Coal Tar Pitch Market

Coal Tar Pitch Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_705134 | Last Updated : August 11, 2025 |

Format : ![]()

![]()

![]()

![]()

Coal Tar Pitch Market Size

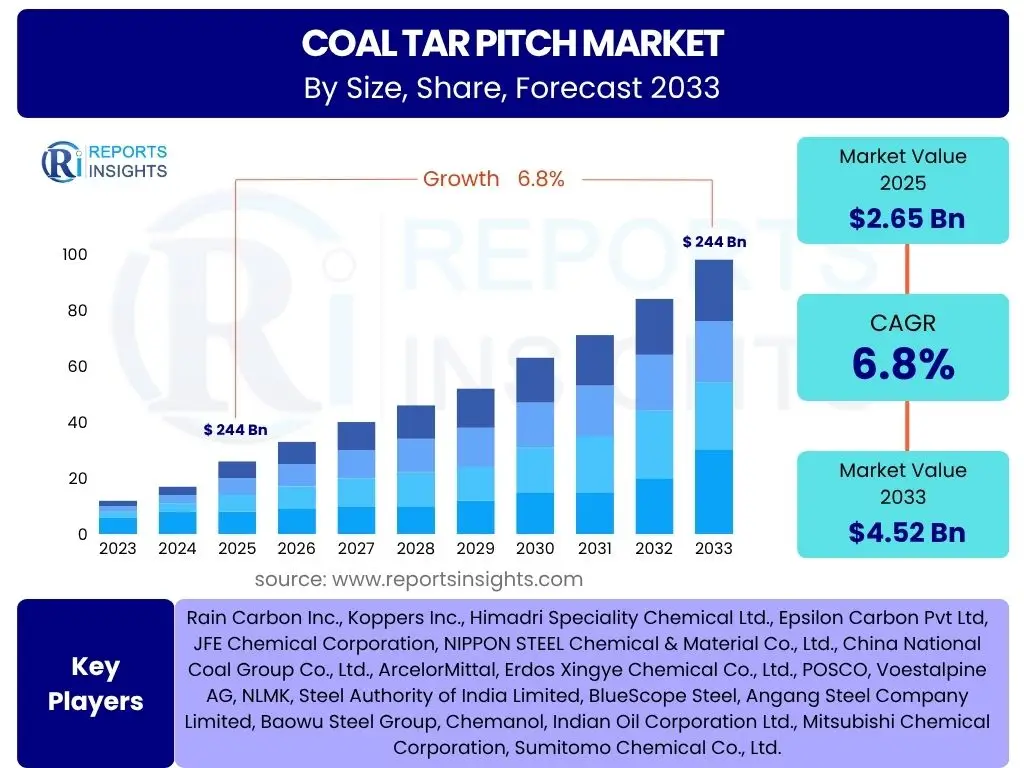

According to Reports Insights Consulting Pvt Ltd, The Coal Tar Pitch Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2033. The market is estimated at USD 2.65 Billion in 2025 and is projected to reach USD 4.52 Billion by the end of the forecast period in 2033.

Key Coal Tar Pitch Market Trends & Insights

The Coal Tar Pitch (CTP) market is currently shaped by several evolving dynamics, reflecting shifts in industrial demands, environmental consciousness, and technological advancements. Key user inquiries frequently center on the increasing adoption of CTP in advanced material applications, the impact of sustainability initiatives on its production and usage, and the emergence of new processing technologies. There is a strong interest in understanding how global economic growth, particularly in developing nations, will sustain or accelerate demand for CTP derivatives in critical sectors. Additionally, the market is witnessing a trend towards specialized CTP grades that offer enhanced performance and reduced environmental footprint, catering to niche applications and stringent regulatory requirements.

Market insights suggest a sustained demand from traditional end-use industries like aluminum and steel, coupled with burgeoning opportunities in high-performance materials. The ongoing global push for lightweighting in transportation and renewable energy infrastructure further drives innovation in carbon materials derived from CTP. Furthermore, efforts to optimize production processes for higher yield and purity are becoming paramount, ensuring a stable supply of high-quality CTP to diverse markets. The industry is also observing a consolidation among key players to achieve economies of scale and enhance supply chain resilience.

