Base Station Antenna Market

Base Station Antenna Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_704522 | Last Updated : August 11, 2025 |

Format : ![]()

![]()

![]()

![]()

Base Station Antenna Market Size

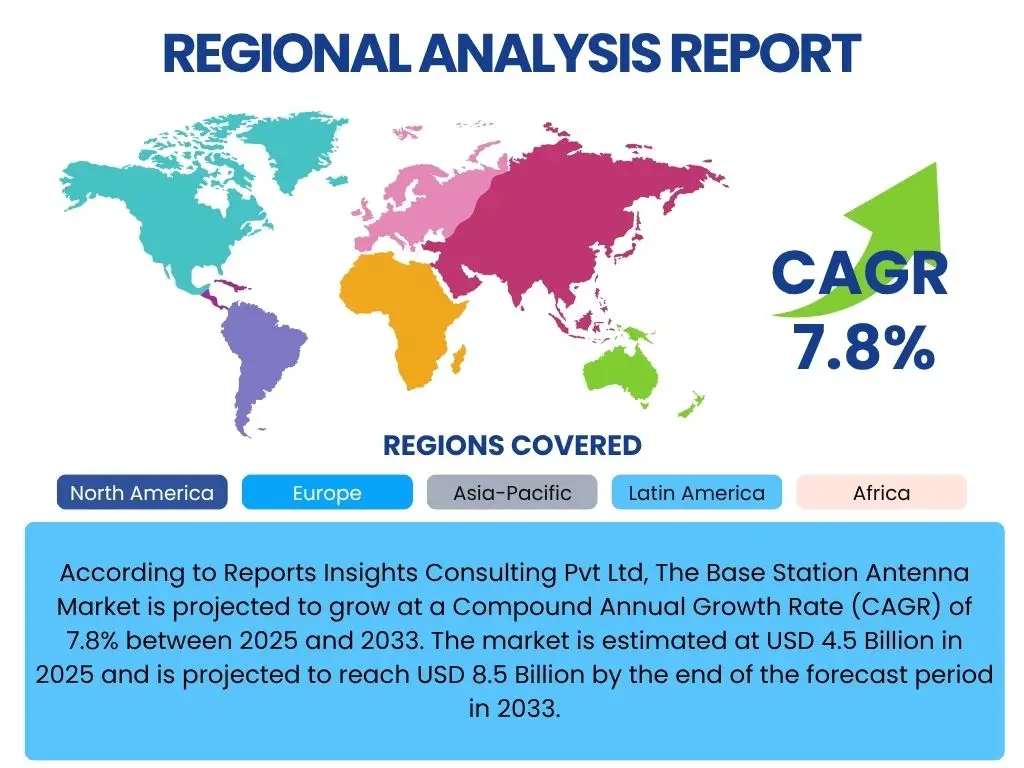

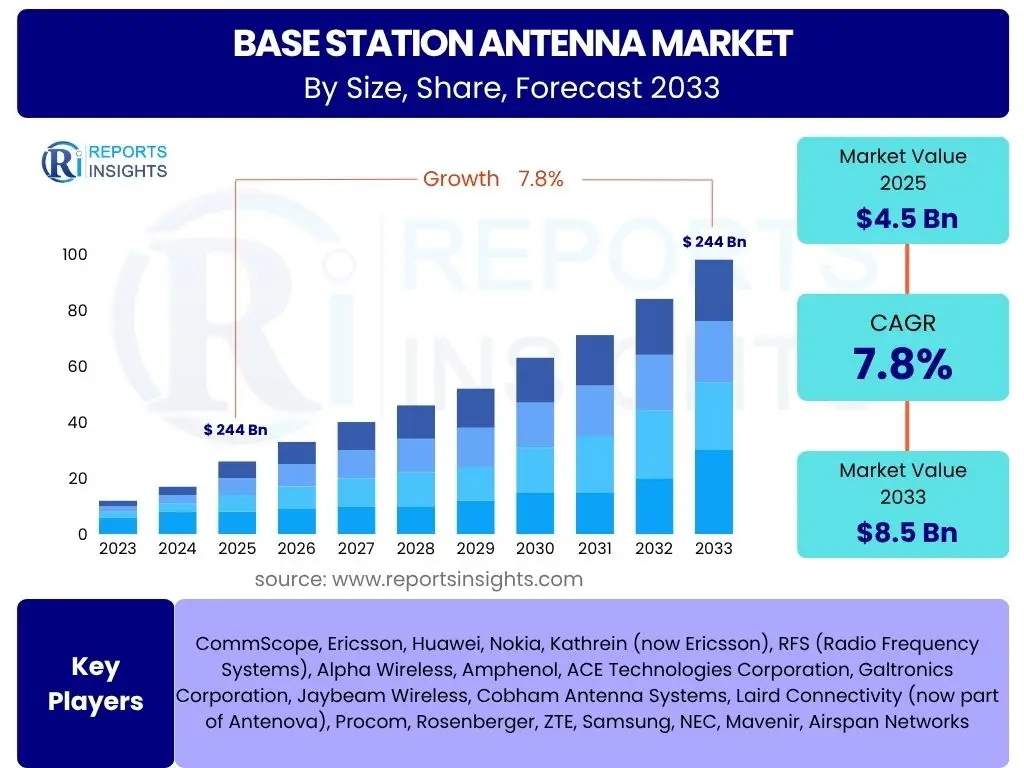

According to Reports Insights Consulting Pvt Ltd, The Base Station Antenna Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2025 and 2033. The market is estimated at USD 4.5 Billion in 2025 and is projected to reach USD 8.5 Billion by the end of the forecast period in 2033.

Key Base Station Antenna Market Trends & Insights

User queries frequently center on the evolving technological landscape and market dynamics influencing base station antennas. A primary area of interest is the transition to 5G and beyond, including the adoption of Massive MIMO and millimeter-wave technologies. There is also significant attention on the increasing densification of networks, the rise of small cells, and the integration of advanced features such as energy efficiency and AI-driven optimization. Users are keen to understand how these trends are shaping product development, deployment strategies, and the competitive environment within the market.

Furthermore, discussions often revolve around the economic viability and deployment challenges associated with new antenna technologies, particularly in diverse geographical contexts. The impact of open radio access network (Open RAN) architectures on traditional antenna designs and supply chains is another prominent area of inquiry, alongside the growing emphasis on sustainable and compact antenna solutions. These trends collectively underscore a market driven by continuous innovation aimed at enhancing network capacity, speed, and reliability while addressing operational complexities and environmental considerations.

- Proliferation of 5G and 5G-Advanced Deployments Driving Demand

