Power Module Packaging Market

Power Module Packaging Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_702295 | Last Updated : July 31, 2025 |

Format : ![]()

![]()

![]()

![]()

Power Module Packaging Market Size

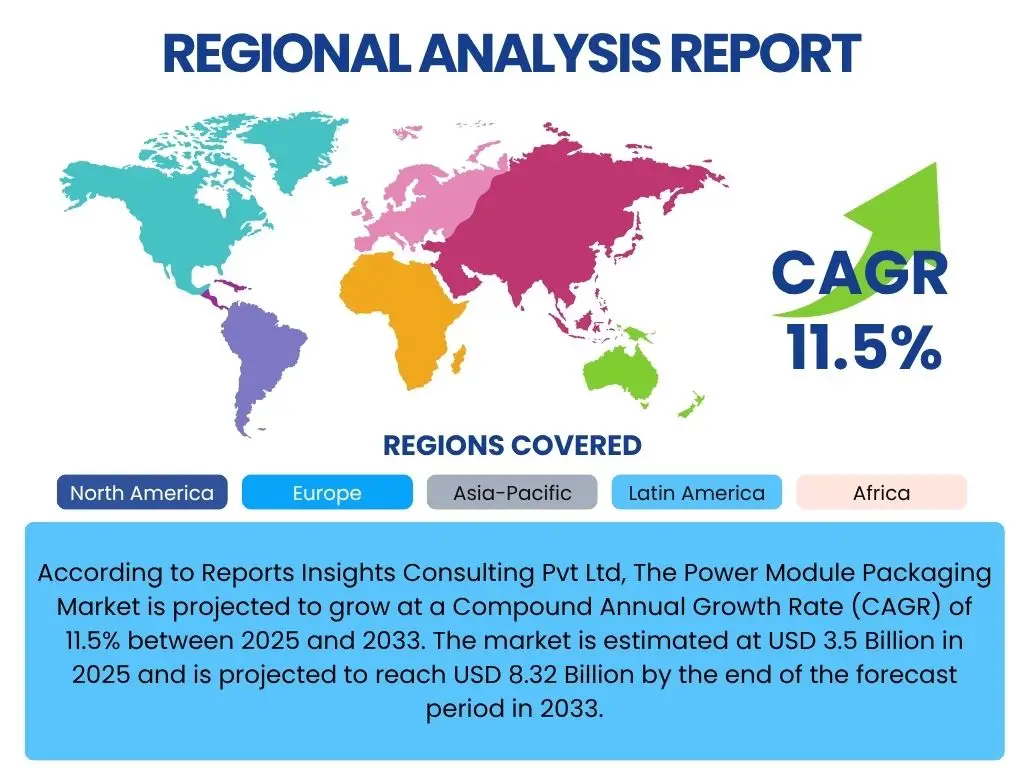

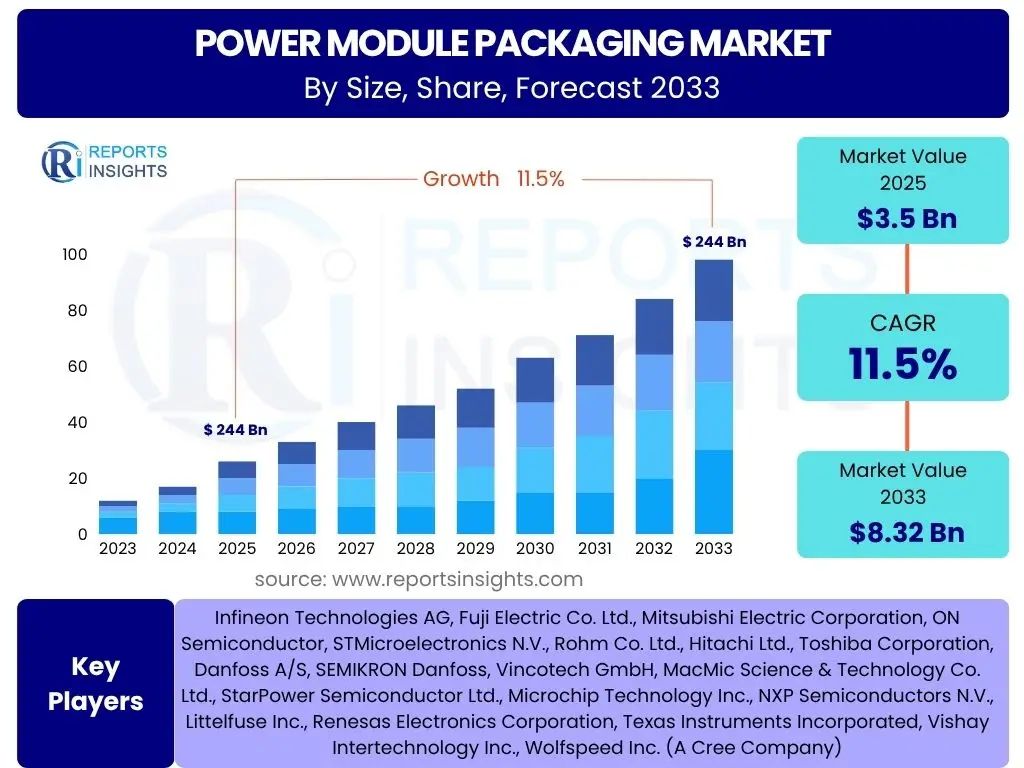

According to Reports Insights Consulting Pvt Ltd, The Power Module Packaging Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2025 and 2033. The market is estimated at USD 3.5 Billion in 2025 and is projected to reach USD 8.32 Billion by the end of the forecast period in 2033.

Key Power Module Packaging Market Trends & Insights

The Power Module Packaging market is undergoing significant transformation, driven by the escalating demand for higher power density, increased efficiency, and enhanced reliability across a multitude of applications. A prominent trend involves the widespread adoption of Wide Bandgap (WBG) semiconductors, such as Silicon Carbide (SiC) and Gallium Nitride (GaN), which necessitate novel packaging solutions capable of withstanding higher operating temperatures and switching frequencies while minimizing parasitic inductance. This shift is profoundly influencing material selection, package design, and interconnection technologies.

Furthermore, miniaturization and integration remain critical focuses, as industries strive to reduce the overall footprint and weight of power conversion systems. This involves advanced packaging techniques like 3D integration, module-level integration, and improved thermal management solutions, including liquid cooling and advanced heatsink designs. The industry is also witnessing a surge in demand for robust and long-lasting packaging, particularly in harsh environments such as those found in electric vehicles and renewable energy systems, emphasizing the importance of bond wire-less interconnections and enhanced encapsulation materials for increased durability. The growing complexity also drives the need for more sophisticated simulation and design tools that can accurately predict thermal, electrical, and mechanical performance, leading to a more holistic approach to packaging design.

- Increased adoption of Wide Bandgap (WBG) semiconductors (SiC, GaN) necessitating high-temperature packaging.

- Miniaturization and higher power density driving advanced integration techniques.

- Enhanced thermal management solutions, including liquid cooling and advanced substrates.

- Demand for increased reliability and longer lifespan in harsh operating environments.

