Bicycle Component Market

Bicycle Component Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_702531 | Last Updated : July 31, 2025 |

Format : ![]()

![]()

![]()

![]()

Bicycle Component Market Size

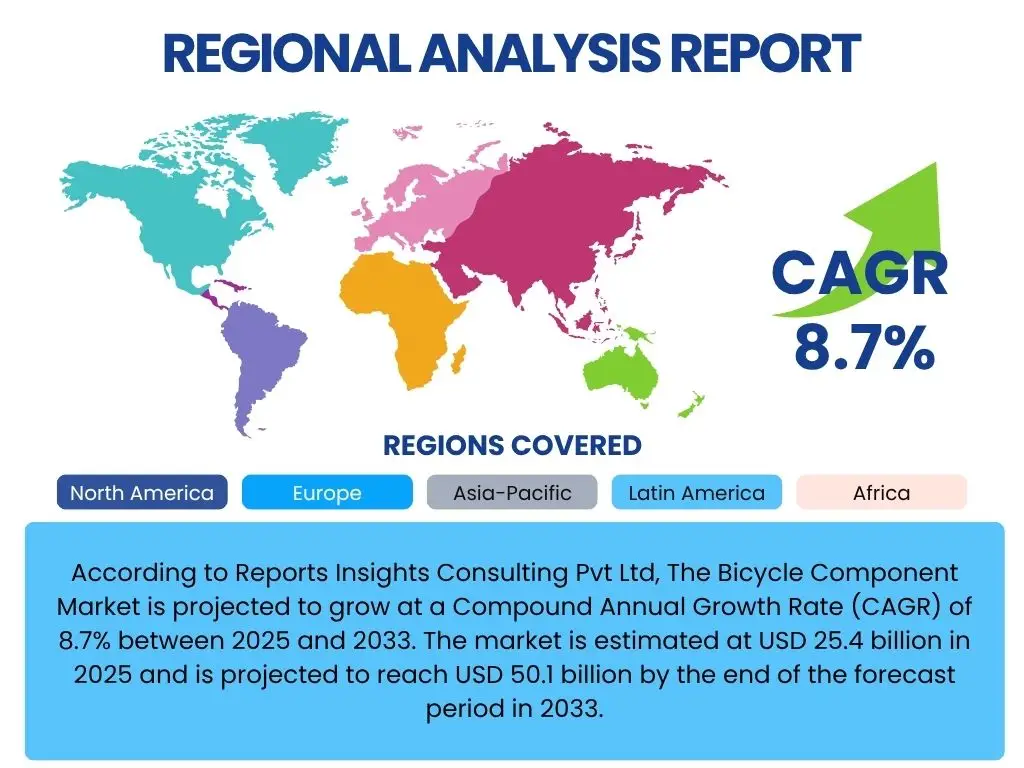

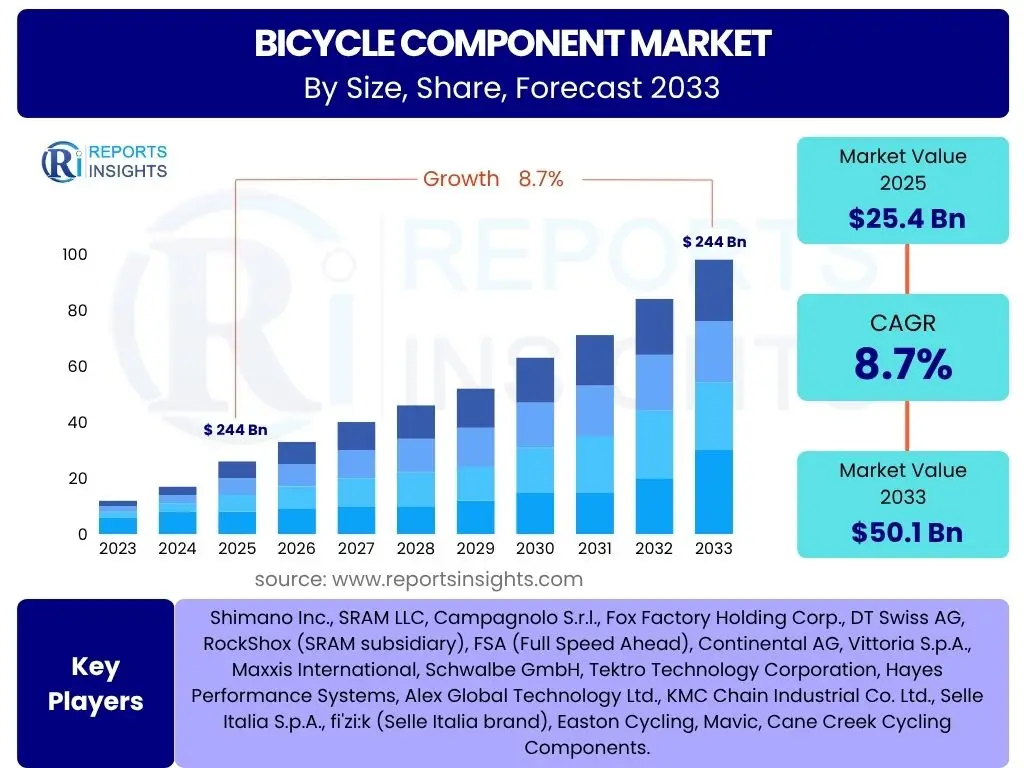

According to Reports Insights Consulting Pvt Ltd, The Bicycle Component Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.7% between 2025 and 2033. The market is estimated at USD 25.4 billion in 2025 and is projected to reach USD 50.1 billion by the end of the forecast period in 2033.

Key Bicycle Component Market Trends & Insights

The Bicycle Component Market is undergoing significant transformation driven by evolving consumer preferences, technological advancements, and increasing environmental consciousness. Users frequently inquire about the impact of e-bike proliferation, the demand for lightweight and durable materials, and the integration of smart technologies in components. Furthermore, there is growing interest in sustainable manufacturing practices and the globalization of supply chains, which are reshaping market dynamics and influencing product development. The focus is shifting towards performance, comfort, and enhanced user experience across various cycling disciplines, from daily commuting to professional sports.

The rise of cycling as a leisure activity and a sustainable mode of transport, amplified by urban planning initiatives supporting bike infrastructure, continues to fuel demand for a wide array of components. Innovation in areas such as advanced braking systems, sophisticated gearing mechanisms, and ergonomic designs is paramount. The aftermarket segment also plays a crucial role, driven by enthusiasts seeking upgrades and replacements, further emphasizing the need for high-quality, readily available components.

- Rapid adoption and innovation in E-bike specific components, including motors, batteries, and integrated sensor systems.

- Increasing demand for lightweight and durable materials such as carbon fiber, advanced alloys, and composite materials.

- Integration of smart technologies, including GPS tracking, performance monitoring sensors, and connectivity features in components.

- Growing emphasis on sustainable and eco-friendly manufacturing processes and recyclable materials for components.

- Customization and personalization trends driving demand for modular and interchangeable components.

- Expansion of the aftermarket segment fueled by cycling enthusiasts and upgrade cycles.

- Globalization of manufacturing and supply chains, leading to diversified sourcing and production hubs.

- Focus on enhanced safety features, including advanced braking systems and improved visibility components.

AI Impact Analysis on Bicycle Component

Users frequently raise questions regarding how Artificial intelligence (AI) will influence the design, manufacturing, and supply chain of bicycle components. Concerns and expectations often revolve around AI's potential to optimize product development cycles, enhance predictive maintenance capabilities, and streamline logistical operations. There is also significant curiosity about AI's role in creating more personalized cycling experiences through data analysis and adaptive component systems.

