Cloud Spending by SMB Market

Cloud Spending by SMB Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_704287 | Last Updated : August 05, 2025 |

Format : ![]()

![]()

![]()

![]()

Cloud Spending by SMB Market Size

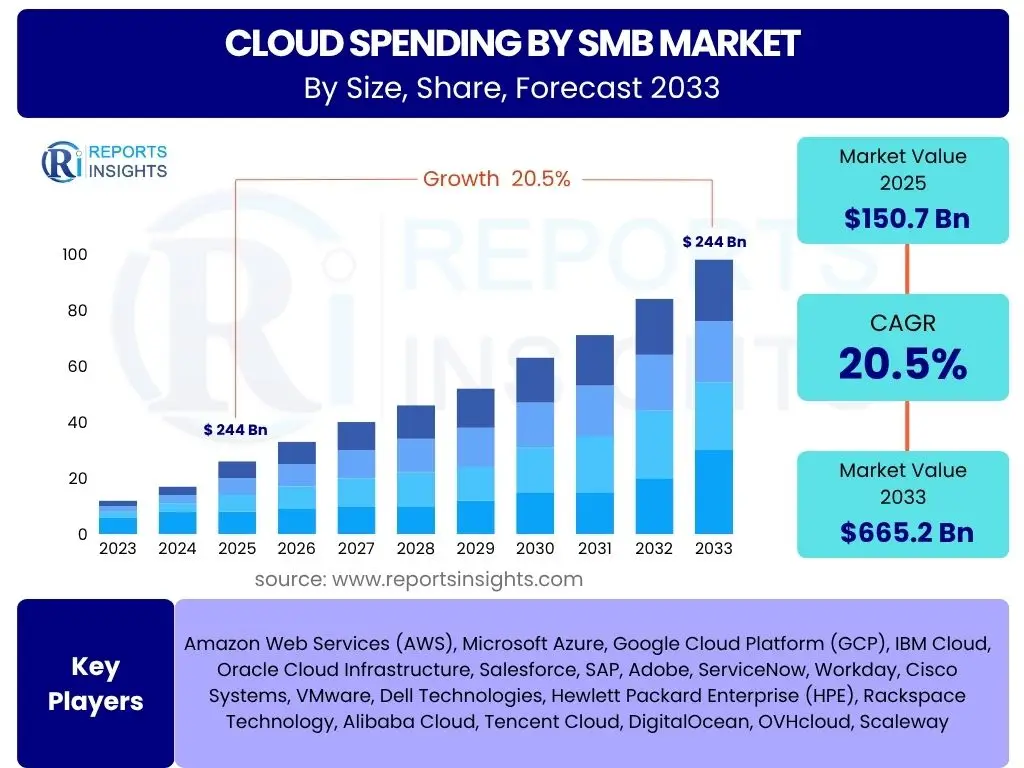

According to Reports Insights Consulting Pvt Ltd, The Cloud Spending by SMB Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 20.5% between 2025 and 2033. The market is estimated at USD 150.7 billion in 2025 and is projected to reach USD 665.2 billion by the end of the forecast period in 2033.

Key Cloud Spending by SMB Market Trends & Insights

Analysis of common user questions regarding trends in Cloud Spending by SMB reveals a strong emphasis on digital transformation, the ongoing shift from CAPEX to OPEX models, and the increasing adoption of Software as a Service (SaaS) solutions. Small and medium-sized businesses are increasingly recognizing cloud computing as a critical enabler for agility, scalability, and cost efficiency, moving beyond basic infrastructure to more specialized, value-added cloud services. This transition is also driven by the need to support remote and hybrid work models, requiring robust and accessible IT infrastructure.

Furthermore, there is significant interest in how SMBs leverage cloud to enhance cybersecurity postures and manage data more effectively, despite inherent concerns about data security and vendor lock-in. The demand for industry-specific cloud solutions and managed services is also a recurring theme, indicating a preference for tailored, plug-and-play solutions that minimize internal IT overhead. User queries also reflect a growing awareness of sustainability in cloud operations and the potential for cloud to democratize advanced technologies previously exclusive to large enterprises.

- Accelerated digital transformation initiatives among SMBs.