- Growing demand for aluminum across various industries including automotive and aerospace.

- Expansion of global infrastructure projects driving demand for refractories and construction materials.

- Increased focus on lightweight and high-performance carbon materials.

- Technological advancements in CTP refining for specialized applications.

- Regulatory pressures leading to development of low-emission and eco-friendly CTP variants.

AI Impact Analysis on Coal Tar Pitch

User questions regarding the impact of Artificial Intelligence (AI) on the Coal Tar Pitch (CTP) market often revolve around its potential to optimize production efficiency, enhance product quality, and revolutionize supply chain management. Stakeholders are keen to understand how AI-driven analytics can predict market fluctuations, manage raw material sourcing more effectively, and streamline logistical operations to reduce costs and improve responsiveness. The integration of AI is expected to transform traditional CTP manufacturing processes by enabling more precise control over chemical reactions and material properties, leading to higher-grade products.

AI's influence is anticipated across the entire CTP value chain, from raw material procurement to end-product distribution. In manufacturing, AI algorithms can monitor production parameters in real-time, predict equipment failures, and optimize energy consumption, leading to significant operational savings. Furthermore, AI's capability in data analysis can accelerate research and development efforts for novel CTP applications or modified pitch formulations, addressing evolving market needs and environmental concerns. While the initial adoption might require substantial investment in digital infrastructure and skilled personnel, the long-term benefits in terms of efficiency, quality, and market adaptability are projected to be substantial.

- Optimized production processes through predictive maintenance and real-time parameter control.

- Enhanced quality control and consistency in CTP grades via machine learning algorithms.

- Improved supply chain efficiency and logistics management using AI-driven forecasting.

- Accelerated research and development for new CTP derivatives and applications.

- Reduced operational costs and energy consumption in manufacturing facilities.

Key Takeaways Coal Tar Pitch Market Size & Forecast

The Coal Tar Pitch (CTP) market exhibits robust growth prospects, primarily driven by sustained demand from the global aluminum industry and the expansion of infrastructure projects. Key user queries often focus on the critical factors influencing this growth, the dominant regional markets, and the most impactful applications. The market forecast indicates a steady upward trajectory, underpinned by industrialization in emerging economies and the continuous need for high-performance carbon-based materials. Despite potential challenges related to environmental regulations and raw material price volatility, the fundamental demand drivers remain strong, positioning CTP as an indispensable industrial binder.

A significant takeaway is the increasing emphasis on specialized and high-purity CTP grades, which command premium pricing and cater to advanced applications such as graphite electrodes and specialty carbon fibers. Asia Pacific is poised to remain the largest and fastest-growing market due to its extensive industrial base and ongoing development initiatives. The market's resilience is also attributed to innovation in manufacturing processes aimed at reducing emissions and improving product sustainability, aligning with global environmental objectives. Strategic partnerships and investments in R&D are crucial for companies seeking to capitalize on emerging opportunities and navigate the evolving regulatory landscape.

- Stable growth driven by the expansion of primary aluminum production globally.

- Strong demand from the construction and infrastructure sectors for roofing and road materials.

- Asia Pacific retains its position as the leading market due to rapid industrialization.

- Innovation in CTP grades for advanced material applications presents significant opportunities.

- Regulatory compliance and sustainability initiatives are critical factors influencing market strategy.

Coal Tar Pitch Market Drivers Analysis

The Coal Tar Pitch (CTP) market is primarily propelled by the burgeoning demand from the global aluminum industry, where CTP serves as a crucial binder in the production of carbon anodes. As global aluminum production continues to expand, driven by its versatile applications in construction, automotive, and packaging sectors, the demand for high-quality CTP directly correlates. The efficiency and environmental performance of aluminum smelters are heavily reliant on the quality of their carbon anodes, ensuring sustained high demand for CTP.

