Aluminum Welding Wire Market

Aluminum Welding Wire Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_704356 | Last Updated : August 05, 2025 |

Format : ![]()

![]()

![]()

![]()

Aluminum Welding Wire Market Size

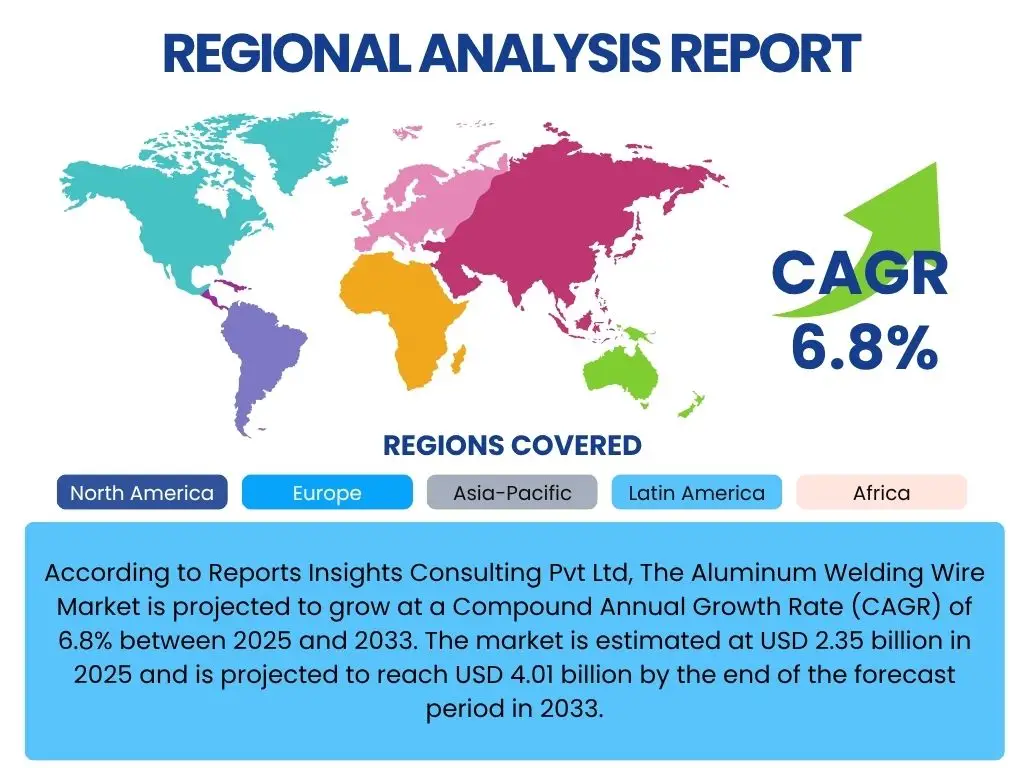

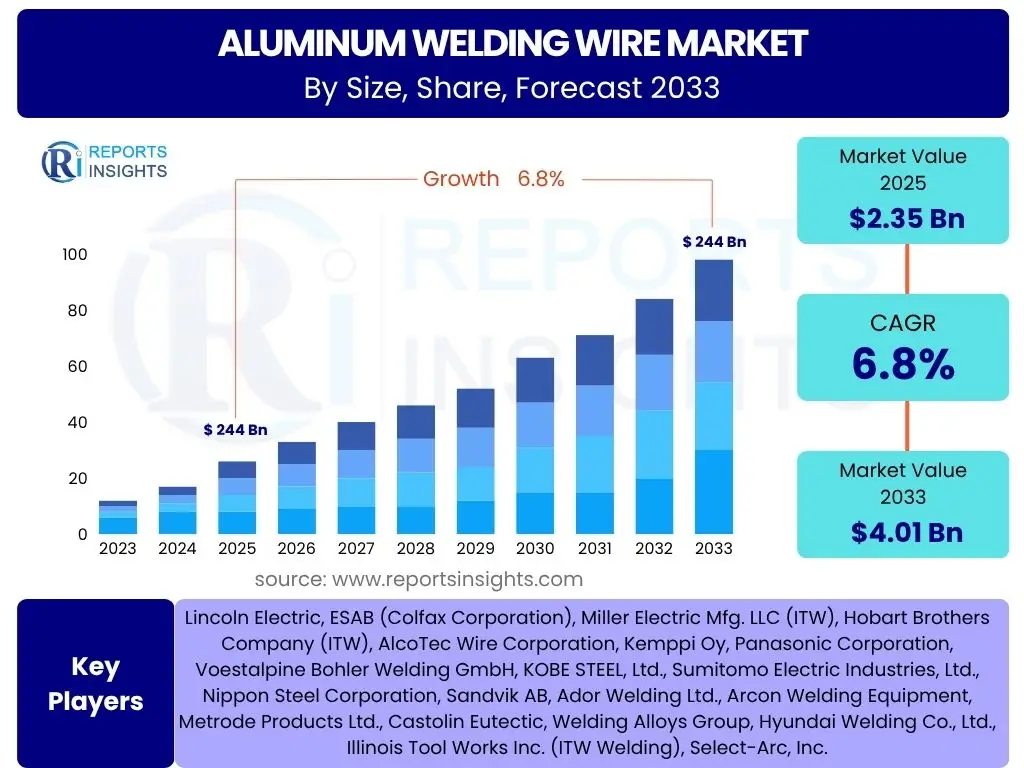

According to Reports Insights Consulting Pvt Ltd, The Aluminum Welding Wire Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2033. The market is estimated at USD 2.35 billion in 2025 and is projected to reach USD 4.01 billion by the end of the forecast period in 2033.

This substantial growth trajectory is underpinned by the increasing global demand for lightweight materials across various industries, notably automotive, aerospace, and construction. Aluminum welding wire facilitates the fabrication of strong yet lighter structures, which directly contributes to fuel efficiency and reduced carbon emissions, aligning with contemporary environmental and regulatory imperatives. The market's expansion is also a testament to ongoing advancements in welding technologies and the continuous development of new aluminum alloys that require specialized welding solutions.

Key Aluminum Welding Wire Market Trends & Insights

The Aluminum Welding Wire market is currently witnessing several transformative trends driven by technological advancements, evolving industrial demands, and a heightened focus on sustainability. User inquiries frequently highlight a keen interest in how innovation is shaping welding practices, the adoption of new materials, and the industry's response to environmental concerns. Key insights reveal a significant shift towards higher performance, greater efficiency, and more automated welding processes to meet the stringent requirements of modern manufacturing sectors.

