Coal Fired Generation Market

Coal Fired Generation Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_706118 | Last Updated : August 17, 2025 |

Format : ![]()

![]()

![]()

![]()

Coal Fired Generation Market Size

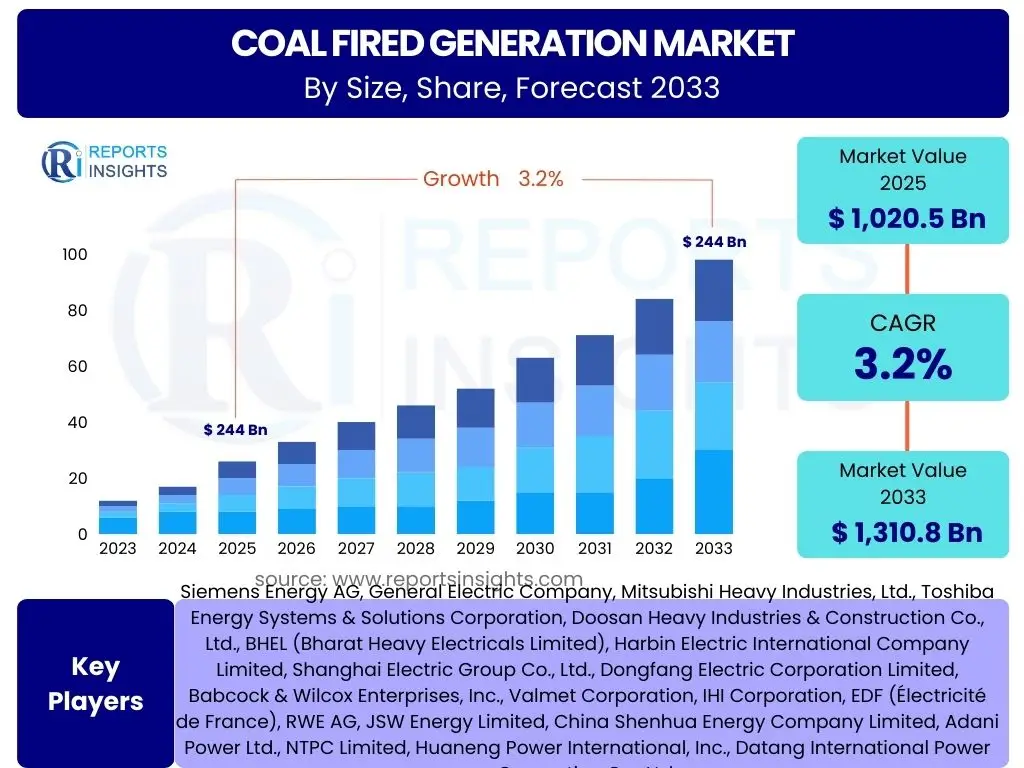

According to Reports Insights Consulting Pvt Ltd, The Coal Fired Generation Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 3.2% between 2025 and 2033. The market is estimated at USD 1,020.5 billion in 2025 and is projected to reach USD 1,310.8 billion by the end of the forecast period in 2033.

Key Coal Fired Generation Market Trends & Insights

The global coal fired generation market is characterized by a dichotomy of trends. While many developed nations are actively pursuing decarbonization strategies, leading to a gradual phase-out or reduction in coal-fired power, emerging economies continue to rely heavily on coal due to its abundance, affordability, and established infrastructure. This divergence shapes the market landscape, with significant investment in advanced combustion technologies and emissions control systems in regions where coal remains a foundational energy source. Furthermore, the imperative for energy security, especially amidst geopolitical uncertainties, can temporarily bolster the role of coal in certain national energy mixes, even as long-term environmental targets drive diversification.

Innovations in "clean coal" technologies, such as supercritical and ultra-supercritical boilers, continue to gain traction, improving efficiency and reducing specific emissions per unit of electricity generated. The integration of carbon capture, utilization, and storage (CCUS) technologies, though still economically challenging, represents a critical area of research and development aimed at mitigating the environmental impact of coal. Additionally, trends indicate a strategic focus on modernizing existing plants rather than building new ones in mature markets, optimizing their operational lifespan and environmental performance before eventual retirement. The market is also witnessing increased deployment of digital solutions for plant optimization and predictive maintenance, enhancing reliability and efficiency.

- Declining share of coal in developed economies due to environmental policies and renewable energy expansion.

- Persistent and, in some cases, increasing reliance on coal in rapidly industrializing nations, particularly in Asia.

