Automotive Sensor Market

Automotive Sensor Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_703057 | Last Updated : August 01, 2025 |

Format : ![]()

![]()

![]()

![]()

Automotive Sensor Market Size

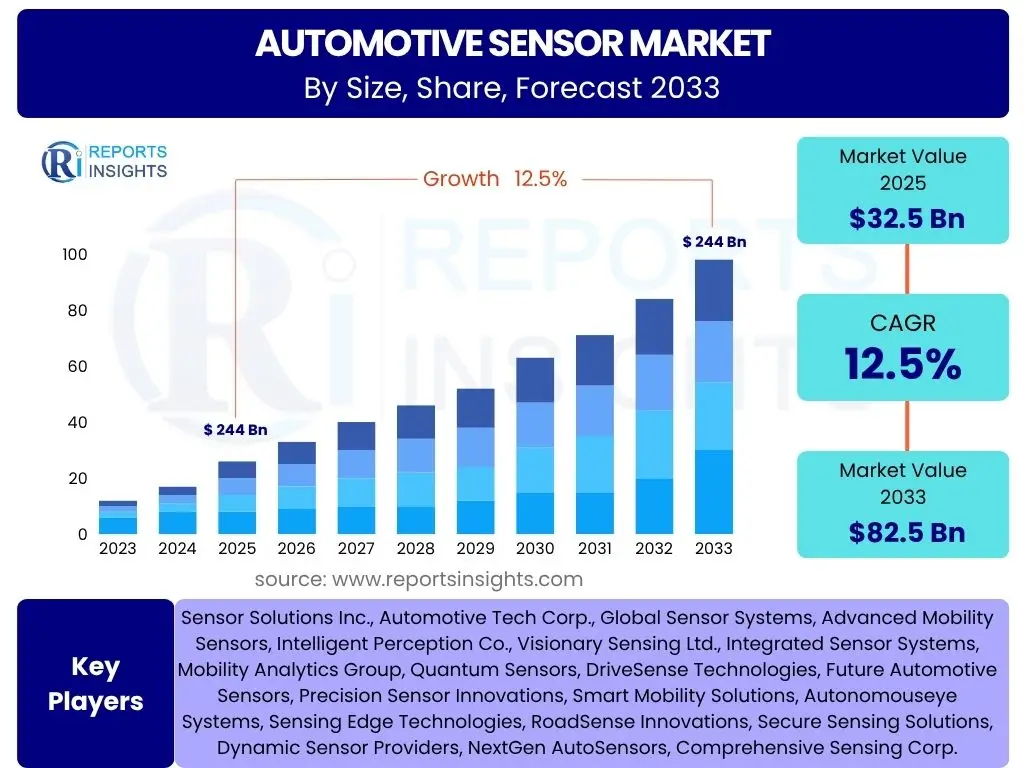

According to Reports Insights Consulting Pvt Ltd, The Automotive Sensor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2025 and 2033. The market is estimated at USD 32.5 Billion in 2025 and is projected to reach USD 82.5 Billion by the end of the forecast period in 2033.

Key Automotive Sensor Market Trends & Insights

Users frequently inquire about the evolving landscape of automotive sensor technologies and their integration into modern vehicles. Common questions revolve around the impact of autonomous driving, the proliferation of electric vehicles, and advancements in sensor fusion. Insights reveal a significant shift towards more sophisticated sensor systems that enable higher levels of vehicle autonomy, enhanced safety features, and improved operational efficiency. The market is also witnessing a strong trend towards miniaturization, cost reduction, and increased data processing capabilities at the edge.

Another area of interest for users is the adoption of new sensor types, such as solid-state lidar and advanced radar, which offer superior performance in challenging environmental conditions. Furthermore, the increasing demand for vehicle-to-everything (V2X) communication is driving the need for sensors that can seamlessly integrate with broader intelligent transportation systems. These trends collectively underscore a dynamic market propelled by technological innovation and evolving consumer expectations for safer, smarter, and more connected automobiles.

- Growing adoption of Advanced Driver-Assistance Systems (ADAS) and autonomous driving features.