Beyond aluminum, the expansion of the steel and graphite electrode industries also acts as a significant driver. CTP is essential in manufacturing graphite electrodes, which are critical for electric arc furnaces in steel production. Furthermore, extensive infrastructure development projects worldwide, particularly in emerging economies, fuel the demand for CTP in applications such as roofing, road construction (as a binder in asphalt), and refractories, underscoring its foundational role in industrial growth and urbanization.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growth in Aluminum Smelting Industry | +2.5% | Asia Pacific, Middle East, North America | Short to Medium-Term (2025-2030) |

| Expanding Infrastructure & Construction Activities | +1.8% | Asia Pacific, Latin America, Africa | Medium to Long-Term (2025-2033) |

| Increasing Demand for Graphite Electrodes | +1.5% | China, India, Europe | Short to Medium-Term (2025-2030) |

| Rise in Specialty Carbon and Refractory Production | +1.0% | Global, particularly Industrial Hubs | Medium-Term (2027-2033) |

| Urbanization and Industrialization in Emerging Economies | +1.2% | China, India, Southeast Asia | Long-Term (2028-2033) |

Coal Tar Pitch Market Restraints Analysis

The Coal Tar Pitch (CTP) market faces significant restraints primarily due to increasingly stringent environmental regulations concerning polycyclic aromatic hydrocarbons (PAHs) and other volatile organic compounds (VOCs) associated with its production and use. These regulations, particularly in developed regions, necessitate substantial investments in emission control technologies and often lead to increased operational costs, thereby impacting the competitiveness and availability of certain CTP grades. The health and safety concerns for workers exposed to CTP also contribute to regulatory scrutiny, driving up compliance expenses and potentially limiting market expansion.

Another prominent restraint is the volatility of raw material prices, specifically coal tar, which is a byproduct of the coking process. Fluctuations in coal and steel production directly affect coal tar availability and pricing, subsequently influencing CTP production costs and market stability. The emergence of alternative binders or materials in specific applications, driven by sustainability goals or performance enhancements, also poses a long-term threat to CTP's market share, compelling manufacturers to innovate or face potential displacement in certain segments.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Stringent Environmental Regulations (PAHs) | -1.2% | Europe, North America, Japan | Medium to Long-Term (2025-2033) |

| Volatile Raw Material Prices (Coal Tar) | -0.8% | Global | Short to Medium-Term (2025-2030) |

| Availability of Substitute Materials | -0.6% | Developed Economies | Long-Term (2028-2033) |

| Health and Safety Concerns for Workers | -0.5% | Global, particularly Regulated Markets | Short to Medium-Term (2025-2030) |

Coal Tar Pitch Market Opportunities Analysis

Significant opportunities exist in the Coal Tar Pitch (CTP) market through the development of modified and low-emission CTP grades. Manufacturers are increasingly investing in research and development to produce CTP variants with reduced PAH content and improved binding properties, aligning with stricter environmental standards and demand for higher performance materials. These advanced CTP formulations can open doors to new applications or help retain market share in traditional segments where environmental compliance is paramount, offering a competitive edge.

Moreover, the burgeoning market for advanced carbon materials, including carbon fibers, composites, and energy storage solutions (like anode materials for lithium-ion batteries), presents substantial growth avenues for specialized CTP derivatives. As industries pivot towards lightweighting and enhanced material performance, the unique properties of CTP can be leveraged to create innovative products. The expansion into developing economies, particularly in Asia Pacific, also offers considerable market penetration opportunities, driven by industrialization and infrastructure development requiring fundamental materials like CTP.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Development of Modified and Low-Emission CTP | +1.5% | Europe, North America, Japan | Medium to Long-Term (2027-2033) |

| Emerging Applications in Advanced Materials & Energy Storage | +1.3% | Global, especially Technology Hubs | Long-Term (2028-2033) |

| Expansion into Developing Economies | +1.0% | Asia Pacific, Latin America, Africa | Short to Medium-Term (2025-2030) |

| Circular Economy & Recycling Initiatives | +0.7% | Europe, North America | Medium to Long-Term (2027-2033) |

Coal Tar Pitch Market Challenges Impact Analysis

The Coal Tar Pitch (CTP) market faces significant challenges from increasingly stringent regulatory compliance requirements, particularly concerning environmental emissions and worker safety. Adhering to these evolving global standards, such as those related to polycyclic aromatic hydrocarbons (PAHs), demands substantial investments in advanced pollution control technologies and operational modifications, which can escalate production costs and potentially reduce profit margins. Failure to comply can lead to hefty fines, operational shutdowns, and reputational damage, posing a continuous hurdle for market players.