- Advancements in high-efficiency, low-emission (HELE) coal technologies like ultra-supercritical plants.

- Growing investment in carbon capture, utilization, and storage (CCUS) projects for existing and new coal plants.

- Emphasis on modernizing and optimizing the operational efficiency of existing coal-fired power infrastructure.

- Increased integration of digital technologies and automation for improved plant performance and maintenance.

AI Impact Analysis on Coal Fired Generation

User inquiries frequently center on how artificial intelligence (AI) can potentially enhance the efficiency, safety, and environmental performance of coal fired generation, given the ongoing pressures on the industry. There is particular interest in AI's role in predictive maintenance to minimize downtime, optimize fuel consumption, and improve operational stability. Users also frequently question AI's capacity to aid in emissions monitoring and control, providing real-time data analysis for compliance and reduction strategies. The consensus among these questions is a desire to understand how AI can act as a tool for extending the viability and improving the sustainability profile of existing coal assets, rather than for promoting new installations.

AI technologies are being progressively integrated into coal-fired power plant operations, offering substantial benefits in terms of operational optimization and cost reduction. AI-powered predictive maintenance systems can analyze vast amounts of sensor data to anticipate equipment failures, allowing for proactive repairs and significantly reducing unplanned outages. This not only enhances plant reliability but also extends the lifespan of critical components. Furthermore, AI algorithms can optimize combustion processes by adjusting parameters in real-time based on coal quality and operational conditions, leading to improved fuel efficiency and reduced greenhouse gas emissions per unit of energy generated. The application of AI also extends to supply chain management, optimizing coal procurement and logistics, and to grid integration, ensuring stable power delivery in conjunction with other energy sources.

- Predictive maintenance and anomaly detection: AI algorithms analyze sensor data to forecast equipment failures, minimizing downtime and maintenance costs.

- Combustion optimization: AI systems dynamically adjust boiler parameters for enhanced fuel efficiency and reduced emissions (NOx, SOx, CO2).

- Performance monitoring and diagnostics: Real-time analysis of plant data to identify inefficiencies and optimize operational parameters.

- Emissions control and compliance: AI aids in continuous monitoring and control of pollutants, ensuring adherence to environmental regulations.

- Automated fault detection and root cause analysis: Rapid identification of operational issues, improving plant reliability and safety.

- Optimized resource allocation: AI can manage fuel inventories and operational scheduling for greater economic efficiency.

Key Takeaways Coal Fired Generation Market Size & Forecast

Common user questions regarding the coal fired generation market forecast reveal a curiosity about its long-term viability, given the global shift towards renewable energy. Users seek clarity on whether coal will maintain a significant share in the energy mix and what factors might influence its projected growth or decline. There is a strong emphasis on understanding the regional disparities in coal consumption and the impact of technological advancements and policy changes on future market dynamics. The insights derived suggest a nuanced future for coal power, where its role varies significantly by geography and is increasingly shaped by efficiency improvements and environmental mitigation efforts rather than outright expansion.

The market for coal-fired generation is entering a complex phase characterized by regional divergence. While developed nations are observing a steady decline in new coal plant construction and a focus on decommissioning older units, significant growth persists in regions like Asia Pacific due to burgeoning energy demand, economic development, and energy security concerns. The forecast indicates that despite global decarbonization efforts, coal will remain a foundational energy source for several countries through 2033, driven by its cost-effectiveness and established infrastructure. Future growth will largely be attributed to the modernization of existing fleets and the deployment of advanced clean coal technologies rather than the construction of conventional new power plants in most regions.

- Continued global reliance on coal, primarily driven by developing economies in Asia Pacific.

- Gradual decline in coal's share of the energy mix in North America and Europe.

- Focus on upgrading existing coal-fired power plants with high-efficiency, low-emission technologies.

- Significant investment in emissions control technologies and carbon capture solutions to meet environmental targets.

- Coal's role as a critical component for baseload power and grid stability in many countries.

- Market size growth underpinned by economic expansion and energy security imperatives in key regions.

Coal Fired Generation Market Drivers Analysis

The primary drivers for the coal fired generation market stem from the fundamental need for stable and affordable baseload power in rapidly industrializing economies. Coal's extensive global reserves and relatively low extraction costs make it an economically attractive option for power generation compared to other fossil fuels or even some renewable sources, especially in regions with limited access to natural gas or suitable conditions for large-scale renewable deployment. The existence of a vast, established infrastructure for coal mining, transportation, and power generation further reinforces its continued use, providing a readily available and proven energy supply capable of meeting growing electricity demand.

