Computer on Module Market

Computer on Module Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_700287 | Last Updated : July 23, 2025 |

Format : ![]()

![]()

![]()

![]()

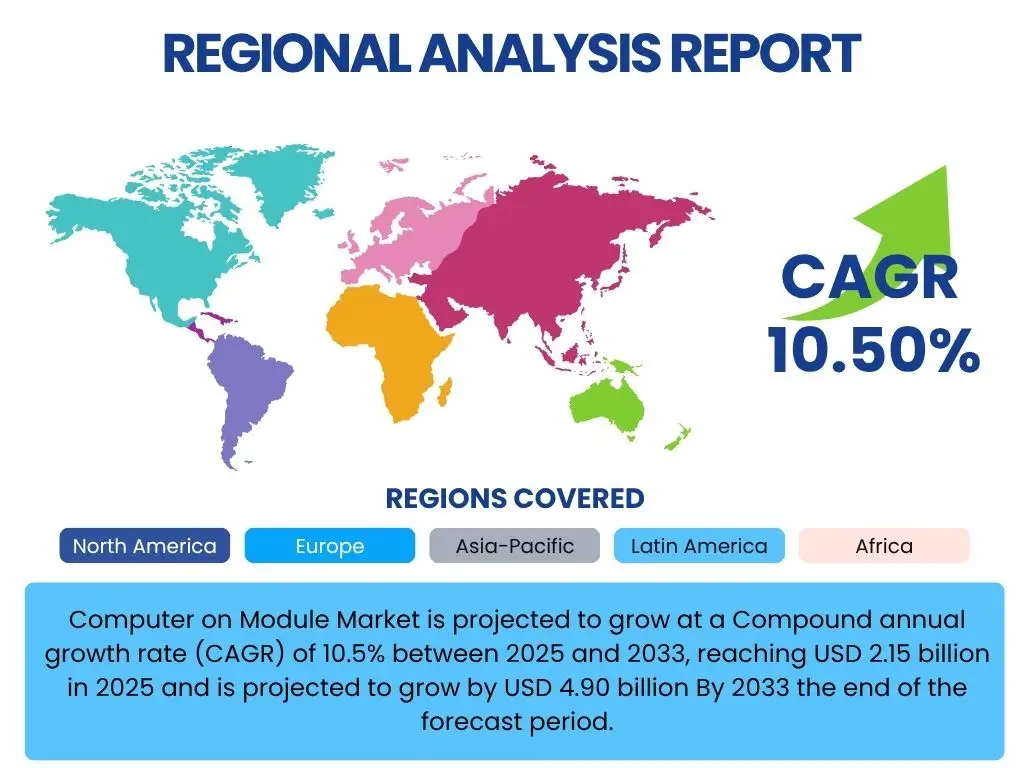

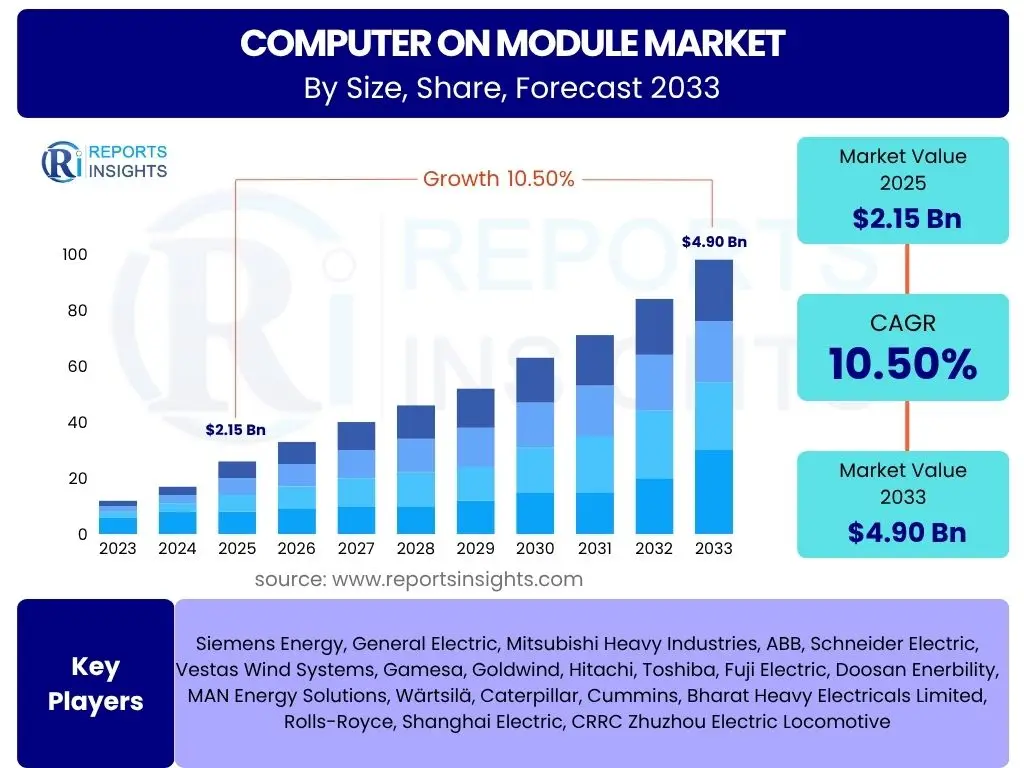

Computer on Module Market is projected to grow at a Compound annual growth rate (CAGR) of 10.5% between 2025 and 2033, reaching USD 2.15 billion in 2025 and is projected to grow by USD 4.90 billion By 2033 the end of the forecast period.

Key Computer on Module Market Trends & Insights

The Computer on Module (CoM) market is currently experiencing a transformative phase, driven by several overarching trends that are reshaping its landscape. A significant shift towards higher integration and miniaturization is evident, as manufacturers strive to pack more processing power, memory, and connectivity options into increasingly compact form factors. This trend is directly fueled by the growing demand for smaller, more efficient embedded systems across various industries, from industrial automation to medical devices and consumer electronics. Furthermore, there is a pronounced focus on enhanced connectivity capabilities, including the integration of 5G, Wi-Fi 6E, and advanced Ethernet options, to support the escalating data requirements of modern IoT and edge computing applications. The convergence of artificial intelligence and machine learning at the edge is also a critical trend, demanding CoMs with specialized AI accelerators and robust processing power to handle complex AI workloads locally, reducing latency and bandwidth consumption.

Another pivotal insight lies in the increasing adoption of CoMs for specialized vertical markets. While industrial automation remains a stronghold, emerging applications in smart cities, autonomous vehicles, and advanced healthcare systems are opening new avenues for CoM integration, often requiring tailored solutions for specific environmental conditions or regulatory compliances. The emphasis on ruggedized designs and extended temperature ranges is becoming more prevalent to ensure reliability in harsh operating environments. Lastly, sustainability and energy efficiency are gaining prominence, with developers seeking CoMs that offer optimal performance per watt, aligning with global efforts to reduce energy consumption and operational costs. These trends collectively underscore a dynamic market that is continuously innovating to meet the evolving demands of intelligent, connected, and power-efficient embedded solutions.

- Miniaturization and higher integration for compact embedded systems.

- Enhanced connectivity features including 5G, Wi-Fi 6E for IoT and edge.

- Integration of AI acceleration for on-device machine learning capabilities.

- Rising demand from specialized vertical markets like smart cities and autonomous systems.

- Focus on ruggedized designs and extended temperature tolerance.

- Emphasis on energy efficiency and sustainable manufacturing practices.

- Increasing preference for standardized form factors to ensure interoperability.

- Shift towards ARM-based CoMs for power-sensitive applications.

