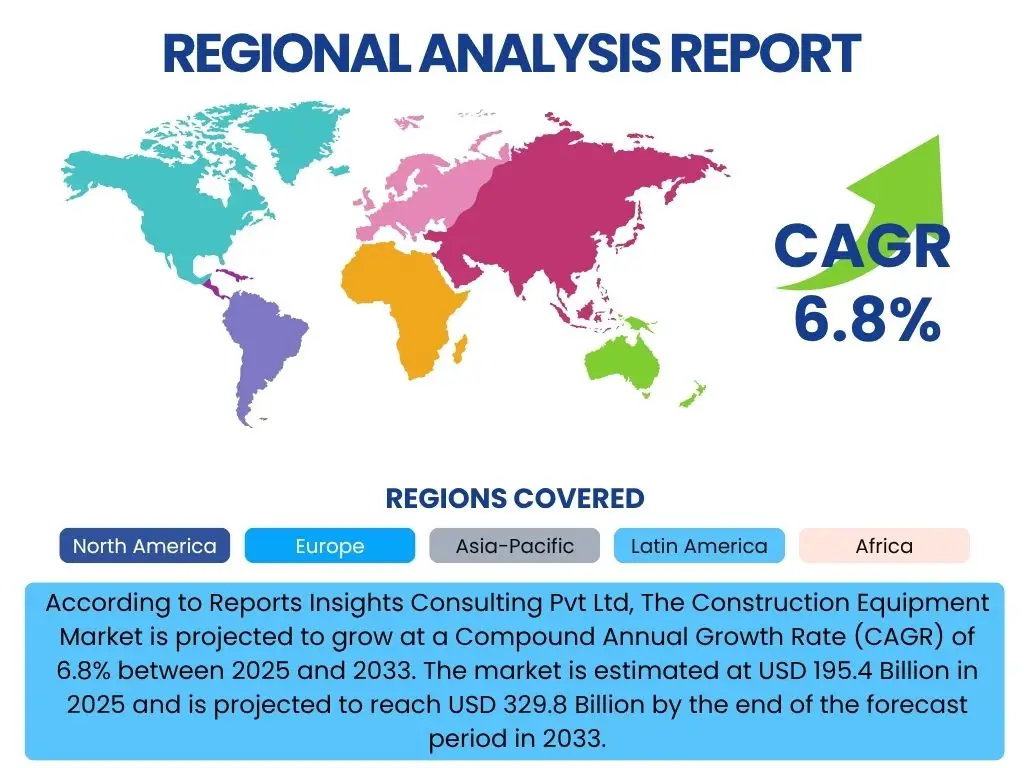

According to Reports Insights Consulting Pvt Ltd, The Construction Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2033. The market is estimated at USD 195.4 Billion in 2025 and is projected to reach USD 329.8 Billion by the end of the forecast period in 2033.

Key Construction Equipment Market Trends & Insights

The construction equipment market is undergoing significant transformation, driven by evolving project demands, technological advancements, and a heightened focus on sustainability. Users frequently inquire about the latest innovations, how operational efficiencies are being improved, and the shift towards more environmentally friendly machinery. The industry is responding with sophisticated solutions that not only enhance productivity and safety but also address growing environmental concerns, making equipment more intelligent, autonomous, and energy-efficient.

This market evolution is characterized by a strong emphasis on integrating digital technologies, optimizing machinery performance through data analytics, and expanding service offerings to reduce total cost of ownership. The increasing complexity of modern construction projects, coupled with a global drive for infrastructure development, necessitates robust and adaptable equipment solutions. Furthermore, the rising preference for rental equipment and the expansion of aftermarket services are reshaping business models within the sector.

- Electrification and Hybridization of Equipment: Growing adoption of electric and hybrid models for reduced emissions and noise.

- Automation and Autonomous Operations: Development of self-operating machinery for enhanced precision, safety, and efficiency.

- Telematics and IoT Integration: Real-time data monitoring, predictive maintenance, and fleet management optimization.

- Advanced Safety Features: Implementation of AI-powered object detection, proximity sensors, and remote control capabilities.