Beyond economic considerations, energy security plays a crucial role in maintaining the market for coal-fired generation. Many nations view a diversified energy mix, including a significant portion of domestic coal, as essential for national energy independence and resilience against geopolitical supply disruptions. Furthermore, the inherent dispatchability of coal-fired power plants ensures a reliable and continuous power supply, which is critical for supporting industrial growth and maintaining grid stability, particularly when integrated with intermittent renewable energy sources. This combination of affordability, abundance, established infrastructure, and energy security concerns continues to underpin the demand for coal-fired electricity in various parts of the world.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Affordability and Abundance of Coal Resources | +0.8% | Asia Pacific, parts of Africa, South Asia | 2025-2033 (Long-term) |

| Growing Energy Demand in Emerging Economies | +1.1% | China, India, Southeast Asia, South Africa | 2025-2030 (Medium-term) |

| Energy Security and Baseload Power Needs | +0.7% | Global, especially nations with limited alternative resources | 2025-2033 (Long-term) |

| Established Infrastructure and Lower Capital Investment for Expansion | +0.5% | Global, particularly in regions with existing facilities | 2025-2028 (Short-term) |

Coal Fired Generation Market Restraints Analysis

The coal fired generation market faces significant restraints primarily driven by global environmental concerns and increasingly stringent regulatory frameworks. The consensus among scientific bodies regarding coal's substantial contribution to greenhouse gas emissions, particularly carbon dioxide, has led to immense pressure for its reduction and eventual phase-out. Governments worldwide are implementing stricter emission standards for air pollutants, carbon pricing mechanisms, and mandates for renewable energy adoption, making new coal plant construction more challenging and economically unfeasible in many regions. These policies not only increase the operational costs of coal plants but also create an unfavorable investment climate for new projects.

Beyond regulatory hurdles, the escalating competition from rapidly maturing and cost-effective renewable energy sources poses a significant restraint. Solar photovoltaic and wind power technologies have witnessed dramatic cost reductions, making them increasingly competitive alternatives for new power generation capacity, often without the associated environmental liabilities of coal. Public opposition and shifting societal preferences towards cleaner energy also contribute to a negative perception of coal, impacting financing opportunities and political support. This combination of environmental pressure, regulatory burden, and market competition creates substantial headwinds for the expansion and even continued operation of coal-fired generation facilities, particularly in developed nations.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Stringent Environmental Regulations and Emission Standards | -1.5% | North America, Europe, parts of Asia | 2025-2033 (Long-term) |

| Increasing Competition from Renewable Energy Sources | -1.2% | Global, particularly developed and rapidly developing economies | 2025-2033 (Long-term) |

| Growing Public Opposition and Negative Perception | -0.9% | Global, particularly in democratic nations | 2025-2030 (Medium-term) |

| Carbon Pricing Mechanisms and Taxation | -0.7% | Europe, Canada, parts of Asia, Australia | 2025-2033 (Long-term) |

Coal Fired Generation Market Opportunities Analysis

Despite significant headwinds, the coal fired generation market presents distinct opportunities, primarily centered around technological innovation and strategic adaptation. A major avenue for growth lies in the widespread adoption and advancement of Carbon Capture, Utilization, and Storage (CCUS) technologies. As global climate targets become more ambitious, CCUS offers a pathway for coal-fired power plants to significantly reduce their carbon footprint, potentially allowing them to continue operating in a carbon-constrained world. Investment in research and development for more efficient and cost-effective CCUS solutions could unlock new possibilities for the industry, transforming coal from a high-emission source into a more environmentally compatible baseload power option.

Another key opportunity resides in the modernization and retrofitting of existing coal plants with High-Efficiency, Low-Emission (HELE) technologies. Upgrading older, less efficient units to ultra-supercritical or even advanced ultra-supercritical parameters can substantially improve thermal efficiency, reduce fuel consumption, and lower specific pollutant emissions, thereby extending their operational lifespan and improving their environmental profile. Furthermore, the integration of coal-fired plants within a smart grid framework, leveraging digital solutions for optimization and incorporating co-firing options with biomass or other alternative fuels, presents avenues for enhanced flexibility, reduced carbon intensity, and improved economic viability. The growing energy demand in developing nations, coupled with the need for stable baseload power, also creates opportunities for the deployment of advanced coal technologies where renewables alone cannot meet all energy needs.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Development and Deployment of Carbon Capture, Utilization, and Storage (CCUS) | +1.0% | Global, particularly developed economies and large emitters | 2027-2033 (Long-term) |

| Modernization and Retrofitting of Existing Plants with HELE Technologies | +0.9% | Global, especially China, India, Southeast Asia | 2025-2030 (Medium-term) |

| Growing Energy Demand in Developing Economies | +1.2% | Asia Pacific, parts of Africa, Latin America | 2025-2033 (Long-term) |

| Co-firing with Biomass or Other Alternative Fuels | +0.7% | Europe, North America, Southeast Asia | 2025-2030 (Medium-term) |