Another critical challenge is the potential for supply chain disruptions, influenced by geopolitical tensions, trade disputes, and unforeseen global events like pandemics. As coal tar is a byproduct of the steel industry, any instability in steel production or international trade policies directly impacts the availability and cost of the primary raw material for CTP. Furthermore, the long-term threat of technological obsolescence from alternative binding agents or new material discoveries in CTP's core applications could gradually erode market share, necessitating continuous innovation and diversification from CTP manufacturers.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Heightened Regulatory Compliance Burden | -1.0% | Global, particularly Developed Markets | Short to Medium-Term (2025-2030) |

| Potential for Supply Chain Disruptions | -0.9% | Global | Short-Term (2025-2027) |

| Shifting Public Perception & Health Concerns | -0.7% | Europe, North America | Medium to Long-Term (2027-2033) |

| Risk of Technological Obsolescence | -0.5% | Global | Long-Term (2028-2033) |

Coal Tar Pitch Market - Updated Report Scope

This comprehensive market report provides an in-depth analysis of the Coal Tar Pitch (CTP) market, offering a detailed segmentation by grade, application, and end-use industry, alongside a thorough regional breakdown. The scope covers historical trends from 2019 to 2023 and provides a robust forecast from 2025 to 2033, quantifying market size, growth rate, and key influencing factors. It further includes an exhaustive competitive landscape analysis, identifying key players, their strategies, and market positioning. The report's insights are crucial for stakeholders seeking to understand market dynamics, identify growth opportunities, and formulate informed business strategies in the evolving CTP industry.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 2.65 Billion |

| Market Forecast in 2033 | USD 4.52 Billion |

| Growth Rate | 6.8% |

| Number of Pages | 247 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Rain Carbon Inc., Koppers Inc., Himadri Speciality Chemical Ltd., Epsilon Carbon Pvt Ltd, JFE Chemical Corporation, NIPPON STEEL Chemical & Material Co., Ltd., China National Coal Group Co., Ltd., ArcelorMittal, Erdos Xingye Chemical Co., Ltd., POSCO, Voestalpine AG, NLMK, Steel Authority of India Limited, BlueScope Steel, Angang Steel Company Limited, Baowu Steel Group, Chemanol, Indian Oil Corporation Ltd., Mitsubishi Chemical Corporation, Sumitomo Chemical Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Coal Tar Pitch (CTP) market is extensively segmented based on its diverse grades, a wide array of applications, and the various end-use industries that leverage its unique properties. This granular segmentation provides a detailed understanding of the market's structure, allowing for precise analysis of demand patterns, growth drivers, and specific market opportunities within each category. The varying technical specifications and performance requirements for different CTP grades directly influence their suitability for distinct applications and ultimately impact their market value and growth trajectory across different industrial sectors.

Understanding these segments is crucial for market participants to identify lucrative niches, develop targeted products, and optimize their supply chain strategies. For instance, the Anode Grade CTP, which dominates the market, is meticulously produced to meet the stringent purity and binding characteristics required for aluminum smelting. Similarly, the diverse applications of CTP, ranging from heavy industrial processes like steelmaking to specialized uses in advanced materials, underscore its versatility and integral role in modern manufacturing, necessitating a comprehensive breakdown of each category to capture the full market landscape.

- By Grade

- Anode Grade: Primarily used as a binder for pre-baked carbon anodes in aluminum smelting, critical for electrochemical reduction processes due to its high carbon content and strong binding properties.

- Impregnating Grade: Utilized for impregnating graphite electrodes, specialty graphites, and carbon materials to enhance their density, strength, and electrical conductivity, improving overall performance.