- Increased adoption of hybrid and multi-cloud strategies for flexibility and redundancy.

- Growing demand for industry-specific cloud solutions and vertical SaaS.

- Emphasis on cost optimization and operational efficiency through cloud services.

- Surge in cloud-based cybersecurity solutions and data management platforms.

- Expansion of cloud-enabled remote and hybrid work environments.

- Rising interest in serverless computing and containerization for agile development.

- Integration of advanced analytics and business intelligence tools within cloud platforms.

- Focus on sustainability and green computing initiatives in cloud infrastructure.

- Vendor consolidation and strategic partnerships to offer comprehensive cloud portfolios.

AI Impact Analysis on Cloud Spending by SMB

User inquiries concerning AI's impact on Cloud Spending by SMB frequently revolve around two main axes: how AI technologies drive increased cloud consumption and how AI can optimize existing cloud expenditures. There is a clear recognition that deploying and leveraging AI tools, especially generative AI and machine learning models, necessitates significant cloud resources for computational power, data storage, and specialized services like AI/ML platforms. SMBs are increasingly looking to embed AI capabilities into their operations, from automated customer support to predictive analytics, which directly translates into higher cloud spending for AI-as-a-Service offerings and underlying infrastructure.

Conversely, users are also keen to understand how AI can help them manage and reduce their cloud costs. AI-powered tools for cost optimization, resource allocation, and performance monitoring are gaining traction, allowing SMBs to identify inefficiencies and make data-driven decisions about their cloud usage. This dual impact suggests a strategic approach where initial investments in AI drive up cloud spending, but subsequent AI-driven optimizations contribute to more efficient and cost-effective cloud operations over time, fostering a cycle of innovation and efficiency.

- Increased spending on AI-as-a-Service (AIaaS) platforms and tools.

- Higher demand for cloud-based compute and storage for AI model training and inference.

- Adoption of AI-powered analytics to derive insights from vast datasets stored in the cloud.

- Growth in spending on cloud data platforms optimized for AI workloads.

- Emergence of AI-driven cloud cost optimization and resource management solutions.

- Enhanced cloud security through AI-powered threat detection and response systems.

- Automation of IT operations and application deployment using AI-driven tools.

- Integration of generative AI capabilities into SMB business applications hosted in the cloud.

- Demand for cloud providers offering specialized AI infrastructure (e.g., GPUs, TPUs).

- Shift towards intelligent, self-optimizing cloud environments for SMBs.

Key Takeaways Cloud Spending by SMB Market Size & Forecast

Common user questions about the key takeaways from the Cloud Spending by SMB market size and forecast consistently point to the robust and sustained growth expected in this segment. The significant projected increase in market size underscores the strategic importance of cloud adoption for SMBs, positioning it as an indispensable element for business continuity, innovation, and competitive advantage. The forecast indicates that cloud computing is no longer a luxury but a fundamental operational expenditure for businesses seeking to modernize and scale.

Moreover, the analysis highlights that this growth is not merely about infrastructure but increasingly about specialized services, managed solutions, and the integration of advanced technologies like AI within cloud environments. SMBs are prioritizing solutions that offer simplified management, enhanced security, and clear return on investment, reflecting a mature understanding of cloud benefits beyond mere cost savings. The market is evolving rapidly, driven by technological advancements and the ever-present need for agility and resilience in a dynamic economic landscape.

- The Cloud Spending by SMB market is poised for substantial growth, exceeding 20% CAGR through 2033.

- Cloud adoption is shifting from foundational infrastructure to advanced, value-added services for SMBs.

- Scalability, operational efficiency, and access to modern technologies are primary drivers for SMB cloud investment.

- AI integration is a significant emerging factor influencing both increased spending and optimization opportunities.

- Security and compliance remain paramount considerations for SMBs in their cloud strategies.

- The market is characterized by a strong demand for managed services and simplified solutions for SMBs lacking extensive in-house IT expertise.

Cloud Spending by SMB Market Drivers Analysis

The Cloud Spending by SMB Market is propelled by a confluence of powerful drivers that empower small and medium-sized enterprises to enhance their operational capabilities and market competitiveness. A primary driver is the accelerating pace of digital transformation, where SMBs are increasingly reliant on cloud solutions to modernize their IT infrastructure, streamline workflows, and enable remote or hybrid work models. The inherent scalability and flexibility of cloud services allow SMBs to adapt quickly to changing business demands without significant upfront capital expenditure.