Coal Fired Generation Market Challenges Impact Analysis

The coal fired generation market faces several formidable challenges that impede its growth and sustainability. One significant challenge is the substantial capital expenditure required for building new, highly efficient, and environmentally compliant coal power plants. Modern coal technologies, especially those incorporating advanced emissions controls and carbon capture, involve immense upfront costs, making them less attractive compared to increasingly cheaper renewable energy alternatives. Furthermore, the long lead times and complex permitting processes associated with such large-scale projects often deter potential investors, creating a difficult financial environment for expansion.

Beyond financial hurdles, the industry grapples with a pervasive negative public perception and increasing social opposition. The association of coal with air pollution, climate change, and health issues has led to widespread public and activist campaigns, influencing policy decisions and making it difficult to secure social license for new projects or even maintain existing operations. Geopolitical shifts, such as fluctuating fuel prices, trade disputes, and international climate agreements, also introduce volatility and uncertainty into the market, impacting long-term planning and investment decisions. Navigating these multifaceted challenges requires innovative solutions, significant policy support, and a strategic re-evaluation of coal's role within the broader energy transition landscape.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Capital Investment and Financing Difficulties | -1.3% | Global, particularly developed nations | 2025-2033 (Long-term) |

| Adverse Public Perception and Social Opposition | -1.1% | Global, particularly in politically active regions | 2025-2030 (Medium-term) |

| Geopolitical Instability and Volatility in Fuel Prices | -0.8% | Global | 2025-2028 (Short-term) |

| Integration Challenges with Intermittent Renewable Energy Sources | -0.6% | Global, particularly countries with high renewable penetration | 2025-2033 (Long-term) |

Coal Fired Generation Market - Updated Report Scope

This comprehensive market report provides an in-depth analysis of the global Coal Fired Generation Market, covering historical data, current market dynamics, and future projections. The scope encompasses market size estimations, growth forecasts, key trends, drivers, restraints, opportunities, and challenges influencing the industry from 2025 to 2033. The report also details the impact of emerging technologies like Artificial Intelligence, outlines a robust segmentation analysis by boiler type, technology, and capacity, and provides a thorough regional breakdown. Furthermore, it profiles leading market players, offering valuable insights for stakeholders to navigate the evolving energy landscape.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 1,020.5 billion |

| Market Forecast in 2033 | USD 1,310.8 billion |

| Growth Rate | 3.2% |

| Number of Pages | 250 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Siemens Energy AG, General Electric Company, Mitsubishi Heavy Industries, Ltd., Toshiba Energy Systems & Solutions Corporation, Doosan Heavy Industries & Construction Co., Ltd., BHEL (Bharat Heavy Electricals Limited), Harbin Electric International Company Limited, Shanghai Electric Group Co., Ltd., Dongfang Electric Corporation Limited, Babcock & Wilcox Enterprises, Inc., Valmet Corporation, IHI Corporation, EDF (Électricité de France), RWE AG, JSW Energy Limited, China Shenhua Energy Company Limited, Adani Power Ltd., NTPC Limited, Huaneng Power International, Inc., Datang International Power Generation Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The coal fired generation market is comprehensively segmented to provide granular insights into its diverse operational and technological facets. These segmentations allow for a detailed understanding of market dynamics across various plant configurations, technological advancements, and power generation capacities. Analyzing the market by boiler type reveals the dominance of pulverized coal (PC) technologies, especially the highly efficient supercritical and ultra-supercritical variants, which represent the forefront of modern coal combustion for reduced emissions and improved efficiency. Fluidized bed combustion (FBC) boilers, known for their fuel flexibility and lower NOx/SOx emissions, also constitute a significant segment.