AI Impact Analysis on Computer on Module

Artificial intelligence is profoundly transforming the Computer on Module market, acting as both a catalyst for innovation and a demanding application driver. The burgeoning need for AI capabilities at the edge, where data is generated and processed, directly translates into a heightened demand for CoMs equipped with specialized AI processing units such as NPUs (Neural Processing Units), GPUs, or dedicated AI accelerators. These components enable CoMs to perform real-time inference, machine learning model execution, and complex data analysis locally, significantly reducing the reliance on cloud infrastructure. This on-device AI capability is critical for applications requiring low latency, such as autonomous systems, industrial automation, predictive maintenance, and real-time video analytics, where instantaneous decision-making is paramount. The integration of AI also necessitates more robust thermal management solutions and increased power efficiency in CoM designs to handle the intensive computational demands of AI workloads without compromising reliability or form factor.

Furthermore, AI is influencing the design philosophy of future CoMs by driving the need for more sophisticated software development kits (SDKs), AI frameworks, and development tools that simplify the deployment and management of AI models on embedded hardware. Manufacturers are increasingly focusing on providing comprehensive ecosystems that include optimized libraries and pre-trained models to accelerate time-to-market for AI-powered applications. The synergy between AI and edge computing is creating a virtuous cycle, where AI advancements enable more intelligent edge devices, which in turn generate richer data for further AI training and optimization. This dynamic is pushing CoM vendors to innovate in areas like heterogeneous computing, secure AI inference, and over-the-air (OTA) updates for AI model deployment, ensuring that CoMs remain at the forefront of the intelligent embedded systems revolution.

- Increased demand for CoMs with integrated AI accelerators (NPUs, GPUs).

- Facilitates real-time AI inference and machine learning at the edge.

- Drives need for enhanced thermal management and power efficiency in CoMs.

- Promotes development of sophisticated AI software tools and frameworks for CoM deployment.

- Enables advanced applications like autonomous vehicles, predictive maintenance, and smart vision systems.

- Influences CoM design towards heterogeneous computing for diverse AI workloads.

- Accelerates market growth in sectors demanding on-device intelligence.

Key Takeaways Computer on Module Market Size & Forecast

- The Computer on Module market is projected for substantial growth, driven by increasing adoption across diverse industries.

- Market valuation is set to reach USD 2.15 billion in 2025, indicating a robust starting point for the forecast period.

- Anticipated to achieve USD 4.90 billion by 2033, demonstrating strong upward trajectory.

- Forecasted Compound Annual Growth Rate (CAGR) of 10.5% from 2025 to 2033 highlights steady expansion.

- Growth is primarily fueled by the proliferation of IoT, edge computing, and industrial automation.

- Miniaturization and demand for high-performance, low-power embedded solutions are key growth accelerators.

- Emerging applications in AI, robotics, and medical devices contribute significantly to market expansion.

- The market's resilience is supported by continuous innovation in processor technology and connectivity options.

Computer on Module Market Drivers Analysis

The Computer on Module (CoM) market is propelled by a confluence of powerful drivers that underscore its integral role in the evolving landscape of embedded systems. A primary driver is the accelerating proliferation of the Internet of Things (IoT) and the subsequent demand for sophisticated edge computing capabilities. As more devices become interconnected and generate vast amounts of data at the network's periphery, there's an increasing need for compact, powerful, and energy-efficient processing units that can perform real-time data analysis and decision-making locally. CoMs, with their integrated processing, memory, and I/O functionalities in a standardized form factor, perfectly address this requirement, enabling faster deployment and easier scalability for IoT gateways, industrial controls, and smart city infrastructure.

Another significant driver is the continuous advancement in processor technology, offering higher performance, improved power efficiency, and integrated specialized accelerators for AI and graphics within smaller footprints. This innovation allows CoM manufacturers to provide cutting-edge solutions that meet the demanding requirements of next-generation applications, such as autonomous vehicles, advanced robotics, and high-resolution medical imaging. Furthermore, the growing trend towards industrial automation and Industry 4.0 initiatives globally drives the adoption of CoMs, as they provide the robust, reliable, and scalable computing platforms necessary for factory automation, machine vision, and predictive maintenance systems. The modularity and standardization offered by CoMs significantly reduce design complexity and time-to-market for original equipment manufacturers (OEMs), fostering innovation and accelerating market growth across a multitude of vertical industries.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Proliferation of IoT and Edge Computing | +2.5% | Global, particularly North America, Asia Pacific, Europe | Short to Mid-term (2025-2030) |