Another significant driver is the increasing accessibility and affordability of cloud services, particularly Software as a Service (SaaS) applications, which offer specialized functionalities for various business needs without requiring extensive technical expertise. Furthermore, the imperative for robust cybersecurity solutions and efficient data management is pushing SMBs towards cloud platforms that offer enterprise-grade security features and simplified compliance frameworks. The global expansion of internet connectivity and the maturity of cloud ecosystems also lower barriers to entry for SMBs, making cloud adoption a more viable and attractive proposition for businesses of all sizes.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Digital Transformation Imperative | +5.2% | Global | 2025-2033 |

| Increasing SaaS Adoption | +4.8% | North America, Europe, Asia Pacific | 2025-2033 |

| Remote and Hybrid Work Models | +3.5% | Global | 2025-2029 |

| Enhanced Data Security & Compliance Needs | +3.0% | Europe (GDPR), North America, Asia Pacific | 2025-2033 |

| Cost Efficiency & OPEX Model Preference | +2.5% | Global | 2025-2033 |

Cloud Spending by SMB Market Restraints Analysis

Despite the strong growth drivers, the Cloud Spending by SMB Market faces several notable restraints that can impede its full potential. A primary concern for many SMBs is the initial and ongoing cost perception, especially for businesses with tight budgets or those underestimating the total cost of ownership (TCO) once data egress, integration, and management overheads are factored in. This budget constraint often limits the scale or type of cloud services SMBs are willing to adopt, favoring basic solutions over more comprehensive, high-value offerings.

Furthermore, significant apprehension exists regarding data security and privacy in the cloud, particularly for sensitive customer or proprietary information. SMBs, often lacking dedicated cybersecurity teams, are wary of potential breaches or compliance violations. Vendor lock-in, where exiting a specific cloud provider becomes technically or financially prohibitive, also poses a substantial restraint, limiting flexibility and competitive pricing. Lastly, the lack of in-house IT expertise to effectively manage and optimize cloud environments remains a pervasive challenge, leading to underutilization or misconfiguration of cloud resources.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Budgetary Constraints & Cost Overruns | -3.8% | Global | 2025-2033 |

| Data Security & Privacy Concerns | -3.5% | Global, Europe (GDPR emphasis) | 2025-2033 |

| Lack of Internal IT Expertise | -2.9% | Global, particularly Emerging Markets | 2025-2031 |

| Vendor Lock-in Concerns | -2.1% | Global | 2025-2033 |

| Complexity of Cloud Migration & Integration | -1.5% | Global | 2025-2028 |

Cloud Spending by SMB Market Opportunities Analysis

Numerous opportunities are emerging within the Cloud Spending by SMB Market, promising to further accelerate adoption and unlock new avenues for growth. The increasing demand for vertical-specific cloud solutions presents a significant opportunity, as SMBs seek highly specialized software and platforms tailored to their industry's unique regulatory, operational, and data requirements. This niche focus allows cloud providers to offer greater value beyond generic infrastructure or productivity tools, addressing specific pain points for sectors like healthcare, finance, retail, and manufacturing.

Moreover, the burgeoning market for managed cloud services represents another substantial opportunity. Many SMBs lack the internal resources or expertise to efficiently manage complex cloud environments, creating a strong demand for third-party providers who can handle cloud migration, optimization, security, and ongoing maintenance. The integration of advanced technologies like Artificial Intelligence (AI) and Machine Learning (ML) directly into cloud service offerings also opens doors for SMBs to leverage sophisticated analytics, automation, and generative AI capabilities without heavy upfront investments, thereby stimulating further cloud spending. The expansion into untapped emerging markets and the continued evolution of hybrid and multi-cloud strategies also provide fertile ground for market expansion.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Development of Vertical-Specific Cloud Solutions | +4.5% | Global | 2025-2033 |

| Growth in Managed Cloud Services for SMBs | +4.0% | Global | 2025-2033 |

| Integration of AI/ML Capabilities | +3.2% | Global | 2025-2033 |

| Expansion into Emerging Markets | +2.8% | Asia Pacific, Latin America, MEA | 2027-2033 |

| Hybrid and Multi-Cloud Strategy Adoption | +2.0% | North America, Europe | 2025-2030 |