Further segmentation by technology differentiates between conventional coal-fired power plants, which remain the backbone of the industry, and advanced concepts like Integrated Gasification Combined Cycle (IGCC), offering higher efficiency and potential for carbon capture integration. Capacity-based segmentation provides insight into the size and scale of operational units, from smaller industrial plants to large-scale utility power stations providing baseload electricity. Lastly, an application-based segmentation distinguishes between power plants primarily serving baseload electricity needs, those for peaking power, and specific industrial applications, illustrating the varied roles coal continues to play in global energy systems.

- By Boiler Type:

- Pulverized Coal (PC) Boilers

- Subcritical

- Supercritical

- Ultra-Supercritical

- Fluidized Bed Combustion (FBC) Boilers

- Circulating FBC (CFBC)

- Bubbling FBC (BFBC)

- Pulverized Coal (PC) Boilers

- By Technology:

- Conventional Coal-Fired Power Plants

- Integrated Gasification Combined Cycle (IGCC)

- By Capacity:

- Up to 300 MW

- 301 MW - 600 MW

- Above 600 MW

- By Application:

- Baseload Power Generation

- Peaking Power Generation

- Industrial Use (e.g., Cement, Steel, Chemical Industries)

Regional Highlights

- Asia Pacific (APAC): Dominates the global coal fired generation market, driven by robust industrialization, urbanization, and a continuous surge in energy demand from countries like China, India, Indonesia, and Vietnam. While China is also investing heavily in renewables, it continues to operate and build highly efficient coal plants to meet baseload requirements. India's energy landscape is heavily reliant on coal, with significant planned capacity additions to support economic growth.

- North America: Experiencing a notable decline in coal fired generation due to stringent environmental regulations, competitive natural gas prices, and increasing renewable energy penetration. Focus remains on decommissioning older plants and modernizing select efficient units, with limited new construction.

- Europe: Undergoing a rapid transition away from coal, with many countries committed to phased coal power plant closures by specific deadlines. Policies like the EU Emissions Trading System (ETS) make coal-fired generation increasingly uneconomical, pushing investment towards renewables and gas.

- Middle East & Africa (MEA): Shows mixed trends. While some countries are exploring coal as an affordable energy source to meet growing demand and diversify away from oil and gas (e.g., South Africa, Egypt), others are prioritizing solar and wind. Challenges here include financing and environmental concerns.

- Latin America: A relatively smaller market for coal-fired generation compared to Asia Pacific, with diverse energy mixes across countries. Brazil, Chile, and Colombia have some operational coal plants, but there's a growing shift towards hydropower and other renewables, limiting coal expansion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Coal Fired Generation Market.- Siemens Energy AG

- General Electric Company

- Mitsubishi Heavy Industries, Ltd.

- Toshiba Energy Systems & Solutions Corporation

- Doosan Heavy Industries & Construction Co., Ltd.

- BHEL (Bharat Heavy Electrical Limited)

- Harbin Electric International Company Limited

- Shanghai Electric Group Co., Ltd.

- Dongfang Electric Corporation Limited

- Babcock & Wilcox Enterprises, Inc.

- Valmet Corporation

- IHI Corporation

- EDF (Électricité de France)

- RWE AG

- JSW Energy Limited

- China Shenhua Energy Company Limited

- Adani Power Ltd.

- NTPC Limited

- Huaneng Power International, Inc.

- Datang International Power Generation Co., Ltd.

Frequently Asked Questions

What is the projected growth rate for the Coal Fired Generation Market?

The Coal Fired Generation Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 3.2% between 2025 and 2033.

Which regions are driving the growth in coal fired generation?

The primary driver for growth in coal fired generation is the Asia Pacific region, particularly countries like China, India, and Southeast Asian nations, due to their increasing energy demand and reliance on coal for baseload power.

How are environmental concerns impacting the coal fired generation market?

Environmental concerns are a significant restraint, leading to stricter regulations, carbon pricing, and a shift towards renewables in developed nations. However, opportunities exist in carbon capture technologies and the modernization of existing plants to reduce emissions.

What role does technology, specifically AI, play in coal power plants?

AI is increasingly used in coal power plants for predictive maintenance, optimizing combustion efficiency, monitoring emissions, and improving overall operational reliability and safety, aiming to extend the lifespan and enhance the environmental performance of existing assets.

Will coal-fired power still be relevant in the long term, given the rise of renewables?

While the share of coal in the global energy mix is expected to decline in many regions, it will remain relevant in the long term, especially in developing economies, as a crucial source of baseload power and energy security, with a focus on high-efficiency and low-emission technologies.