AI's analytical prowess is anticipated to revolutionize material science applications within component manufacturing, enabling the development of lighter, stronger, and more efficient parts through sophisticated simulations and generative design. Furthermore, AI-driven demand forecasting and inventory management are expected to significantly mitigate supply chain inefficiencies and reduce lead times. This technological integration promises to foster an era of smarter, more responsive, and environmentally conscious component production, directly addressing evolving market needs and consumer desires.

- Design Optimization and Generative Design: AI algorithms can rapidly iterate through thousands of design variations, optimizing component geometry for weight, strength, and aerodynamic performance, leading to more efficient and durable parts.

- Predictive Maintenance: AI-powered sensors integrated into components can monitor wear and tear in real-time, predicting maintenance needs and preventing failures, thereby extending product lifespan and improving safety.

- Smart Manufacturing and Quality Control: AI can enhance production lines by optimizing machine parameters, detecting defects with high precision, and ensuring consistent product quality, reducing waste and improving efficiency.

- Supply Chain Optimization: AI-driven analytics can forecast demand more accurately, optimize inventory levels, and manage logistics, leading to reduced costs, faster delivery, and improved resilience against disruptions.

- Personalized User Experience: AI can analyze rider data to recommend optimal component setups or even adapt component performance dynamically, offering a highly customized and optimized cycling experience.

Key Takeaways Bicycle Component Market Size & Forecast

The market size and forecast for bicycle components reveal a robust growth trajectory, primarily driven by the enduring global shift towards sustainable transportation and recreational cycling. Common user inquiries highlight the critical influence of e-bike expansion and the increasing awareness of health and environmental benefits associated with cycling. These factors are compelling manufacturers to innovate rapidly, particularly in areas like lightweight materials, smart technology integration, and enhanced durability.

A significant takeaway is the strong interdependence between the growth of the overall bicycle market and the demand for high-performance and specialized components. The aftermarket segment, fueled by cycling enthusiasts seeking upgrades and customization, also contributes substantially to the market's dynamism. The forecast indicates sustained investment in research and development, aiming to meet the evolving demands for both original equipment manufacturing (OEM) and aftermarket solutions, ensuring a continuous supply of cutting-edge components.

- The market exhibits strong growth potential, primarily driven by the e-bike revolution and increasing global cycling participation.

- Technological advancements in materials and smart integration are pivotal for market expansion and competitive advantage.

- Aftermarket and upgrade segments represent significant revenue opportunities, indicating a mature and engaged consumer base.

- Sustainability and supply chain resilience are emerging as critical considerations influencing future market strategies and investments.

- The forecast underscores a shifting focus towards performance-oriented, ergonomic, and user-centric component designs.

Bicycle Component Market Drivers Analysis

The Bicycle Component Market is significantly propelled by several key drivers that reflect global societal shifts and technological advancements. The increasing adoption of electric bicycles (e-bikes) stands out as a primary catalyst, demanding specialized and robust components capable of handling higher power outputs and integrating complex electronic systems. Concurrently, a growing global emphasis on health and wellness encourages more individuals to embrace cycling as a form of exercise and leisure, thereby boosting demand for both entry-level and high-performance components. Urbanization trends also contribute, as cycling becomes a preferred, eco-friendly mode of transport in congested city environments, necessitating durable and efficient parts.

Furthermore, continuous innovation in materials science and manufacturing processes allows for the production of lighter, stronger, and more aerodynamic components, appealing to professional cyclists and enthusiasts alike. Government initiatives promoting cycling infrastructure and offering incentives for bicycle usage also indirectly stimulate the component market by expanding the overall bicycle user base. The confluence of these factors creates a fertile ground for sustained market expansion and technological evolution within the bicycle component industry.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Rapid Growth of E-bike Sales and Adoption | +1.5% | Europe, North America, Asia Pacific (China, Japan) | 2025-2033 (Mid to Long-term) |

| Increasing Health and Wellness Consciousness | +1.2% | Global, particularly developed economies | 2025-2033 (Mid to Long-term) |

| Growing Urbanization and Sustainable Mobility Trends | +1.0% | Europe, Asia Pacific (India, Southeast Asia) | 2025-2033 (Mid to Long-term) |

| Advancements in Material Science and Manufacturing Technologies | +0.8% | Global, especially R&D hubs | 2025-2033 (Mid to Long-term) |

| Government Support for Cycling Infrastructure & Incentives | +0.7% | Europe (Netherlands, Denmark), North America (USA, Canada) | 2025-2033 (Mid to Long-term) |