- Transition towards bond wire-less interconnections for improved robustness.

- Growing emphasis on simulation and AI-driven design optimization.

AI Impact Analysis on Power Module Packaging

Artificial Intelligence (AI) is beginning to revolutionize various stages of the power module packaging lifecycle, from initial design and simulation to manufacturing and in-field performance monitoring. In the design phase, AI algorithms can rapidly analyze complex parameters, optimizing package layouts for thermal efficiency, electrical performance, and mechanical robustness, significantly reducing iterative design cycles and accelerating time-to-market for new power modules. This capability allows engineers to explore a much broader design space than traditional methods, identifying optimal configurations that might otherwise be overlooked and achieving designs that were previously unattainable through manual iteration.

In manufacturing, AI-powered systems are enhancing process control, quality inspection, and predictive maintenance. Machine learning models can analyze real-time production data to identify anomalies, predict equipment failures before they occur, and optimize manufacturing parameters to improve yield and reduce waste. Automated optical inspection (AOI) systems, leveraging AI, can perform highly accurate defect detection, ensuring the high reliability required for mission-critical applications by identifying microscopic flaws that human inspectors might miss, leading to superior product quality and reduced scrap rates.

Beyond manufacturing, AI contributes to the reliability and longevity of power modules in operational settings. Predictive maintenance strategies, enabled by AI, use sensor data from installed power modules to anticipate potential failures, allowing for proactive servicing and minimizing downtime. This extends the lifespan of the modules and reduces overall operational costs for end-users, thereby increasing the value proposition of advanced power module packaging solutions. The ability of AI to process vast amounts of operational data provides actionable insights into real-world performance and degradation patterns, enabling continuous improvement in future packaging designs and materials.

- AI-driven design optimization for thermal, electrical, and mechanical performance.

- Enhanced manufacturing process control and yield improvement through machine learning.

- Automated quality inspection with AI for defect detection.

- Predictive maintenance for in-field power modules, extending lifespan and reducing downtime.