- Circular Economy Principles: Emphasis on equipment longevity, reusability, and recycling of components.

- Data Analytics for Operational Efficiency: Leveraging machine-generated data to improve project planning, fuel consumption, and uptime.

- Growing Rental Equipment Market: Increased preference for renting specialized equipment over outright purchase due to cost efficiencies and project flexibility.

AI Impact Analysis on Construction Equipment

User inquiries concerning AI's influence on construction equipment often revolve around its practical applications, potential benefits for productivity and safety, and associated implementation challenges. Key themes include the role of AI in autonomous operation, predictive maintenance, and optimizing site logistics. There is also a significant interest in how AI can mitigate labor shortages and enhance project efficiency through intelligent data processing and decision-making capabilities.

AI is poised to revolutionize the construction equipment sector by enabling smarter, more efficient, and safer operations. It addresses critical industry pain points such as high operational costs, safety incidents, and project delays. As AI technologies mature, their integration into machinery will become more seamless, leading to a new generation of intelligent construction solutions that can adapt to dynamic site conditions and learn from operational data, ultimately driving significant advancements across the entire construction lifecycle.

- Predictive Maintenance: AI algorithms analyze sensor data to predict equipment failures, enabling proactive repairs and minimizing downtime.

- Autonomous Operation: AI powers self-driving and remote-controlled machinery, reducing human error and improving operational speed and safety in hazardous environments.

- Site Optimization and Logistics: AI-driven systems optimize material flow, equipment scheduling, and site layout for increased efficiency.

- Enhanced Safety: AI-powered vision systems and real-time alerts detect potential hazards, preventing accidents and improving worker safety.

- Quality Control and Monitoring: AI analyzes construction progress and quality against blueprints, identifying deviations early.

- Operator Assistance: AI-enabled systems provide real-time guidance and feedback to operators, improving performance and reducing fatigue.

Key Takeaways Construction Equipment Market Size & Forecast

Common user questions regarding market size and forecast often focus on understanding the overarching growth trajectory, the key drivers behind the projected expansion, and the long-term viability of investment in the sector. Users seek clear insights into what the future holds for the construction equipment industry and how external factors might influence its development. The market is positioned for sustained growth, underpinned by fundamental global trends and continuous technological innovation.

The forecasted growth indicates a robust and evolving market, highly influenced by global infrastructure development, rapid urbanization in emerging economies, and the increasing adoption of advanced technologies like AI and electrification. Stakeholders should note the critical shift towards smart, efficient, and sustainable equipment solutions. Furthermore, the market's resilience will be tested by economic fluctuations and supply chain dynamics, making adaptability and technological leadership crucial for success.

- Sustained Growth Momentum: The market is projected to achieve consistent growth driven by global infrastructure spending and urbanization.

- Technological Integration is Critical: Adoption of telematics, AI, automation, and electric powertrains will define future market leadership.

- Emerging Markets as Growth Engines: Asia Pacific, Latin America, and MEA are expected to be primary contributors to market expansion.

- Focus on Sustainability: Environmental regulations and corporate sustainability goals are accelerating the demand for greener equipment.

- Shift Towards Rental Solutions: The flexibility and cost-efficiency of equipment rentals are increasingly appealing to construction firms.

Construction Equipment Market Drivers Analysis

The global construction equipment market is primarily propelled by a robust increase in infrastructure development activities worldwide, especially in developing economies. Governments are investing heavily in new road networks, bridges, railway systems, and urban infrastructure projects, creating significant demand for a wide range of construction machinery. This trend is further amplified by rapid urbanization, which necessitates the construction of commercial buildings, residential complexes, and public amenities to accommodate growing populations.