- Binder Grade: Employed in the production of various carbon products, including refractory bricks, carbon blocks, and friction materials, where its adhesive and carbonizing characteristics are essential.

- Refractory Grade: Tailored for high-temperature applications in refractory linings and bricks, providing excellent binding and thermal stability in furnaces and kilns.

- Special Grade: Customized CTP formulations designed for niche applications such as advanced composites, energy storage components, and other high-performance materials requiring specific chemical and physical properties.

- By Application

- Aluminum Smelting: The largest application segment, where CTP acts as a binder for carbon anodes used in the Hall-Héroult process for primary aluminum production.

- Graphite Electrodes: Essential for binding carbonaceous raw materials in the manufacture of graphite electrodes, crucial for electric arc furnaces in the steel industry.

- Refractories: Used as a binder in the production of high-temperature resistant refractory materials, including bricks and monolithic linings for industrial furnaces.

- Roofing: Employed in the construction industry as a waterproofing agent and adhesive in built-up roofing systems due to its excellent sealing and weather-resistant properties.

- Carbon Black Production: Used as a feedstock in the production of certain types of carbon black, which is then used in tires, pigments, and other rubber products.

- Paving & Coatings: Incorporated into road paving materials and protective coatings to enhance durability, water resistance, and adhesion.

- Other Industrial Applications: Includes uses in friction materials, sealants, anti-corrosive coatings, and as a raw material for specialty chemicals.

- By End-Use Industry

- Metallurgy: Encompasses the primary aluminum and steel industries, as well as foundries, where CTP is integral to electrode and refractory production.

- Building & Construction: Relates to roofing, paving, and sealant applications that leverage CTP's binding and waterproofing capabilities in infrastructure development.

- Chemical: Involves the use of CTP as a feedstock for producing advanced carbon materials, carbon fibers, and other specialty chemicals.

- Automotive & Transportation: Indirectly benefits from CTP through its use in lightweight carbon composites, tires, and advanced brake materials.

- Electrical & Electronics: Utilizes CTP derivatives in specialized graphite components for various electrical and electronic applications.

- Energy: Emerging applications in energy storage solutions, such as anode materials for batteries, and components for fuel cells.

- Others: Includes aerospace, industrial manufacturing, and other sectors requiring high-performance carbonaceous materials.

Regional Highlights

- Asia Pacific: This region dominates the Coal Tar Pitch market, primarily driven by the colossal industrial growth in countries like China and India. These nations are major producers of aluminum and steel, which directly fuels the demand for CTP as a binder for carbon anodes and graphite electrodes. Rapid urbanization, extensive infrastructure projects, and a burgeoning manufacturing sector further contribute to the region's market leadership. The presence of numerous CTP manufacturers and robust supply chains also strengthens its position.

- North America: The North American market for Coal Tar Pitch is characterized by stable demand from established aluminum and steel industries. While not experiencing the explosive growth seen in Asia Pacific, the region focuses on high-quality CTP grades and compliance with stringent environmental regulations. The emphasis is on developing and utilizing CTP with reduced polycyclic aromatic hydrocarbon (PAH) content and improved performance characteristics, catering to advanced industrial processes.

- Europe: Europe represents a mature but technologically advanced market for Coal Tar Pitch. The region is at the forefront of implementing strict environmental regulations concerning CTP production and emissions, which drives the development of eco-friendly and high-performance CTP variants. Demand primarily stems from the established aluminum, steel, and specialty graphite industries, which prioritize product quality, consistency, and compliance.

- Latin America: The Coal Tar Pitch market in Latin America is experiencing gradual growth, primarily influenced by expanding industrial activities and infrastructure development in key countries like Brazil and Mexico. The region's increasing primary aluminum and steel production capacities are directly impacting the demand for CTP. While regulatory frameworks are developing, there is a growing awareness of environmental concerns, which may influence future market dynamics.

- Middle East and Africa (MEA): The MEA region exhibits significant potential for CTP market growth, largely driven by substantial investments in aluminum smelters, particularly in the Gulf Cooperation Council (GCC) countries. These investments aim to diversify economies away from oil and gas, creating a strong demand for essential industrial raw materials like CTP. Infrastructure expansion and industrialization efforts across various African nations are also contributing to a rising, albeit nascent, demand for CTP in construction and other industrial applications.