Cloud Spending by SMB Market Challenges Impact Analysis

The Cloud Spending by SMB Market, while promising, is not without its share of significant challenges that can hinder adoption and optimal utilization. Cybersecurity threats remain a paramount concern for SMBs, as they often lack sophisticated security infrastructure and expertise, making them vulnerable targets for cyberattacks leveraging cloud vulnerabilities. The increasing sophistication of ransomware and data breaches necessitates robust, yet often costly, cloud security measures, posing a dilemma for budget-conscious SMBs.

Another critical challenge involves the complexities associated with data migration and integration of legacy systems with new cloud environments. This process can be time-consuming, resource-intensive, and prone to errors, particularly for SMBs with outdated on-premise infrastructure. Furthermore, navigating complex regulatory compliance landscapes and ensuring data sovereignty, especially in industries like healthcare or finance, presents a substantial hurdle. Lastly, managing and optimizing cloud costs effectively can be challenging, as SMBs often struggle with 'cloud sprawl' and the intricate pricing models of various cloud providers, leading to unforeseen expenses if not meticulously managed.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Escalating Cybersecurity Threats | -4.2% | Global | 2025-2033 |

| Complexity of Data Migration & Integration | -3.0% | Global | 2025-2030 |

| Regulatory Compliance & Data Sovereignty | -2.5% | Europe, Asia Pacific, North America | 2025-2033 |

| Cloud Cost Management & Optimization | -2.0% | Global | 2025-2033 |

| Talent Gap in Cloud Expertise | -1.8% | Global | 2025-2033 |

Cloud Spending by SMB Market - Updated Report Scope

This report provides an in-depth analysis of the Cloud Spending by SMB market, covering historical trends from 2019 to 2023, with a comprehensive forecast extending from 2025 to 2033. It examines market size estimations, growth drivers, restraints, opportunities, and challenges specific to small and medium-sized businesses. The scope encompasses various cloud service models, deployment types, industry verticals, and regional landscapes, offering a holistic view of the market dynamics. Additionally, the report integrates an impact analysis of Artificial Intelligence on SMB cloud spending, highlighting emerging trends and strategic implications for market participants and decision-makers.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 150.7 Billion |

| Market Forecast in 2033 | USD 665.2 Billion |

| Growth Rate | 20.5% |

| Number of Pages | 250 |

| Key Trends | |

| Segments Covered | |

| Key Companies Covered | Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform (GCP), IBM Cloud, Oracle Cloud Infrastructure, Salesforce, SAP, Adobe, ServiceNow, Workday, Cisco Systems, VMware, Dell Technologies, Hewlett Packard Enterprise (HPE), Rackspace Technology, Alibaba Cloud, Tencent Cloud, DigitalOcean, OVHcloud, Scaleway |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Cloud Spending by SMB market is comprehensively segmented to provide a granular understanding of its diverse components and evolving dynamics. This segmentation facilitates targeted analysis, enabling stakeholders to identify key growth areas, understand market preferences, and tailor their offerings to specific SMB needs. The primary segmentation is by service model, differentiating between the foundational infrastructure (IaaS), development environments (PaaS), and ready-to-use applications (SaaS), reflecting distinct operational and strategic requirements of SMBs.

Further segmentation by deployment type (public, private, hybrid cloud) highlights the varying levels of control, security, and integration sought by different SMBs. Industry vertical segmentation provides insights into which sectors are driving cloud adoption and for what purposes, recognizing the unique technological needs of healthcare, retail, manufacturing, and other industries. Lastly, segmentation by organization size within the SMB category (small vs. medium enterprises) acknowledges that spending patterns and cloud maturity often differ based on the number of employees, allowing for more precise market sizing and strategic planning.

- By Service Model:

- Infrastructure-as-a-Service (IaaS): Focus on virtualized computing resources, storage, and networking.

- Platform-as-a-Service (PaaS): Emphasis on development and deployment environments for applications.