- Increased Adoption of Massive MIMO (Multiple-Input, Multiple-Output) Antennas

- Growth in Small Cell Deployments for Network Densification

- Development of Energy-Efficient and Sustainable Antenna Solutions

- Integration of AI and Machine Learning for Network Optimization and Predictive Maintenance

- Emergence of Open RAN Architectures Influencing Antenna Design and Interoperability

- Focus on Multi-Band and Ultra-Wideband Antennas for Spectrum Flexibility

- Rising Demand for Antennas Supporting Private Networks and Enterprise Connectivity

AI Impact Analysis on Base Station Antenna

Common user questions regarding AI's impact on base station antennas primarily focus on how artificial intelligence can enhance network performance, operational efficiency, and predictive capabilities. Users inquire about AI's role in optimizing antenna beamforming, managing network traffic dynamically, and improving energy consumption. There's a strong interest in understanding how AI algorithms can process vast amounts of real-time data from base stations to identify anomalies, predict potential failures, and automate maintenance tasks, thereby reducing downtime and operational costs. The expectation is that AI will transform passive antenna systems into intelligent, adaptive components of a larger, self-optimizing network.

Furthermore, inquiries often delve into the potential for AI to facilitate more precise network planning and deployment, ensuring optimal coverage and capacity with fewer physical adjustments. Users also question the security implications and data privacy concerns associated with collecting and processing sensitive network data for AI analysis. The consensus suggests that AI integration is viewed as a critical step towards future autonomous networks, promising unprecedented levels of efficiency and reliability, though requiring significant investment in data infrastructure and specialized skills.