- Increased demand for sensors in Electric Vehicles (EVs) for battery management, motor control, and charging systems.

- Advancements in sensor fusion technologies for improved perception and decision-making.

- Development and integration of next-generation sensor technologies like solid-state lidar and 4D imaging radar.

- Focus on cybersecurity for sensor data and communication networks.

- Miniaturization and cost reduction of sensor components.

- Expansion of connectivity features (V2X, 5G) driving demand for integrated sensor solutions.

AI Impact Analysis on Automotive Sensor

User queries regarding the impact of Artificial Intelligence (AI) on automotive sensors often focus on how AI enhances sensor capabilities, processes complex data, and contributes to improved safety and autonomy. AI is increasingly vital for interpreting raw sensor data, enabling vehicles to understand their surroundings with greater precision and reliability. This includes object detection, classification, tracking, and predicting behavior, all of which are crucial for advanced ADAS and autonomous driving systems. AI algorithms, particularly deep learning and machine learning, are transforming how sensor inputs from various modalities (camera, radar, lidar, ultrasonic) are processed and fused to create a comprehensive environmental model, leading to more robust perception and reduced false positives.

Furthermore, users are interested in AI's role in the development of "smart" sensors that can perform on-chip processing and decision-making, reducing latency and data transfer burdens. AI also plays a significant role in predictive maintenance for sensors, ensuring their optimal performance and longevity, and in continuously improving sensor performance through over-the-air (OTA) updates and machine learning models trained on vast datasets. The integration of AI is not merely an enhancement but a fundamental shift towards more intelligent and adaptive sensor systems, addressing key challenges like adverse weather conditions, complex traffic scenarios, and edge case detection, thereby accelerating the path towards fully autonomous vehicles.

- Enhances sensor data processing and interpretation through machine learning algorithms.

- Improves object detection, classification, and tracking accuracy for ADAS and autonomous driving.

- Enables advanced sensor fusion to create a more comprehensive environmental perception model.

- Facilitates predictive maintenance for sensor systems, optimizing performance and longevity.

- Drives the development of "smart" sensors with embedded AI for edge computing capabilities.

- Contributes to real-time decision-making and adaptive vehicle control.

- Supports continuous learning and improvement of sensor performance through OTA updates.

Key Takeaways Automotive Sensor Market Size & Forecast

User questions frequently center on the overall market outlook, the primary growth drivers, and the most promising future directions for the automotive sensor market. A significant takeaway is the robust growth trajectory, primarily fueled by the relentless pursuit of vehicle autonomy and enhanced safety features. The market's expansion is not merely about increasing sensor volumes but also about the increasing sophistication and diversification of sensor types. The forecast indicates sustained investment in research and development, particularly for next-generation sensing technologies that can handle more complex environments and provide higher fidelity data.

Another crucial insight is the accelerating integration of AI and machine learning into sensor systems, which is transforming raw data into actionable intelligence, thereby enabling higher levels of ADAS and autonomous driving. The market is also heavily influenced by regulatory pressures for vehicle safety and environmental considerations, pushing manufacturers to adopt advanced sensor solutions. Regional dynamics highlight Asia Pacific as a significant growth engine, driven by high vehicle production and technology adoption. Overall, the market is characterized by innovation, increasing complexity, and a clear path towards more intelligent and interconnected automotive ecosystems.

- The automotive sensor market is poised for substantial growth, driven by ADAS, autonomous vehicles, and EVs.

- Technological advancements, particularly in AI and sensor fusion, are key enablers of market expansion.

- Regulatory mandates for safety and environmental efficiency are strong market catalysts.

- Asia Pacific is projected to be a dominant growth region due to burgeoning automotive manufacturing and adoption of advanced technologies.

- Investment in next-generation sensor technologies like solid-state lidar and 4D radar is increasing.

- Cybersecurity and data integrity for sensor systems are becoming critical considerations.