Bicycle Component Market Restraints Analysis

Despite robust growth drivers, the Bicycle Component Market faces several significant restraints that could temper its expansion. One prominent challenge is the volatility in raw material prices, particularly for metals like aluminum, steel, and carbon fiber, which directly impacts production costs and profit margins. Supply chain disruptions, exacerbated by global events such as pandemics or geopolitical conflicts, also pose a considerable threat, leading to delays, increased freight costs, and scarcity of critical components. Furthermore, the market is susceptible to the influx of counterfeit and low-quality products, which can erode consumer trust, undermine reputable brands, and create unfair competition.

Moreover, the intense competition from alternative transportation modes, including shared mobility services and improved public transport, could divert potential cyclists, indirectly affecting component demand. Regulatory hurdles, such as varying import duties, safety standards, and environmental compliance requirements across different regions, add complexity and cost to international operations. These restraints necessitate strategic adaptation, including diversified sourcing, technological innovation to reduce material dependency, and robust quality control measures to maintain market integrity and growth momentum.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Volatile Raw Material Prices and Supply Chain Disruptions | -0.8% | Global, particularly economies reliant on imports | 2025-2028 (Short to Mid-term) |

| Inflow of Low-Quality and Counterfeit Products | -0.6% | Emerging Markets, Online Sales Channels | 2025-2033 (Mid to Long-term) |

| Intense Competition from Alternative Transportation Modes | -0.5% | Urban areas, developed economies | 2025-2033 (Mid to Long-term) |

| Increasing Environmental Regulations and Compliance Costs | -0.4% | Europe, North America, Japan | 2028-2033 (Mid to Long-term) |

| Economic Downturns Affecting Disposable Income | -0.7% | Global, all major economies | 2025-2027 (Short to Mid-term) |

Bicycle Component Market Opportunities Analysis

The Bicycle Component Market is ripe with significant opportunities driven by evolving consumer demands and technological advancements. One primary opportunity lies in the continued innovation of lightweight and high-performance materials, such as advanced carbon composites and specialized alloys, which cater to the growing segment of professional and enthusiast cyclists. The surging popularity of e-bikes worldwide presents an unparalleled opportunity for component manufacturers to develop specialized motors, battery housings, advanced braking systems, and integrated electronic components tailored for electric drivetrains. This niche requires robust, reliable, and often smart-enabled solutions that differ significantly from traditional bicycle parts, opening up new revenue streams and specialized market segments.

Furthermore, the expanding aftermarket segment, fueled by consumers seeking upgrades, customization, and DIY repairs, offers fertile ground for component sales. This includes everything from performance-enhancing parts to aesthetic modifications. The integration of smart technology and IoT (Internet of Things) into components, such as smart sensors for performance tracking, navigation, and security, also represents a substantial growth area. These innovations not only enhance the cycling experience but also provide valuable data for product improvement and personalized user solutions. Finally, the increasing focus on sustainability and circular economy principles presents opportunities for companies to develop eco-friendly components and recycling programs, appealing to environmentally conscious consumers and bolstering brand reputation.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Innovation in Lightweight and High-Performance Materials | +1.3% | Global, particularly high-end markets (Europe, North America, Japan) | 2025-2033 (Mid to Long-term) |

| Expansion of E-bike Specific Component Development | +1.8% | Europe, Asia Pacific, North America | 2025-2033 (Mid to Long-term) |

| Growth in the Aftermarket and Customization Segment | +1.0% | Global, strong in enthusiast communities | 2025-2033 (Mid to Long-term) |

| Integration of Smart Technology and IoT in Components | +1.1% | Developed Economies, Tech-forward markets | 2026-2033 (Mid to Long-term) |

| Sustainable Manufacturing and Recyclable Component Solutions | +0.9% | Europe, North America, environmentally conscious markets | 2027-2033 (Mid to Long-term) |