Furthermore, the market is profoundly influenced by the global push for lightweighting in transportation sectors, which necessitates a robust supply of high-quality aluminum welding wire. The expansion of infrastructure projects, particularly in emerging economies, also contributes significantly to market dynamics. Trends indicate a growing preference for specialized aluminum alloys and corresponding welding wires that offer superior strength-to-weight ratios and enhanced corrosion resistance, crucial for applications in extreme environments.

- Increased adoption of advanced aluminum alloys requiring specialized welding wire formulations.

- Rising demand for lightweight materials in automotive and aerospace industries to improve fuel efficiency and performance.

- Growing integration of automation and robotics in welding processes for enhanced precision and productivity.

- Emphasis on sustainable manufacturing practices and the development of eco-friendly welding solutions.

- Technological advancements in wire manufacturing leading to improved wire feeding, arc stability, and reduced spatter.

- Expansion of infrastructure development projects globally, particularly in building and construction.

AI Impact Analysis on Aluminum Welding Wire

The integration of Artificial Intelligence (AI) is set to significantly revolutionize the Aluminum Welding Wire market, addressing common user concerns about quality control, operational efficiency, and skilled labor shortages. Users frequently inquire about AI's potential to optimize welding parameters, enhance defect detection, and streamline production processes. AI's influence extends from the manufacturing of the wire itself to its application in diverse industrial settings, promising a paradigm shift towards smarter, more autonomous welding operations.