Automotive Sensor Market Drivers Analysis

The automotive sensor market is experiencing significant growth propelled by several key drivers. The increasing global adoption of Advanced Driver-Assistance Systems (ADAS) is a primary catalyst, as these systems rely heavily on various types of sensors for functions such as lane keeping, adaptive cruise control, automatic emergency braking, and parking assistance. As safety standards become more stringent worldwide and consumers demand advanced safety features, the integration of an expanded array of sensors becomes imperative for automotive manufacturers. This trend is further amplified by the development and eventual commercialization of autonomous vehicles, which require an even greater density and sophistication of sensors to achieve full self-driving capabilities.

Another powerful driver is the rapid proliferation of Electric Vehicles (EVs). EVs utilize a diverse range of sensors for critical functions beyond traditional internal combustion engine vehicles, including battery management, motor control, power electronics monitoring, and charging infrastructure communication. The push for environmental sustainability and government incentives for EV adoption are directly contributing to the increased demand for specialized sensors in this segment. Additionally, the growing focus on vehicle connectivity, integrating vehicles into the broader Internet of Things (IoT) ecosystem, drives the need for sensors that enable seamless communication for infotainment, telematics, and V2X applications, thereby enhancing the overall intelligent transportation system infrastructure.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Adoption of ADAS and Autonomous Driving | +3.0% | North America, Europe, Asia Pacific (China, Japan) | 2025-2033 (Long-term) |

| Growth in Electric Vehicle (EV) Production and Sales | +2.5% | Asia Pacific (China), Europe, North America | 2025-2033 (Long-term) |

| Strict Regulatory Mandates for Vehicle Safety | +1.5% | Europe, North America, Japan | 2025-2030 (Medium-term) |

| Advancements in Sensor Technology (e.g., Sensor Fusion) | +2.0% | Global | 2025-2033 (Long-term) |

| Rising Demand for Vehicle Connectivity and IoT Integration | +1.0% | Global | 2025-2033 (Long-term) |

Automotive Sensor Market Restraints Analysis

Despite the robust growth potential, the automotive sensor market faces several significant restraints. One major challenge is the high cost associated with advanced sensor technologies, particularly for emerging solutions like lidar and high-resolution radar. These costs can significantly increase the overall price of vehicles, potentially limiting their widespread adoption, especially in cost-sensitive emerging markets. Additionally, the complexity involved in integrating multiple sensor types, each with its own data streams and processing requirements, presents engineering hurdles and increases development time and costs for automotive manufacturers. Ensuring seamless operation and data synchronization across diverse sensor modalities is a considerable technical challenge.

Furthermore, the automotive industry's susceptibility to global supply chain disruptions poses a substantial restraint. The production of sensors relies on a complex network of specialized components and raw materials, and disruptions due to geopolitical events, natural disasters, or pandemics can severely impact sensor availability and lead to production delays. Concerns regarding data privacy and cybersecurity also present a growing challenge. As vehicles collect vast amounts of sensitive data through their sensor arrays, ensuring the secure handling and transmission of this data is paramount. Any breach or vulnerability could erode consumer trust and lead to stringent regulations, potentially slowing down market growth and adoption of highly connected and autonomous vehicles.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Cost of Advanced Sensor Technologies | -1.2% | Global, particularly emerging markets | 2025-2030 (Medium-term) |

| Complexity of Sensor Integration and Data Processing | -0.8% | Global | 2025-2028 (Short-term) |

| Supply Chain Volatility and Component Shortages | -1.0% | Global | 2025-2027 (Short-term) |

| Data Privacy and Cybersecurity Concerns | -0.7% | North America, Europe | 2025-2033 (Long-term) |

Automotive Sensor Market Opportunities Analysis

Significant opportunities are emerging within the automotive sensor market, driven by evolving technological landscapes and increasing demand for advanced vehicle capabilities. One prominent opportunity lies in the burgeoning market for autonomous vehicles (AVs). As AV technology matures and regulatory frameworks develop, the demand for highly reliable, redundant, and diverse sensor suites will skyrocket. This includes opportunities for specialized lidar, radar, and camera systems tailored for Level 3 and above autonomous driving, as well as the integration of novel sensor types like thermal cameras and acoustic sensors for enhanced environmental perception in all conditions. The development of sensor cleaning and calibration systems for AVs also presents a substantial niche market opportunity.