- Enhanced Dynamic Beamforming and Steering for Optimized Coverage

- Predictive Maintenance and Anomaly Detection for Reduced Downtime

- AI-Driven Network Optimization for Traffic Management and Load Balancing

- Improved Energy Efficiency Through Intelligent Power Management

- Automated Fault Diagnosis and Self-Healing Network Capabilities

- Data-Driven Network Planning and Antenna Placement Optimization

- Real-time Performance Monitoring and Adaptive Configuration

Key Takeaways Base Station Antenna Market Size & Forecast

User inquiries about key takeaways from the base station antenna market size and forecast consistently highlight the robust growth trajectory driven by global 5G expansion and the increasing need for network densification. A primary insight is the significant investment by telecom operators in advanced antenna technologies to support higher data speeds, lower latency, and massive connectivity demands. The market is set for sustained expansion, propelled by the continuous evolution of wireless communication standards and the proliferation of connected devices across various sectors. Emphasis is placed on the strategic importance of innovative antenna designs, such as Massive MIMO and multi-band solutions, in achieving future network capabilities.

Another crucial takeaway frequently sought by users relates to the regional variations in market growth and technology adoption. While developed regions lead in 5G deployment, emerging markets present substantial long-term opportunities due to ongoing infrastructure development. The forecast indicates a shift towards more intelligent, adaptable, and energy-efficient antenna systems, underscoring the market's responsiveness to both technological advancements and sustainability goals. The competitive landscape is characterized by innovation and strategic partnerships, as companies strive to offer solutions that meet the complex demands of next-generation networks.

- Market Projected for Strong Growth, Driven by Global 5G Rollout.

- Significant Increase in Network Densification Requiring Advanced Antenna Solutions.

- Massive MIMO and Multi-Band Antennas are Key Growth Enablers.

- Emphasis on Energy Efficiency and Sustainability in New Antenna Designs.

- Developing Regions Present Substantial Future Growth Opportunities.

- Continuous Investment in Research and Development for Next-Generation Antennas.

- Strategic Importance of Antennas for IoT and Enterprise Private Networks.

Base Station Antenna Market Drivers Analysis

The base station antenna market is primarily driven by the global imperative to deploy next-generation cellular networks, most notably 5G. This widespread rollout necessitates the installation of a greater number of base stations and, consequently, advanced antennas capable of supporting higher frequencies, wider bandwidths, and increased data throughput. The insatiable demand for high-speed internet connectivity, propelled by the growth of data-intensive applications, video streaming, and online services, directly translates into a need for more robust and efficient network infrastructure, with antennas forming the core of signal transmission and reception.

Further bolstering market growth is the accelerating trend of network densification, particularly in urban and densely populated areas. As subscriber numbers and data usage surge, operators are deploying more small cells and microcells to enhance coverage, capacity, and user experience. This densification strategy requires a diverse range of antenna types, including compact, aesthetically pleasing designs that can be integrated into various urban environments. Additionally, the proliferation of IoT devices and the development of smart cities are creating new use cases for cellular connectivity, demanding ubiquitous and reliable network access which is facilitated by an expanded and upgraded antenna infrastructure.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Global 5G Network Rollout | +2.5% | Global, particularly North America, Asia Pacific, Europe | Medium to Long-term (2025-2033) |

| Increasing Network Densification and Small Cell Deployment | +1.8% | Urban areas globally, high-traffic zones | Medium-term (2025-2030) |

| Rising Demand for High-Speed Internet and Data Services | +1.5% | Global | Long-term (2025-2033) |

| Proliferation of IoT Devices and Smart City Initiatives | +1.0% | Global, especially smart cities projects | Medium to Long-term (2026-2033) |

| Government Initiatives and Digital Transformation Programs | +0.7% | Emerging Economies, specific national policies | Medium-term (2025-2030) |

Base Station Antenna Market Restraints Analysis

Despite the robust growth prospects, the base station antenna market faces several significant restraints. One primary challenge is the substantial capital expenditure (CapEx) required for network infrastructure upgrades and new deployments. The cost associated with acquiring, installing, and maintaining advanced antennas, coupled with the necessary backend infrastructure, can be prohibitive for smaller operators or in regions with limited investment capacity. This high upfront investment often extends the return on investment period, impacting deployment timelines and potentially slowing market expansion.