AI-driven solutions offer unprecedented opportunities for predictive maintenance of welding equipment, optimizing material usage, and ensuring consistent weld quality. By analyzing vast datasets from welding operations, AI algorithms can identify patterns, predict potential failures, and recommend adjustments, thereby minimizing downtime and waste. This intelligent automation not only improves the overall efficiency and precision of aluminum welding but also addresses the critical challenge of skilled labor scarcity by enabling more intuitive and assisted welding processes.

- Optimized Welding Parameters: AI algorithms can analyze real-time data to automatically adjust voltage, current, and travel speed for optimal weld quality and efficiency.

- Predictive Maintenance: AI models predict equipment failures, enabling proactive maintenance and reducing costly downtime in welding operations.

- Enhanced Quality Control: AI-powered vision systems can detect microscopic defects and inconsistencies in welds with high precision, surpassing human capabilities.

- Automated Robotics Integration: AI enhances robotic welding systems with advanced path planning, adaptive control, and real-time adjustment capabilities.

- Supply Chain Optimization: AI can forecast demand for specific aluminum welding wire types, optimizing inventory management and logistics for manufacturers and distributors.

- Operator Assistance and Training: AI-driven systems provide real-time feedback and guidance to welders, accelerating skill development and improving performance.

Key Takeaways Aluminum Welding Wire Market Size & Forecast

Analysis of common user questions regarding the Aluminum Welding Wire market size and forecast reveals a strong interest in understanding the primary growth drivers, the segments poised for significant expansion, and the long-term viability of market trends. Users seek concise insights into where the most impactful opportunities lie and how current technological shifts are expected to shape future market dynamics. The key takeaways emphasize the critical role of lightweighting trends and industrial growth in sustaining market expansion.

The market is characterized by a consistent demand fueled by its indispensable role in key manufacturing sectors. Future growth is projected to be robust, driven by innovation in material science, increasing automation in welding, and the expanding global footprint of industries that heavily rely on aluminum fabrication. Strategic investments in research and development, coupled with an agile response to emerging application requirements, will be crucial for stakeholders aiming to capitalize on the market's trajectory.

- The Aluminum Welding Wire market is on a robust growth trajectory, primarily driven by increasing adoption in automotive, aerospace, and construction sectors.

- Technological advancements in both aluminum alloys and welding processes are critical enablers for market expansion and product innovation.

- The global emphasis on lightweighting and fuel efficiency continues to be a fundamental demand driver for aluminum welding solutions.

- Emerging economies, particularly in Asia Pacific, are expected to contribute significantly to market growth due to rapid industrialization and infrastructure development.

- Sustainability initiatives and the push for reduced environmental impact are influencing the development of more efficient and eco-friendly welding wire production.

Aluminum Welding Wire Market Drivers Analysis

The Aluminum Welding Wire market is significantly propelled by several fundamental drivers that underscore its growing importance across diverse industrial landscapes. A primary driver is the accelerating demand for lightweight and high-strength materials, particularly within the transportation sector. Industries such as automotive, aerospace, and marine are increasingly utilizing aluminum to reduce vehicle weight, thereby enhancing fuel efficiency, improving performance, and lowering carbon emissions. This pervasive lightweighting trend directly translates into a heightened requirement for specialized aluminum welding wires capable of forming robust and reliable joints in these critical applications.

Another pivotal driver is the continuous expansion of infrastructure and construction projects globally. Aluminum, with its desirable properties of corrosion resistance, aesthetic appeal, and structural integrity, is increasingly favored in modern building designs, bridges, and public infrastructure. This necessitates a steady supply of high-quality aluminum welding wire for fabrication and assembly processes. Furthermore, ongoing technological advancements in welding equipment and processes, including the rise of robotic and automated welding systems, are enhancing the efficiency and precision of aluminum welding, thereby further boosting market demand and opening new application avenues.