Another major opportunity exists in the continuous innovation of sensor fusion platforms. The ability to seamlessly combine data from multiple sensor modalities to create a more robust and accurate perception of the vehicle's surroundings is critical. This drives demand for advanced processors, AI-powered algorithms, and specialized software development, offering significant growth for companies providing integrated sensor fusion solutions. Furthermore, the expansion of smart city infrastructure and vehicle-to-everything (V2X) communication creates opportunities for sensors that can interact with external environments, such as smart traffic lights, road infrastructure, and other vehicles, enhancing overall transportation efficiency and safety. The aftermarket segment, providing upgrades and replacements for advanced sensor systems, also presents a lucrative, albeit more niche, opportunity as the vehicle parc of ADAS-equipped vehicles expands.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Accelerated Development of Autonomous Driving (L3-L5) | +2.5% | North America, Europe, China | 2028-2033 (Long-term) |

| Advancements in Sensor Fusion and AI Integration | +1.8% | Global | 2025-2033 (Long-term) |

| Emergence of New Sensor Technologies (e.g., 4D Radar, Solid-State Lidar) | +1.5% | Global | 2026-2033 (Long-term) |

| Growth in Aftermarket Sales and Retrofit Solutions | +0.7% | North America, Europe, Developing Regions | 2025-2033 (Long-term) |

| Integration with Smart City Infrastructure and V2X Communication | +1.0% | Europe, Asia Pacific (Singapore, South Korea) | 2028-2033 (Long-term) |

Automotive Sensor Market Challenges Impact Analysis

The automotive sensor market faces inherent challenges that can impede its growth and widespread adoption. Ensuring the reliability and robustness of sensors in diverse and harsh automotive environments is a primary concern. Sensors must operate flawlessly under extreme temperatures, vibrations, humidity, and exposure to dirt, dust, and water, which necessitates rigorous testing and material science innovation. Failures in these conditions can lead to critical system malfunctions, especially for safety-critical ADAS and autonomous driving functions. The rapid pace of technological innovation also presents a challenge, as new sensor generations emerge quickly, potentially leading to rapid obsolescence of current technologies and significant R&D investments to keep pace.

Another significant challenge is the lack of universal standardization across different sensor types and communication protocols. This fragmentation complicates integration efforts for vehicle manufacturers, leading to increased development costs and potential interoperability issues between components from various suppliers. Achieving consensus on performance metrics, data formats, and communication interfaces is crucial for streamlining development and reducing costs. Furthermore, the sheer volume of data generated by advanced sensor suites poses a significant challenge for real-time processing, transmission, and storage, requiring substantial computational power, efficient data compression algorithms, and robust network infrastructure, all of which add complexity and cost to the vehicle architecture.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Ensuring Sensor Reliability and Durability in Harsh Environments | -0.9% | Global | 2025-2033 (Long-term) |

| Lack of Standardization and Interoperability Issues | -0.6% | Global | 2025-2030 (Medium-term) |

| High Data Processing and Bandwidth Requirements | -0.7% | Global | 2025-2033 (Long-term) |

| Regulatory Hurdles and Liability Concerns for Autonomous Systems | -0.5% | North America, Europe | 2025-2033 (Long-term) |

Automotive Sensor Market - Updated Report Scope

This comprehensive report provides an in-depth analysis of the global automotive sensor market, encompassing detailed market size estimations, historical trends, and future growth projections from 2025 to 2033. It meticulously examines key market drivers, restraints, opportunities, and challenges that shape the industry landscape. The report segments the market by sensor type, application, vehicle type, and region, offering granular insights into various market dynamics. Furthermore, it includes a competitive analysis of leading market players, assessing their strategies, product portfolios, and recent developments to provide a holistic view of the market ecosystem. The report also integrates the impact of emerging technologies like AI and their influence on sensor capabilities and applications, providing a forward-looking perspective for stakeholders.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 32.5 Billion |