| Advancements in Processor Technology and AI Integration | +2.0% | Global, particularly leading tech hubs in North America, Asia Pacific (China, South Korea, Japan) | Short to Long-term (2025-2033) |

| Growing Demand for Industrial Automation and Industry 4.0 | +1.8% | Europe, Asia Pacific (China, Japan), North America | Mid to Long-term (2027-2033) |

| Miniaturization and Demand for Compact Embedded Systems | +1.5% | Global, especially in consumer electronics and medical device manufacturing regions | Short to Mid-term (2025-2030) |

| Increased Focus on Time-to-Market and Reduced Development Costs | +1.2% | Global, prevalent in competitive markets | Short-term (2025-2027) |

| Expansion of Applications in Healthcare and Medical Devices | +0.8% | North America, Europe, parts of Asia Pacific (e.g., Japan, South Korea) | Mid to Long-term (2028-2033) |

| Emergence of Autonomous Systems and Robotics | +0.7% | North America, Europe, Asia Pacific (China, Japan, South Korea) | Long-term (2030-2033) |

Computer on Module Market Restraints Analysis

Despite robust growth drivers, the Computer on Module (CoM) market faces several restraints that could potentially temper its expansion. One significant challenge is the relatively higher initial cost associated with CoM solutions compared to custom-designed embedded boards, especially for very high-volume production runs where economies of scale for custom designs become more attractive. While CoMs offer benefits in terms of reduced development time and engineering effort, the upfront module cost can be a deterrent for cost-sensitive applications or startups with limited budgets, leading them to opt for less flexible but cheaper component-level designs. This cost sensitivity is particularly pronounced in emerging markets or for mass-market consumer electronics where price competitiveness is paramount.

Another restraint stems from the complexity of software integration and ecosystem fragmentation. Although CoMs provide a hardware foundation, integrating the operating system, drivers, and application software can still be challenging, especially when dealing with diverse processor architectures (x86, ARM, RISC-V) and proprietary peripheral interfaces. The lack of a universally unified software ecosystem can increase development effort and debugging time, negating some of the time-to-market advantages. Furthermore, the rapid pace of technological obsolescence in the semiconductor industry poses a long-term challenge. As newer, more powerful processors are released, older CoM modules may quickly become less competitive or even end-of-life, requiring frequent redesigns or product updates that can incur additional costs and resource allocation for OEMs, impacting the long-term planning and investment in CoM-based solutions.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Higher Initial Cost Compared to Custom Boards | -1.2% | Global, especially cost-sensitive markets in Asia Pacific, Latin America | Short to Mid-term (2025-2030) |

| Complexity of Software Integration and Ecosystem Fragmentation | -0.9% | Global, impacting smaller developers and diverse application areas | Mid-term (2027-2031) |

| Rapid Technological Obsolescence and Product Lifecycles | -0.8% | Global, affecting long-term industrial and medical applications | Long-term (2030-2033) |

| Supply Chain Volatility of Key Semiconductor Components | -0.7% | Global, particularly affecting manufacturing hubs | Short-term (2025-2026) |

| Limited Customization for Niche, Highly Specialized Applications | -0.5% | Global, affecting highly proprietary system designs | Mid-term (2027-2032) |

Computer on Module Market Opportunities Analysis

The Computer on Module (CoM) market is poised to capitalize on several significant opportunities driven by technological convergence and expanding application domains. One of the most prominent opportunities lies in the escalating demand for edge AI and machine learning capabilities across various industries. As businesses increasingly seek to deploy AI models closer to the data source for real-time inference, CoMs equipped with neural processing units (NPUs), GPUs, and other AI accelerators become indispensable. This opens avenues for CoM manufacturers to innovate in developing AI-optimized modules that offer superior performance-per-watt for applications like industrial vision, autonomous navigation, and predictive analytics, creating a substantial growth segment.