The continued industrialization in Southeast Asian countries, coupled with significant investments in metal production and construction, ensures sustained demand. Moreover, the region is a hub for chemical manufacturing and the production of advanced carbon materials, creating additional avenues for CTP consumption beyond traditional applications. Environmental regulations are becoming stricter, pushing for innovation in cleaner production methods and lower-emission CTP grades, while still maintaining high output volumes.

Innovation in carbon materials and a steady need for infrastructure maintenance also contribute to demand. The market here is driven by technological advancements aimed at increasing efficiency and reducing the environmental footprint of CTP production and utilization, often through collaboration between manufacturers and end-users to meet specific industrial requirements.

European manufacturers are heavily invested in R&D to optimize CTP properties for enhanced efficiency and sustainability, exploring its potential in new applications such as advanced composites and energy solutions. The market is also influenced by circular economy initiatives, with a growing interest in sustainable sourcing and waste reduction in CTP-related industries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Coal Tar Pitch Market.- Rain Carbon Inc.

- Koppers Inc.

- Himadri Speciality Chemical Ltd.

- Epsilon Carbon Pvt Ltd

- JFE Chemical Corporation

- NIPPON STEEL Chemical & Material Co., Ltd.

- China National Coal Group Co., Ltd.

- ArcelorMittal

- Erdos Xingye Chemical Co., Ltd.

- POSCO

- Voestalpine AG

- NLMK

- Steel Authority of India Limited

- BlueScope Steel

- Angang Steel Company Limited

- Baowu Steel Group

- Chemanol

- Indian Oil Corporation Ltd.

- Mitsubishi Chemical Corporation

- Sumitomo Chemical Co., Ltd.

Frequently Asked Questions

What is Coal Tar Pitch primarily used for?

Coal Tar Pitch (CTP) is primarily used as a binder for the production of carbon anodes in the aluminum smelting industry. It is also a critical component in manufacturing graphite electrodes for steel production, and finds applications in refractories, roofing, and specialty carbon materials. Its strong binding and carbonizing properties make it indispensable in these heavy industrial processes, supporting foundational industries globally.

What factors are driving the demand for Coal Tar Pitch?

The demand for Coal Tar Pitch is primarily driven by the expanding global aluminum industry, which relies on CTP for carbon anode production. Additionally, growth in the steel industry, increasing infrastructure development worldwide (for applications like roofing and road paving), and the rising demand for specialty carbon materials and graphite electrodes significantly contribute to the market's growth. Industrialization in emerging economies further strengthens these demand drivers.

What are the major challenges in the Coal Tar Pitch market?

The primary challenges in the CTP market include increasingly stringent environmental regulations, particularly concerning polycyclic aromatic hydrocarbons (PAHs), which necessitate costly compliance measures and impact production processes. Volatility in raw material prices (coal tar) and potential supply chain disruptions also pose significant hurdles. Furthermore, health and safety concerns for workers handling CTP and the long-term threat from substitute materials present ongoing market challenges.

Are there sustainable alternatives to Coal Tar Pitch?

While direct, widespread substitutes for Coal Tar Pitch are limited for its primary applications, research is ongoing into more sustainable alternatives, such as petroleum pitch, bio-pitch derived from biomass, or modified synthetic binders. These alternatives aim to address environmental concerns and reduce reliance on coal-derived products. However, they often face challenges in matching CTP's performance characteristics, cost-effectiveness, and scale of production required by industries like aluminum smelting.

How do environmental regulations impact the Coal Tar Pitch market?

Environmental regulations significantly impact the CTP market by imposing strict limits on emissions and the presence of harmful compounds like PAHs. This necessitates substantial investments in advanced pollution control technologies, forces manufacturers to develop cleaner production processes, and encourages the development of low-emission CTP grades. Compliance with these regulations increases operational costs and can influence regional market dynamics, pushing for greater sustainability in the CTP value chain.