- Software-as-a-Service (SaaS): Dominant segment for ready-to-use business applications (e.g., CRM, ERP, productivity suites).

- By Deployment Type:

- Public Cloud: Shared infrastructure, cost-effective, high scalability.

- Private Cloud: Dedicated infrastructure, enhanced security and control.

- Hybrid Cloud: Combination of public and private clouds for flexibility and workload optimization.

- By Industry Vertical:

- Retail & E-commerce: For online stores, inventory management, customer data.

- Healthcare & Life Sciences: For patient data management, research, telehealth.

- BFSI: For secure transactions, data analytics, regulatory compliance.

- Manufacturing: For IoT, supply chain management, operational efficiency.

- IT & Telecommunications: For network infrastructure, software development, data centers.

- Education: For e-learning platforms, administrative systems.

- Media & Entertainment: For content creation, streaming, digital asset management.

- Government & Public Sector: For citizen services, data archives.

- Others: Including professional services, logistics, and agriculture.

- By Organization Size:

- Small Enterprises (1-99 Employees): Focus on basic SaaS and public cloud for core operations.

- Medium Enterprises (100-999 Employees): More complex needs, hybrid cloud, specialized applications, data analytics.

Regional Highlights

- North America: This region holds the largest market share due to early adoption of cloud technologies, the presence of major cloud service providers, and a high concentration of technologically advanced SMBs. Strong emphasis on digital transformation and SaaS solutions drives continuous growth.

- Europe: Characterized by robust regulatory frameworks (like GDPR) and a growing focus on data sovereignty, driving adoption of private and hybrid cloud solutions. Western European countries are mature markets, while Eastern Europe is experiencing rapid growth.

- Asia Pacific (APAC): Expected to exhibit the highest growth rate, fueled by rapid digitalization initiatives, increasing internet penetration, and the booming number of SMBs, particularly in emerging economies like India, China, and Southeast Asian nations. Cost-effectiveness and scalability are key drivers.

- Latin America: An emerging market with significant growth potential, driven by the need for business modernization, economic development, and increasing access to digital infrastructure. SMBs are increasingly leveraging cloud for basic operations and productivity.

- Middle East and Africa (MEA): Demonstrating strong growth, particularly in the GCC countries and South Africa, driven by government-led digital initiatives, diversification from oil-dependent economies, and the rise of local cloud data centers addressing data residency requirements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cloud Spending by SMB Market.- Amazon Web Services (AWS)

- Microsoft Azure

- Google Cloud Platform (GCP)

- IBM Cloud

- Oracle Cloud Infrastructure

- Salesforce

- SAP

- Adobe

- ServiceNow

- Workday

- Cisco Systems

- VMware

- Dell Technologies

- Hewlett Packard Enterprise (HPE)

- Rackspace Technology

- Alibaba Cloud

- Tencent Cloud

- DigitalOcean

- OVHcloud

- Scaleway

Frequently Asked Questions

What is the projected growth rate for Cloud Spending by SMB?

The Cloud Spending by SMB market is projected to grow at a Compound Annual Growth Rate (CAGR) of 20.5% from 2025 to 2033, reaching an estimated USD 665.2 billion by 2033.

How does AI impact cloud spending for small and medium businesses?

AI significantly impacts SMB cloud spending in two ways: by driving increased expenditure on AI-as-a-Service (AIaaS) and specialized compute resources for AI workloads, and by enabling AI-powered tools for cloud cost optimization and efficient resource management.

What are the primary drivers of cloud adoption among SMBs?

Key drivers include the imperative for digital transformation, the increasing adoption of SaaS applications, the need to support remote and hybrid work models, enhanced data security requirements, and the preference for cost-efficient, operational expenditure (OPEX) models.

What are the main challenges SMBs face with cloud spending?

Major challenges include escalating cybersecurity threats, complexities of data migration and integration, navigating regulatory compliance and data sovereignty, effective cloud cost management and optimization, and a prevalent talent gap in cloud expertise.

Which service model is most popular among SMBs for cloud spending?

Software-as-a-Service (SaaS) is the most popular service model among SMBs, driven by its ease of use, ready-to-deploy business applications (e.g., CRM, ERP, productivity suites), and reduced need for in-house IT management.