Moreover, the construction industry's increasing adoption of advanced technologies, including automation, telematics, and electrification, is a crucial driver. These innovations enhance operational efficiency, reduce project timelines, and improve safety, making new equipment more attractive to buyers seeking competitive advantages. The expansion of the equipment rental market also contributes significantly, providing construction companies with flexible and cost-effective access to modern machinery without the burden of large capital expenditures.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Infrastructure Development | +1.5% | Global, particularly Asia Pacific (China, India), North America, Africa | Long-term (2025-2033) |

| Rapid Urbanization and Population Growth | +1.2% | Asia Pacific, Africa, Latin America | Long-term (2025-2033) |

| Technological Advancements (Automation, Telematics, IoT) | +1.0% | North America, Europe, Asia Pacific (developed economies) | Mid to Long-term (2025-2033) |

| Growth in Equipment Rental Market | +0.8% | North America, Europe, parts of Asia Pacific | Mid-term (2025-2030) |

| Government Initiatives and Investments | +0.7% | Global, varies by national policy (e.g., US Infrastructure Bill, China's BRI) | Long-term (2025-2033) |

Construction Equipment Market Restraints Analysis

The construction equipment market faces several significant restraints that could impede its growth trajectory. One primary concern is the high initial investment required for purchasing modern, technologically advanced machinery. This substantial capital outlay can be a barrier for smaller construction companies or those operating in volatile economic environments, forcing them to opt for older, less efficient equipment or rely more heavily on rental options.

Another critical restraint is the volatility of raw material prices, particularly steel and other metals, which are essential components in manufacturing heavy machinery. Fluctuations in these prices directly impact production costs, potentially leading to increased equipment prices for end-users or reduced profit margins for manufacturers. Additionally, the shortage of skilled labor to operate and maintain sophisticated construction equipment poses a considerable challenge, especially in regions with aging workforces or inadequate vocational training programs. This shortage can lead to underutilization of advanced machinery and increased operational costs.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Initial Investment Costs | -0.9% | Global, particularly emerging markets | Long-term (2025-2033) |

| Volatility in Raw Material Prices | -0.7% | Global | Short to Mid-term (2025-2028) |

| Shortage of Skilled Labor | -0.6% | North America, Europe, parts of Asia Pacific | Long-term (2025-2033) |

| Strict Environmental Regulations | -0.5% | Europe, North America, Japan | Mid to Long-term (2025-2033) |

Construction Equipment Market Opportunities Analysis

Significant opportunities exist within the construction equipment market, primarily driven by the increasing global emphasis on sustainable construction practices and the demand for eco-friendly machinery. The push for reduced carbon emissions and noise pollution is accelerating the development and adoption of electric, hybrid, and hydrogen-powered equipment. This trend not only aligns with environmental regulations but also caters to a growing segment of environmentally conscious buyers, opening new revenue streams for manufacturers investing in green technologies.

Another major opportunity lies in the expanding scope of digital integration and smart construction. The proliferation of IoT, AI, and advanced analytics in construction equipment offers avenues for improved predictive maintenance, remote diagnostics, and optimized fleet management. This allows manufacturers to offer value-added services beyond equipment sales, such as data-driven insights and comprehensive service contracts, fostering stronger customer relationships and recurring revenue streams. Furthermore, the robust growth in emerging economies, coupled with significant infrastructure deficits, presents untapped potential for market penetration and expansion into new geographical territories.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Electrification and Alternative Fuel Equipment | +1.3% | Global, strong in Europe, North America, China | Long-term (2025-2033) |

| Expansion of Aftermarket Services and Digital Solutions | +1.0% | Global | Long-term (2025-2033) |

| Untapped Markets in Developing Economies | +0.9% | Africa, parts of Latin America, Southeast Asia | Long-term (2028-2033) |

| Integration of AI and Advanced Analytics | +0.8% | Global, strong in developed markets | Mid to Long-term (2025-2033) |

Construction Equipment Market Challenges Impact Analysis

The construction equipment market faces several pressing challenges that require strategic responses from manufacturers and stakeholders. One significant hurdle is the susceptibility to global economic slowdowns and geopolitical uncertainties. Economic downturns can lead to reduced construction projects, decreased demand for equipment, and tighter credit availability, directly impacting market sales and investment. Geopolitical tensions can disrupt supply chains, affecting the availability of components and increasing manufacturing costs, thereby reducing profitability and delaying production.