Another notable restraint is the scarcity and high cost of suitable spectrum, particularly for higher frequency bands essential for 5G and future technologies. Regulatory hurdles, complex licensing processes, and fragmented spectrum allocation across different regions can hinder efficient network planning and deployment, thereby limiting the full potential of advanced antenna technologies. Additionally, environmental concerns and aesthetic considerations, particularly in urban areas, pose challenges for antenna placement and visual impact, leading to public resistance and stringent zoning regulations that complicate deployment efforts and increase project timelines.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Capital Expenditure (CapEx) for Network Rollout | -1.2% | Global, particularly developing regions | Medium-term (2025-2030) |

| Spectrum Availability and Licensing Challenges | -0.9% | Global, varies by regulatory environment | Medium-term (2025-2030) |

| Environmental and Aesthetic Concerns for Deployment | -0.7% | Urban areas, densely populated regions | Long-term (2025-2033) |

| Supply Chain Disruptions and Component Shortages | -0.5% | Global | Short-term (2025-2027) |

| Interoperability Issues with Legacy Infrastructure | -0.4% | Global, particularly older networks | Medium-term (2025-2030) |

Base Station Antenna Market Opportunities Analysis

The base station antenna market presents significant opportunities driven by the continuous evolution of wireless technologies and the expansion of connectivity requirements. One major opportunity lies in the burgeoning demand for antennas capable of operating across multiple frequency bands, including millimeter-wave (mmWave) for 5G, enabling higher bandwidth and capacity. The development of advanced antenna arrays, such as Massive MIMO, is paving the way for unprecedented spectral efficiency and network performance, opening new avenues for innovation and market penetration. As network operators seek to maximize their spectrum assets, multi-band and ultra-wideband antenna solutions offer a compelling value proposition.

Furthermore, the growth of private networks for enterprises, industries, and campuses creates a niche but rapidly expanding market segment for specialized base station antennas. These dedicated networks require bespoke antenna solutions tailored to specific operational environments and security needs, offering manufacturers an opportunity to diversify their product portfolios. The increasing focus on smart city initiatives, remote area connectivity, and the integration of satellite communication with terrestrial networks also provides fertile ground for the development and deployment of innovative antenna technologies. Finally, the emphasis on energy-efficient and sustainable network infrastructure offers opportunities for companies to differentiate themselves by developing environmentally friendly antenna solutions that reduce power consumption and operational costs for operators.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Emergence of Millimeter-Wave (mmWave) Technology | +1.5% | Developed markets, densely populated urban areas | Medium to Long-term (2026-2033) |

| Growth of Private 5G and Enterprise Networks | +1.2% | Industrial sectors, large enterprises globally | Medium-term (2025-2030) |

| Focus on Energy-Efficient and Sustainable Solutions | +1.0% | Global, driven by corporate sustainability goals | Long-term (2027-2033) |

| Expansion into Untapped Rural and Remote Areas | +0.8% | Developing economies, underserved regions | Medium to Long-term (2026-2033) |

| Integration with Satellite Communication for Hybrid Networks | +0.6% | Global, particularly for specialized applications | Long-term (2028-2033) |

Base Station Antenna Market Challenges Impact Analysis

The base station antenna market faces several persistent challenges that could impede its growth. One significant hurdle is the rapid pace of technological evolution, which can lead to accelerated product obsolescence. As new communication standards like 5G-Advanced and 6G emerge, current antenna technologies may quickly become outdated, requiring substantial and frequent investments in upgrades. This constant need for innovation puts pressure on manufacturers to accelerate research and development cycles while maintaining competitive pricing, potentially impacting profit margins and market stability.