Bicycle Component Market Challenges Impact Analysis

The Bicycle Component Market navigates a complex landscape punctuated by several significant challenges that demand strategic foresight and adaptive responses. One primary hurdle is the rapid pace of technological obsolescence, especially with the accelerated innovation in e-bike components and smart technologies. Manufacturers must constantly invest in research and development to keep pace, risking significant capital if new products fail to gain market traction. Moreover, intense global competition, particularly from low-cost manufacturers, puts pressure on pricing and profit margins for companies offering premium or innovative components. This competitive environment necessitates a delicate balance between quality, innovation, and affordability.

Another critical challenge involves maintaining resilient and ethical supply chains in an increasingly globalized and interconnected world. Geopolitical tensions, trade disputes, and environmental regulations can severely disrupt the flow of raw materials and finished components, leading to production delays and increased costs. Furthermore, ensuring intellectual property protection against counterfeiting and unauthorized replication remains a persistent issue, particularly in emerging markets, which can undermine brand value and innovation incentives. Successfully navigating these challenges requires robust operational strategies, continuous innovation, and a strong commitment to sustainable and ethical business practices.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Rapid Technological Obsolescence and R&D Investment | -0.7% | Global, especially in e-bike and smart tech segments | 2025-2033 (Mid to Long-term) |

| Intense Global Competition and Price Pressure | -0.9% | Global, particularly sensitive in mass-market segments | 2025-2033 (Mid to Long-term) |

| Supply Chain Vulnerabilities and Geopolitical Risks | -1.0% | Global, impacting import/export reliant regions | 2025-2028 (Short to Mid-term) |

| Intellectual Property Infringement and Counterfeiting | -0.6% | Asia Pacific, emerging markets | 2025-2033 (Mid to Long-term) |

| Shifting Consumer Preferences and Demand Volatility | -0.5% | Developed economies, trend-sensitive markets | 2025-2030 (Short to Mid-term) |

Bicycle Component Market - Updated Report Scope

This comprehensive market report offers an in-depth analysis of the Bicycle Component Market, providing a holistic view of its current landscape and future growth prospects. It encompasses a detailed examination of market size, historical trends, and an eight-year forecast, shedding light on the key drivers, restraints, opportunities, and challenges shaping the industry. The report segments the market extensively by component type, material, application, and distribution channel, providing granular insights into various sub-segments and their respective growth trajectories. Furthermore, it includes a robust regional analysis, highlighting market dynamics across major geographical areas, along with a competitive landscape assessment profiling leading companies and their strategic initiatives, offering valuable intelligence for stakeholders.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 25.4 billion |

| Market Forecast in 2033 | USD 50.1 billion |

| Growth Rate | 8.7% |

| Number of Pages | 265 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Shimano Inc., SRAM LLC, Campagnolo S.r.l., Fox Factory Holding Corp., DT Swiss AG, RockShox (SRAM subsidiary), FSA (Full Speed Ahead), Continental AG, Vittoria S.p.A., Maxxis International, Schwalbe GmbH, Tektro Technology Corporation, Hayes Performance Systems, Alex Global Technology Ltd., KMC Chain Industrial Co. Ltd., Selle Italia S.p.A., fi'zi:k (Selle Italia brand), Easton Cycling, Mavic, Cane Creek Cycling Components. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Bicycle Component Market is meticulously segmented to provide a granular understanding of its diverse landscape and consumer preferences. This segmentation allows for precise analysis of market dynamics within specific categories, offering insights into growth drivers and market potential for various component types, materials, applications, and distribution channels. The comprehensive breakdown helps stakeholders identify niche opportunities and tailor strategies to meet specific market demands, ranging from high-performance racing components to durable parts for everyday commuting.