- Acceleration of R&D cycles by simulating and analyzing complex packaging interactions.

Key Takeaways Power Module Packaging Market Size & Forecast

The Power Module Packaging market is poised for substantial growth, primarily driven by the global mega-trends of electrification, energy efficiency, and digitalization across diverse sectors. The increasing adoption of electric vehicles, the expansion of renewable energy infrastructure, and the growing demand for high-performance computing and industrial automation are creating unprecedented demand for advanced and reliable power module packaging solutions. The market’s trajectory underscores the critical role packaging plays in enabling the performance, reliability, and lifespan of power electronic devices, making it an indispensable component in modern power conversion systems.

A key insight is the imperative for innovation in materials and manufacturing processes to meet the stringent requirements of next-generation power semiconductors, particularly Wide Bandgap (WBG) devices. This includes the development of thermally conductive substrates, advanced interconnection technologies, and robust encapsulation materials capable of operating under extreme conditions and high power cycling. Furthermore, the market emphasizes the need for solutions that support higher power density and miniaturization without compromising thermal performance or reliability, signaling a continuous push towards integrated and compact designs that can deliver superior efficiency and extended operational life.

- Robust market growth driven by electrification in automotive, industrial, and renewable energy sectors.

- Critical role of advanced packaging in enabling performance and reliability of power modules.

- Significant demand for solutions supporting Wide Bandgap (WBG) semiconductors.

- Focus on enhanced thermal management and high-temperature material solutions.

- Continuous innovation in miniaturization and power density for compact designs.

Power Module Packaging Market Drivers Analysis

The Power Module Packaging market is experiencing significant growth, propelled by several key factors that underscore the increasing demand for sophisticated power electronic solutions across diverse industries. These drivers are fundamentally reshaping the landscape of power module design and manufacturing, pushing the boundaries of material science, thermal management, and integration capabilities. The overarching global push towards higher energy efficiency, reduced carbon emissions, and advanced technological adoption serves as the primary impetus for these market accelerants.

Innovations in power semiconductor technology, particularly the widespread commercialization of Wide Bandgap (WBG) materials, are creating a cascading effect, demanding more advanced and resilient packaging solutions. Concurrently, the burgeoning markets for electric vehicles and renewable energy systems require power modules that can operate under extreme conditions with exceptional reliability and power density. These sectors, along with the increasing automation in industrial processes, are driving the need for packaging that can ensure optimal performance and longevity of the underlying semiconductor devices, thereby significantly expanding the market for power module packaging.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Electrification of Transportation (EVs, HEVs) | +1.8% | Global (Asia Pacific, Europe, North America) | Long-term (2025-2033) |

| Growth in Renewable Energy (Solar, Wind) | +1.5% | Global (Asia Pacific, Europe) | Long-term (2025-2033) |

| Industrial Automation & Robotics Adoption | +1.2% | Global (Europe, North America, Asia Pacific) | Medium to Long-term (2025-2033) |

| Advancements in Wide Bandgap (WBG) Semiconductors | +1.7% | Global | Long-term (2025-2033) |

Power Module Packaging Market Restraints Analysis

Despite the robust growth prospects, the Power Module Packaging market faces several significant restraints that could temper its expansion. These limiting factors often stem from the inherent complexities of developing and manufacturing high-performance packaging, as well as broader economic and supply chain challenges. Addressing these restraints requires concerted efforts in research and development, supply chain optimization, and cost-efficient manufacturing innovations.

A primary concern revolves around the high costs associated with specialized materials and advanced manufacturing processes required for cutting-edge packaging solutions. Furthermore, the increasing power density and operating temperatures of modern power modules pose formidable challenges in thermal management, requiring sophisticated and often custom-engineered solutions that add to complexity and cost. Lastly, global supply chain volatility continues to present a considerable hurdle, impacting the availability and pricing of critical components and materials, which can lead to production delays and increased operational expenses for manufacturers.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Material and Manufacturing Costs | -0.8% | Global | Medium-term (2025-2029) |

| Complexity in Thermal Management Design | -0.7% | Global | Ongoing (2025-2033) |

| Supply Chain Volatility and Geopolitical Risks | -0.5% | Global | Short to Medium-term (2025-2028) |

Power Module Packaging Market Opportunities Analysis

The Power Module Packaging market is characterized by numerous burgeoning opportunities that are set to drive future innovation and market expansion. These opportunities are largely fueled by technological advancements, evolving application demands, and the continuous pursuit of higher performance and efficiency in power electronics. Strategic investments in these areas can unlock significant growth potential for market players.