The growth of industrial manufacturing across various sectors, coupled with the increasing adoption of aluminum in consumer goods and renewable energy applications, also contributes substantially to market expansion. As industries seek more efficient and durable manufacturing solutions, the unique benefits offered by aluminum welding wire become more pronounced, solidifying its position as an indispensable material in modern fabrication. The inherent recyclability of aluminum also aligns with global sustainability goals, further cementing its long-term market relevance.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Demand for Lightweight Materials in Automotive & Aerospace | +1.2% | Global, North America, Europe, Asia Pacific | Short-term to Long-term |

| Growth in Building & Construction Sector | +0.9% | Asia Pacific, North America, Europe | Mid-term |

| Advancements in Welding Technology & Automation | +0.7% | Global | Short-term to Mid-term |

| Expansion of Marine & Shipbuilding Industry | +0.6% | Asia Pacific, Europe | Mid-term to Long-term |

| Rising Application in Electrical & Electronics Industries | +0.5% | Asia Pacific, North America | Mid-term |

Aluminum Welding Wire Market Restraints Analysis

Despite its robust growth prospects, the Aluminum Welding Wire market faces several significant restraints that could temper its expansion. One of the primary challenges is the volatility of raw material prices, particularly aluminum ingots. Fluctuations in the global aluminum market, driven by geopolitical factors, supply chain disruptions, and demand-supply imbalances, directly impact the production costs of welding wire. This unpredictability can lead to fluctuating profit margins for manufacturers and higher acquisition costs for end-users, potentially slowing adoption or encouraging the search for alternative materials.

Another considerable restraint is the persistent shortage of skilled welding labor globally. High-quality aluminum welding, especially for specialized applications, requires a specific skill set and extensive experience due to aluminum's unique metallurgical properties, such as high thermal conductivity and susceptibility to oxidation. The lack of adequately trained personnel can hinder the widespread adoption of aluminum welding processes, limit production capacities, and increase operational costs, despite the availability of advanced welding technologies.

Furthermore, the high initial capital investment required for advanced aluminum welding equipment, including sophisticated power sources, robotic systems, and specialized wire feeders, can pose a barrier to entry or expansion for smaller and medium-sized enterprises. This high upfront cost can deter companies from upgrading their welding infrastructure, thereby slowing the market's natural progression towards more efficient and advanced aluminum welding techniques. Competition from other joining technologies, such as riveting, adhesive bonding, and friction stir welding, also presents a restraint, as these alternatives may offer cost or performance advantages in specific niche applications, compelling some industries to diversify their joining strategies.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Volatile Raw Material Prices (Aluminum) | -0.8% | Global | Short-term to Mid-term |

| Shortage of Skilled Welding Labor | -0.6% | North America, Europe, parts of Asia Pacific | Long-term |

| High Initial Investment for Advanced Welding Equipment | -0.5% | Global, particularly SMEs | Mid-term |

| Competition from Alternative Joining Technologies | -0.4% | Global, specific industrial applications | Mid-term to Long-term |

| Stringent Quality Control and Defect Minimization Requirements | -0.3% | Global, highly regulated industries | Ongoing |

Aluminum Welding Wire Market Opportunities Analysis

Significant opportunities are emerging within the Aluminum Welding Wire market, driven by evolving industrial needs and technological advancements. One key area of opportunity lies in the continuous development of new and specialized aluminum alloys. As industries demand materials with enhanced properties such as higher strength, improved corrosion resistance, or better fatigue performance, there is a corresponding need for welding wires tailored to these novel compositions. This creates a fertile ground for manufacturers to innovate and introduce high-performance welding wires that can meet the stringent requirements of next-generation applications in aerospace, defense, and high-speed transportation.

Another substantial opportunity stems from the expansion into emerging markets, particularly in Asia Pacific, Latin America, and the Middle East. These regions are experiencing rapid industrialization, urbanization, and significant investments in infrastructure development, including automotive manufacturing plants, construction projects, and renewable energy installations. As these economies grow, so does their demand for lightweight, durable, and cost-effective fabrication solutions, positioning aluminum welding wire for considerable growth in these previously underserved or less mature markets. Localized production and distribution networks in these regions could unlock significant market potential.