Another compelling opportunity arises from the ongoing global shift towards digital transformation and the increasing complexity of embedded systems. Many industries are modernizing their infrastructure, adopting modular and scalable computing solutions to enhance efficiency and adaptability. CoMs, with their inherent modularity and standardized interfaces, offer a compelling value proposition by significantly reducing development cycles, engineering risks, and overall time-to-market for complex embedded projects. This appeals to a broader range of OEMs, including those in non-traditional embedded sectors. Furthermore, the emergence of 5G connectivity and advanced wireless standards presents a significant opportunity for CoMs to serve as the computing backbone for next-generation communication infrastructure, smart city applications, and connected vehicles, where high bandwidth, low latency, and robust processing at the edge are critical. The continuous evolution of open-source software platforms and development tools also lowers barriers to entry, enabling more developers to adopt CoM solutions and fostering a vibrant ecosystem for innovation.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growing Demand for Edge AI and Machine Learning Implementations | +2.8% | Global, particularly North America, Europe, Asia Pacific (China, South Korea) | Short to Long-term (2025-2033) |

| Expansion into New Vertical Markets (e.g., Robotics, Medical Imaging) | +2.0% | North America, Europe, Asia Pacific (Japan, South Korea, China) | Mid to Long-term (2027-2033) |

| Integration with 5G and Advanced Wireless Communication | +1.5% | Global, especially countries with rapid 5G rollout | Short to Mid-term (2025-2030) |

| Increased Adoption in Smart City and Smart Infrastructure Projects | +1.0% | Asia Pacific (China, India), Europe, North America | Mid to Long-term (2028-2033) |

| Growing Preference for Modular and Scalable Embedded Solutions | +0.8% | Global, especially for complex, long-lifecycle industrial systems | Short to Mid-term (2025-2031) |

Computer on Module Market Challenges Impact Analysis

The Computer on Module (CoM) market, while promising, contends with several significant challenges that could impede its growth trajectory and adoption rates. One primary hurdle is the intense competition from alternative embedded solutions, including single-board computers (SBCs) and custom-designed system-on-chips (SoCs). While CoMs offer modularity, SBCs provide a ready-to-use solution with all necessary peripherals, often at a lower entry cost, appealing to smaller projects or hobbyists. Custom SoCs, though requiring higher upfront investment and longer development cycles, offer unparalleled optimization for specific applications, potentially yielding superior performance and cost efficiencies at very high volumes. This diverse competitive landscape necessitates that CoM vendors consistently highlight the unique value proposition of modularity, scalability, and faster time-to-market to justify their positioning.

Another significant challenge stems from the complexities of thermal management and power dissipation, particularly as CoMs integrate increasingly powerful processors and accelerators within compact form factors. High-performance CoMs generate substantial heat, requiring sophisticated cooling solutions that add to the overall system design complexity, cost, and physical size. This can be particularly challenging in space-constrained or passively cooled applications, limiting the deployment of high-performance CoMs in certain environments. Furthermore, ensuring long-term product availability and support for embedded systems, which often have lifecycles spanning a decade or more, presents a unique challenge. With the rapid evolution of semiconductor technology, managing component obsolescence, ensuring backward compatibility, and providing consistent technical support over extended periods requires robust supply chain management and strategic partnerships, posing a continuous operational and financial burden on CoM manufacturers and their customers.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Competition from Alternative Embedded Solutions (SBCs, Custom SoCs) | -1.5% | Global, especially in low-volume or extremely high-volume applications | Short to Long-term (2025-2033) |

| Thermal Management and Power Dissipation Constraints | -1.0% | Global, particularly for high-performance or ruggedized applications | Mid to Long-term (2027-2033) |

| Ensuring Long-term Product Availability and Obsolescence Management | -0.8% | Global, critical for industrial, medical, and defense sectors | Mid to Long-term (2028-2033) |

| Adherence to Evolving Industry Standards and Certifications | -0.6% | Global, impacting market entry and product compliance | Short to Mid-term (2025-2030) |

| Cybersecurity Risks in Connected Embedded Systems | -0.5% | Global, critical for all connected IoT and edge applications | Short to Long-term (2025-2033) |