One of the most promising avenues lies in the development of advanced packaging materials, including novel substrates, die-attach solutions, and encapsulation compounds, which can withstand extreme operating conditions and improve thermal conductivity. Concurrently, the increasing industry trend towards highly integrated power modules, combining multiple functionalities into single, compact packages, offers significant scope for value creation and market differentiation. Furthermore, the emergence of new high-growth applications, such as Artificial Intelligence infrastructure, advanced data centers, and 5G telecommunication networks, presents untapped markets with unique and demanding requirements for power module packaging, creating new revenue streams and fostering specialized product development.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Development of Advanced Packaging Materials | +1.0% | Global | Long-term (2025-2033) |

| Increased Demand for Integrated Power Modules | +0.9% | Global | Long-term (2025-2033) |

| Emerging Applications (AI, Data Centers, 5G) | +0.8% | Global | Medium to Long-term (2025-2033) |

Power Module Packaging Market Challenges Impact Analysis

The Power Module Packaging market, while experiencing significant growth, is not without its inherent challenges. These obstacles demand continuous innovation, robust engineering solutions, and collaborative industry efforts to overcome. Addressing these challenges is paramount for ensuring the sustained reliability, performance, and competitiveness of power module solutions in an increasingly demanding technological landscape.

A primary challenge involves ensuring long-term reliability and operational lifetime, particularly when power modules are subjected to extreme conditions such as high temperatures, repeated thermal cycling, and mechanical vibrations, common in applications like electric vehicles. Furthermore, the relentless pursuit of miniaturization and higher power density presents a complex engineering dilemma: how to effectively dissipate heat from increasingly compact designs without compromising electrical performance or mechanical integrity. Lastly, the absence of universally adopted standardization across various industries and applications creates fragmentation, which can lead to higher development costs and slower market adoption of new packaging technologies, posing a significant hurdle for manufacturers operating in diverse market segments.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Ensuring Reliability and Lifetime under Extreme Conditions | -0.7% | Global | Ongoing (2025-2033) |

| Miniaturization and Power Density Requirements | -0.6% | Global | Ongoing (2025-2033) |

| Standardization Issues Across Industries | -0.4% | Global | Medium-term (2025-2029) |

Power Module Packaging Market - Updated Report Scope

This comprehensive report provides an in-depth analysis of the Power Module Packaging Market, offering detailed insights into market dynamics, key trends, and growth opportunities from 2025 to 2033. It covers extensive segmentation based on type, material, application, and packaging technology, alongside a thorough regional analysis. The report also profiles leading market players, providing a holistic view of the competitive landscape and strategic recommendations for stakeholders.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 8.32 Billion |

| Growth Rate | 11.5% |

| Number of Pages | 250 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Infineon Technologies AG, Fuji Electric Co. Ltd., Mitsubishi Electric Corporation, ON Semiconductor, STMicroelectronics N.V., Rohm Co. Ltd., Hitachi Ltd., Toshiba Corporation, Danfoss A/S, SEMIKRON Danfoss, Vincotech GmbH, MacMic Science & Technology Co. Ltd., StarPower Semiconductor Ltd., Microchip Technology Inc., NXP Semiconductors N.V., Littelfuse Inc., Renesas Electronics Corporation, Texas Instruments Incorporated, Vishay Intertechnology Inc., Wolfspeed Inc. (A Cree Company) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Power Module Packaging market is extensively segmented to provide a granular view of its diverse components and applications. This segmentation allows for a detailed analysis of market dynamics across different product types, materials used, specific application areas, and the various packaging technologies employed. Understanding these segments is crucial for identifying specific growth drivers, emerging trends, and areas of high potential within the market, enabling stakeholders to make informed strategic decisions.

The segmentation reflects the complexity and varied requirements of power electronics across multiple industries. From the type of semiconductor device being packaged, such as IGBTs and the rapidly growing SiC and GaN modules, to the critical materials that define thermal and electrical performance, and the diverse applications ranging from electric vehicles to renewable energy systems, each segment plays a pivotal role. The report also differentiates by packaging technology, acknowledging the evolution from traditional wire bonding to more advanced sintering and direct bond copper methods, which are crucial for achieving higher power density and reliability.

- By Type: IGBT Modules, MOSFET Modules, SiC Modules, GaN Modules, Thyristor Modules, Diode Modules, Others.

- By Material: Ceramic Substrates (Al2O3, AlN, Si3N4), Metal Baseplates (Copper, Aluminum), Encapsulation Materials (Epoxy Resins, Silicone Gels), Die Attach Materials (Solder, Sintering), Bonding Wires (Aluminum, Copper).