Furthermore, the increasing global focus on automation and robotics integration in manufacturing processes presents a prime opportunity. As industries strive for greater efficiency, precision, and consistency, robotic welding systems are becoming more prevalent. Aluminum welding wire manufacturers can capitalize on this trend by developing wires optimized for automated feeding systems, ensuring stable arcs and consistent weld quality in high-speed robotic applications. The growing demand for electric vehicles and renewable energy infrastructure also presents new avenues, as these sectors heavily rely on aluminum components and therefore require specialized welding solutions for their fabrication.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Development of New and Specialized Aluminum Alloys | +1.0% | Global | Mid-term to Long-term |

| Expansion into Emerging Markets & Developing Economies | +0.9% | Asia Pacific, Latin America, MEA | Short-term to Long-term |

| Increasing Adoption of Automation & Robotics in Welding | +0.8% | Global, particularly developed regions | Mid-term |

| Growth in Electric Vehicle (EV) Manufacturing | +0.7% | North America, Europe, Asia Pacific | Long-term |

| Rising Investment in Renewable Energy Infrastructure | +0.6% | Global | Mid-term to Long-term |

Aluminum Welding Wire Market Challenges Impact Analysis

The Aluminum Welding Wire market, while exhibiting robust growth, is not without its challenges. One significant hurdle is maintaining consistent quality control and minimizing weld defects, which are inherently more complex with aluminum compared to steel. Aluminum's high thermal conductivity, low melting point, and susceptibility to oxidation and porosity during welding necessitate precise control over parameters and a high degree of welder skill. Achieving defect-free welds consistently across diverse applications and environments remains a critical challenge for both wire manufacturers and end-users, impacting productivity and material waste.

Another pressing challenge involves navigating increasingly stringent environmental regulations and addressing waste management concerns associated with welding processes. Industries are under pressure to reduce their carbon footprint, manage fumes and waste materials responsibly, and adhere to global environmental standards. This drives the need for more eco-friendly welding solutions and sustainable manufacturing practices, which can incur additional costs for research, development, and compliance. Companies must invest in cleaner production technologies and waste recycling initiatives, adding complexity to their operational frameworks.

Furthermore, the global supply chain for raw aluminum and its derivatives faces logistical complexities, including transportation costs, lead times, and potential disruptions. Ensuring a consistent and cost-effective supply of high-grade aluminum for wire manufacturing can be challenging, especially amidst geopolitical instabilities or unforeseen global events. Lastly, market saturation in certain developed regions, combined with intense competition among established players and new entrants, can lead to pricing pressures and reduced profit margins. Companies must differentiate their products through innovation, specialized solutions, or superior customer service to remain competitive in such environments.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Ensuring Consistent Quality Control and Minimizing Weld Defects | -0.7% | Global, highly regulated industries | Ongoing |

| Navigating Environmental Regulations and Waste Management | -0.6% | Europe, North America, Asia Pacific | Mid-term to Long-term |

| Logistical Complexities and Supply Chain Disruptions | -0.5% | Global | Short-term to Mid-term |

| Intense Market Competition and Pricing Pressures | -0.4% | Developed Regions, Asia Pacific | Ongoing |

| Integration with Advanced Materials and Dissimilar Metals | -0.3% | Global, specialized applications | Mid-term |

Aluminum Welding Wire Market - Updated Report Scope

This comprehensive market report on Aluminum Welding Wire provides an in-depth analysis of the industry's landscape, examining historical data, current market dynamics, and future projections. It covers key market attributes, including size estimations, growth rates, and a detailed breakdown by various segments. The scope is designed to offer stakeholders a clear understanding of the market's evolution, pinpointing critical trends, drivers, restraints, opportunities, and challenges that influence its trajectory.