Computer on Module Market - Updated Report Scope

The comprehensive report on the Computer on Module market provides an in-depth analysis of market dynamics, growth drivers, restraints, opportunities, and challenges influencing the industry's trajectory from 2019 through 2033. It offers detailed insights into market sizing, segmentation across various dimensions, regional performance, and the competitive landscape, equipping stakeholders with actionable intelligence for strategic decision-making. The scope encompasses historical data, current market conditions, and future projections, including the impact of emerging technologies and macroeconomic factors.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 2.15 Billion |

| Market Forecast in 2033 | USD 4.90 Billion |

| Growth Rate | 10.5% CAGR from 2025 to 2033 |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Congatec AG, ADLINK Technology Inc., Kontron S&T AG, Advantech Co. Ltd., SECO S.p.A., Axiomtek Co. Ltd., AAEON Technology Inc., Toradex AG, Eurotech S.p.A., Digi International Inc., iBase Technology Inc., Shenzhen Myir Technology Co. Ltd., Variscite Ltd., EMAC Inc., VersaLogic Corporation, VIA Technologies Inc., Avalue Technology Inc., Phytec America LLC, Commell, Arbor Technology Corp. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

:The Computer on Module (CoM) market is extensively segmented to provide a granular understanding of its diverse components and growth avenues. This segmentation allows for targeted analysis of market dynamics, competitive landscapes, and emerging opportunities across different product types, technological architectures, and application areas. Understanding these distinct segments is crucial for businesses aiming to develop tailored strategies, identify niche markets, and optimize their product portfolios in response to evolving industry demands. The intricate layers of segmentation reflect the varied requirements of end-use industries, from high-performance industrial applications to compact consumer electronics, ensuring that the market analysis provides a comprehensive and actionable framework for stakeholders.

Detailed segmentation further illuminates the adoption trends of specific CoM form factors, processor types, and integrated functionalities, which are directly influenced by application-specific needs such as power efficiency, processing capability, and environmental resilience. For instance, the demand for CoMs in industrial automation often prioritizes ruggedness and long-term availability, while consumer electronics may emphasize miniaturization and cost-effectiveness. The report delves into each segment and its sub-segments, providing quantitative data and qualitative insights into their respective market shares, growth rates, and future projections, offering a complete panoramic view of the Computer on Module ecosystem.

- By Type:

- COM Express (Basic, Compact, Mini, Extended): Widely adopted due to standardized interfaces and scalability, catering to diverse performance needs.

- SMARC: Optimized for low-power, small-form-factor embedded applications, common in portable and IoT devices.

- Qseven: Focuses on ultra-low power consumption and compact size for mobile and battery-powered solutions.

- ETX/XTX: Legacy standards still utilized in industrial applications requiring robust and long-lifecycle support.

- COM-HPC: Next-generation standard designed for high-performance computing, servers-on-modules, and edge AI applications.

- Custom CoM: Tailored solutions for highly specific performance or form factor requirements not met by standard modules.

- By Processor Architecture:

- x86 (Intel, AMD): Dominant in high-performance computing, industrial PCs, and traditional embedded systems requiring broad software compatibility.

- ARM (Cortex-A series): Gaining significant traction for power-efficient, cost-effective solutions, prevalent in IoT, mobile, and edge AI.

- RISC-V: Emerging open-source architecture offering flexibility and customizability, attracting growing interest for specialized embedded designs.

- Others: Includes MIPS, PowerPC, and other proprietary architectures used in niche applications.

- By Application:

- Industrial Automation: Robotics, Machine Vision, Control Systems, HMI panels for manufacturing efficiency.

- Medical Devices: Imaging, Diagnostics, Patient Monitoring, surgical equipment for advanced healthcare solutions.

- Gaming and Infotainment: Arcade systems, digital signage, kiosks, and in-vehicle entertainment.

- Retail and Digital Signage: POS systems, interactive kiosks, digital displays for enhanced customer experience.

- Transportation: Automotive (infotainment, ADAS), Railway (signaling, control), Aerospace (avionics, ground support).