| Market Forecast in 2033 | USD 82.5 Billion |

| Growth Rate | 12.5% |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Sensor Solutions Inc., Automotive Tech Corp., Global Sensor Systems, Advanced Mobility Sensors, Intelligent Perception Co., Visionary Sensing Ltd., Integrated Sensor Systems, Mobility Analytics Group, Quantum Sensors, DriveSense Technologies, Future Automotive Sensors, Precision Sensor Innovations, Smart Mobility Solutions, Autonomouseye Systems, Sensing Edge Technologies, RoadSense Innovations, Secure Sensing Solutions, Dynamic Sensor Providers, NextGen AutoSensors, Comprehensive Sensing Corp. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The automotive sensor market is comprehensively segmented to provide granular insights into its diverse components and applications. These segmentations allow for a detailed analysis of market performance across different sensor technologies, their specific uses within vehicles, and their adoption rates across various vehicle types and sales channels. Understanding these segments is crucial for identifying key growth areas, assessing competitive landscapes, and formulating targeted market strategies. The market's complexity necessitates a multi-dimensional approach to segmentation, reflecting the intricate interdependencies between different sensor types and their increasing integration within advanced automotive systems. This detailed breakdown aids stakeholders in pinpointing specific opportunities and challenges within the vast automotive ecosystem.

- By Sensor Type:

- Radar Sensor: Used for distance measurement, speed detection, and object recognition (e.g., ADAS features like adaptive cruise control, blind spot detection).

- Lidar Sensor: Provides high-resolution 3D mapping of surroundings, crucial for autonomous driving and detailed environmental perception.

- Camera Sensor: Captures visual data for image processing, lane keeping assistance, traffic sign recognition, and rear-view displays.

- Ultrasonic Sensor: Primarily used for short-range detection, parking assistance, and obstacle warning systems.

- Pressure Sensor: Monitors fluid pressure (e.g., tire pressure, engine oil pressure, brake fluid pressure) and gas pressure (e.g., manifold absolute pressure).

- Temperature Sensor: Measures temperature in various vehicle components (e.g., engine coolant, exhaust gas, cabin climate control, battery temperature in EVs).

- Position Sensor: Detects the position or displacement of mechanical parts (e.g., throttle position, crankshaft position, pedal position).

- Speed Sensor: Measures vehicle speed and wheel speed for functions like ABS, traction control, and transmission control.

- Others: Includes gas sensors, humidity sensors, rain sensors, and gyroscopes/accelerometers for stability control and navigation.

- By Application:

- Powertrain: Sensors for engine management, transmission, fuel systems, and emissions control.

- Chassis: Sensors for suspension, steering, braking systems (ABS, ESC), and tire pressure monitoring.

- Safety & Control: Sensors contributing to airbag deployment, occupant detection, and pre-tensioner systems.

- Body Electronics: Sensors for convenience features like rain sensing wipers, automatic lights, and climate control.

- Telematics: Sensors integrated for vehicle tracking, emergency services, and remote diagnostics.

- ADAS (Advanced Driver-Assistance Systems): Comprehensive sensor suites enabling features like lane assist, collision avoidance, and adaptive cruise control.

- Others: Includes sensors for infotainment systems, security, and interior monitoring.

- By Vehicle Type:

- Passenger Vehicles: Sedans, SUVs, hatchbacks, and other personal use vehicles.

- Commercial Vehicles: Trucks, buses, vans, and other vehicles used for business or transportation of goods/passengers.

- By Sales Channel:

- OEM (Original Equipment Manufacturer): Sensors supplied directly to automotive manufacturers for new vehicle production.

- Aftermarket: Sensors sold for replacement, repair, or upgrade after the vehicle's initial sale.

Regional Highlights

- North America: This region demonstrates strong growth, driven by early adoption of ADAS technologies and a growing market for premium vehicles. Stringent safety regulations and high consumer demand for advanced features like automated parking and semi-autonomous driving capabilities contribute significantly to sensor integration. Key countries like the United States and Canada are also witnessing increased investment in autonomous vehicle research and development, further bolstering the demand for sophisticated sensor arrays. The presence of major automotive OEMs and technology companies fosters innovation and market expansion.