The report's scope also encompasses a thorough regional analysis, highlighting the performance and potential of key geographical markets, alongside profiles of leading market participants. It aims to deliver actionable insights that assist businesses in strategic decision-making, competitive positioning, and identifying lucrative investment opportunities within the aluminum welding wire sector. The data presented is meticulously researched to provide a reliable foundation for market forecasting and business development.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 2.35 billion |

| Market Forecast in 2033 | USD 4.01 billion |

| Growth Rate | 6.8% |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Lincoln Electric, ESAB (Colfax Corporation), Miller Electric Mfg. LLC (ITW), Hobart Brothers Company (ITW), AlcoTec Wire Corporation, Kemppi Oy, Panasonic Corporation, Voestalpine Bohler Welding GmbH, KOBE STEEL, Ltd., Sumitomo Electric Industries, Ltd., Nippon Steel Corporation, Sandvik AB, Ador Welding Ltd., Arcon Welding Equipment, Metrode Products Ltd., Castolin Eutectic, Welding Alloys Group, Hyundai Welding Co., Ltd., Illinois Tool Works Inc. (ITW Welding), Select-Arc, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Aluminum Welding Wire market is meticulously segmented across various parameters to provide a granular view of its diverse dynamics and growth opportunities. This comprehensive segmentation allows for a detailed analysis of specific product types, application areas, and geographic regions, enabling stakeholders to pinpoint high-potential niches and tailor their strategies accordingly. Understanding these segments is crucial for identifying targeted growth strategies and assessing the competitive landscape within each sub-market.

The market is predominantly segmented by type, differentiating between various aluminum alloy compositions designed for specific material properties and welding requirements. Further segmentation by application highlights the key end-use industries driving demand, from high-precision aerospace fabrication to large-scale construction projects. Additional breakdowns by form, diameter, and welding process offer insights into product preferences and technological adoption trends across the industry, providing a holistic perspective on market structure and consumption patterns.

- By Type:

- ER4043: Widely used for general purpose applications, good fluidity.

- ER5356: Known for its higher strength and excellent corrosion resistance, especially in marine environments.

- ER1100: Pure aluminum wire, suitable for highly ductile applications and electrical conductivity.

- ER4943: Offers higher strength post-welding due to heat-treatable characteristics.

- Other Types (e.g., ER5183, ER5556): Specialized alloys for specific high-strength or low-temperature applications.

- By Application:

- Automotive & Transportation: For lightweighting components, chassis, and body structures.

- Aerospace & Defense: Critical for aircraft fuselages, wings, and military equipment.

- Building & Construction: Used in structural elements, facades, and architectural designs.

- Marine & Shipbuilding: Essential for boat hulls, decks, and offshore structures due to corrosion resistance.

- Industrial Manufacturing: Broad applications in machinery, equipment, and general fabrication.

- Electrical & Electronics: For components requiring high conductivity and thermal dissipation.

- Other Applications (e.g., Consumer Goods, Renewable Energy): Including HVAC systems, solar panel frames, and sporting equipment.

- By Form:

- Spools: Most common form for automated and semi-automated welding processes.

- Coils: Larger quantities for industrial scale consumption.

- Cut Lengths: For specific manual welding applications or TIG welding.

- By Diameter:

- 0.8 mm – 1.6 mm: Predominantly for thinner materials and precise welding.

- 1.6 mm – 3.2 mm: Standard range for general industrial applications.

- Above 3.2 mm: For heavy-duty applications and thicker sections.

- By Process:

- MIG (GMAW): Gas Metal Arc Welding, widely used for speed and efficiency.

- TIG (GTAW): Gas Tungsten Arc Welding, preferred for high-quality, precise welds.

- Other Processes (e.g., Plasma Arc Welding): Niche applications requiring specialized control.

Regional Highlights

The global Aluminum Welding Wire market exhibits significant regional variations in terms of demand, growth drivers, and competitive landscapes. These regional dynamics are shaped by varying levels of industrialization, technological adoption, regulatory frameworks, and economic growth rates. Understanding these geographical highlights is crucial for market participants to formulate effective localization strategies and capitalize on specific regional opportunities.