- Telecommunication and Networking: Edge routers, base stations, network appliances, communication infrastructure.

- Defense and Aerospace: Ruggedized systems for military vehicles, surveillance, and mission-critical applications.

- Smart Home and Building Automation: Energy management, security systems, smart appliances.

- Test and Measurement: Industrial testers, scientific instruments, data acquisition systems.

- Others: Agriculture, marine, smart agriculture, etc.

- By End-Use Industry:

- Manufacturing: For factory automation, process control, and quality inspection.

- Healthcare: For advanced medical imaging, diagnostic equipment, and patient care systems.

- Automotive: For in-vehicle infotainment, ADAS, and autonomous driving platforms.

- Energy & Utilities: For smart grid management, renewable energy systems, and infrastructure monitoring.

- Consumer Electronics: For smart appliances, gaming consoles, and personal computing devices.

- IT & Telecommunication: For network infrastructure, edge servers, and data center solutions.

- Retail: For intelligent vending machines, digital signage, and point-of-sale terminals.

- Others: Including defense, aerospace, logistics, and transportation.

- By Form Factor:

- Ultra-Small: For highly compact or wearable devices.

- Small: For space-constrained embedded systems and IoT devices.

- Medium: Versatile for various industrial and medical applications.

- Large: For high-performance computing requiring more physical space for components and cooling.

- By Thermal Management:

- Passive Cooling: Utilizes heat sinks and natural convection for low-power applications.

- Active Cooling: Employs fans or liquid cooling for high-performance modules to dissipate heat effectively.

- By Connectivity:

- Ethernet: For reliable wired network connections.

- Wi-Fi: For wireless local area networking.

- Bluetooth: For short-range wireless communication and peripheral connectivity.

- 5G/LTE: For high-speed cellular connectivity in mobile and remote applications.

- USB: For universal peripheral connections.

- PCIe: For high-speed interconnects to expansion cards.

- SATA: For storage device connectivity.

- Display Interfaces: HDMI, DisplayPort, LVDS for display output.

Regional Highlights

The global Computer on Module (CoM) market exhibits distinct regional dynamics, with certain geographies leading in adoption and innovation due to varying industrial landscapes, technological readiness, and investment in embedded systems. Understanding these regional nuances is critical for market players to tailor their strategies and prioritize market entry or expansion efforts effectively. Each region contributes uniquely to the market's overall growth, driven by specific applications, regulatory environments, and consumer preferences.

North America and Europe currently hold significant market shares, characterized by advanced industrial automation, robust R&D activities, and early adoption of cutting-edge technologies like AI and IoT. Asia Pacific, however, is projected to be the fastest-growing region, driven by rapid industrialization, burgeoning electronics manufacturing, and increasing government initiatives supporting smart city infrastructure and digitalization. Latin America and the Middle East & Africa are emerging markets, showing gradual but steady growth fueled by developing industrial sectors and increasing investment in digital transformation initiatives.

- North America: This region leads the CoM market in terms of technological innovation and early adoption, particularly in high-growth sectors such as medical devices, aerospace and defense, and advanced industrial automation. The presence of numerous key players, extensive R&D investments, and a strong focus on edge computing and AI integration are pivotal drivers. The United States and Canada are at the forefront, with robust ecosystems supporting sophisticated embedded solutions for mission-critical applications and highly regulated industries. Demand is further propelled by smart infrastructure projects and the expansion of data centers requiring compact, powerful computing solutions.

- Europe: Europe is a mature market for CoMs, characterized by a strong emphasis on industrial automation, Industry 4.0 initiatives, and automotive applications. Countries like Germany, the UK, and France are significant contributors, driven by their well-established manufacturing bases and a focus on precision engineering. The region's stringent quality standards and demand for long-life cycle products also favor the adoption of reliable CoM solutions. Furthermore, increasing investments in renewable energy infrastructure and smart city development are fueling demand for energy-efficient CoMs.