Another substantial challenge is the increasing stringency of environmental regulations worldwide. These regulations mandate lower emissions and higher fuel efficiency, forcing manufacturers to invest heavily in research and development to comply with evolving standards. This often leads to higher production costs, which can translate to increased prices for end-users, potentially dampening demand. Furthermore, intense market competition, particularly from regional players and emerging manufacturers offering cost-effective alternatives, necessitates continuous innovation and differentiation for established market participants to maintain their competitive edge.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Economic Downturns and Market Volatility | -1.1% | Global | Short to Mid-term (2025-2028) |

| Disruptions in Global Supply Chain | -0.8% | Global, particularly manufacturing hubs in Asia | Short-term (2025-2026) |

| Stringent Regulatory Compliance | -0.7% | Europe, North America, Japan, China | Long-term (2025-2033) |

| Intense Market Competition | -0.6% | Global, particularly Asia Pacific | Long-term (2025-2033) |

Construction Equipment Market - Updated Report Scope

This market research report offers a comprehensive analysis of the global Construction Equipment Market, providing an in-depth understanding of its current dynamics and future projections. The scope encompasses detailed market sizing, segmentation by various criteria, regional analysis, competitive landscape assessment, and identification of key trends, drivers, restraints, opportunities, and challenges influencing market growth. The report is designed to provide actionable insights for stakeholders seeking to make informed strategic decisions in this evolving industry.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 195.4 Billion |

| Market Forecast in 2033 | USD 329.8 Billion |

| Growth Rate | 6.8% |

| Number of Pages | 247 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Caterpillar Inc., Komatsu Ltd., Volvo Construction Equipment (Volvo CE), Hitachi Construction Machinery, Liebherr Group, JCB (JC Bamford Excavators Ltd.), Sany Heavy Industry Co. Ltd., XCMG Group, Zoomlion Heavy Industry Science and Technology Co. Ltd., Hyundai Doosan Infracore, CNH Industrial (Case Construction, New Holland Construction), John Deere (Deere & Company), Terex Corporation, Manitou Group, Atlas Copco, Kubota Corporation, Epiroc, Wirtgen Group (John Deere), Sandvik AB, Tadano Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Construction Equipment Market is meticulously segmented to provide a granular understanding of its diverse components, allowing for targeted analysis of market dynamics and growth opportunities across various product types, applications, power sources, end-use sectors, and sales channels. This detailed breakdown highlights the unique drivers and challenges within each segment, enabling stakeholders to identify key areas for investment and strategic development. The segmentation reflects the complexity of modern construction demands and the continuous innovation within the industry.

Understanding these segments is crucial for manufacturers to tailor their product offerings, for suppliers to optimize their supply chains, and for investors to identify high-growth niches. For instance, the shift towards electric equipment impacts the power source segment, while large-scale infrastructure projects significantly boost demand in specific equipment types. The interplay between these segments defines the market's overall structure and future trajectory.

- By Equipment Type:

- Excavators (Crawler, Wheeled, Mini)

- Loaders (Skid-steer, Backhoe, Wheel Loaders)

- Cranes (Mobile, Tower, Crawler)

- Dozers

- Motor Graders

- Road Rollers/Compactors

- Articulated Dump Trucks

- Forklifts

- Material Handling Equipment

- Other Equipment

- By Application:

- Construction (Residential, Commercial, Industrial, Infrastructure)

- Mining

- Forestry

- Agriculture

- Oil & Gas

- Other Applications

- By Power Source:

- Diesel

- Electric

- Hybrid

- Other (e.g., Hydrogen)

- By End-Use Sector:

- Public Works & Infrastructure

- Residential Construction

- Commercial Construction

- Industrial Construction

- Mining & Quarrying

- Utilities

- By Sales Channel:

- New Sales

- Aftermarket Sales

- Rental

Regional Highlights

- North America: The North American construction equipment market is characterized by significant investment in infrastructure projects, driven by government initiatives focused on upgrading aging infrastructure and promoting economic growth. The region exhibits high adoption rates of advanced technologies such as telematics, automation, and electric equipment due to stringent environmental regulations and a focus on operational efficiency. The robust rental market also plays a crucial role, providing flexible solutions for diverse project needs across the United States and Canada. Economic stability and a mature construction industry underpin consistent demand.