The segmentation reflects the multifaceted nature of the cycling industry, acknowledging the distinct requirements of different bicycle types and rider demographics. For instance, the demand for components for electric bikes often differs significantly from those for traditional mountain or road bikes, both in terms of design and material. Understanding these intricate segmentations is crucial for manufacturers to optimize their product portfolios, for distributors to refine their supply chains, and for retailers to manage their inventory effectively, ultimately contributing to a more responsive and efficient market ecosystem.

- By Component Type:

- Drivetrain: Includes crucial parts such as Chains, Cassettes/Freewheels, Cranksets, Derailleurs (front and rear), and Shifters. This segment is highly performance-driven.

- Braking Systems: Comprises Rim Brakes, advanced Disc Brakes (mechanical and hydraulic), and Brake Levers, essential for rider safety and control.

- Wheels & Tires: Encompasses Rims, Hubs, Spokes, Tires (tubeless, clincher), and Tubes, critical for ride quality and traction.

- Frame & Fork: The foundational structures of a bicycle, varying significantly by material and application.

- Handlebars & Stems: Affecting bike handling, rider posture, and comfort.

- Saddles & Seatposts: Influencing rider comfort and power transfer.

- Pedals: Connecting the rider to the drivetrain, including clipless and platform options.

- Suspension: Front forks and rear shocks designed for shock absorption in mountain and comfort bikes.

- Other Components: A broad category including Lights, Bells, Kickstands, Fenders, Grips, and various accessories enhancing functionality and safety.

- By Material:

- Aluminum Alloys: Widely used for their balance of strength, weight, and cost-effectiveness.

- Carbon Fiber: Preferred for high-performance applications due to its exceptional strength-to-weight ratio and stiffness.

- Steel: Durable and affordable, often found in entry-level and utility bikes.

- Titanium: Valued for its lightweight, strength, corrosion resistance, and ride quality.

- Composites: Hybrid materials offering customized properties for specific component needs.

- Others: Includes rubber (for tires), plastics, and various other specialized materials.

- By Application:

- Mountain Bikes (MTB): Components designed for durability and performance in off-road conditions.

- Road Bikes: Focused on lightweight construction, aerodynamics, and efficiency for paved surfaces.

- Hybrid Bikes: Versatile components suitable for both urban commuting and light trail riding.

- Electric Bikes (E-bikes): Specialized components to accommodate motors, batteries, and higher torque.

- City/Commuter Bikes: Emphasizing comfort, durability, and practical features for urban environments.

- Kids Bikes: Components designed for safety, simplicity, and durability for younger riders.

- Others: Includes components for BMX bikes, gravel bikes, touring bikes, and folding bikes.

- By Distribution Channel:

- OEM (Original Equipment Manufacturer): Components supplied directly to bicycle manufacturers for new bike assembly.

- Aftermarket: Components sold separately for replacement, upgrade, or customization by end-users.

- Specialty Bicycle Retailers: Dedicated bike shops offering expert advice and installation.

- Online Retailers: E-commerce platforms providing wide selection and convenience.

- Mass Merchants: Large retail chains offering more budget-friendly options.

- Other Retail Channels: Includes department stores, sporting goods stores, and direct-to-consumer models.

Regional Highlights

The Bicycle Component Market exhibits distinct regional dynamics, with each major geographical area contributing uniquely to its overall growth and evolution. Asia Pacific (APAC) stands as a powerhouse, dominating both the manufacturing and demand aspects. Countries like China, Taiwan, and Japan are global hubs for bicycle and component production, benefiting from extensive manufacturing infrastructure, skilled labor, and a strong supply chain ecosystem. Furthermore, the rising disposable incomes and increasing adoption of cycling for commuting and recreation in emerging economies within APAC, such as India and Southeast Asian nations, are fueling robust demand for a wide range of components.