- By Application: Automotive (EVs, HEVs, Charging Infrastructure), Industrial (Motor Drives, Robotics, UPS, Welding), Renewable Energy (Solar Inverters, Wind Turbine Converters), Consumer Electronics (Home Appliances, Power Adapters), IT & Telecommunications (Servers, Data Centers, 5G Base Stations), Aerospace & Defense, Medical Equipment.

- By Packaging Technology: Wire Bonding, Flip Chip, Sintering, Encapsulation, Direct Bond Copper (DBC), Active Metal Brazing (AMB), Liquid Cooling Integration.

Regional Highlights

- North America: A hub for technological innovation and adoption of electric vehicles. Strong presence in industrial automation and data center infrastructure drives demand for high-performance power modules. Significant investments in smart grid technologies and renewable energy further contribute to market growth.

- Europe: Characterized by robust automotive manufacturing, particularly in Germany and France, driving demand for EV-related power module packaging. Strong focus on renewable energy integration and industrial automation within the European Union fuels market expansion. Research and development in advanced materials and packaging technologies are prominent.

- Asia Pacific (APAC): The largest and fastest-growing market globally, driven by extensive manufacturing capabilities, rapid industrialization, and massive adoption of electric vehicles, especially in China. India, Japan, and South Korea are also significant contributors with growing electronics manufacturing and renewable energy sectors. APAC's dominance in consumer electronics and IT infrastructure further boosts demand.

- Latin America: An emerging market with increasing investments in infrastructure development, industrial modernization, and renewable energy projects. Though smaller in market share, the region presents growing opportunities as industrial and automotive sectors expand.

- Middle East and Africa (MEA): Gradually growing market, primarily driven by investments in energy infrastructure, including solar and wind power projects, and industrial diversification initiatives. Urbanization and development in various sectors are creating nascent opportunities for power electronics.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Power Module Packaging Market.- Infineon Technologies AG

- Fuji Electric Co. Ltd.

- Mitsubishi Electric Corporation

- ON Semiconductor

- STMicroelectronics N.V.

- Rohm Co. Ltd.

- Hitachi Ltd.

- Toshiba Corporation

- Danfoss A/S

- SEMIKRON Danfoss

- Vincotech GmbH

- MacMic Science & Technology Co. Ltd.

- StarPower Semiconductor Ltd.

- Microchip Technology Inc.

- NXP Semiconductors N.V.

- Littelfuse Inc.

- Renesas Electronics Corporation

- Texas Instruments Incorporated

- Vishay Intertechnology Inc.

- Wolfspeed Inc. (A Cree Company)

Frequently Asked Questions

Analyze common user questions about the Power Module Packaging market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Power Module Packaging?

Power module packaging refers to the protective enclosure and interconnections that house and protect power semiconductor devices, such as IGBTs, MOSFETs, and SiC/GaN devices. Its primary functions include providing electrical isolation, efficient thermal management, mechanical support, and reliable electrical connections, all critical for the optimal performance and longevity of power electronic systems in various applications.

What are the key drivers for the Power Module Packaging market growth?

The primary drivers for market growth include the escalating global demand for electric vehicles (EVs) and hybrid electric vehicles (HEVs), significant investments in renewable energy infrastructure (solar and wind power), and the rapid expansion of industrial automation and robotics. Additionally, continuous advancements in Wide Bandgap (WBG) semiconductors like SiC and GaN, which require specialized packaging, are strongly propelling market expansion.

How do advanced materials impact power module packaging?

Advanced materials significantly impact power module packaging by enabling higher performance, improved thermal management, and enhanced reliability. Materials like advanced ceramic substrates (e.g., AlN, Si3N4) offer superior thermal conductivity, while advanced die-attach materials (e.g., silver sintering) improve heat transfer and mechanical robustness. These innovations are crucial for accommodating higher power densities and operating temperatures of next-generation power semiconductors.

What are the primary challenges in Power Module Packaging?

Key challenges include ensuring long-term reliability and lifetime under extreme operating conditions such as high temperatures, thermal cycling, and vibrations. Additionally, the constant push for miniaturization and higher power density presents a complex challenge in designing effective thermal management solutions within confined spaces. Standardization across diverse industrial applications also remains a significant hurdle.

Which applications are driving demand for Power Module Packaging?

Major applications driving demand include the automotive sector, specifically electric and hybrid vehicles and their charging infrastructure. The industrial sector, encompassing motor drives, robotics, and uninterruptible power supplies, is another significant area. Renewable energy systems like solar inverters and wind turbine converters, along with high-growth emerging areas like data centers, AI infrastructure, and 5G telecommunications, are also key demand drivers.