Another critical challenge is the growing complexity of network deployment and optimization. The rollout of advanced networks, particularly those leveraging Massive MIMO and small cells, demands highly specialized skills for installation, calibration, and maintenance. A shortage of skilled professionals capable of handling these sophisticated antenna systems can lead to deployment delays and increased operational costs. Furthermore, ensuring seamless interoperability between various antenna types, network equipment from different vendors, and legacy infrastructure presents a significant technical challenge, potentially hindering the efficient integration and performance of heterogeneous networks.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Rapid Technological Obsolescence and Upgrade Cycles | -1.0% | Global | Medium to Long-term (2025-2033) |

| Shortage of Skilled Workforce for Deployment and Maintenance | -0.8% | Global, particularly in specialized areas | Medium-term (2025-2030) |

| Interoperability Issues with Diverse Network Equipment | -0.7% | Global | Medium-term (2025-2030) |

| Increasing Cybersecurity Threats to Network Infrastructure | -0.6% | Global | Long-term (2025-2033) |

| Economic Downturns and Fluctuations in Telecom Investment | -0.5% | Global, varies by economic stability | Short to Medium-term (2025-2028) |

Base Station Antenna Market - Updated Report Scope

This market insights report provides a comprehensive analysis of the base station antenna market, examining its current landscape, growth drivers, restraints, opportunities, and challenges. It offers detailed market sizing and forecasts, segmented by technology, type, application, and end-user, across key global regions. The report includes an in-depth competitive analysis of leading market players, highlighting their strategies, product portfolios, and recent developments, serving as a critical resource for stakeholders seeking strategic market intelligence.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 8.5 Billion |

| Growth Rate | 7.8% |

| Number of Pages | 255 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | CommScope, Ericsson, Huawei, Nokia, Kathrein (now Ericsson), RFS (Radio Frequency Systems), Alpha Wireless, Amphenol, ACE Technologies Corporation, Galtronics Corporation, Jaybeam Wireless, Cobham Antenna Systems, Laird Connectivity (now part of Antenova), Procom, Rosenberger, ZTE, Samsung, NEC, Mavenir, Airspan Networks |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The base station antenna market is comprehensively segmented to provide a granular understanding of its diverse components and evolving landscape. This segmentation allows for precise analysis of market dynamics, growth drivers, and opportunities across various technological advancements, antenna types, deployment applications, and end-user industries. By breaking down the market, stakeholders can identify key areas of investment, assess competitive advantages, and tailor strategies to specific market niches, reflecting the complex demands of modern wireless communication infrastructure.

Understanding these segments is crucial for recognizing how different market forces interact. For instance, the transition to 5G heavily influences technology-based segments, while network densification drives the growth of specific antenna types and applications like small cells. End-user segmentation highlights the distinct needs of telecom operators versus private enterprises, impacting product specifications and market approaches. This multi-faceted analysis ensures a holistic view of the market's structure and its future trajectory.

- By Technology:

- 4G/LTE: Represents the widespread current generation, still undergoing upgrades and capacity enhancements.

- 5G: The primary growth driver, encompassing sub-6 GHz and millimeter-wave deployments.

- Others (2G, 3G): Legacy networks requiring ongoing maintenance and phased replacement.

- By Type:

- Omnidirectional Antennas: Provide 360-degree coverage, commonly used in areas requiring broad signal dispersion.

- Directional Antennas: Focus signal in a specific direction, enhancing range and reducing interference.

- Multi-Band Antennas: Support multiple frequency bands, optimizing spectrum utilization and reducing site footprint.

- Small Cell Antennas: Compact antennas for network densification in urban and indoor environments.

- Massive MIMO Antennas: Feature a large number of antenna elements for enhanced capacity and spectral efficiency in 5G.

- Phased Array Antennas: Electronically steer beams for dynamic coverage and interference mitigation.

- By Application:

- Macrocell: Traditional large coverage area base stations, forming the backbone of cellular networks.

- Small Cell: Microcells, picocells, and femtocells used for localized coverage and capacity enhancement.