- Asia Pacific (APAC): APAC is expected to be the fastest-growing region in the CoM market, primarily driven by rapid industrialization, massive manufacturing capabilities, and burgeoning investments in IoT and smart technologies across countries like China, Japan, South Korea, and India. China's massive electronics manufacturing sector and its ambitious smart city projects contribute significantly to market expansion. Japan and South Korea lead in advanced robotics and consumer electronics, necessitating high-performance, compact CoM solutions. The region's competitive landscape and focus on cost-effective, high-volume production are shaping market trends.

- Latin America: This region is an emerging market for CoMs, experiencing gradual growth driven by increasing industrialization, infrastructure development, and growing adoption of automation in sectors like mining, agriculture, and manufacturing. Countries such as Brazil and Mexico are leading the adoption due to expanding automotive and industrial bases. While still smaller than other regions, the rising demand for digital transformation and smart solutions presents significant opportunities for CoM market penetration.

- Middle East and Africa (MEA): The MEA region is witnessing nascent but promising growth in the CoM market, primarily driven by investments in smart city projects, oil and gas automation, and the diversification of economies away from traditional sectors. Countries like UAE, Saudi Arabia, and South Africa are investing in digital infrastructure and IoT deployments, creating new avenues for CoM adoption. The need for ruggedized solutions in harsh environments further contributes to market demand in certain segments.

Top Key Players:

The market research report covers the analysis of key stake holders of the Computer on Module Market. Some of the leading players profiled in the report include -:- Congatec AG

- ADLINK Technology Inc.

- Kontron S&T AG

- Advantech Co. Ltd.

- SECO S.p.A.

- Axiomtek Co. Ltd.

- AAEON Technology Inc.

- Toradex AG

- Eurotech S.p.A.

- Digi International Inc.

- iBase Technology Inc.

- Shenzhen Myir Technology Co. Ltd.

- Variscite Ltd.

- EMAC Inc.

- VersaLogic Corporation

- VIA Technologies Inc.

- Avalue Technology Inc.

- Phytec America LLC

- Commell

- Arbor Technology Corp.

Frequently Asked Questions:

What is a Computer on Module (CoM)?

A Computer on Module (CoM) is a highly integrated, ready-to-use embedded board that contains the core components of a computer system, such as the processor, memory, and essential I/O functions. It is designed to be mounted onto a custom carrier board, which provides application-specific interfaces and connectors. This modular approach allows for faster development, reduced design complexity, and easier upgrades or replacements of the computing core without redesigning the entire system.

How does the Computer on Module market benefit from IoT and edge computing?

The Computer on Module market benefits significantly from IoT and edge computing by providing compact, powerful, and energy-efficient processing units that can handle real-time data analysis and decision-making locally. CoMs are ideal for IoT gateways, industrial controls, and smart devices that require robust performance at the network edge, minimizing latency, reducing cloud dependency, and enhancing data security. Their modularity also facilitates rapid deployment and scalability for diverse IoT applications.

What are the primary advantages of using a Computer on Module over a custom-designed board?

The primary advantages of using a Computer on Module over a custom-designed board include significantly reduced development time and costs due to pre-integrated components and standardized interfaces. CoMs offer higher flexibility for upgrades and scalability, enabling easier migration to newer processors or technologies. They also come with established software support and extended product lifecycles, which are crucial for long-term industrial and medical applications, lowering overall total cost of ownership.

Which industries are the major adopters of Computer on Modules?

Major industries adopting Computer on Modules include industrial automation, medical devices, gaming and infotainment, retail and digital signage, transportation (automotive, railway, aerospace), and telecommunication and networking. The demand is driven by the need for high-performance, reliable, and compact embedded computing solutions tailored to specific industry requirements for real-time processing, ruggedness, and long-term availability.

What is the impact of AI on the Computer on Module market?

The impact of AI on the Computer on Module market is substantial, driving demand for CoMs equipped with specialized AI accelerators like NPUs and GPUs. This enables on-device AI inference and machine learning at the edge, crucial for applications such as autonomous systems, industrial vision, and predictive maintenance. AI's integration also necessitates advances in thermal management and power efficiency for CoMs, pushing innovation in hardware and software ecosystems to support complex AI workloads.