Asia Pacific currently dominates the market and is projected to maintain its leading position due to robust economic growth, rapid industrialization, and extensive infrastructure development, particularly in China, India, and Southeast Asian countries. North America and Europe represent mature markets characterized by stringent quality standards, significant technological advancements, and a strong emphasis on automotive, aerospace, and advanced manufacturing sectors. Latin America and the Middle East & Africa are emerging as promising regions, driven by increasing investments in manufacturing, construction, and oil & gas industries, presenting new avenues for market expansion.

- North America: Characterized by a strong automotive and aerospace industry, driving demand for high-performance aluminum welding wire for lightweighting initiatives. Significant investments in infrastructure modernization also contribute to market growth.

- Europe: A mature market with a focus on advanced manufacturing, renewable energy, and stringent environmental regulations, fostering demand for high-quality and sustainable welding solutions. Germany, France, and the UK are key contributors.

- Asia Pacific (APAC): The largest and fastest-growing market, propelled by rapid industrialization, urbanization, and substantial investments in automotive, construction, and marine sectors across countries like China, India, Japan, and South Korea.

- Latin America: An emerging market with growing automotive production, infrastructure development, and increasing industrial activities, particularly in Brazil and Mexico, creating new demand opportunities.

- Middle East and Africa (MEA): Witnessing growth due to investments in oil & gas infrastructure, construction projects, and economic diversification efforts, though the market is comparatively smaller.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aluminum Welding Wire Market.- Lincoln Electric

- ESAB (Colfax Corporation)

- Miller Electric Mfg. LLC (ITW)

- Hobart Brothers Company (ITW)

- AlcoTec Wire Corporation

- Kemppi Oy

- Panasonic Corporation

- Voestalpine Bohler Welding GmbH

- KOBE STEEL, Ltd.

- Sumitomo Electric Industries, Ltd.

- Nippon Steel Corporation

- Sandvik AB

- Ador Welding Ltd.

- Arcon Welding Equipment

- Metrode Products Ltd.

- Castolin Eutectic

- Welding Alloys Group

- Hyundai Welding Co., Ltd.

- Illinois Tool Works Inc. (ITW Welding)

- Select-Arc, Inc.

Frequently Asked Questions

The following frequently asked questions address common user inquiries about the Aluminum Welding Wire market, providing concise and informative answers to key topics and concerns. These questions reflect the primary areas of interest for individuals seeking to understand market dynamics, product applications, and future trends within this sector.What are the primary applications of aluminum welding wire?

Aluminum welding wire is primarily used across diverse industries including automotive and transportation for lightweight vehicle components, aerospace and defense for aircraft structures, building and construction for architectural elements, and marine and shipbuilding for vessel fabrication. Its high strength-to-weight ratio and corrosion resistance make it ideal for these demanding applications.

Which types of aluminum welding wire are most commonly used?

The most commonly used types of aluminum welding wire are ER4043 and ER5356. ER4043 is popular for its excellent fluidity and crack resistance, suitable for general-purpose applications. ER5356 offers higher tensile strength and superior corrosion resistance, making it ideal for marine and structural applications where strength and durability are paramount.

What factors are driving the growth of the Aluminum Welding Wire market?

Key drivers include the global push for lightweighting in the automotive and aerospace sectors to enhance fuel efficiency and reduce emissions, increasing investments in infrastructure and construction projects, and continuous technological advancements in welding processes, including automation and robotics, which improve welding quality and efficiency.

What are the main challenges faced by the Aluminum Welding Wire market?

Significant challenges include the volatility of raw material (aluminum) prices, the persistent shortage of skilled welding labor, the high initial capital investment required for advanced welding equipment, and the complexities associated with achieving consistent weld quality and minimizing defects due to aluminum's unique metallurgical properties.

Which region holds the largest share in the Aluminum Welding Wire market?

The Asia Pacific region currently holds the largest market share in the Aluminum Welding Wire market. This dominance is attributed to rapid industrialization, substantial growth in the automotive and construction industries, and increasing manufacturing activities in countries such as China, India, and Japan.