- Europe: Europe stands as a leader in sustainable construction and advanced equipment technologies. The market is heavily influenced by stringent emission standards and a strong emphasis on reducing environmental impact, driving the demand for electric and hybrid machinery. Innovation in digital solutions, including AI-powered analytics and remote monitoring, is also a key characteristic. Western European countries like Germany, France, and the UK lead in technological adoption, while Eastern European nations show promising growth due to ongoing modernization efforts and EU funding for infrastructure.

- Asia Pacific (APAC): The Asia Pacific region represents the largest and fastest-growing market for construction equipment globally, propelled by rapid urbanization, industrialization, and massive infrastructure development projects, particularly in China and India. Government investments in smart cities, transportation networks, and residential construction are primary demand drivers. While traditional diesel-powered equipment still dominates, there is a burgeoning interest in electric and automated solutions, especially in technologically advanced economies like Japan and South Korea, and increasingly in China due to its ambitious environmental goals.

- Latin America: The Latin American construction equipment market is heavily influenced by investments in natural resource extraction, particularly mining, and ongoing infrastructure development. Countries like Brazil, Mexico, and Chile are significant contributors, driven by government spending on public works and foreign direct investment. While economic volatility can pose challenges, the region presents long-term growth opportunities as urbanization continues and there is a sustained need for better transportation, energy, and residential infrastructure. The adoption of advanced technologies is gradually increasing, often tied to global construction trends.

- Middle East and Africa (MEA): The MEA region's construction equipment market is characterized by significant investments in large-scale infrastructure projects, driven by government visions for economic diversification away from oil dependence and rapid population growth. Countries like Saudi Arabia, UAE, and Qatar are undertaking ambitious megaprojects in real estate, tourism, and transportation. Africa's market is spurred by developing economies, increasing foreign investments, and projects related to urban development and resource extraction. While still reliant on conventional equipment, there's a growing interest in technology to enhance efficiency and sustainability for future projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Construction Equipment Market.- Caterpillar Inc.

- Komatsu Ltd.

- Volvo Construction Equipment (Volvo CE)

- Hitachi Construction Machinery

- Liebherr Group

- JCB (JC Bamford Excavators Ltd.)

- Sany Heavy Industry Co. Ltd.

- XCMG Group

- Zoomlion Heavy Industry Science and Technology Co. Ltd.

- Hyundai Doosan Infracore

- CNH Industrial (Case Construction, New Holland Construction)

- John Deere (Deere & Company)

- Terex Corporation

- Manitou Group

- Atlas Copco

- Kubota Corporation

- Epiroc

- Wirtgen Group (John Deere)

- Sandvik AB

- Tadano Ltd.

Frequently Asked Questions

What is the projected size of the Construction Equipment Market?

The Construction Equipment Market is projected to reach USD 329.8 Billion by 2033, growing at a Compound Annual Growth Rate (CAGR) of 6.8% from 2025.

What are the primary drivers of growth in the Construction Equipment Market?

Key drivers include increasing global infrastructure development, rapid urbanization, government investments in public works, technological advancements like automation and telematics, and the expansion of the equipment rental market.

How is AI impacting the Construction Equipment sector?

AI is transforming the sector through predictive maintenance, autonomous operations, enhanced safety features, optimized site logistics, and improved data analytics for operational efficiency.

What are the major challenges facing the Construction Equipment Market?

Significant challenges include global economic volatility, disruptions in supply chains, stringent environmental regulations, high initial investment costs for machinery, and the shortage of skilled labor.

Which regions are expected to show significant growth in the Construction Equipment Market?

The Asia Pacific region, particularly China and India, is expected to lead growth due to rapid urbanization and large-scale infrastructure projects, followed by North America and Europe driven by technological adoption and infrastructure upgrades.