Europe represents a highly mature and innovation-driven market, particularly for e-bike components and high-end cycling accessories. Countries like Germany, the Netherlands, and France lead in e-bike adoption, driven by government incentives, developed cycling infrastructure, and strong environmental awareness. This translates into a high demand for advanced drivetrain systems, integrated electronics, and premium braking solutions. North America, while having a significant aftermarket segment driven by cycling enthusiasts and sports-related activities, is also experiencing a surge in e-bike sales, similar to Europe. This region places a high emphasis on performance-oriented components, customization, and sustainable products, driving demand for lightweight materials and smart technologies. Latin America, the Middle East, and Africa (MEA) are emerging markets with growing potential. While currently smaller in market share, increasing urbanization, rising health consciousness, and developing cycling cultures are expected to drive future demand for entry-level and mid-range components, alongside infrastructure development supporting cycling as a viable mode of transport.

- Asia Pacific (APAC): Dominates global manufacturing, particularly in China, Taiwan, and Japan. Experiences high demand driven by increasing urbanization, rising disposable incomes, and the widespread adoption of cycling for commuting and leisure. Strong growth in e-bike component production and consumption.

- Europe: A mature and innovation-led market, especially for e-bikes and premium components. Driven by strong cycling culture, robust infrastructure, and environmental consciousness. Germany, Netherlands, and France are key markets for advanced braking, drivetrain, and electronic components.

- North America: Significant aftermarket demand from cycling enthusiasts and sports segments. Growing e-bike market contributing to demand for specialized components. Emphasis on performance, customization, and adoption of smart technologies.

- Latin America: Emerging market with increasing adoption of cycling for commuting and fitness. Potential for growth in mid-range and entry-level components, supported by urban development and infrastructure improvements.

- Middle East & Africa (MEA): Nascent but growing market for bicycle components, driven by increasing awareness of health benefits and initial investments in cycling infrastructure in select urban areas. Opportunities for basic and mid-range component imports.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bicycle Component Market.- Shimano Inc.

- SRAM LLC

- Campagnolo S.r.l.

- Fox Factory Holding Corp.

- DT Swiss AG

- RockShox (SRAM subsidiary)

- FSA (Full Speed Ahead)

- Continental AG

- Vittoria S.p.A.

- Maxxis International

- Schwalbe GmbH

- Tektro Technology Corporation

- Hayes Performance Systems

- Alex Global Technology Ltd.

- KMC Chain Industrial Co. Ltd.

- Selle Italia S.p.A.

- fi'zi:k (Selle Italia brand)

- Easton Cycling

- Mavic

- Cane Creek Cycling Components

Frequently Asked Questions

What is the current size and projected growth of the Bicycle Component Market?

The Bicycle Component Market is estimated at USD 25.4 billion in 2025 and is projected to reach USD 50.1 billion by 2033, growing at a Compound Annual Growth Rate (CAGR) of 8.7% during the forecast period.

What key trends are driving the Bicycle Component Market?

Key trends include the rapid adoption of e-bike specific components, increasing demand for lightweight and durable materials, integration of smart technologies, and a growing emphasis on sustainable manufacturing practices within the industry.

What are the main drivers of growth for the Bicycle Component Market?

The market is primarily driven by the surging growth of e-bike sales, increasing global health and wellness consciousness promoting cycling, growing urbanization favoring sustainable mobility, and continuous advancements in material science and manufacturing technologies.

What are the major challenges faced by the Bicycle Component Market?

Significant challenges include the rapid pace of technological obsolescence requiring constant R&D investment, intense global competition and price pressure, vulnerabilities in global supply chains, and issues related to intellectual property infringement and counterfeiting.

Which regions are key contributors to the Bicycle Component Market?

Asia Pacific (APAC) leads in both manufacturing and demand, with Europe and North America being mature markets known for e-bike adoption, innovation, and strong aftermarket segments. Latin America, the Middle East, and Africa (MEA) represent emerging growth opportunities.