- Europe: Europe is a mature market for automotive sensors, characterized by strict emission norms and advanced safety standards (e.g., Euro NCAP). The region is a pioneer in implementing ADAS features as standard in new vehicles. Germany, France, and the UK are leading countries, driven by significant automotive production and a focus on electric vehicles and connected car technologies. The emphasis on road safety and environmental sustainability translates into continuous demand for high-performance and reliable sensor solutions across all vehicle segments.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, primarily due to the rapid expansion of automotive manufacturing bases in countries like China, Japan, South Korea, and India. China, in particular, is a dominant force with its large vehicle production volume and aggressive push for electric vehicles and autonomous driving. Economic growth, increasing disposable incomes, and urbanization in these countries are driving the demand for personal vehicles equipped with advanced safety and convenience features, thereby fueling the automotive sensor market. Government initiatives supporting EV adoption and intelligent transportation systems also play a crucial role.

- Latin America: This region is an emerging market for automotive sensors, with growth primarily driven by increasing vehicle production, particularly in Brazil and Mexico. While the adoption of advanced sensor systems may be slower compared to developed regions due to cost sensitivities, there is a gradual increase in demand for basic safety and engine management sensors. As automotive safety standards improve and manufacturing capabilities expand, the market for automotive sensors is expected to witness steady, albeit moderate, growth.

- Middle East and Africa (MEA): The MEA region is at an nascent stage in terms of advanced automotive sensor adoption, with growth mainly concentrated in economically stronger nations like Saudi Arabia and the UAE. Investments in infrastructure development and a growing automotive aftermarket contribute to market demand. The market is influenced by international vehicle imports which increasingly come equipped with ADAS features, and a rising awareness regarding vehicle safety. Future growth is anticipated as regional governments prioritize smart city initiatives and vehicle connectivity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Sensor Market.- Sensor Solutions Inc.

- Automotive Tech Corp.

- Global Sensor Systems

- Advanced Mobility Sensors

- Intelligent Perception Co.

- Visionary Sensing Ltd.

- Integrated Sensor Systems

- Mobility Analytics Group

- Quantum Sensors

- DriveSense Technologies

- Future Automotive Sensors

- Precision Sensor Innovations

- Smart Mobility Solutions

- Autonomouseye Systems

- Sensing Edge Technologies

- RoadSense Innovations

- Secure Sensing Solutions

- Dynamic Sensor Providers

- NextGen AutoSensors

- Comprehensive Sensing Corp.

Frequently Asked Questions

What types of sensors are most critical for autonomous vehicles?

For autonomous vehicles, lidar, radar, and camera sensors are most critical. Lidar provides precise 3D mapping, radar offers robust object detection in various weather conditions, and cameras deliver detailed visual information for object recognition and lane keeping. The combination of these, known as sensor fusion, creates a comprehensive and reliable perception system.

How is the growth of Electric Vehicles (EVs) impacting the automotive sensor market?

The growth of EVs significantly impacts the market by driving demand for new types of sensors, such as those for battery management systems (BMS), electric motor control, and charging infrastructure. EVs also require traditional sensors for ADAS and safety, but with an emphasis on optimized power consumption and integration with electric powertrains.

What role does Artificial Intelligence (AI) play in automotive sensors?

AI plays a crucial role in enhancing automotive sensors by processing and interpreting complex data from multiple sensor inputs. AI algorithms enable advanced functions like real-time object classification, behavior prediction, and improved environmental perception for ADAS and autonomous driving, making vehicles smarter and safer.

What are the key challenges facing the automotive sensor market?

Key challenges include the high cost of advanced sensor technologies, ensuring sensor reliability and durability in harsh automotive environments, the lack of universal standardization and interoperability, and managing the vast amounts of data generated by sensor suites. Cybersecurity and data privacy concerns also present significant hurdles.

Which regions are leading the growth in the automotive sensor market?

Asia Pacific, particularly China, is leading in market growth due to its burgeoning automotive manufacturing sector and aggressive adoption of electric vehicles and autonomous driving technologies. North America and Europe also maintain strong market positions driven by stringent safety regulations, advanced technology adoption, and significant R&D investments.