- Distributed Antenna Systems (DAS): Networks of spatially separated antenna nodes connected to a common source, for indoor or specific outdoor coverage.

- Private Networks: Dedicated cellular networks for specific enterprises or industries, offering enhanced security and control.

- By End-User:

- Telecommunication Operators: Major consumers, deploying antennas for public mobile networks.

- Enterprise: Industries, campuses, and businesses deploying private networks for operational efficiency.

- Government & Public Safety: Agencies utilizing dedicated networks for critical communication.

Regional Highlights

- North America: This region is a frontrunner in 5G adoption and deployment, characterized by substantial investments in network infrastructure upgrades. The presence of major telecom operators and technology innovators drives demand for advanced base station antennas, including Massive MIMO and millimeter-wave solutions. Early commercial 5G rollouts and continuous efforts toward network densification in urban centers position North America as a key market, with a strong focus on high-performance and energy-efficient antenna technologies.

- Europe: Characterized by diverse regulatory landscapes and varying paces of 5G rollout across countries. While Western European nations are actively deploying 5G, Eastern Europe is gradually catching up. The region emphasizes the development of open and disaggregated network architectures, such as Open RAN, which influences antenna design and interoperability requirements. Sustainability and energy efficiency are also critical considerations in European antenna deployments, driving demand for greener solutions.

- Asia Pacific (APAC): Expected to be the largest and fastest-growing market for base station antennas due to massive 5G deployments in countries like China, India, Japan, and South Korea. Rapid urbanization, increasing mobile data consumption, and government initiatives to enhance digital connectivity are propelling network expansion and densification efforts. This region offers significant opportunities for antenna manufacturers, particularly for high-capacity and cost-effective solutions to meet the demands of a vast and diverse subscriber base.

- Latin America: Demonstrating steady growth in base station antenna adoption, driven by increasing smartphone penetration and the nascent stages of 5G deployment. Governments and operators are focused on expanding network coverage, particularly in underserved rural areas, and upgrading existing 4G/LTE infrastructure. The market in this region is characterized by a demand for robust and versatile antennas that can withstand diverse environmental conditions and support efficient network rollout in developing economies.

- Middle East and Africa (MEA): This region is experiencing significant investment in telecommunications infrastructure, especially driven by Vision 2030 initiatives in the Middle East and digital transformation efforts across Africa. Countries like UAE, Saudi Arabia, and South Africa are leading 5G rollouts, creating demand for advanced base station antennas. The focus is on bridging the digital divide, expanding mobile broadband access, and supporting economic diversification through enhanced connectivity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Base Station Antenna Market.- CommScope

- Ericsson

- Huawei

- Nokia

- Kathrein (now Ericsson)

- RFS (Radio Frequency Systems)

- Alpha Wireless

- Amphenol

- ACE Technologies Corporation

- Galtronics Corporation

- Jaybeam Wireless

- Cobham Antenna Systems

- Laird Connectivity (now part of Antenova)

- Procom

- Rosenberger

- ZTE

- Samsung

- NEC

- Mavenir

- Airspan Networks

Frequently Asked Questions

What is the projected growth rate of the Base Station Antenna Market?

The Base Station Antenna Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2025 and 2033, driven by global 5G expansion and network densification efforts.

How does 5G impact the demand for base station antennas?

5G significantly drives demand for base station antennas by requiring higher numbers of antennas, especially Massive MIMO and millimeter-wave types, to support increased data speeds, lower latency, and expanded network capacity.

What are the key technological trends influencing base station antennas?

Key technological trends include the adoption of Massive MIMO, the proliferation of small cells, the integration of AI for network optimization, and the development of energy-efficient and multi-band antenna solutions.

What are the primary challenges in the Base Station Antenna Market?

Primary challenges include high capital expenditures, spectrum availability issues, rapid technological obsolescence, and the shortage of skilled professionals for complex deployment and maintenance tasks.

Which regions are leading in the adoption of advanced base station antennas?

North America and Asia Pacific are leading in the adoption of advanced base station antennas due to aggressive 5G rollouts and significant investments in network infrastructure upgrades.